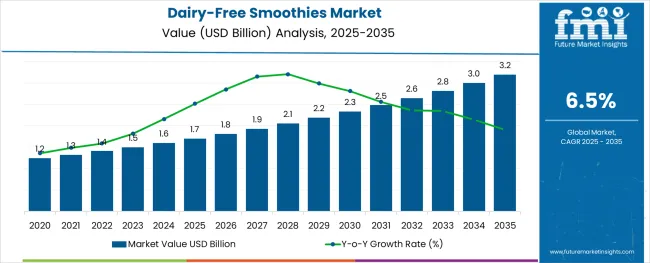

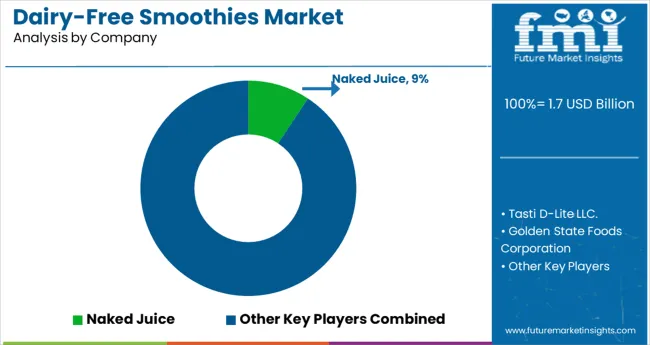

The global dairy-free smoothies market is projected to be valued at USD 1.7 billion in 2025, and is expected to reach approximately USD 3.2 billion by 2035, expanding at a steady CAGR of 6.5% during the forecast period.

This growth is being fueled by an escalating global shift toward plant-based and functional beverages. As consumers become more health-conscious and environmentally aware, the demand for dairy-free alternatives has accelerated, especially in categories that traditionally rely on dairy, such as smoothies. This shift is not only consumer-driven but also supported by advancements in food technology, formulation capabilities, and investments in production methods that align with both wellness trends and climate-conscious consumption.

The industry registers an estimated 6-8% share within the broader dairy alternatives market, which includes products like plant-based milk, yogurt, cheese, and ice cream. Within the functional beverages market, its share is comparatively smaller at around 2-3%, as this category encompasses a wide range of drinks like energy beverages, fortified waters, and probiotic drinks. In the plant-based food and beverage market, dairy-free smoothies account for roughly 4-5%, reflecting their niche yet growing role in plant-based nutrition.

The market captures around 3% of the health and wellness food sector, with increasing traction among fitness and wellness enthusiasts. Within the RTD beverages market, it forms 1-2%, but is expanding rapidly due to rising demand for on-the-go, clean-label, nutrient-rich drinks.

The market involves a complex but increasingly streamlined value chain that begins with sourcing of plant-based raw materials, such as oats, almonds, coconuts, and soybeans, from certified organic farms. These raw materials are then processed into bases, often in specialized non-dairy processing facilities equipped to prevent cross-contamination. Smoothie manufacturing integrates fruit purées, botanical extracts, plant proteins, and functional additives into these bases, requiring a coordinated approach to formulation and quality control.

Post-production, companies invest in advanced cold-chain logistics and eco-friendly packaging solutions to ensure product freshness. Distribution spans online retail, supermarkets, cafés, and direct-to-consumer platforms, with marketing heavily reliant on wellness branding and social media engagement. As the market evolves, collaborative partnerships between ingredient suppliers, co-manufacturers, and retailers are becoming central to optimizing cost, ensuring traceability, and delivering consistently high-quality products to a global consumer base.

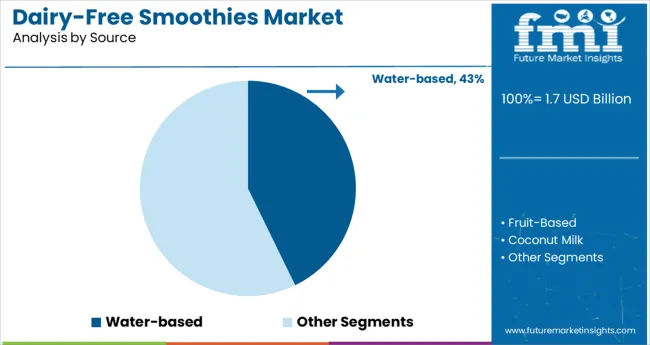

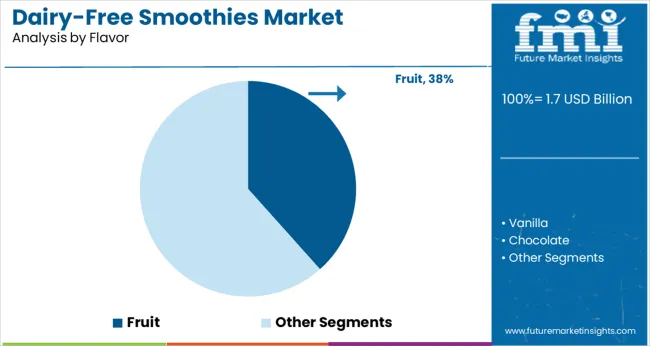

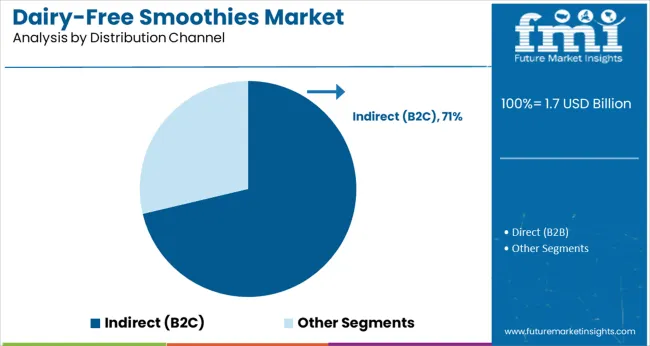

Water-based smoothies lead the dairy-free market with a 43% share in 2025, driven by demand for lighter, hydrating, and clean-label options. Fruit-flavored variants follow closely at 38%, appealing to consumers seeking natural sweetness and nutritional value. Indirect (B2C) distribution dominates with a 71% share, fueled by retail visibility, e-commerce growth, and strong consumer engagement.

Water-based smoothies have emerged as the leading segment, capturing a dominant 43% market share in 2025. This segment’s rapid rise is rooted in evolving consumer preferences for lighter, more refreshing, and lower-calorie beverage options.

In the flavor category, fruit-flavored dairy-free smoothies hold the leading position, accounting for 38% of the market share in 2025. This dominance is driven by consumers’ strong preference for naturally sweet, refreshing, and nutrient-rich options that align with clean-label and plant-based lifestyles.

The indirect (B2C) distribution channel holds the dominant share of 71% in the dairy-free smoothies market as of 2025. This reflects the strong penetration of dairy-free beverages in retail environments such as supermarkets, health food stores, and especially online platforms.

Clean-label dairy-free smoothies with transparent, additive-free ingredients are gaining shelf space and turning over 1.8× faster, especially in the USA and Southeast Asia. Digestive wellness blends with probiotics and prebiotic fibers are driving up sales by 27% in markets like Japan and France.

Clean-Label Positioning Drives Shelf Preference

Retail buyers and consumers are showing strong alignment toward dairy-free smoothies with transparent, additive-free ingredient profiles. Brands emphasizing “no added sugar,” “all-natural,” and “plant-only” attributes are gaining traction across major B2C channels. In the USA and Germany, shelf placement of clean-label dairy-free smoothies increased by 22% in Q1 2025, with retailers reporting 1.8× faster turnover compared to conventional blends. Southeast Asian convenience chains now mandate QR-based ingredient traceability for new listings, pushing brands to adopt transparent sourcing narratives.

Digestive Wellness and Functional Ingredient Inclusion

Consumer demand for gut health and low-allergen nutrition is fueling the inclusion of digestive-friendly ingredients like plant-based probiotics, prebiotic fibers, and easily digestible fruit bases. Dairy-free smoothies formulated with banana, oat fiber, or turmeric are now gaining a foothold in wellness aisles. In Japan and France, smoothies containing inulin or fermented adaptogens saw a 27% increase in month-on-month sales during Q1 2025. Specialty health food retailers have begun favoring SKUs with on-pack gut health claims, nudging mainstream brands to follow suit.

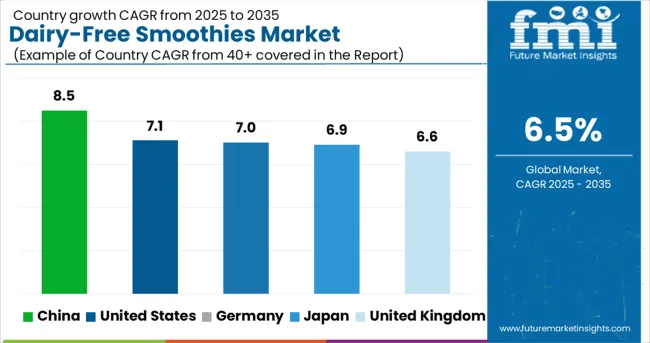

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 7.1% |

| Germany | 7.0% |

| United Kingdom | 6.6% |

| China | 8.5% |

| Japan | 6.9% |

With the global dairy-free smoothies market set to grow at a 6.5% CAGR through 2035, key BRICS and OECD markets are showing varied performance. China leads at 8.5%, well above the global average, fueled by demand for soy, almond, and coconut-based blends positioned as functional breakfast replacements. Urban health trends and e-commerce-driven distribution are accelerating penetration in tier-1 and tier-2 cities.

The United States, part of the OECD group, records 7.1%, supported by clean-label and growing retail shelf space for blended, low-sugar formats. Germany and Japan follow at 7.0% and 6.9% respectively, with product development focused on protein-enhanced variants and refrigerated grab-and-go formats. The United Kingdom posts 6.6%, just above the global average, with oat- and berry-based SKUs leading launches across private label and direct-to-consumer channels.

ASEAN markets such as Thailand and Indonesia are emerging players, with blended fruit-nut bases gaining traction among lactose-intolerant urban populations.

The USA dairy-free smoothies market expanded at a CAGR of 5.7% from 2020 and 2024, driven by vegan lifestyle adoption and the rise of plant-based beverage start-ups across metro hubs. Between 2025 and 2035, the market is expected to grow at a higher CAGR of 7.1%, supported by enhanced availability in B2C retail, clean-label trends, and the rise of protein-rich and fiber-fortified smoothies.

Functional health positioning and demand for allergen-free drinks are further accelerating refrigerated and cold-chain retail distribution. Online wellness platforms and gym-centric marketing campaigns are also contributing to premiumization and brand loyalty.

The UK dairy-free smoothies market posted a CAGR of 4.8% from 2020 to 2024, restricted by high pricing and limited in-store variety. However, the growth outlook for 2025 to 2035 is stronger at 6.6% CAGR, slightly above the global average, supported by increased retail distribution, low-sugar recipes, and improved allergen transparency. Gen Z’s health habits and influencer-led promotions are reshaping consumption patterns across London, Manchester, and Birmingham. Expansion into organic chains and better flavor profiles are encouraging repeat purchases and driving shelf differentiation.

The German dairy-free smoothies market expanded at a 5.1% CAGR from 2020 to 2024, propelled by growing awareness of lactose intolerance and strong clean-label demand. Looking ahead, the market is set to grow faster at a 7.0% CAGR from 2025 to 2035, spurred by policy support for organic labeling, the maturity of natural foods distribution, and widespread flexitarian dietary habits.

Retailers are prioritizing immune-boosting and antioxidant smoothies, while consumer trust in domestic certifications boosts repeat sales. Berlin and Hamburg remain hubs for dairy-free, influencing purchasing behavior across Western Europe.

The China dairy-free smoothies market recorded a solid 6.2% CAGR from 2020 to 2024, led by cross-border e-commerce and rising urban health awareness. The outlook is even stronger for 2025 to 2035, with an estimated CAGR of 8.5%, as domestic players introduce fruit- and TCM-based formulations.

The fusion of wellness traditions with online retail, mini-program commerce, and livestream selling is boosting visibility and consumer education. Increasing lactose intolerance, combined with demand for functional convenience drinks, is catalyzing the expansion of local brands and new distribution channels.

The Japan dairy-free smoothies market registered a CAGR of 4.3% between 2020 and 2024, held back by traditional dairy habits and narrow product availability beyond Tokyo and Osaka. For 2025 to 2035, growth is projected at 6.9% CAGR, led by aging consumers embracing gut-friendly and beauty-enhancing drinks.

Plant-based smoothies with subtle taste profiles, natural sweeteners, and on-pack wellness claims are finding favor, especially in convenience stores and vending channels. Market traction is further supported by increasing female consumer interest in "beauty-from-within" nutrition and functional wellness positioning.

Leading Company - Naked Juice

Industry Share - ~9.3%

In the dairy-free smoothies market, leading players like Naked Juice, Innocent Drinks, Campbell Soup Company, and Beaming Wellness, Inc. are pursuing growth through wellness-driven formulations, clean-label transparency, and targeted retail expansion. Companies such as Life Force Beverages LLC, Tasti D-Lite LLC, and Maui Wowi Franchising, Inc. are leveraging cold-chain logistics and functional ingredients to tap into fitness-conscious and urban millennial segments. Their strategies revolve around low-sugar, high-protein, and allergen-free positioning, enabling premium placement across grocery, cafés, and online channels.

Ingredient-focused entities like Tate & Lyle plc. and Golden State Foods Corporation provide key back-end support, enhancing texture, flavor, and shelf-life stability. Retail Zoo Pty Ltd. and WWF Operating Company are expanding through co-branded smoothie bars and wellness cafés. As demand surges, competitive intensity remains high, with brands focusing on RTD, direct-to-consumer models, and regional ingredient partnerships.

Recent Industry News

In August 2024, Golden State Foods announced that Lindsay Goldberg, a family- and founder-focused private equity firm, acquired a controlling interest in the company while the founding Wetterau family retained a significant ownership stake.

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 1.7 billion |

| Projected Industry Size (2035) | USD 3.2 billion |

| CAGR (2025 to 2035) | 6.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Source Analyzed (Segment 1) | Fruit-Based, Water-Based, Coconut Milk, and Others. |

| Flavor Analyzed (Segment 2) | Fruit, Vanilla, Chocolate, and Others. |

| Distribution Channel Analyzed (Segment 3) | Direct (B2B) and Indirect (B2C). |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Life Force Beverages LLC, Tasti D-Lite LLC, Golden State Foods Corporation, Naked Juice, WWF Operating Company, Beaming Wellness, Inc., Maui Wowi Franchising, Inc., Innocent Drinks, Tate & Lyle plc, Campbell Soup Company, Retail Zoo Pty Ltd, Others. |

| Additional Attributes | Dollar sales by base and flavor, market share by region and channel, growth drivers, B2C vs. B2B trends, pricing strategies, and competitive positioning. |

The industry includes fruit-based, water-based, coconut milk, and others.

The industry is segmented into fruit, vanilla, chocolate, and others.

The segmentation covers direct (B2B) and indirect (B2C).

The industry is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific.

The industry is valued at USD 1.7 billion in 2025.

It is forecasted to reach USD 3.2 billion by 2035.

The industry is anticipated to grow at a CAGR of 6.5% during this period.

Indirect (B2C) Channels are projected to lead the market with a 71% share in 2025.

Asia Pacific, particularly China, is expected to be the key growth region with a projected growth rate of 8.5%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Assessing Dairy-Free Smoothies Market Share & Industry Trends

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA