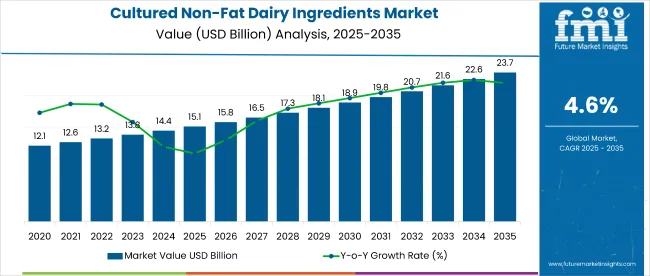

The global cultured non-fat dairy ingredients market is valued at USD 15.1 billion by 2025 and USD 23.7 billion by 2035, reflecting a CAGR of 4.6%. Factors driving this growth include rising demand for healthy, low-fat dairy alternatives. The market is also benefiting from the rising popularity of functional foods and dairy products with longer shelf life, which is attributed to fermentation processes used in cultured non-fat dairy ingredients.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 15.1 billion |

| Projected Value (2035F) | USD 23.7 billion |

| CAGR (2025 to 2035) | 4.6% |

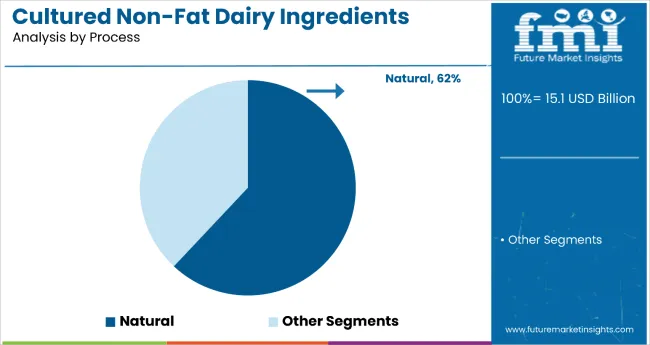

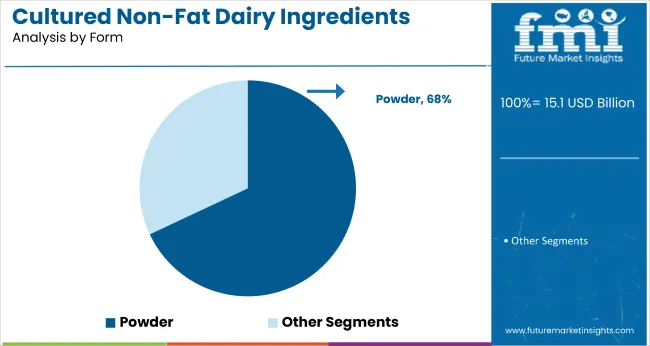

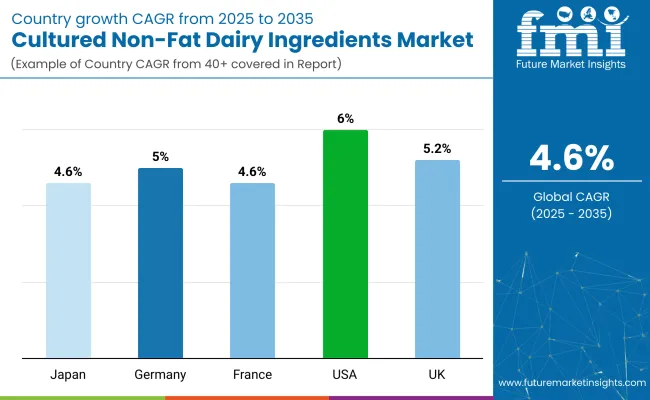

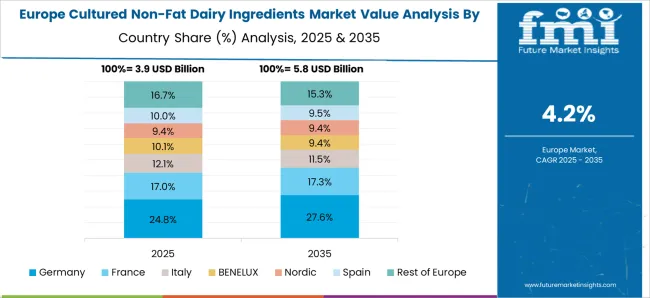

North America is expected to remain the dominant market for cultured non-fat dairy ingredients, particularly in the USA, growing at a CAGR of 6.0%. Meanwhile, the UK and Germany closely follow this rapid growth with prominent CAGRs of 5.2% and 5.0% from 2025 to 2035. Natural process leads the process segment with 62% of the market share. Meanwhile, the powdered form segment accounts for a significant share of 68% in 2025.

The market holds a significant share in several related parent markets. Within the dairy ingredients market, it accounts for approximately 12-15%, driven by the increasing demand for health-conscious and low-fat dairy options. In the functional dairy ingredients market, it contributes around 10-12%, as consumers seek functional benefits such as probiotics in cultured dairy products.

The market holds about 8-10% of the fermented dairy ingredients market, supported by the growing popularity of fermented products like yogurt. Additionally, in the reduced-fat dairy market, it makes up approximately 14-16%, reflecting the rising preference for low-fat dairy alternatives. These percentages highlight the growing prominence of cultured non-fat dairy ingredients across various dairy-related segments.

Recent innovations in the cultured non-fat dairy ingredients market include advancements in fermentation technology, which have led to improvements in the taste, texture, and shelf life of dairy products. These innovations are expected to expand the product offerings available to consumers, enhancing market appeal.

Government regulations promoting healthier food choices, coupled with increased consumer awareness about the health benefits of low-fat dairy, will continue to drive the growth of the cultured non-fat dairy ingredients market in the coming years. Additionally, there is growing investment in R&D for new product formulations and cleaner production processes, which will contribute to market competitiveness.

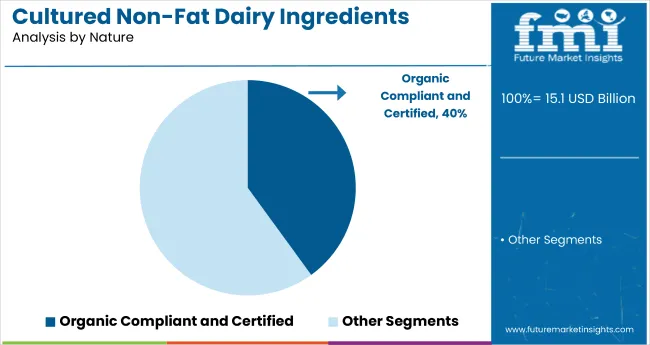

The global cultured non-fat dairy ingredients market is segmented by process, nature, form, distribution channel, and region. The key segments under process include natural and artificial, while the nature segment is divided into organic compliant and certified, kosher certified, and conventional.

The form segment consists of liquid and powder options. Distribution channels are categorized into direct sales, indirect sales, store-based retailing, hypermarkets/supermarkets, convenience stores, discount stores, independent small groceries, and online retail. Geographically, the market is analyzed across North America, Latin America, Europe, the Middle East & Africa, East Asia, South Asia, and Oceania.

The natural process segment will continue to dominate the cultured non-fat dairy ingredients market in 2025 and 2035, accounting for 62% of the market share. This is primarily driven by the increasing demand for clean-label and minimally processed products, as consumers continue to seek healthier and more natural food options. With greater consumer focus on natural, healthy alternatives and the growing trend of avoiding artificial additives, the natural process segment’s market share is expected to expand.

The organic, compliant, and certified segment is expected to lead the market with a 40% share in 2025, as demand for organic and clean food options continues to rise. Consumers are increasingly turning to organic products as they offer healthier, sustainable, and eco-friendly options. Organic dairy ingredients are highly valued, particularly in regions with high consumer health consciousness, such as North America and Europe.

Among the form segments, powdered cultured non-fat dairy ingredients will maintain their position as the largest segment with a 68% market share in 2025. This form’s popularity is driven by its extended shelf life, ease of transport, and versatility in various applications, such as food processing, nutritional supplements, and ready-to-eat meals. The increasing preference for convenience and cost-effective solutions will further bolster the powder segment’s share.

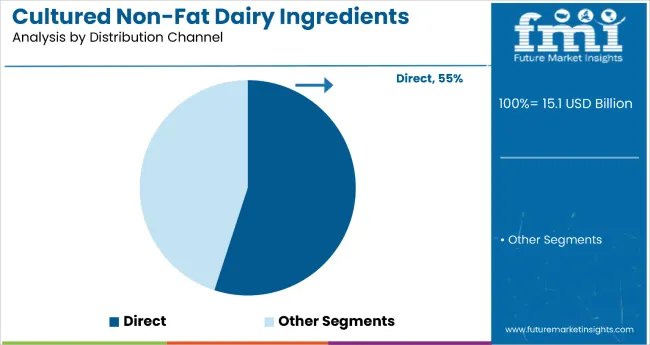

The direct sales channel will remain the leading distribution method for cultured non-fat dairy ingredients, accounting for 55% market share in 2025. Direct sales cater to bulk buyers, including food manufacturers and retailers, allowing for long-term contracts and large-scale orders. With increasing demand for functional ingredients, direct sales will remain crucial for market expansion, especially in developed regions.

Recent Trends in the Cultured Non-Fat Dairy Ingredients Market

Challenges in the Cultured Non-Fat Dairy Ingredients Market

The growth rates in the market vary across countries. The USA leads with a projected CAGR of 6.0%, driven by a strong demand for health-conscious products among millennials and government initiatives. The UK follows closely with a 5.2% CAGR, supported by a preference for organic and clean-label foods.

Germany is expected to grow at 5.0%, driven by consumer interest in health-focused dairy alternatives. France shows a steady growth rate of 4.6%, fueled by the demand for premium dairy products. Japan also exhibits a 4.6% CAGR, driven by an aging population and a focus on wellness.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

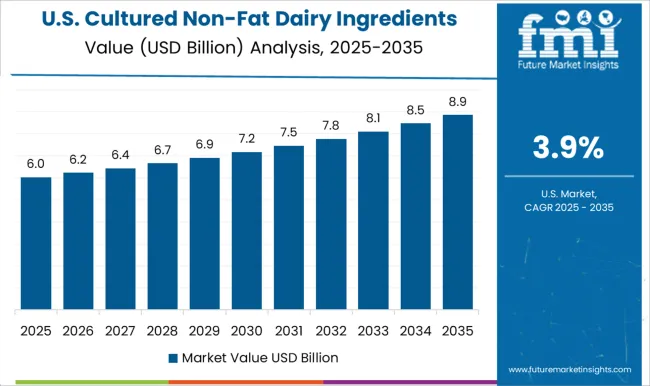

The cultured non-fat dairy ingredients market in the United States is projected to grow at a CAGR of 6.0% from 2025 to 2035. The demand for health-conscious and low-fat alternatives has significantly increased, especially among the millennial population. This shift is further supported by government initiatives promoting healthier dietary habits and the growing popularity of functional foods.

The cultured non-fat dairy ingredients market in the UK is projected to grow at a CAGR of 5.2% from 2025 to 2035. The UK has seen an increasing shift towards organic and clean-label food products, with a growing preference for low-fat dairy alternatives. The country’s regulatory support for organic food certification and its highly competitive retail environment contribute to the rapid distribution of cultured non-fat dairy ingredients.

The sales of cultured non-fat dairy ingredients in Germany are anticipated to grow at a CAGR of 5.0% from 2025 to 2035. The German market is supported by an increasing demand for healthier food products, particularly within the dairy sector. German consumers are highly receptive to the health benefits associated with non-fat dairy ingredients, which aligns with the country’s broader focus on sustainability and nutritional wellness.

The revenue from cultured non-fat dairy ingredients in France is projected to experience a steady growth rate of 4.6% CAGR from 2025 to 2035 in the cultured non-fat dairy ingredients market. The French market is characterized by a high preference for premium dairy products, including those with health benefits.

Japan’s cultured non-fat dairy ingredients market is expected to grow at a CAGR of 4.6% from 2025 to 2035. Japan has seen a growing preference for non-fat dairy products driven by an aging population and a strong focus on health and wellness. As Japanese consumers increasingly seek functional food ingredients, the demand for cultured non-fat dairy products is expected to rise.

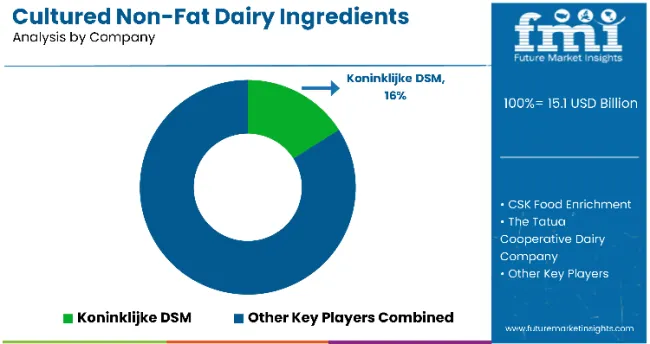

The cultured non-fat dairy ingredients market is moderately fragmented, with numerous global players competing on the basis of pricing, innovation, and distribution reach. Key companies like Koninklijke DSM, CSK Food Enrichment, and Arla Foods Ingredients Group are investing heavily in new product development and expanding their presence through strategic partnerships and acquisitions. These companies are working to provide high-quality dairy ingredients that meet the growing demand for clean-label, organic, and functional food products.

The competitive landscape is marked by significant efforts from these top suppliers to stay ahead through diversification of product portfolios, expansion into emerging markets, and increasing investment in R&D. Companies such as Cargill Incorporated and Chr.

Hansen Holding is leveraging its global distribution networks and technological advancements in fermentation to cater to the increasing demand for non-fat dairy ingredients. With growing demand for functional foods, companies are also focusing on improving the nutritional profiles of their offerings.

Recent Cultured Non-Fat Dairy Ingredients Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 15.1 billion |

| Projected Market Size (2035) | USD 23.7 billion |

| CAGR (2025 to 2035) | 4.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions/Volume in kilotons |

| By Process | Natural, Artificial |

| By Nature | Organic Compliant and Certified, Kosher Certified, Conventional |

| By Form | Liquid, Powder |

| By Distribution Channel | Direct Sales, Indirect Sales, Store-based Retailing, Hypermarkets/Supermarkets, Convenience Stores, Discount Stores, Independent Small Groceries, Online Retail |

| Regions Covered | North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia, Oceania |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Koninklijke DSM, CSK Food Enrichment, The Tatua Cooperative Dairy Company, Arla Foods Ingredients Group, Cargill Incorporated, Archer Daniels Midland Company, Chr. Hansen Holding, DairyChem, Epi Ingredients, Ingredion Incorporated, Dairy Connection, Novozymes, Socius Ingredients |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The global cultured non-fat dairy ingredients market is estimated to be valued at USD 15.1 billion in 2025.

The market size for the cultured non-fat dairy ingredients market is projected to reach USD 23.7 billion by 2035.

The cultured non-fat dairy ingredients market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in cultured non-fat dairy ingredients market are natural and artificial.

In terms of nature, organic compliant and citified segment to command 47.6% share in the cultured non-fat dairy ingredients market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dairy Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Cultured Dairy Product Market Size and Share Forecast Outlook 2025 to 2035

Cultured Dairy Blends Market

Dairy Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Dairy Container Market Analysis Size and Share Forecast Outlook 2025 to 2035

Dairy Packaging Market Size and Share Forecast Outlook 2025 to 2035

Dairy Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Cultured Wheat Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ingredients Market for Plant-based Food & Beverages Size and Share Forecast Outlook 2025 to 2035

Dairy Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Filtration Systems Market Size and Share Forecast Outlook 2025 to 2035

Dairy Concentrate Market Forecast and Outlook 2025 to 2035

Dairy Testing Services Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Dairy-Free Smoothies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy-Based Dressings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy-Free Spreads Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Blends Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Whiteners Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cultured Meat Market Insights - Lab-Grown Innovation & Market Expansion 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA