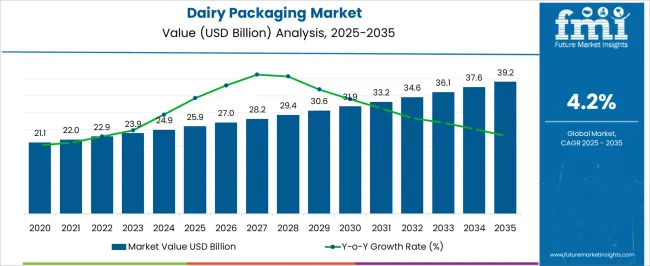

The dairy packaging market is projected at USD 25.9 billion in 2025 and anticipated to reach USD 39.2 billion by 2035, advancing at a CAGR of 4.2% over the ten-year horizon. During this decade-long comparison, the industry is expected to grow steadily, influenced by shifting consumer preferences, rising dairy consumption, and the evolution of packaging formats that prioritize safety and convenience. In 2025, the market stands at USD 25.9 billion, with cartons, pouches, and rigid plastics dominating product formats.

By 2030, the industry is expected to cross USD 31.9 billion, supported by increasing adoption of lightweight materials, improved sealing technologies, and growing exports of processed dairy products. The second half of the decade is marked by enhanced demand for functional packaging that ensures extended shelf life, greater portability, and improved design appeal. Emerging regions are anticipated to witness the fastest adoption due to expanding dairy processing industries and broader retail penetration. By 2035, the market will achieve USD 39.2 billion, underscoring the role of packaging not only in protecting dairy but also in meeting branding and sustainability requirements that influence consumer loyalty.

| Metric | Value |

|---|---|

| Dairy Packaging Market Estimated Value in (2025 E) | USD 25.9 billion |

| Dairy Packaging Market Forecast Value in (2035 F) | USD 39.2 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

The dairy packaging market is shaped by five interconnected parent markets, each contributing a distinct share to overall demand. The food and beverage packaging market holds the largest share at 35%, as dairy is one of the highest consumed food categories, requiring reliable packaging to ensure freshness and product safety. The retail and supermarket distribution market contributes 25%, reflecting the rising influence of modern trade channels, where packaged milk, cheese, yogurt, and butter are presented in consumer-friendly formats for wider shelf appeal.

The foodservice and hospitality market accounts for 15%, with hotels, cafes, and restaurants depending on packaged dairy for portion control and convenience. The packaging materials market represents 15%, with plastics, paperboard, and flexible pouches driving cost efficiency, shelf life, and portability of dairy products. The export and international trade market provides 10%, supported by the rising global exchange of dairy products that demand tamper-proof, durable, and regulatory-compliant packaging.

The dairy packaging market is experiencing stable growth as demand for safe, sustainable, and shelf stable packaging solutions intensifies across global dairy supply chains. Shifts in consumer behavior toward fresh and convenient dairy formats have prompted manufacturers to invest in packaging that extends product life and ensures tamper evidence.

Advances in aseptic technologies, lightweight materials, and recyclable packaging formats are reinforcing adoption across liquid and solid dairy product lines. With increasing urbanization and cold chain infrastructure development, particularly in emerging economies, packaging innovations are enabling better reach and product safety.

Regulatory emphasis on food contact compliance, recyclability, and labeling transparency is also influencing packaging choices. The market outlook remains positive as dairy processors focus on enhancing brand visibility, reducing packaging waste, and optimizing transportation efficiency.

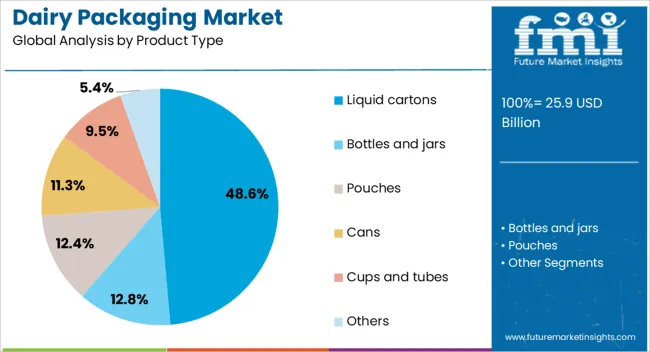

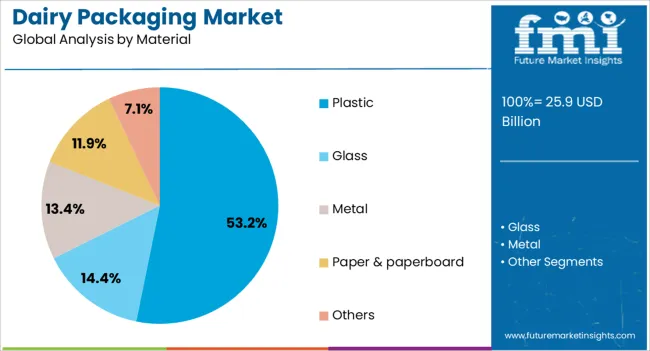

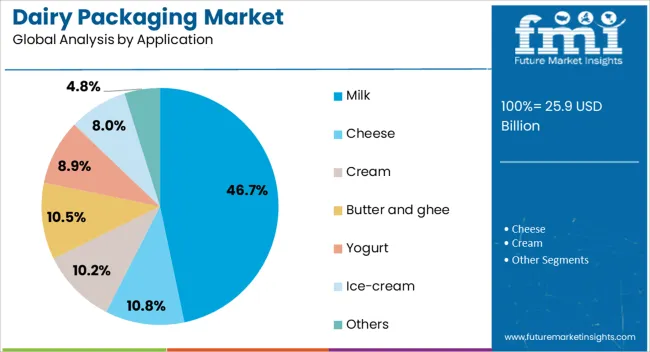

The dairy packaging market is segmented by product type, material, application, and geographic regions. By product type, dairy packaging market is divided into Liquid cartons, Bottles and jars, Pouches, Cans, Cups and tubes, and Others. In terms of material, dairy packaging market is classified into Plastic, Glass, Metal, Paper & paperboard, and Others. Based on application, dairy packaging market is segmented into Milk, Cheese, Cream, Butter and ghee, Yogurt, Ice-cream, and Others.

Regionally, the dairy packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The liquid cartons segment is projected to hold 48.60% of total market revenue by 2025 under the product type category, making it the leading segment. This is due to its ability to provide superior barrier protection against light and oxygen while maintaining the nutritional integrity of dairy products.

Cartons are also favored for their lightweight nature, ease of stacking, and improved storage efficiency. Their recyclability and compatibility with aseptic filling systems support long shelf life without refrigeration, making them suitable for extended distribution channels.

These attributes have driven preference among manufacturers seeking cost effective and sustainable packaging formats, solidifying liquid cartons as the dominant product type in the dairy packaging landscape.

The plastic segment is anticipated to contribute 53.20% of market revenue by 2025 within the material category, positioning it as the leading material type. This dominance is attributed to its durability, flexibility, and excellent protective properties, which are essential for preserving freshness and preventing contamination.

Plastics also support a wide variety of packaging forms, such as bottles, tubs, pouches, and films, that cater to diverse dairy applications. Continued advancements in recyclable and bio based plastic materials have enhanced their appeal amid rising environmental concerns.

As dairy brands seek packaging that balances performance with sustainability, plastic remains the material of choice due to its versatility and cost effectiveness.

The milk segment is expected to account for 46.70% of total market revenue by 2025 under the application category, making it the most significant end use area. This is driven by the high volume consumption of milk across households and food service sectors, necessitating consistent and efficient packaging solutions.

Packaging formats for milk are expected to maintain product safety, enable longer shelf life, and meet regulatory requirements for hygiene and labeling. Innovations in resealable caps, tamper evident closures, and portion controlled sizes have enhanced user convenience and safety.

The widespread availability of both chilled and ambient milk products across retail formats further supports the dominance of this application in the dairy packaging market.

The dairy packaging market is driven by rising consumption, retail expansion, material diversity, and export demand. Packaging innovation ensures product safety, shelf appeal, and compliance across global supply chains.

The dairy packaging market is expanding due to rising global consumption of milk, cheese, yogurt, and butter, which depend on effective packaging for preservation and safe distribution. Growth in ready-to-drink milk and flavored dairy beverages has increased the demand for portable formats such as cartons, bottles, and pouches. Consumers prefer packaging that ensures hygiene, longer shelf life, and easy handling. With dairy products being highly perishable, packaging plays a vital role in protecting nutritional quality during storage and transport. Both developed and emerging regions are witnessing stronger adoption of packaged dairy, making packaging innovations central to industry competitiveness. The expanding dairy trade has also reinforced the need for durable export-ready formats.

The retail and supermarket sector has become a critical factor shaping the dairy packaging market. Modern trade formats and organized retail demand products with attractive presentation, clear labeling, and convenient usage. Cartons and rigid plastics dominate display shelves due to their appeal and ability to carry brand messaging. Online grocery channels are also creating demand for tamper-proof, leak-resistant packaging that ensures safe doorstep delivery. Retailers emphasize shelf-ready packaging to streamline stocking and improve visibility. In emerging economies, the rise of hypermarkets and convenience stores is increasing the adoption of standardized packaging formats that extend reach to a wider consumer base. Retail expansion continues to directly influence both packaging design and material selection.

Material preferences are reshaping the dairy packaging market, as manufacturers adopt a balanced mix of rigid plastics, flexible pouches, glass, and paperboard to meet diverse consumer expectations. Rigid plastics remain popular for milk and yogurt due to durability, while cartons and paperboard are gaining prominence for their lightweight and versatile applications. Flexible pouches are widely used for cost-effective single-serve and bulk milk packaging. Glass containers maintain a niche appeal in premium segments, particularly for high-end milk and artisanal dairy products. Each material type offers distinct advantages in preservation, handling, and branding, creating a competitive mix in the industry. This diversity ensures manufacturers can cater to different price points and consumption patterns.

International trade in dairy products is generating new opportunities for packaging companies, as cross-border shipments demand reliable and compliant solutions. Export of powdered milk, cheese, and butter requires packaging that withstands long transit times while ensuring freshness. Tamper-proof features, vacuum sealing, and moisture-resistant formats are increasingly adopted to maintain product quality in overseas markets. Compliance with international food safety standards is another driving factor, pushing manufacturers to invest in specialized packaging technologies. Growth in dairy exports from countries such as New Zealand, the United States, and parts of Europe is creating steady demand for export-oriented packaging solutions. As the dairy trade expands, packaging companies are securing growth by catering to diverse international requirements.

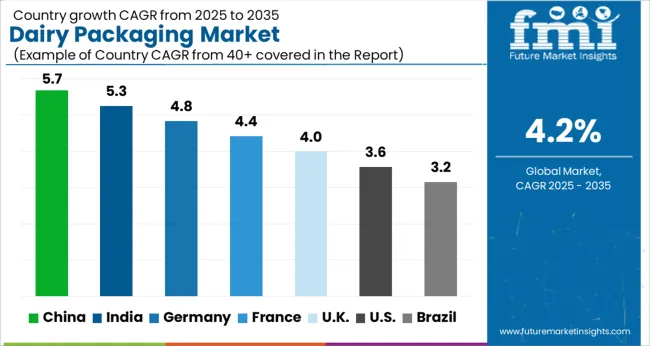

| Country | CAGR |

|---|---|

| China | 5.7% |

| India | 5.3% |

| Germany | 4.8% |

| France | 4.4% |

| UK | 4.0% |

| USA | 3.6% |

| Brazil | 3.2% |

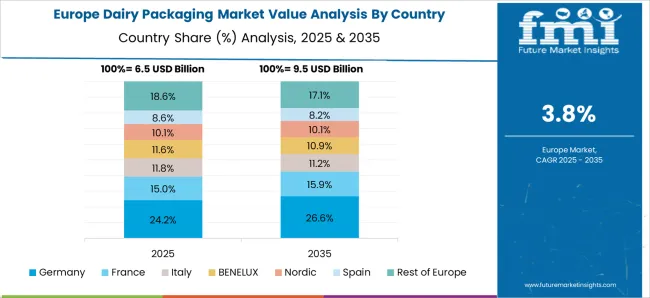

The global dairy packaging market is projected to grow at a CAGR of 4.2% from 2025 to 2035. China leads with 5.7%, followed by India at 5.3%, Germany at 4.8%, France at 4.4%, the UK at 4.0%, and the USA at 3.6%. Growth is supported by rising consumption of packaged milk, cheese, butter, and yogurt, coupled with advancements in lightweight, durable, and extended shelf-life formats. BRICS nations, particularly China and India, are driving expansion through higher dairy production, wider retail penetration, and investment in flexible packaging. OECD economies such as Germany, France, the UK, and the USA emphasize premium packaging, compliance with safety standards, and branding-led differentiation. Increasing exports of dairy products and demand for portion-controlled, convenient packaging formats are accelerating opportunities across global markets. The analysis includes over 40+ countries, with the leading markets detailed below.

The dairy packaging market in China is projected to grow at a CAGR of 5.7% from 2025 to 2035, supported by rising dairy consumption and expanding exports of milk, yogurt, and cheese. Domestic producers are investing in flexible pouches, cartons, and lightweight plastics to meet growing consumer demand for convenience and shelf stability. Urban supermarkets and e-commerce platforms are increasing requirements for tamper-proof and attractive packaging formats. Export-oriented dairy producers demand moisture-resistant, durable, and regulatory-compliant packaging to access international markets. Collaboration between packaging manufacturers and dairy processors has led to the adoption of portion-controlled packs suitable for younger demographics and busy professionals. This growth trajectory highlights how packaging innovation is essential to maintaining quality, extending shelf life, and capturing consumer loyalty across diverse channels.

The dairy packaging market in India is expected to grow at a CAGR of 5.3% from 2025 to 2035, driven by strong demand for packaged milk, curd, and butter across both urban and rural markets. Increasing retail penetration, combined with the rise of organized dairy cooperatives and private brands, has boosted demand for cost-efficient yet reliable packaging. Flexible packaging, particularly pouches, dominates due to its affordability and widespread consumer acceptance. Paperboard cartons and rigid plastics are gradually expanding in premium segments, such as flavored milk and probiotic yogurt. Government initiatives promoting dairy exports are creating new opportunities for export-compliant packaging. Manufacturers are focusing on affordability, tamper resistance, and easy handling to cater to diverse income groups, ensuring steady adoption across regions.

The dairy packaging market in Germany is projected to rise at a CAGR of 4.8% from 2025 to 2035, fueled by high consumer demand for yogurt, cheese, and specialty dairy products. Strong emphasis on product quality, safety, and branding has encouraged producers to invest in innovative carton and rigid plastic solutions. Portion-sized packs and resealable designs are gaining popularity among busy consumers. Supermarkets demand packaging that enhances shelf visibility and meets strict labeling regulations, while premium dairy brands favor eye-catching formats for differentiation. Export markets for German cheese and milk powder also require compliance with strict international safety standards, creating steady opportunities for packaging firms. Growth is sustained by Germany’s established dairy industry and its emphasis on high-value packaging formats.

The dairy packaging market in the United Kingdom is anticipated to grow at a CAGR of 4.0% between 2025 and 2035. Consumer preferences for cheese, butter, and flavored dairy products are shaping packaging requirements that emphasize convenience and freshness. Retailers prioritize shelf-ready and eco-conscious packaging formats that improve logistics efficiency and product presentation. Pouches and cartons dominate milk packaging, while premium cheese brands increasingly favor rigid plastics and paperboard solutions for branding appeal. Export-focused producers seek tamper-proof packaging that ensures compliance with EU and global regulations. With rising online grocery sales, demand for durable and leak-proof packaging formats has increased. These developments highlight a balanced growth trajectory for packaging across both domestic and international channels.

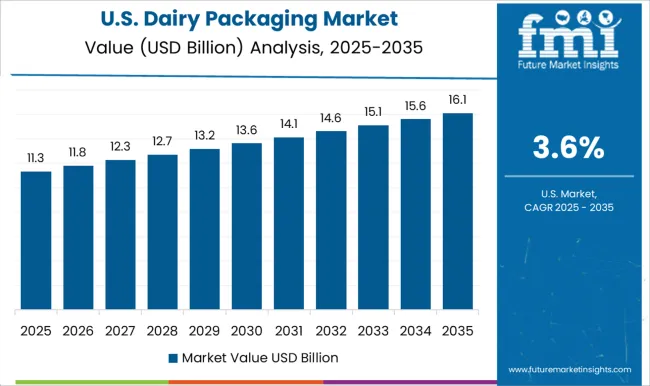

The dairy packaging market in the United States is expected to expand at a CAGR of 3.6% from 2025 to 2035, supported by demand for milk, cheese, and yogurt in both retail and foodservice channels. Packaged cheese and single-serve yogurt cups dominate growth, supported by convenience-focused lifestyles. Producers are adopting rigid plastics, cartons, and multilayer films to improve product preservation and branding appeal. The export of milk powder and cheese to Asia and the Middle East requires packaging formats that are tamper-resistant and suitable for long-distance shipping. Retail chains emphasize private-label packaging with distinctive designs, encouraging packaging firms to offer customized solutions. The steady growth outlook reflects a mature but evolving market with strong emphasis on convenience, branding, and export readiness.

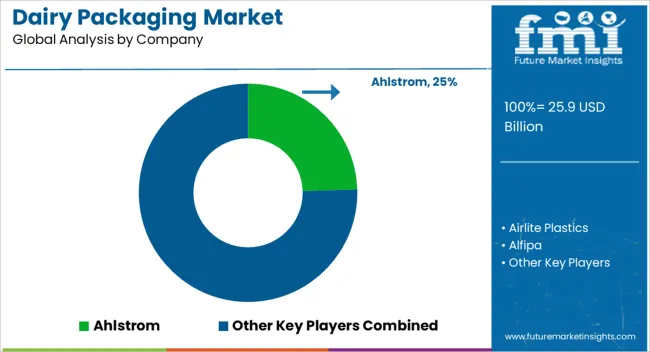

The dairy packaging market is shaped by global packaging manufacturers, regional suppliers, and specialized food-grade packaging solution providers catering to liquid and processed dairy products. Leading players such as Tetra Pak, Amcor, SIG Combibloc, and Berry Global hold strong positions by offering diversified portfolios of cartons, pouches, bottles, and aseptic packaging solutions for milk, yogurt, cheese, and flavored dairy beverages. Competitive differentiation is largely driven by packaging durability, material quality, shelf-life extension, sustainability features, and compliance with food safety regulations such as FDA and EFSA standards. Regional manufacturers, particularly in Asia-Pacific and Europe, compete by providing cost-effective solutions, customized designs, and localized technical support for dairy processors and retailers.

Strategic partnerships with dairy brands, bottlers, and cold chain distributors enhance market reach and operational efficiency. Innovation in biodegradable materials, recyclable packaging, aseptic processing, and smart packaging technologies further strengthens competitive positioning. Companies prioritizing environmental compliance, quality assurance, and robust supply chains are well-positioned to capture significant market share.

| Item | Value |

|---|---|

| Quantitative Units | USD 25.9 Billion |

| Product Type | Liquid cartons, Bottles and jars, Pouches, Cans, Cups and tubes, and Others |

| Material | Plastic, Glass, Metal, Paper & paperboard, and Others |

| Application | Milk, Cheese, Cream, Butter and ghee, Yogurt, Ice-cream, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ahlstrom, Airlite Plastics, Alfipa, Amcor, Berry Global, CDF Corporation, CKS Packaging, Elopak, Huhtamaki, International Paper, Mondi, Point Five Packaging, SABIC, Sealed Air, SIG, Smurfit Kappa, Stanpac, Stora Enso, WestRock, and Winpak |

| Additional Attributes | Dollar sales, share, regional demand distribution, growth drivers, competitive positioning, regulatory landscape, end-use adoption patterns, pricing trends, and upcoming opportunities shaping future expansion. |

The global dairy packaging market is estimated to be valued at USD 25.9 billion in 2025.

The market size for the dairy packaging market is projected to reach USD 39.2 billion by 2035.

The dairy packaging market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in dairy packaging market are liquid cartons, bottles and jars, pouches, cans, cups and tubes and others.

In terms of material, plastic segment to command 53.2% share in the dairy packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dairy Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Dairy Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Dairy Product Packaging Companies

Dairy Container Market Analysis Size and Share Forecast Outlook 2025 to 2035

Dairy Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Filtration Systems Market Size and Share Forecast Outlook 2025 to 2035

Dairy Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Dairy Concentrate Market Forecast and Outlook 2025 to 2035

Dairy Testing Services Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Dairy-Free Smoothies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy-Based Dressings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy-Free Spreads Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Blends Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Whiteners Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Dairy Flavors Market Trends - Growth & Industry Forecast 2025 to 2035

Dairy-Free Evaporated Milk Market Analysis by Application, Type, Sales Channel Through 2025 to 2035

Dairy Protein Crisps Market Flavor, Packaging, Application and Distribution Channel Through 2025 to 2035

Dairy Products Market Analysis by Product Type, End Use, Distribution Channel and Region through 2035

Dairy-Free Cream Market Insights – Plant-Based Dairy Alternatives 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA