The dairy concentrate market is estimated to be valued at USD 23.2 billion in 2025 and is projected to reach USD 48.7 billion by 2035, registering a CAGR of 7.7% over the forecast period. The dairy concentrate market is projected to add an absolute dollar opportunity of USD 15.5 billion over the forecast period.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 23.2 billion |

| Forecast Value in (2035F) | USD 48.7 billion |

| Forecast CAGR (2025 to 2035) | 7.7% |

This reflects a 1.83 times growth at a compound annual growth rate of 7.7%. The market's evolution is expected to be shaped by rising demand for high-protein nutritional products, convenience foods, and functional dairy ingredients, particularly where enhanced nutritional profiles and extended shelf life are required.

By 2030, the market is likely to reach approximately USD 25.3 billion, accounting for USD 6.6 billion in incremental value over the first half of the decade. The remaining USD 8.9 billion is expected during the second half, suggesting a moderately back-loaded growth pattern. Product innovation in protein concentration and clean-label formulations is gaining traction due to dairy concentrate's favorable nutritional advantages and functional properties.

Companies such as Nestlé and Fonterra are advancing their competitive positions through investment in advanced processing technologies and scalable concentration systems. Health-conscious procurement models are supporting expansion into sports nutrition, infant formula, and functional food applications. Market performance will remain anchored in nutritional efficacy, processing innovation, and clean-label compliance benchmarks.

The dairy concentrate market holds approximately 42% of the functional dairy ingredients market, driven by its superior nutritional density, extended shelf life, and suitability for various food and beverage applications. It accounts for around 35% of the protein fortification ingredients market, supported by its high protein content and compatibility with sports nutrition and health supplements.

The market contributes nearly 28% to the dairy processing ingredients market, particularly for applications requiring concentrated nutritional profiles and functional properties. It holds close to 24% of the infant nutrition ingredients market, where dairy concentrates are essential for meeting specific nutritional requirements. The share in the clean label ingredients market reaches about 31%, reflecting its preference among manufacturers seeking natural, minimally processed dairy solutions.

The market is undergoing structural changes driven by rising demand for high protein, nutrient dense, and convenient food products. Advanced concentration technologies using membrane filtration, spray drying, and freeze concentration have enhanced nutritional profiles, functional properties, and shelf stability, making dairy concentrates viable alternatives to traditional dairy ingredients.

Manufacturers are introducing specialized formulations and customized concentration levels tailored for specific applications, expanding their role beyond basic protein supplementation. Strategic collaborations between dairy processors and food manufacturers have accelerated adoption in functional foods and beverages. Clean label positioning and nutritional transparency have widened consumer acceptance, reshaped traditional ingredient sourcing and forcing conventional dairy suppliers to adapt.

Dairy concentrate's superior nutritional density, functional properties, and extended shelf life make it an attractive ingredient for health conscious consumers and food manufacturers seeking high quality protein and nutritional enhancement solutions. This growth is driven by increasing awareness of protein rich diets and functional foods, which is further propelling adoption, especially in sports nutrition, infant formula, and health supplement sectors.

Government initiatives promoting nutritional fortification, along with innovations in concentration technology, are also enhancing product quality and application versatility. Market expansion is supported by technological improvements in concentration processes that ensure nutritional stability during manufacturing and storage.

As health and wellness trends accelerate across demographics and clean label preferences become critical, the market outlook remains favorable. With consumers and manufacturers prioritizing nutritional density, protein quality, and functional benefits, dairy concentrates are well positioned to expand across various food, beverage, and nutraceutical applications. This growth trajectory is anchored in the ingredient's ability to deliver concentrated nutrition while maintaining production efficiency and controlling moisture content in final products.

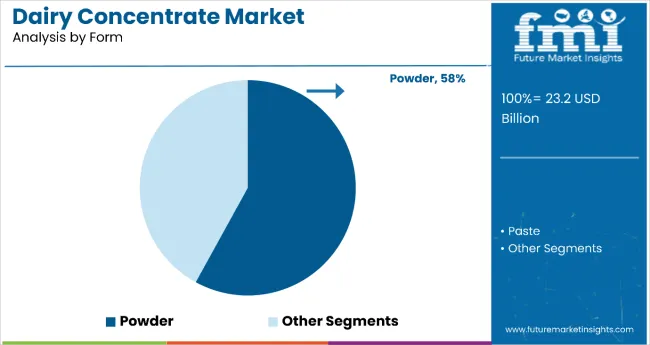

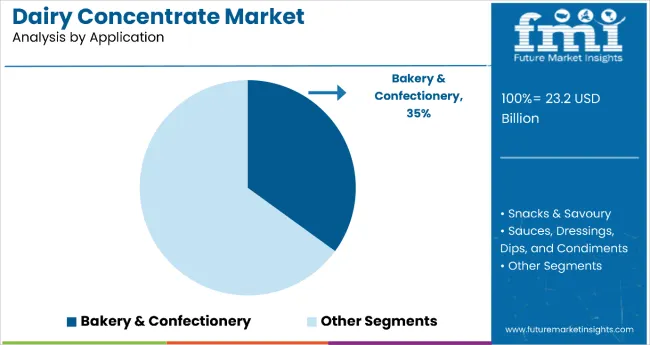

The market is segmented into form, application, and regions. By form, the market is divided into powder and paste. By application, the market is segmented into snacks & savoury, bakery & confectionery, sauces, dressings, dips, and condiments, ready meals, and other specialized uses. By region, the market is classified into North America, Europe, Asia-Pacific, Latin America, Middle East & Africa.

The powder form segment holds a dominant position with 58% of the market share in the form category, owing to its extended shelf life, ease of storage, and versatile reconstitution properties. Powdered dairy concentrates are widely used across food manufacturing sectors, including bakery, ready meals, and infant nutrition, due to their superior stability and convenience in dry blend formulations.

They enable manufacturers to deliver concentrated nutrition while maintaining production efficiency and controlling moisture content in final products. As demand for shelf stable, clean label, and nutrient dense ingredients grows, the powdered form continues to gain preference in both industrial and commercial applications.

Manufacturers are investing in spray drying technologies, micronization, and formulation improvements to enhance solubility, taste, and bioavailability. The segment is poised to expand further as global supply chains favor dry, lightweight, and transport efficient dairy formats.

Bakery & confectionery remains a core application segment with 35% of the market share in 2025, as dairy concentrates enhance flavor, moisture retention, and protein content in baked goods, fillings, and dairy based confections. Their functional versatility supports product innovation in clean label baked snacks, high protein cookies, and dairy forward chocolate fillings.

Dairy concentrates also improve shelf stability and textural uniformity in baked items, while offering dairy richness without the need for fresh milk. This makes them indispensable in industrial baking environments.

Ongoing demand for fortified indulgence and the premiumization of bakery items are key trends driving the sustained relevance of dairy concentrates in this application.

In 2024, global dairy concentrate consumption increased by 18% year on year, with Asia Pacific accounting for 38% of demand. Key drivers include growing use in high protein food fortification, nutritional supplements, and functional beverages. Restraints stem from processing complexity and cost intensive formulation.

Trends highlight clean label formulations, advanced concentration ratios, and ready to use dairy blends with integrated nutritional profiles. These innovations enhance transparency, simplify manufacturing, and support consumer confidence in protein rich, health focused products across global markets, positioning dairy concentrates as a preferred solution for versatile applications in food and beverage sectors.

Key Drivers Fueling Dairy Concentrate Market Expansion

Rising demand for protein rich diets and functional food products is the primary driver of dairy concentrate growth, supported by increasing health consciousness among consumers. These concentrates offer up to 85% protein content, significantly higher than conventional dairy components at 25-35%.

Their application in ready to drink formats ensures enhanced nutritional density while reducing serving sizes by up to 65%. Clean label requirements have increased adoption in premium product lines, driven by consumer preference for natural and minimally processed ingredients. Technological improvements in concentration processes ensure nutritional stability during manufacturing and storage, anchored in advanced membrane filtration and spray drying technologies.

Major Restraints Challenging Dairy Concentrate Market Development

Despite strong growth prospects, the market faces hurdles linked to raw material pricing, supply chain complexity, and specialized processing infrastructure. Milk price volatility, ranging from USD 15 to USD 25 per hundredweight, affects concentrate pricing and procurement planning. Concentration processes, combined with strict quality control, extend product development timelines by 4-6 weeks. Cold chain storage and specialized logistics increase distribution expenses by 15-20% compared to conventional dairy ingredients. Limited access to concentration capable facilities further restricts scalability, creating adoption barriers in cost sensitive regions.

Emerging Key Trends Influencing Dairy Concentrate Market Direction

Innovative concentration technologies and multi functional dairy blends are shaping the competitive landscape, driven by manufacturers introducing advanced formulations with enhanced solubility, heat stability, and improved amino acid profiles for broader application versatility. Clean label positioning has become a dominant trend, appealing to consumers seeking natural and transparent ingredient solutions. Ready to use concentrate systems offered by technology providers are reducing complexity for food manufacturers, supported by technological partnerships and integrated processing solutions. Regional adoption patterns show Asia Pacific leading growth, supported by rising demand for protein rich convenience products and fortified beverages across urban populations.

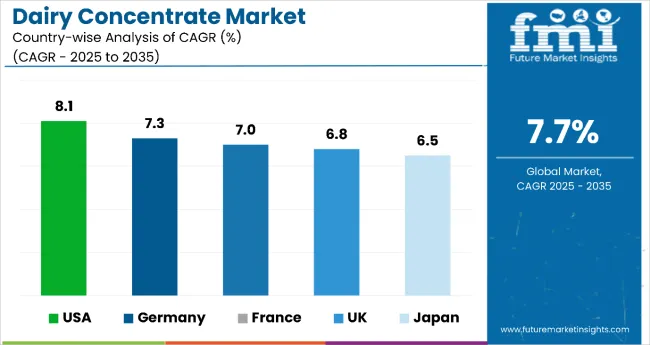

| Countries | CAGR |

|---|---|

| USA | 8.1% |

| Germany | 7.3% |

| France | 7% |

| UK | 6.8% |

| Japan | 6.5% |

In the dairy concentrate market, the USA leads with the highest projected CAGR of 8.1% from 2025 to 2035, driven by robust demand in sports and medical nutrition. Germany follows closely with a CAGR of 7.3%, supported by clean label innovations and functional food applications. France is next at 7.0%, benefiting from artisanal and premium food integration. The UK shows moderate growth at 6.8%, constrained by supply challenges but supported by sports nutrition demand. Japan, with a CAGR of 6.5%, experiences steady expansion fueled by precision nutrition and aging population needs, reflecting a regional pivot toward high quality and specialized dairy applications.

The report covers an in depth analysis of 40+ countries; five top performing OECD countries are highlighted below.

The revenue from dairy concentrate in the USA is projected to grow at a CAGR of 8.1% from 2025 to 2035, slightly ahead of the global average. Growth is fueled by demand for high protein dairy ingredients in sports nutrition, medical nutrition, and clean label food manufacturing across major urban regions such as California, Illinois, and Texas. USA dairy processors are investing in protein isolation and microfiltration technologies to improve quality and functional performance, supported by strong export activity and rising domestic demand for fortified foods and beverages.

Key Statistics

The dairy concentrate market in Germany is anticipated to expand at a CAGR of 7.3% from 2025 to 2035, exceeding the global rate by 0.9%. Growth is centered on functional food innovation and premium nutritional applications in Munich, Hamburg, and Frankfurt regions, driven by advanced concentration technologies and clean label dairy ingredients.

These ingredients are being deployed for sports nutrition, clinical nutrition, and specialty food applications, supported by dairy concentrate partnerships between German food technology companies and European dairy cooperatives. EU nutritional labeling standards and German food safety regulations support practical dairy concentrate application development.

Key Statistics

The sales of dairy concentrate in France are slated to flourish at a CAGR of 7.0% from 2025 to 2035, marginally above the global average. Growth has been concentrated in premium dairy applications and artisanal food production in Paris, Lyon, and Bordeaux regions, driven by dairy concentrate adoption shifting from industrial applications toward specialized nutrition and gourmet food enhancement. Custom concentration services and specialized processing capabilities lead commercial dairy concentrate deployment, supported by domestic dairy technology partnerships and increased collaboration between French dairy cooperatives and food ingredient companies.

Key Statistics

The revenue from dairy concentrate in the UK is expected to grow at a CAGR of 6.8% from 2025 to 2035, underperforming the global average by 0.3%. Demand is driven by sports nutrition growth and functional food development in London, Manchester, and Edinburgh markets, supported by health supplement manufacturers and protein product companies increasingly adopting dairy concentrates for product differentiation and nutritional enhancement.

Dairy concentrate costs remain elevated due to limited domestic concentration capacity and reliance on European suppliers post Brexit trade arrangements. Market growth is shifting toward premium protein products and specialized nutritional applications, especially among fitness focused demographics, anchored in government nutrition guidelines that have helped promote protein consumption.

Key Statistics

The dairy concentrate market in Japan is projected to rise at a CAGR of 6.5% from 2025 to 2035, supported by strong demand for precision nutrition and high quality dairy applications. Urban markets like Tokyo, Osaka, and Nagoya are experiencing a shift toward protein fortified foods, infant nutrition products, and functional beverages, driven by domestic dairy companies leveraging imported and domestic concentrates to meet quality expectations for clean label and premium positioned goods.

Key Statistics

The dairy concentrate market is moderately consolidated, featuring a mix of global dairy giants, specialized ingredient companies, and regional processors with varying degrees of concentration technology, product innovation, and application expertise. Nestlé S.A. and Fonterra Co-operative Group lead the milk based concentrate segment, supplying advanced nutritional ingredients for infant formula, sports nutrition, and functional food applications. Their strength lies in comprehensive dairy processing capabilities, global distribution networks, and established relationships with major food manufacturers.

Arla Foods Ingredients and Lactalis Ingredients differentiate through specialized concentration technologies, custom formulation services, and application specific solutions that cater to premium nutrition and pharmaceutical applications. Dairy Farmers of America Inc. and Glanbia Nutritionals focus on large scale protein concentrate production, addressing growing demand for sports nutrition, functional beverages, and industrial food ingredient applications.

Regional specialists such as FrieslandCampina, Saputo Inc., and Kerry Group emphasize processing innovation, clean label positioning, and sustainable dairy sourcing, creating value in premium ingredient markets and specialized nutrition applications.

Entry barriers remain significant, driven by challenges in advanced processing technology, dairy supply chain integration, and compliance with food safety and nutritional standards across multiple application categories. Competitiveness increasingly depends on concentration efficiency, nutritional customization capabilities, and application development expertise for diverse food and nutrition manufacturing environments.

Key Developments in the Dairy Concentrate Market

Dairy Farmers of America (DFA) launched new products like TruMoo Zero Whole Chocolate Milk (lactose free, zero added sugar), Borden Cheese's "Flavor Sensations" bold flavored slices, and Milk50™, a 50 calorie nutrient rich real dairy milk.

| Item | Value |

|---|---|

| Quantitative Units | USD 23.2 Billion |

| Form | Powder, Paste |

| Application | Snacks & Savoury, Bakery & Confectionery, Sauces, Dressings, Dips, And Condiments, Ready Meals, And Other Specialized Uses |

| Regions Covered | North America, Europe, Latin America, East Asia, South Asia, Oceania, Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia, and 40+ countries |

| Key Companies Profiled | Dairy Farmers of America Inc., The Kraft Heinz Company, Land O’ Lakes Inc., All American Foods, Bluegrass Dairy & Food Inc., First Choice Ingredients Inc., Archer Daniels Midland Company, Edlong Dairy Technologies, Ingredion Incorporated, Kerry Group Plc., Vika BV, Fromatech Ingredients B.V., Thornico A/S, and Kanegrade Ltd. |

| Additional Attributes | Dollar sales by product type and concentration level, regional demand trends, competitive landscape, buyer preferences for liquid versus powder formats, integration with clean-label positioning and nutritional profiling, innovations in membrane filtration, spray drying, and sustainable processing methods for enhanced nutritional density and functional properties. |

The global dairy concentrate market is estimated to be valued at USD 23.2 billion in 2025.

The market size for the dairy concentrate market is projected to reach USD 48.7 billion by 2035.

The dairy concentrate market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The powder form is projected to lead in the dairy concentrate market with 58% market share in 2025.

In terms of application, bakery & confectionery segment to command 35% share in the dairy concentrate market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dairy Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Dairy Container Market Analysis Size and Share Forecast Outlook 2025 to 2035

Dairy Packaging Market Size and Share Forecast Outlook 2025 to 2035

Dairy Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Dairy Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Filtration Systems Market Size and Share Forecast Outlook 2025 to 2035

Dairy Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Dairy Testing Services Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Dairy-Free Smoothies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy-Based Dressings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy-Free Spreads Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Blends Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Whiteners Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Dairy Flavors Market Trends - Growth & Industry Forecast 2025 to 2035

Dairy-Free Evaporated Milk Market Analysis by Application, Type, Sales Channel Through 2025 to 2035

Dairy Protein Crisps Market Flavor, Packaging, Application and Distribution Channel Through 2025 to 2035

Dairy Products Market Analysis by Product Type, End Use, Distribution Channel and Region through 2035

Dairy-Free Cream Market Insights – Plant-Based Dairy Alternatives 2025 to 2035

Dairy Snacks Market Growth - Consumer Preferences & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA