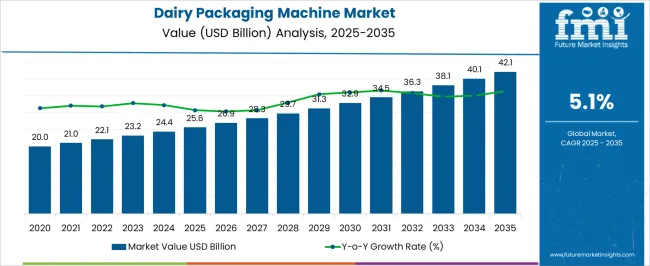

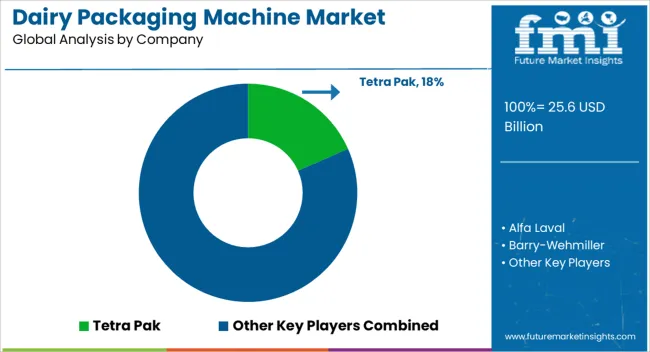

The dairy packaging machine market demonstrates a consistent upward trajectory, increasing from USD 25.6 billion in 2025 to USD 42.1 billion by 2035, at a compound annual growth rate (CAGR) of 5.1%. CAGR is a critical performance indicator as it captures the compounded effect of growth over time rather than simple year-on-year increments. In this market, the steady 5.1% CAGR illustrates how consistent expansion, when compounded annually, results in a substantial long-term market size increase.

The yearly progression from USD 20.0 billion in 2020 to USD 42.1 billion in 2035 highlights not just rising demand for dairy products but also the expanding need for automated, efficient, and hygienic packaging technologies. By 2030, the market is projected to reach USD 32.9 billion, marking a pivotal milestone where the adoption of sustainable and digitalized packaging technologies becomes mainstream. This growth pattern underscores the importance of CAGR in understanding not just linear scaling but also the underlying structural shifts shaping industry dynamics.

The CAGR further reflects factors such as increased urbanization, changing consumer preferences toward packaged dairy products, and stricter regulatory frameworks requiring advanced packaging standards. For stakeholders, the CAGR analysis confirms the market’s potential for predictable returns, scalability, and technological innovation, ensuring long-term opportunities in machinery, automation, and sustainable packaging solutions.

| Metric | Value |

|---|---|

| Dairy Packaging Machine Market Estimated Value in (2025 E) | USD 25.6 billion |

| Dairy Packaging Machine Market Forecast Value in (2035 F) | USD 42.1 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The dairy packaging machine market is strongly influenced by five interconnected parent industries, each shaping its growth, adoption, and innovation trajectory. The food and beverage packaging machinery market contributes the largest share at 32%, as dairy products form a core element of daily consumption across the globe. Manufacturers prioritize automated packaging for hygiene, quality, and efficiency, driving sustained investments in machinery that can handle high volumes with minimal contamination risk. The dairy processing equipment market follows with 25%, as packaging machines are deeply integrated into the production of milk, yogurt, cheese, butter, and cream. These systems are essential for extending shelf life, maintaining product integrity, and complying with stringent international food safety standards. The flexible and rigid packaging market accounts for 18%, fueled by the rising preference for bottles, cartons, pouches, tubs, and cups. Each format requires specialized packaging machines that adapt to varied material properties and consumer needs. The automated filling and sealing equipment market adds 15%, supported by the strong demand for precision filling, advanced sealing, and tamper-proof capping technologies, which enhance accuracy while reducing wastage. The sustainable and smart packaging market holds a 10% share, reflecting industry-wide moves toward recyclable, biodegradable, and intelligent packaging solutions that align with global eco-regulations and consumer expectations.

The dairy packaging machine market is witnessing consistent expansion, supported by rising global dairy consumption, increasing emphasis on product safety, and the need for extended shelf life in highly perishable products. Technological advancements have enabled higher production efficiency, improved hygiene standards, and greater adaptability to diverse dairy product formats.

Demand is being reinforced by automation adoption in both large-scale processing facilities and emerging regional dairies seeking cost optimization and operational scalability. Flexible production lines, quick changeover capabilities, and integration with advanced monitoring systems are driving purchasing decisions among manufacturers.

Global trade in dairy products and the proliferation of value-added dairy offerings are further stimulating equipment upgrades and replacements. Over the forecast period, market growth is expected to be supported by sustainability-driven innovations, such as energy-efficient machinery and eco-friendly packaging compatibility, alongside capacity expansions in developing economies to meet growing domestic and export-oriented dairy demand.

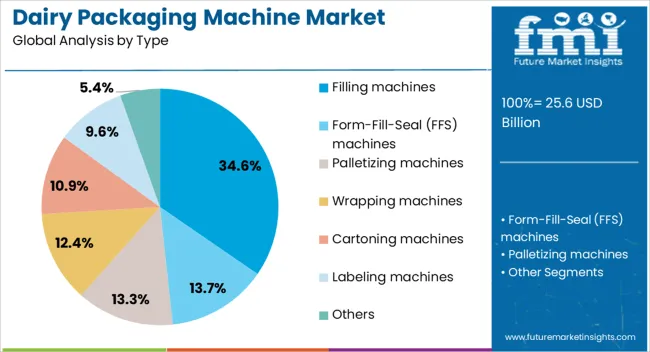

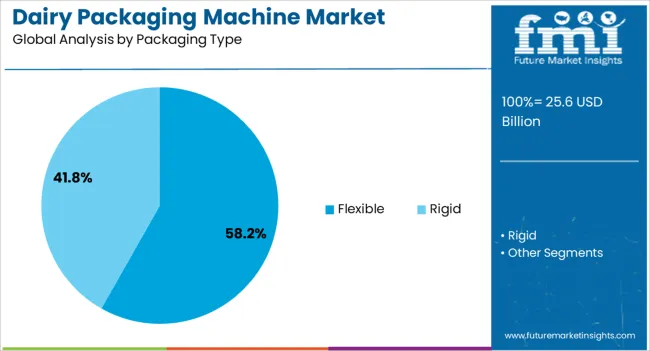

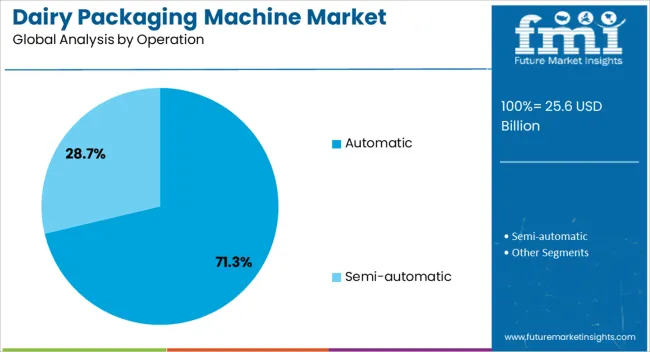

The dairy packaging machine market is segmented by type, packaging type, operation, application, distribution channel, and geographic regions. By type, dairy packaging machine market is divided into Filling machines, Form-Fill-Seal (FFS) machines, Palletizing machines, Wrapping machines, Cartoning machines, Labeling machines, and Others. In terms of packaging type, dairy packaging machine market is classified into Flexible and Rigid. Based on operation, dairy packaging machine market is segmented into Automatic and Semi-automatic. By application, dairy packaging machine market is segmented into Milk, Fresh dairy products, Butter & buttermilk, Milk powder, and Others. By distribution channel, dairy packaging machine market is segmented into Direct and Indirect. Regionally, the dairy packaging machine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The filling machines segment, holding 34.60% of the type category, maintains its lead due to its pivotal role in ensuring precise portion control, product hygiene, and operational efficiency in dairy packaging lines. Its dominance is supported by high adaptability across a range of dairy formats, from milk and yogurt to cream-based products.

The segment benefits from integration with advanced sealing and sterilization technologies, reducing contamination risks and meeting stringent regulatory requirements. Automated filling lines are increasingly being deployed to reduce labor dependency and enhance throughput consistency, particularly in high-volume production environments.

Cost efficiency, coupled with advancements in multi-format filling capability, has solidified the segment’s position, while R&D investments in high-speed, low-wastage systems are expected to sustain its competitive advantage over the forecast period.

The flexible packaging type segment, with a 58.20% share, leads the market by offering cost-effective, lightweight, and versatile solutions that cater to both consumer convenience and logistical efficiency. Its prominence is reinforced by the growing popularity of pouches, sachets, and flexible films, which enable portion control and reduce material usage.

Compatibility with automated filling and sealing machines enhances production speed while minimizing operational costs. The segment’s adoption is also being driven by the increasing focus on sustainable materials, where biodegradable and recyclable films are gaining traction.

Flexible packaging’s ability to adapt to varied dairy product viscosities and formats ensures its relevance across diverse product lines. Continuous innovation in barrier properties and printing technologies is expected to further strengthen its market leadership.

The automatic operation segment, capturing 71.30% of the market, dominates due to its capacity to deliver high-speed, consistent, and hygienic packaging processes essential for dairy product safety and shelf life. Automation reduces human handling, thereby lowering contamination risks and ensuring compliance with strict food safety regulations.

High-volume dairy processors particularly favor fully automated systems for their efficiency, precision, and integration with advanced monitoring and quality control systems. The segment’s growth is being reinforced by labor cost pressures, a shortage of skilled operators, and the need for 24/7 production capabilities.

Technological advancements in robotics, machine learning-driven adjustments, and predictive maintenance are enhancing operational reliability and reducing downtime, securing the segment’s position as the preferred choice for large-scale dairy packaging operations.

The dairy packaging machine market is expanding as producers prioritize efficiency, hygiene, and extended shelf life across milk, cheese, yogurt, butter, and cream products. Demand is driven by automation adoption, rising dairy consumption, and the need for flexible and rigid packaging solutions. Challenges include high capital investments, maintenance costs, and compliance with stringent food safety standards. Opportunities exist in modular and energy-efficient machines, smart packaging systems, and robotic-assisted lines.

Trends highlight faster changeover technologies, digital monitoring, and integrated filling-sealing capabilities. Suppliers delivering end-to-end packaging lines, customization options, and strong after-sales support are best positioned to secure long-term partnerships with global dairy processors.

Dairy manufacturers are increasingly adopting automated packaging machines to ensure product safety, shelf stability, and operational efficiency. Packaging equipment is essential for processing milk, cheese, yogurt, and cream into consumer-ready formats such as cartons, bottles, pouches, and tubs. Rising global dairy consumption and the expansion of retail-ready formats are fueling adoption. Key priorities include precision in filling, reduced wastage, tamper-proof sealing, and packaging hygiene compliance. Automated systems support faster output, consistent quality, and reduced labor dependency. With growing demand from large-scale dairy processors and convenience-driven consumers, dairy packaging machines are positioned as critical assets in maintaining supply chain efficiency and brand reliability.

Growth is constrained by resin price volatility, freight rates, and energy costs that elevate total landed cost for converters and brand owners. Regional restrictions on single-use items add compliance complexity, while extended producer obligations raise administrative and fee burdens in certain jurisdictions. Post-consumer recovery of flexible films remains inconsistent, with sorting contamination and limited curbside collection undermining circular flows. These gaps can influence brand choices toward alternative formats for public perception reasons, even when mailers meet performance needs. On the line, sealing failures, ink scuffing, and tear propagation from sharp edges create quality complaints when specifications are not tightly controlled. Supply chain risks for films, adhesives, and closures continue to lengthen lead times during demand spikes. Smaller e commerce sellers face minimum order quantities and artwork prepress costs that reduce agility. Together, these pressures make specification discipline and supplier reliability decisive for wider adoption.

Opportunities lie in modular packaging systems, energy-efficient machines, and smart packaging integration. Customizable modules allow dairy processors to adapt quickly to new formats, flavors, and product lines. Smart features such as real-time monitoring, automated quality checks, and digital inventory integration improve efficiency and reduce waste. Rising dairy consumption in Asia-Pacific, North America, and Europe drives machine demand in both established and emerging markets. Robotic-assisted filling and sealing technologies create scope for higher throughput and reduced human contact, supporting food safety goals. Suppliers offering turnkey solutions with technical support, training, and integration capabilities are well positioned to capitalize on evolving opportunities in the dairy sector.

The market is trending toward digital monitoring, robotic-assisted operations, and flexible packaging designs. IoT-enabled machines allow predictive maintenance, real-time performance tracking, and remote troubleshooting, reducing downtime. Robotic arms integrated into filling and palletizing improve speed and consistency while minimizing contamination risks. Flexible packaging capabilities, such as switching between cartons, bottles, or pouches with minimal downtime, enhance operational adaptability.

Dairy processors increasingly demand compact, energy-efficient, and high-speed machines to meet consumer preferences for convenient, portable dairy products. Suppliers that combine advanced technology, reliable service, and application-specific customization are best positioned to address the evolving needs of dairy manufacturers worldwide.

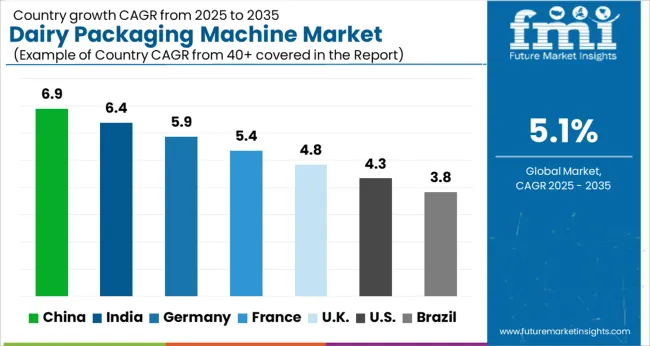

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

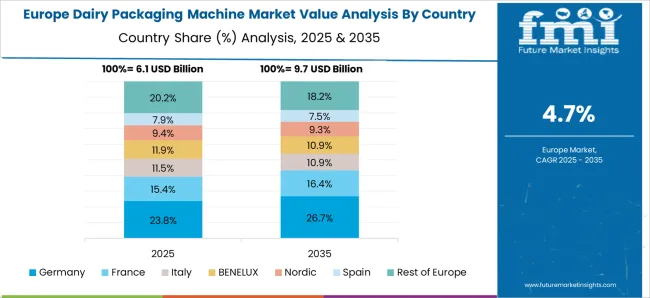

The global dairy packaging machine market is projected to grow at a CAGR of 5.1% from 2025 to 2035. China (6.9%) and India (6.4%) lead growth due to rising packaged dairy consumption and industrial modernization. France (5.4%) focuses on premium dairy and recyclable packaging innovations, while the UK (4.8%) emphasizes convenience packaging and automation. The USA (4.3%) shows steady demand with upgrades in compliance and robotics adoption. Globally, trends include the shift toward aseptic and hygienic packaging, rising automation with IoT and robotics, and strong demand for flexible, innovative, and consumer-friendly formats. The analysis spans over 40+ countries, with the leading markets shown below.

The dairy packaging machine market in China is projected to expand at a CAGR of 6.9% from 2025 to 2035, supported by rapid urbanization, higher dairy consumption, and modernization of food processing facilities. Rising consumer preference for packaged milk, yogurt, and cheese is fueling demand for high-speed, automated, and aseptic packaging systems. Domestic manufacturers are investing in advanced filling, sealing, and labeling machines equipped with IoT-enabled monitoring, digital controls, and robotic integration to improve throughput and hygiene. Industrial hubs in Zhejiang, Jiangsu, and Guangdong provinces are key contributors, offering strong production capacity and after-sales service. Collaborations with global packaging leaders are helping local firms adopt robotics, modularity, and energy-efficient systems. Growing demand for extended shelf life and attractive branding further enhances adoption of smart packaging machines. Government initiatives promoting smart factory adoption and food safety modernization are also reinforcing long-term market growth.

The dairy packaging machine market in India is forecasted to grow at a CAGR of 6.4% between 2025 and 2035, underpinned by strong dairy production and rising demand for packaged milk, yogurt, butter, and value-added products. Organized dairy cooperatives and private enterprises are investing in efficient pouch-filling, capping, and bottle-packaging machines to meet increasing consumer demand. Domestic manufacturers focus on cost-effective and semi-automatic systems, particularly for small-to-medium enterprises, while large producers are adopting fully automated lines for higher productivity and hygiene compliance. Key industrial hubs in Gujarat, Maharashtra, and Tamil Nadu provide robust infrastructure and local servicing, accelerating deployment. Rising consumption of packaged dairy in semi-urban and rural areas, supported by cold chain improvements, further contributes to growth. Government initiatives such as “Make in India” and financial subsidies for food processing are encouraging local innovation and technology upgrades.

The dairy packaging machine market in France is projected to expand at a CAGR of 5.4% between 2025 and 2035, led by its premium dairy sector specializing in cheese, yogurt, and specialty milk products. French consumers prioritize sustainability, driving demand for recyclable, biodegradable, and eco-friendly packaging formats. Packaging machinery providers are increasingly offering modular, energy-efficient, and precision systems capable of handling innovative packaging designs that preserve product freshness and brand appeal. Local manufacturers are integrating advanced automation, robotics, and digital controls, while collaborations with international players foster the adoption of cutting-edge sealing and filling technologies. The rise of online grocery retail, alongside traditional supermarket dominance, boosts demand for varied packaging solutions catering to convenience and durability. French dairy companies also emphasize product traceability and labeling compliance, prompting investments in technologically advanced packaging equipment.

The UK’s dairy packaging machine market is forecast to expand at a CAGR of 4.8% between 2025 and 2035, supported by growing consumer demand for convenience-driven formats such as resealable bottles, single-serve packs, and cartons. Rising automation adoption is enabling dairy producers to reduce costs, enhance efficiency, and meet strict food safety standards. Packaging machinery manufacturers are integrating smart filling systems, robotic handling, and real-time digital monitoring for improved accuracy and productivity. Industrial clusters across the Midlands and northern England provide strong supply chain infrastructure and maintenance networks, aiding faster technology adoption. Online grocery growth and shifting consumer lifestyles are creating new opportunities for innovative packaging formats tailored to convenience. Manufacturers are also focusing on automated packaging lines to align with the UK’s carbon reduction goals.

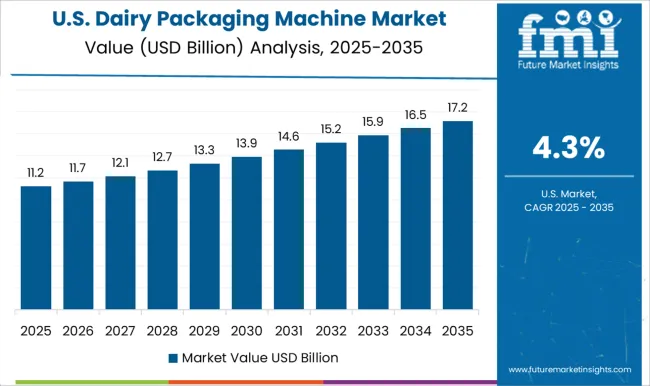

The USA dairy packaging machine market is expected to expand at a CAGR of 4.3% between 2025 and 2035. Despite being a mature market, steady demand is fueled by equipment upgrades required for FDA compliance, consumer preferences for premium packaging, and growing value-added dairy production. Manufacturers are emphasizing robotics, flexible packaging formats, and high-speed automated systems to cater to a wide range of products including cheese, milk, yogurt, and cream. States such as Wisconsin, California, and Texas serve as key industrial hubs, ensuring large-scale deployment and after-sales service networks. The growing importance of automation, precision temperature control, and sustainability is driving modernization investments across the sector.

The dairy packaging machine market is competitive, featuring a mix of global leaders and regional manufacturers offering advanced solutions for filling, sealing, and packaging dairy products. Key players such as Tetra Pak, SIG Combibloc, GEA Group, Krones AG, and IMA Group dominate through technological innovation, reliability, and broad product portfolios. These companies differentiate by providing automation-enabled systems, aseptic packaging, and customizable solutions to meet diverse industry requirements.

Regional and niche manufacturers compete on cost-effectiveness, specialized designs, and local support, particularly in emerging markets where dairy consumption is rising rapidly. Competition is also influenced by trends such as energy-efficient machinery, smart packaging integration, and eco-friendly materials, which appeal to sustainability-conscious consumers and regulatory compliance. Companies leverage R&D, strategic partnerships, and after-sales service to strengthen their market presence, enhance operational efficiency, and maintain long-term client relationships. Firms that can combine advanced technology, operational reliability, and adaptability to regional needs are gaining competitive advantages in this growing and evolving market.

| Item | Value |

|---|---|

| Quantitative Units | USD 25.6 Billion |

| Type | Filling machines, Form-Fill-Seal (FFS) machines, Palletizing machines, Wrapping machines, Cartoning machines, Labeling machines, and Others |

| Packaging Type | Flexible and Rigid |

| Operation | Automatic and Semi-automatic |

| Application | Milk, Fresh dairy products, Butter & buttermilk, Milk powder, and Others |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Tetra Pak, Alfa Laval, Barry-Wehmiller, Carpigiani, DeLaval, Feldmeier Equipment, GEA, IMA, Krones, Paul Mueller, PFM, Scherjon Dairy Equipment, Sidel, SPX Flow, and Technogel |

| Additional Attributes | Dollar sales by machine type (aseptic, filling & sealing, labeling, wrapping), automation level (manual, semi-automatic, fully automatic), and end-use (milk, yogurt, cheese, ice cream, cream). Demand is driven by rising dairy consumption, sustainability requirements, and adoption of smart packaging technologies. Regional trends highlight strong demand in North America and Europe due to mature dairy industries, while Asia-Pacific shows rapid growth from urbanization, dietary shifts, and investments in modernized dairy processing infrastructure. |

The global dairy packaging machine market is estimated to be valued at USD 25.6 billion in 2025.

The market size for the dairy packaging machine market is projected to reach USD 42.1 billion by 2035.

The dairy packaging machine market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in dairy packaging machine market are filling machines, form-fill-seal (ffs) machines, palletizing machines, wrapping machines, cartoning machines, labeling machines and others.

In terms of packaging type, flexible segment to command 58.2% share in the dairy packaging machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dairy Container Market Analysis Size and Share Forecast Outlook 2025 to 2035

Dairy Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Filtration Systems Market Size and Share Forecast Outlook 2025 to 2035

Dairy Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Dairy Concentrate Market Forecast and Outlook 2025 to 2035

Dairy Testing Services Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Dairy-Free Smoothies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy-Based Dressings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy-Free Spreads Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Blends Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Whiteners Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Dairy Flavors Market Trends - Growth & Industry Forecast 2025 to 2035

Dairy-Free Evaporated Milk Market Analysis by Application, Type, Sales Channel Through 2025 to 2035

Dairy Protein Crisps Market Flavor, Packaging, Application and Distribution Channel Through 2025 to 2035

Dairy Products Market Analysis by Product Type, End Use, Distribution Channel and Region through 2035

Dairy-Free Cream Market Insights – Plant-Based Dairy Alternatives 2025 to 2035

Dairy Snacks Market Growth - Consumer Preferences & Industry Trends 2025 to 2035

Market Leaders & Share in the Dairy Blends Industry

Assessing Dairy-Free Smoothies Market Share & Industry Trends

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA