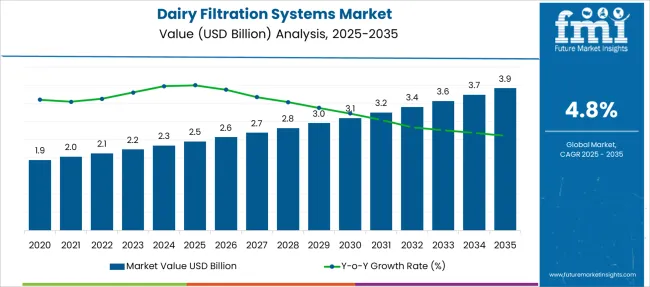

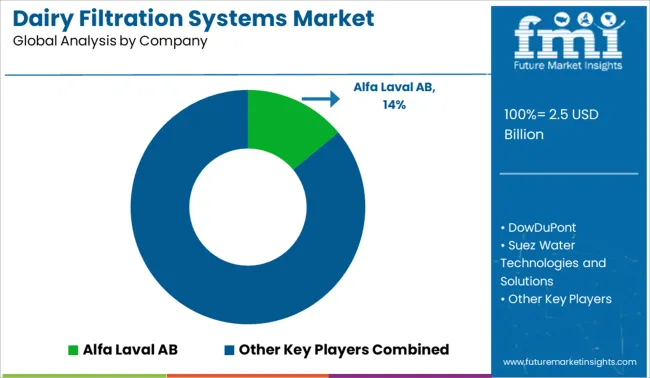

The Dairy Filtration Systems Market is estimated to be valued at USD 2.5 billion in 2025 and is projected to reach USD 3.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

| Metric | Value |

|---|---|

| Dairy Filtration Systems Market Estimated Value in (2025 E) | USD 2.5 billion |

| Dairy Filtration Systems Market Forecast Value in (2035 F) | USD 3.9 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The Dairy Filtration Systems Market is experiencing sustained growth as dairy processors worldwide continue to modernize their operations in response to shifting consumer preferences and stringent food safety standards. The market’s current momentum is being driven by the rising demand for high-protein dairy products, improved shelf life, and cleaner label formulations.

This evolution in processing standards is supported by the increasing adoption of filtration systems that offer precision separation, cost-efficiency, and consistent product quality. Industry journals and company statements have highlighted how filtration technologies are enabling the separation of valuable components such as whey proteins, lactose, and fat, which is opening up new product innovation opportunities.

Sustainability has also emerged as a core factor influencing investments, with processors seeking technologies that reduce water usage and minimize waste generation The future outlook remains promising as dairy manufacturers continue to upgrade to advanced systems that can support large-scale production, meet international compliance norms, and offer operational flexibility, particularly in emerging markets where dairy demand is on the rise.

The market is segmented by Membrane Material, Module Design, Product, and Application and region. By Membrane Material, the market is divided into Polymeric and Ceramic. In terms of Module Design, the market is classified into Spiral wound, Tubular systems, and Plates & frames and hollow fibers. Based on Product, the market is segmented into Ultrafiltration, Reverse Osmosis, Microfiltration, and Nanofiltration. By Application, the market is divided into Cheese, Processed Milk, Milk Powder, Cream, and Yogurt. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

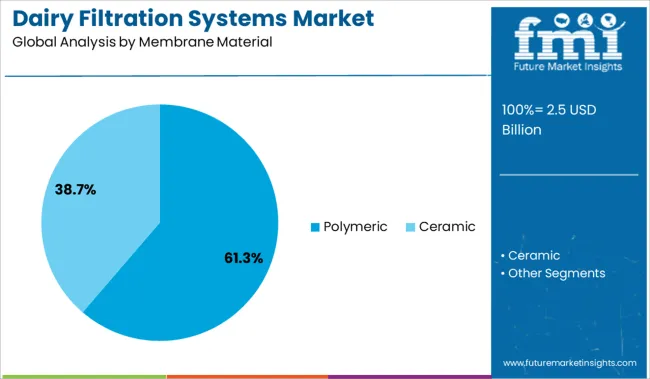

The polymeric membrane material segment is expected to account for 61.3% of the Dairy Filtration Systems Market revenue share in 2025, making it the leading membrane material. This leadership has been driven by the widespread use of polymeric membranes due to their flexibility, affordability, and compatibility with a wide range of dairy filtration applications. Technical literature and product briefs have noted that polymeric materials offer effective resistance to fouling and are easily maintained, making them ideal for continuous processing environments.

Their ability to withstand the rigors of clean-in-place systems without degradation has further supported their widespread adoption in modern dairy plants. Additionally, manufacturers have continued to invest in improving polymeric membrane formulations to extend operational life and enhance filtration precision.

The segment’s dominance has also been reinforced by the availability of these membranes across multiple module designs and their regulatory acceptance for food-grade processing These factors have positioned polymeric membranes as the most preferred option in dairy filtration facilities.

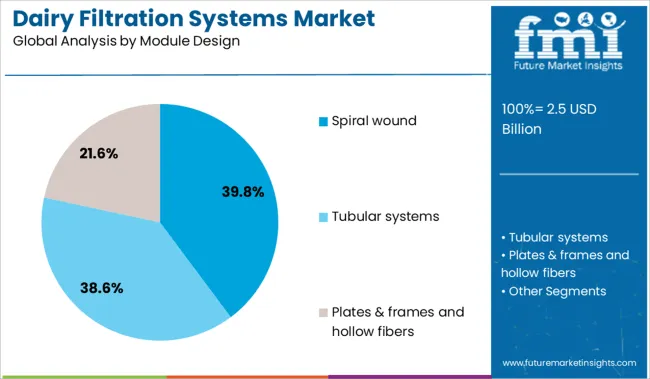

The spiral wound module design segment is projected to contribute 39.8% of the Dairy Filtration Systems Market revenue share in 2025, establishing it as the dominant module configuration. This prominence is being supported by the design’s compact structure and high surface area, which allow for efficient separation in high-volume dairy operations.

Product specifications and equipment manufacturer statements have consistently highlighted the segment’s capability to deliver consistent performance under varying flow conditions, which is a key advantage in large-scale milk and whey processing plants. Spiral wound modules are also favored for their cost-effectiveness and ease of replacement, which reduces downtime and maintenance costs.

Their adaptability to different membrane materials, particularly polymeric membranes, has made them a versatile choice for processors aiming to optimize protein recovery, lactose concentration, and microbial removal These advantages have made spiral wound modules a key component in modern dairy filtration system configurations.

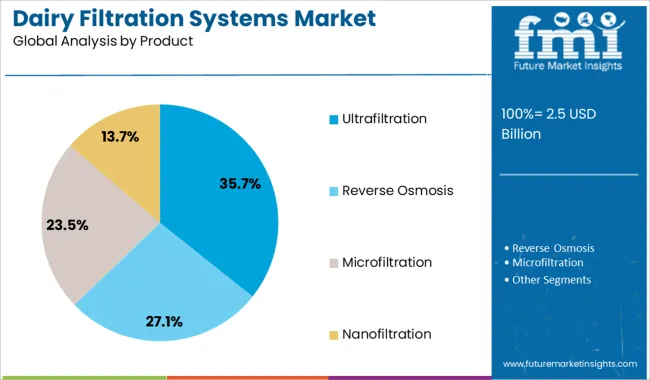

The ultrafiltration product segment is expected to hold 35.7% of the Dairy Filtration Systems Market revenue share in 2025, positioning it as the leading product segment. Its leadership has been enabled by its ability to retain high-value proteins while allowing smaller molecules like lactose and minerals to pass through, making it ideal for applications such as milk protein concentration and whey protein isolate production.

Technical documentation and dairy processing guidelines have highlighted ultrafiltration’s critical role in improving nutritional content and enhancing product functionality without compromising taste or texture. The segment’s dominance is further supported by its broad adoption in cheese production, protein standardization, and the manufacture of low-lactose dairy alternatives.

Equipment suppliers have also emphasized the segment’s compatibility with energy-efficient operations and reduced chemical usage, aligning with sustainability and regulatory trends in food processing These benefits have continued to drive the demand for ultrafiltration systems, ensuring their leading position within the dairy filtration technology landscape.

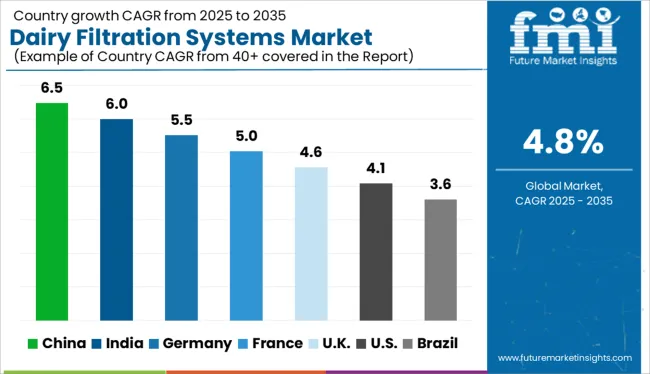

The global dairy filtration systems market is projected to expand at 4.8% CAGR between 2025 and 2035 in comparison to the 3.3% CAGR registered during the historical period from 2020 to 2025. The growing adoption of dairy filtration systems across the thriving dairy industry is a key factor driving demand in the global market.

Over the years, the growing prevalence of foodborne diseases and rising food safety concerns have necessitated the adoption of filtration systems across dairy industries. These filtration systems are being increasingly used to remove spores, bacteria, fat globules, whey, and other components from milk.

Growing demand for milk protein concentrates and isolates across the world due to increasing health awareness, a rising number of fitness enthusiasts, and changing eating habits is expected to boost the growth of dairy filtration systems during the forecast period.

Similarly, the introduction of new food safety regulations for improving food quality and safety will aid in the expansion of dairy filtration systems over the next decade.

A number of influential factors have been identified that are expected to drive the global dairy filtration systems market forward during the assessment period (2025 to 2035). Besides the proliferating aspects prevailing in the market, the analysts at FMI have also analyzed the restraining elements, lucrative opportunities, and upcoming threats that can somehow impact market dynamics.

The drivers, restraints, opportunities, and threats (DROTs) identified are as follows:

DRIVERS

RESTRAINTS

OPPORTUNITIES

THREATS

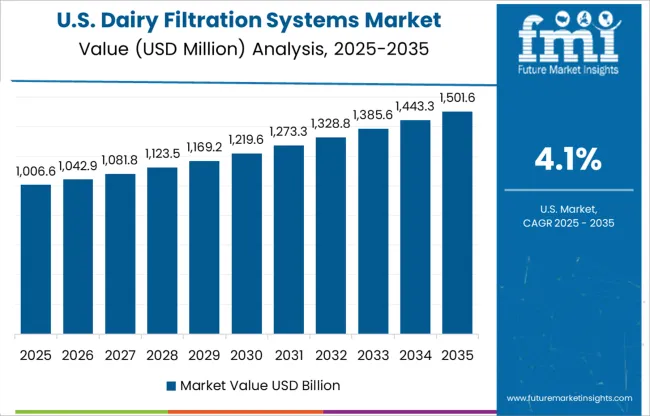

Presence of Stringent Regulations Driving Market in the USA

According to FMI, the USA dairy filtration systems market is currently valued at USD 576.5 Million and it accounts for a market share of 68% in the North American dairy filtration systems market. Growing consumer demand for high-quality dairy products and the rising adoption of advanced filtration technologies by dairy manufacturing companies are driving the USA dairy filtration systems market.

All dairy processing facilities and dairy farmers across the USA are required by stringent laws and regulations to ensure that the milk they are producing is free of pollutants and microorganisms. Bacterial (Standard Plate Count) Limits and Somatic Cell Count in milk shall not be greater than 50,000 per ml and 600,000 per ml, respectively, in California. This has generated huge demand for dairy filtration systems in the country and the trend is likely to continue during the forecast period.

Similarly, the heavy presence of leading manufacturers which are constantly striving to introduce new and advanced filtration systems is positively impacting the USA dairy filtration systems market.

Rising Production and Consumption of Milk Pushing Demand in India

Demand for dairy filtration systems across India is projected to grow at a steady pace during the next ten years owing to the rapid growth of the dairy industry, increasing penetration of automation across dairy processing industries, and favorable government support.

India has the largest dairy herd in the world, producing 187 million tonnes of milk annually from approximately 300 million cattle. India leads all other nations in both milk production and consumption. In order to filter this huge amount of raw milk and make it consumable, companies are employing dairy filtration systems.

The dairy filtering systems market in India is seeing a large influx of new local manufacturers, and competition is heating up quickly. Companies are coming up with novel dairy filtration products with cost-efficient features. This will further expand the dairy filtration systems market in India during the projected period.

Increasing Adoption of Membrane Filtration Technology Boosting market in China

According to FMI, China’s dairy filtration systems market size reached USD 2.5 Million in 2025 and it holds around 32% share of the Asia Pacific dairy filtration systems market. Furthermore, with the growing adoption of membrane filtration technology across the thriving dairy industry, the overall dairy filtration systems market in China is poised to exhibit strong growth during the next ten years (2025 to 2035).

Dairy filtration technology is in high demand in this country owing to the increased use in dairy and food industries for pasteurization, sterilization, and concentration operations. Similarly, increasing consumer spending on dairy products will aid in the expansion of the dairy filtration systems market during the projection period.

Demand Remains High for Reverse Osmosis-based Dairy Filtration Systems

Based on product, the global dairy filtration system market is segmented into reverse osmosis, ultrafiltration, microfiltration, and nanofiltration. Among these, reverse osmosis holds the largest market share of the global dairy filtration systems market. This can be attributed to the rising usage of reverse osmosis-based filtration systems across the dairy industry.

Reverse osmosis is most frequently used in the dairy sector for water reclamation, milk solids recovery, and volume reduction of milk and whey. It helps manufacturers easily create quality whey and milk concentrates,

3M Co., GEA Group, The Wabag Group, Alfa Laval, Cytiva, Porvair, Koch Membrane Systems, and Veolia Water Technologies are key participants in the global dairy filtration systems market.

The quickly changing technical environment is prompting manufacturers to refresh their product portfolio on a regular basis. Hence, key participants are investing in research and development activities to develop advanced dairy filtration systems. Besides this, they are adopting strategies such as partnerships, acquisitions, partnerships, mergers, collaborations, and facility expansion to expand their global footprint. For instance,

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 2.5 billion |

| Projected Market Size (2035) | USD 3.9 billion |

| Anticipated Growth Rate (2025 to 2035) | 4.8% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; Middle East & Africa (MEA) |

| Key Countries Covered | The USA, Canada, Mexico, Germany, The UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, UAE |

| Key Segments Covered | Membrane Material, Module Design, Product, Application, Region |

| Key Companies Profiled | Suez Water Technologies and Solutions (USA), GEA Group AG (Germany), Veolia (France), O. Smith Corporation (USA), Porvair Filtration Group (UK), Alfa Laval AB (Sweden), DowDuPont (USA), Pall Corporation (USA), 3M Company (USA), Koch Membrane Systems Inc (USA), SPX Flow, Inc. (USA), Prominent GmbH (Germany), Pentair Plc. (USA), Brita LP (USA), Eureka Forbes Ltd. (India) |

| Report Coverage | Market Forecast, Company Share Analysis, Competitive Landscape, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global dairy filtration systems market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the dairy filtration systems market is projected to reach USD 3.9 billion by 2035.

The dairy filtration systems market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in dairy filtration systems market are polymeric and ceramic.

In terms of module design, spiral wound segment to command 39.8% share in the dairy filtration systems market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dairy Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Dairy Container Market Analysis Size and Share Forecast Outlook 2025 to 2035

Dairy Packaging Market Size and Share Forecast Outlook 2025 to 2035

Dairy Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Dairy Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Dairy Concentrate Market Forecast and Outlook 2025 to 2035

Dairy Testing Services Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Dairy-Free Smoothies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy-Based Dressings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy-Free Spreads Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Blends Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Whiteners Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Dairy Flavors Market Trends - Growth & Industry Forecast 2025 to 2035

Dairy-Free Evaporated Milk Market Analysis by Application, Type, Sales Channel Through 2025 to 2035

Dairy Protein Crisps Market Flavor, Packaging, Application and Distribution Channel Through 2025 to 2035

Dairy Products Market Analysis by Product Type, End Use, Distribution Channel and Region through 2035

Dairy-Free Cream Market Insights – Plant-Based Dairy Alternatives 2025 to 2035

Dairy Snacks Market Growth - Consumer Preferences & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA