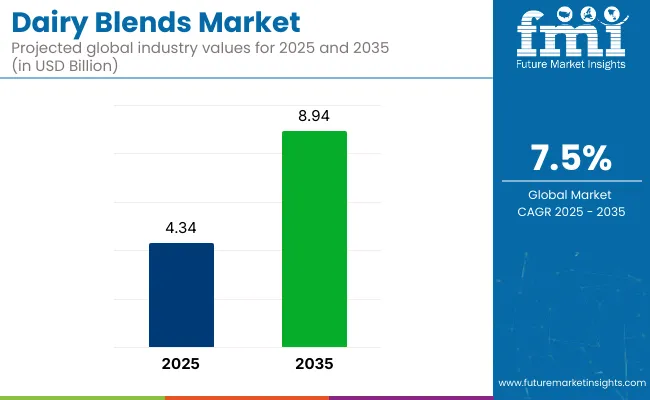

The global dairy blends market is projected to grow from USD 4.34 billion in 2025 to USD 8.94 billion by 2035, reflecting a value-based CAGR of 7.5%. This steady growth is driven by the increasing demand for dairy products blended with other ingredients to meet consumer preferences for enhanced texture, flavor, and nutritional benefits.

| Attributes | Description |

|---|---|

| Estimated Global Industry Size (2025E) | USD 4.34 billion |

| Projected Global Value (2035F) | USD 8.94 billion |

| Value-based CAGR (2025 to 2035) | 7.5% |

Dairy mixtures are being increasingly favored in food processing, particularly in the production of spreads, sauces, and dairy-based beverages. The trend towards premium, functional, and clean-label products is also contributing to the growing adoption of dairy-based mixture in various applications, especially in the foodservice and retail sectors.

The dairy blends industry is estimated to hold a modest share within each of its parent industries, typically ranging from 5-8% of the dairy products industry. Within the food & beverage ingredients industry, approximately 4-6% is accounted for by dairy blends, as they are increasingly used in processed foods and snacks.

A smaller portion, around 3-5%, is represented in the butter & margarine industry, given their functional similarity to traditional butter. Within the functional foods industry, a share of 6-8% is seen, especially in health-conscious formulations. Lastly, in the plant-based dairy alternatives industry, approximately 5-7% is held by dairy blends mixed with plant-based ingredients, reflecting the growing demand for hybrid dairy products.

In 2024, DSM-Firmenich, a global leader in nutrition and health proudly announces ‘Milky Maple’ as its Flavor of the Year for 2025. This unique flavor blend harmoniously combines the creamy softness of milk with the rich, natural sweetness of maple, capturing a global desire for warmth, indulgence, and well-being.

“As food and beverage trends shift toward comfort, nature, and personal wellbeing, people increasingly gravitate towards flavors that offer a taste of familiarity, balance, and connection,” said Maurizio Clementi, Executive Vice President of Taste, Texture, and Health at DSM-Firmenich.

The dairy blends market is segmented by form type into powder, spreadable, and liquid. By product type, it includes milk proteins with vegetable fats, butter blends, cheese blends, whey protein blends, milk powder blends, butter oil blends, and others. By distribution channel, the segmentation covers B2B, hypermarkets/supermarkets, convenience stores, grocery stores, specialty stores, and online retail.

By application, the market includes bakery & confectionery, ice cream & desserts, ready meals, beverages, HoReCa (hotels, restaurants, and cafés), and household consumption. Regional analysis includes North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and Middle East & Africa.

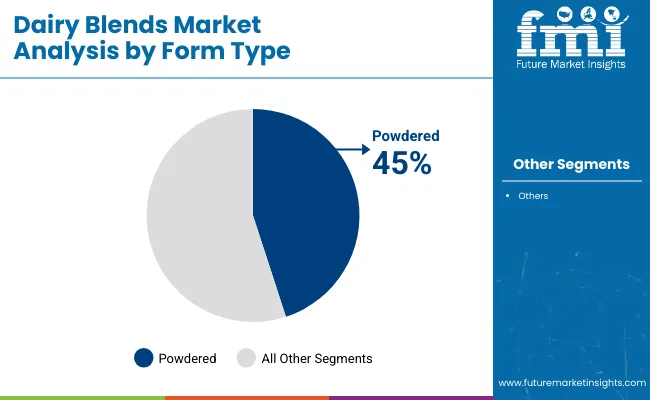

Powdered dairy blends are projected to hold 45% industry share in 2025. Longer shelf life and ease of storage have driven preference for powdered forms across geographies. These blends are being deployed across infant formula, bakery, and beverage applications. Manufacturers like Nestlé, Arla, and DMK have increased focus on powder standardisation to meet regional demand variability. Growth has been steered by improved export logistics, especially in Asia Pacific and Africa. Shelf-stable use in non-refrigerated supply chains remains a key factor.

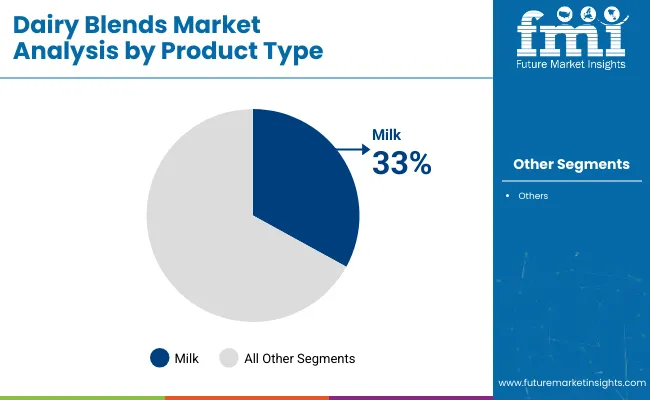

Milk proteins combined with vegetable fats are estimated to reach a 33% share in 2025. Blends designed for lactose-reduction and fat substitution have been implemented by Oatly, Danone, and Nestlé. These formulations have been utilised in coffee mixes, bakery, and ready meals, where texture replication is required without full dairy input. Demand has been supported by rising preference for plant-enhanced profiles. Equipment for spray-dried emulsions has been modified to ensure better fat dispersion across applications.

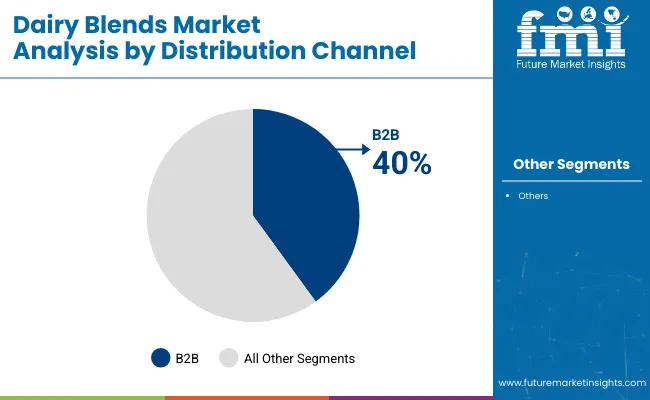

B2B distribution is expected to account for 40% of industry sales by 2025. Foodservice and food manufacturing buyers have opted for direct bulk supply over retail sourcing. Kerry Group, Friesl and Campina, and Nestlé Professional have been engaged in customised dairy blend contracts to ensure uniformity and cost control. Product specification tools and contract packaging have enhanced adoption in industrial kitchens and beverage production units.

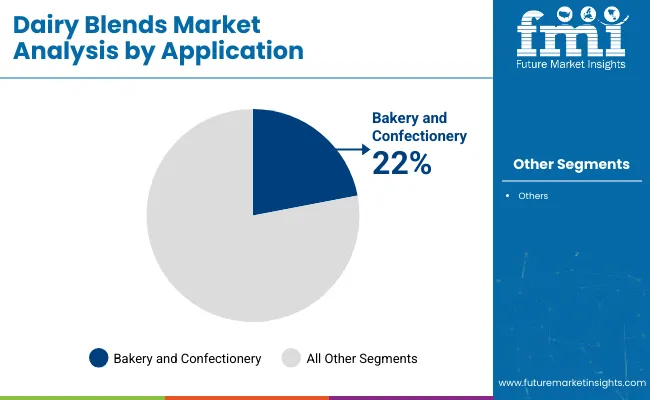

Bakery and confectionery applications are forecast to hold 22% of industry share by 2025. Dairy-based mixtures have been integrated for consistent aeration, extended shelf life, and flavour enhancement in baked goods. Brands like Lactalis, General Mills, and Danone have been leveraging dairy-plant composites for both conventional and plant-forward product lines. Texture enhancement and cost-effective lamination inputs have driven demand across Europe and North America.

The industry is being influenced by a mix of product innovation, changing dietary preferences, and supply-side adaptations. As hybrid dairy solutions gain traction across B2B food manufacturing, rising demand for cost-effective, functional alternatives to traditional dairy ingredients continues to support volume growth. However, volatility in commodity pricing and growing competition from dairy-free blends present persistent challenges.

Consumer Preference Shift Toward Functional Hybrid Dairy

Demand for dairy blends is rising due to their formulation flexibility and ability to deliver enhanced nutrition, taste, and shelf life. These blends, often combining dairy proteins with vegetable oils or functional starches, meet diverse functional needs across bakery, confectionery, and ready-to-eat sectors. Their extended stability and lower cost-to-solids ratio make them ideal for manufacturers facing price pressures.

Challenges from Ingredient Cost Spikes and Plant-Based Competition

Raw material inflation, especially in dairy fat and caseinate sourcing has increased production costs for manufacturers. The shift toward non-dairy alternatives among younger and flexitarian consumers challenges traditional dairy based mixtures, especially in North America and parts of Europe. Meanwhile, regulatory scrutiny around labelling and compositional transparency has increased compliance costs.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 7.4% |

| Germany | 6.8% |

| Netherlands | 7.6% |

| China | 8.1% |

| France | 7.1% |

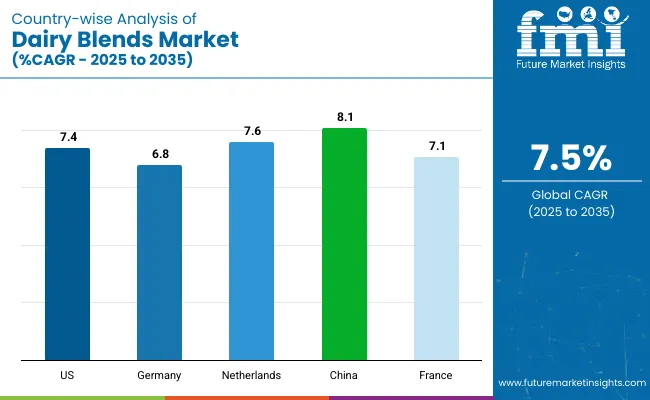

Global dairy blends demand is projected to expand at a 7.5% CAGR between 2025 and 2035. Among the five profiled countries, China leads with 8.1%, followed by the Netherlands at 7.6% and the United States at 7.4%, while France posts 7.1% and Germany records 6.8%. These trends indicate a growth premium of +8% for China, +1% for the Netherlands, and-1% for the United States against the global baseline.

France and Germany trail by -5% and -9%, respectively. Variation stems from China’s expanding dairy intake, the Netherlands' export-oriented dairy output, USA foodservice integration, France’s clean-label alignment, and Germany’s high production overheads.

The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

The dairy blends market in the United States is projected to expand at a CAGR of 7.4% between 2025 and 2035. Growth is being supported by consumer demand for convenient, nutritious, and clean-label foods. A shift toward functional ingredients has been observed, particularly in ready-to-use formats favored by both retail and foodservice sectors.

Product innovations are being developed to meet health-conscious trends, especially low-fat and protein-rich formulations. Supply chains have been stabilized through participation in USMCA, and regulatory compliance has been maintained across processing and distribution.

Demand for dairy blends in China is forecast to expand at a CAGR of 8.1% through2035. Growth is being driven by increased Western dietary influence and rising preference for functional dairy ingredients. Dairy based mixtures containing added proteins, probiotics, and reduced lactose are being promoted through e-commerce platforms.

Localization of taste profiles and alignment with global nutritional trends have been prioritized by both domestic and international players. China’s position in the BRICS network has enabled large-scale sourcing and cross-border supply of dairy ingredients.

Sales of dairy blends in Germany are projected to witness a CAGR of 6.8% through 2035. Growth is being driven by increased consumer focus on organic-certified, clean-label offerings. Functional benefits, particularly in digestive health and low-fat formulations, are being incorporated into new product lines.

Regulatory expectations under EU27 compliance are being met by major manufacturers. However, production cost pressures are being encountered due to energy and raw material inflation. Emphasis on quality and traceability continues to define domestic output.

The Netherlands is positioned for steady growth of dairy blends, with a CAGR of 7.6% expected from 2025 to 2035. Dutch consumers have a deep-rooted appreciation for dairy products, and this cultural affinity provides a strong foundation for the industry.

The demand for functional dairy based mixture that offer specific health benefits, such as improved digestion or enhanced protein content, is particularly high. Additionally, the country's robust dairy infrastructure supports the ongoing expansion of dairy blend offerings, with innovations focused on flavor customization and nutritional enhancements.

Demand for dairy blends in France is projected to grow at a CAGR of 7.1% from 2025 to 2035. French consumers, known for their culinary sophistication, are showing a growing preference for premium dairy based mixtures that combine flavor, texture, and nutritional value.

The industry growth is driven by an increased demand for gourmet-style dairy based mixtures, which are incorporated into a variety of dishes. As consumers become more adventurous in their taste preferences, French brands are increasingly innovating with new flavor profiles, ensuring these blends cater to both traditional and modern food trends.

The industry is characterized by strong competition among established players and emerging innovators. Kerry Group leads the sector with its extensive portfolio of hybrid dairy-plant blends, while Fonterra Co-operative Group Ltd. strengthens its position through strategic mergers and regional consolidation, particularly in Australia and New Zealand.

Danone S.A. continues to grow by focusing on health-conscious and plant-based product lines, catering to lactose-intolerant and vegan consumers. Lactalis Group is expanding its hybrid offerings in Europe and North America, blending traditional dairy with plant-based alternatives. Emerging players like Oatly and Blue Diamond Growers are gaining traction with innovative oat and almond-based blends, responding to increasing demand for lactose-free options.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Estimated Global Industry Size (2025E) | USD 4.34 billion |

| Projected Global Value (2035F) | USD 8.94 billion |

| Value-based CAGR (2025 to 2035) | 7.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for market value, Metric tons for volume |

| Form Types Analyzed | Powder, Spreadable, Liquid |

| Product Types Analyzed | Milk proteins with vegetable fats, Butter blends, Cheese blends, Whey protein blends, Milk powder blends, Butter oil blends, Others |

| Distribution Channels Analyzed | B2B, Hypermarkets/Supermarkets, Convenience Stores, Grocery Stores, Specialty Stores, Online Retail |

| Applications Analyzed | Bakery & Confectionery, Ice Cream & Desserts, Ready Meals, Beverages, HoReCa, Household Consumption |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Key Players | DSM, CSPC Pharmaceutical Group, Northeast Pharmaceutical Group (NEPG), North China Pharmaceutical Group, Shandong Luwei Pharmaceutical, Aland Nutraceuticals Group, Anhui Tiger Biotech, Bactolac Pharmaceuticals, Hebei Welcome Pharmaceutical, Shandong Tianli Pharmaceutical, Zhengzhou Tuoyang, Ningxia Qiyuan, Henan Huaxing Pharmaceutical, Foodchem International Corporation, Zhejiang Hangzhou Xinfu Pharmaceutical, Others |

| Additional Attributes | Dollar sales by product type and region, demand trends by application and form, impact of online and B2B channels, regional consumption patterns, innovation in protein and fat blends |

The segment is categorized into Powder, Spreadable, and Liquid.

This includes Milk Proteins with Vegetable Fats, Butter Blends, Cheese Blends, Whey Protein Blends, Milk Powder Blends, Butter Oil Blends, and Others.

The industry is segmented into B2B, Hypermarkets/Supermarkets, Convenience Stores, Grocery Stores, Specialty Stores, and Online Retail.

This segment covers Bakery & Confectionery, Ice Cream & Desserts, Ready Meals, Beverages, HoReCa (Hotels, Restaurants, and Cafés), and Household Consumption.

Regional analysis includes North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and Middle East & Africa.

The industry is projected to reach USD 4.34 billion in 2025.

The industry is expected to grow at a CAGR of 7.5% from 2025 to 2035.

Powdered form is expected to capture 45% in 2025.

The Asia Pacific region, particularly China projected to register a CAGR of 8.1% from 2025 to 2035.

The industry is projected to reach USD 8.94 billion by 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Leaders & Share in the Dairy Blends Industry

UK Dairy Blends Market Growth – Trends, Demand & Innovations 2025–2035

USA Dairy Blends Market Insights – Demand, Size & Industry Trends 2025–2035

Cultured Dairy Blends Market

Dairy Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Dairy Container Market Analysis Size and Share Forecast Outlook 2025 to 2035

Dairy Packaging Market Size and Share Forecast Outlook 2025 to 2035

Dairy Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Dairy Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Filtration Systems Market Size and Share Forecast Outlook 2025 to 2035

Dairy Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Dairy Concentrate Market Forecast and Outlook 2025 to 2035

Dairy Testing Services Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Dairy-Free Smoothies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy-Based Dressings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy-Free Spreads Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Whiteners Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Dairy Flavors Market Trends - Growth & Industry Forecast 2025 to 2035

Dairy-Free Evaporated Milk Market Analysis by Application, Type, Sales Channel Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA