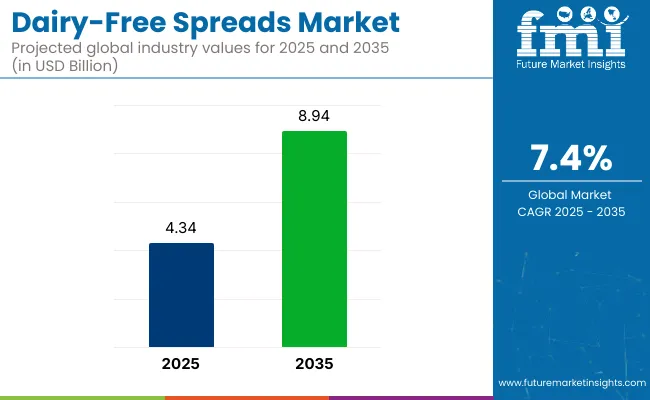

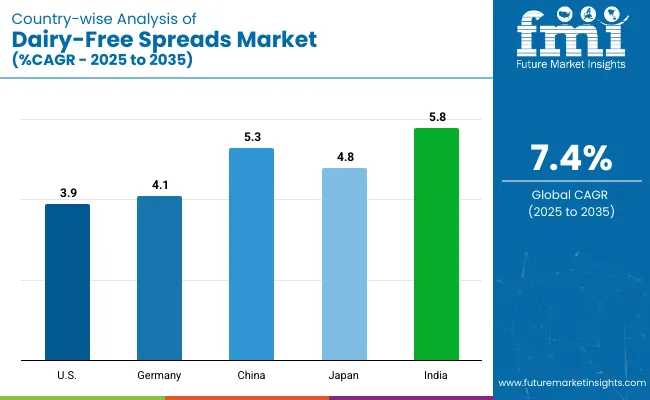

The global dairy-free spreads market is set to grow from USD 4.4 billion in 2025 to USD 9.02 billion by 2035, at a CAGR of 7.4%.This expansion is primarily driven by the growing consumer shift towards plant-based and dairy-free alternatives, particularly as health-conscious choices and dietary restrictions such as lactose intolerance and veganism continue to rise.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 4.4 billion |

| Market Value (2035) | USD 9.02 billion |

| CAGR (2025 to 2035) | 7.4% |

As consumers become more mindful of their health and the environmental impact of their choices, this spreads are becoming increasingly popular as substitutes for traditional butter and margarine.

Dairy-free spreads accounted for an estimated 11.4% share of the plant-based food products industry, reflecting rising cross-category use. Within vegan dairy alternatives, the segment held a 16.2% share, driven by demand for allergen-free and cholesterol-free formulations. A 9.7% share was recorded in the specialty food ingredients category, supported by clean-label positioning and customization.

In the margarine and fats industry, dairy-free spreads claimed 13.5%, as vegetable oil-based substitutes replaced traditional fat sources. Lastly, the segment captured 8.9% of the functional food products space, where value was driven by fortification and fiber inclusions. These shares reflect structural overlap across processing categories and shifting purchase drivers linked to dietary preference segmentation and channel diversification.

In April 2025, Miyoko’s Creamery introduced its new Jalapeño PlantMilk Cheese Spread. Stuart Kronauge, CEO, remarked,“As more consumers dabble in eating and drinking dairyfree, it’s important that we keep our innovation approachable, familiar and just as delicious as traditional dairy options. Jalapeño Plant Milk Cheese Spread checks off all of those boxes, and is another testament to our unwavering commitment to pushing the boundaries of plantbased innovation.”

Geographically, North America and Europe are expected to remain the largest industry for this spreads, with a significant share of the demand coming from the United States and the United Kingdom. These regions are leading the charge in the adoption of plant-based diets and the shift towards more organic food options. In Asia-Pacific, countries like India are seeing a growing preference for dairy-free products, further driving the global industry.

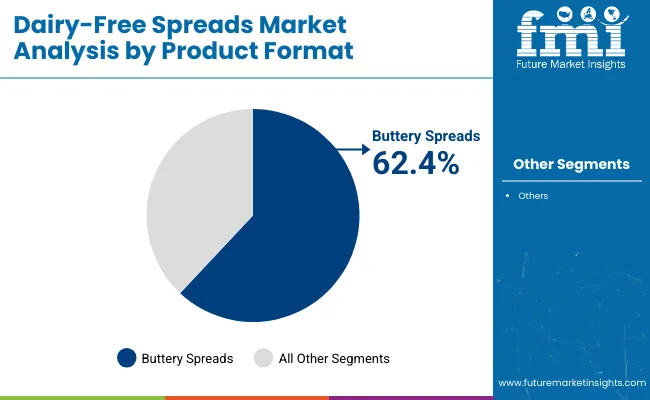

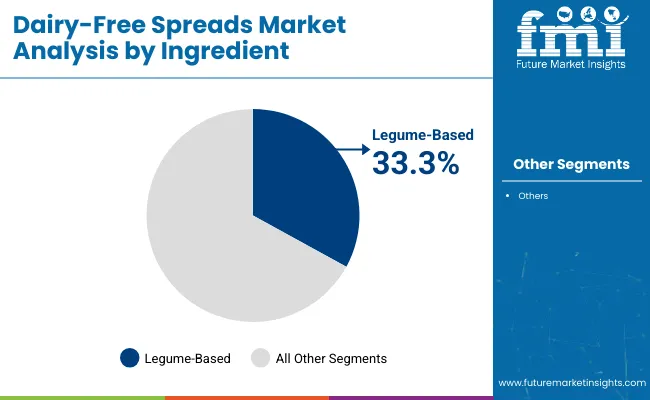

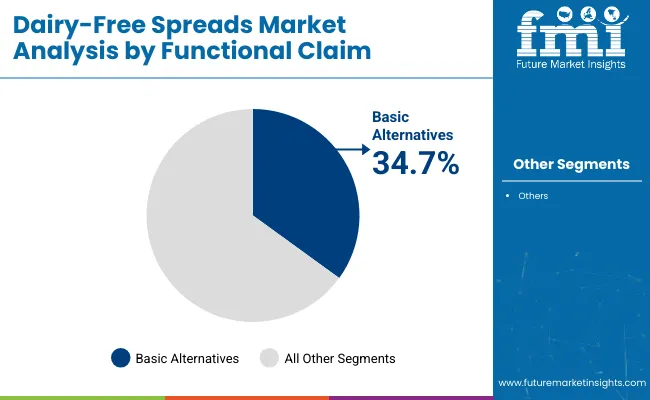

The dairy-free spreads market is segmented by primary ingredient into legume-based, nut-based, seed-based, coconut-based, and oil-based ingredients. By product format, the segment includes buttery spreads, nut & seed butters, cream cheese alternatives, and specialty spreads. By functional claim, the segmentation covers basic alternatives, fortified/enhanced, allergen-free, and organic/non-GMO functional claims.

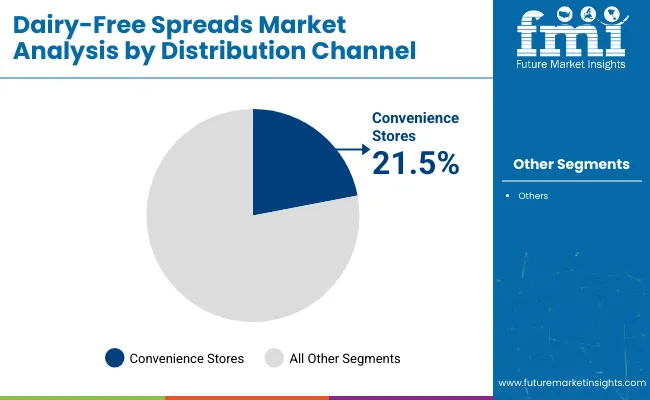

By distribution channel, the industry is segmented into supermarkets/hypermarkets, convenience stores, specialty stores, online retail, and direct-to-consumer channels. Industry analysis has been conducted in key regions including North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, Middle East, and Africa.

Buttery formats are expected to command 62.4% share in 2025. Recipe functionality has been retained by blending coconut, shea, and canola oils with natural emulsifiers, giving cooks a like-for-like butter swap. Violife, Miyoko’s Creamery, and Earth Balance have increased batch capacity in North America and Europe, allowing food-service distributors to secure pallet-scale orders.

Product lines have been diversified into salted blocks, whipped tubs, and baking sticks, ensuring cross-category placement. Retail sell-through has been strengthened by coupon programs that encourage trial adoption.

Legume inputs are projected to secure a 33.3% share by 2025. Pea, lentil, and chickpea proteins have been combined with sunflower and rapeseed oils, producing spreads with elevated amino-acid density. Ripple Foods and J.M. Smucker have scaled extrusion and micro-milling, improving mouthfeel while avoiding allergen warnings linked to nuts. Food-service buyers have adopted legume spreads for school menus where dairy exclusion policies apply. Retail trial rates have been supported by clear plant-protein claims on front panels.

Unfortified dairy-free spreads are anticipated to hold a 34.7% share within functional claims. Formulators have concentrated on healthy fats and moderate protein without supplement additions, keeping labels concise.

Earth Balance and Miyoko’s have trimmed ingredient counts, aiding shoppers who avoid gums and synthetic flavors. Pricing has remained competitive against dairy margarine, encouraging bulk purchase by budget-focused households. Channel partners have emphasised “simple plant butter” shelf tags to attract first-time buyers.

Convenience outlets are expected to contribute 21.5% of the 2025 turnover. Single-serve pouches and 100 g tubs have been stocked near sandwich stations, serving commuters seeking non-dairy condiments. Operators such as 7-Eleven and Circle K have negotiated direct-store-delivery terms with Upfield and Violife, ensuring refrigerated facings remain full during peak hours. Higher unit pricing, typical of c-stores, has preserved margins for brand owners despite smaller volumes.

Reformulated oil matrices, clean-label positioning, and allergen-conscious branding have helped expand these dairy-free products into mainstream usage. Industrial kitchens and retail shelves have absorbed a wider variety of plant-based formats across margarine, seed-oil spreads, and butter substitutes.

Clean Label Reformulation Reshapes Spread Preferences

Substitution of dairy with legume proteins and specialty oils has been carried out to appeal to ingredient-conscious buyers. Simpler compositions with no artificial additives have gained shelf space in Europe and North America. Spread ability, taste retention, and neutral flavor profiles have been engineered to match traditional butter usage in both households and bakery production

Price Sensitivity Constrains Value-Added Spread Sales

Retail and foodservice channels have shifted toward cost-effective plant-oil blends as input costs fluctuate. Seed-based spreads with higher oil content have faced slower adoption in commercial baking due to margin compression. In low- and mid-tier grocery, the willingness to pay for dairy-free labels has remained limited despite branding efforts.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 3.9% |

| Germany | 4.1% |

| China | 5.3% |

| Japan | 4.8% |

| India | 5.8% |

Global dairy-free spreads demand is projected to expand at a 4.8% CAGR from 2025 to 2035. Of the five profiled countries, India leads at 5.8%, followed by China at 5.3% and Japan at 4.8%, while Germany posts 4.1% and the United States records 3.9%.

These rates translate to a growth premium of +21% for India, +10% for China, and baseline alignment for Japan, whereas Germany and the United States trail by -15% and -19%, respectively. Divergence stems from regional factors. Plant-fat substitution in Indian bakery applications, soy-based innovation scale in China, functional dairy-alternative blends in Japan, retail price ceilings in Germany, and industry consolidation across mature USA vegan brands.

The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

The dairy-free spreads market in the USA is projected to expand at a CAGR of 3.9% from 2025 to 2035. Growth has been shaped by private-label expansion and continued retail alignment with allergen-free shelf-space strategies. Buttery-style substitutes have remained dominant, driven by consumer familiarity and ease of recipe integration.

Refrigerated sections have been optimized by national retailers to accommodate multiple formats, including tubs and bricks. While health-conscious segments drive innovation, pricing dynamics remain sensitive. Legume-based alternatives have been selectively introduced into public nutrition programs and specialty grocers to address dietary preferences across regional populations.

Demand for dairy-free spreads is forecast to grow at a CAGR of 4.1% through 2035. Clean-label expectations have driven demand for reduced-ingredient formats, particularly oat-oil and sunflower-based emulsions. The shift away from margarine with artificial stabilizers has redirected bakery procurement toward dairy-free fats with enhanced mouthfeel.

Strong retail support for natural spreads has increased listings in bio and Rewe-format stores. Regulatory clarity on plant-fat definitions has helped streamline product approvals, supporting faster product launches in the vegan category.

Sales of dairy-free spreads in China is expected to grow at a CAGR of 5.3% between 2025 and 2035. Growth has been enabled by the adoption of western-style diets and increased lactose intolerance diagnoses. Imported blends have entered via e-commerce, with domestic production ramping up via partnerships.

Breakfast spreads and bakery inclusions have seen significant uptake, especially in second-tier cities. Retailers have aligned promotions with wellness-oriented campaigns, creating visibility for plant-oil alternatives that meet evolving nutritional expectations.

Demand for dairy-free spreads in Japan is projected to expand at a CAGR of 4.8% from 2025 to 2035. Small-format packaging and functional simplicity have guided retail uptake. Convenience stores have adopted mini-tubs and sachets for sandwich preparation, especially among lactose-sensitive consumers.

High-fat margarine replacements using soy and rice oil have entered bakery channels with mild taste profiles. Ingredient lists have been scrutinized by shoppers, prompting brands to eliminate synthetic emulsifiers. Growth remains tied to innovations in umami-forward flavors and spread ability in both refrigerated and ambient segments.

Sales of dairy-free spreads in India areset to grow at 5.8% CAGR between 2025 and 2035. Demand has been influenced by vegetarian dietary practices and the expansion of urban retail formats. Coconut- and peanut-oil-based spreads have been marketed as ghee replacements, securing entry into home cooking. Regional brands have localized flavor profiles such as masala and curry-leaf infusions, to align with traditional meal routines. The rising availability in kirana stores and online grocery platforms has supported access across income tiers.

The industry is moderately fragmented, with leading, key, and emerging players shaping competition through differentiated formulation, brand positioning, and multi-channel expansion. Dominant players such as Upfield (Flora Food Group), Conagra Brands, and Earth Balance command significant share through scale manufacturing, wide retail presence, and legacy plant-based portfolios.

Upfield leads with brands like Flora and Country Crock, backed by investments in plastic-free packaging and clean-label reformulation. Key players including Miyoko's Creamery, Califia Farms, and Follow Your Heart drive growth via flavor innovation, oat- and nut-based product development, and retail diversification. Emerging companies like Nutiva, Melt Organic, and Good Planet Foods are gaining ground through allergen-free offerings, regional distribution gains, and functional nutrition strategies that meet evolving consumer demand.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 4.4 billion |

| Projected Industry Size (2035) | USD 9.02 billion |

| CAGR (2025 to 2035) | 7.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand metric tons for volume |

| Primary Ingredients Analyzed (Segment 1) | Legume-Based, Nut-Based, Seed-Based, Coconut-Based, Oil-Based |

| Product Formats Analyzed (Segment 2) | Buttery Spreads, Nut & Seed Butters, Cream Cheese Alternatives, Specialty Spreads |

| Functional Claims Analyzed (Segment 3) | Basic Alternatives, Fortified/Enhanced, Allergen-Free, Organic/Non-GMO |

| Distribution Channels Analyzed (Segment 4) | Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, Direct-to-Consumer Channels |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, Middle East, Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Upfield, Nutiva, Conagra Brands, Miyoko's Creamery, Califia Farms, Earth Balance, Follow Your Heart, Melt Organic, Good Planet Foods, Others |

| Additional Attributes | Dollar sales, share by format and functional claim, product innovations in plant-based butter, expansion of allergen-free variants, growth in e-commerce and DTC formats, regional trends in dairy-alternative adoption |

As per primary ingredient, the industry has been categorized into Legume-Based, Nut-Based, Seed-Based, Coconut-Based, and Oil-Based ingredients.

The segment is further categorized into Buttery Spreads, Nut & Seed Butters, Cream Cheese Alternatives, and Specialty Spreads.

This segment includes categorizations of Basic Alternatives, Fortified/Enhanced, Allergen-Free, and Organic/Non-GMO functional claims.

Industry analysis has been conducted across Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, and Direct-to-Consumer Channels.

Industry analysis has been conducted in key regions including North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, Middle East, and Africa.

The industry is projected to reach USD 9.02 billion by 2035.

The industry will expand at a CAGR of 7.4% during the forecast period.

Buttery spreads are expected to account for approximately 62.4% in 2025.

Legume-based spreads will contribute around 33.3% to the industry in 2025.

India leads the industry with a CAGR of 5.8% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Spreads Market Size and Share Forecast Outlook 2025 to 2035

Spreads and Toppings Packaging Market Trends – Growth & Forecast 2025 to 2035

Dips and Spreads Market Size and Share Forecast Outlook 2025 to 2035

Yeast-based Spreads Market Size and Share Forecast Outlook 2025 to 2035

Demand for Yeast-Based Spreads in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Plant-based Cheese & Spreads in CIS Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA