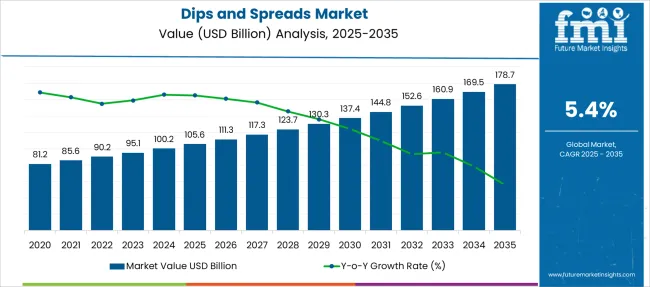

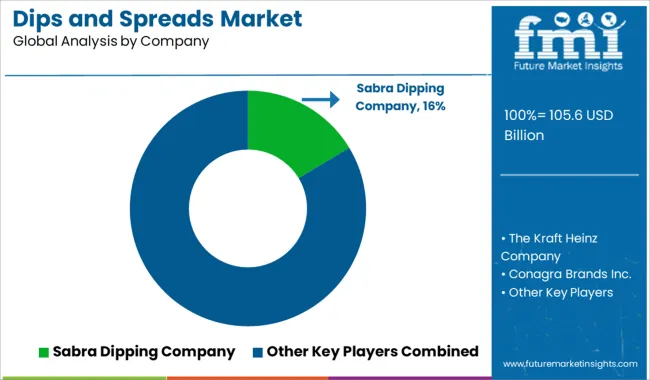

The Dips and Spreads Market is estimated to be valued at USD 105.6 billion in 2025 and is projected to reach USD 178.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

| Metric | Value |

|---|---|

| Dips and Spreads Market Estimated Value in (2025 E) | USD 105.6 billion |

| Dips and Spreads Market Forecast Value in (2035 F) | USD 178.7 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The dips and spreads market is witnessing accelerated growth driven by evolving consumer eating habits and the rising preference for convenient, ready-to-eat condiments that complement various meal occasions. Health-conscious consumers are increasingly seeking nutrient-rich, plant-based alternatives, which has boosted the appeal of dips made with natural ingredients and clean labels.

Global cuisines gaining popularity in mainstream markets have also played a significant role in driving product diversity and innovation. The market is further supported by advancements in packaging technologies, extended shelf life, and the growing availability of specialty options through both online and offline retail channels.

Future growth is expected to remain strong as manufacturers focus on introducing low-fat, organic, and allergen-free variants, while targeting wider demographics through flavor innovation and strategic brand positioning.

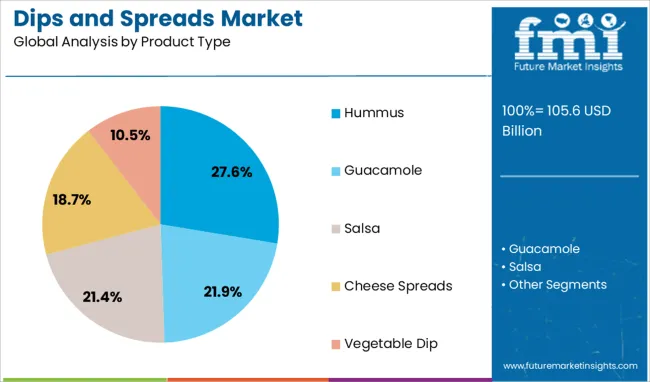

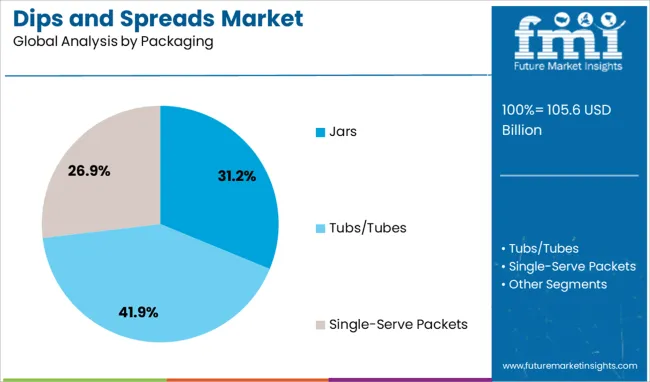

The dips and spreads market is segmented by product type, packaging, distribution channel, and geographic regions. The dips and spreads market is divided by product type into Hummus, Guacamole, Salsa, Cheese Spreads, and Vegetable Dip. In terms of packaging, the dips and spreads market is classified into Jars, Tubs/Tubes, and Single-Serve Packets.

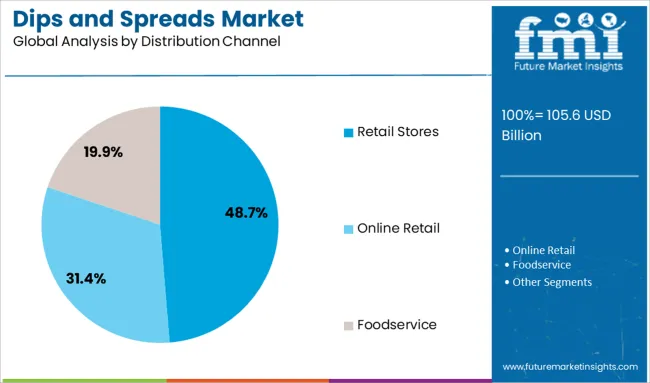

Based on the distribution channel of the dips and spreads, the market is segmented into Retail Stores, Online Retail, and Foodservice. Regionally, the dips and spreads industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hummus segment leads the product type category with a 27.6% market share, bolstered by its rising status as a healthy, protein-rich dip alternative favored in both Western and Middle Eastern cuisines. Its composition, centered around chickpeas, olive oil, tahini, and lemon, aligns well with consumer demand for clean, minimally processed, and plant-based food options.

The segment's growth is further accelerated by its adaptability across meals—used as a dip, spread, or even ingredient in wraps and salads. Foodservice expansion and increasing shelf presence in supermarkets and convenience stores have also contributed to its market traction.

With growing awareness of the nutritional benefits of legumes and the surging popularity of Mediterranean diets, hummus is expected to retain its dominant position. Continued innovation in flavor blends, such as roasted red pepper, garlic, or spicy variants, will support deeper market penetration and broaden its consumer appeal.

The jars packaging segment accounts for 31.2% of the market, favored for its durability, resealability, and ability to maintain product freshness over multiple uses. Glass and PET jars offer visibility of product texture and color, which is an important purchasing factor for many consumers. Their reusability and recyclable nature also align with growing environmental concerns and sustainability preferences.

This segment benefits from its strong association with premium and gourmet products, making it especially popular in dips and spreads that emphasize authenticity and quality. Retailers often prefer jar packaging for its efficient shelf stacking, branding opportunities, and consumer convenience.

As clean-label trends continue and consumers lean toward responsibly packaged foods, jars are expected to remain a top choice for manufacturers aiming to combine functionality with premium shelf appeal. Innovations in lightweight and eco-friendly materials are likely to further strengthen this segment’s market position.

Retail stores dominate the distribution channel category with a 48.7% share, highlighting their continued importance in driving sales for dips and spreads through wide accessibility and impulse-buying behavior. Supermarkets and hypermarkets offer extensive product assortments and encourage trial through in-store promotions, which have proven effective in capturing consumer interest, especially for newly launched or seasonal flavors.

Retail outlets also benefit from consumer trust and convenience, particularly in urban markets where weekly grocery shopping habits persist. The ability to compare multiple brands, packaging types, and price points on the shelf contributes to higher conversion rates.

As physical retail continues to integrate digital enhancements such as QR codes and smart shelving, the segment’s effectiveness as a primary distribution channel is expected to persist. In-store visibility, combined with active promotional campaigns and sampling programs, will continue to bolster retail store dominance in the dips and spreads market.

The dips and spreads segment is driven by bold flavor exploration, convenient packaging, and health-focused formulations, supported by strategic collaborations that enhance visibility and expand usage occasions. These factors collectively position the category as a key contributor to premium snacking and value-added food experiences.

Consumer interest in bold and authentic flavor profiles has been considered the primary growth driver for the dips and spreads segment. Increased adoption of globally inspired recipes in mainstream diets has contributed to consistent demand.

Market observers highlight that regional spice blends, Mediterranean herbs, and artisanal combinations have gained strong acceptance. The category has been reinforced by social dining habits, where shared snacking occasions and casual gatherings fuel consumption.

Premium offerings featuring exotic ingredients, organic certification, and natural textures have seen preference in developed markets. These factors have positioned dips and spreads as a central element in modern snacking experiences, driving their adaptability in both household and commercial food service settings

Innovative packaging designs have been recognized as a vital contributor to market growth. Brands have invested in portable packs, resealable containers, and multi-compartment solutions to improve usability and shelf life. The trend toward ready-to-consume and single-serve portions caters to the fast-paced lifestyle of consumers seeking quick flavor solutions without compromising quality. Transparent packaging and clear ingredient labeling have boosted consumer confidence, particularly in regions where informed choices dominate purchase decisions. The inclusion of value-added features, such as dual-dip compartments or mix-and-match formats, reflects an industry shift toward convenience and versatility. Such packaging adaptations have provided a competitive advantage for brands in premium and mid-tier categories.

The growing demand for health-oriented dips and spreads has transformed product development strategies. Reduced-fat versions, sugar-free alternatives, and products enriched with proteins or probiotics have emerged as essential offerings. Manufacturers have focused on incorporating plant-based ingredients and allergen-free formulations to cater to evolving dietary needs. This shift has been supported by increasing consumer awareness of ingredient transparency and nutritional benefits. Market specialists consider these adaptations as decisive for long-term category relevance, particularly as consumers balance indulgence with health-conscious preferences. Brands that successfully blend taste and wellness attributes have been able to capture loyalty and drive repeat purchases across diverse demographic segments.

Strategic collaborations with local producers and culinary experts have strengthened the position of dips and spreads across global markets. Limited-edition flavors inspired by cultural cuisines have created engagement and novelty appeal among consumers. Co-branding initiatives with popular restaurant chains and celebrity chefs have amplified brand visibility. The category has also experienced traction through partnerships with quick-service and ready-meal brands, expanding usage occasions beyond snacking. Market analysts believe that these partnerships have been instrumental in setting new consumption trends, enhancing shelf presence, and creating differentiation in a competitive landscape. Such strategies are anticipated to reinforce category growth and drive premiumization opportunities across retail and foodservice channels.

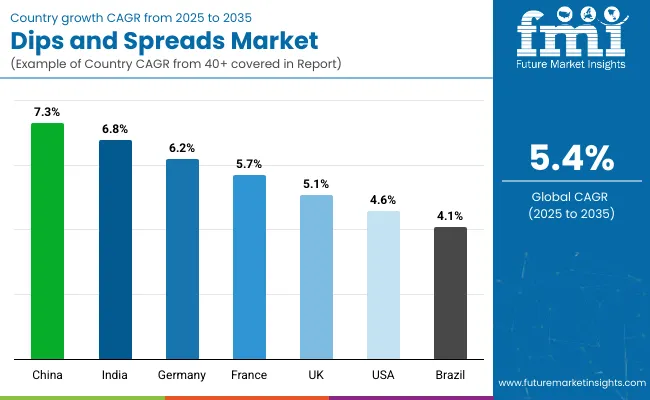

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

| USA | 4.6% |

| Brazil | 4.1% |

The global dips and spreads market, projected to grow at a CAGR of 5.4% from 2025 to 2035, is experiencing varying growth across key countries. China leads with a 7.3% CAGR, driven by a growing demand for diverse snack options, particularly in urban areas, and the rising popularity of western food products. India follows closely with a 6.8% CAGR, fueled by the expanding urban population and increasing interest in international cuisines, particularly in the fast-food and snack segments.

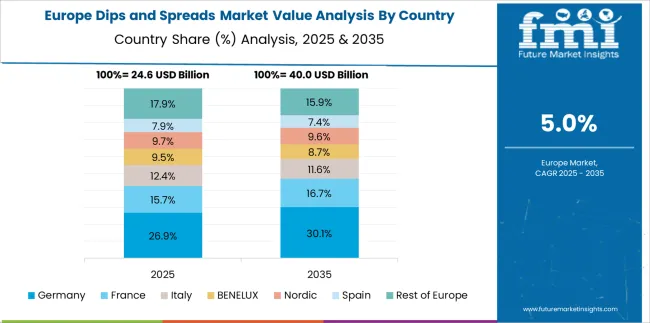

Germany shows steady growth at a 6.2% CAGR, as consumers become more health-conscious and seek out natural and organic dips and spreads in the market. The UK is projected to grow at a slower 5.1%, due to the mature market and shifting consumer preferences towards healthier alternatives and homemade spreads.

The USA sees the lowest growth rate at 4.6%, influenced by market saturation and a shift toward more premium, niche products. Despite the slower growth in developed markets, demand for innovative flavors, healthier options, and eco-friendly packaging in dips and spreads is expected to continue to drive the market forward. The report covers a detailed analysis of 40+ countries, with the top five countries shared as a reference.

India’s dips and spreads market is projected to grow at a CAGR of 6.8% from 2025 to 2035, up from 5.7% during 2020–2024. The rise in growth rate is driven by the expanding middle class, increasing disposable incomes, and shifting consumer preferences toward convenient, ready-to-eat snacks. India’s growing urbanization and a rise in modern retail outlets are also contributing to the surge in demand for packaged dips and spreads. Additionally, the growing trend toward health-conscious eating, including demand for organic, plant-based, and low-calorie options, will continue to boost the market. This shift aligns with the rising awareness about the benefits of cleaner, more sustainable food products.

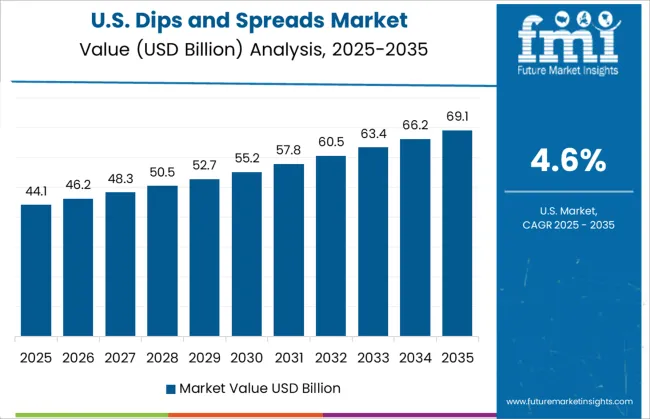

The USA dips and spreads market is projected to grow at a CAGR of 4.6% from 2025 to 2035, up from 3.5% during 2020–2024. The growth is driven by the increasing demand for healthier and more sustainable snacking options. Consumers’ preference for plant-based, organic, and low-calorie dips and spreads continues to rise, supporting this steady growth.

The market remains mature, but innovations in flavors and packaging, including eco-friendly and clean-label products, will contribute to the ongoing demand. As the trend toward healthier eating habits strengthens, the USA market for dips and spreads is likely to maintain stable growth.

The CAGR for the UK dips and spreads market is expected to rise from approximately 4.5% during 2020–2024 to 5.1% for 2025–2035. The market experienced steady growth during 2020–2024, driven by consistent demand for dips and spreads in both retail and foodservice sectors. However, this growth rate is projected to accelerate from 2025 due to a rise in consumer preferences for healthier and more sustainable food options.

The shift toward plant-based, organic, and low-calorie alternatives will play a key role in driving market growth. Increased demand for convenient, eco-friendly, and innovative products in food packaging will also boost the market during the forecast period. The UK’s increasing focus on sustainability and reducing food waste aligns with these trends, offering a further opportunity for the expansion of dips and spreads.

China’s dips and spreads market is expected to grow at a CAGR of 7.3% from 2025 to 2035, up from 6.0% during 2020–2024. This rise in growth is driven by rapid urbanization, growing disposable incomes, and the increasing popularity of western-style food products. As China’s middle class expands and consumer spending increases, the demand for convenient, ready-to-eat snacks, including dips and spreads, continues to grow. The retail market’s expansion and increasing consumer preference for healthier, eco-friendly food options will also play a significant role in this growth. Additionally, China’s growing awareness of environmental sustainability, coupled with a preference for clean-label products, will continue to drive demand for non-toxic, sustainable ingredients in dips and spreads.

Germany’s dips and spreads market is projected to grow at a CAGR of 6.2% from 2025 to 2035, compared to 5.7% during 2020–2024. This increase is driven by the country’s growing interest in healthier, sustainable food options, including dips and spreads made from organic and natural ingredients. As German consumers increasingly prioritize clean-label products, the demand for eco-friendly packaging and plant-based alternatives will continue to rise. The country’s strong retail sector and innovation in the food industry will further contribute to the growth of dips and spreads. The continued focus on sustainability and green food production will help to drive this market.

The dips and spreads segment is driven by a mix of multinational corporations and regional specialists, each influencing consumer trends with differentiated strategies. Global giants like The Kraft Heinz Company, Nestlé S.A., Conagra Brands Inc., Hormel Foods Corporation, and General Mills, Inc. dominate through extensive distribution networks, strong brand portfolios, and continuous flavor diversification across retail and foodservice channels.

PepsiCo, Inc. also plays a strategic role, leveraging its snack ecosystem to integrate complementary dip solutions. Grupo Bimbo and Lantmannen Unibake enhance category relevance by pairing bakery items with spreads, reinforcing cross-selling opportunities. Specialty players such as Sabra Dipping Company, a recognized leader in hummus and plant-based dips, and Cedar’s Mediterranean, focused on authentic Mediterranean recipes, cater to niche segments emphasizing authenticity and natural ingredients. Premium artisanal brands like Stonewall Kitchen, Cucina Fresca Gourmet, and Armanino Foods capture consumer interest through small-batch production and distinctive ingredient blends. Lancaster Colony Corp. strengthens its market hold with versatile offerings across retail and institutional channels, while Amy’s Kitchen, Inc. integrates organic and allergen-free principles into its portfolio to meet rising health-conscious preferences. Collectively, these companies influence flavor innovation, packaging enhancements, and co-branding strategies, making dips and spreads an essential component of contemporary snacking experiences.

In November 2024, PepsiCo announced via an official press release that it would acquire the remaining 50 % interest in Sabra Dipping Company LLC.

| Item | Value |

|---|---|

| Quantitative Units | USD 105.6 Billion |

| Product Type | Hummus, Guacamole, Salsa, Cheese Spreads, and Vegetable Dip |

| Packaging | Jars, Tubs/Tubes, and Single-Serve Packets |

| Distribution Channel | Retail Stores, Online Retail, and Foodservice |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sabra Dipping Company, The Kraft Heinz Company, Conagra Brands Inc., Nestlé S.A., Hormel Foods Corporation, General Mills, Inc., PepsiCo, Inc., Lantmannen Unibake, Grupo Bimbo, Armanino Foods, Cucina Fresca Gourmet, Stonewall Kitchen, Cedar's Mediterranean, Lancaster Colony Corp., and Amy's Kitchen, Inc. |

| Additional Attributes | Dollar sales trends, share by product type, competitive pricing benchmarks, consumer flavor preferences, regional demand patterns, retail vs foodservice performance, packaging innovations, health-focused product positioning, distribution channel effectiveness. |

The global dips and spreads market is estimated to be valued at USD 105.6 billion in 2025.

The market size for the dips and spreads market is projected to reach USD 178.7 billion by 2035.

The dips and spreads market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in dips and spreads market are hummus, guacamole, salsa, cheese spreads and vegetable dip.

In terms of packaging, jars segment to command 31.2% share in the dips and spreads market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Spreads Market Size and Share Forecast Outlook 2025 to 2035

Spreads and Toppings Packaging Market Trends – Growth & Forecast 2025 to 2035

Vegan Dips Market Size and Share Forecast Outlook 2025 to 2035

Yogurt Dips Market Size, Growth, and Forecast for 2025 to 2035

Dairy-Free Spreads Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Yeast-based Spreads Market Size and Share Forecast Outlook 2025 to 2035

Demand for Yeast-Based Spreads in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Plant-based Cheese & Spreads in CIS Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA