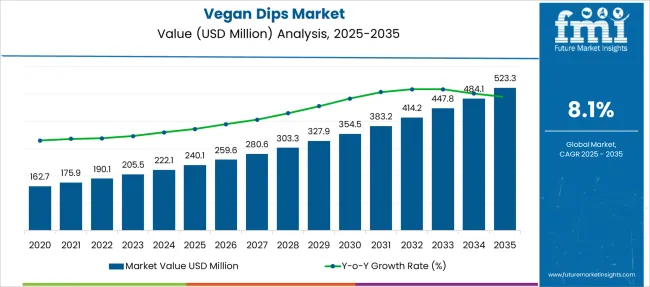

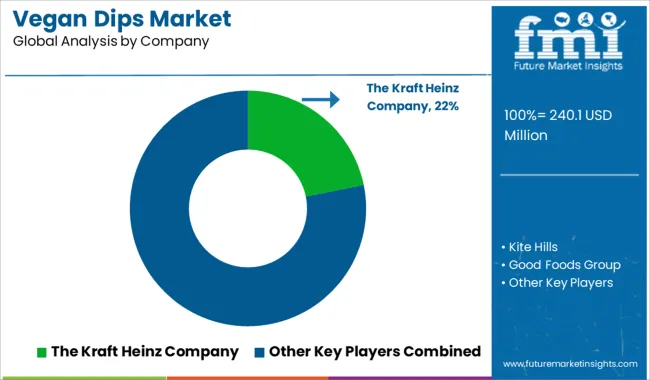

The Vegan Dips Market is estimated to be valued at USD 240.1 million in 2025 and is projected to reach USD 523.3 million by 2035, registering a compound annual growth rate (CAGR) of 8.1% over the forecast period.

| Metric | Value |

|---|---|

| Vegan Dips Market Estimated Value in (2025E) | USD 240.1 million |

| Vegan Dips Market Forecast Value in (2035F) | USD 523.3 million |

| Forecast CAGR (2025 to 2035) | 8.1% |

The vegan dips market is expanding rapidly, driven by increasing consumer interest in plant-based diets and healthier snack options. Growing awareness of dietary restrictions and environmental concerns has led to a higher demand for vegan alternatives that offer both taste and nutritional benefits.

Product innovation focusing on clean-label ingredients and natural flavors has attracted health-conscious consumers and flexitarians alike. Retailers have responded by expanding shelf space and introducing ready-to-eat options that cater to convenience-seeking shoppers.

Social trends promoting sustainable food choices and the rise of veganism in mainstream culture have further supported market growth. Moving forward, the market is expected to benefit from continued flavor diversification and improvements in packaging formats that enhance product freshness and portability. Segmental growth is being led by the Hummus type, classic flavors, and single-serve pack packaging, reflecting consumer preference for familiar tastes and convenience.

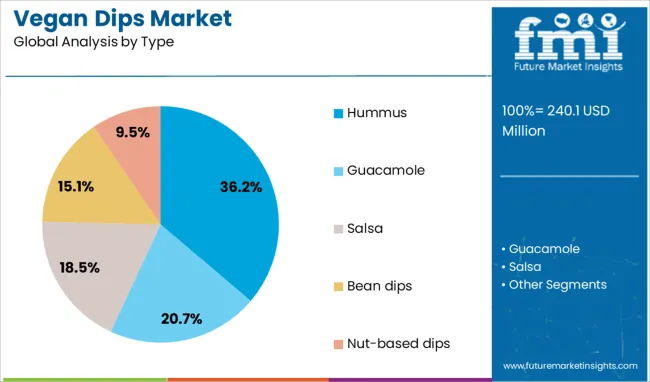

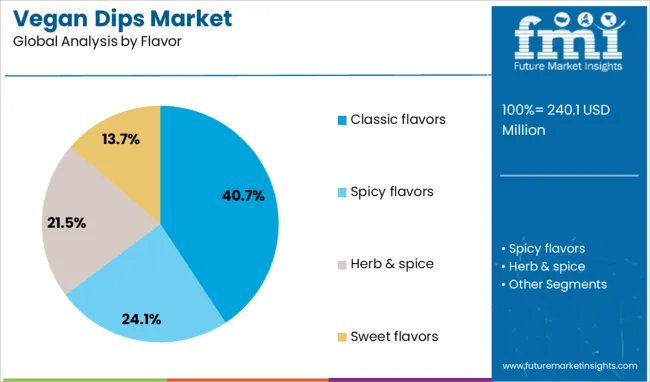

The vegan dips market is segmented by type, flavor, packaging, and end-user and geographic regions. The vegan dips market is divided by type into Hummus, Guacamole, Salsa, Bean dips, and Nut-based dips. The vegan dips market is classified by flavor into Classic flavors, Spicy flavors, Herb & spice, and Sweet flavors. The vegan dips market is segmented based on packaging into Single-serve packs, Bulk packs, and Reusable containers. The vegan dips market is segmented by end-user into Household, Foodservice, and Industrial. Regionally, the vegan dips industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Hummus segment is projected to capture 36.2% of the vegan dips market revenue in 2025, securing its position as the leading product type. This segment has gained popularity due to its nutritional profile, which is rich in protein and fiber, and its versatility as a dip or spread. Consumers have favored hummus for its creamy texture and ability to pair well with a variety of foods.

Plant-based diets have increased the demand for legume-based products like hummus, which offer a wholesome alternative to traditional dairy-based dips. Product formulations have evolved to include diverse ingredient blends and organic options, meeting consumer expectations for both health and taste.

The sustained interest in Mediterranean flavors and clean eating has further strengthened the hummus segment’s growth prospects.

The Classic Flavors segment is expected to hold 40.7% of the market share in 2025, maintaining its lead among flavor categories. This segment’s popularity stems from consumer familiarity and the comfort offered by traditional taste profiles such as garlic, lemon, and roasted chickpeas. Classic flavors have wide appeal across demographic groups, providing a reliable choice for both new and repeat consumers.

Flavor innovation in this category has focused on enhancing natural ingredients and reducing artificial additives to align with clean-label trends.

The ability to pair classic vegan dips with a variety of foods and snacks has also supported consumer loyalty. The ongoing preference for authentic and simple flavors suggests continued growth for this segment.

The Single-Serve Packs segment is projected to represent 46.9% of the vegan dips market revenue in 2025, establishing it as the preferred packaging format. Growth in this segment has been driven by increasing consumer demand for convenience, portion control, and on-the-go snacking options.

Single-serve packs offer easy usability for busy lifestyles, making them popular among working professionals, students, and health-conscious consumers. Retailers have supported this trend by increasing shelf availability and incorporating single-serve formats into grab-and-go sections.

Sustainability concerns have prompted some brands to adopt recyclable materials for these packs, enhancing consumer appeal. As lifestyles become more mobile and snacking occasions diversify, the single-serve packaging segment is expected to maintain its dominant position in the market.

Vegan dips are plant-based spreads and sauces formulated without animal-derived ingredients. They are made from sources such as legumes, nuts, seeds, vegetables, and herbs to deliver flavor and texture. These products are used at home, in foodservice, and in retail snack occasions. Demand is driven by increasing interest in plant-based diets, health-conscious eating, and ethical consumer choices. Manufacturers offering products with clean ingredient lists, high nutritional value, and appealing taste profiles have been well-positioned. Product formats that offer ease of use, long shelf life, and compatibility with diverse cuisines continue to influence purchase decisions among retail consumers and foodservice operators.

Growth in vegan dips has been supported by rising consumer focus on plant-based eating and health-conscious snacking. Interest in reducing animal protein intake and managing dietary restrictions has reinforced demand. Brand efforts to showcase nutrient-dense ingredients such as chickpeas, avocado, lentils, and cashews have increased appeal. Retailers have expanded shelf space for vegan items to meet shopper expectations. Partnerships with meal kit providers and prepared food brands have introduced dips into meal occasions and catering segments. Clean label positioning and allergen-friendly recipes have helped broaden reach. Consumers seeking flavor-rich yet responsibly made food continue to drive product development in this category.

Adoption has been constrained by the higher cost of premium plant-based ingredients compared to conventional dairy or oil-based dips. Pricing sensitivity has limited broad appeal in budget-focused markets. Consumer perception of flavor or texture deficiencies compared to traditional dips has reduced repeat purchases in some cases. Supply variations of seasonal produce, such as avocado or fresh herbs, have caused formulation inconsistency. Regulatory requirements for allergen claims and nutritional labeling have increased complexity for small producers. Shelf life limitations of plant-based formulations without preservatives have posed logistical challenges for retail distribution. Consumer education about the storage and serving of vegan dips has not been widespread in all target segments.

Opportunities are being identified in flavored dip variants such as spiced hummus, turmeric lentil spreads, and plant-based cheese alternatives. Foodservice channels in quick service restaurants, cafes, and meal delivery platforms have begun offering vegan dip additions. Co-branding with snack crackers, vegetable chips, and sandwich kits supports bundled promotion. Emerging interest in regional flavor profiles such as Mediterranean, Asian or Latin-inspired dip formats has allowed product innovation. Subscription-based home delivery packs of assorted vegan dips are creating direct-to-consumer revenue streams. Collaborations with health food influencers and chef-driven recipes have increased brand visibility. Retailers offering ready-to-use dip assortments for entertaining occasions have created new access points for growth.

Trend toward clean-label vegan dips has led to increased use of minimal-ingredient recipes with recognizable plant-based components. Packaging formats such as portion cups, resealable tubs and single-serve sachets offer convenience for on-the-go and meal prep usage. Plant-based nutritional profiles enriched with protein, fiber and healthy fats have attracted health-aware consumers. Innovation in preservative-free options using high-pressure processing or natural antioxidants is advancing shelf life. Interest in eco-conscious packaging materials and recyclable containers is increasing among buyers. Product lines featuring strong vegan certifications are being prioritized for transparency and trust. Flavor innovations such as smoky, herbed or fermented versions are gaining traction in both retail and foodservice channels.

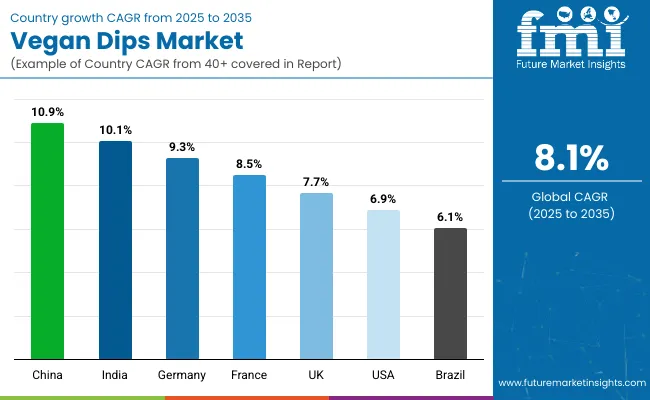

| Country | CAGR |

|---|---|

| China | 10.9% |

| India | 10.1% |

| Germany | 9.3% |

| France | 8.5% |

| UK | 7.7% |

| USA | 6.9% |

| Brazil | 6.1% |

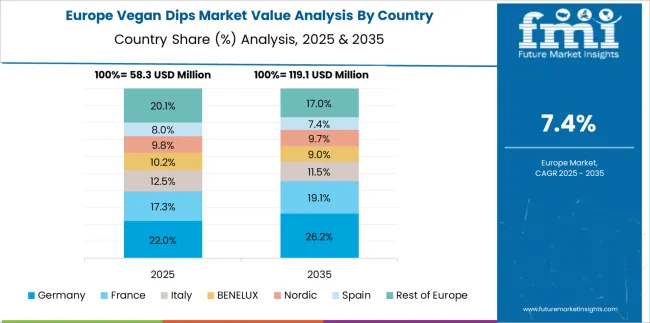

The vegan dips market is projected to grow at a CAGR of 8.1% from 2025 to 2035, supported by rising demand for plant-based spreads, innovation in dairy-free formulations, and premiumization trends in healthy snacking. China leads at 10.9% CAGR, driven by strong retail penetration and the popularity of plant-based sauces in urban households. India follows at 10.1%, where growing health awareness and premium snack pairing trends are fueling demand. Among European markets, Germany posts 9.3%, emphasizing organic-certified and clean-label variants, while France records 8.5%, led by culinary innovation and expansion in gourmet retail channels. The United Kingdom grows at 7.7%, with e-grocery platforms and private-label offerings boosting product accessibility. The analysis includes over 40 countries, with the top five detailed below.

China is forecast to grow at a 10.9% CAGR, driven by rapid urbanization and the growing preference for plant-based condiments in packaged foods and restaurant offerings. Domestic brands are introducing innovative flavor profiles combining traditional Asian spices with dairy-free formulations to attract health-conscious consumers. E-commerce channels are strengthening product reach with curated vegan snack bundles, while offline retail chains promote private-label options in supermarkets. Foodservice operators are incorporating vegan dips in fusion cuisine menus to cater to flexitarian consumers. Investments in manufacturing facilities for high-protein, soy-based dip formulations are expected to support large-scale production in the coming years.

India is projected to post a 10.1% CAGR, supported by the rising demand for healthier snacking alternatives in both metro and tier-two cities. Consumers are shifting from traditional dairy-based condiments to plant-based dips made from lentils, nuts, and legumes. Premium retail stores and QSR chains are introducing hummus, guacamole, and chickpea spreads in ready-to-eat packs to target convenience-driven buyers. Startups and local brands are experimenting with regional spice-infused dip variants to differentiate product portfolios. Strategic partnerships between food aggregators and online delivery platforms are enhancing product accessibility, ensuring penetration into smaller towns through digital commerce.

Germany is expected to grow at a 9.3% CAGR, fueled by strong demand for organic-certified, clean-label plant-based dips in retail and HoReCa segments. High-protein dips made from legumes and seeds dominate product innovation, appealing to health-conscious consumers. Gourmet restaurants and cafes are featuring vegan dips in appetizer menus, driving adoption beyond packaged food. Domestic manufacturers focus on introducing preservative-free formulations with locally sourced ingredients. Supermarkets and specialty health stores offer private-label lines emphasizing sustainability claims and recyclable packaging to attract eco-conscious buyers.

France is projected to post an 8.5% CAGR, supported by the increasing popularity of vegan cuisine in gourmet dining and retail. Artisanal brands are developing sophisticated dip varieties such as truffle-infused hummus and Mediterranean-style spreads to appeal to premium consumers. Hypermarkets and specialty gourmet stores are expanding shelf space for plant-based condiments under private labels. Marketing campaigns highlighting culinary creativity and recipe versatility are influencing adoption in home cooking. Export-oriented manufacturers are leveraging France’s culinary reputation to position premium vegan dips across European markets.

The United Kingdom is expected to grow at a 7.7% CAGR, driven by strong online grocery adoption and increasing availability of private-label vegan dips. Supermarkets are introducing exclusive plant-based dip assortments at competitive prices, creating affordability in mainstream categories. Snack pairing trends in urban households, particularly with baked chips and vegetable sticks, are expanding usage occasions. Foodservice outlets such as cafes and quick-service restaurants are adding vegan dips to menus as part of value meal combinations. Startups and challenger brands are utilizing subscription-based direct-to-consumer channels to increase customer retention and brand loyalty.

The vegan dips market is rapidly expanding, driven by growing demand for plant-based alternatives across snacks, spreads, and meal accompaniments. Leading players include The Kraft Heinz Company, SABRA DIPPING CO. LLC, Frito-Lay North America Inc., and Bolthouse Farms Inc., which leverage strong distribution networks and brand recognition to dominate mainstream retail channels.

Kraft Heinz and Frito-Lay are focusing on plant-based reformulations of traditional dips like cheese and ranch, while SABRA specializes in hummus and chickpea-based products. Good Foods Group and Kite Hill stand out for innovation in clean-label and almond-based dips, targeting health-conscious consumers through grocery and e-commerce platforms.

Galaxy Nutritional Foods Inc. and DAIYA FOODS INC. lead in dairy-free cheese-style dips, catering to both vegan and lactose-intolerant segments. Emerging brands such as Wingreen World, Siete, and Hippeas emphasize premium positioning with organic ingredients, bold flavors, and gluten-free certifications to capture niche markets.

Competitive differentiation revolves around taste authenticity, clean-label claims, allergen-free certifications, and convenience-driven packaging formats like single-serve and resealable tubs. The market shows moderate entry barriers as companies need R&D capabilities to mimic dairy-based flavors and textures while maintaining shelf stability. Strategic priorities include partnerships with retailers for shelf space, expansion into foodservice channels, and diversification into culturally inspired flavors.

Future growth will be driven by rising plant-based consumption trends, product innovations in protein-rich and probiotic dips, and demand for low-fat, allergen-friendly alternatives. Companies investing in flavor diversity, e-commerce strategies, and functional ingredients will secure a strong position in this evolving segment.

| Item | Value |

|---|---|

| Quantitative Units | USD 240.1 Million |

| Type | Hummus, Guacamole, Salsa, Bean dips, and Nut-based dips |

| Flavor | Classic flavors, Spicy flavors, Herb & spice, and Sweet flavors |

| Packaging | Single-serve packs, Bulk packs, and Reusable containers |

| End-User | Household, Foodservice, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | The Kraft Heinz Company, Kite Hills, Good Foods Group, Wingreen World, Galaxy Nutritional Foods Inc., SABRA DIPPING CO. LLC, DAIYA FOODS INC., Frito-Lay North America Inc., Bolthouse Farms Inc., Siete, and Hippeas |

| Additional Attributes | Dollar sales by product type (hummus, plant-based cheese dips, salsa alternatives, yogurt-style dips) and distribution channel (supermarkets, convenience stores, e-commerce, specialty retailers), with demand driven by plant-based eating trends, snacking convenience, and health-conscious consumer choices. Regional dynamics indicate strong growth in North America and Europe due to widespread adoption of vegan products, while Asia-Pacific shows emerging demand linked to dietary diversification. Innovation trends include protein-enriched vegan dips, functional blends with probiotics, and packaging innovations such as recyclable and resealable containers to enhance portability and shelf life. |

The global vegan dips market is estimated to be valued at USD 240.1 million in 2025.

The market size for the vegan dips market is projected to reach USD 523.3 million by 2035.

The vegan dips market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in vegan dips market are hummus, guacamole, salsa, bean dips and nut-based dips.

In terms of flavor, classic flavors segment to command 40.7% share in the vegan dips market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vegan Vitamin D3 Supplements Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Market Size and Share Forecast Outlook 2025 to 2035

Vegan Confectionery Market Size and Share Forecast Outlook 2025 to 2035

Vegan Steak Market Size and Share Forecast Outlook 2025 to 2035

Vegan Pasta Market Size and Share Forecast Outlook 2025 to 2035

Vegan Hyaluronic Acid Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Peptides Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Skincare Market Size and Share Forecast Outlook 2025 to 2035

Vegan Protein Powder Market Analysis - Size, Share, and Forecast 2025 to 2035

Vegan Tortillas Market Size and Share Forecast Outlook 2025 to 2035

Vegan Casing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dressing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Sauce Market Size and Share Forecast Outlook 2025 to 2035

Vegan Yogurt Market Size, Growth, and Forecast for 2025 to 2035

Vegan Meals Market Size, Growth, and Forecast for 2025 to 2035

Vegan Dog Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Protein Bars Market Analysis – Size, Share & Trends 2025–2035

Vegan Vitamins and Supplements Market – Growth & Demand 2025 to 2035

Analysis and Growth Projections for Vegan Fast-Food Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA