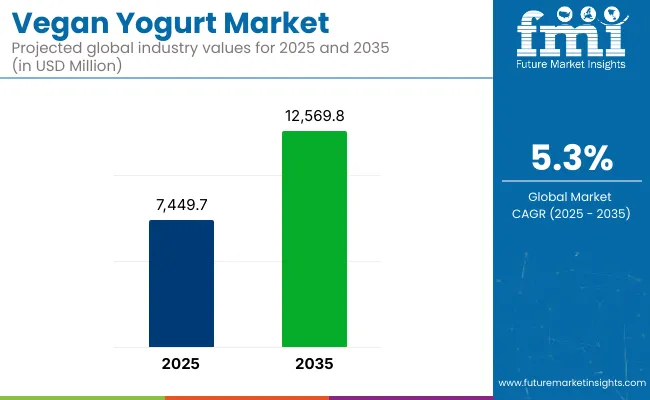

In 2025, the global vegan yogurt market size is assessed at USD 7,449.7 million and is forecasted to witness robust expansion, reaching USD 12,569.8 million by 2035, reflecting a CAGR of 5.3%. This expansion is being reinforced by dynamic shifts in dietary habits, with plant-based dairy alternatives increasingly favored over conventional products.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 7,449.7 Million |

| Market Value (2035F) | USD 12,569.8 Million |

| CAGR (2025 to 2035) | 5.3% |

Accelerated interest in vegan, lactose-free, and sustainable offerings has intensified innovation pipelines across product categories, particularly in flavored and fortified formats. The market landscape is undergoing rapid evolution, driven by multiple reinforcing factors. Consumers are seeking cruelty-free, allergen-friendly, and health-boosting dairy alternatives, compelling manufacturers to launch differentiated formats including Greek-style, high-protein, and functional yogurts.

Flavor variety is being expanded with tropical fruits, spices, and botanicals to appeal to broader demographics. However, challenges persist around taste perception, texture parity with dairy, and higher price points relative to traditional yogurt. Increasing R&D investments have been observed in ingredient emulsification and fermentation processes to improve creaminess and shelf stability. Market participants are strategically targeting retail and online channels, while new entrants are leveraging clean-label positioning to gain visibility.

By 2035, the market is expected to display significant maturity, underpinned by deepening consumer alignment with environmental, ethical, and health values. Soy, almond, and coconut bases are forecast to continue dominating, although oats and cashew are expected to see accelerated uptake.

Functional claims like gut health, immunity, and protein enhancement will play a key role in brand differentiation. Growth is likely to be more pronounced in North America, Western Europe, and East Asia, supported by well-established cold chain logistics and strong vegan advocacy. With taste and texture technologies improving steadily, vegan yogurt is anticipated to become a mainstream dairy alternative category by 2035.

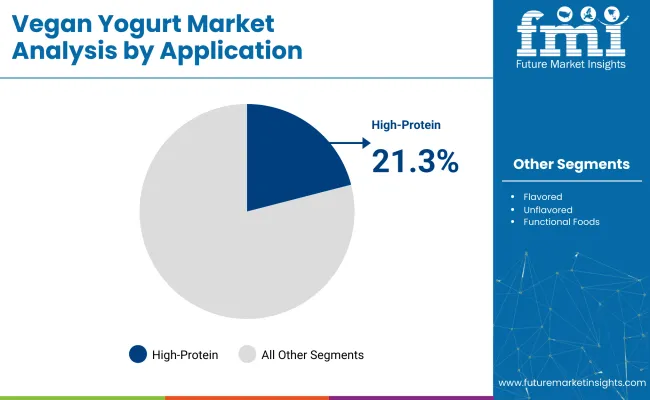

High-protein formats are estimated to account for 21.3% of the vegan yogurt market in 2025. This segment is evolving from a niche positioning into a performance-driven offering, aligning with protein-conscious dietary trends and the active lifestyle consumer base.

Products fortified with pea, fava, or soy protein isolates are being prioritized by manufacturers seeking to improve nutritional density without compromising plant-based claims. The demand is being further catalyzed by the growing adoption of flexitarian and athletic diets, wherein protein-enriched vegan options are replacing traditional Greek yogurts and dairy-based skyr.

Major brands such as Alpro (Danone) and Siggi’s have expanded their high-protein SKUs across the UK, Germany, and the Nordics, supported by structured retail promotions and macro-influencer marketing. From a regulatory perspective, the European Food Safety Authority (EFSA) has validated the use of novel protein blends such as oat- and legume-derived ingredients, which is enabling rapid reformulations. Shelf-stable and ambient-stored options with high-protein claims are gaining traction in East Asia, reflecting increasing urban consumption and convenience expectations.

According to EFSA’s Novel Food Catalogue, several plant-based protein sources have cleared safety reviews for use in dairy alternatives, supporting this segment’s expansion. As protein fortification converges with sustainability and functional health, this sub-segment is expected to witness intensified innovation and competitive activity.

Private label brands are projected to hold 18.6% of vegan yogurt sales by 2025, driven by value-conscious consumers and retailer strategies to improve category margin retention. The rise of own-label offerings has shifted from basic SKUs to more complex, differentiated products, including organic, probiotic, and high-protein variants. This shift is driven by major retail groups in Western Europe and North America seeking to control pricing volatility while enhancing customer loyalty through plant-based product portfolios.

Retailers such as Tesco (UK), E.Leclerc (France), and Whole Foods (USA) have introduced in-house vegan yogurts with competitive taste and texture profiles, narrowing the gap with premium brands. These developments are also enabling shelf space democratization for emerging flavors such as mango turmeric or oat blueberry with probiotic blends.

Retailer-driven sourcing agreements with regional co-packers and contract fermenters are enabling cost efficiencies without compromising quality. Additionally, private label growth is supported by clean-label and non-GMO certifications, aligning with rising consumer scrutiny of ingredient panels.

While private labels traditionally faced skepticism over consistency and mouthfeel, innovations in emulsification and stabilizer technologies are helping address these challenges. As retailers expand vegan assortments, private labels are expected to play a pivotal role in driving mass-market adoption across mid-income households.

High Production Costs and Texture Challenges

The extrusion processing and high-quality ingredients required to make rich, creamy, probiotic-filled vegan yogurt lead to higher production costs than traditional dairy yogurt. Without the use of artificial stabilizers, manufacturers struggle to produce the desired texture, taste and nutritional profile. Plus, though, sourcing plant-based cultures, and fermented consistency can make the production process much more complicated.

Expansion of Functional and Fortified Vegan Yogurts

As protein enriched, probiotic enhanced, fortified plant-based yogurts gain traction, the incentives for innovation in plant-based yogurts only grow stronger. Advances in fermenting, extracting plant proteins and formulating alternative ingredients helps brands make high-performance deviated yogurts. Increased penetration of private-label vegan products and growing investment in sustainable packaging solutions are likely to fuel the market development.

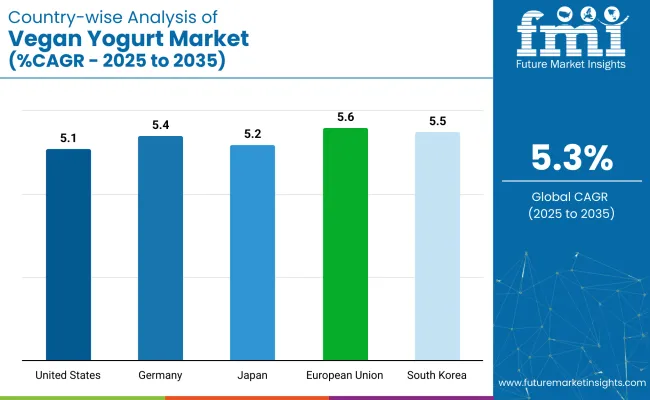

The vegan yogurt market in the United States has been on track with its growth as the consumer demand for the dairy-free alternatives continues to rise. Market growth is driven primarily by the increasing popularity of plant-based diets and a growing awareness of lactose intolerance.

Yogurts based on soy, almond and coconut have achieved healthy penetration with oat-based variants achieving strong momentum due to their creamy texture and sustainable sourcing. Supermarkets and online platforms broaden their offerings of plant-based yogurt, and food giants roll out fortified varieties that include added probiotics and extra protein to woo health-conscious shoppers.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.1% |

The UK vegan yogurt sector is experiencing robust growth as a result of a growing trend towards plant-based eating and concerns around sustainability. As consumers request dairy-free yogurt including cashew, soy, and oat bases the growing demand is driving innovation in flavours and functional ingredient improvements like added fibre and probiotics.

Plant-based dairy alternatives are getting an even wider shelf presence in stores, and foodservice outlets are adding vegan yogurt to their offerings. Furthermore, market growth is being propelled by government-assisted programs encouraging decreased dairy consumption for both ecological and health concerns.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.4% |

Growing consumer interests in lactose-free and ecological dairy alternatives have kept the European Union at the forefront of the vegan yogurt. Countries like Germany, France and the Netherlands lead with high adoption rates of plant-based alternatives to dairy.

A combination of regulatory support for sustainable food production, increasing vegan and flexitarian populations, and advances in food technology that improve taste and texture is fuelling the market. Growing demand due to better fermentation techniques enhancing gut health benefits.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.6% |

Japan's vegan yogurt market is slowly growing up as health-conscious consumers increasingly lean towards functional foods with probiotic benefits. Plant-based yogurts appeal to those who wish to maintain gut health, given traditional dietary habits involving fermented foods (such as miso and natto).

Given Japan’s familiarity with soy-based products, such as tofu or soy milk, the demand for soy-based yogurt is high. Manufacturers are targeting the healthy living market, creating premium, organic, and minimally processed products.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.2% |

With the growing interest in plant-based diets and prevalence of lactose intolerance, There is strong growth for both almond and oat based yogurt varieties driven by value-added probiotic rich varieties being a major area of focus within the yogurt category.

The South Korean emphasis on beauty and wellness is also affecting consumer preferences because dairy-free options are often seen as healthier for the gut and skin. Supermarkets and convenience stores are adding to their dairy-free sections to serve the trend.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.5% |

Plant-based, lactose-free, and clean-label options are driving a rapid growth of the vegan yogurt market at a considerable CAGR during the forecast period as food-wise consumers become more conscious about what they consume.

Brands are coming up with novel formulations creating options that are high in protein, rich in probiotics, and low in sugar to increase the nutrition while also appealing to health-minded customers. Market growth and competitive differentiation are further fuelled by advances in fermentation techniques and plant-based ingredient sourcing.

The overall market size for the Vegan Yogurt Market was USD 7,449.7 Million in 2025.

The Vegan Yogurt Market is expected to reach USD 12,569.8 Million in 2035.

The demand is driven by rising consumer preference for plant-based dairy alternatives, increasing lactose intolerance cases, growing awareness of health benefits, expansion of product varieties, and higher availability of vegan yogurt in retail and online stores.

The top 5 countries driving market growth are the USA, UK, Europe, Japan and South Korea.

The Soy Milk Yogurt segment is expected to command a significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vegan Vitamin D3 Supplements Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Market Size and Share Forecast Outlook 2025 to 2035

Vegan Confectionery Market Size and Share Forecast Outlook 2025 to 2035

Vegan Steak Market Size and Share Forecast Outlook 2025 to 2035

Vegan Pasta Market Size and Share Forecast Outlook 2025 to 2035

Yogurt Powder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Hyaluronic Acid Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Peptides Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Skincare Market Size and Share Forecast Outlook 2025 to 2035

Vegan Protein Powder Market Analysis - Size, Share, and Forecast 2025 to 2035

Vegan Tortillas Market Size and Share Forecast Outlook 2025 to 2035

Vegan Casing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dressing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Sauce Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dips Market Size and Share Forecast Outlook 2025 to 2035

Vegan Meals Market Size, Growth, and Forecast for 2025 to 2035

Yogurt Dips Market Size, Growth, and Forecast for 2025 to 2035

Vegan Dog Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Yogurt Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA