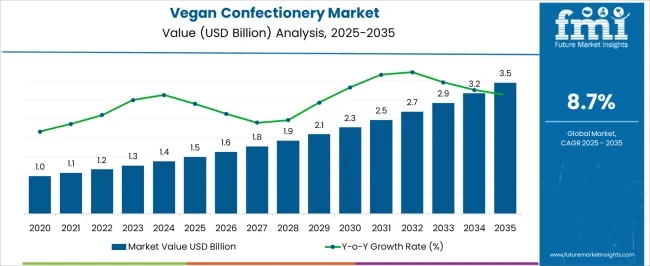

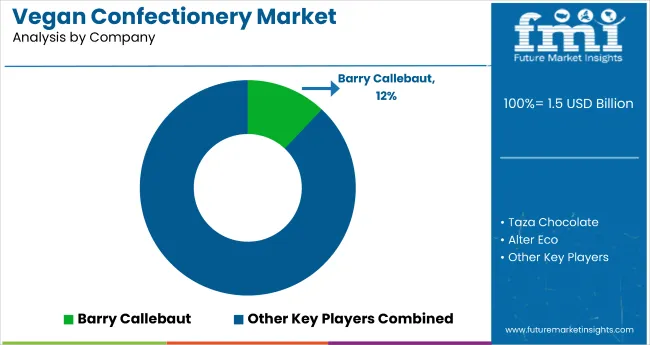

The global vegan confectionery market is projected to reach USD 1.5 billion in 2025 and will likely expand to USD 3.5 billion by 2035, advancing at a CAGR of 8.7% over the forecast period. In 2025, the broader global confectionery market is estimated at USD 270 billion, positioning vegan offerings at just 0.6% share.

| Attribute | Values |

|---|---|

| Estimated Industry Size (2025E) | USD 1.5 billion |

| Projected Industry Value (2035F) | USD 3.5 billion |

| CAGR (2025 to 2035) | 8.7% |

This marginal share reflects both the nascency of plant-based alternatives in indulgence categories and the structural lag in mainstream retail adoption despite rising ethical and health-conscious consumption. Rising health awareness, ethical consumerism, and mainstreaming of plant-based diets continue to reshape the global confectionery landscape. Vegan confectionery, once a niche, has transitioned into a scalable growth segment, driven by demand for dairy-free, gelatin-free, and allergen-light alternatives.

While chocolate bars lead product innovation, growth is supported by expanded retail distribution, upgraded labeling, and cleaner formulations. However, the segment still faces headwinds in scaling beyond early adopters, with a 0.6% share of the total confectionery market in 2025 reflecting limited mass-market penetration despite double-digit growth in select European regions.

The market is segmented into Product; Distribution Channel; and Region. By Product: Chocolate, Sugar, and Flour. By Distribution Channel: Offline and Online. By Region: North America; Latin America; Western Europe; Eastern Europe; South Asia & Pacific; East Asia; Middle East & Africa.

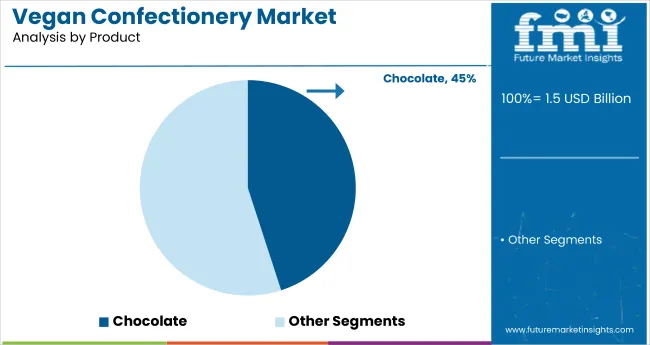

Chocolate will dominate the global vegan confectionery market in 2025 with a 45% share. The segment benefits from strong consumer familiarity, a broad product mix, ranging from bars to truffles, and high visibility in both premium and mass-market retail formats.

Growth has been driven by increased demand for dairy-free indulgence and accelerated SKU expansion across dark, nut-based, and filled variants. Friction remains in the form of elevated production costs and fragmented cocoa supply, which pressure margins in price-sensitive regions.

The hidden disruptor lies in visual design: confectionery brands offering uniquely shaped chocolate products report 2.8x higher repurchase intent, reinforcing customer retention in an impulse-driven category.

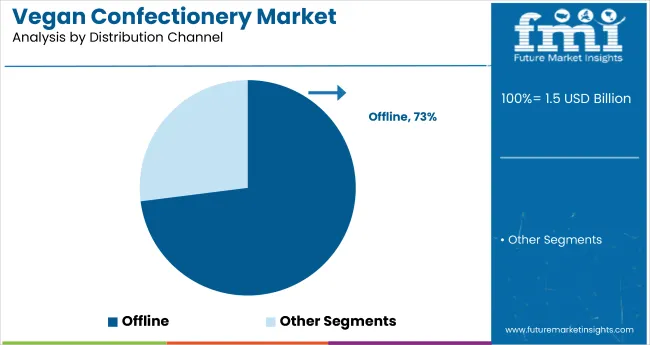

Offline retail formats will account for 73% of global vegan confectionery sales in 2025, cementing their dominance over online alternatives. Supermarkets, specialty health stores, and convenience outlets continue to drive volume through impulse-driven placement, brand visibility, and consumer trust in physical verification.

Two levers are driving this change - widespread presence of vegan SKUs in mainstream grocery chains, and strong tie-ins with seasonal promotions and in-store sampling. However, the channel faces pressure from rising D2C sales and shifting discovery patterns on social media platforms.

The disruptor is shelf adjacency, vegan confectionery placed next to conventional sweets sees a 2.1x higher purchase rate versus isolated placement, suggesting the key to conversion lies not in segmentation, but in seamless substitution.

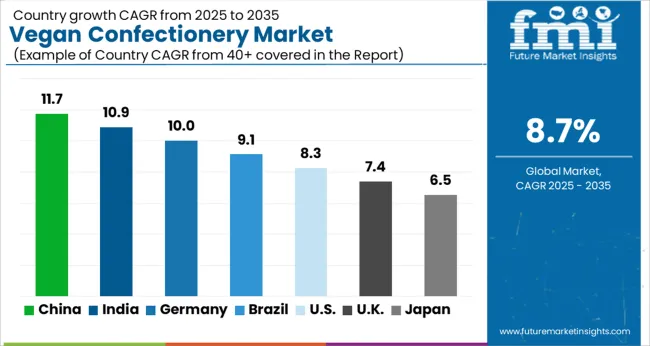

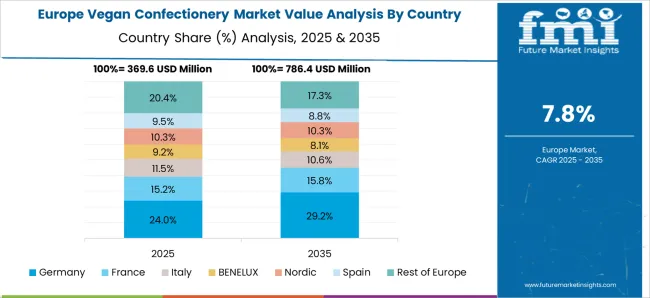

The vegan confectionery market exhibits varied momentum across countries, shaped by cultural food norms, retail infrastructure, and consumer awareness of plant-based alternatives. Western Europe remains the most progressive cluster, driven by ethical consumption patterns and strong retail penetration of dairy-free and gelatin-free products.

The United Kingdom and BENELUX have emerged as early movers, while Germany continues to lead on clean-label preferences. In North America, market expansion is tempered by price sensitivity and mature chocolate categories, whereas Australia reflects a balanced shift driven by health and sustainability narratives. Overall, national growth trajectories remain tied to availability, visibility, and reformulation of traditional confectionery into vegan equivalents.

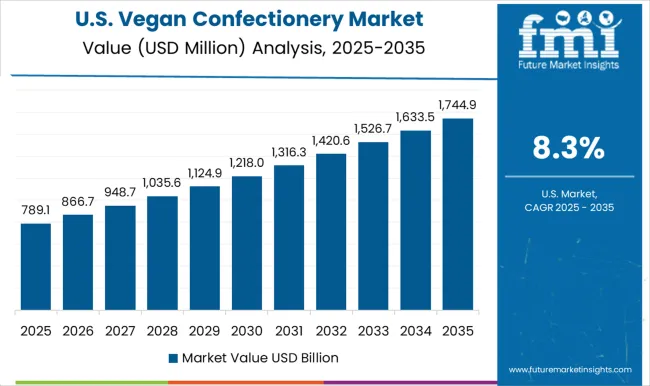

The USA vegan confectionery market is projected to reach USD 235.8 million in 2025 and grow to approximately USD 452 million by 2035, reflecting a CAGR of 8.3%. Growth remains steady but moderate, limited by high price elasticity in mainstream segments and saturation in traditional chocolate formats.

Margins benefit from expanded plant-based portfolios in urban supermarkets, but drag factors include limited consumer awareness outside core wellness-driven regions and inconsistent labeling standards. Offline retail accounts for the majority of volume, yet online platforms are gaining traction among younger demographics.

According to a 2025 FMI consumer survey, 48% of USA respondents expressed willingness to try vegan sweets, but only 21% reported consistent repurchase, signaling a gap between trial and conversion, often driven by perceived taste compromises.

Demand for vegan Confectionery in the UK is estimated at USD 148.6 million in 2025 and is expected to exceed USD 395.3 million by 2035, registering a CAGR of 7.4%. Growth is driven by a sharp shift toward plant-based indulgence, supported by well-established ethical consumption patterns and early reformulation efforts by major brands.

Margins are expanding as private labels and legacy confectioners introduce vegan SKUs with no compromise on taste or mouthfeel. Retail channels dominate, aided by clear on-pack vegan labeling and sustained in-store promotion. Regulatory clarity and retailer mandates have also accelerated shelf-space reallocation.

A 2025 FMI consumer poll found that 56% of UK shoppers consider ethical sourcing when buying sweets, with 38% indicating they prefer vegan confectionery over traditional options-indicating higher baseline acceptance compared to other markets.

Germany’s vegan confectionery market is projected to reach USD 132.9 million in 2025 and grow to USD 323.3 million by 2035, expanding at a CAGR of 10.0%. Growth is underpinned by strong health-conscious consumer behavior, high demand for clean-label alternatives, and dense distribution through drugstores and organic food chains.

Margin expansion is supported by efficient domestic production and ingredient traceability, while drag persists in smaller cities where traditional sweets still dominate. Offline channels maintain majority share, although online retailers targeting wellness shoppers are steadily gaining ground.

According to a 2025 FMI survey, 41% of German consumers actively seek vegan confectionery due to health reasons, with 29% citing ingredient transparency as a key purchase factor-highlighting the market’s shift toward informed, purpose-driven consumption.

Australia’s vegan confectionery market is estimated at USD 87.2 million in 2025 and is projected to reach USD 177.8 million by 2035, growing at a CAGR of 7.4%. Growth is driven by rising public awareness around animal welfare, clean-eating habits, and increased availability of plant-based SKUs in supermarkets and specialty stores.

Margins benefit from premium product positioning and health-led marketing, but uptake is constrained by higher unit prices and limited rural penetration. Offline retail remains dominant, though online platforms have seen rising interest among younger and urban consumers seeking variety.

A 2025 FMI survey revealed that 36% of Australian consumers are likely to buy vegan sweets if labeled as palm-oil-free and allergen-friendly, indicating that label transparency plays a crucial role in shopper decision-making.

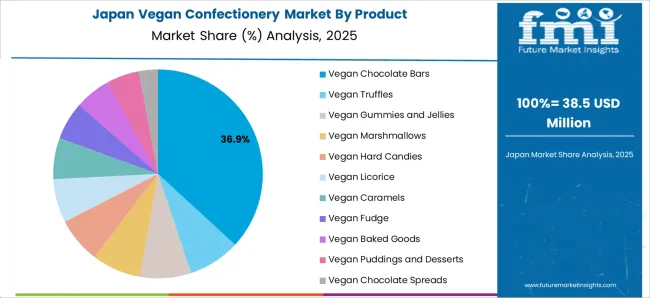

Japan’s vegan confectionery market is forecast to reach USD 65.4 million in 2025 and is expected to grow to USD 141.4 million by 2035, reflecting a CAGR of 6.5%. Growth is shaped by rising lactose intolerance awareness, premiumization of plant-based indulgence, and limited but growing interest in ethical consumption among younger demographics.

Margin uplift is supported by small-batch, locally sourced innovations, especially in matcha, mochi, and bean-based confections, yet the category faces friction due to low baseline awareness and unclear vegan labeling in traditional retail channels. Department stores and health food outlets continue to lead physical distribution, while e-commerce accounts for a growing share in metro regions.

According to a 2025 FMI consumer survey, 32% of Japanese respondents reported trying vegan sweets in the past year, but only 14% recognized “vegan” as a distinct product label-indicating latent demand but poor market signaling.

The players in the vegan confectionery market are focusing on product reformulation, packaging design, and retail partnerships to widen reach and strengthen consumer loyalty. Established confectioners such as Mondelez and Nestlé have introduced dairy-free variants under core brands, while newer entrants like NOMO and Goodio are leveraging niche positioning and allergen-free claims to capture health-conscious segments.

Recent expansion by Hershey and Unilever into vegan SKUs reflects increased competition in mainstream grocery. In contrast, smaller players such as Endorfin and Alter Eco have invested in limited-edition, high-cacao, low-sugar offerings tailored to ethical and wellness-focused shoppers. Manufacturing capacity upgrades are underway across Western Europe, particularly in BENELUX and the UK, where vegan labeling and clean ingredients drive shelf-space advantage.

Over the next three years, winners will be those who can balance indulgence with label clarity and price accessibility. Late entrants without reformulated portfolios or retailer backing may struggle to secure visibility in crowded snack aisles.

Vegan Confectionery Industry News

| Attribute | Details |

| Market Name | Vegan Confectionery Market |

| Base Year | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| 2025 Market Size | USD 1.5 billion |

| 2035 Market Size | USD 3.5 billion |

| CAGR (2025to 2035) | 8.7% |

| Forecast Units | Value (USD Million) |

| Segments Covered | By Product, By Distribution Channel |

| Product Segments | Chocolate, Sugar, Flour |

| Distribution Channels | Offline, Online |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Key Countries Covered | United States, United Kingdom, Germany, Australia, Japan, and 40+ others |

| Key Players Profiled | Mondelez, Nestlé, Hershey, Taza Chocolate, NOMO, Alter Eco, Freedom Confectionery, Goodio, Dylan's Candy Bar, and others |

| Report Coverage | Market size, CAGR, segment shares, country-wise analysis, competitive landscape, consumer survey insights |

The global vegan confectionery market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the vegan confectionery market is projected to reach USD 3.5 billion by 2035.

The vegan confectionery market is expected to grow at a 8.7% CAGR between 2025 and 2035.

The key product types in vegan confectionery market are vegan chocolate bars, vegan truffles, vegan gummies and jellies, vegan marshmallows, vegan hard candies, vegan licorice, vegan caramels, vegan fudge, vegan baked goods, vegan puddings and desserts and vegan chocolate spreads.

In terms of distribution channel, retail segment to command 42.5% share in the vegan confectionery market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vegan Vitamin D3 Supplements Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Market Size and Share Forecast Outlook 2025 to 2035

Vegan Steak Market Size and Share Forecast Outlook 2025 to 2035

Vegan Pasta Market Size and Share Forecast Outlook 2025 to 2035

Vegan Hyaluronic Acid Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Peptides Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Skincare Market Size and Share Forecast Outlook 2025 to 2035

Vegan Protein Powder Market Analysis - Size, Share, and Forecast 2025 to 2035

Vegan Tortillas Market Size and Share Forecast Outlook 2025 to 2035

Confectionery Coating Market Size and Share Forecast Outlook 2025 to 2035

Vegan Casing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dressing Market Size and Share Forecast Outlook 2025 to 2035

Confectionery Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Cheese Sauce Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dips Market Size and Share Forecast Outlook 2025 to 2035

Confectionery Fillings Market Size and Share Forecast Outlook 2025 to 2035

Vegan Yogurt Market Size, Growth, and Forecast for 2025 to 2035

Vegan Meals Market Size, Growth, and Forecast for 2025 to 2035

Confectionery Packaging Market Size, Share & Forecast 2025 to 2035

Confectionery Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA