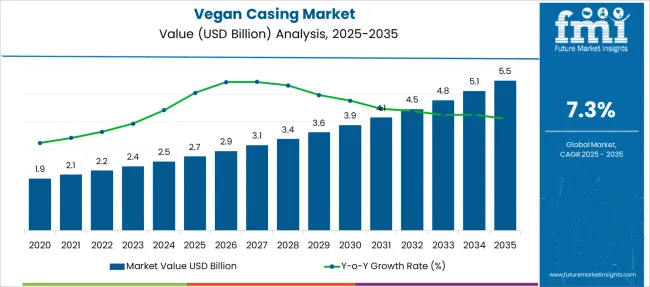

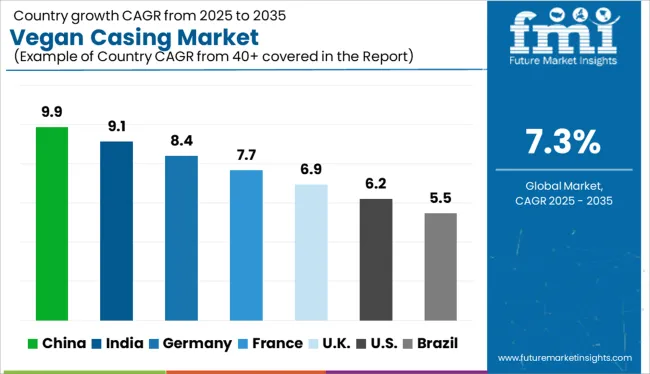

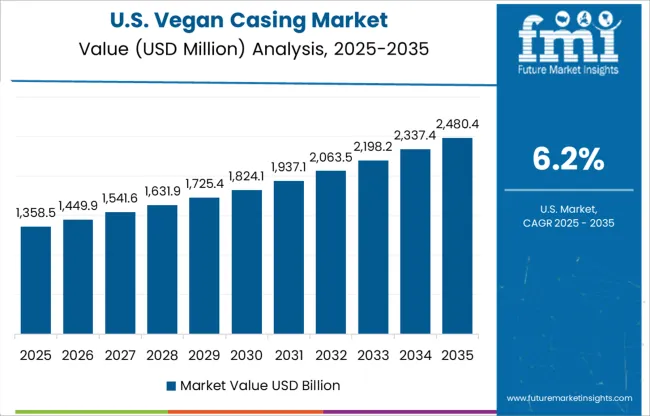

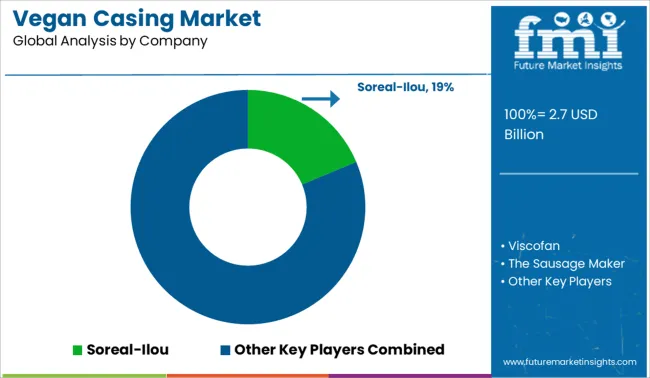

The Vegan Casing Market is estimated to be valued at USD 2.7 billion in 2025 and is projected to reach USD 5.5 billion by 2035, registering a compound annual growth rate (CAGR) of 7.3% over the forecast period.

| Metric | Value |

|---|---|

| Vegan Casing Market Estimated Value in (2025 E) | USD 2.7 billion |

| Vegan Casing Market Forecast Value in (2035 F) | USD 5.5 billion |

| Forecast CAGR (2025 to 2035) | 7.3% |

The vegan casing market is witnessing accelerated growth, supported by the global rise in plant-based dietary preferences, ethical consumption, and environmental awareness. As food manufacturers increasingly reformulate their product lines to align with vegan and vegetarian consumer segments, plant-derived casings have gained significant traction in processed meat substitutes. The growing scrutiny of animal-derived ingredients in food production, especially gelatin and collagen-based casings, has further catalyzed the shift toward plant-origin alternatives.

Innovations in polysaccharide and cellulose-based materials have enabled manufacturers to develop casings that mimic the texture, elasticity, and cooking performance of traditional sausage skins. This market growth is also aligned with clean-label and allergen-free formulation trends in functional food innovation.

Regulatory clarity in major regions regarding vegan labeling standards is creating a favorable landscape for large-scale commercial adoption The ability to offer uniform quality, stability, and shelf-life compatibility through continuous extrusion technologies is paving the way for expanded usage across artisanal and industrial food applications, reinforcing the market’s long-term potential.

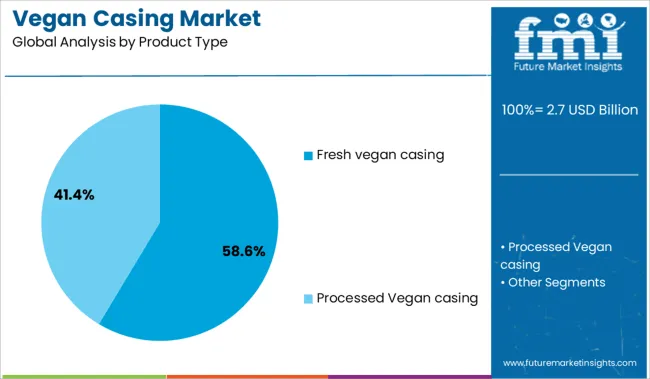

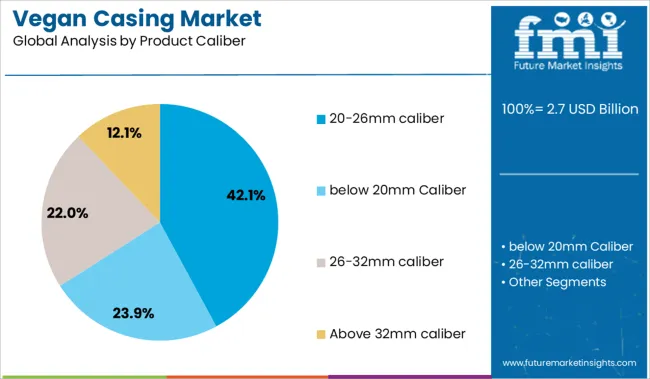

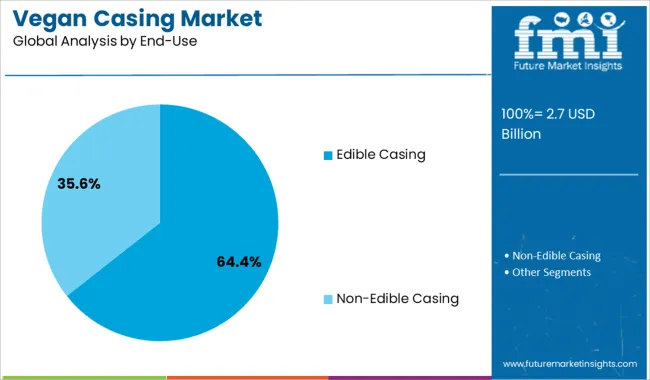

The market is segmented by Product Type, Product Caliber, End-Use, and Sales Channel and region. By Product Type, the market is divided into Fresh vegan casing and Processed Vegan casing. In terms of Product Caliber, the market is classified into 20-26mm caliber, below 20mm Caliber, 26-32mm caliber, and Above 32mm caliber. Based on End-Use, the market is segmented into Edible Casing and Non-Edible Casing. By Sales Channel, the market is divided into B2B/HoReCa and B2C. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fresh vegan casing segment is projected to contribute 58.6% of the total revenue share in the vegan casing market in 2025, making it the most dominant product type. This leading position is being driven by increasing demand for minimally processed, ready-to-cook plant-based sausages and meat substitutes that retain natural moisture and texture. Fresh vegan casings have been adopted widely by manufacturers due to their ability to maintain product freshness while delivering desired elasticity and bite, essential for replicating traditional sausage formats.

The growing consumer preference for refrigerated plant-based proteins and the expansion of chilled distribution networks have further supported the segment’s growth. Technical advancements in non-animal gelling agents and water-based polymers have enabled the creation of soft, durable casings compatible with cold storage and short shelf-life products.

Additionally, fresh vegan casings are aligned with trends in high-moisture extrusion cooking, making them ideal for gourmet vegan sausages and refrigerated deli offerings Their compatibility with organic and preservative-free labeling claims has further elevated their market presence.

The 20 to 26mm caliber segment is expected to hold 42.1% of the vegan casing market’s revenue share in 2025, emerging as the leading product caliber category. This growth is being influenced by the rising production of standard-sized vegan sausages and frankfurters that are commonly distributed through retail and quick-service restaurant channels. The segment has benefited from being the preferred size range for single-serving and portion-controlled sausage applications, offering familiarity to consumers accustomed to conventional formats.

Manufacturers have increasingly standardized extrusion and filling lines around this caliber to streamline processing and reduce material waste. The size also provides an optimal balance between cookability, visual appeal, and structural integrity, particularly under grilling and pan-frying conditions.

As food service operators and packaged food brands continue to expand their vegan offerings, the 20 to 26mm range is being favored for its consumer acceptance, scalability, and operational efficiency The segment's consistent demand across private label, branded retail, and fast-food formats reinforces its leading share in the market.

The edible casing segment is forecasted to account for 64.4% of the overall revenue in the vegan casing market in 2025, representing the most prominent end-use category. This segment's dominance is being supported by increasing adoption of plant-based sausages and deli products where consumption without peeling is required for sensory consistency and consumer convenience. Edible vegan casings have gained favor for their ability to dissolve or soften during cooking, eliminating the need for removal and enhancing the overall eating experience.

The growing focus on clean-label food formulations and reduction in post-processing steps has further encouraged the use of edible casings in commercial plant-based meat lines. Technological innovations in edible film formation using natural polysaccharides and water-soluble fibers have enabled high-strength, heat-resistant casings suitable for grilling, steaming, and baking.

As regulatory clarity around food-grade vegan films continues to improve, manufacturers are increasingly using edible options to simplify labeling, reduce waste, and ensure product uniformity This aligns with broader sustainability goals across food processing operations, reinforcing the segment’s leadership.

Vegan casing demand grew at 8.9% CAGR between 2020 and 2024. The vegan casing can be used for both raw and cooked applications. This is a ready-to-use case, offered in a stick format that is easy to pack and manage. Due to this factor, the sales of vegan casing are likely to rise in the market.

It works with meat filling and processing equipment. There is no need to peel the casing because it is edible, and it improves sensory qualities while also providing a structure to the final product & it is estimated to grow the vegan casing market trends & forecast in the coming year as per the vegan casing market report.

Recent research has revolutionized the industry over the period and is further projected to grow at a CAGR worth 7.7% in the forecast year of 2025 to 2035. The vegan casing market, along with fresh vegan casing, 20-26mm Caliber, edible casings as end use, and B2C sales channel segments, are projected to reflect a favorable growth outlook in terms of revenue, according to the vegan casing market analysis conducted by Future Market Insights.

Halal and Kosher-compliant vegan casings are in demand in the USA, which are also suitable for vegetarians. The products come with no artificial coloring and are used as an alternative to collagen films, which have excellent machine-ability to be filled up with sausages. The products are also free from all known allergens and have non-GMO and GRAS status.

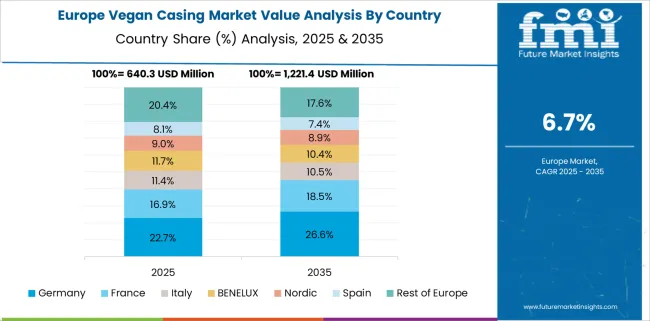

The demand for vegan casing in Spain is appropriate for both raw and cooked applications, with excellent frying characteristics and a super-tender bite. The ready-to-use case from Viscofan Group is delivered on a stick style that is easy to stuff and handle, just like the other edible casings in the market, which is likely to increase the adoption of vegan casing in the country.

The product does not concern with animal-based illness or contributes to cross-species contamination and comes with no artificial coloring, which is likely to increase the sales of vegan casing in the market.

Brands like Weschenfelder Direct Ltd drive the United Kingdom vegan casing market size with an edible vegan casing made from polysaccharides, a water-soluble component, and a unique alternative to collagen, cellulose, and natural sausage casing.

The product ingredient is abundantly available and renewable as well. Products available from the company come in a wide range of diameters, including 17mm to 32mm, along with 20mm, 23mm, and 24mm in between. The wide range of product categories is anticipated to boost the sales of vegan casing in the coming year.

Demand for the vegan casing is increasing as it is likely suitable with fresh, smoked & cooked, and dry-cured sausage products. The vegan casing is composed of entirely non-animal-based polymers with unique textures and appearances, which do not affect the nutritional profile of the main product.

As this remarkable plant-based casing is 100% vegetable, it is not just for consumers who eat a 100% vegetable-based diet but also for non-vegetarian people who value these types of products even more, which increases the production of vegan casing market growth in the coming year.

Though the product was created with vegetarian and vegan dishes in mind, it can also be used in meat items because of its all-rounding characteristics, which raise the production of vegan casing products and increase the vegan casing statistics during the forecast period from 2025 to 2035.

Key vegan casing manufacturers that are looking to capture the market in the adoption of the vegan casing with joint ventures, partnerships, mergers, and acquisitions while keeping up with research for innovative product lines supported by governments.

Due to all these tactics & methodologies, the industries are going to achieve the goal of rising in the vegan casing market trends during the forecast period.

These are the top Vegan Casing brands that are focusing on upgraded and modified products with rising demand for new formulations from the food and beverage industry, which has increased over time with vegan casing consumption among all populations. These factors are growing vegan casing market key trends & opportunities in the coming forecast period from 2025 to 2035.

For instance:

| Attributes | Details |

|---|---|

| Market Size Value in 2025 | USD 2.7 billion |

| Market Forecast Value in 2035 | USD 5.5 billion |

| Global Growth Rate | 7.3% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | MT for Volume and USD Billion for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; and Middle East and Africa |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Argentina, Chile, Peru, Germany, France, Italy, Spain, United Kingdom, Netherlands, Belgium, Nordic, Russia, Poland, China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Singapore, Australia, New Zealand, GCC Countries, South Africa, Central Africa, and others |

| Key Market Segments Covered | Product Type, Product Caliber, End Use, Sales Channel, and Regions |

| Key Companies Profiled | Euroduna Food Ingredients GmbH; Weschenfelder Direct Ltd; Dunninghams Ltd; Viscofan Group; The Sausage Maker Inc.; Kalle GmbH; Ruitenberg Ingredients B.V.; PROMAR Sp. z o. o; Nutra Produkte AG; Ennio International; Sonjal Casing® (SOREAL); Smoked and Cured; Ascona Foods Group; High Caliber Products; Suzy Spoon's; Others |

| Pricing | Available upon Request |

The global vegan casing market is estimated to be valued at USD 2.7 billion in 2025.

The market size for the vegan casing market is projected to reach USD 5.5 billion by 2035.

The vegan casing market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in vegan casing market are fresh vegan casing and processed vegan casing.

In terms of product caliber, 20-26mm caliber segment to command 42.1% share in the vegan casing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vegan Vitamin D3 Supplements Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Market Size and Share Forecast Outlook 2025 to 2035

Vegan Confectionery Market Size and Share Forecast Outlook 2025 to 2035

Vegan Steak Market Size and Share Forecast Outlook 2025 to 2035

Vegan Pasta Market Size and Share Forecast Outlook 2025 to 2035

Vegan Hyaluronic Acid Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Peptides Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Skincare Market Size and Share Forecast Outlook 2025 to 2035

Vegan Protein Powder Market Analysis - Size, Share, and Forecast 2025 to 2035

Vegan Tortillas Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dressing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Sauce Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dips Market Size and Share Forecast Outlook 2025 to 2035

Vegan Yogurt Market Size, Growth, and Forecast for 2025 to 2035

Vegan Meals Market Size, Growth, and Forecast for 2025 to 2035

Vegan Dog Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Protein Bars Market Analysis – Size, Share & Trends 2025–2035

Vegan Vitamins and Supplements Market – Growth & Demand 2025 to 2035

Analysis and Growth Projections for Vegan Fast-Food Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA