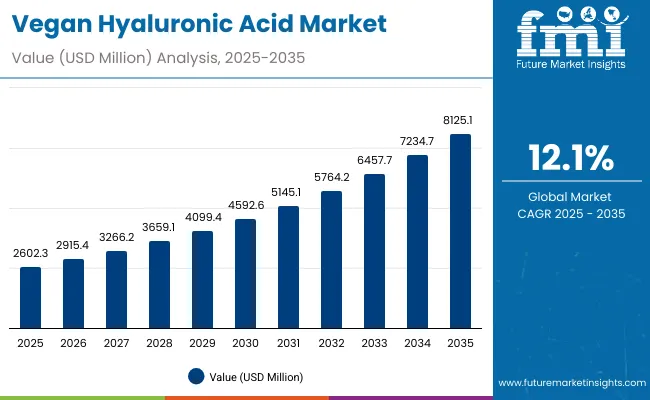

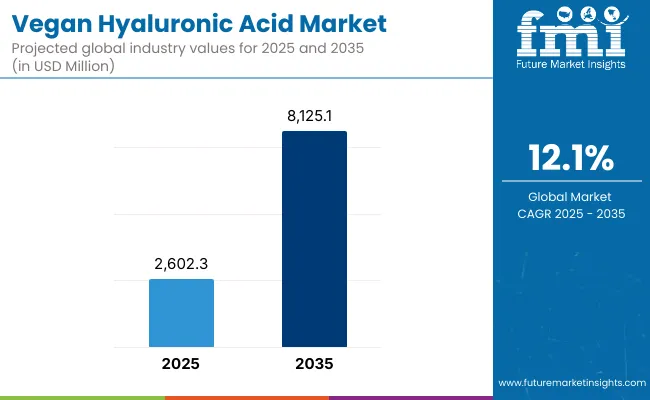

The Vegan Hyaluronic Acid Market is anticipated to secure a valuation of USD 2,602.3 million in 2025, expanding to USD 8,125.1 million by 2035. This progression represents an absolute growth of USD 5,522.8 million, equivalent to a threefold expansion over the period. A compound annual growth rate (CAGR) of 12.1% has been projected, highlighting consistent acceleration in demand across global regions.

Vegan Hyaluronic Acid Market Key Takeaways

| Metric | Value |

|---|---|

| Vegan Hyaluronic Acid Market Estimated Value in (2025E) | USD 2,602.3 million |

| Vegan Hyaluronic Acid Market Forecast Value in (2035F) | USD 8,125.1 million |

| Forecast CAGR (2025 to 2035) | 12.10% |

During the initial half of the forecast window, between 2025 and 2030, the market is set to advance from USD 2,602.3 million to USD 4,592.6 million, adding nearly USD 1,990.3 million in value, which accounts for approximately 36% of the overall decade’s growth. This initial momentum is expected to be underpinned by rising adoption of clean-label antioxidant-rich formulations in nutrition, skincare, and preventive health sectors.

The latter phase, extending from 2030 to 2035, will contribute a significant USD 3,532.5 million, translating to 64% of the decade’s incremental gains, as the market surges from USD 4,592.6 million to USD 8,125.1 million. This acceleration is expected to be supported by advancements in extraction technologies, improved bioavailability, and widespread consumer acceptance of functional botanicals as preventive healthcare becomes mainstream.

A stronger push from emerging economies, particularly in Asia, is likely to reinforce growth, with cultivated sources and clinically validated extracts gaining priority. As regulatory clarity strengthens and validated supply chains expand, antioxidant-rich Sea Buckthorn is positioned to emerge as a cornerstone ingredient in the nutraceutical and cosmeceutical landscapes through 2035.

From 2020 to 2024, the Vegan Hyaluronic Acid Market expanded steadily, supported by rising demand for clean-label nutraceuticals and premium cosmeceuticals. During this period, fermentation-derived sources began to dominate, holding nearly two-thirds of total value by 2024, while hydration applications were established as the leading function.

Competitive dynamics were shaped by companies such as Bloomage Biotech, DSM-Firmenich, and Evonik, which strengthened their positions through bioactive standardization and cross-industry partnerships. Growth was also reinforced by rising investments in clinical validation and sustainable sourcing.

Looking ahead, the market is expected to accelerate toward USD 8,125.1 million by 2035, with Asia-Pacific driving the highest incremental gains. Competitive differentiation is forecasted to shift from raw ingredient supply toward ecosystem-based offerings, including traceability, formulation support, and digital-first consumer engagement. Leaders that integrate transparency, sustainability, and clinically supported outcomes are anticipated to secure long-term competitive advantage.

Growth in the Vegan Hyaluronic Acid Market is being driven by rising consumer preference for natural and clean-label products, reinforced by increasing awareness of antioxidant benefits in preventive health and skin wellness. Demand is being strengthened by clinical validation of bioactive compounds, including flavonoids, vitamins, and omega fatty acids, which are associated with improved immunity, cardiovascular support, and barrier restoration.

Adoption is being accelerated by the convergence of nutraceuticals and cosmeceuticals, where beauty-from-within and functional nutrition concepts are being embraced by both consumers and healthcare professionals. Expansion is being supported by e-commerce penetration and D2C brand strategies, which are enabling wider product access and education-driven marketing.

Technological advances in sustainable cultivation, extraction, and encapsulation are being positioned to ensure higher bioavailability and traceability. Over the forecast horizon, the market is expected to be propelled by growing emphasis on holistic wellness, clinical evidence, and eco-friendly positioning, securing long-term relevance and scalability.

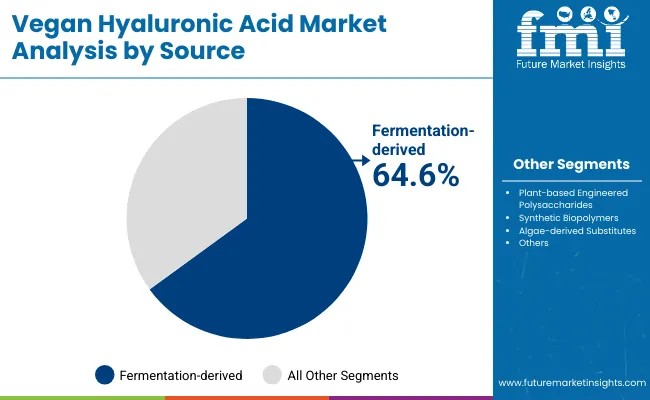

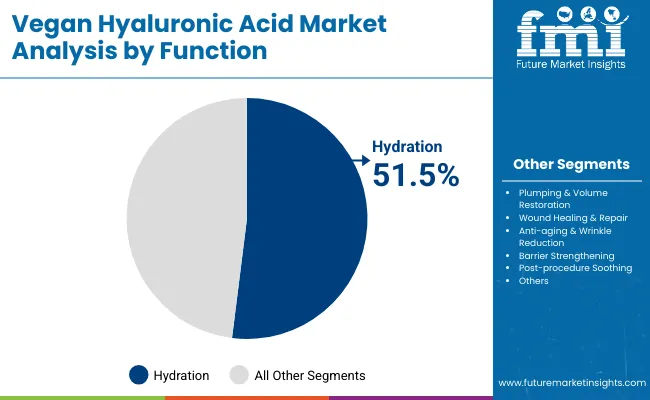

The Vegan Hyaluronic Acid Market has been segmented across multiple dimensions to provide clarity on key growth drivers. Segmentation by source, function, and claim has been adopted to highlight how demand patterns are shifting across supply chains, consumer preferences, and application benefits. Each segment offers distinct insights into value creation and competitive positioning.

Fermentation-derived sources are expected to lead with efficiency in extraction and standardization, hydration-based functions are gaining traction as consumers focus on skin barrier restoration, and vegan-certified claims are shaping brand narratives in both nutraceuticals and cosmeceuticals. By analyzing these categories, the evolving structure of demand can be understood, showcasing how natural positioning, validated efficacy, and ethical claims are aligning to influence adoption globally.

| Segment | Market Value Share, 2025 |

|---|---|

| Fermentation-derived | 64.6% |

| Others | 35.4% |

Fermentation-derived sources are expected to command a 64.6% share of theVegan Hyaluronic Acid Market in 2025, valued at USD 1,680.8 million. Growth is being driven by advancements in biotechnological processes that ensure higher purity, standardized potency, and scalability compared to traditional extraction methods.

Demand is being reinforced by the rising preference for sustainable and traceable supply chains, as fermentation allows consistent yields independent of climatic fluctuations. Increasing validation from regulatory bodies and clinical researchers is further supporting adoption in nutraceuticals and cosmeceuticals. As cost efficiencies improve and quality assurances strengthen, fermentation-derived sources are expected to retain their leadership, providing manufacturers with reliable inputs for premium-positioned products across global markets.

| Segment | Market Value Share, 2025 |

|---|---|

| Hydration | 51.5% |

| Others | 48.5% |

Hydration functions are projected to represent 51.5% of the Vegan Hyaluronic Acid Market in 2025, equivalent to USD 1,339.4 million. Growth is being sustained by strong consumer demand for skin barrier protection, moisture retention, and anti-aging solutions supported by antioxidant efficacy. Sea Buckthorn’s natural omega and flavonoid profiles are being positioned as highly effective for maintaining elasticity and reducing oxidative stress, making hydration a central claim across formulations.

Adoption is being accelerated by dermatology clinics and cosmeceutical brands promoting barrier-strengthening benefits for sensitive and aging skin. As awareness of water-loss prevention and environmental stress defense grows, hydration-focused formulations are expected to dominate, positioning this function as a cornerstone of product innovation and consumer loyalty within the segment.

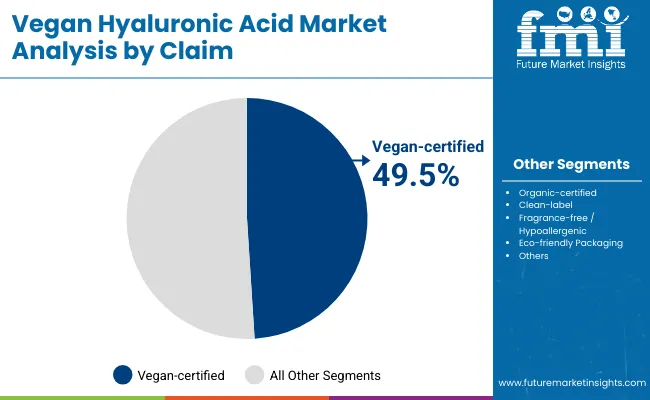

| Segment | Market Value Share, 2025 |

|---|---|

| Vegan-certified | 49.5% |

| Others | 50.5% |

Vegan-certified claims are forecasted to secure 49.5% of the Vegan Hyaluronic Acid Market in 2025, generating USD 1,286.9 million. Expansion is being supported by the growing consumer inclination toward ethical, sustainable, and plant-based products. Certification is acting as a key differentiator for brands, providing reassurance of cruelty-free sourcing and alignment with clean-label expectations.

Adoption is being encouraged by regulatory clarity and increased retail demand for certified, transparent labeling. Vegan certification is also driving trust among younger demographics seeking eco-conscious and socially responsible choices. With ethical branding and sustainability narratives gaining momentum across the nutraceutical and personal care landscape, vegan-certified products are expected to sustain their strong growth trajectory and increase market penetration over the decade.

The Vegan Hyaluronic Acid Market is being shaped by evolving dynamics where cost barriers and regulatory complexities coexist with growing scientific validation, functional innovation, and consumer preference for natural antioxidants, positioning the category as a critical pillar of future nutraceutical and cosmeceutical adoption.

Clinical Standardization and Bioactive Validation

Market growth is being propelled by the increasing focus on standardized bioactive compositions, such as omega-7 fatty acids, polyphenols, and flavonoids, validated through controlled clinical trials. This scientific rigor is enabling stronger differentiation in premium nutraceutical and skincare categories, moving products beyond generic antioxidant claims.

Clinical substantiation is fostering partnerships between ingredient suppliers, academic researchers, and pharmaceutical stakeholders, ensuring that formulations align with pharmacopoeial standards and achieve broader acceptance among healthcare professionals.

This driver is expected to reinforce consumer trust, strengthen regulatory compliance, and open pathways into prescription-adjacent functional solutions, elevating Sea Buckthorn from a niche botanical to a clinically credible ingredient across multiple high-value applications.

Agronomic Volatility and Regional Supply Risk

Expansion is being constrained by agricultural volatility, as Sea Buckthorn cultivation is highly sensitive to altitude, soil salinity, and temperature fluctuations. Climate variability and limited mechanization are resulting in inconsistent yields, which complicates supply planning and raises costs for manufacturers.

Dependence on wild harvests in certain regions is creating further challenges in ensuring consistent phytochemical profiles and meeting global demand for standardized inputs. These constraints are magnified by logistical inefficiencies in high-altitude regions, where transport and processing infrastructure remain underdeveloped.

Unless supply chains are stabilized through contract farming, irrigation modernization, and cultivation diversification, the ability to scale reliably will remain limited, restraining the pace of global adoption despite increasing downstream demand.

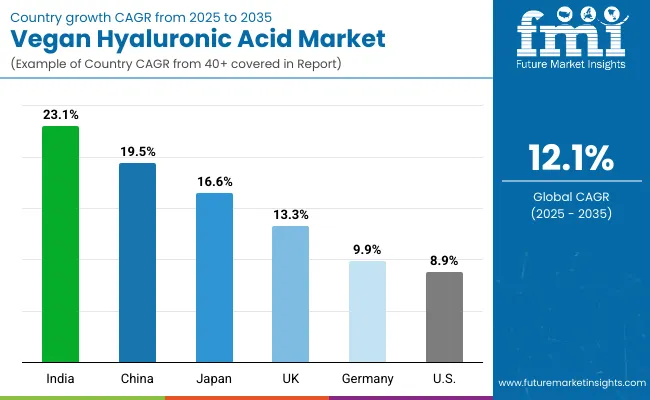

| Country | CAGR |

|---|---|

| China | 19.5% |

| USA | 8.9% |

| India | 23.1% |

| UK | 13.3% |

| Germany | 9.9% |

| Japan | 16.6% |

The global Vegan Hyaluronic Acid Market demonstrates distinct growth trajectories across key countries, shaped by consumer health awareness, regulatory structures, and advances in cultivation practices. India is projected to record the fastest expansion with a CAGR of 23.1% between 2025 and 2035, supported by increasing adoption of preventive nutrition, rising disposable incomes, and the rapid growth of nutraceutical consumption.

China is forecasted to follow closely with a CAGR of 19.5%, driven by large-scale cultivation initiatives, growing cosmeceutical innovation, and rising demand for clean-label, antioxidant-rich products. Japan’s growth, estimated at 16.6%, is expected to be powered by its mature beauty and skincare industries, where Sea Buckthorn is being positioned as a premium anti-aging and hydration ingredient.

In Europe, the UK is projected to advance at a CAGR of 13.3%, reflecting strong momentum in clean-label supplementation and plant-based wellness markets. Germany, while expanding at a slower CAGR of 9.9%, is expected to benefit from regulatory-driven quality standards and the country’s emphasis on evidence-based nutraceuticals.

The USA is anticipated to grow at a CAGR of 8.9%, representing a mature but steadily expanding market where premium cosmeceuticals and functional beverages are driving incremental adoption. Collectively, these country-level variations underline how regional demand drivers and regulatory environments are expected to shape the competitive landscape of antioxidant-rich Sea Buckthorn over the next decade.

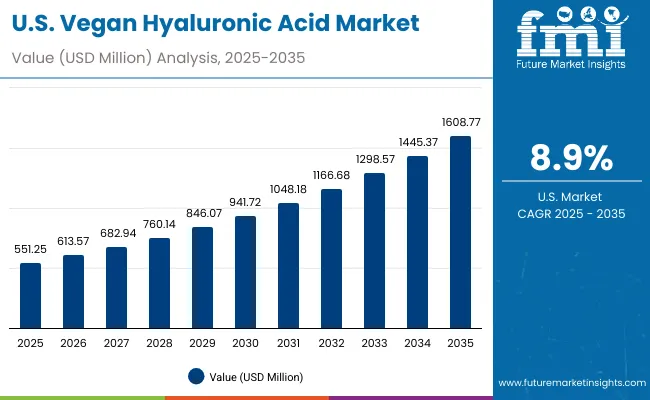

| Year | USA Market (USD Million) |

|---|---|

| 2025 | 551.25 |

| 2026 | 613.57 |

| 2027 | 682.94 |

| 2028 | 760.14 |

| 2029 | 846.07 |

| 2030 | 941.72 |

| 2031 | 1,048.18 |

| 2032 | 1,166.68 |

| 2033 | 1,298.57 |

| 2034 | 1,445.37 |

| 2035 | 1,608.77 |

The Vegan Hyaluronic Acid Market in the United States is projected to expand at a CAGR of 12% from 2025 to 2035, reflecting steady acceleration in demand across nutraceuticals, functional beverages, and cosmeceuticals. Market valuation is expected to rise from USD 551.25 million in 2025 to USD 1,608.77 million by 2035. Expansion is being fueled by a strong consumer shift toward natural antioxidants and clean-label health solutions, supported by clinical evidence highlighting Sea Buckthorn’s efficacy in skin hydration, anti-aging, and immune reinforcement.

Growth is also being strengthened by the integration of bioactive-rich formulations into dermatology-led skincare ranges and wellness-focused dietary supplements. The USA landscape is being further shaped by transparent supply chains, e-commerce distribution, and advances in extraction technologies that ensure potency and bioavailability.

The Vegan Hyaluronic Acid Market in the United Kingdom is projected to expand at a CAGR of 13.3% through 2035. Growth is expected to be underpinned by pharmacy-led dermacosmetics, premium supplementation, and retailer preference for evidentiary claims. Fermentation-derived inputs are likely to be prioritized for batch-to-batch consistency, while hydration-focused positioning is expected to anchor skincare launches.

Vegan-certified labelling is anticipated to resonate with ethical shoppers and support price realization. E-commerce and specialty retail are expected to drive discovery, with clinicians and aestheticians influencing regimen adoption. Sustainability requirements around packaging and supply-chain traceability are likely to shape vendor selection, rewarding transparent COA practices and stable sensory profiles for beverage formats.

TheVegan Hyaluronic Acid Market in India is projected to expand at a CAGR of 23.1% over 2025 to 2035. Growth is expected to be catalyzed by mainstreamization of preventive nutrition, fast-scaling e-commerce, and Ayurveda-aligned botanicals positioned with modern clinical narratives. Contract farming and domestic processing pilots are likely to reduce import dependence and variability.

Hydration and barrier-strengthening claims are expected to proliferate across mass and masstige skincare, supported by dermatologist content. Sachetization and localized flavor systems are anticipated to expand penetration in functional beverages. Regulatory clarity around labelling and contaminant thresholds is expected to favor standardized, fermentation-derived inputs and audited traceability.

The Vegan Hyaluronic Acid Market in China is projected to expand at a CAGR of 19.5% to 2035. Momentum is expected from cosmeceutical innovation, cross-border and domestic e-commerce, and traditional-wellness alignment reframed with clinical endpoints. Cultivation zones are likely to scale under quality programs emphasizing pesticide-residue control and standardized omega/polyphenol profiles.

Hydration, redness relief, and post-procedure soothing are expected to feature in dermatologist-influenced assortments. Fermentation-derived, pharmacopoeia-aligned inputs are anticipated to strengthen OEM partnerships and accelerate NMPA-compliant launches. Live-commerce formats are expected to compress education cycles and lift premium tiers.

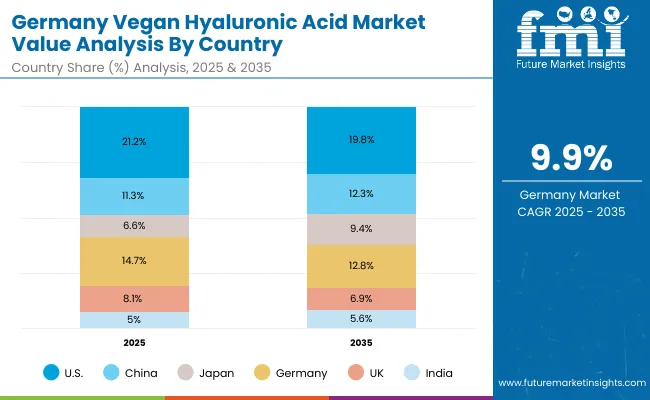

| Countries | 2025 |

|---|---|

| USA | 21.2% |

| China | 11.3% |

| Japan | 6.6% |

| Germany | 14.7% |

| UK | 8.1% |

| India | 5.0% |

| Countries | 2035 |

|---|---|

| USA | 19.8% |

| China | 12.3% |

| Japan | 9.4% |

| Germany | 12.8% |

| UK | 6.9% |

| India | 5.6% |

The Vegan Hyaluronic Acid Market in Germany is projected to expand at a CAGR of 9.9% during 2025 to 2035. Expansion is expected to reflect evidence-led consumer behavior, pharmacist-mediated recommendations, and strict conformity with EU quality frameworks. Organic and vegan certifications are likely to remain decisive purchase cues, while fermentation-derived inputs are expected to secure preference for reproducibility and safety dossiers.

Hydration-centric cosmeceuticals and clinically characterized supplements are anticipated to lead, with traceable, low-oxidation oils prioritized for stability. Brick-and-mortar pharmacies and specialty health retail are expected to anchor trial, complemented by disciplined D2C education.

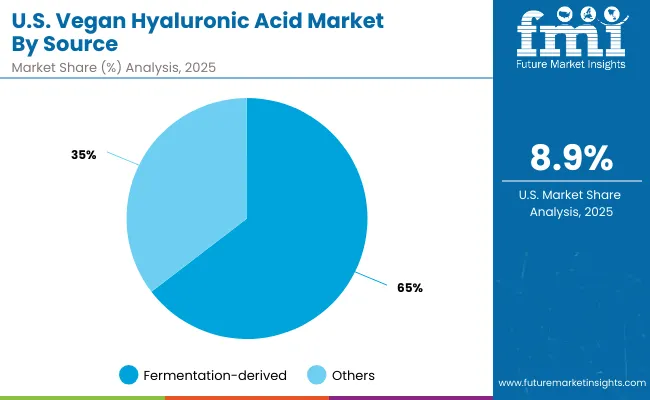

| Segment | Market Value Share, 2025 |

|---|---|

| Fermentation-derived | 64.6% |

| Others | 35.4% |

The vegan hyaluronic acid market in the United States is projected at USD 551.25 million in 2025. Fermentation-derived sources contribute 64.6%, while others hold 35.4%, indicating a strong preference toward biotechnological production methods. This dominance of fermentation-derived inputs is being reinforced by growing consumer trust in sustainability, purity, and traceability of vegan-certified formulations. Increasing adoption of biotech-driven production is being favored due to its ability to ensure consistent quality, scalability, and alignment with regulatory frameworks that discourage animal-derived ingredients.

The “Others” segment, while smaller, is expected to retain relevance in niche applications, particularly where hybrid sourcing or cost optimization is sought. However, a gradual shift is anticipated toward fermentation processes as R&D investments accelerate, yielding higher yields and cost efficiencies.

Growth is also being shaped by rising demand for hydration-focused skincare, where fermentation-derived hyaluronic acid demonstrates superior molecular weight control and bioavailability. Nutraceutical manufacturers are increasingly exploring fermentation-based inputs to address consumer needs for joint health, wellness, and anti-aging benefits. Strategic partnerships between biotechnology firms and cosmetics leaders are expected to define future competition, as USA players emphasize innovation pipelines and certification-driven branding strategies.

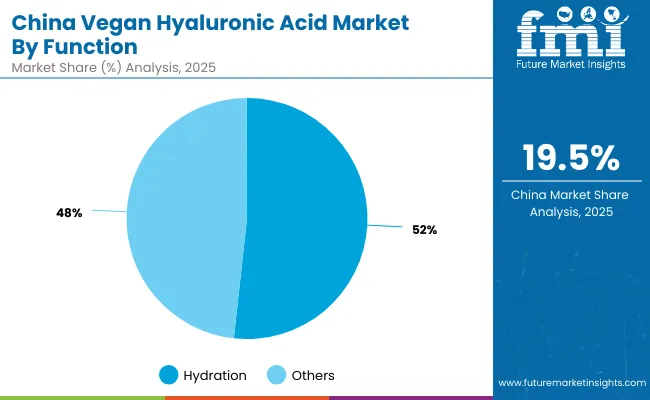

| Segment | Market Value Share, 2025 |

|---|---|

| Hydration | 51.5% |

| Others | 48.5% |

The vegan hyaluronic acid market in China is projected at USD 294.06 million in 2025. Hydration-driven applications contribute 51.5%, while other functional categories account for 48.5%, reflecting a balanced distribution of demand. A marginal dominance of hydration is being reinforced by the growing preference for anti-aging, moisture retention, and elasticity-enhancing solutions in cosmetics and personal care. This trend is being accelerated by urban lifestyles, rising disposable incomes, and the increasing influence of global clean beauty standards in the Chinese market.

The “Others” segment, while slightly smaller, is expected to expand through applications in nutraceuticals, pharmaceuticals, and tissue-repair formulations, driven by the rising adoption of wellness-oriented supplements. As consumer awareness of vegan-certified ingredients continues to build, product differentiation is being shaped by purity, molecular weight customization, and clinical validation.

The Chinese market is expected to be propelled by rapid biotechnology advancements and domestic R&D investment, enabling cost-efficient production and broader functional diversification. Multinational collaborations with local firms are projected to accelerate innovation pipelines, ensuring consistent supply and global export potential. Functional versatility beyond hydration — such as wound healing and regenerative applications — is anticipated to emerge as a long-term growth catalyst.

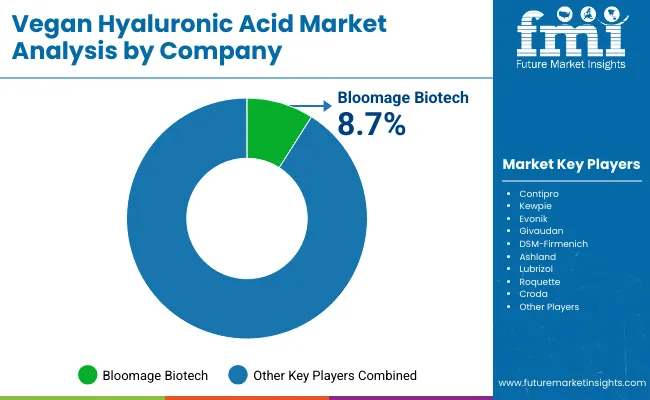

| Comapany | Global Value Share 2025 |

|---|---|

| Bloomage Biotech | 8.7% |

| Others | 91.3% |

The Vegan Hyaluronic Acid Market is moderately fragmented, with established global leaders, regional innovators, and specialized suppliers shaping competitive dynamics. Large-scale players such as Bloomage Biotech, DSM-Firmenich, and Evonik are positioned as key influencers, leveraging advanced extraction technologies, clinical validation programs, and strong global distribution. Their portfolios are increasingly aligned with vegan-certified, clean-label trends, ensuring stronger penetration in nutraceutical and cosmeceutical applications. Bloomage Biotech dominates with a global value share of 8.7% in 2025, making it the largest single company in this market. Its estimated share in 2024 is around 8.5%, reflecting steady leadership.

Mid-sized innovators such as Contipro, Kewpie, and Roquette are contributing significantly by supplying high-quality fermentation-derived inputs and specialty formulations that cater to regional needs. Their strategies emphasize supply reliability, cost efficiency, and partnerships with beauty and nutrition brands. Companies like Givaudan, Croda, Ashland, and Lubrizol are entering the market through active ingredient diversification, positioning antioxidant-rich Sea Buckthorn alongside their broader functional actives portfolios.

Niche-focused suppliers are building strength through traceability, localized sourcing, and application-specific customization, particularly for markets emphasizing organic and eco-friendly claims. Competitive differentiation is expected to move beyond raw material supply toward integrated solutions, combining science-backed formulations, transparent labelling, and sustainability-driven narratives to capture long-term brand loyalty.

Key Developments in Vegan Hyaluronic Acid Market

| Item | Value |

|---|---|

| Quantitative Units | USD 2,602.3 million (2025), USD 8,125.1 million (2035), CAGR 12.1% (2025 to 2035) |

| Source | Fermentation-derived, Plant-based polysaccharides, Synthetic biopolymers, Algae-derived substitutes |

| Function | Hydration & moisture-binding, Plumping & volume restoration, Wound healing & repair, Anti-aging & wrinkle reduction, Barrier strengthening, Post-procedure soothing |

| Product Type | Serums & ampoules, Creams & lotions, Masks & patches, Capsules/ nutricosmetics , Sprays & mists, Injectables |

| Claim | Vegan-certified, Organic-certified, Clean-label, Fragrance-free/Hypoallergenic, Eco-friendly packaging |

| End-use Industry | Dermatology clinics, Mass retail, Pharmacies & drugstores, Specialty beauty retailers, E-commerce marketplaces, D2C brand websites |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Korea |

| Key Companies Profiled | Bloomage Biotech, DSM- Firmenich , Evonik , Contipro , Kewpie, Givaudan , Croda , Roquette , Ashland, Lubrizol |

| Additional Attributes | Market size and forecast by source, function, and claim; adoption trends in cosmeceuticals, nutraceuticals, and functional beverages; rising demand for vegan-certified and clean-label ingredients; growing influence of e-commerce; technological advances in extraction and encapsulation; regulatory frameworks shaping quality standards; sustainability and traceability trends driving competitive positioning |

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vegan Cheese Market Size and Share Forecast Outlook 2025 to 2035

Vegan Confectionery Market Size and Share Forecast Outlook 2025 to 2035

Vegan Steak Market Size and Share Forecast Outlook 2025 to 2035

Vegan Pasta Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Peptides Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Skincare Market Size and Share Forecast Outlook 2025 to 2035

Vegan Protein Powder Market Analysis - Size, Share, and Forecast 2025 to 2035

Vegan Tortillas Market Size and Share Forecast Outlook 2025 to 2035

Vegan Casing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dressing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Sauce Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dips Market Size and Share Forecast Outlook 2025 to 2035

Vegan Yogurt Market Size, Growth, and Forecast for 2025 to 2035

Vegan Meals Market Size, Growth, and Forecast for 2025 to 2035

Vegan Dog Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Protein Bars Market Analysis – Size, Share & Trends 2025–2035

Vegan Vitamins and Supplements Market – Growth & Demand 2025 to 2035

Analysis and Growth Projections for Vegan Fast-Food Market

Vegan Flavor Market – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA