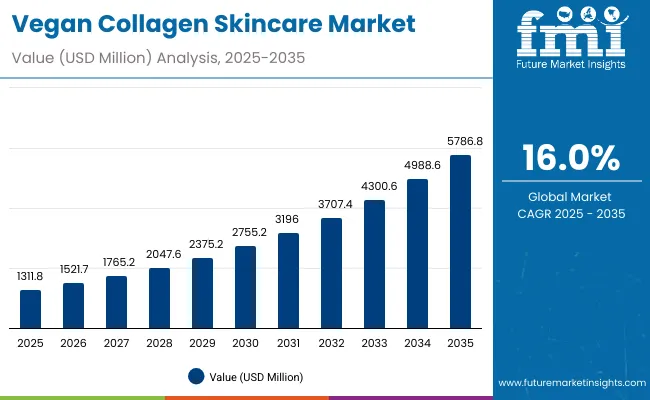

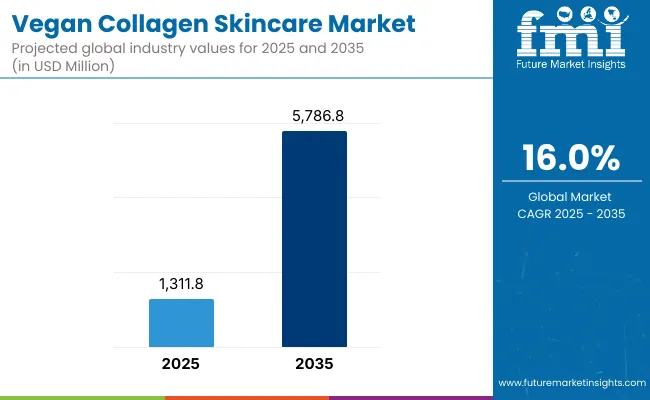

The Global Vegan Collagen Skincare Market is expected to record a valuation of USD 1,311.8 million in 2025 and USD 5,786.8 million in 2035, with an increase of USD 4,475.0 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 16.0% and a nearly 2X increase in market size.

Global Vegan Collagen Skincare Market Key Takeaways

| Metric | Value |

|---|---|

| Global Vegan Collagen Skincare Market Estimated Value in (2025E) | USD 1,311.8 million |

| Global Vegan Collagen Skincare Market Forecast Value in (2035F) | USD 5,786.8 million |

| Forecast CAGR (2025 to 2035) | 16.0% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,311.8 million to USD 2,755.2 million, adding USD 1,443.4 million, which accounts for 32% of the total decade growth. This phase records steady adoption in anti-aging serums, moisturizers, and nutricosmetic hybrids, driven by the need for clinically backed vegan collagen alternatives. Yeast-derived collagen dominates this period as it caters to over 43% of applications requiring scalable and sustainable formulations.

The second half from 2030 to 2035 contributes USD 3,031.6 million, equal to 68% of total growth, as the market jumps from USD 2,755.2 million to USD 5,786.8 million. This acceleration is powered by widespread deployment of nutricosmetic hybrids, AI-personalized skincare solutions, and algae-derived formulations in smart beauty platforms. Ingestible formats such as capsules and gummies together capture a larger share above 40% by the end of the decade. E-commerce-led retail models and direct-to-consumer platforms add recurring revenue, increasing the online channel share beyond 45% in total value.

From 2020 to 2024, the Global Vegan Collagen Skincare Market grew from USD 630 million to USD 1,200 million, driven by topical-centric adoption. During this period, the competitive landscape was dominated by multinational beauty conglomerates controlling nearly 80% of revenue, with leaders such as L’Oréal, Shiseido, and Unilever focusing on anti-aging skincare formats infused with plant-based actives. Competitive differentiation relied on brand credibility, distribution reach, and clinical efficacy, while vegan collagen was often positioned as a niche ingredient rather than a mainstream offering. Ingestible hybrids had minimal traction, contributing less than 10% of the total market value.

Demand for vegan collagen skincare will expand to USD 1,311.8 million in 2025, and the revenue mix will shift as nutricosmetic hybrids and e-commerce channels grow to over 45% share. Traditional topical leaders face rising competition from biotech-first players offering fermentation-derived collagen, algae innovations, and subscription-based skincare ecosystems.

Major incumbents are pivoting to hybrid models, integrating ingestibles, AI-led personalization, and clean-label claims to retain relevance. Emerging entrants specializing in precision fermentation, cruelty-free platforms, and microbiome-compatible products are gaining share. The competitive advantage is moving away from legacy beauty branding alone to biotech partnerships, sustainable sourcing, and ecosystem-driven loyalty models.

Advances in precision fermentation and algae biotechnology have improved efficacy and purity, allowing for more efficient integration across skincare and ingestible formats. Yeast-derived collagen has gained popularity due to its scalability and established supply chain advantages. The rise of anti-aging serums and creams has contributed to strong penetration across premium beauty markets, while nutricosmetic hybrids are creating new cross-category adoption.

Expansion of e-commerce and direct-to-consumer subscription models has fueled market growth. Innovations in capsule/gummy formats and skincare AI-personalization platforms are expected to open new application areas. Segment growth is expected to be led by creams & lotions in product forms, yeast-derived in collagen sources, and anti-aging serums in applications due to their clinical positioning, high consumer demand, and adaptability across regions.

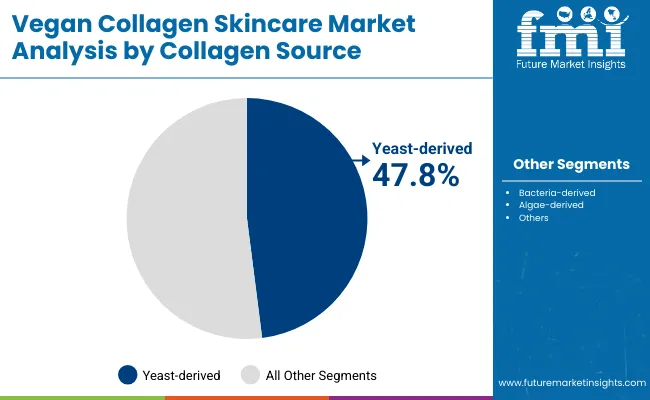

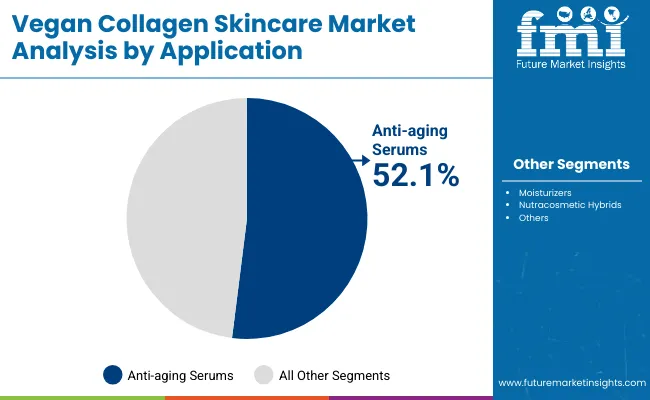

The market is segmented by collagen source, application, product form, distribution channel, and geography. Collagen sources include yeast-derived, bacteria-derived, and algae-derived, highlighting the biotech-led supply landscape. Applications cover anti-aging serums, moisturizers, and nutricosmetic hybrids to address multi-functional beauty demands.

Product forms include creams & lotions, powders, and capsules/gummies catering to both topical and ingestible skincare. Distribution channels span e-commerce, pharmacies/drugstores, and beauty specialty retailers, reflecting the diverse consumer purchase pathways. Regionally, the scope spans North America, Latin America, Europe, Asia-Pacific, and the Middle East & Africa, with China, India, Japan, USA, Germany, and UK being the most significant growth contributors.

| Collagen Source Segment | Market Value Share, 2025 |

|---|---|

| Yeast-derived | 47.8% |

| Others | 52.2% |

The yeast-derived segment is projected to contribute 47.8% of the Global Vegan Collagen Skincare Market revenue in 2025, maintaining its lead as the dominant collagen source category. This is driven by the scalability of precision fermentation, which enables high-purity collagen production without animal inputs. Yeast-derived collagen continues to gain preference among formulators for its consistency, safety profile, and ability to integrate across serums, creams, and ingestible formats.

The segment’s growth is also supported by advancements in biotech processes that reduce production costs while improving yield. As sustainable and cruelty-free positioning becomes central to skincare purchasing decisions, yeast-derived collagen manufacturers are enhancing their capacity to meet rising demand. The yeast-derived segment is expected to retain its position as the backbone of the vegan collagen category.

| Application Segment | Market Value Share, 2025 |

|---|---|

| Anti-aging serums | 52.1% |

| Others | 47.9% |

The anti-aging serums segment is forecasted to hold 52.1% of the market share in 2025, led by its strong adoption across premium beauty consumers seeking clinically backed anti-wrinkle and elasticity benefits. These formulations are favored for their high concentration of active ingredients and their ability to deliver visible results, making them the entry point for vegan collagen in skincare routines.

Their lightweight texture, compatibility with multiple skin types, and positioning in the high-margin premium category have facilitated widespread adoption. The segment’s growth is further strengthened by strong online and offline retail promotion of anti-aging benefits. As consumers increasingly seek targeted, evidence-based beauty solutions, anti-aging serums are expected to continue their dominance in the market.

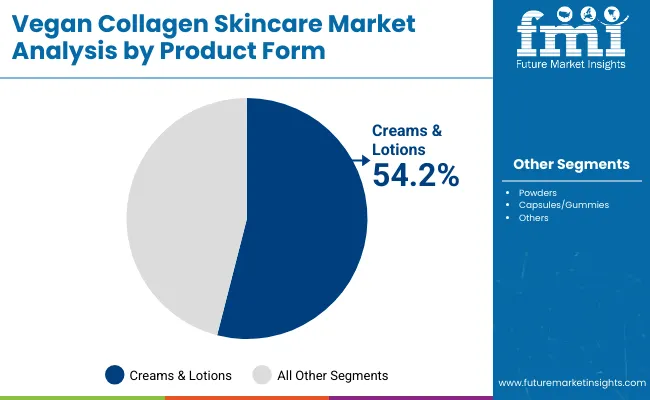

| Product Form Segment | Market Value Share, 2025 |

|---|---|

| Creams & lotions | 54.2% |

| Others | 45.8% |

The creams & lotions segment is projected to account for 54.2% of the Global Vegan Collagen Skincare Market revenue in 2025, establishing it as the leading product form. This format is preferred for its ease of application, high consumer familiarity, and ability to integrate vegan collagen alongside other actives such as hyaluronic acid, peptides, and antioxidants.

Its suitability for hydration, anti-aging, and daily skincare routines has made it popular across mass, masstige, and premium categories. Developments in clean-label formulations and sensorial textures have further enhanced consumer acceptance. Given its balance of accessibility and premium positioning, creams & lotions are expected to maintain their leading role in the Global Vegan Collagen Skincare Market.

Biotech-led Ingredient Innovation and Brand Partnerships

The most significant driver is the rise of precision fermentation partnerships between biotech startups (e.g., Geltor, Amyris) and multinational cosmetic brands (e.g., L’Oréal, Shiseido). Unlike generic plant-based claims, these collaborations directly address consumer skepticism by validating vegan collagen’s efficacy with clinical studies and co-branded launches.

For example, Geltor’s fermentation-based “HumaColl21” was adopted in high-end serums and marketed as a scientifically superior alternative to animal collagen. Such partnerships accelerate adoption by transferring biotech credibility into established retail pipelines, enabling vegan collagen to penetrate both prestige and masstige beauty categories. This driver is unique because it moves the market beyond “vegan-friendly branding” into science-backed efficacy, ensuring long-term scalability and differentiation.

Nutricosmetic Hybridization and Cross-Category Growth

A second driver is the convergence of topical and ingestible formats, where capsules, gummies, and powders featuring vegan collagen are marketed alongside skincare products. This hybridization allows brands to position vegan collagen as a “360° beauty solution”-enhancing skin elasticity from within and without.

The integration of ingestibles into beauty specialty retailers and direct-to-consumer subscription models has been particularly strong in Asia-Pacific (China, Japan, India), where holistic beauty traditions resonate with this approach. By blurring the line between skincare and wellness, brands create higher consumer stickiness and recurring revenue models, making nutricosmetic hybrids a major growth driver not seen in conventional collagen markets.

High Production Costs and Pricing Barrier in Mass Market

While biotech innovation drives growth, the cost of producing fermentation- or algae-derived collagen remains significantly higher than conventional animal-based collagen. This results in vegan collagen skincare products being priced at a 30-50% premium, restricting their penetration in mass-market retail segments and limiting adoption among cost-sensitive consumers in emerging markets.

Even though demand is strong in North America and Europe, price elasticity in markets like India and Latin America creates a structural barrier, slowing volume expansion. Until large-scale fermentation capacity and supply chain efficiencies reduce costs, vegan collagen will remain concentrated in premium and upper-masstige price tiers.

Consumer Skepticism about Efficacy vs. Traditional Collagen

A major restraint is lingering consumer doubt about whether vegan collagen matches the efficacy of animal-derived collagen in skin rejuvenation and anti-aging. Unlike hydrolyzed bovine or marine collagen, which has decades of clinical data, vegan collagen is relatively new, and its long-term results are still under scrutiny. This skepticism is particularly evident in markets like the USA and Germany, where educated consumers demand hard proof. Without broad clinical validation and transparent marketing, adoption could remain restricted to niche, ethically motivated segments instead of breaking into the mainstream beauty consumer base.

Regional Shift Toward Asia-Pacific as the Growth Engine

One of the most pronounced trends is the shift in market momentum toward Asia-Pacific, especially China, India, and Japan, which together are projected to contribute more than 45% of incremental global revenue growth by 2035. In these countries, consumers associate collagen with skin brightness, elasticity, and holistic wellness.

Unlike the West, where vegan collagen is positioned around ethics and sustainability, in Asia it is marketed as a functional, innovative ingredient for beauty and health convergence. This regional nuance will reshape global strategies, with MNCs allocating more R&D and marketing spend toward Asia-Pacific launches.

Rise of AI-Driven Personalized Vegan Collagen Solutions

A second trend is the emergence of AI-personalized skincare platforms that recommend vegan collagen products based on skin type, microbiome profile, and lifestyle inputs. Startups and established brands are using AI not only for product personalization but also to predict consumer demand trends and optimize D2C subscription models.

For instance, personalized regimens combining topical vegan collagen serums with ingestible capsules are being promoted as tailored anti-aging solutions. This trend is unique to the vegan collagen market because it directly addresses efficacy concerns, positioning biotech collagen as part of next-gen personalized beauty ecosystems rather than a generic ingredient.

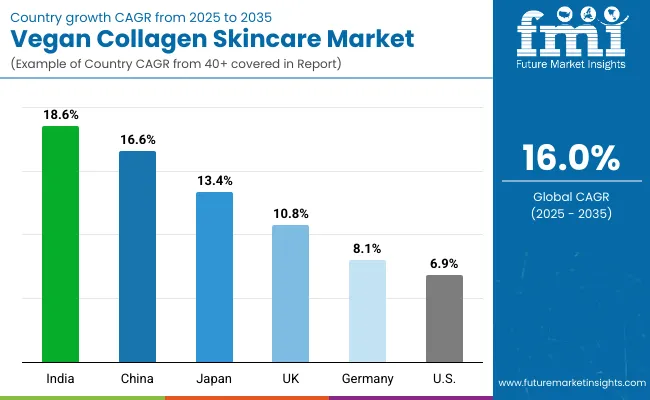

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 16.6% |

| USA | 6.9% |

| India | 18.6% |

| UK | 10.8% |

| Germany | 8.1% |

| Japan | 13.4% |

The country-level growth outlook shows that India (18.6% CAGR), China (16.6% CAGR), and Japan (13.4% CAGR) are emerging as the primary growth engines of the global vegan collagen skincare market. India leads with the fastest projected growth, supported by a rising middle-class population, increasing awareness of plant-based beauty, and strong consumer openness to nutricosmetic hybrids.

China follows closely, driven by premium beauty adoption, government support for biotech innovation, and the growing popularity of cruelty-free brands among Gen Z consumers. Japan, with its established reputation for advanced beauty formulations and consumer preference for functional ingredients, is also expected to witness robust adoption, particularly in anti-aging serums and holistic beauty regimens. Together, these three Asia-Pacific markets will contribute significantly to the market’s incremental revenue, making the region the strategic focus for global players.

By contrast, growth in Western markets such as the USA (6.9% CAGR), Germany (8.1% CAGR), and the UK (10.8% CAGR) will remain steady but slower compared to Asia. The USA market is already mature, with vegan beauty positioned in the premium skincare segment and supported by strong e-commerce penetration. However, pricing barriers and consumer skepticism about efficacy limit its pace of expansion.

Germany and the UK, as Europe’s leading markets, show moderate growth potential, underpinned by sustainability-driven consumer choices and regulatory support for clean-label formulations. While growth is slower, these markets remain critical for revenue stability and brand positioning, particularly in premium retail channels. The divergence highlights a two-speed global market-with Asia-Pacific markets driving rapid volume growth, while North America and Europe secure steady, high-value contributions.

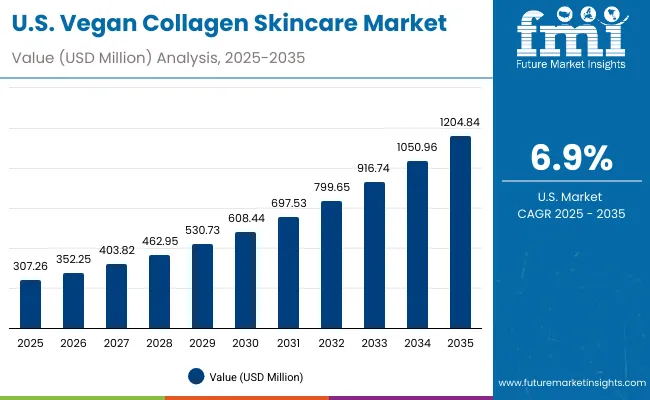

| Year | USA Vegan Collagen Skincare Market (USD Million) |

|---|---|

| 2025 | 307.3 |

| 2026 | 352.3 |

| 2027 | 403.8 |

| 2028 | 463.0 |

| 2029 | 530.7 |

| 2030 | 608.4 |

| 2031 | 697.5 |

| 2032 | 799.7 |

| 2033 | 916.7 |

| 2034 | 1051.0 |

| 2035 | 1204.8 |

The Vegan Collagen Skincare Market in the United States is projected to grow at a CAGR of 6.9%, supported by strong demand for premium skincare formats. Anti-aging serums remain the leading application, particularly in prestige retail and e-commerce channels, where vegan collagen is positioned as a clean and cruelty-free alternative to animal-based formulations. Growth is further supported by subscription-based D2C models that combine topical serums with ingestible collagen gummies. While pricing barriers persist, USA consumers are increasingly drawn to biotech-backed brands that highlight clinical validation and sustainable sourcing.

The Vegan Collagen Skincare Market in the United Kingdom is expected to grow at a CAGR of 10.8%, fueled by a strong ethical beauty culture and rising demand for sustainable skincare. Local and multinational brands are promoting vegan collagen as part of clean beauty portfolios, with creams and lotions leading the adoption. The UK also shows early traction in nutricosmetic hybrids, particularly gummies marketed via pharmacies and health & wellness chains. Institutional support for sustainable cosmetics innovation, along with strong influencer-driven digital campaigns, continues to boost market penetration.

India is witnessing the fastest growth in the Global Vegan Collagen Skincare Market, projected at a CAGR of 18.6% through 2035. Growth is being driven by a rising middle-class population, expanding beauty e-commerce platforms, and increasing adoption of Ayurveda-inspired formulations blended with biotech-derived collagen. Tier-2 and tier-3 cities are seeing strong uptake of affordable creams and moisturizers, while urban metros show higher demand for premium anti-aging serums and ingestible formats. Educational initiatives and local biotech startups are also pushing consumer awareness about cruelty-free, plant-based collagen alternatives, creating a foundation for rapid expansion.

The Vegan Collagen Skincare Market in China is expected to grow at a CAGR of 16.6%, one of the highest among major economies. Growth is driven by strong consumer adoption of nutricosmetic hybrids, where capsules and powders are marketed alongside topical creams. Local brands are investing in biotech partnerships to reduce reliance on imports, while premium brands are positioned around anti-aging efficacy for urban consumers. Municipal and provincial regulations supporting cruelty-free products further accelerate adoption. With competitive innovation from domestic firms and strong e-commerce penetration, vegan collagen is rapidly transitioning into a mainstream skincare category in China.

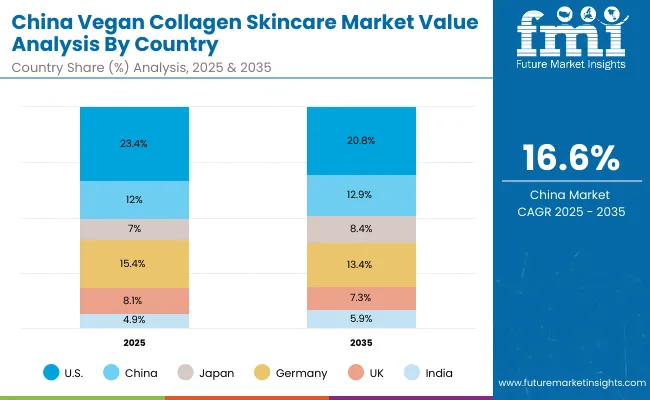

| Country | 2025 Share (%) |

|---|---|

| USA | 23.4% |

| China | 12.0% |

| Japan | 7.0% |

| Germany | 15.4% |

| UK | 8.1% |

| India | 4.9% |

| Country | 2035 Share (%) |

|---|---|

| USA | 20.8% |

| China | 12.9% |

| Japan | 8.4% |

| Germany | 13.4% |

| UK | 7.3% |

| India | 5.9% |

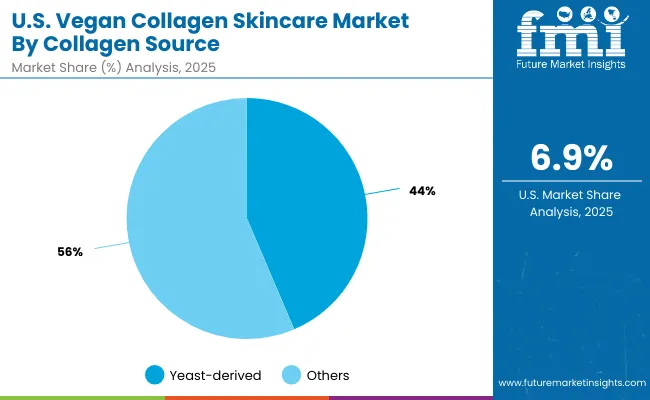

| Collagen Source Segment | Market Value Share, 2025 |

|---|---|

| Yeast-derived | 43.6% |

| Others | 56.4% |

The Vegan Collagen Skincare Market in the USA is valued at USD 307.3 million in 2025, with yeast-derived collagen accounting for 43.6% of revenue. The dominance of yeast-based formulations stems from USA consumers’ preference for clinically validated biotech ingredients and the established production scalability of yeast fermentation. Premium beauty brands are adopting yeast-derived collagen for serums and creams targeted at anti-aging and skin elasticity, with strong traction in masstige and luxury categories.

This advantage positions yeast-derived collagen as the foundation of USA vegan collagen innovation, particularly in serums and ingestible hybrids marketed through subscription-based e-commerce platforms. While algae and bacteria-derived alternatives are entering niche segments, yeast remains indispensable due to its consistency, cost efficiency, and proven safety. Future growth will be enhanced by AI-personalized beauty solutions and bundled topical + ingestible regimens, creating long-term revenue opportunities.

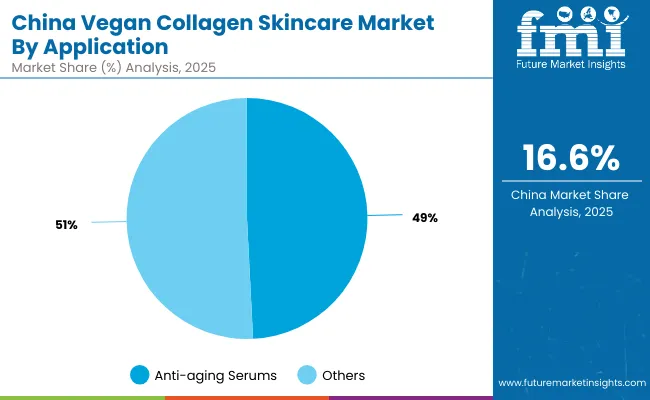

| Application Segment | Market Value Share, 2025 |

|---|---|

| Anti-aging serums | 49.2% |

| Others | 50.8% |

The Vegan Collagen Skincare Market in China is valued at USD 157.0 million in 2025, with anti-aging serums contributing 49.2% of sales. This dominance is directly tied to China’s premium beauty culture, where anti-aging and whitening products are the fastest-growing categories. Consumers in urban centers such as Shanghai and Beijing are particularly receptive to vegan collagen serums marketed with efficacy-focused claims like wrinkle reduction and elasticity improvement.

This positioning makes anti-aging serums the entry point for vegan collagen adoption in China, supported by cross-category launches in nutricosmetic hybrids (capsules, powders) marketed through Tmall, JD.com, and direct-to-consumer apps. While moisturizers and hybrid formats hold nearly equal share, serums remain critical for capturing the high-margin segment. The expansion of cruelty-free regulations and government encouragement of biotech innovation will further amplify opportunities in China.

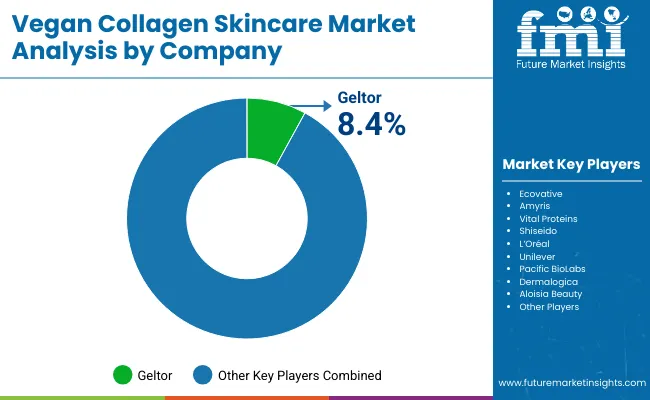

| Company | Global Value Share 2025 |

|---|---|

| Geltor | 8.4% |

| Others | 91.6% |

The Global Vegan Collagen Skincare Market is moderately fragmented, with biotech innovators, multinational beauty giants, and niche clean beauty brands competing across topical and ingestible applications. Global biotech leaders such as Geltor and Amyris hold measurable market share, driven by fermentation-based collagen with clinically backed performance. Their strategies emphasize biotech IP, clinical partnerships, and ingredient licensing to large beauty companies.

Multinational brands like L’Oréal, Shiseido, and Unilever dominate retail penetration, leveraging distribution scale and brand trust to integrate vegan collagen into creams, serums, and masstige product lines. Meanwhile, niche brands such as Dermalogica, Pacific BioLabs, and Aloisia Beauty differentiate through clean-label formulations, digital-first engagement, and strong positioning in the wellness-beauty crossover. Competitive differentiation is shifting away from legacy beauty branding toward biotech partnerships, ecosystem integration, and sustainable sourcing strategies that resonate with ethically minded consumers.

Key Developments in Vegan Collagen Skincare Market Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,311.8 million |

| Collagen Source | Yeast-derived, Bacteria-derived, Algae-derived |

| Application | Anti-aging serums, Moisturizers, Nutricosmetic hybrids |

| Product Form | Creams & lotions, Powders, Capsules/gummies |

| Distribution Channel | E-commerce, Pharmacies/drugstores, Beauty specialty retailers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Geltor , Ecovative , Amyris , Vital Proteins, Shiseido, L’Oréal, Unilever, Pacific BioLabs , Dermalogica , Aloisia Beauty |

| Additional Attributes | Dollar sales by collagen source, application, product form, and distribution channel; adoption trends in anti-aging serums and nutricosmetic hybrids; rising demand for ingestible collagen formats such as gummies and powders; sector-specific growth across premium beauty and wellness categories; e-commerce and D2C subscription channel expansion; integration with AI-personalized skincare platforms; regional trends influenced by ethical beauty movements and cruelty-free regulations; innovations in fermentation, algae biotechnology, and cross-category hybrids. |

The Global Vegan Collagen Skincare Market is estimated to be valued at USD 1,311.8 million in 2025.

The market size for the Global Vegan Collagen Skincare Market is projected to reach USD 5,786.8 million by 2035.

The Global Vegan Collagen Skincare Market is expected to grow at a 16.0% CAGR between 2025 and 2035.

The key product forms in the Global Vegan Collagen Skincare Market are creams & lotions, powders, and capsules/gummies.

In terms of application, anti-aging serums are expected to command a 52.1% share in the Global Vegan Collagen Skincare Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vegan Cheese Market Size and Share Forecast Outlook 2025 to 2035

Vegan Confectionery Market Size and Share Forecast Outlook 2025 to 2035

Vegan Steak Market Size and Share Forecast Outlook 2025 to 2035

Vegan Pasta Market Size and Share Forecast Outlook 2025 to 2035

Vegan Hyaluronic Acid Market Size and Share Forecast Outlook 2025 to 2035

Vegan Protein Powder Market Analysis - Size, Share, and Forecast 2025 to 2035

Vegan Tortillas Market Size and Share Forecast Outlook 2025 to 2035

Vegan Casing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dressing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Sauce Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dips Market Size and Share Forecast Outlook 2025 to 2035

Vegan Yogurt Market Size, Growth, and Forecast for 2025 to 2035

Vegan Meals Market Size, Growth, and Forecast for 2025 to 2035

Vegan Dog Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Protein Bars Market Analysis – Size, Share & Trends 2025–2035

Vegan Vitamins and Supplements Market – Growth & Demand 2025 to 2035

Analysis and Growth Projections for Vegan Fast-Food Market

Vegan Flavor Market – Trends & Forecast 2025 to 2035

Vegan Sauces Market - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA