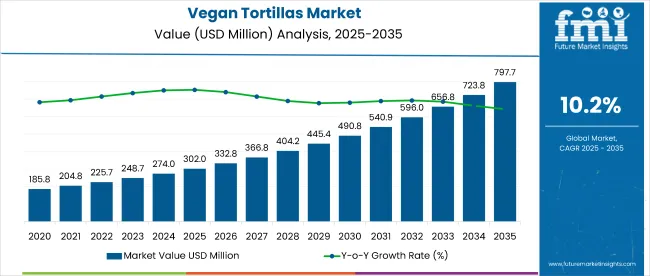

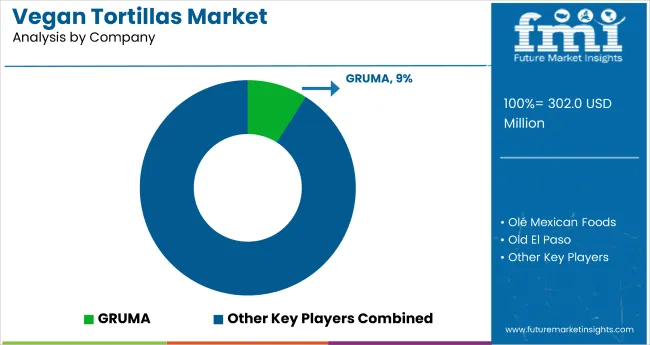

The global vegan tortillas market is projected to grow from USD 302 million in 2025 to USD 797.7 million by 2035, registering a CAGR of 10.2% over the forecast period. The market growth is primarily driven by rising consumer preference for plant-based and gluten-free foods, increasing vegan population worldwide, and growing influence of global cuisines like Mexican and Tex-Mex.

| Attribute | Values |

|---|---|

| Estimated Industry Size (2025E) | USD 302 million |

| Projected Industry Value (2035F) | USD 797.7 million |

| CAGR (2025 to 2035) | 10.2% |

Vegan tortillas produced without dairy or animal-derived ingredients are gaining traction due to their versatility, convenience, and compatibility with health-conscious lifestyles. Innovations in alternative protein sources (such as chickpea, pea, and soy) and expansion of e-commerce food channels are accelerating their adoption across both retail and food service segments.

The market holds an estimated 7.2% share in the global vegan bakery and snacks category, reflecting its increasing presence in the plant-based food niche. Within the gluten-free food market, vegan tortillas account for 4.5%, underscoring their appeal among gluten-intolerant and health-aware consumers.

They contribute around 3.2% to the overall ready-to-eat (RTE) food segment, driven by rising demand for convenient, on-the-go meal options. In the plant-based food market, they command a 2.1% share due to their alignment with clean-label and sustainable consumption trends. However, in the broader global packaged food industry, their share remains limited to under 0.1%, highlighting significant room for growth through innovation, awareness, and distribution expansion.

Government and industry regulations across key markets like the USA, UK, and India are strengthening demand for vegan tortilla formulations. In the USA, the USDA and FDA regulations support clear plant-based labeling and allergen disclosures, while retailers emphasize clean ingredients and transparency.

In the United Kingdom, consumer advocacy and supermarket initiatives promoting meat-free alternatives have boosted shelf space for vegan tortilla products. In India, the rise in flexitarian eating and growth in modern retail formats is creating a favorable landscape for gluten-free and dairy-free tortilla options. These policy and consumer shifts are shaping a healthier, inclusive, and convenience-driven global food ecosystem.

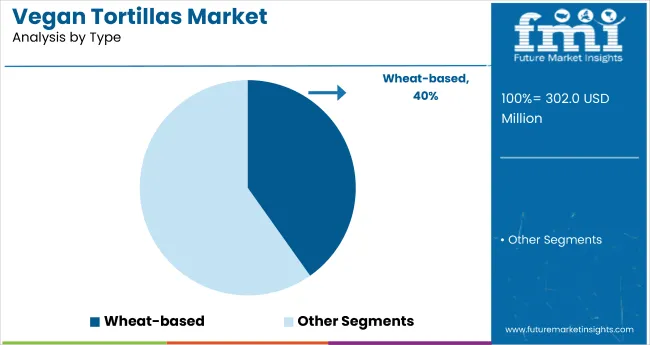

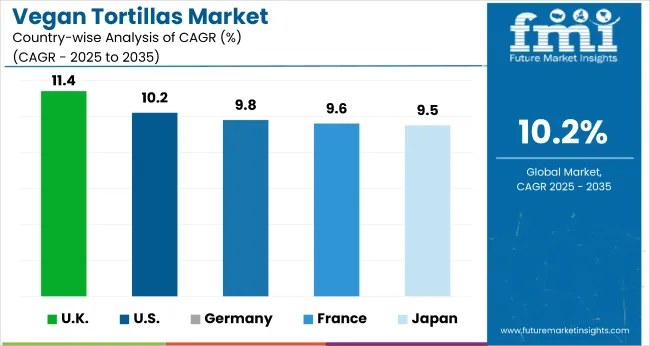

The UK is projected to be the fastest-growing market in the global market, expected to expand at a CAGR of 11.4% from 2025 to 2035. Wheat-based will dominate the type segment with a 40.2% share in 2025. Plain will be the leading flavor segment, accounting for 46% of the market. The USA and Germany markets are expected to grow steadily as well, registering CAGRs of 10.2% and 9.8%, respectively.

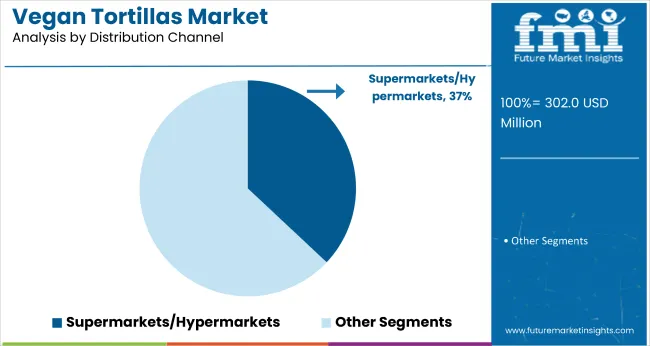

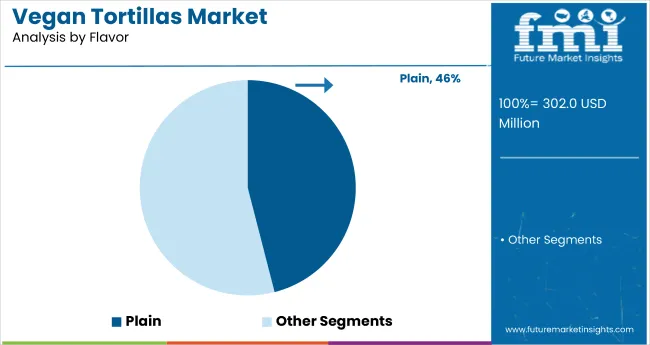

The global market is segmented by type, distribution channel, flavor, and region.By type, the market is categorized into corn-based, wheat-based, and others (flaxseed-based, spinach-based, multigrain, gluten-free).In terms of distribution channels, the market is segmented into supermarkets/hypermarkets, convenience stores, online retailers, and other distribution channels (health food stores, foodservice outlets, farmers’ markets, club stores). By flavor, the market includes plain, multi-grain, and flavor. Regionally, the market is classified into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa (MEA).

Wheat-based is projected to lead the type segment with a 40.2% market share by 2025, owing to its perceived health benefits, fiber content, and compatibility with gluten-free and vegan formulations. Consumers increasingly favor whole grain options, contributing to the segment’s growth.

Supermarkets and hypermarkets are expected to dominate the distribution channel, accounting for 37% of the total market share by 2025. Growth is driven by the rising preference for modern retail outlets offering dedicated plant-based product aisles.

Plain is projected to capture 46% of the market by 2025, favored for its versatility across global cuisines like Mexican, Mediterranean, and fusion dishes. Its neutral flavor base supports broad culinary application and household usage.

The global vegan tortillas market is experiencing robust growth, driven by increasing consumer demand for plant-based, gluten-free, and clean-label food products. Vegan tortillas are becoming a staple across health-conscious households and foodservice menus, thanks to their versatility, convenience, and alignment with sustainable eating trends.

Recent Trends in the Vegan Tortillas Market

Challenges in the Vegan Tortillas Market

Among the top five countries in the market, the UK leads with the highest CAGR of 11.4%, outpacing the global average of 10.2% due to strong retail momentum and flexitarian demand. The USA matches the global rate at 10.2%, supported by product innovation and widespread availability.

Germany follows with a 9.8% CAGR, while France trails slightly at 9.6%, both driven by EU-backed sustainability and clean-label trends. Japan records the lowest growth at 9.5%, reflecting moderate expansion linked to niche urban demand and preference for minimally processed plant-based options.

The UK leads in modern retail adoption of plant-based SKUs where vegan tortillas are increasingly positioned as healthy, convenient staples. Germany and France are leveraging food innovation funding and organic product awareness, while the United States emphasizes on-the-go consumption, retail-led product launches, and allergen-friendly offerings. Japan’s market focuses on small-batch production, convenience-store penetration, and clean-label innovation.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The UK vegan tortillas revenue is growing at a CAGR of 11.4% from 2025 to 2035. Growth is driven by supermarket plant-based category expansion, rising flexitarian diets, and strong consumer advocacy for meat and dairy alternatives.

The sales of vegan tortillas in Germany are expected to expandat 9.8% CAGR during the forecast period, slightly below the global average but strongly backed by green food initiatives. EU organic labeling, school food reform, and bakery innovation are supporting expansion.

The French vegan tortillas market is projected to grow at a 9.6% CAGR during the forecast period, driven by government-supported meat reduction programs, premiumization in plant-based foods, and demand for gluten-free bakery items.

The USA vegan tortillas revenue is projected to grow at 10.2% CAGR from 2025 to 2035, aligning directly with the global rate. Demand is driven by increasing health-conscious consumers, innovation in grain and legume-based formulations, and expanded shelf space across mass retail channels.

The Japan vegan tortillas market is projected to grow at a CAGR of 9.5% from 2025 to 2035, representing 0.93 times the global pace. Growth is led by rising awareness of dairy-free and egg-free products, premium small-batch options, and cross-cultural menu fusion in urban areas.

The global market is moderately fragmented, with key players such as GRUMA, Olé Mexican Foods, Old El Paso, Food for Life, and Siete Food leading the global industry. These companies offer a wide range of plant-based tortillas catering to health-conscious consumers, foodservice providers, and retail markets. GRUMA focuses on mass production and distribution efficiency, while Olé Mexican Foods emphasizes authentic formulations aligned with modern dietary preferences.

Old El Paso delivers mainstream accessibility through its supermarket presence. Food for Life and Siete Food are recognized for organic, gluten-free, and grain-free product lines. Additional players such as Rudi’s Bakery, Whole Foods, Wrawp Original Wraps, and Pas Nisht contribute with artisanal and specialty tortillas designed for niche dietary needs.

Other notable names like BFree, Sunfood Super Foods, Tyson Foods Inc., NUCO, Julian Bakery, Del Sole, La Canasta, Mi Rancho, Azteca Foods Inc., La Corona, and La Tortilla Factory continue to expand their vegan tortilla portfolios, reinforcing competition and innovation in this rapidly growing category.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 302 million |

| Projected Market Size (2035) | USD 797.7 million |

| CAGR (2025 to 2035) | 10.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD million for value/volume in metric tons |

| Product Type Analyzed | Corn Tortillas, Wheat-Based, and Others (Flaxseed-based, Spinach-based, Multigrain, Gluten-free) |

| Flavor Analyzed | Plain, Multi-grain, and Flavor |

| Distribution Channel Analyzed | Supermarkets/Hypermarkets, Convenience Stores, Online Retail, and Others (Health Food Stores, Foodservice Outlets, Farmers’ Markets, Club Stores) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia |

| Key Players Influencing the Market | GRUMA, Olé Mexican Foods, Old El Paso, Food for Life, Siete Food, Rudi’s Bakery, Whole Foods, Wrawp Original Wraps, Pas Nisht, BFree, Sunfood Super Foods, Tyson Foods Inc., NUCO, Julian Bakery, Del Sole, La Canasta, Mi Rancho, Azteca Foods Inc., La Corona, La Tortilla Factory |

| Additional Attributes | Dollar sales by product type, share by flavor and distribution channel, regional demand trends, retail positioning, clean-label influence, competitive benchmarking |

The global vegan tortillas market is estimated to be valued at USD 302.0 million in 2025.

The market size for the vegan tortillas market is projected to reach USD 797.7 million by 2035.

The vegan tortillas market is expected to grow at a 10.2% CAGR between 2025 and 2035.

The key product types in vegan tortillas market are corn-based, wheat-based and others.

In terms of distribution channel, supermarkets/hypermarkets segment to command 47.9% share in the vegan tortillas market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vegan Vitamin D3 Supplements Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Market Size and Share Forecast Outlook 2025 to 2035

Vegan Confectionery Market Size and Share Forecast Outlook 2025 to 2035

Vegan Steak Market Size and Share Forecast Outlook 2025 to 2035

Vegan Pasta Market Size and Share Forecast Outlook 2025 to 2035

Vegan Hyaluronic Acid Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Peptides Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Skincare Market Size and Share Forecast Outlook 2025 to 2035

Vegan Protein Powder Market Analysis - Size, Share, and Forecast 2025 to 2035

Vegan Casing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dressing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Sauce Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dips Market Size and Share Forecast Outlook 2025 to 2035

Vegan Yogurt Market Size, Growth, and Forecast for 2025 to 2035

Vegan Meals Market Size, Growth, and Forecast for 2025 to 2035

Vegan Dog Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Protein Bars Market Analysis – Size, Share & Trends 2025–2035

Vegan Vitamins and Supplements Market – Growth & Demand 2025 to 2035

Analysis and Growth Projections for Vegan Fast-Food Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA