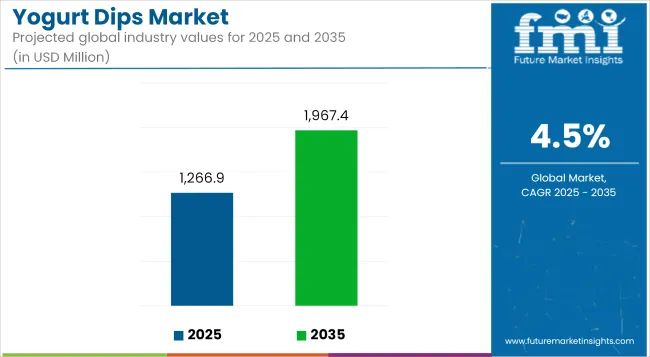

Driven by rising demand and innovation, the global yogurt dips market is forecast to increase at a CAGR of 4.5% between 2025 and 2035, growing from USD 1,266.9 million to USD 1,967.4 million. Rising demand for convenient, healthier snacking solutions with clean-label credentials has invigorated interest in yogurt-based dips, particularly in Western markets.

| Attributes | Description |

|---|---|

| Estimated Market Size (2025E) | USD 1,266.9 million |

| Projected Market Value (2035F) | USD 1,967.4 million |

| Value-based CAGR (2025 to 2035) | 4.5% |

Positioned as a better-for-you alternative to sour cream or mayonnaise-based offerings, yogurt dips have gained traction across both the retail and foodservice landscapes. The use of probiotic-rich bases, paired with herb and spice blends, has allowed brands to deliver functional indulgence that aligns with evolving dietary preferences.

Market growth is being driven by strong consumer demand for protein-rich snacks and expanding global awareness surrounding gut health. The trend toward flexitarian and high-protein eating has fueled product innovation within the segment, including launches featuring Greek-style, plant-based, and low-fat yogurt bases.

However, growth is being restrained by cold chain logistics and shorter shelf-life considerations, particularly in emerging markets with limited refrigeration infrastructure. Product development is gravitating toward enhanced shelf stability, differentiated flavor blends, and eco-conscious packaging. Market participants are accelerating investments in refrigerated dip assortments, strengthening D2C and omnichannel sales strategies, and exploring fusion flavor formats that appeal to multicultural palates.

By 2025, Greek yogurt dips are expected to dominate product launches, attributed to their perceived satiety, thick consistency, and macro-nutrient profile. By 2035, further penetration in developing regions is projected, with brands adapting to local taste preferences and dietary norms. Plant-based and hybrid formulations are likely to gain meaningful traction, supported by growing dairy alternative adoption.

Retail will remain the primary distribution channel, although strategic expansion into foodservice packs, travel packs, and online D2C formats will shape future sales trajectories. The decade ahead is expected to witness consolidation of product lines with broader health claims, as yogurt dips transition from niche to mainstream appeal across global snack categories.

The table below illustrates the CAGR variations through a comparative analysis over six months for both the global yogurt dips market's base year (2024) and the current year (2025). This half-year update shows the market changes and provides considerable insight into the revenue and growth of the companies.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 4.2% |

| H2 (2024 to 2034) | 4.5% |

| H1 (2025 to 2035) | 4.3% |

| H2 (2025 to 2035) | 4.7% |

Between the two periods of 2025 and 2035, the market is expected to increase steadily, with an increase in the first half and continuous growth in the second half. The yogurt dips market is positively affected by growing consumer preference for natural, protein-rich, and probiotic-enhanced dips.

The health trend in snacking and the demand for clean-label ingredients are two of the main supportive factors for the increase in the industry. In H1, the sector experienced an increase of 10 BP; however, in H2, there was a small increase of 20 BP.

The single-serve yogurt dips segment is projected to account for 23.5% of the global market share in 2025, reflecting its growing role in snacking convenience. This segment has gained momentum due to rising demand for portion-controlled, healthy snacks suited for lunchboxes, travel packs, and workday consumption. The combination of portability, clean-label credentials, and protein enrichment aligns well with health-conscious consumer behavior across North America and Western Europe.

Brands such as Chobani and Arla have expanded their single-serve dip offerings with flavor innovations like dill, sriracha, and Mediterranean herb, targeting both adult and teen demographics. Regulatory bodies such as the European Food Safety Authority (EFSA) have outlined permissible probiotic claims that enhance the positioning of these dips within functional snacking categories.

Growth is further supported by premium positioning in refrigerated aisles, where cold-chain infrastructure is mature. However, manufacturers are being challenged to balance freshness with shelf-life, leading to increased exploration of HPP (high-pressure processing) and active packaging.

Strategic retail placements near cut vegetables and baked chips are further boosting impulse purchases. The segment is expected to expand rapidly in Asia-Pacific by 2030, where Western-style snacking is accelerating. Continued product innovation, packaging optimization, and supply chain efficiency will define leadership in this space.

Plant-based yogurt dips are anticipated to represent 11.8% of the total yogurt dips market by 2025. This niche, while smaller in scale, is driving innovation in allergen-free, vegan, and flexitarian snack categories. Growth is being driven by rising lactose intolerance, ethical consumption trends, and the proliferation of plant-derived ingredients like almond, oat, and coconut yogurt bases.

Companies such as Kite Hill and Forager Project in the USA have already launched plant-based yogurt dips that cater to premium consumers seeking dairy-free yet flavorful options. Regulatory support in markets like the European Union, where the Novel Food Regulation applies to certain new plant-based formulations, continues to shape ingredient choices and labeling practices.

While price remains a constraint, flavor innovation and gut-health benefits are helping offset the cost premium. Products are increasingly being bundled with plant-based cracker packs or included in vegan meal kits, enhancing visibility and uptake.

Market success will depend on texture optimization and masking of plant notes to deliver parity with dairy counterparts. As this segment scales, co-branding opportunities with plant-based snack brands and the rise of clean-label formulations will be pivotal in moving plant-based yogurt dips from specialty shelves to mainstream refrigerated sections.

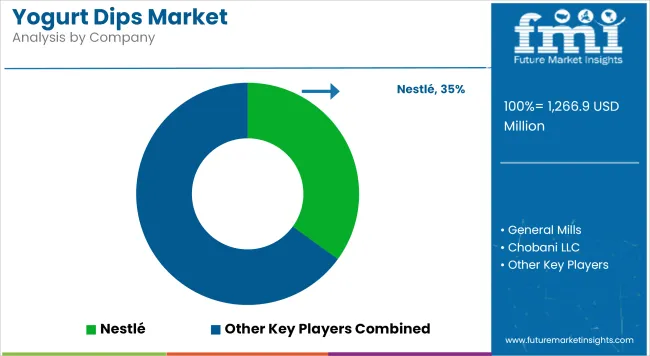

The global yogurt dips market is moderately fragmented, with a blend of multinational corporations (MNCs), regional brands, and local players actively competing in the field. Although MNCs control the wheel due to their strong distribution networks and well-known brands, the regional ones are taking advantage of introducing localized flavors and thereby further developing the market in regions adjusted to the specific preferences of consumers in each of those regions.

The regional brands are strong in such key markets as North America, Europe, and the Middle East. In North America, the regional dairy processors and specialty food brands make use of local ingredients and organic certification as a promotional tool for their health-conscious products.

The regional players in Europe are using traditional yogurt dip recipes, such as Greek tzatziki and Middle Eastern labne, while creating innovative tastes to reach broader clients. The Middle East continues to be a stronghold for regional brands operating in the yogurt dips sector along the lines of traditional diets.

The local brands from China are crowding in and are now strong players, thanks to the increasing demand of urban markets for yogurt products. The probiotics embedded in the infusion of herbal ingredients in the dip products are the result of changing lifestyles and rising demand for dairy alternatives and functional foods in China. The new e-commerce channels have precipitated their whole market expansion, thereby making it possible for local brands to appear on the same level as the international players.

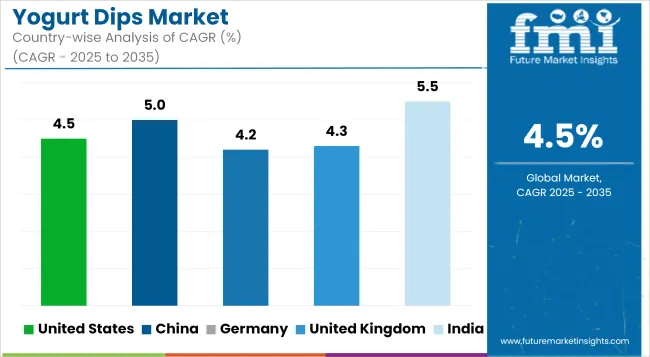

| Country | United States |

|---|---|

| Market Volume (2025) | USD 436 million |

| CAGR (2025 to 2035) | 4.5% |

| Country | China |

|---|---|

| Market Volume (2025) | USD 268 million |

| CAGR (2025 to 2035) | 5.0% |

| Country | Germany |

|---|---|

| Market Volume (2025) | USD 206 million |

| CAGR (2025 to 2035) | 4.2% |

| Country | United Kingdom |

|---|---|

| Market Volume (2025) | USD 170 million |

| CAGR (2025 to 2035) | 4.3% |

| Country | India |

|---|---|

| Market Volume (2025) | USD 129 million |

| CAGR (2025 to 2035) | 5.5% |

The USA has been targeted to keep its first place on the global yogurt dips market, with a market volume of around USD 436 million and a projected CAGR of 4.5% from 2025 to 2035, said the company. The possible mission of the company is to manage customer relationships through their preferred healthy foods, especially those that are based on yogurt and high in probiotics and protein.

The demand for clean-label and natural ingredients is living proof of the existing trend. The manufacturers are very imaginative in developing new flavors and easy-to-carry packages to meet consumers' everyday needs. The market growth can also be associated with a combination of the robust distributor networks and the important market players in the USA

The yogurt dips market level in China is likely to be USD 368 million in 2025, which offers a CAGR of 5.0% through the period in question. The middle class of China continues to grow while the people's concerns about different health issues are amplified, and all these have positive impacts on the demand for healthy and convenient food alternatives.

Besides being a healthy and versatile food, yogurt dips have also been getting more acceptance, especially among urban populations. The local manufacturers are, meanwhile, making the most of this trend as they come out with products that mix yogurt with traditional Chinese flavors. Platforms like e-commerce, which create channels that enhance the market's proliferation, are also behind the success of these products.

German yogurt dips are expected to reach a market volume of USD 206 million in 2025, growing at a CAGR of 4.2% from 2025 to 2035. The market is defined by the robust consumption of dairy-rich products, which has been the case for a long time owing to the traditional side note.

Consumers have been choosing organic and natural products that have been backed up by a decent distribution of high-quality ingredients. The manufacturing plant has been issuing organic certification, and the addition of the local specialties is one of the product differentiation tactics they have taken. The yogurt dips market in Germany is backed up by the presence of established dairy brands and a well-structured retail network.

The yogurt dip global market will be witnessing a large-scale change from 2024 on as a result of the strategic actions taken by the leading companies in the market. The companies have taken up various initiatives to change their properties to adhere to the dynamic and ever-changing consumer preferences and market forces. It is a time for restructurings, which include divestitures, expansions, and product innovations to achieve the objectives of higher market share and profitability.

The global yogurt dips market is anticipated to grow at a CAGR of 4.5% between 2025 and 2035.

The market is expected to reach approximately USD 1,967.4 million by 2035.

Strained yogurt or Greek-style yogurt is expected to be the fastest-growing segment due to its high protein content and increasing demand for thick, creamy dips.

The market is driven by increasing consumer preference for high-protein, probiotic-rich, and clean-label dairy products, along with rising demand for convenient and healthy snacking options.

Leading players include Danone, General Mills, Lactalis, Nestlé, Arla Foods, and Chobani.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Yogurt Powder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dips and Spreads Market Size and Share Forecast Outlook 2025 to 2035

Yogurt Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Yogurt Maker Market – Trends, Growth & Forecast 2025 to 2035

Yogurt Packaging Market Trends – Growth & Demand Forecast 2025 to 2035

Yogurt And Probiotic Drink Market Analysis by Product Type, Source Type, and Region Through 2035

A2 Yogurt Market Trends – Growth, Demand & Innovations

Dry Yogurt Market Outlook - Growth, Demand & Forecast 2025 to 2035

Greek Yogurt Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dips Market Size and Share Forecast Outlook 2025 to 2035

Vegan Yogurt Market Size, Growth, and Forecast for 2025 to 2035

Japan Yogurt Powder Market Analysis by Product Type, Flavor, Nature, Application, End-Use, and Distribution Channel Through 2035

Frozen Yogurt Market Size and Share Forecast Outlook 2025 to 2035

Citrus Yogurt Market Insights – Flavor Trends & Consumer Demand 2025 to 2035

Analysis and Growth Projections for Savory Yogurt Market

Non-GMO yogurt Market Analysis by Product Type, By End use, By Distribution Channel of the and End User Through 2035

Flavored Yogurt Market Analysis by Form, Flavor, End Use and Distribution Channel Through 2035

Non-Dairy Yogurt Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Drinkable Yogurt Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Yogurt Market Analysis - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA