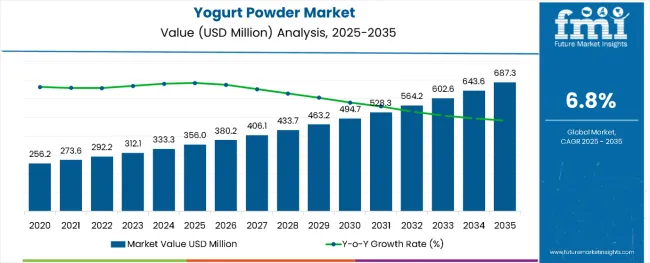

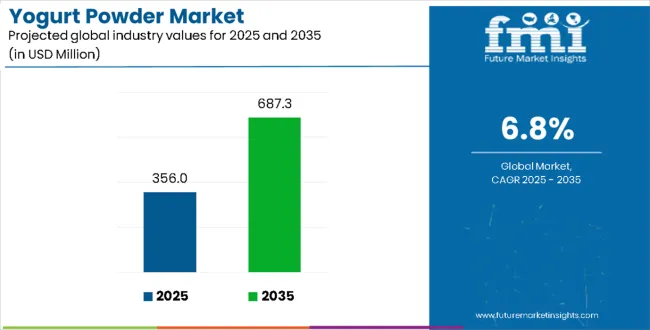

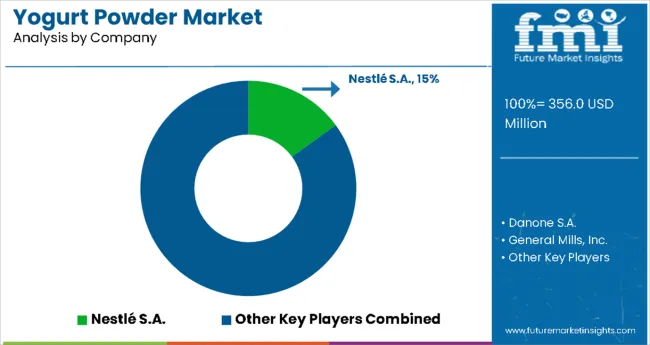

The global yogurt powder market is forecast to grow from USD 356.0 million in 2025 to USD 687.3 million by 2035, registering an absolute gain of USD 331.3 million and a CAGR of about 6.8%. This translates into a total growth of 93.1%, with the market forecast to expand at a compound annual growth rate (CAGR) of 6.8% between 2025 and 2035. The overall market size is expected to grow by nearly 1.93X during the same period, supported by the rising demand for convenient dairy products and increasing application across diverse food processing industries.

Yogurt Powder Market Key Takeaways

| Metric | Value (USD Million) |

|---|---|

| Yogurt Powder Market (2025) | USD 356.0 Million |

| Yogurt Powder Market (2035) | USD 687.3 Million |

| Yogurt Powder Market CAGR (2025 to 2035) | 6.8% |

Between 2020 and 2025, the Yogurt Powder market experienced steady expansion, driven by increasing health awareness and growing applications in food manufacturing. The market developed as food processors recognized the value of yogurt powder in extending shelf life while maintaining nutritional benefits. Consumer preference for convenient, shelf-stable dairy products and the rise of functional food trends contributed significantly to market development during this period.

Between 2025 and 2030, the yogurt powder market is projected to expand from USD 356.0 million to USD 511.2 million, resulting in a value increase of USD 155.2 million, which represents 46.8% of the total forecast growth for the decade. This phase of growth will be shaped by rising health consciousness among consumers, increasing demand for protein-rich functional foods, and expanding applications in the food processing industry. Manufacturers are enhancing production capabilities to meet growing demand for diverse yogurt powder formulations across multiple end-use sectors.

From 2030 to 2035, the market is forecast to grow from USD 511.2 million to USD 687.3 million, adding another USD 176.1 million, which constitutes 53.2% of the overall ten-year expansion. This period is expected to be characterized by technological advancements in spray-drying and freeze-drying processes, development of specialized yogurt powder variants, and increasing penetration in emerging markets. The growing adoption of clean-label products and organic yogurt powders will drive demand for premium formulations and specialized manufacturing expertise.

Market expansion is being supported by the increasing consumer preference for convenient and shelf-stable dairy products that retain nutritional benefits of fresh yogurt. Yogurt powder offers extended storage capabilities, reduced transportation costs, and versatility in food processing applications, making it an attractive ingredient for manufacturers across various industries. The growing awareness of probiotics and their health benefits is driving demand for yogurt powder in functional food formulations and dietary supplement applications.

The expanding food processing industry and rising demand for natural flavor enhancers are creating opportunities for yogurt powder manufacturers to develop specialized products for different applications. Food service establishments and commercial bakeries are increasingly adopting yogurt powder to improve texture, taste, and nutritional content of their products while maintaining cost effectiveness and operational efficiency.

The market segments include type, flavor, packaging type, application, distribution channel, and region. The type segment covers regular, low fat, and non fat. The flavor segment includes plain and flavored. The packaging type segment comprises sachets/pouches, cans/jars, and bulk packaging. The application segment covers food and beverage industry, nutraceuticals and dietary supplements, and cosmetics and personal care products. The distribution channel segment includes supermarkets and hypermarkets, convenience stores, online retailing, specialty stores, and others such as independent grocery stores, foodservice outlets, institutional buyers, and specialty & ethnic stores. The regional segment includes North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and Middle East & Africa.

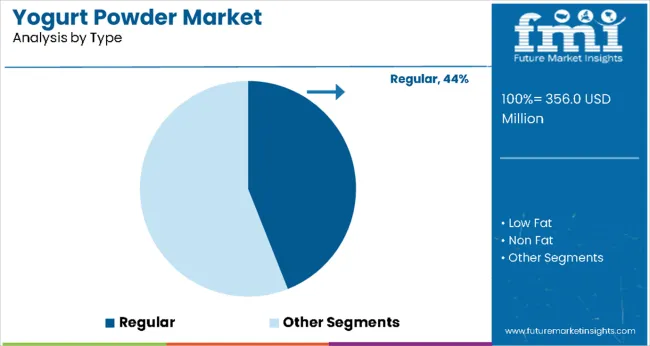

Regular yogurt powder is projected to account for 44% of the yogurt powder market in 2025. This leading share is supported by the widespread preference for traditional yogurt taste and texture in various food applications. Regular yogurt powder maintains the authentic flavor profile and creamy characteristics that consumers associate with conventional yogurt products. The segment benefits from established manufacturing processes and broad application scope across bakery, confectionery, and beverage industries.

Regular yogurt powder provides optimal functionality in food formulations, offering balanced fat content that enhances texture and mouthfeel in finished products. Food manufacturers prefer regular variants for applications requiring rich taste and smooth consistency, particularly in premium product segments where authentic yogurt characteristics are essential for consumer acceptance and market positioning.

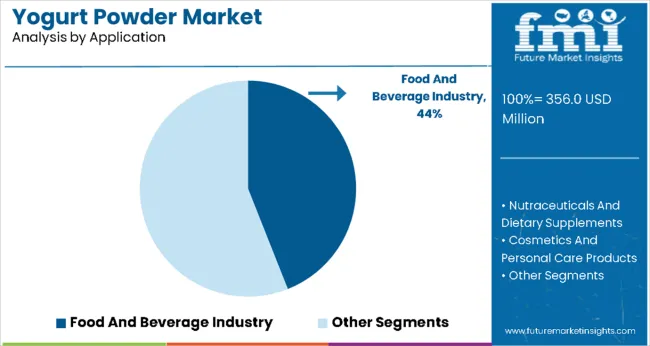

The food and beverage industry is expected to represent 44% of yogurt powder demand in 2025. This dominant share reflects the extensive use of yogurt powder as a functional ingredient across diverse food processing applications. Food manufacturers utilize yogurt powder to enhance nutritional profiles, improve texture, and add tangy flavor to various products including baked goods, snacks, beverages, and frozen desserts.

The segment benefits from growing consumer demand for protein-enriched foods and natural ingredients that provide health benefits while maintaining taste and quality. Food processors are increasingly incorporating yogurt powder into formulations to meet clean label requirements and deliver products that align with health-conscious consumer preferences without compromising on taste or functionality.

The yogurt powder market is advancing steadily due to increasing health consciousness and growing demand for convenient nutritional ingredients. However, the market faces challenges including fluctuating raw material prices, need for specialized storage conditions, and competition from fresh dairy alternatives. Quality standardization and supply chain optimization continue to influence market development and competitive positioning.

Expansion of Functional Food Applications

The growing integration of yogurt powder into functional food formulations is enabling manufacturers to develop products that combine taste, nutrition, and health benefits. Food processors are incorporating yogurt powder into protein bars, meal replacement shakes, and fortified snacks to meet consumer demand for convenient nutrition solutions. These applications provide opportunities for premium pricing and market differentiation.

Development of Specialized Production Technologies

Modern yogurt powder manufacturers are implementing advanced spray-drying and freeze-drying technologies that preserve nutritional content and improve product stability. Enhanced processing methods enable production of yogurt powder with superior solubility, flavor retention, and extended shelf life. These technological improvements support expansion into new applications and geographic markets while maintaining product quality standards.

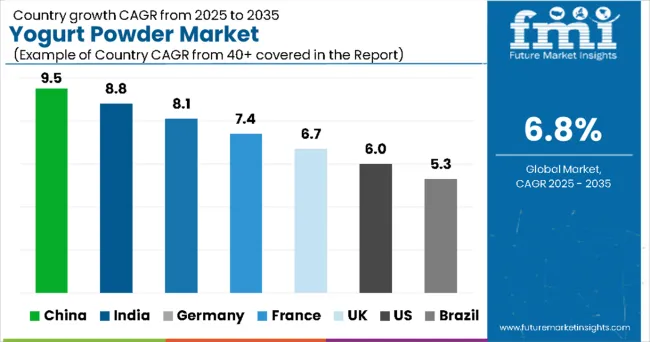

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| United Kingdom | 6.7% |

| United States | 6.0% |

| Brazil | 5.3% |

The yogurt powder market demonstrates varied growth dynamics across key countries from 2025 to 2035. China leads with the highest market share of 9.5%, driven by rapid industrial expansion, modernization of food processing facilities, and increasing consumer demand for convenient dairy-based ingredients. India follows closely at 8.8%, supported by a strong dairy industry, growing middle class, and expanding food processing and bakery sectors. Germany holds an 8.1% share, emphasizing premium quality, technological innovation, and organic/natural product offerings. France records a 7.4% share, focusing on culinary applications, product innovation, and gourmet food segments. The United Kingdom maintains 6.7%, propelled by health-conscious consumers and functional food demand. The United States shows 6.0%, driven by diversified applications across food processing, nutraceuticals, and allergen-free or specialty variants. Brazil rounds out the top seven with 5.3%, supported by domestic consumption, food industry modernization, and export opportunities.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from yogurt powder in China is projected to exhibit strong growth with a 9.5% market share, driven by rapid expansion of food processing industries and increasing consumer acceptance of dairy-based ingredients. The country's growing middle class and urbanization trends are creating demand for convenient food products that incorporate yogurt powder. Major food manufacturers are establishing production facilities to serve both domestic and export markets with cost-effective yogurt powder solutions.

Government initiatives supporting dairy industry development and food safety regulations are encouraging investment in modern yogurt powder production technologies. The expanding e-commerce sector and changing dietary preferences among urban consumers are creating new distribution channels and application opportunities for yogurt powder manufacturers throughout major metropolitan areas.

Revenue from yogurt powder in India is expanding with an 8.8% market share, supported by the country's established dairy industry and growing food processing sector. Traditional yogurt consumption patterns and increasing awareness of convenient dairy alternatives are creating opportunities for yogurt powder manufacturers. The expanding middle class and changing food habits are driving demand for processed foods that incorporate yogurt powder as a functional ingredient.

Dairy cooperatives and food processing companies are investing in yogurt powder production capabilities to serve domestic and international markets. The government's focus on value addition in agriculture and dairy sectors is supporting development of modern processing facilities that can produce high-quality yogurt powder meeting international standards.

Demand for yogurt powder in Germany is projected with an 8.1% market share, supported by the country's emphasis on food quality and technological innovation in dairy processing. German manufacturers are developing high-quality yogurt powder products that meet stringent European food safety standards and consumer expectations for premium ingredients. The market is characterized by focus on organic and natural variants that align with consumer preferences for clean label products.

Food technology research and development activities are advancing yogurt powder applications in specialized nutrition and functional food segments. German companies are investing in sustainable production methods and innovative packaging solutions that extend product shelf life while maintaining nutritional integrity and flavor characteristics.

Demand for yogurt powder in France is growing with a 7.4% market share, driven by the country's sophisticated food culture and emphasis on culinary innovation. French food manufacturers are incorporating yogurt powder into premium bakery products, gourmet snacks, and artisanal food preparations that cater to discerning consumer preferences. The market benefits from strong domestic dairy industry and established food processing expertise.

Culinary schools and professional kitchens are adopting yogurt powder for its convenience and consistent quality in food preparation applications. The expanding organic food segment and consumer preference for natural ingredients are creating opportunities for premium yogurt powder products that command higher market prices and margins.

Demand for yogurt powder in the United Kingdom is expanding with a 6.7% market share, supported by increasing consumer interest in health and wellness products. British manufacturers are developing yogurt powder formulations for sports nutrition, dietary supplements, and functional foods that address specific health needs. The market is characterized by emphasis on protein content and probiotic benefits that appeal to health-conscious consumers.

Food retailers and supplement companies are expanding yogurt powder product offerings to meet growing demand for convenient nutrition solutions. The increasing prevalence of busy lifestyles and emphasis on portable nutrition are driving adoption of yogurt powder in meal replacement products and on-the-go snack applications.

Demand for yogurt powder in the United States is projected with a 6.0% market share, driven by diverse application opportunities across food processing, nutraceutical, and food service industries. American manufacturers are developing innovative yogurt powder products that cater to specific dietary requirements including organic, non-GMO, and allergen-free variants. The market benefits from advanced food processing technologies and extensive distribution networks.

Food service establishments and commercial bakeries are increasingly adopting yogurt powder to improve product nutritional profiles while maintaining operational efficiency. The growing popularity of high-protein foods and functional ingredients is creating opportunities for yogurt powder manufacturers to develop specialized products for different market segments.

Revenue from yogurt powder in Brazil is growing with a 5.3% market share, supported by the country's expanding food processing industry and increasing consumer acceptance of dairy-based ingredients. Brazilian manufacturers are developing yogurt powder products that cater to local taste preferences while meeting international quality standards. The market benefits from abundant raw material availability and growing domestic consumption of processed foods.

Food processing companies are investing in modern production facilities that can produce high-quality yogurt powder for both domestic and export markets. The expanding middle class and urbanization trends are creating demand for convenient food products that incorporate yogurt powder as a nutritional and functional ingredient.

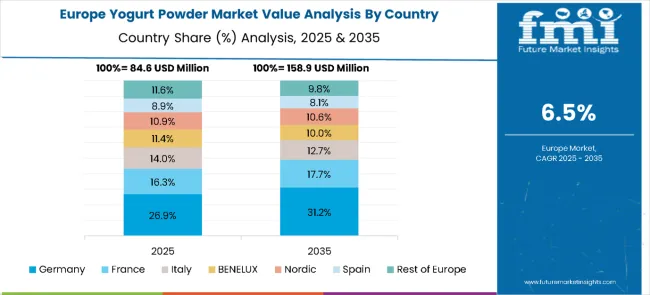

The yogurt powder market in Europe is projected to grow from USD 84.6 million in 2025 to USD 158.9 million by 2035, registering a CAGR of 6.5% over the forecast period. Germany is expected to dominate with a 26.9% share in 2025, followed by France at 16.3%, reflecting strong applications in dairy-based food and beverage formulations. Italy accounts for 14.0% of the market, while BENELUX represents 11.4% and the Nordic countries hold 10.9%.

Spain contributes 8.9%, while the Rest of Europe collectively makes up 11.6%. By 2035, Germany will expand its lead to 31.2%, France will grow to 17.7%, and Italy will slightly reduce to 12.7%. BENELUX and the Nordic countries are projected at 10.0% and 10.6%, respectively, while Spain will reach 8.1%, and the Rest of Europe will ease to 9.8%, highlighting increasing concentration of demand in Europe’s top dairy innovation hubs.

The yogurt powder market is characterized by competition among established dairy companies, food ingredient manufacturers, and specialized powder production facilities. Companies are investing in advanced processing technologies, product innovation, and quality assurance systems to deliver consistent, high-quality yogurt powder products that meet diverse application requirements.

Major players focus on developing specialized yogurt powder variants, expanding production capacity, and establishing strategic partnerships with food manufacturers to strengthen market presence. Technological innovation, supply chain optimization, and geographic expansion are central to competitive positioning and market growth strategies.

Yogurt powder is a versatile ingredient bridging dairy nutrition and convenience - used in instant drinking yogurts, beverage mixes, baked goods, clinical nutrition, and shelf-stable food kits. Its growth is driven by demand for longer-shelf-life dairy proteins, probiotic-enabled products, easier cold-chain logistics, and new applications (snacking, on-the-go nutrition, military & disaster rations). Scaling the category requires attention to probiotic viability, sensory equivalence on reconstitution, energy-intensive drying processes, and dairy supply resilience - and that’s where coordinated stakeholder action matters.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 356 Million |

| Type | Regular, Low Fat, Non Fat |

| Flavor | Plain and Flavored |

| Packaging Type | Sachets/Pouches, Cans/Jars, and Bulk Packaging |

| Application | Food And Beverage Industry, Nutraceuticals And Dietary Supplements, Cosmetics and Personal Care Products |

| Distribution Channel | Supermarkets And Hypermarkets, Convenience Stores, Online Retailing, Specialty Stores, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, France, United Kingdom, United States, Brazil, and 40+ countries |

| Key Companies Profiled | Nestlé S.A., Danone S.A., General Mills, Inc., Kerry Group plc, Glanbia plc |

| Additional Attributes | Dollar sales by type and application, regional demand trends across major markets, competitive landscape analysis, technological innovations in powder processing, quality standards and certification requirements, and emerging applications in functional foods and specialized nutrition products. |

The global Yogurt Powder industry is estimated at a value of USD 356.0 million in 2025.

Sales of Yogurt Powder increased at 5.2% CAGR between 2020 and 2024.

Nestlé S.A., Danone S.A., General Mills, Inc., Yakult Honsha Co., Ltd., and FrieslandCampina N.V. are some of the leading players in this industry.

The South Asia domain is projected to hold a revenue share of 23% over the forecast period.

North America holds 31% share of the global demand space for Yogurt Powder.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Yogurt Powder Market Analysis by Product Type, Flavor, Nature, Application, End-Use, and Distribution Channel Through 2035

Demand and Trend Analysis of Yogurt Powder in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yogurt Powder in Korea Size and Share Forecast Outlook 2025 to 2035

Yogurt Dips Market Size, Growth, and Forecast for 2025 to 2035

Yogurt Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Yogurt Maker Market – Trends, Growth & Forecast 2025 to 2035

Yogurt Packaging Market Trends – Growth & Demand Forecast 2025 to 2035

Yogurt And Probiotic Drink Market Analysis by Product Type, Source Type, and Region Through 2035

A2 Yogurt Market Trends – Growth, Demand & Innovations

Dry Yogurt Market Outlook - Growth, Demand & Forecast 2025 to 2035

Greek Yogurt Market Size and Share Forecast Outlook 2025 to 2035

Vegan Yogurt Market Size, Growth, and Forecast for 2025 to 2035

Citrus Yogurt Market Insights – Flavor Trends & Consumer Demand 2025 to 2035

Analysis and Growth Projections for Savory Yogurt Market

Frozen Yogurt Market Insights – Growth & Forecast 2024-2034

Non-GMO yogurt Market Analysis by Product Type, By End use, By Distribution Channel of the and End User Through 2035

Flavored Yogurt Market Analysis by Form, Flavor, End Use and Distribution Channel Through 2035

Non-Dairy Yogurt Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Drinkable Yogurt Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Yogurt Market Analysis - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA