The frozen yogurt market is experiencing robust expansion driven by growing consumer inclination toward healthier dessert alternatives and the rising popularity of probiotic-rich foods. Increasing awareness regarding digestive health and balanced nutrition has accelerated the adoption of frozen yogurt as a preferred choice among health-conscious consumers. The market is also benefiting from innovation in product formulations, enhanced flavor offerings, and broader availability through retail and foodservice channels.

Manufacturers are focusing on clean-label ingredients and reduced-sugar variants to meet evolving dietary trends and regulatory guidelines. The future outlook remains positive as consumers continue to favor functional and low-calorie desserts that align with lifestyle-oriented consumption habits.

Strategic product diversification, coupled with the expansion of distribution networks in emerging markets, is expected to drive sustained market growth The overall growth rationale is anchored in product innovation, continuous investments in cold chain logistics, and marketing strategies emphasizing freshness, nutritional value, and indulgence.

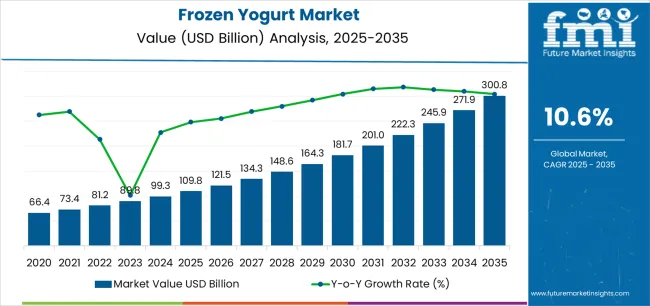

| Metric | Value |

|---|---|

| Frozen Yogurt Market Estimated Value in (2025 E) | USD 109.8 billion |

| Frozen Yogurt Market Forecast Value in (2035 F) | USD 300.8 billion |

| Forecast CAGR (2025 to 2035) | 10.6% |

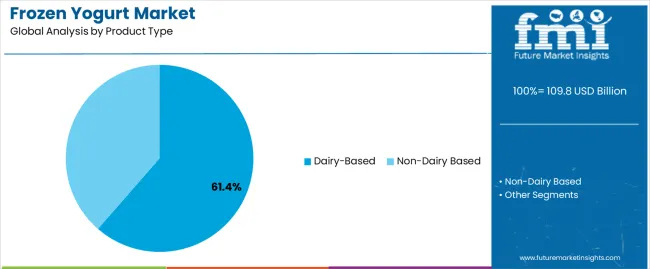

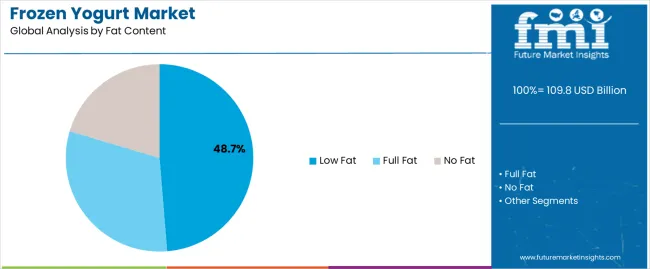

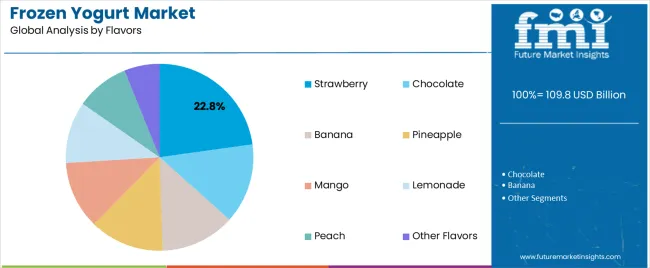

The market is segmented by Product Type, Fat Content, Flavors, and Sales Channel and region. By Product Type, the market is divided into Dairy-Based and Non-Dairy Based. In terms of Fat Content, the market is classified into Low Fat, Full Fat, and No Fat. Based on Flavors, the market is segmented into Strawberry, Chocolate, Banana, Pineapple, Mango, Lemonade, Peach, and Other Flavors. By Sales Channel, the market is divided into Offline Sales Channel and Online Sales Channel. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The dairy-based segment, holding 61.4% of the product type category, has dominated the market due to its creamy texture, authentic taste, and nutritional value derived from milk proteins and probiotics. Demand has been reinforced by consumer preference for natural ingredients and the perception of dairy-based frozen yogurt as a healthier alternative to traditional ice cream.

Technological advancements in dairy processing and fermentation techniques have improved product consistency and extended shelf life. The segment’s growth is supported by strong brand positioning and widespread retail availability, particularly in premium and artisanal categories.

Market penetration has been strengthened by the inclusion of fortified variants enriched with calcium and vitamins Continued consumer loyalty toward dairy-origin products, combined with innovation in low-fat and high-protein formulations, is expected to sustain the segment’s leading position over the forecast period.

The low-fat segment, representing 48.7% of the fat content category, has emerged as the most preferred option among health-oriented consumers. Rising awareness about calorie management and dietary balance has driven adoption of low-fat frozen yogurt in both retail and quick-service channels.

The segment’s dominance is being reinforced by product development efforts focusing on taste enhancement without compromising nutritional value. Consumer acceptance has been boosted by the growing availability of low-fat options featuring natural sweeteners and probiotic cultures.

Manufacturers are leveraging advanced formulations and fat-replacement technologies to maintain product texture and mouthfeel The segment’s growth trajectory is further supported by the fitness and wellness trend, which has positioned low-fat frozen yogurt as a guilt-free indulgence, ensuring consistent demand across age groups and regions.

The strawberry flavor segment, accounting for 22.8% of the flavors category, remains the leading choice among consumers due to its refreshing taste, versatility, and widespread appeal across demographics. Its popularity has been strengthened by consistent product launches and promotional campaigns emphasizing natural fruit content and antioxidant properties.

Strawberry-flavored frozen yogurt benefits from broad acceptance in both standalone and mixed-flavor offerings, making it a staple in retail and foodservice menus. The segment’s continued leadership is supported by stable sourcing of fruit purees and innovations in flavor enhancement technologies that preserve freshness and color.

Seasonal demand peaks and consumer familiarity contribute to sustained sales volumes Over the forecast horizon, the strawberry segment is expected to maintain strong momentum through ongoing flavor diversification and alignment with consumer preferences for natural, fruity, and health-oriented dessert options.

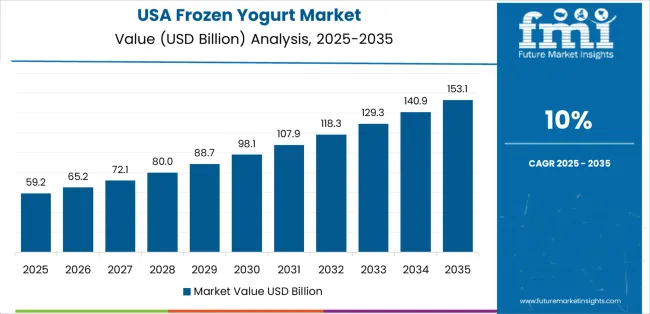

In 2020, the global frozen yogurt market was estimated to reach a valuation of USD 66.4 billion, according to a report from Future Market Insights (FMI). The frozen yogurt market witnessed significant growth, registering a CAGR of 9.9% during the historical period 2020 to 2025.

| Historical CAGR | 9.9% |

|---|---|

| Forecast CAGR | 10.6% |

The availability of various flavors and variations and rising consumer desire for healthy dessert options propelled the worldwide frozen yogurt market to a valuation of USD 66.4 billion in 2020. With a historical CAGR of 9.9% between 2020 and 2025, this market experienced significant growth. The frozen yogurt market is expected to grow, with an anticipated CAGR of 10.6%.

The growth is anticipated to be directed by expanded distribution channels, creative product options, and a surge in disposable income. The developments above highlight the remarkable prospects in the frozen yogurt industry, as companies are well-positioned in using the change in consumer inclinations and market conditions to maintain expansion in the upcoming years.

The below section shows the leading segment. Based on the product type, the dairy-based segment is accounted to hold a market share of 88.2% in 2025. Based on sales channel, the hypermarket/supermarket segment is accounted to hold a market share of 44.2% in 2025.

A surge in demand for these time-honored classics in the frozen desserts market as so many customers are accustomed to the flavor and texture of dairy-based desserts like ice cream and frozen yogurt.

Customers tend to readily discover a variety of frozen dessert alternatives at hypermarkets and supermarkets, which make it easier for them to buy their favorite treats on regular grocery shopping trips.

| Category | Market Share in 2025 |

|---|---|

| Dairy-based | 88.2% |

| Hypermarket/Supermarket | 44.2% |

Based on the dairy-based segment, holding a significant market share of 88.2% in 2025, the dairy-based sector is leading the frozen desserts market. The market shows that frozen desserts with dairy products, including milk and cream, are highly preferred by customers because they have a rich, creamy texture.

Several variables, including taste preference, perceived indulgence, and familiarity with classic dairy flavors, are probably responsible for the appeal of frozen desserts containing dairy.

Based on sales channel, the hypermarket/supermarket segment holds 44.2% of the market share in 2025. The market emphasizes how important big-box retailers are in getting frozen treats to customers.

A large selection of frozen dessert options is available in supermarkets and hypermarkets, which gives customers convenience and accessibility. A boom in sales of frozen desserts within their locations is the promotional events and eye-catching displays that these retail outlets frequently have.

The table mentions the top five countries ranked by revenue, with India holding the top position.

India is the market leader in frozen yogurt due to the heightened desire for healthier dessert options from its urban population.

The recognized health benefits and adaptability of frozen yogurt are gaining traction among consumers in India, who are placing a greater emphasis on wellness and health. This automatically has resulted in significant market expansion and adoption across metropolitan centers.

Forecast CAGRs from 2025 to 2035

| Countries | CAGRs through 2035 |

|---|---|

| United States | 3.5% |

| Germany | 4.1% |

| China | 5.5% |

| Japan | 5.8% |

| India | 6% |

In the United States, the frozen yogurt market is primarily utilized as a healthier dessert option, catering to health-conscious consumers seeking alternatives to traditional ice cream.

Major chains and independent shops offer a wide range of flavors and toppings, attracting a diverse customer base.

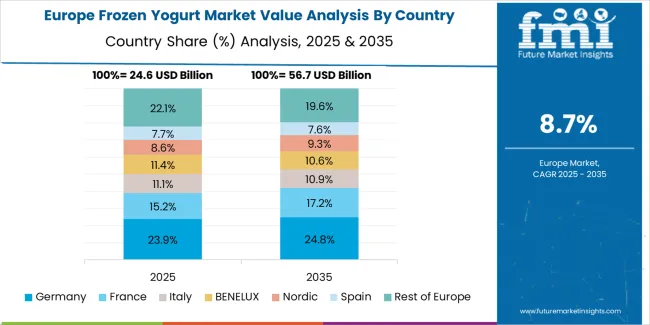

In Germany, frozen yogurt is enjoyed as a refreshing treat, particularly during the warmer months.

Consumers appreciate its creamy texture and tangy taste, making it a popular choice for indulgence.

In China, the frozen yogurt market is leveraged as a trendy dessert option, especially among urban millennials. Its customizable nature and association with health benefits appeal to young consumers seeking novel experiences.

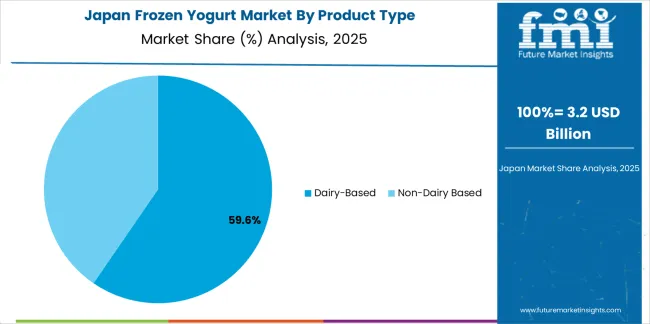

In Japan, frozen yogurt is a light and refreshing snack, often paired with fresh fruit or mochi. Its availability in various flavors and formats caters to the discerning tastes of consumers of Japan.

In India, the frozen yogurt market is embraced as a modern dessert option, particularly in urban areas. Its perceived health benefits and versatility make it a favored choice among health-conscious individuals seeking guilt-free indulgence.

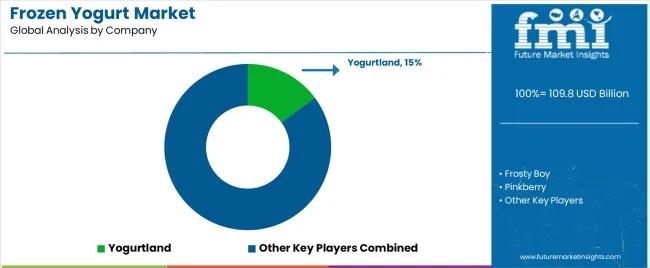

The frozen yogurt market is a competitive landscape that subsequently features a variety of brands offering diverse flavors and toppings. Major chains like Pinkberry and Frosty Boy dominate alongside local and regional players.

Customization options, innovative flavors, and strategic partnerships with supermarkets and specialty stores contribute to market growth. Consumer preferences for healthier dessert options also drive demand in this market.

Some of the key developments are:

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 99.29 billion |

| Projected Market Valuation in 2035 | USD 272.74 billion |

| Value-based CAGR 2025 to 2035 | 10.6% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East and Africa |

| Key Market Segments Covered | Product Type, Fat Content, Flavours, Sales Channel, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Frosty Boy; Pinkberry; Honey Hill Farms; Scott Brothers Dairy; Red Mango; Yogurtland; Llaollao; I Can't Believe It's Yogurt!; Menchie's Frozen Yogurt; Orange Leaf Frozen Yogurt |

The global frozen yogurt market is estimated to be valued at USD 109.8 billion in 2025.

The market size for the frozen yogurt market is projected to reach USD 300.8 billion by 2035.

The frozen yogurt market is expected to grow at a 10.6% CAGR between 2025 and 2035.

The key product types in frozen yogurt market are dairy-based and non-dairy based.

In terms of fat content, low fat segment to command 48.7% share in the frozen yogurt market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Frozen Pet Food Market Size and Share Forecast Outlook 2025 to 2035

Frozen Egg Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Frozen Tissues Samples Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Pastries Market Size and Share Forecast Outlook 2025 to 2035

Frozen Baked Goods Market Size and Share Forecast Outlook 2025 to 2035

Frozen Potatoes Market Size and Share Forecast Outlook 2025 to 2035

Frozen Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Frozen Meat Grinder Market Size and Share Forecast Outlook 2025 to 2035

Frozen Fruits and Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Frozen Vegetable Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Cheese Market Size and Share Forecast Outlook 2025 to 2035

Frozen Snacks Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Frozen Fruit Bars Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Frozen Desserts Market Growth Share Trends 2025 to 2035

Frozen Ready Meals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Tortilla Market Size, Growth, and Forecast for 2025 to 2035

Market Share Insights in the Frozen Food Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA