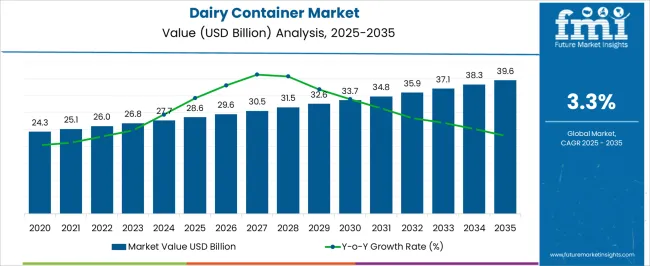

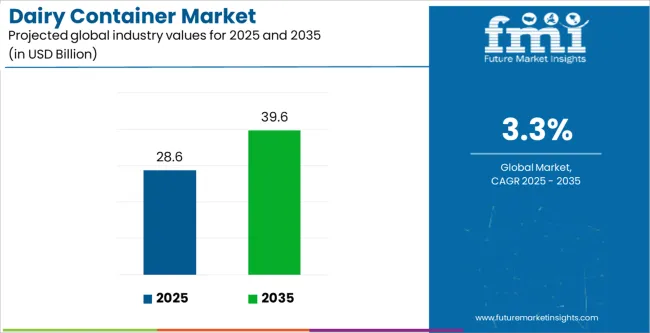

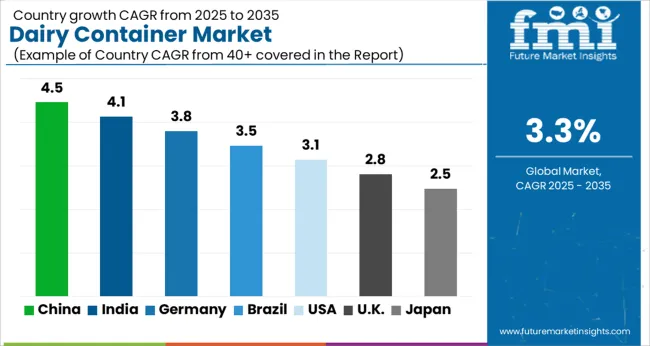

The Dairy Container Market is estimated to be valued at USD 28.6 billion in 2025 and is projected to reach USD 39.6 billion by 2035, registering a compound annual growth rate (CAGR) of 3.3% over the forecast period.

| Metric | Value |

|---|---|

| Dairy Container Market Estimated Value in (2025 E) | USD 28.6 billion |

| Dairy Container Market Forecast Value in (2035 F) | USD 39.6 billion |

| Forecast CAGR (2025 to 2035) | 3.3% |

The dairy container market is advancing steadily, underpinned by rising global dairy consumption and the increasing focus on safe, durable, and cost-effective packaging solutions. Industry journals and packaging sector reports have emphasized the growing demand for hygienic storage and transport systems that preserve freshness while extending product shelf life. Manufacturers have prioritized packaging innovations that align with food safety regulations and sustainability commitments, including lightweighting initiatives and recyclable material integration.

Press releases from packaging companies have highlighted capacity expansions and strategic investments to meet the growing requirements of large-scale dairy producers. Additionally, changing consumer preferences toward packaged milk and other dairy products in urban markets have stimulated demand for standardized container formats. Digitalization of the dairy supply chain, with enhanced logistics and cold-chain efficiency, has further accelerated container adoption.

Over the coming years, continued emphasis on sustainability, advancements in barrier materials, and growth in dairy exports are expected to drive additional market opportunities, with Plastic, Rigid, and Milk segments contributing significantly to the market’s revenue profile.

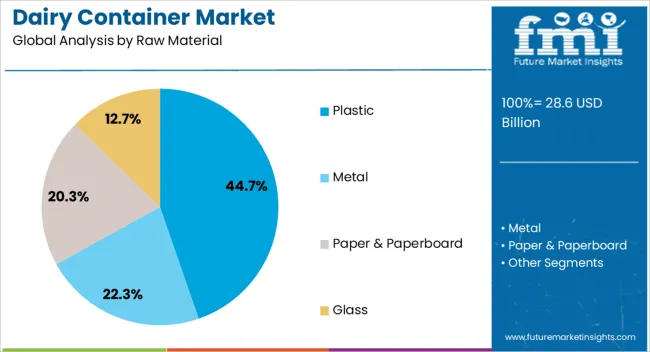

The Plastic segment is projected to account for 44.7% of the dairy container market revenue in 2025, sustaining its leadership position due to cost efficiency, versatility, and widespread availability. Plastic containers have been favored for their lightweight nature, durability, and ease of transportation, which reduce overall logistics costs. Food-grade plastics have been widely adopted to comply with safety standards while offering design flexibility that supports branding and convenience features such as resealable lids.

Moreover, plastic containers have demonstrated superior resistance to breakage compared to glass alternatives, making them highly practical for large-scale distribution. Industry updates have also highlighted continuous improvements in recyclable and biodegradable plastic formulations, addressing environmental concerns and regulatory requirements.

This combination of affordability, adaptability, and evolving sustainability features has reinforced the dominance of plastic in dairy packaging applications.

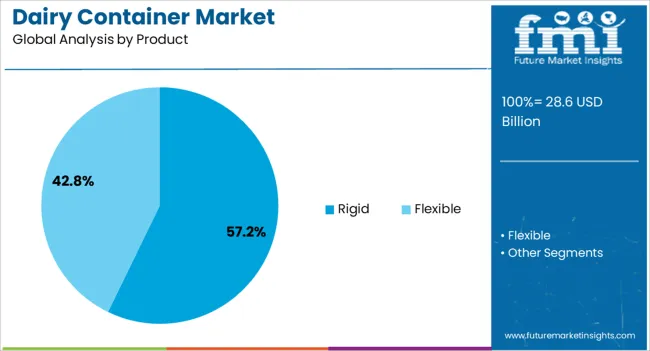

The Rigid segment is projected to capture 57.2% of the dairy container market revenue in 2025, maintaining its position as the most utilized product category. This growth has been driven by the strength and protective qualities of rigid containers, which ensure safe handling during storage and transportation. Dairy producers have relied on rigid formats such as bottles, jugs, and cartons to safeguard against contamination and leakage.

Industry announcements have pointed to the widespread use of rigid containers in automated filling and sealing processes, which enhance operational efficiency for large-scale dairy operations. Rigid packaging also allows for consistent portion control and standardized retail presentation, strengthening its role in mass-market dairy distribution.

With advancements in molding technologies and the increasing adoption of recyclable rigid plastics, this segment is expected to remain at the forefront of the dairy container market.

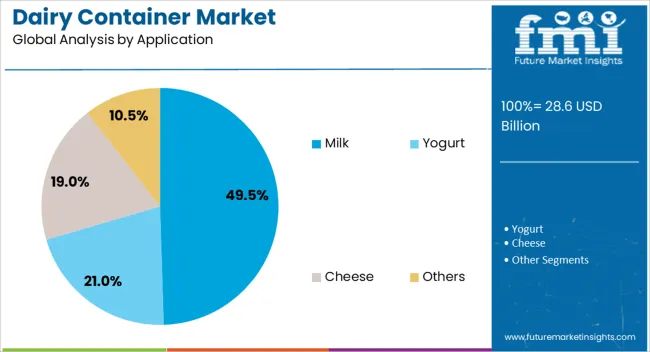

The Milk segment is projected to contribute 49.5% of the dairy container market revenue in 2025, representing the leading application area. Milk consumption has been consistently high across global markets, supported by rising population, urbanization, and nutritional awareness. Containers designed for milk storage have been optimized to preserve freshness, prevent contamination, and withstand transportation through cold-chain systems.

Regulatory authorities have reinforced strict packaging standards for milk, further driving the adoption of reliable and tamper-proof containers. Press releases from dairy producers have underscored the increasing demand for single-serve and family-size milk packaging, catering to diverse consumer needs.

Furthermore, innovation in packaging design, including light-blocking features to maintain nutrient stability, has enhanced consumer trust in packaged milk. As dairy consumption expands in both developed and emerging economies, the Milk application segment is expected to maintain its market leadership, supported by consistent demand and ongoing packaging advancements.

78% of consumers believe that sustainability is important. 77% of companies say that their sustainability initiatives increase customer loyalty. With more people caring about the environment, it has become important to introduce sustainable dairy containers. Businesses are researching on packaging that breaks down easily, and has minimal to no impact on being discarded.

Recyclable, biodegradable, and compostable packaging solutions are getting more preference in the dairy industry. These changes are important because they help reduce the negative impact of packaging on the environment. They help meet regulations, and match what customers want. So, businesses are working to make packaging that is actually better for the planet.

Like, in January 2025, Gippsland Dairy's parent business, Chobani Australia, introduced a new reduced-plastic packaging for its Gippsland Dairy 160-gram products. This new format is focused on sustainability and cuts the amount of plastic used in each product by half. Chobani aims to remove nearly 95,000 kilograms of plastics from its business in 2025.

This section analyzes the demand for dairy containers in key countries as given in the table below. The industry is led by sales of dairy containers in India. China and Thailand are catching up too. This indicates that Asia Pacific is emerging as a key hotspot for growth. The demand in Germany and the United States is comparatively lower being mature markets.

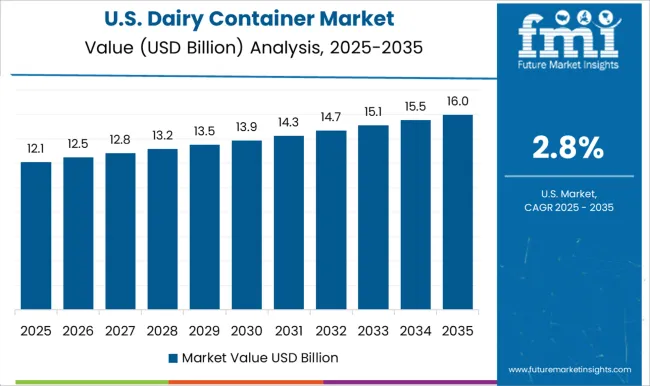

The demand for dairy containers in the United States will rise at a 2.4% CAGR until 2035. Specialty dairy products, like fancy cheeses and gourmet yogurts, are getting more popular. People are willing to pay extra for these special items. As such, companies are investing in packaging to show off the products' quality and uniqueness.

Also, the way people buy things is changing, with more online shopping and special stores for food. This means companies need to think about how their products look online or in a store. People are also more interested in healthy food, so dairy products with health benefits are becoming more popular. Packaging that shows these benefits, like being low in sugar or high in protein, can attract more customers.

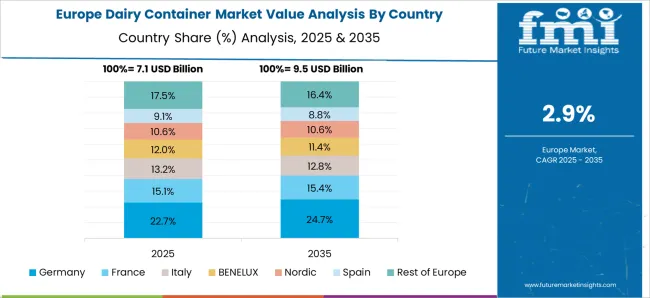

The sales of dairy containers in Germany will amplify at a 2.1% CAGR till 2035. Germans tend to like premium products that come in nice packages, like glass jars or pretty cans. But people are getting busier, especially in cities, so they also want dairy foods they can take with them easily.

Packaging formats like small cups or pouches are becoming more popular here. Germans are proud of their different dairy foods, like Greek yogurt, and they like packages that show off the history and variety of these foods. Plus, more people are interested in plant-based foods. So, dairy brands in Germany need to make sure their packaging matches what people want.

China is an opportunistic dairy containers market, flourishing at a 5.7% CAGR till 2035. In China, the way people buy dairy products online has changed because of websites like Alibaba and JD.com. So, dairy brands need packaging that looks good online and keeps the products safe.

They use special things like QR codes to give shoppers more information. Also, they make dairy products that Chinese people like, with flavors and designs that feel right. And, as more people in China have more money to spend, they want fancier dairy products in nicer packaging. These factors create a high demand in the Chinese food and beverage industry.

The growth of the dairy containers market in India is estimated at a 6.5% CAGR until 2035. In India, supermarkets and hypermarkets are making it easier for people to buy dairy products. These stores have lots of different dairy items in packaging that look nice and grab attention. Packaging that's easy to see on the shelves and shows what's good about the product helps sell more.

India has different cultures, so packaging that shows this diversity and local traditions helps keep customers coming back. Also, as more people care about staying healthy, they want products with clear labels showing what's inside and how good it is for them. And since more people are shopping online, dairy brands need packaging that looks good on websites and gives shoppers useful information.

The demand for dairy containers in Thailand will amplify at a 5.4% CAGR until 2035. In cities like Bangkok, people are often busy and want convenient dairy products. They like packaging that is easy to carry and open, like single-serve cups or pouches.

Dairy brands in Thailand make interesting flavors inspired by Thai food, like mango sticky rice. They use colorful packaging to catch people's attention. As Thai people get more indulged in caring about their health, they look for dairy products that are good for them, like low-fat or high-protein options.

Packaging that says these products are healthy is important. Also, the Thai government helps the dairy industry grow by supporting farmers and research, which means more dairy products and packaging showing they're safe and good quality.

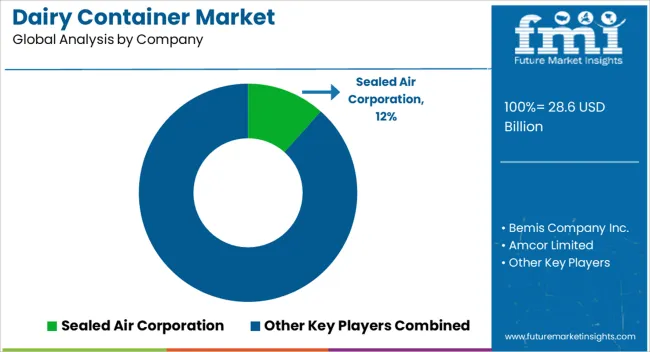

The dairy container industry is highly competitive, with reputable businesses such as Amcor and Tetra Pak dominating. Regional and local producers concentrate on particular niches. Consumer need for environmentally sustainable and convenient packaging fuels innovation. Strategic alliances and mergers are frequent ways to improve market position. Regulatory actions also have an impact on competitive strategy.

Recent Developments

The industry is segregated into Liquid Cartons, Bottles & Jars, Cans & Jerry Cans, Cups & Tubs, and Folding Cartons.

The industry is classified into Plastic {(Polyethylene (PE), Polypropylene (PP), and Polyethylene Terephthalate (PET)}, Paper & Paperboard, Glass, and Metal.

The industry is segmented into Milk, Cheese, Cream, Butter/Ghee, Yogurt, Ice Cream, and Other Dairy Products.

Analysis of the market has been conducted in the countries of North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa (MEA).

The global dairy container market is estimated to be valued at USD 28.6 billion in 2025.

The market size for the dairy container market is projected to reach USD 39.6 billion by 2035.

The dairy container market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in dairy container market are plastic, metal, paper & paperboard and glass.

In terms of product, rigid segment to command 57.2% share in the dairy container market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dairy Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Dairy Packaging Market Size and Share Forecast Outlook 2025 to 2035

Dairy Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Dairy Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Filtration Systems Market Size and Share Forecast Outlook 2025 to 2035

Dairy Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Dairy Concentrate Market Forecast and Outlook 2025 to 2035

Dairy Testing Services Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Dairy-Free Smoothies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy-Based Dressings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy-Free Spreads Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Blends Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Whiteners Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Dairy Flavors Market Trends - Growth & Industry Forecast 2025 to 2035

Dairy-Free Evaporated Milk Market Analysis by Application, Type, Sales Channel Through 2025 to 2035

Dairy Protein Crisps Market Flavor, Packaging, Application and Distribution Channel Through 2025 to 2035

Dairy Products Market Analysis by Product Type, End Use, Distribution Channel and Region through 2035

Dairy-Free Cream Market Insights – Plant-Based Dairy Alternatives 2025 to 2035

Dairy Snacks Market Growth - Consumer Preferences & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA