The dairy product packaging market is experiencing notable growth driven by rising global dairy consumption, expanding retail distribution channels, and increasing demand for packaging solutions that ensure product safety, freshness, and extended shelf life. Manufacturers are focusing on material innovation, design efficiency, and sustainable packaging formats to align with evolving environmental regulations and consumer expectations.

The current landscape reflects strong adoption of advanced barrier materials and recyclable formats that minimize contamination risks while preserving nutritional integrity. Market expansion is further supported by automation in packaging lines and technological advancements in sealing and labeling processes.

The future outlook remains positive as emerging economies continue to witness increasing dairy production and consumption, thereby driving packaging demand Growth rationale is founded on the industry’s shift toward eco-friendly materials, the emphasis on cost-effective yet high-performance packaging solutions, and the consistent investment in product differentiation that enhances brand visibility and consumer trust across global dairy markets.

| Metric | Value |

|---|---|

| Dairy Product Packaging Market Estimated Value in (2025 E) | USD 33.9 billion |

| Dairy Product Packaging Market Forecast Value in (2035 F) | USD 44.2 billion |

| Forecast CAGR (2025 to 2035) | 2.7% |

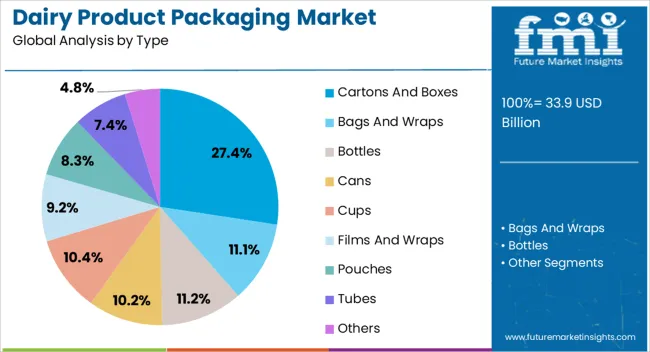

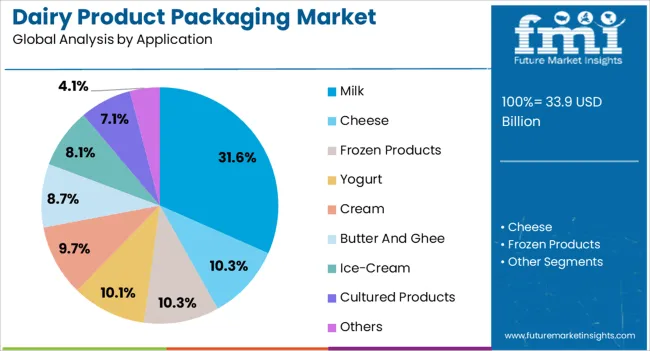

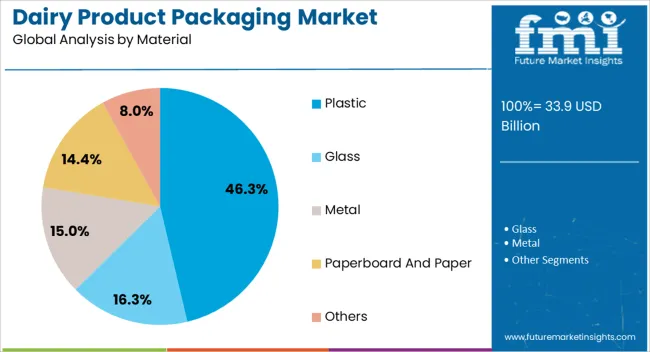

The market is segmented by Type, Application, Material, and Distribution Channel and region. By Type, the market is divided into Cartons And Boxes, Bags And Wraps, Bottles, Cans, Cups, Films And Wraps, Pouches, Tubes, and Others. In terms of Application, the market is classified into Milk, Cheese, Frozen Products, Yogurt, Cream, Butter And Ghee, Ice-Cream, Cultured Products, and Others. Based on Material, the market is segmented into Plastic, Glass, Metal, Paperboard And Paper, and Others. By Distribution Channel, the market is divided into Supermarkets And Hypermarkets, E-Commerce, Specialty Retailers, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cartons and boxes segment, accounting for 27.40% of the type category, has been leading the market due to its widespread use in milk, cream, and yogurt packaging applications. Its dominance is supported by the ability to offer lightweight, recyclable, and cost-efficient solutions that maintain product integrity during transportation and storage.

Market adoption has been strengthened by the segment’s compatibility with both aseptic and chilled packaging systems, ensuring extended shelf stability. Technological advancements in paper-based laminates and coatings have enhanced moisture resistance and printability, improving brand presentation.

Regulatory emphasis on sustainable packaging has further accelerated the preference for carton-based formats Continuous improvements in design flexibility and filling efficiency are expected to sustain demand growth and reinforce the segment’s role as a reliable and environmentally favorable packaging solution in the dairy sector.

The milk segment, representing 31.60% of the application category, has remained dominant owing to consistent global consumption levels and high turnover frequency in both fresh and processed forms. Packaging demand is being driven by the necessity for contamination prevention, temperature control, and ease of distribution across retail and institutional networks. The segment’s growth has been reinforced by advancements in aseptic packaging technology, which enable extended shelf life without refrigeration.

Increased focus on consumer convenience has resulted in the proliferation of portable and resealable packaging formats. Branding and labeling innovations have improved shelf appeal and consumer engagement.

With rising health awareness and demand for fortified milk variants, packaging adaptability has become essential Continuous innovation in material composition and design efficiency is expected to maintain the milk segment’s leadership and drive sustained expansion in the overall dairy packaging landscape.

The plastic segment, holding 46.30% of the material category, continues to dominate due to its versatility, durability, and cost-effectiveness across various dairy packaging applications. Its high market share is attributed to the ability to form lightweight containers with superior barrier properties and ease of mass production. Polyethylene and polypropylene remain the primary materials used for bottles, cups, and pouches due to their recyclability and strength.

The segment’s resilience is further supported by technological progress in biodegradable and bio-based plastics that address sustainability concerns while maintaining performance. Demand from both traditional dairy producers and ready-to-drink product manufacturers has reinforced consumption levels.

Ongoing investments in advanced molding and sealing technologies are enhancing production efficiency and reducing material waste These trends are expected to sustain the plastic segment’s leadership while supporting the transition toward more circular and eco-friendly packaging systems.

| Leading Product Type | F-style Steel Cans |

|---|---|

| Value Share (2025) | 28.70% |

Based on product type, the F-style steel cans segment is anticipated to acquire a market share of 28.70% in 2025. The segment is propelled by the following factors:

| Leading Material Type | Steel |

|---|---|

| Value Share (2025) | 45.50% |

The steel material is anticipated to acquire a market share of 45.50% in 2025. This segment is driven by the following factors:

| Countries | Forecast CAGR (2025 to 2035) |

|---|---|

| The United States | 1.60% |

| Spain | 2.10% |

| India | 6.40% |

| China | 4.70% |

| Thailand | 4.10% |

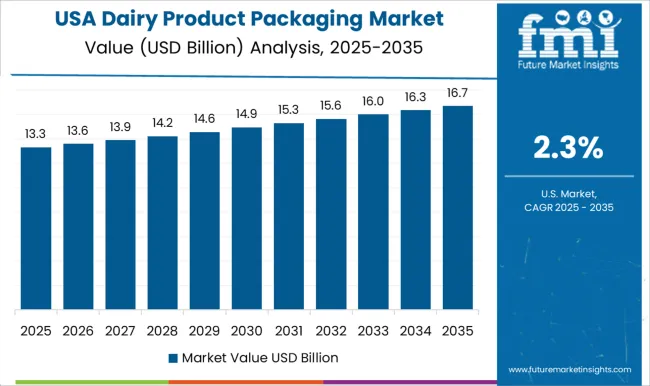

Sales of dairy product packaging in the United States are projected to register a CAGR of 1.6% through 2035. Given below are the top factors that are catapulting the market growth:

Demand for dairy product packaging in Spain is anticipated to propel at a CAGR of 2.1% through 2035. Top factors that are propelling the market growth are:

The growth rate of the dairy product packaging market in India is projected to record a CAGR of 6.4% through 2035. Leading factors that are impacting the market dynamics are:

Demand for dairy product packaging in China is anticipated to expand at a CAGR of 4.7% from 2025 to 2035. The market is driven by the following factors:

The Thailand dairy products packaging industry is projected to be driven at a CAGR of 4.1% through 2035. The following factors propel the market growth:

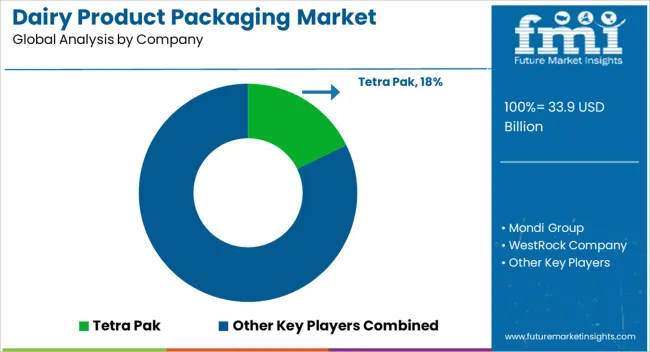

Key players are developing sustainable and enhanced packaging solutions by using biodegradable, recyclable, and compostable materials. Additionally, players are designing packaging that offers prolonged shelf life, offers convenience features, and reduces spoilage. Industry participants are developing visually appealing packaging that echoes with their consumers and bonds with the brand identity.

Market contenders are targeting under-penetrated regions with high-growth potential in the dairy sector. Furthermore, the players are merging and buying out competitors to increase their access to new technologies, production capacity, and market share. Dairy producers are working in close association with dairy firms to comprehend certain consumer needs and create tailor-made packaging solutions. In addition to this, players are partnering with research labs and universities to create innovative packaging materials and technologies.

Key players are highlighting the functionality, sustainability, and aesthetic appeal of their packaging materials to rev up their sales. Additionally, industry participants are investing in marketing campaigns to increase brand awareness and their image in the dairy industry.

Manufacturers are further investing in technology and automation to streamline production processes and lower operational costs over the forecast period.

Latest Developments in the Dairy Product Packaging Market

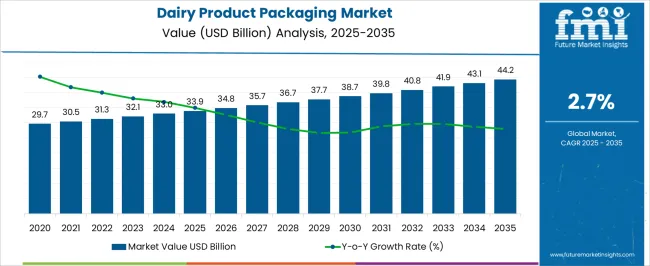

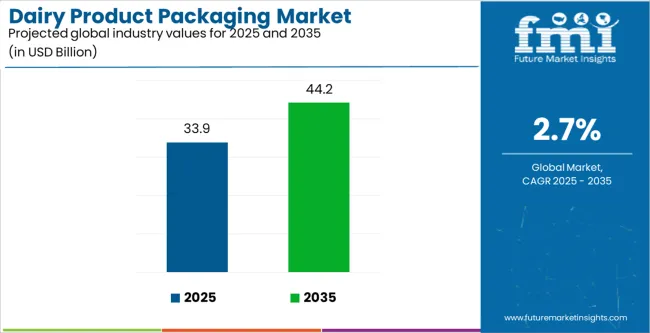

The global dairy product packaging market is estimated to be valued at USD 33.9 billion in 2025.

The market size for the dairy product packaging market is projected to reach USD 44.2 billion by 2035.

The dairy product packaging market is expected to grow at a 2.7% CAGR between 2025 and 2035.

The key product types in dairy product packaging market are cartons and boxes, bags and wraps, bottles, cans, cups, films and wraps, pouches, tubes and others.

In terms of application, milk segment to command 31.6% share in the dairy product packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Dairy Product Packaging Companies

Dairy Container Market Analysis Size and Share Forecast Outlook 2025 to 2035

Dairy Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Filtration Systems Market Size and Share Forecast Outlook 2025 to 2035

Dairy Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Dairy Concentrate Market Forecast and Outlook 2025 to 2035

Dairy Testing Services Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Dairy-Free Smoothies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy-Based Dressings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy-Free Spreads Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Blends Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Whiteners Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Dairy Flavors Market Trends - Growth & Industry Forecast 2025 to 2035

Dairy-Free Evaporated Milk Market Analysis by Application, Type, Sales Channel Through 2025 to 2035

Dairy Protein Crisps Market Flavor, Packaging, Application and Distribution Channel Through 2025 to 2035

Dairy-Free Cream Market Insights – Plant-Based Dairy Alternatives 2025 to 2035

Dairy Snacks Market Growth - Consumer Preferences & Industry Trends 2025 to 2035

Market Leaders & Share in the Dairy Blends Industry

Assessing Dairy-Free Smoothies Market Share & Industry Trends

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA