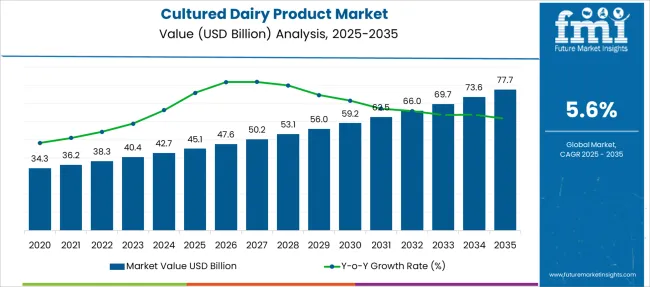

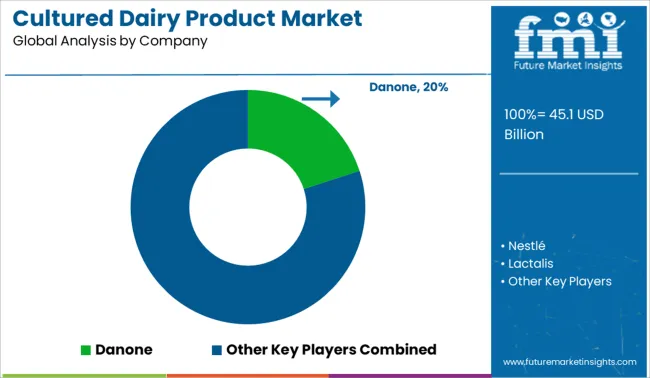

The Cultured Dairy Product Market is estimated to be valued at USD 45.1 billion in 2025 and is projected to reach USD 77.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

| Metric | Value |

|---|---|

| Cultured Dairy Product Market Estimated Value in (2025 E) | USD 45.1 billion |

| Cultured Dairy Product Market Forecast Value in (2035 F) | USD 77.7 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The Cultured Dairy Product market is undergoing steady expansion, supported by growing consumer awareness regarding gut health, probiotics, and functional foods. This market has been influenced by rising health consciousness, evolving dietary preferences, and the demand for convenient yet nutrient-dense food options. Manufacturers have been increasingly focusing on innovation in fermentation processes and clean-label ingredients to cater to both traditional and modern consumers.

The consumption of cultured dairy products has been further driven by their role in supporting digestive health, immunity, and overall wellness. With urbanization and increased disposable income across developing regions, access to a broader range of refrigerated and shelf-stable products is improving.

The future growth outlook remains favorable as companies invest in sustainable packaging, product diversification, and region-specific taste profiles to expand their market presence. As nutritional trends continue to shift toward natural and functional ingredients, the cultured dairy segment is expected to gain deeper market penetration globally.

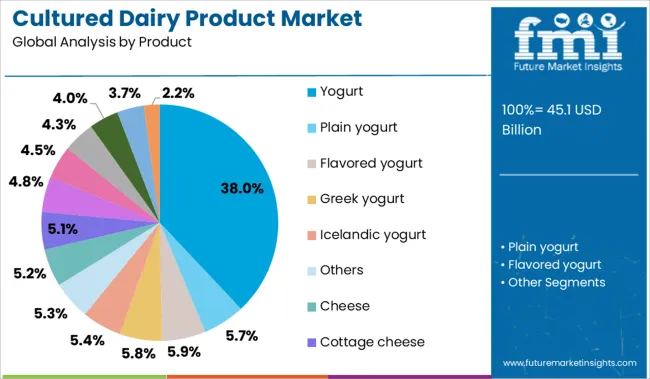

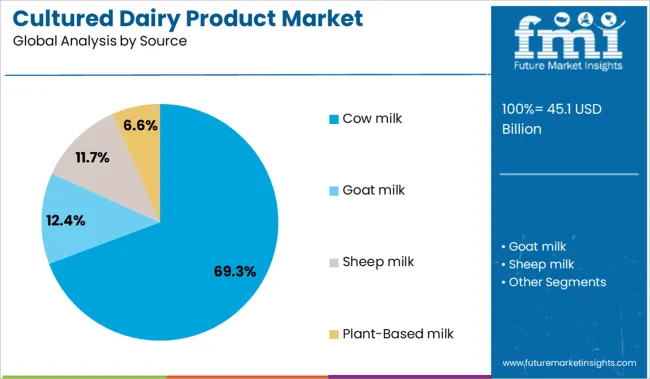

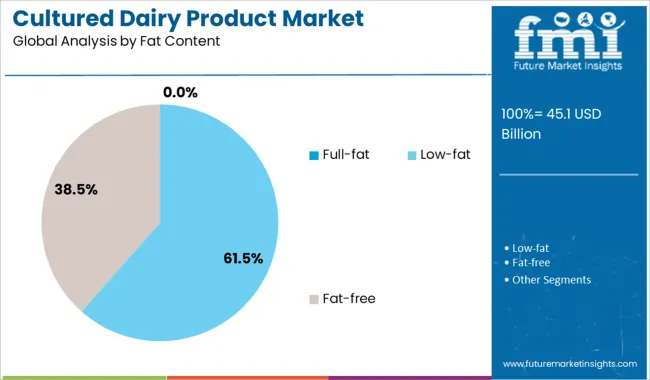

The cultured dairy product market is segmented by product, source, fat content, flavour, packaging, distribution, and end use and geographic regions. By product of the cultured dairy product market is divided into Yogurt, Plain yogurt, Flavored yogurt, Greek yogurt, Icelandic yogurt, Others, Cheese, Cottage cheese, Cream cheese, Blue cheese, Feta, Others, Sour Cream (treated as Cream), Kefir, Sour Cream, Buttermilk, Fermented milk, Probiotic drinks, and Others. In terms of the source of the cultured dairy product, the market is classified into Cow milk, Goat milk, Sheep milk, and Plant-Based milk. Based on fat content of the cultured dairy product market is segmented into Full-fat, Low-fat, and Fat-free. By flavour of the cultured dairy product market is segmented into Plain/Natural, Fruit-Flavored, Vanilla, Chocolate, Herb/Spice-Infused, and Others. By packaging of the cultured dairy product market is segmented into Cups, Bottles, Tubs, Cartons, Pouches, and Others. By distribution of the cultured dairy product market is segmented into Supermarkets/Hypermarkets, Convenience stores, Online retail, Specialty stores, and Others. By end use of the cultured dairy product market is segmented into Household, Food service industry, and Food processing industry. Regionally, the cultured dairy product industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The yogurt product segment is projected to contribute 38% of the Cultured Dairy Product market revenue share in 2025, making it the dominant product type. The preference for yogurt has been shaped by its versatility in both spoonable and drinkable formats, as well as its probiotic properties that promote digestive health. The segment has benefited from continuous innovation in flavor, texture, and fortified nutritional content, addressing a wide range of consumer lifestyles and dietary requirements.

The high share has been further driven by its widespread cultural acceptance and strong positioning as a healthy alternative to traditional snacks and desserts. Consumer demand for high-protein, low-sugar, and natural products has supported yogurt’s relevance in wellness-focused consumption patterns.

Additionally, advancements in refrigeration logistics and retail expansion have enabled yogurt to remain accessible across diverse regions. The segment’s continued appeal has also been reinforced by marketing initiatives promoting its health benefits, contributing to its sustained growth and leadership in the market.

The cow milk source segment is anticipated to account for 69.30% of the Cultured Dairy Product market revenue share in 2025, establishing it as the most utilized base ingredient. This dominance has been attributed to the abundant availability, cost-efficiency, and nutrient profile of cow milk, which supports optimal fermentation and textural consistency. The segment has been propelled by long-standing consumer trust and regulatory familiarity with cow milk-based dairy products across both traditional and modern markets.

Its use has enabled manufacturers to produce a consistent range of cultured dairy items with favorable shelf life and taste appeal. The high protein and calcium content in cow milk has also positioned it as a preferred choice for health-conscious consumers.

The adaptability of cow milk across various cultured formats, including yogurt, kefir, and sour cream, has solidified its utility in product innovation. As demand for clean-label and minimally processed ingredients rises, cow milk continues to hold strategic value in maintaining product integrity and consumer loyalty.

The full fat segment within the fat content category is gaining momentum and is expected to maintain a strong position in the Cultured Dairy Product market through 2025. This trend has been reinforced by a consumer shift toward minimally processed, whole-food nutrition, where full fat dairy is being re-evaluated for its satiety benefits and nutrient density. The appeal of full fat cultured dairy products has been strengthened by their rich mouthfeel, natural flavor, and reduced need for artificial additives.

Growing interest in ketogenic and low-carbohydrate diets has supported consumption patterns that favor higher fat content over low-fat alternatives. Additionally, emerging research indicating the potential metabolic and hormonal advantages of full fat dairy has contributed to its positive repositioning among health-conscious demographics.

The segment has also benefited from premium branding and artisan-style production, which are aligned with evolving lifestyle and wellness trends. As consumer perception continues to shift toward natural sources of fat, the full fat segment is expected to contribute significantly to value-driven market growth..

Demand for cultured dairy products is rising as consumers seek gut-health solutions, protein-rich snacks, and clean-label formulations. Sales of probiotic yogurts, kefir, and sour cream are accelerating through retail diversification, region-specific taste innovation, and advancements in live culture stabilization.

Demand for cultured dairy products fortified with probiotics rose 22% in 2025, as gut microbiome awareness expanded in North America and Europe. Brands reformulated Greek-style and Icelandic skyr products to include five-strain probiotic blends with proven gastrointestinal benefits. Shelf-stable probiotic drinks saw a 31% spike in Southeast Asian supermarkets, supported by encapsulation techniques that preserved colony-forming units above 10⁹ CFU at 25°C. In the Middle East, consumer preference for fermented laban drinks drove an 18% increase in private-label SKUs with digestive health claims. Leading processors shortened cold chain cycles by 15% using thermal-resistant cultures, enabling cost-effective distribution across Tier 2 cities.

Sales of flavored cultured dairy products with less than 5g sugar per serving increased 28% in 2025, with Western Europe and Japan showing the strongest momentum. Artisanal processors launched saffron-yogurt and cardamom-kefir hybrids targeting premium dessert categories, while USA. brands introduced chai and hibiscus-flavored drinkable yogurts. In Latin America, dairy co-operatives reformulated sour creams using native starter cultures, appealing to local palates and improving margin by 12%. Low-sugar strawberry and mango variants became top sellers in institutional breakfast channels, aided by school meal program certifications. Category expansion into wellness-focused retail led to 14% higher footfall for probiotic-rich chilled shelves.

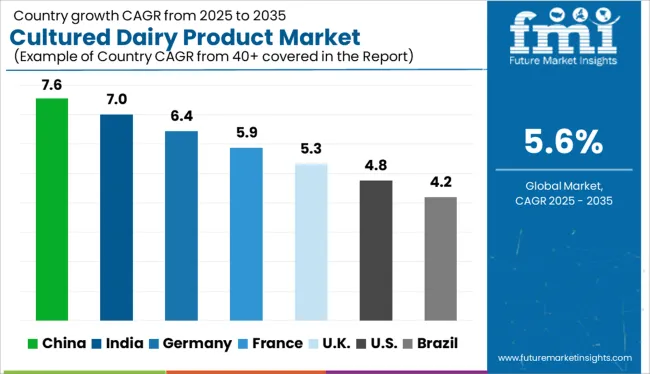

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

The global cultured dairy product market is projected to grow at a CAGR of 6.0% from 2025 to 2035. Among the leading nations, China (BRICS) leads with a growth rate of 7.6%, outpacing the global average by 1.6 percentage points, supported by a shift in consumer preference toward probiotic-rich dairy and urban dietary diversification. India (BRICS) follows at 7.0% (+1.0 pp), benefiting from rising middle-class demand and increased consumption of traditional fermented products. Within the OECD bloc, Germany posts 6.4% (+0.4 pp), aided by clean-label innovation and high-quality dairy processing standards. In contrast, the UK records 5.3% (–0.7 pp) and the United States trails at 4.8% (–1.2 pp), indicating more mature markets with slower growth potential. The divergence highlights accelerated growth in emerging BRICS economies driven by dietary shifts and infrastructure expansion, while OECD nations experience steadier trends influenced by health awareness and saturated product categories. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

Registering a CAGR of 7.6% through 2035, China is witnessing fast-growing demand for cultured dairy products across urban and semi-urban households. From 2020 to 2024, consumption was centered on imported yogurts and probiotic drinks. The upcoming decade will see domestic brands drive innovation in microbially fermented dairy beverages, functional spoonable yogurts, and value-added probiotic lines. Urban lifestyle shifts, along with growing digestive health awareness, are fueling retail expansion, especially in tier II cities supported by cold chain logistics.

India’s cultured dairy product market is forecast to rise at a CAGR of 7.0% between 2025 and 2035, as health-conscious consumption rises among urban millennials and Gen Z buyers. During 2020–2024, sales were driven by traditional dahi and curd. Going forward, flavored yogurts, probiotic drinks, and fortified lassi variants will see higher uptake. Domestic brands are launching premium, low-sugar formulations while dairy cooperatives are deploying fortified cultured dairy products in rural health initiatives.

A projected CAGR of 6.4% positions Germany as a key growth hub for cultured dairy innovation, particularly within the gut health and functional nutrition segments. Between 2020 and 2024, spoonable yogurt and probiotic drinks led the market. The next phase of growth will be powered by high-protein yogurts, plant-based fermented alternatives, and fortified quark products. Consumers are prioritizing sustainability, clean labels, and added prebiotics prompting manufacturers to enhance transparency and optimize packaging.

The United Kingdom is on track for a 5.3% CAGR in cultured dairy product demand through 2035, driven by consumer interest in personalized wellness and dairy reformulation. From 2020 to 2024, drinkable kefir and Greek-style yogurt saw steady growth. In the years ahead, demand will favor protein-enriched yogurts, functional ingredients like vitamin D, and clean-label fermented milk products. Retailers are curating low-sugar options and sourcing locally to appeal to both health-conscious and sustainability-focused buyers.

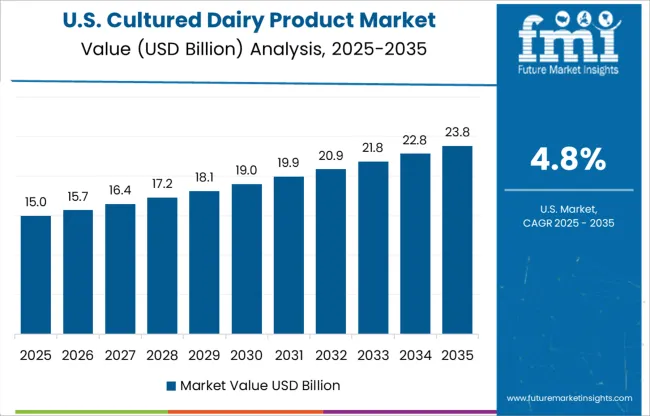

An expected CAGR of 4.8% reflects the steady evolution of the USA cultured dairy product market, influenced by clean-label movements and digestive health science. From 2020 to 2024, Greek yogurt and kefir dominated shelves. In the forecast period, growth will emerge from low-sugar, probiotic-rich formulations and hybrid dairy-plant blends. Brands are investing in DTC models, personalized nutrition, and fermentation technologies that boost gut and immune health while maintaining taste and texture.

Growing interest in gut health, high-protein diets, and clean-label formulations is fueling demand for cultured dairy products in 2025. Danone leads the global market, supported by its diverse probiotic-rich portfolio and strong retail penetration in Europe and Latin America. Nestlé and Lactalis continue to expand through functional yogurt and kefir innovations, responding to shifting consumer preferences. Sales of cultured dairy by Chobani LLC and Yakult Honsha are increasing in North America and Asia, driven by aggressive marketing of immune-boosting benefits. Arla and Fonterra are investing in value-added SKUs, while Amul dominates in South Asia through affordability and local sourcing. Innovation in plant-enriched and lactose-free cultured dairy segments is intensifying competition globally.

In October 2024, Chobani rolled out its High Protein Greek yogurt line, featuring 20 g protein cups and ready-to-drink beverages delivering up to 30 g protein per serving. All products are lactose-free, naturally sweetened, and meet growing demand for functional, protein-rich dairy.

| Item | Value |

|---|---|

| Quantitative Units | USD 45.1 Billion |

| Product | Yogurt, Plain yogurt, Flavored yogurt, Greek yogurt, Icelandic yogurt, Others, Cheese, Cottage cheese, Cream cheese, Blue cheese, Feta, Others, Sour Cream (treated as Cream), Kefir, Sour Cream, Buttermilk, Fermented milk, Probiotic drinks, and Others |

| Source | Cow milk, Goat milk, Sheep milk, and Plant-Based milk |

| Fat Content | Full-fat, Low-fat, and Fat-free |

| Flavour | Plain/Natural, Fruit-Flavored, Vanilla, Chocolate, Herb/Spice-Infused, and Others |

| Packaging | Cups, Bottles, Tubs, Cartons, Pouches, and Others |

| Distribution | Supermarkets/Hypermarkets, Convenience stores, Online retail, Specialty stores, and Others |

| End Use | Household, Food service industry, and Food processing industry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Danone, Nestlé, Lactalis, Chobani LLC, Yakult Honsha Co., Ltd., and [Others… Amul, Arla, Fonterra…] |

| Additional Attributes | Dollar sales by product type and fat content, demand dynamics across retail and foodservice channels, regional trends in probiotic-rich dairy consumption, innovation in fermentation strains and plant-based dairy cultures, environmental impact of dairy sourcing and processing emissions, and emerging use cases in functional foods and personalized nutrition plans. |

The global cultured dairy product market is estimated to be valued at USD 45.1 billion in 2025.

The market size for the cultured dairy product market is projected to reach USD 77.7 billion by 2035.

The cultured dairy product market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in cultured dairy product market are yogurt, plain yogurt, flavored yogurt, greek yogurt, icelandic yogurt, others, cheese, cottage cheese, cream cheese, blue cheese, feta, others, sour cream (treated as cream), kefir, sour cream, buttermilk, fermented milk, probiotic drinks and others.

In terms of source, cow milk segment to command 69.3% share in the cultured dairy product market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cultured Wheat Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cultured Meat Market Insights - Lab-Grown Innovation & Market Expansion 2025 to 2035

Cultured Wheat Flour Market Analysis by Bread, Bakery Products, Pasta, and Others Through 2035

Market Share Distribution Among Cultured Wheat Manufacturers

Cultured Buttermilk Market Insights - Size, Share & Growth Forecast 2025-2035

Cultured Dairy Blends Market

Cultured Non-Fat Dairy Ingredients Market Size and Share Forecast Outlook 2025 to 2035

UK Cultured Wheat Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Cultured Wheat Market Report – Trends, Demand & Industry Forecast 2025–2035

Tissue Cultured Date Palm Market Trends – Growth & Industry Forecast 2024 to 2034

Australia Cultured Wheat Market Report – Growth, Demand & Innovations 2025-2035

Naturally Cultured Beverages Market

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Dairy Container Market Analysis Size and Share Forecast Outlook 2025 to 2035

Dairy Packaging Market Size and Share Forecast Outlook 2025 to 2035

Dairy Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Dairy Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Filtration Systems Market Size and Share Forecast Outlook 2025 to 2035

Dairy Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Dairy Concentrate Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA