The global Cultured Wheat Market is consolidated moderately. The industry includes leading agribusiness conglomerates startups in biotechnology and companies specializing in fermentation. The conventional agribusiness corporations such as ADM and Cargill account for 34.6% of the market. They have developed advanced processing technologies and have a considerable production capacity.

Specialized food ingredient companies including MGP Ingredients, IFF, and Leprino Foods control 29.4% of the market. The companies specialize in tissue-engineered and fermentation-based wheat applications. New entrants such as Perfect Day, Every Company, Nature's Fynd, Motif FoodWorks, and New Culture account for 36% of the market.

The companies are working on lab-grown wheat and alternative protein applications. The top five companies in the Global Cultured Wheat Market control 58% of the market. The industry is moderately consolidated, and players compete based on their ability to develop functional ingredient applications and scale up.

| Market Structure | Top Agribusiness Suppliers |

|---|---|

| Industry Share (%) | 34.6% |

| Key Companies | ADM, Cargill |

| Market Structure | Specialized Food Ingredient Companies |

|---|---|

| Industry Share (%) | 29.4% |

| Key Companies | MGP Ingredients, IFF, Leprino Foods |

| Market Structure | Biotech and Cellular Agriculture Innovators |

|---|---|

| Industry Share (%) | 36% |

| Key Companies | Perfect Day, Every Company, Nature's Fynd, Motif FoodWorks, New Culture |

The market for cultured wheat is moderately consolidated, with big agribusinesses dominating bulk supply, and biotech startups targeting high-performance and sustainability-focused wheat solutions.

Lab-grown wheat (65.3%) leads with its scalability and controlled production process, with ADM and Cargill investing in high-efficiency lab-grown wheat technology for food processing. Cell culture wheat (34.7%) emerges in specialty uses like high-protein wheat alternatives, where Nature's Fynd and Every Company are spearheading cell-based wheat innovation for functional foods.

Cellular agriculture (72.4%) is the most common method because it is precise and can produce functional wheat proteins, with Perfect Day and Motif FoodWorks working on structured wheat proteins for dairy and meat alternatives. Tissue engineering (18.9%) is growing in high-value wheat production, with Leprino Foods and IFF working on bioactive wheat strains. Fermentation-based wheat (8.7%) is increasingly accepted for food safety and bioavailability improvement, with MGP Ingredients and Nature's Fynd being at the forefront of microbial fermentation applications.

Food processing (58.2%) accounts for the biggest market share, since cultured wheat is employed in baked food, meat substitutes, and functional food products, with ADM and Cargill selling bulk wheat ingredients. Research & Development (22.4%) is growing with the development of new products in biotech wheat applications, where Perfect Day and New Culture are targeting alternative wheat protein structures. Alternatives to animal feed (19.4%) are growing with sustainable feed solutions, where IFF and MGP Ingredients develop fermented wheat proteins for livestock and aquaculture.

The Global Cultured Wheat Market is fast-changing with improvements in cellular agriculture, fermentation-based processing, and sustainable food options. Firms emphasize scalability, high-protein wheat substitutes, and functional ingredients used to address increasing demand in food processing and biotech advancements.

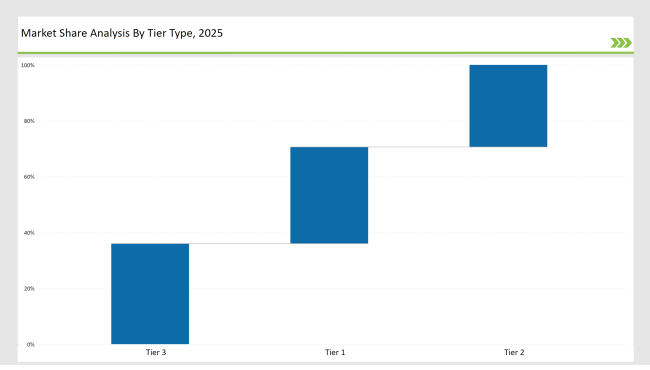

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 35% |

| Example of Key Players | ADM, Cargill |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 30% |

| Example of Key Players | MGP Ingredients, IFF, Leprino Foods |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 35% |

| Example of Key Players | Perfect Day, Every Company, Nature’s Fynd, Motif FoodWorks, New Culture |

| Brand | Key Focus |

|---|---|

| ADM | Expanded lab-grown wheat production for functional ingredient applications. |

| Cargill | Developed fermentation-based wheat proteins for sustainable food solutions. |

| MGP Ingredients | Introduced bio-fermented wheat proteins to enhance clean-label food applications. |

| IFF | Strengthened cell-cultured wheat protein formulations for high-performance food ingredients. |

| Leprino Foods | Integrated engineered wheat proteins into dairy and nutraceutical applications. |

| Perfect Day | invested in precision fermentation for wheat-based proteins. |

| Every Company | Developed structured wheat proteins for meat alternatives and functional foods. |

| Nature’s Fynd | Launched fermentation-based wheat proteins for gut health and clean-label foods. |

| Motif FoodWorks | Innovated tissue-engineered wheat proteins for bakery and gluten-free applications. |

| New Culture | Strengthened wheat-based proteins in alternative dairy formulations. |

The speed with which lab-grown wheat will become a scalable ingredient in foods will significantly increase as both ADM and Cargill invest in less-costly models for production. This would further encourage mass adoption in bakery and processed foods as well as plant-based formulations.

Fermented wheat proteins will gain traction for probiotic and prebiotic enhanced formulations based on clean labels and gut health-supported wheat ingredients from MGP Ingredients and Nature's Fynd.

Cell-cultured wheat will gain greater traction in alternative proteins to add value to texture, protein quality, and digestibility for plant-based meat and dairy substitutes. IFF and New Culture are expected to expand wheat-based dairy-free and high-protein meat alternative solutions.

Demand increases for alternative protein feeds that are sustainable and, above all, for fermentation-based wheat proteins are critical in mitigating dependency on conventional grains. The innovation of these high-nutrient wheat proteins will be conducted by Cargill and MGP Ingredients.

Cultured wheat will become mainstream, followed by most stringent bioengineering and clean label regulations by most governments. Every Company and Motif FoodWorks will focus on compliance, safety testing, and transparent labeling for consumer trust.

Leading companies include ADM, Cargill, MGP Ingredients, IFF, Leprino Foods, and emerging biotech firms like Perfect Day and Every Company.

Cultured wheat is used in food processing, alternative protein development, functional foods, and animal feed formulations.

Fermentation enhances wheat protein bioavailability, improves digestibility, and supports clean-label food formulations.

Lab-grown wheat offers higher protein efficiency, reduced agricultural land use, and lower environmental impact.

Stricter regulations on bioengineered wheat ingredients require companies to meet safety and labeling compliance standards.

Expect continued growth in food processing, biotech innovation, and sustainable protein applications, driving commercialization in multiple industries.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cultured Non-Fat Dairy Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Cultured Dairy Product Market Size and Share Forecast Outlook 2025 to 2035

Cultured Meat Market Insights - Lab-Grown Innovation & Market Expansion 2025 to 2035

Cultured Buttermilk Market Insights - Size, Share & Growth Forecast 2025-2035

Cultured Dairy Blends Market

Cultured Wheat Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cultured Wheat Flour Market Analysis by Bread, Bakery Products, Pasta, and Others Through 2035

UK Cultured Wheat Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Cultured Wheat Market Report – Trends, Demand & Industry Forecast 2025–2035

Tissue Cultured Date Palm Market Trends – Growth & Industry Forecast 2024 to 2034

Naturally Cultured Beverages Market

Australia Cultured Wheat Market Report – Growth, Demand & Innovations 2025-2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Wheat Malt Market Size and Share Forecast Outlook 2025 to 2035

Wheatgrass Products Market Size and Share Forecast Outlook 2025 to 2035

Wheat Gluten Market Size and Share Forecast Outlook 2025 to 2035

Wheat Germ Oil Market Outlook - Demand & Forecast 2025 to 2035

Wheat Starch Market Size and Share Forecast Outlook 2025 to 2035

Wheat Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Wheat Protein Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA