The ASEAN Cultured Wheat market is set to grow from an estimated USD 21.8 million in 2025 to USD 96.2 million by 2035, with a compound annual growth rate (CAGR) of 17.3% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Market Size (2025E) | USD 21.8 million |

| Projected ASEAN Value (2035F) | USD 96.2 million |

| Value-based CAGR (2025 to 2035) | 17.3% |

The ASEAN Cultured Wheat Market shows an expanding trend because people align themselves toward sustainable, nutritious food sources. The issues of food security and population increase alongside climate change force the region to turn towards cultured wheat as a viable solution. External agricultural techniques give society cultured wheat as an eco-friendly wheat farming alternative because compared to conventional wheat cultivation, using pesticides and fertilizers remains widespread.

Agricultural technology investment has boomed across the ASEAN region in recent years because governments coordinate with private sectors to boost production efficiency for food. Cultured wheat development occurs mainly in Singapore, where Malaysia and Thailand lead this technological advancement using their current technological infrastructure. Consumer health awareness drives market expansion because they view cultured wheat as better than conventional wheat for health benefits.

The demand for cultured wheat increases because more people follow plant-based dietary patterns and adopt gluten-free products. Food innovation requires immediate focus on developing various dietary options because modern customers actively choose what they eat. Market research shows that the ASEAN Cultured Wheat Market will experience strong expansion throughout the forthcoming years. This market incorporates solutions to sustain food supplies at the same time that it fulfills worldwide consumer demand for healthier meals.

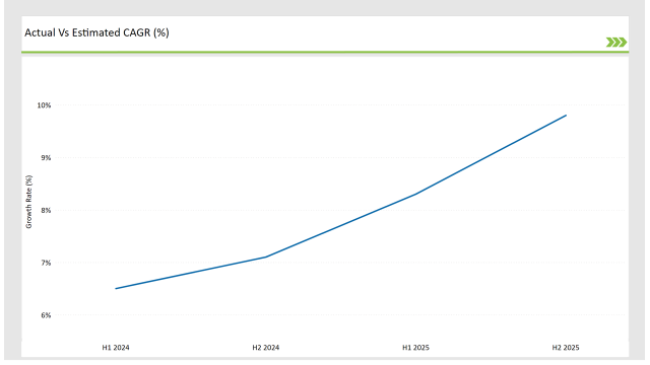

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEANCultured Wheat market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December

For the ASEAN Cultured Wheat market, the sector is predicted to grow at a CAGR of 6.5% during the first half of 2024, increasing to 7.1% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 8.3% in H1 but is expected to rise to 9.8% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Wheat Innovations Inc. launched a new line of gluten-free cultured wheat products aimed at health-conscious consumers, including gluten-free pasta and bread, addressing the rising demand for gluten-free alternatives. |

| 2024 | AgriTech Solutions introduced an IoT -based monitoring system for cultured wheat production, enhancing yield and quality through real-time data analytics, allowing for precise control over environmental conditions. |

| 2024 | NutriWheat Corp. announced a partnership with a biotechnology firm to develop high-protein cultured wheat varieties, targeting the fitness and health food market, thus catering to the growing demand for protein-rich food options. |

| 2024 | EcoGrain Technologies secured funding for a vertical farming project focused on cultured wheat, utilizing renewable energy sources to minimize carbon footprint and enhance sustainability in food production. |

Integration of Smart Agriculture Technologies

Smart agriculture technologies have become a distinct pattern in the cultured wheat market production process. The production process for cultured wheat, together with its monitoring and enhancement functions, receives innovation through IoT devices and AI technology alongside data analytics.

Modern companies employ IoT sensors as environmental condition monitors during the cultivation of cultured wheat in real-time. The technology provides manufacturers with exact manipulation capabilities of temperature and humidity together with nutrient distribution, which produces superior yields of better-quality end products. The analysis of data using AI algorithms allows producers to forecast suitable growth conditions, thereby serving to enhance production efficiency as well as sustainability practices.

Development of Gluten-Free Cultured Wheat Products

The market for cultured wheat exhibits an active development of gluten-free wheat products as its main current trend. The rising numbers of people who are aware of gluten intolerance and celiac disease have created a market need for gluten-free product alternatives. Strains of wheat produced through biotechnology are now engineered to make gluten-free wheat varieties, keeping the traditional taste and texture profiles like regular wheat foods.

Businesses allocate resources to studies that aim to develop wheat strains with either natural gluten deficiency or decreased gluten protein concentration. Gluten sensitivity is increasing rapidly in the ASEAN region. Modern brands offer cultured wheat ingredients used for ironing out gluten-free products, including bread and pasta, with snacks suitable for health-focused consumers who need dietary control. The innovation ensures it tackles essential market requirements and establishes cultured wheat as an adaptable gluten-free ingredient.

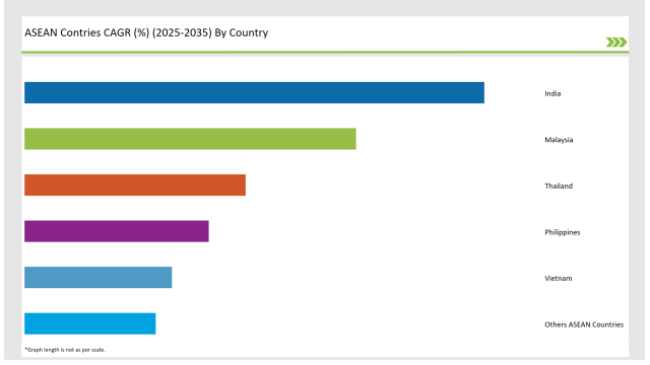

The following table shows the estimated growth rates of the top fourmarkets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The Indian market for cultured wheat continues to multiply since people increasingly seek sustainable food systems. Due to its extensive population and increasing food security problems, the Indian government strongly supports innovative agricultural solutions. The cultural wheat system shows alignment with Indian government initiatives that encourage sustainability because it provides an eco-friendly wheat farming method to replace traditional wheat practices facing water shortages and soil damage.

Indian consumers who become more conscious about health and nutrition seek better food choices,leading to an increased demand. The market demand for cultured wheat products has been rising because these products are engineered to improve nutritional content. Indian consumers benefit from new product launches that serve gluten-free and fortified wheat-based snack choices by multiple companies.

The cultured wheat market of Thailand demonstrates a deep commitment to technological innovation along with the selection of sophisticated agricultural technologies. Through their support of agricultural research and development initiatives, the Thai government has stimulated more investments in cultured wheat farming. Thailand needs this trend to improve food security and sustainability during climate change because of worldwide environmental threats.

Digital technology integration through IoT and AI systems creates radical changes in how cultured wheat farmers produce their crops in Thailand. These technologies help producers maximize environmental conditions along with yield results and decrease resource needs during production. Due to technological innovation, Thailand has strengthened its position to lead the cultured wheat market across the ASEAN region.

A marked growth exists within the cultured wheat bread market because more consumers embrace healthful and nutritious dietary choices. More consumers now seek gluten-free options because gluten intolerance, along with celiac disease awareness, continues to grow. Cultured wheat provides an answer through the production of gluten-free bread, which maintains the preferred taste and structure found in wheat bread.

Technological advancements in cultured wheat production continue due to the growing artisanal and health-oriented bakery market. Tempering manufacturers are developing different formulations by blending functional ingredients such as seeds, nuts, and superfoods to improve the nutritional value of cultured wheat bread. The market for cultured wheat bread shows expanding potential because consumers are choosing food based on their wellness and health needs.

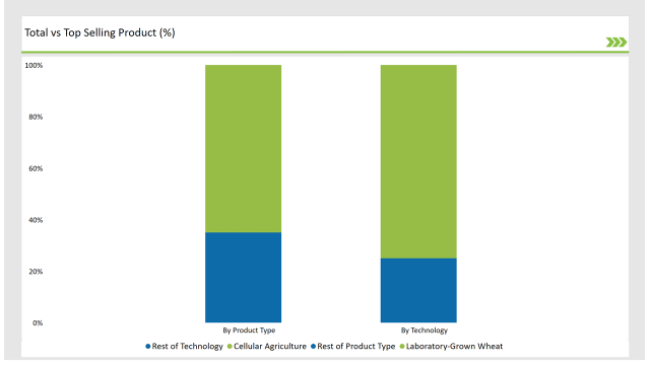

The manufacturing process of cultured wheat depends on technology, and Cellular Agriculture represents the major technology implementation. Experimental approaches involving biotechnological solutions enable controlled cultured wheat production within this particular segment. The main aspects regarding this technology would be the following:

Cellular agriculture introduces new sustainable production methods to wheat cultivation along with other crops through efficient agricultural alternatives. Plant cells optimally grow within laboratory conditions through this technology because scientists can implement thorough management of growth parameters at the same time as eliminating dependence on traditional agricultural land usage along with vast amounts of water.

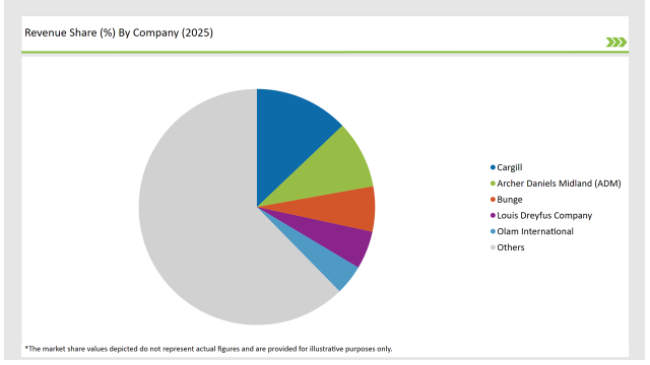

2025 Market Share of ASEAN Cultured Wheat Manufacturers

Note: The above chart is indicative

The cultured wheat market competition has become stronger because various businesses see significant potential in this upcoming food segment. Key businesses continue investments in development research to produce better cultural wheat products and fulfill the expanding market need for ecological and nutritious food choices.

Market-leading organizations dedicate resources to cell-based agriculture and biological techniques for enhancing both productivity and sustainability within cultured wheat industrial operations. About this market is the ongoing research to develop wheat products with elevated protein content along with gluten-free options because people who focus on their health are showing more interest in these varieties.

This Segment is further categorized by Laboratory-Grown Wheat and Cell Culture Wheat.

This Segment further Categorise intoCellular Agriculture, Tissue Engineering, Fermentation-Based

By End Use Application: Food Processing, Research & Development, and Animal Feed Alternatives

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

The ASEAN Cultured Wheat market is projected to grow at a CAGR of 17.3% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 96.2 million.

India are key Country with high consumption rates in the ASEAN Cultured Wheat market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ASEAN Automotive Bearings Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Automotive Aftermarket Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN and Gulf Countries MAP & VSP Packaging Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Flexible Plastic Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN Human Milk Oligosaccharides Market Report – Size, Demand & Growth 2025–2035

ASEAN Probiotic Ingredients Market Outlook – Growth, Size & Forecast 2025–2035

ASEAN Food Additives Market Insights – Growth, Demand & Forecast 2025–2035

ASEAN Chitin Market Analysis – Trends, Demand & Forecast 2025–2035

ASEAN Bakery Mixes Market Outlook – Size, Share & Forecast 2025–2035

ASEAN Non-Alcoholic Malt Beverages Market Trends – Demand & Forecast 2025–2035

ASEAN Animal Feed Alternative Protein Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Chickpea Protein Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Food Emulsifier Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Yeast Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Green and Bio-based Polyol Market Growth – Trends, Demand & Innovations 2025–2035

ASEAN Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Barite Market Analysis – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA