The UK cultured wheat market is forecasted to reach USD 28.0 million by 2025, with rapid expansion anticipated, pushing its valuation to USD 103.2 million by 2035. This trajectory signifies a compound annual growth rate (CAGR) of 13.9% over the forecast period. The market is driven by rising demand for sustainable and lab-grown food ingredients, increased investment in cellular agriculture, and the growing adoption of fermentation-based wheat for alternative protein applications.

| Attributes | Values |

|---|---|

| Estimated UK Industry Size in 2025 | USD 28.0 million |

| Projected UK Industry Size in 2035 | USD 103.2 million |

| Value-based CAGR (2025 to 2035) | 13.9% |

The UK is growing in importance in the market of specialist wheat crops as an innovative and sustainable food ingredient in alternative proteins, food processing, and R&D. Investment in cellular agriculture and tissue engineering technologies is also increasing around these novel growth mediums, as lab grown wheat and cultured cell wheat start to replace traditional wheat growing practices.

Industry shifts have been caused by the expansion of other fermentation industries to wheat, biotech and food manufacturers joint ventures, and policies for lab grown food. Investment in scalable production systems and new product development is realized by key marketers like Tate & Lyle PLC, Associated British Foods, and Kerry Group, who are the most active on the market.

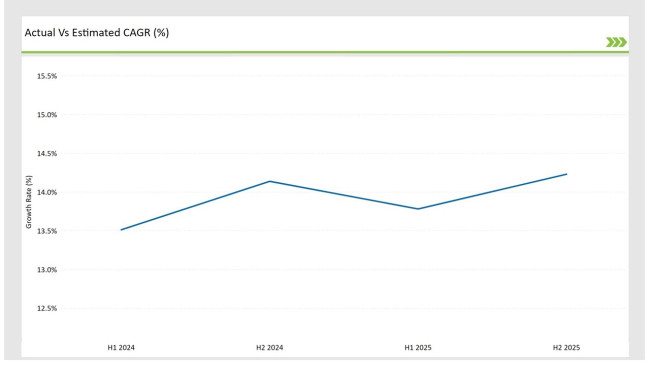

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UKCultured Wheat market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Year | 2024 |

|---|---|

| H1 Growth Rate (%) | 13.5% |

| H2 Growth Rate (%) | 14.1% |

| Year | 2025 |

|---|---|

| H1 Growth Rate (%) | 13.8% |

| H2 Growth Rate (%) | 14.2% |

For the UK market, the Cultured Wheat sector is projected to grow at a CAGR of 13.5% during the first half of 2024, with an increase to 14.1% in the second half of the same year. In 2025, the growth rate is anticipated to slightly rise to 13.8% in H1 and reach14.2% in H2.

| Date | Details |

|---|---|

| Dec-2024 | CultivateWheat Ltd secured £12M funding to develop lab-grown wheat protein in Cambridge. The company aims to produce wheat proteins with enhanced nutritional profiles through cellular agriculture. |

| Sept-2024 | British startup WheatTech launched their first commercial facility for cultured wheat protein production. The facility uses proprietary fermentation technology to produce wheat proteins with improved functionality. |

| July-2024 | Novel Grain Technologies acquired patents for specialized wheat cultivation techniques from Oxford University. The technology allows for the development of wheat varieties with specific protein profiles through controlled environment agriculture. |

| May-2024 | AgriLab UK partnered with major bakery chain Greggs to develop enhanced wheat proteins. The collaboration focuses on creating wheat proteins with improved functionality for baked goods. |

| Feb-2024 | CellWheat opened their first pilot facility in Manchester Science Park. The company specializes in producing custom wheat proteins through precision fermentation. |

Growing Investment in Cellular Agriculture for Lab-Grown Wheat Production

Cellular agriculture is overcoming the limitations of vertically integrated land farming systems by allowing lab grown wheat to solve land misuse, climate change, and supply chain problems. Deep Branch and Moolec Science are at the forefront of scaling advanced tissue engineering combined with cellular agriculture for chickens and are pushing the UK’s focus on agriculture and alternative proteins. Cultured wheat could eventually become a cornerstone of sustainable food systems.

Fermentation-Based Cultured Wheat as an Alternative Protein Source

The shift to fermentation-derived wheat proteins is positioned to transform the landscape of alternative proteins in the UK. This approach is popularizing and gaining acceptance within food manufacturers and animal nutrition providers because it improves the nutritional value and digestibility of the product.

The market is already seeing Unilever Food Solutions and Roquette UK pioneers the industry by integrating fermentation-derived wheat proteins from call for plant protein based meat and functional foods. With a growing need for vegan and allergen-free food additions, fermentation-derived wheat will further increase importance with food innovation.

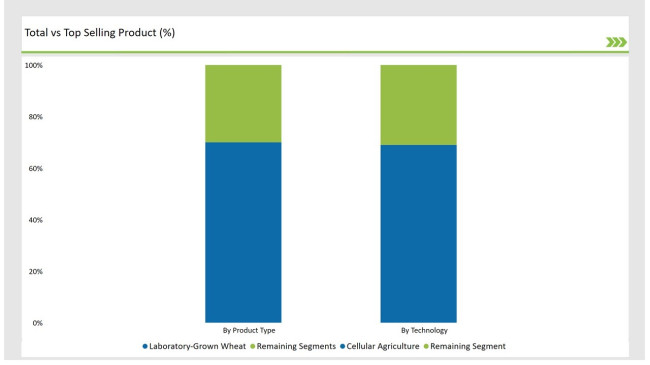

| Product Type | Market Share |

|---|---|

| Laboratory-Grown Wheat | 70.2% |

| Remaining Segments | 29.8% |

Sales of lab-grown wheat still has the biggest slice of the market as a result of leaps forwards in cellular agriculture and the emergence of ‘production ready’ business models. As food companies continue to invest in technologies capable of producing food en masse, this section expands.

But, as the nutrition profile of cell culture wheat becomes more versatile, it is easier to market for more specific uses. It is anticipated that companies engaged in precision fermentation of hybrid wheat protein will be first to increase the market in the next few years.

| Technology | Market Share |

|---|---|

| Cellular Agriculture | 68.5% |

| Remaining Segments | 31.5% |

Tissue engineered products have the potential to catalyze innovation within the agriculture sector, especially as funding for agriculture precision technology increases. This interest stems from the UK’s rice and wheat tissue engineering projects that developed into high value crops, which require a premium. In the UK, tissue engineering methods of production have been on the rise, especially for premium nutrient optimized wheat products.

It is worth mentioning that cellular agriculture is the key technology in the UK cultured wheat sector. This technology has automated the large scale production of wheat while also maintaining quality control. The increase in funding for research and development provisions of sophisticated agriculture seems to promise a hopeful future.

The region has multinational corporations alongside emerging biotech startups, indicating a blend of old and new agriculture business models. Investment in cellular agriculture and fermentation paradigm wheat strategy appears to be on the rise, which further strengthens the premise that the market is still expanding.

This, however, does not come without concern. Deep Branch, a biotech driven enterprise, and Moolec Science have a strong foothold focused on the cultivation of wheat, indicating a shift away from agriculture process and ingredient manufacturing takeover by aids such as Tate & Lyle PLC, Associated British Foods, and Kerry Group. The expansion of the UK cultured Custom Abetted Resource Management market certainly comes with hurdles.

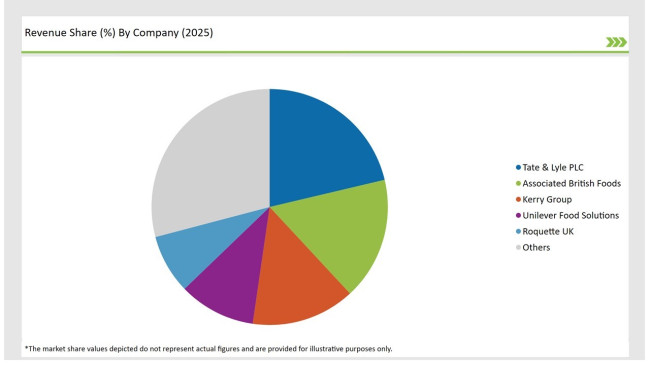

| Company | Market Share (%) |

|---|---|

| Tate & Lyle PLC | 21.3% |

| Associated British Foods | 16.8% |

| Kerry Group | 14.2% |

| Unilever Food Solutions | 10.5% |

| Roquette UK | 8.1% |

| Other Players | 29.1% |

There are key companies in the UK cultured wheat market that have business operations all over England and Scotland and concentrate on investing in research and development of alternative food ingredients. While Tate & Lyle and Roquette UK have put money on fermentation-driven wheat proteins, Kerry Group and Unilever Food Solutions are in the process of growing lab scale wheat for commercial use. New companies such as Hoxton Farms and Moolec Science work together with English universities and biotech incubators to design sophisticated methods of tissue engineering to improve competitiveness in the marketplace.

Laboratory-Grown Wheat, Cell Culture Wheat

Cellular Agriculture, Tissue Engineering, Fermentation-Based

Food Processing, Research & Development, Animal Feed Alternatives

By 2025, the UK cultured wheat market is projected to expand at a CAGR of 13.9%, driven by increasing investments in cellular agriculture and fermentation-based food ingredients.

By 2035, the UK cultured wheat industry is expected to reach a total value of USD 103.2 million, reflecting growing consumer demand for sustainable, lab-grown food alternatives.

The UK cultured wheat market is expanding due to increasing sustainability concerns, technological advancements in cellular agriculture, rising demand for functional wheat-based proteins, and strategic collaborations between biotech startups and food manufacturers.

London and South East England are leading in cultured wheat adoption, particularly in food innovation hubs and research centres. Scotland is also emerging as a biotechnology R&D hotspot supporting alternative wheat production.

Key players in the UK market include Tate & Lyle PLC, Associated British Foods, Kerry Group, Unilever Food Solutions, and Roquette UK, alongside biotech-driven firms such as Deep Branch, Moolec Science, and Hoxton Farms.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UK Cruise Tourism Market Size and Share Forecast Outlook 2025 to 2035

UK Outbound Travel Market Analysis – Size, Share, and Forecast 2025 to 2035

United Kingdom Sweetener Market Trends – Size, Demand & Forecast 2025–2035

United Kingdom Allergen-Free Food Market Report – Trends & Growth Forecast 2025–2035

United Kingdom Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Frozen Ready Meals Market Analysis – Growth, Trends & Forecast 2025–2035

United Kingdom Whole Grain and High Fiber Foods Market Report – Trends & Forecast 2025–2035

United Kingdom Tartrazine Market Outlook – Growth, Trends & Forecast 2025–2035

United Kingdom Wood Vinegar Market Insights – Growth, Trends & Forecast 2025–2035

United Kingdom Vinegar and Vinaigrette Market Insights – Demand & Forecast 2025–2035

United Kingdom Bakery Ingredients Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

United Kingdom Chitin Market Trends – Size, Share & Forecast 2025–2035

UK Non-Alcoholic Malt Beverages Market Analysis from 2025 to 2035

United Kingdom Non-Dairy Creamer Market Insights – Demand, Growth & Forecast 2025–2035

UK Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

UK Banking as a Service (BaaS) Platform Market Growth - Trends & Forecast 2025 to 2035

UK Stationary Battery Storage Industrial Market Growth - Trends & Forecast 2025 to 2035

UK Food Emulsifier Market Analysis – Size, Share & Forecast 2025–2035

UK Food Testing Services Market Report – Trends, Demand & Industry Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA