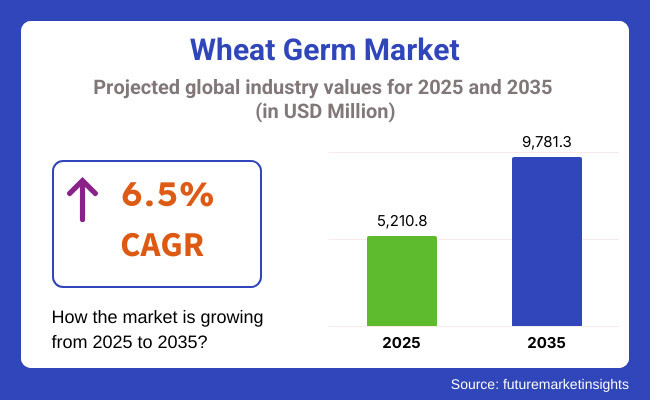

The global wheat germ market in 2023 was USD 4,631.4 million. The demand for wheat germ grew at a year-to-year growth rate of 12.5% in 2024, and the global market would be USD 5,210.8 million in 2035. International trade from 2025 to 2035 in the projection period will be a 6.5% CAGR and USD 9,781.3 million in 2035.

Wheat germ is such a healthy product that it is becoming increasingly popular day by day due to its health importance. Packed with vitamins, minerals, and antioxidants, wheat germ is utilized in all types of products from food stuff, health supplements to cosmetics.

With increasing numbers of consumers demanding plant-based, nutrient-based foods, wheat germ is also being used more in well-being products and functional foods. Wheat germ is driven by consumers' attitudes of value of well-being achieved from consuming more whole grain, expanding consumers' health-awareness, clean-label, natural, and organic food trend.

The nutraceutical aspects of wheat germ, cardiovascular-heart-healthy lipids, and dietary fiber make wheat germ consumers' wish list as a product that consumers will seek to enhance general well-being. With consumers becoming more and more health-conscious, consumption of foods with further health benefits continues to grow.

Wheat germ, a superfood rich in vitamin E, folate, and other nutrients, is applied in immune function, cardiovascular health, and wellness. It is among the best-selling products by health-conscious consumers. Sustainability is among the strongest drivers for the wheat germ market among the strong drivers.

Wheat crop is environmentally superior as a crop than those crops that are cultivated in agricultural plantations and consumes less power and water when cultivated. Because of this growing need for sustainable food materials, it is so promising that wheat germ can be genetically engineered as a healthy and sustainable food material for food and beverage companies.

Market for wheat germ is innovation-led, where its applications are oil and powder. They are being used in more and more applications ranging from bakery foods to smoothies and granola foodstuffs. High essential fatty acid containing wheat germ oil is facing huge demand in the cosmetics and personal care market where it is applied on the basis of moisturizing and antioxidant property.

The following is a comparative half-year variation in CAGR of the base year (2024) to the current year (2025) in the world market for wheat germ. This comparison is done in a bid to obtain differences in performance and thus indicators in realization of revenue and hence leave stakeholders with a proper pointer to direction in growth for the year. July-December is the first half-year or H1. July-December is H2.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 6.1% |

| H2 (2024 to 2034) | 6.2% |

| H1 (2025 to 2035) | 6.3% |

| H2 (2025 to 2035) | 6.5% |

The company will grow by 6.3% in the first half (H1) of period 2025 to 2035 and by an even more considerable percentage of 6.5% in the second half (H2) of the same period. When beginning the second half, H1 2025 to H2 2035, the CAGR would be 6.3% for the first half and once again relatively high at 6.5% for the second half.

Industry recorded a growth of 20 BPS in the first half (H1), with enterprise recording a growth of 30 BPS in the second half (H2). Wheat germ demand is rising with health trends and applications for multifaceted purposes. Its growth potential must be unlocked, however, by overcoming impediments to supply integrity and competition from market forces.

World-Class Wheat Germ Processors and Distributors - They are world-class leading-edge wheat germ processors and distributors with vast production, state-of-the-art processing plants, and well-developed global channels of distribution. They possess expertise in innovation, high-quality processing, and wide market coverage.

Cargill Inc. (USA), it is a leading business of the world, which deals in food ingredients and farm commodities. It produces more processed wheat germ that can be utilized as an ingredient in bakery item, functional food, or an animal feed product. Cargill has the most sophisticated world-class processing plants and strong supply chains.

Regionally Based Players with Expanding Market Base - These firms are well established in a single geographic region and expanding business through partnerships, sustainable sourcing, and product development. VIOBIN USA (USA), High-quality wheat germ oil and nutritionally food dietary with wheat germ as the key ingredient, Viobin is among the health-conscious and dietetics food supplement manufacturers that care about health.

It is establishing its B2B as well as retailing business. Agrocomplex (Russia), one of the leading wheat germ suppliers to Eastern Europe, Agrocomplex is a processor and marketer of wheat germ as an animal feed food ingredient, dietary supplement, and bakery food. Agrocomplex is expanding in Europe and Asia.

Emerging Innovators and Specialty Producers - These are smaller but quickly growing companies with focus on specialty markets, organic production, and new, innovative wheat germ foods. NOW Foods (USA): NOW Foods is a reputable brand name and health and wellness company that manufactures organic wheat germ for use in the dietary supplement industry.

It is a specialist in clean-label, non-GMO, and responsibly grown wheat germ food. Kialla Pure Foods is an Australian specialist foods company that produces organic whole grain and specialty foods. The company produces high-quality wheat germ, which they export to customers for health food as well as organic food manufacturers. It is committed to doing the least amount of processing and using sustainable agriculture practices for the planet.

Trend Towards Functional Nutrition & High-Protein Wheat Germ

Shift: Consumers increasingly accept wheat germ as a best healthy superfood, especially due to its high protein, high fiber, and key vitamins like vitamin E, folic acid, and B-complex vitamins. The emergence of functional foods, clean-label foods, and plant protein substitutes has turned wheat germ into a successful natural product among health shoppers.

Healthy-conscious consumers, vegetarians, and protein-aware dieters are fueling demand for wheat germ-containing foods, from breakfast cereals to protein bars. Concern about gut health is also fueling wheat germ inclusion in probiotic foods as a prebiotic fiber enhancement.

Strategic Response: Bob's Red Mill launched a series of high-protein wheat germ, and this stimulated 22% sales growth in health food stores and web sites. Kellogg's and Nestlé replaced breakfast cereals, smoothies, and granola bars with wheat germ and added fiber and protein, and this generated an 18% sales increase from repeat purchase.

Wheat germ-enriched energy bars launched by German bio-food company Seitenbacher drove its expansion at fitness store chains, inspiring 15% of Q4 2024 revenues. North American and European luxury health companies began incorporating wheat germ into collagen, omega-3, and probiotics, which catered to the interest of those interested in gut health and plant protein, bringing demand up 9%.

Growing Demand for Wheat Germ Oil in Cosmetics & Skincare

Shift: While the natural beauty trend persists, wheat germ oil is emerging as a desirable skin and hair product. Rich in antioxidant and essential fatty acids, and rich in vitamin E, it's a wonderful solution for anti-aging, moisturizing, and restoring the barrier.

Clean-label, chemical-free makeup is gaining momentum in Asia, Europe, and North America as consumers are moving towards natural moisturizing, wrinkle prevention, and scalp maintenance. The need for wheat germ oil-derived hair and skincare products led the large cosmetics and beauty companies to invest in the same.

Strategic Response: Wheat germ oil anti-aging serums were introduced by L'Oréal and The Body Shop, increasing sales in their organic skincare business by 14%. South Korean skincare brands Innisfree and Laneige introduced wheat germ extracts into moisturizing face masks and serums, which drove 19% sales growth in East Asia.

Aveda and Kérastase introduced wheat germ hair oils and shampoos, expanding their upscale salon business share, driving a 12% product sales growth in Q3 2024. Herbivore Botanicals (USA) released organic wheat germ face oils, popular among vegan skincare enthusiasts, with a 16% year-to-year online sales increase.

Uses of Wheat Germ in Gluten-Free & Specialty Flour Mixtures

Shift: Although wheat germ is glutenous, its richer nutrition content and denser fiber profile are causing it to be a top-ranked ingredient for gluten-free and specialty flour blends. Rather than excluding wheat germ from food, food manufacturers are blending wheat germ with almond flour, chickpea flour, and oat flour to add nutrition to gluten-free foods.

The gluten-free baking industry is moving paradigm to high-fiber, high-protein flours due to the desire of the consumer for improved texture, flavor, and nutrition in the baked item. The trend is most prevalently observed in North America and Europe where going gluten-free is mainstream.

Strategic Response: King Arthur Gluten-Free Wheat Germ Flour Blends from King Arthur Baking Company came onto the market, adding a 17% boost in sales to specialty baking flours. Bob's Red Mill launched gluten-free wheat germ-enriched pancake and waffle mixes, expanding online sales by 21%.

Bakery portfolios in European bakeries contained gluten-free wheat germ bread mixes from companies such as Dr. Schär, boosting French and German supermarket sales by 11%. USA and Canadian independent artisan bakers added wheat germ to gluten-free hybrid breads, resulting in a 9% boost in specialty bread retailers' demand.

Incorporation of Wheat Germ in Plant-Based Protein & Dairy Drinks

Shift: With the increasing trend of plants, today wheat germ is being added in dairy alternatives, protein drinks, and functional beverages. Highly nutritious plant-based milk is in high demand, and wheat germ is added as a nutrient-dense ingredient in oat, almond, and soy milk.

In addition, sports nutrition companies are looking toward wheat germ as a natural protein and fiber ingredient to boost recovery drinks following exercise. Apart from antioxidants, vitamin E, and omega-3 fatty acids, wheat germ is applied as an immunity-boosting functional ingredient in functional beverages in European and Asian markets.

Strategic Response: Increased quantities of wheat germ plant milk from Oatly and Silk boosted Q1 2025 supermarket revenues by 13%. Soylent and Huel supplemented their meal replacement shakes with wheat germ, boosting vitamin E and omega-3 content, which led to a 10% increase in online subscription sales.

Nestlé's plant-based beverages business launched wheat germ-fortified dairy-free lattes to appeal to health-conscious consumers, driving sales up by 16% in Europe. Danone's Alpro brand launched wheat germ and oat protein blend drinks, which saw a 12% increase in buy by plant-based protein buyers.

The following table shows the estimated growth rates of the top five territories expected to exhibit high consumption of wheat germ through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| USA | 5.7% |

| Germany | 6.2% |

| China | 4.5% |

| Japan | 6.8% |

| India | 7.1% |

Rising consumer interest in whole-grains, high-fiber diets and functional foods has provided the USA wheat germ market a significant opportunity for growth. Demand is growing for wheat germ in breakfast cereals, baked goods, and sports nutrition products, thanks to wheat germ’s wealth of vitamins, antioxidants, and essential fatty acids. Further, the growing health-consciousness trend among consumers has propelled demand for fortified wheat germ blends and other non-GMO wheat-derived products.

The German wheat germ market is growing steadily as stringent food regulations in the EU are driving the demand for organic, clean-label and minimally processed food ingredients. The BSPC found that consumers have been on the lookout for nutrient-packed, plant-based protein sources for their premium bakery products, muesli, and nutritional supplements, and that is benefit the demand of wheat germ.

Given its strong culture in sustainable and health-oriented eating, German producers have placed increased emphasis on applications for non-GMO wheat germ and functional wheat germ extracts for food and nutraceutical applications.

The Chinese wheat germ market is growing at a faster pace as vitamin functional foods, fiber diets, and gut health knowledge rise among consumers. Sports nutrition and natural health supplements have expanded this use to instant breakfast foods, herbal tonics, and fortified flour blends. Government-backed drives for high-nutrition diets are bolstering local brands' investments in extracting and processing high-quality wheat germ.

The Japanese wheat germ market focuses on functional nutrition, enzyme-rich foods, and fermented health products. Fortified and biologically active wheat germ extracts in probiotic-rich beverages, nutritional powders, and healthy aging supplements are Japanese consumer favorites. Moreover, some advancements in enzyme-assisted wheat germ processing have provided us high-value bioactive wheat germ compounds mainly targeting gut and immune health.

The wheat germ market in India is growing, thanks to a rise in awareness regarding fiber-filled diets, protein-fortified atta (flour), and fortified health foods. Wheat germ is getting popularity in whole wheat bread, cereal, and diabetic preparations. Demand is expected to grow across the country because of government-backed food fortification programs and increasing health consciousness among the rising middle class.

| Segment | Value Share (2025) |

|---|---|

| Bakery & Cereal Products (By Application) | 66.9% |

By application type, bakery and cereal products segment of wheat germ market is followed by the others, with a market value share of 66.9% in 2025. Consumer demand for fiber-rich, whole-grains in everyday foods is driving this dominance. Wheat germ is one of the highest in vitamins, minerals, antioxidants and healthy fats of all the components of the wheat plant, and it’s used in breads, cookies, granola and fortified breakfast cereals as a way to boost nutritional value and texture.

As the functional food market has grown, manufacturers increasingly add vitamin and antioxidant-rich wheat germ extracts to their formulations, benefits like B vitamins, vitamin E, and essential amino acids to enhance digestion, energy, and heart health.

Brands are innovating, replacing conventional with organic wheat germ blends or gluten-friendly, to woo clean-label and non-GMO consumers something they don’t just offer at the top end but also in the middle tier appealing to a broader target market. The growth of better-for-you bakery and breakfast products further solidifies wheat germ’s contribution to the health-centric food marketplace.

| Segment | Value Share (2025) |

|---|---|

| Nutraceuticals & Dietary Supplements (By Application) | 33.1% |

In view of consumers increasingly preferring high-antioxidant and anti-inflammatory foods, wheat germ extracts are broadly applied in nutritional powders, functional beverages, and vitamin-enriched dietary supplements. High in micronutrients such as vitamin E and omega fatty acids, as well as bioactive peptides, wheat germ extracts promote health and wellness, in turn, making these extracts popular ingredients in modern functional foods.

Demand for bioavailable wheat germ extracts in gut health, sports nutrition, and skincare formulations is growing as scientific research increasingly underlines the advantages of wheat germ oil and wheat germ peptides. They help with digestive health, lower oxidative stress, and improve performance and recovery.

Growing Wheat Germ Extract Market to Occupy 33.1% Value Share by 2025 The manufacturers are concentrating upon the cold-pressed extraction method, organic sources, and sustainable processing technologies to cater to the increasing consumer demand for clean-label and highly bioavailable wheat germ-based functional ingredients.

Key players in the wheat germ market are engaging in sustainable sourcing, bioactive compound extraction, and expanding the applications in functional foods. Wheat germ is being fermented, processed organic-certifiably and made part of protein-fortified blends, and of course companies are putting money into development.

Top players include Archer Daniels Midland (ADM), Cargill, Bob's Red Mill, Now Foods, and VIOBIN USA in the field, specializing in the processing of whole grains, the development of nutraceutical ingredients, and the worldwide distribution of these products. Companies are expanding operations in Asia-Pacific and Europe to meet growing demand for foods high in whole grain and fiber.

That's where the "big" opportunity lies, with partnerships in functional food brands, wheat germ oil extraction investments, as well as more effectively bioavailable wheat germ supplement development. In addition, manufacturers are focusing on carbon-neutral production and regenerative wheat farming practices.

For instance

The market is divided into organic and conventional products, catering to different consumer preferences and regulatory standards.

The market operates through B2B and B2C channels.

The B2B segment includes dietary supplements, pharmaceuticals, food additives, pet food, animal feed, and personal care products.

The B2C segment covers store-based retail such as hypermarkets/supermarkets, specialty stores, convenience stores, wholesale stores, grocery stores, and other brick-and-mortar channels, along with online retailing.

Products are available in raw and processed forms, catering to different industry applications.

The market is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The global wheat germ industry is projected to reach USD 5210.8 million in 2025.

Key players include Texture Maker Enterprise Co., Ltd.; Bobs Red Mill Natural Foods Inc; Ffm Berhad Group; RJ Kalantri Flour Milling Group.

North America is expected to dominate due to strong demand for high-fiber, functional food ingredients.

The industry is forecasted to grow at a CAGR of 6.5% from 2025 to 2035.

Key drivers include rising demand for whole-grain and fiber-rich foods, increasing applications in nutraceuticals and sports nutrition, and advancements in wheat germ processing for enhanced bioavailability.

Table 1: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ million) Forecast by Nature, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 5: Global Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Form, 2018 to 2033

Table 7: Global Market Value (US$ million) Forecast by Sales Channel, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 9: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ million) Forecast by Nature, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 13: North America Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 15: North America Market Value (US$ million) Forecast by Sales Channel, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ million) Forecast by Nature, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 21: Latin America Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 23: Latin America Market Value (US$ million) Forecast by Sales Channel, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 25: Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ million) Forecast by Nature, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 29: Europe Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 31: Europe Market Value (US$ million) Forecast by Sales Channel, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 33: East Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 34: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: East Asia Market Value (US$ million) Forecast by Nature, 2018 to 2033

Table 36: East Asia Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 37: East Asia Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 38: East Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 39: East Asia Market Value (US$ million) Forecast by Sales Channel, 2018 to 2033

Table 40: East Asia Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 41: South Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 42: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: South Asia Market Value (US$ million) Forecast by Nature, 2018 to 2033

Table 44: South Asia Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 45: South Asia Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 46: South Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 47: South Asia Market Value (US$ million) Forecast by Sales Channel, 2018 to 2033

Table 48: South Asia Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 49: Oceania Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 50: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 51: Oceania Market Value (US$ million) Forecast by Nature, 2018 to 2033

Table 52: Oceania Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 53: Oceania Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 54: Oceania Market Volume (MT) Forecast by Form, 2018 to 2033

Table 55: Oceania Market Value (US$ million) Forecast by Sales Channel, 2018 to 2033

Table 56: Oceania Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 57: Middle East & Africa Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 58: Middle East & Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 59: Middle East & Africa Market Value (US$ million) Forecast by Nature, 2018 to 2033

Table 60: Middle East & Africa Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 61: Middle East & Africa Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 62: Middle East & Africa Market Volume (MT) Forecast by Form, 2018 to 2033

Table 63: Middle East & Africa Market Value (US$ million) Forecast by Sales Channel, 2018 to 2033

Table 64: Middle East & Africa Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ million) by Nature, 2023 to 2033

Figure 2: Global Market Value (US$ million) by Form, 2023 to 2033

Figure 3: Global Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 4: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ million) Analysis by Nature, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 13: Global Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 17: Global Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Nature, 2023 to 2033

Figure 22: Global Market Attractiveness by Form, 2023 to 2033

Figure 23: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ million) by Nature, 2023 to 2033

Figure 26: North America Market Value (US$ million) by Form, 2023 to 2033

Figure 27: North America Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 28: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ million) Analysis by Nature, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 37: North America Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 41: North America Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Nature, 2023 to 2033

Figure 46: North America Market Attractiveness by Form, 2023 to 2033

Figure 47: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ million) by Nature, 2023 to 2033

Figure 50: Latin America Market Value (US$ million) by Form, 2023 to 2033

Figure 51: Latin America Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ million) Analysis by Nature, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 61: Latin America Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 65: Latin America Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Nature, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ million) by Nature, 2023 to 2033

Figure 74: Europe Market Value (US$ million) by Form, 2023 to 2033

Figure 75: Europe Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 76: Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ million) Analysis by Nature, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 85: Europe Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 89: Europe Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 93: Europe Market Attractiveness by Nature, 2023 to 2033

Figure 94: Europe Market Attractiveness by Form, 2023 to 2033

Figure 95: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ million) by Nature, 2023 to 2033

Figure 98: East Asia Market Value (US$ million) by Form, 2023 to 2033

Figure 99: East Asia Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 100: East Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 102: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ million) Analysis by Nature, 2018 to 2033

Figure 106: East Asia Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 109: East Asia Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 110: East Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 111: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 113: East Asia Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 114: East Asia Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Nature, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ million) by Nature, 2023 to 2033

Figure 122: South Asia Market Value (US$ million) by Form, 2023 to 2033

Figure 123: South Asia Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 124: South Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 125: South Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 126: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Market Value (US$ million) Analysis by Nature, 2018 to 2033

Figure 130: South Asia Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 133: South Asia Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 134: South Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 135: South Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 136: South Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 137: South Asia Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 138: South Asia Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 139: South Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 141: South Asia Market Attractiveness by Nature, 2023 to 2033

Figure 142: South Asia Market Attractiveness by Form, 2023 to 2033

Figure 143: South Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Market Value (US$ million) by Nature, 2023 to 2033

Figure 146: Oceania Market Value (US$ million) by Form, 2023 to 2033

Figure 147: Oceania Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 148: Oceania Market Value (US$ million) by Country, 2023 to 2033

Figure 149: Oceania Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 150: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Market Value (US$ million) Analysis by Nature, 2018 to 2033

Figure 154: Oceania Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 157: Oceania Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 158: Oceania Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 159: Oceania Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 161: Oceania Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 162: Oceania Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 165: Oceania Market Attractiveness by Nature, 2023 to 2033

Figure 166: Oceania Market Attractiveness by Form, 2023 to 2033

Figure 167: Oceania Market Attractiveness by Sales Channel, 2023 to 2033

Figure 168: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East & Africa Market Value (US$ million) by Nature, 2023 to 2033

Figure 170: Middle East & Africa Market Value (US$ million) by Form, 2023 to 2033

Figure 171: Middle East & Africa Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 172: Middle East & Africa Market Value (US$ million) by Country, 2023 to 2033

Figure 173: Middle East & Africa Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 174: Middle East & Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 175: Middle East & Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East & Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East & Africa Market Value (US$ million) Analysis by Nature, 2018 to 2033

Figure 178: Middle East & Africa Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 179: Middle East & Africa Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 180: Middle East & Africa Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 181: Middle East & Africa Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 182: Middle East & Africa Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 183: Middle East & Africa Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 184: Middle East & Africa Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 185: Middle East & Africa Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 186: Middle East & Africa Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 187: Middle East & Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 188: Middle East & Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 189: Middle East & Africa Market Attractiveness by Nature, 2023 to 2033

Figure 190: Middle East & Africa Market Attractiveness by Form, 2023 to 2033

Figure 191: Middle East & Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 192: Middle East & Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wheat Germ Oil Market Outlook - Demand & Forecast 2025 to 2035

Demand for Wheat Germ Oil in EU Size and Share Forecast Outlook 2025 to 2035

Wheat Malt Market Size and Share Forecast Outlook 2025 to 2035

Wheatgrass Products Market Size and Share Forecast Outlook 2025 to 2035

Wheat Gluten Market Size and Share Forecast Outlook 2025 to 2035

Wheat Starch Market Size and Share Forecast Outlook 2025 to 2035

Wheat Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Wheat Protein Market Size, Growth, and Forecast for 2025 to 2035

Wheat Fiber Market Growth - Dietary Fiber & Functional Food Trends 2024 to 2034

Buckwheat Seed Market Size and Share Forecast Outlook 2025 to 2035

Buckwheat Groat Flour Market

Buckwheat Market

White Wheat Malt Market Size and Share Forecast Outlook 2025 to 2035

Spelt Wheat Market Size and Share Forecast Outlook 2025 to 2035

Whole-Wheat Flour Market Size, Growth, and Forecast 2025 to 2035

Durum Wheat Flour Market

Malted Wheat Flour Market

Organic Wheat Flour Market

Cultured Wheat Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cultured Wheat Flour Market Analysis by Bread, Bakery Products, Pasta, and Others Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA