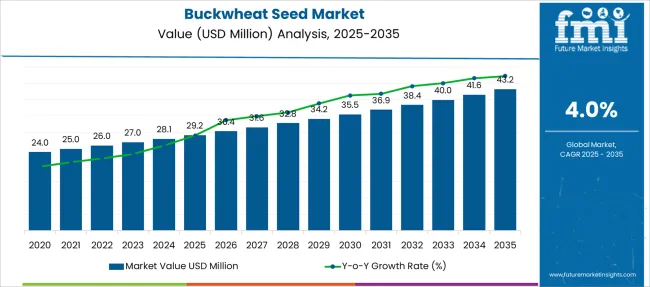

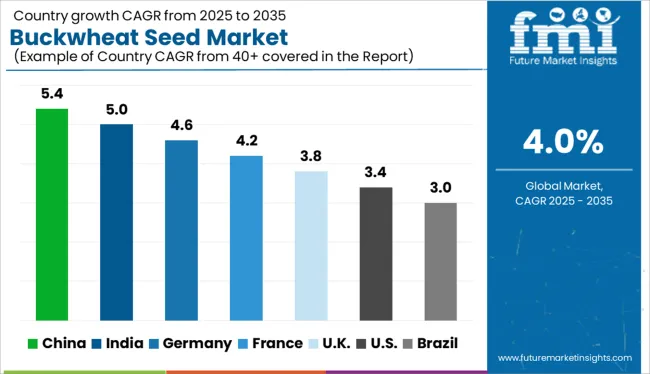

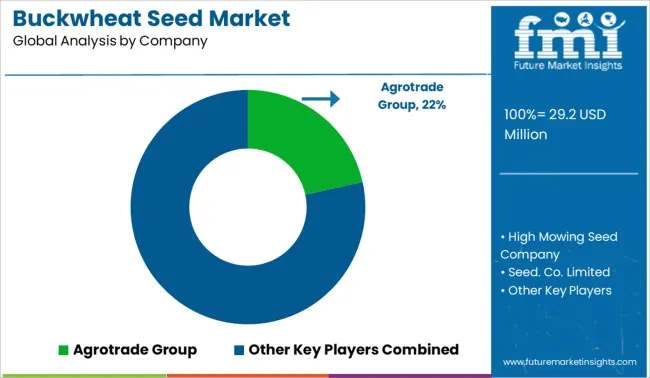

The Buckwheat Seed Market is estimated to be valued at USD 29.2 million in 2025 and is projected to reach USD 43.2 million by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

| Metric | Value |

|---|---|

| Buckwheat Seed Market Estimated Value in (2025 E) | USD 29.2 million |

| Buckwheat Seed Market Forecast Value in (2035 F) | USD 43.2 million |

| Forecast CAGR (2025 to 2035) | 4.0% |

The buckwheat seed market is expanding steadily due to growing consumer interest in health-conscious and natural food products. Awareness of organic food benefits and increasing demand for gluten-free and nutrient-rich ingredients have boosted buckwheat seed consumption globally. Food manufacturers are incorporating buckwheat seeds into various products, including snacks, cereals, and beverages, to meet this rising demand.

Advances in sustainable farming practices and organic cultivation methods have enhanced supply reliability. Additionally, government support for organic agriculture and changing dietary preferences towards plant-based nutrition have contributed to market growth.

The food and beverage industry’s focus on clean-label ingredients and functional foods continues to drive innovation and adoption of buckwheat seeds. Going forward, growth is expected to be led by organic buckwheat seeds, roasted buckwheat seed types, and the food and beverage industry as the largest end user.

The market is segmented by Source, Type, End User, and Distribution Channel and region. By Source, the market is divided into Organic buckwheat seed and Conventional buckwheat seed. In terms of Type, the market is classified into Roasted buckwheat seed and Non-roasted buckwheat seed. Based on End User, the market is segmented into Food and beverage Industry and Cosmetics and personal care industry. By Distribution Channel, the market is divided into B2B, B2C, Store-Based Retailing, Grocery Retailers, and Modern Grocery Retailers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

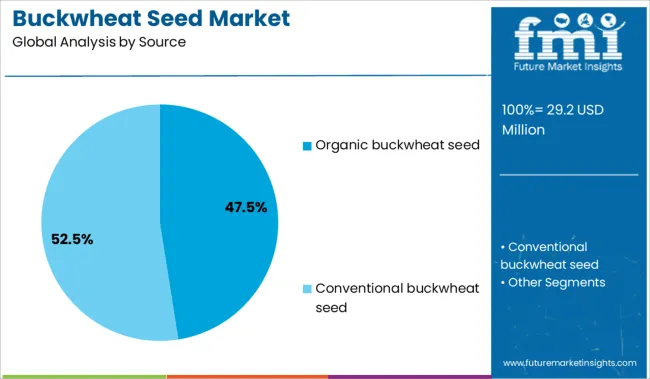

The Organic Buckwheat Seed segment is projected to hold 47.5% of the buckwheat seed market revenue in 2025, leading the source category. The increasing health awareness among consumers and demand for chemical-free, natural foods have propelled this segment’s growth. Organic buckwheat seeds are favored for their purity, sustainability, and perceived higher nutritional value.

Farmers and suppliers have expanded organic cultivation to meet consumer expectations for transparency and environmentally responsible farming. Additionally, the growing presence of organic certification programs has boosted consumer confidence and widened market accessibility.

The trend toward organic diets and clean eating is expected to sustain the growth of the Organic Buckwheat Seed segment.

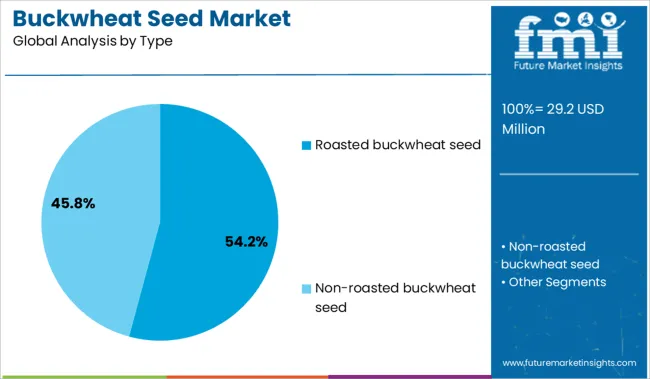

The Roasted Buckwheat Seed segment is anticipated to account for 54.2% of the market revenue in 2025, maintaining its position as the dominant type. Roasting enhances flavor, aroma, and shelf life making roasted buckwheat seeds more appealing to consumers and food processors.

This type is widely used in cereals, snack mixes, and beverages due to its distinctive nutty taste and improved digestibility. Product developers have focused on roasted buckwheat seeds to create innovative food products targeting health-conscious customers.

The segment benefits from increasing adoption in gluten-free and specialty food markets. As consumer demand for flavorful and nutritious ingredients grows, roasted buckwheat seed is expected to remain the preferred choice.

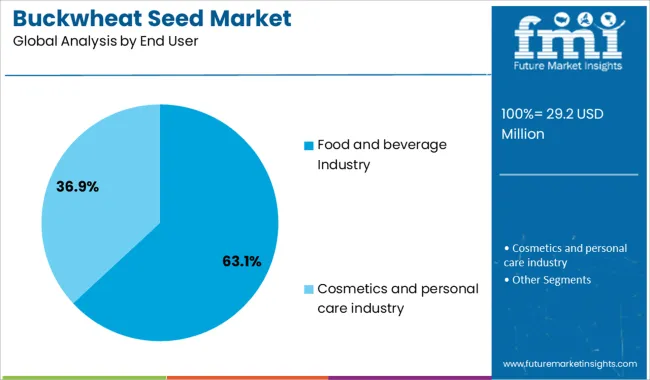

The Food and Beverage Industry segment is projected to hold 63.1% of the buckwheat seed market revenue in 2025, representing the largest end user. The industry has embraced buckwheat seeds as a versatile ingredient for functional foods and health-oriented product lines.

Manufacturers are leveraging buckwheat’s gluten-free status and rich nutrient profile to cater to growing consumer demand for clean-label and allergen-friendly products. The rise of plant-based diets and natural wellness trends has further increased buckwheat’s popularity in the food sector.

Additionally, the industry’s investment in product innovation and marketing has expanded buckwheat seed applications in snacks, bakery items, and beverages. With ongoing consumer focus on health and nutrition, the Food and Beverage Industry segment is expected to continue leading the market.

The buckwheat seed market has received a lot of traction in the industry.

The growth of the buckwheat seed market is driven by the multiple End Users of buckwheat seed that are expected to drive the market over the forecast period. Buckwheat seed is a pseudo-cereal that contains polyphenols that can fight cancer. Buckwheat seed is also used in beverages that reduce liver fattening and in animal feed to ensure proper nutrition.

Consumer awareness of healthy food consumption and attention to protein, carbohydrate, and fat consumption is leading to an increase in buckwheat seed consumption today. This, in turn, leads to better business profits for manufacturers.

According to WHO (World Health Organization), 31% of all death all over the world is caused by cardiovascular disease. Since consumers have a high risk of cardiovascular disease, they are increasing their intake of low-fat foods. Consumers are also choosing food items such as buckwheat seed - a healthy food source containing fiber, complex carbohydrates, and less fat.

Increasing demand for buckwheat seeds has been experienced by cosmetic and personal care manufacturers since a variety of factors such as advancing age, improper diet, and environmental factors like pollution and rising temperature increase the risk of skin and hair problems facing consumers, resulting in high profitability for manufacturers of buckwheat seed.

The Asia Pacific region currently holds the largest market share for buckwheat seeds, and this position is forecast to persist throughout the forecast period. The rapidly expanding agricultural industry, increasing awareness regarding the health benefits of buckwheat seeds, as well as the expanding area under horticultural crops are driving the buckwheat seed market strongly. China and India are among the key countries in the Asia Pacific region that report high levels of buckwheat seed production and consumption.

There are many factors that help to make China a leading market in the world, and these factors support the regional dominance of the global buckwheat seed market. The European market will have considerable demand due to rapid advancements in breeding technologies that result in high-quality seeds for vegetable plantings.

Market growth is forecasted for the foreseeable future in the North American market, as buckwheat seeds are high in demand in the USA, Canada, and Mexico.

Furthermore, hybrid seeds of tomato, lettuce, and sweet pepper are growing in popularity in the country, providing additional fuel to the market.

The increasing area under agricultural crops in the Middle East & Africa is contributing to the growth of the buckwheat seed market. An increase in middle-class populations in Africa also contributes to the expansion of the market. Turkey is a key market for buckwheat seeds in the region, with high demand both locally and abroad.

Some of the leading companies operating in the global buckwheat seed market include Agrotrade Group, High Mowing Seed Company, Seed Co. Limited, Kaveri Seed Company Limited, Pioneer Hi-Bred International, Inc., AB Company Seeds Ltd., Kingherbs Limited, Qingdao Sunrise Biotechnology Co., Ltd., Gansu Zhanhua Import & Export Co., Ltd. Ningxia Original Crops Co., Limited and others.

Companies in this field could bribe consumers by providing them with complimentary items with the product. They could even open up their own factory outlet in order to directly reach consumers. Manufacturers could also offer attractive discounts and offers on buckwheat seeds to attract consumers, thus enriching their business profits, therefore propelling the growth of the buckwheat seed market.

In addition to being used in animal feed for proper nutrition, buckwheat seed is also used in making weight loss supplements. These are all uses of buckwheat seed predicted to drive the growth of the buckwheat seed market over the forecast period thanks to the diversified End Users of buckwheat seed. Due to consumers' awareness of healthy foods and their increased awareness of protein, carbohydrate, and fat consumption, buckwheat seed consumption is increasing today. This leads to better business profits for the manufacturers, creating opportunities for the growth of the buckwheat seed market.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.0% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion, Volume in Kilotons, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Type of Source, By Type, End User, Distribution Channels |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, Russia, Poland, Australia, New Zealand, China, India, Japan, South Korea, Thailand, Malaysia, Vietnam, Indonesia, GCC Countries, Turkey, South Africa, North Africa |

| Key Companies Profiled | Agrotrade Group; High Mowing Seed Company; Seed. Co. Limited; Kaveri Seed Company Limited; Pioneer Hi-Bred International, Inc.; AB Company Seeds Ltd; Kingherbs Limited; Qingdao Sunrise Biotechnology Co., Ltd.; Gansu Zhanhua Import & Export Co., Ltd.; Ningxia Original Crops Co., Limited; Others. |

| Customization | Available Upon Request |

The global buckwheat seed market is estimated to be valued at USD 29.2 million in 2025.

The market size for the buckwheat seed market is projected to reach USD 43.2 million by 2035.

The buckwheat seed market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in buckwheat seed market are organic buckwheat seed and conventional buckwheat seed.

In terms of type, roasted buckwheat seed segment to command 54.2% share in the buckwheat seed market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Buckwheat Groat Flour Market

Buckwheat Market

Seed Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Seed Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Seed Biostimulants Market Size and Share Forecast Outlook 2025 to 2035

Seed Health Market Size and Share Forecast Outlook 2025 to 2035

Seed Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Seed Coating Material Market Analysis - Size, Share, and Forecast 2025 to 2035

Seed Packaging Market Analysis – Growth & Forecast 2025 to 2035

Seed Binders Market Analysis - Size, Share & Forecast 2025 to 2035

Market Share Breakdown of Seed Cracker Manufacturers

Seed Polymer Market

Seed Testing Services Market Growth – Trends & Forecast 2018-2028

Teaseed Cake Market – Trends & Forecast 2025 to 2035

The Linseed Oil Market is Analysis by Nature, Product Type, Application, and Region from 2025 to 2035

Rapeseed Protein Market Size and Share Forecast Outlook 2025 to 2035

Flaxseed Gum Market Size and Share Forecast Outlook 2025 to 2035

Rapeseed Oil Market Size and Share Forecast Outlook 2025 to 2035

Rapeseed Meal Market Analysis by Type, Application, Nature, and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA