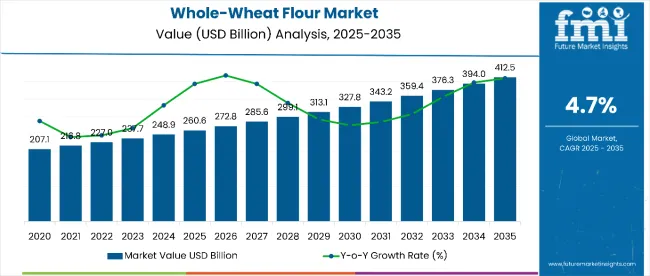

The global whole-wheat flour market is poised for steady growth, with an estimated valuation of USD 260.57 billion in 2025, projected to reach USD 412.46 billion by 2035. This growth corresponds to a CAGR of 4.7% during the forecast period.

North America currently leads in market revenue, driven by the mature bakery sector in the USA, while the Asia Pacific region is expected to exhibit the fastest growth at a CAGR of 5.2%, led by nations such as China and India. Among product categories, whole-wheat bread and bakery applications continue to dominate due to their role in daily diets and shifting consumer preference toward healthier carbohydrates.

| Attributes | Description |

|---|---|

| Estimated Global Industry Size (2025E) | USD 260.57 Billion |

| Projected Global Industry Value (2035F) | USD 412.46 Billion |

| Value-based CAGR (2025 to 2035) | 4.7% |

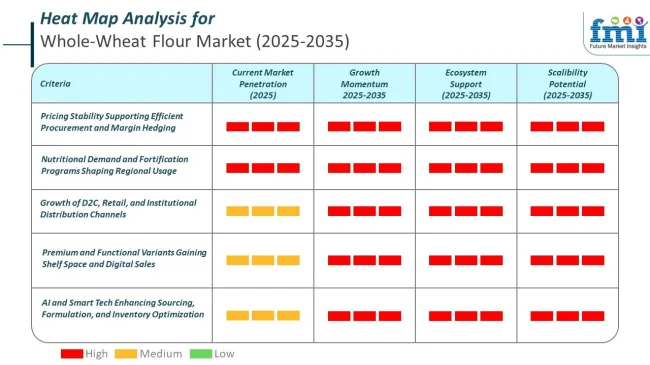

The market’s expansion is heavily influenced by growing consumer awareness about high-fiber, functional, and clean-label ingredients. Whole-wheat flour, which retains the bran, germ, and endosperm, is increasingly preferred over refined alternatives for its nutritional benefits.

Rising health concerns, especially around lifestyle diseases like diabetes and obesity, are leading consumers to shift to whole grain options. As a result, demand is surging in both urban and semi-urban populations. However, the shorter shelf life and higher price of whole-wheat flour compared to refined flour remain as notable barriers to widespread adoption.

A significant driver of the market is the growing demand for baked goods such as bread, rolls, biscuits, and tortillas. With rising urbanization and busy lifestyles, convenience foods made from whole-wheat flour are witnessing an uptick in consumption. The adaptability of the flour across a variety of processed and ready-to-cook food items is also accelerating its demand across multiple demographics. The bakery segment, in particular, is expected to continue registering strong volume growth owing to its direct alignment with health and wellness trends.

Looking ahead, trends such as organic wheat cultivation, fortified whole-wheat flour, and value-added packaging are set to gain traction. Manufacturers are innovating with enhanced milling processes and clean-label marketing strategies to improve both the functional profile and consumer appeal of their products. Governments across key markets are also supporting fortification policies to enhance the micronutrient value of staple foods, further bolstering demand.

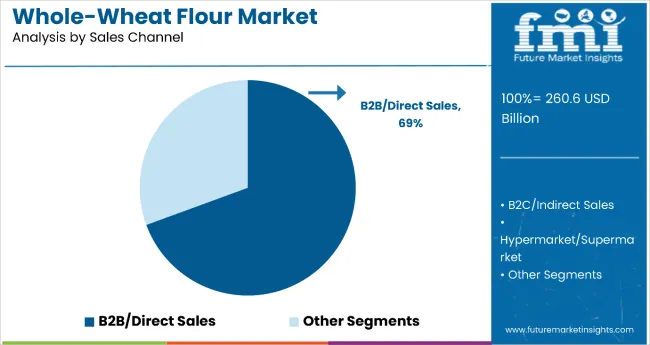

Moreover, the distribution landscape is evolving. Direct B2B sales channels continue to dominate, but supermarkets, hypermarkets, and online channels are growing rapidly. Retail visibility, ease of access, and digital convenience are enabling brands to reach health-conscious consumers across Tier I and Tier II cities, reinforcing the market’s consistent upward trajectory through 2035.

The whole-wheat flour market shows significant disparity in per-capita usage across countries. In the USA, average consumption remains near 58 kg per person. India records higher household volumes, particularly in states where chakki atta is a staple. Urban areas in Japan and France show lower usage but consistent presence in foodservice chains and specialty retail. Public procurement adds volume in North Africa and Southeast Asia.

Modern trade chains in Europe and the Middle East allocate dedicated shelf zones to whole-wheat formats. E-commerce platforms in the USA and South Korea stock vacuum-packed flour SKUs. Cold-chain usage remains unnecessary for dry formats but warehouse humidity controls are common in Southeast Asia.

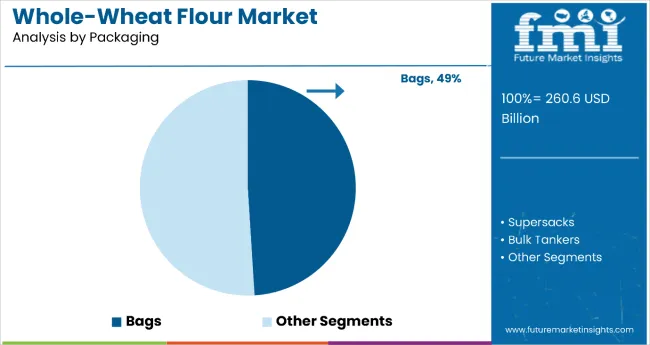

Bags hold the dominant position with 49% of the market share in the packaging category within the whole-wheat flour market. This leadership is driven by bags' cost-effectiveness, storage efficiency, and consumer convenience across both commercial and retail applications.

Bags offer superior protection against moisture and contamination while maintaining affordability for manufacturers and end-users. The packaging format is particularly favored for retail sizes ranging from small household portions to bulk commercial quantities, providing flexibility across diverse consumer needs.

The segment's dominance is reinforced by bags' compatibility with various materials including paper, plastic, and laminated options that can be customized for different storage requirements and shelf life expectations.

Bags provide excellent branding opportunities and are easily stackable for efficient warehouse storage and transportation. As sustainability concerns grow, manufacturers are increasingly adopting eco-friendly bag materials including recyclable and biodegradable options that align with environmental initiatives while maintaining product integrity and consumer appeal.

B2B/Direct sales dominate the whole-wheat flour market with 69.4% of the market share in the sales channel category. This leadership is attributed to the substantial demand from commercial bakeries, food processing companies, and foodservice operators who require large volumes of whole-wheat flour for bread, pasta, and other baked goods production.

Direct sales enable these businesses to secure competitive pricing, ensure consistent supply, and maintain quality specifications that are critical for commercial food production operations.

The segment's dominance is reinforced by the growing trend toward artisanal and specialty bakeries that prioritize high-quality whole-wheat flour for premium products. B2B channels provide manufacturers with predictable demand patterns and long-term contracts that support production planning and inventory management.

As the commercial food sector continues to expand and consumers increasingly demand whole-grain options in restaurants and foodservice establishments, the B2B/Direct sales segment is expected to maintain its dominant position through continued partnerships with food manufacturers and commercial end-users seeking reliable, high-quality whole-wheat flour supplies.

Increase in Population and Healthy Alternative Food Habits Driving Market Growth

Due to the growing demand for food population growth continues to be a major factor driving the global wheat flour market. This demographic boom is accompanied by a notable change in dietary preferences. People are using wheat-based products in their meals as a result of growing awareness of the value of a balanced diet.

Wheat flours perceived health benefits as a source of vital nutrients like fiber and carbohydrates support this tendency. Convenient and easily accessible food options become crucial as urbanization picks up speed and fast-paced lifestyles are created. Due to its adaptability wheat flour is a staple in many culinary applications and is well-suited to meet these needs. Population expansion and changing eating patterns work together to propel the market for wheat flours steady expansion.

Hectic Lifestyle Drives the Market Demand

As a result of lifestyle changes brought about by rapid urbanization there is an increasing need for convenient food options. As cities grow more people are juggling hectic schedules with little time for cooking. This change in perspective has increased the importance of readily available consumable food items notably those made with wheat flour.

Because of its adaptability it can be used to make a variety of quick and easy meal solutions including bread instant noodles and other processed foods. Therefore, the demand for products made with wheat flour has been driven by urban consumers preference for foods that fit into their hectic schedules. The market for wheat flour has essentially evolved due to the rise of urbanization and the busy lifestyles that go along with it highlighting the intersection of shifting societal dynamics and patterns of food consumption.

Tier 1 companies includes industry leaders acquiring a 65% share in the global business market. These leaders are distinguished by their extensive product portfolio and high production capacity. These industry leaders stand out due to their broad geographic reach, in-depth knowledge of manufacturing and reconditioning across various formats and strong customer base. They offer a variety of services and manufacturing with the newest technology while adhering to legal requirements for the best quality.

Tier 2 companies comprises of mid-size players having a presence in some regions and highly influencing the local commerce and has a market share of 30%. These are distinguished by their robust global presence and solid business acumen. These industry participants may not have cutting-edge technology or a broad global reach but they do have good technology and guarantee regulatory compliance.

Tier 3 companies includes mostly of small-scale businesses serving niche economies and operating at the local presence having a market share of 5%. Due to their notable focus on meeting local needs these businesses are categorized as belonging to the tier 3 share segment, they are minor players with a constrained geographic scope. As an unorganized ecosystem Tier 3 in this context refers to a sector that in contrast to its organized competitors, lacks extensive structure and formalization.

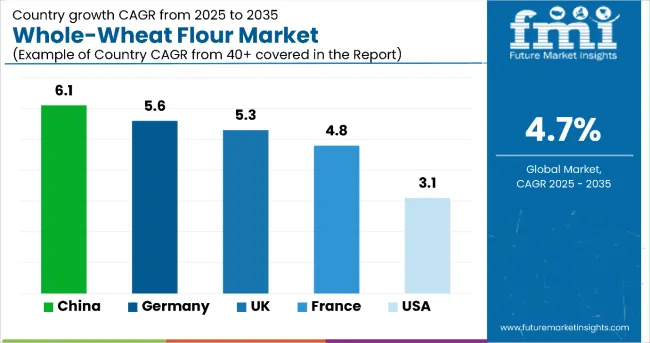

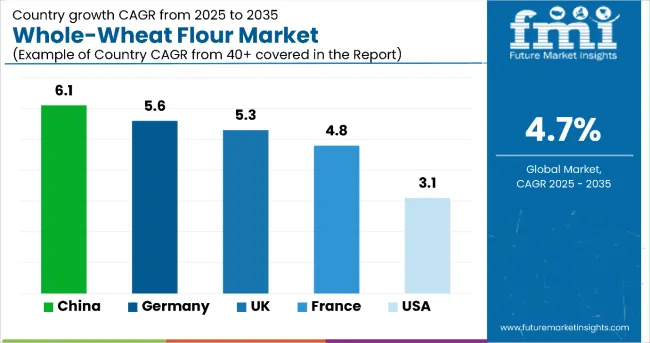

The following table shows the forecasted growth rates of the significant three geographies revenues. USA, UK and China come under the exhibit of high consumption, recording CAGRs of 3.1%, 5.3% and 6.1%, respectively, through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| USA | 3.1% |

| UK | 5.3% |

| China | 6.1% |

Growing USA bakery industry is increasing the demand for the market. According to the American Bakers Association wheat flour accounts for about 2.1% of the nation’s gross domestic product. USA is produced from baked goods.

Manufacturers of wheat flour are expanding their cutting-edge technology manufacturing procedures and providing clients with innovative wheat flour products the need for health care beneficial and multifunctional food ingredients is growing worldwide which has also led producers to introduce a variety of functional wheat flours.

The significant population growth in China has increased demand for wheat flour for staple foods like noodles dumplings and steamed buns causing the country to dominate the global wheat flour market. Demand is continuously driven by this pattern of consumption. Additionally, the growing middle class in China has increased demand for baked goods processed foods and snacks which has increased the demand for wheat flour.

Accordingly, government initiatives that promote agricultural modernization and higher wheat production help China achieve its self-sufficiency objectives. Furthermore, China strengthens its competitive edge by strategically investing in wheat cultivation technologies that improve yield and quality.

Furthermore, China can import and export wheat flour based on market conditions thanks to its global trade presence. China is positioned as a market influencer thanks to its strategic flexibility. Global wheat flour dynamics are impacted by consumption trends that are shaped by the countries changing dietary preferences and economic expansion.

Through 2035 the UK’s consumption of whole-wheat flour is predicted to increase at a compound annual growth rate (CAGR) of 5.3%. Due to its high nutritional content whole-wheat flour known in the nation as whole meal flour is gaining a lot of popularity. The importance of eating a healthier diet even if it costs more has led to the nations notable growth in Europe. Due to this the nation is seeing a large increase in demand for ingredients made through organic farming.

Numerous factors interact dynamically to define the competitive environment in the global wheat flour market. In addition to price market participants compete on product quality effective distribution and technological innovation. Further escalating competition are differentiation tactics like providing specialty flour varieties for particular culinary uses. Sustainability initiatives supply chain resilience and regulatory compliance are also emerging as key differentiators.

Market trends that impact the competitive dynamics include changes in consumer dietary habits and the growing desire for healthier and organic options. Furthermore, competitors differing cost structures and supply capacities are influenced by the geographic diversity of wheat production areas. Adaptability to shifting consumer preferences and the capacity to use digital platforms for distribution and marketing are becoming crucial as the market changes.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 260.57 billion |

| Projected Market Size (2035) | USD 412.46 billion |

| CAGR (2025 to 2035) | 4.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD billion |

| By Product Type |

Bread Flour, Pancake Flour, Cracker Flour, Pizza Flour |

| By Application | Bread, Bakery Products, Biscuits, Rolls, Cookies, Buns, Sweet Goods, Desserts, Tortillas |

| By Nature | Organic, Conventional |

| By Packaging | Supersacks, Bags, Bulk Tankers |

| By Sales Channel | B2B/Direct Sales, B2C/Indirect Sales, Hypermarket/Supermarket, Retail Stores, General Grocery Stores, Specialty Stores, Online Stores |

| Regions Covered | North America, Latin America, Europe, Middle East and Africa, Asia |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | The King Arthur Flour Company, Gold Medal, Bob’s Red Mill Natural Foods, Stone Ground, Georgia Organics, Heartland Mill Inc, Wheat Montana Anson Mills, Siemer Milling Company, Hodgson Mills, and Lindsey Mills. |

| Additional Attributes | Key trends include the adoption of clean-label and organic products, increased demand for high-fiber and functional foods, and innovations in milling technologies. |

| Customization and Pricing | Available upon request |

By product type industry has been categorized into Bread Flour, Pancake Flour, Cracker Flour & Pizza Flour.

By nature, industry has been categorized into conventional & organic.

By application industry has been categorized into Bread, Bakery Products, Biscuits, Rolls, Cookies, Buns, Sweet Goods, Desserts & Tortillas.

By packaging format industry has been categorized into Supersacks, Bags & Bulk Tankers.

By sales channel format industry has been categorized into B2B/Direct Sales, B2C/Indirect Sales, Hypermarket/ Supermarket, Retail Stores, General Grocery Stores, Specialty Stores & Online Stores.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, Middle East and Africa and Asia.

The global whole-wheat flour market is projected to reach USD 412.46 billion by 2035, growing from USD 260.57 billion in 2025 at a CAGR of 4.7% during the forecast period.

Bread flour dominates the product type segment due to its widespread use in baking and staple food applications, favored for its high protein content and dough elasticity.

The growth is driven by rising health-consciousness, increased demand for high-fiber snacks, and the global trend toward convenient, nutritious bakery products like cookies, buns, and sweet goods.

The Asia Pacific region is expected to grow at the fastest pace with a CAGR of 5.2%, fueled by high population, dietary shifts, and increased demand for processed wheat-based products in countries like China and India.

The conventional segment is expected to hold a market share of 90.3% in 2025, owing to its affordability, easy availability, and mass-market adoption across developed and developing economies.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2032

Table 2: Global Market Volume (Tons) Forecast by Region, 2017 to 2032

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 4: Global Market Volume (Tons) Forecast by Product Type, 2017 to 2032

Table 5: Global Market Value (US$ Million) Forecast by Nature, 2017 to 2032

Table 6: Global Market Volume (Tons) Forecast by Nature, 2017 to 2032

Table 7: Global Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 8: Global Market Volume (Tons) Forecast by Application, 2017 to 2032

Table 9: Global Market Value (US$ Million) Forecast by Packaging, 2017 to 2032

Table 10: Global Market Volume (Tons) Forecast by Packaging, 2017 to 2032

Table 11: Global Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2032

Table 12: Global Market Volume (Tons) Forecast by Sales Channel, 2017 to 2032

Table 13: North America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 14: North America Market Volume (Tons) Forecast by Country, 2017 to 2032

Table 15: North America Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 16: North America Market Volume (Tons) Forecast by Product Type, 2017 to 2032

Table 17: North America Market Value (US$ Million) Forecast by Nature, 2017 to 2032

Table 18: North America Market Volume (Tons) Forecast by Nature, 2017 to 2032

Table 19: North America Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 20: North America Market Volume (Tons) Forecast by Application, 2017 to 2032

Table 21: North America Market Value (US$ Million) Forecast by Packaging, 2017 to 2032

Table 22: North America Market Volume (Tons) Forecast by Packaging, 2017 to 2032

Table 23: North America Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2032

Table 24: North America Market Volume (Tons) Forecast by Sales Channel, 2017 to 2032

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 26: Latin America Market Volume (Tons) Forecast by Country, 2017 to 2032

Table 27: Latin America Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 28: Latin America Market Volume (Tons) Forecast by Product Type, 2017 to 2032

Table 29: Latin America Market Value (US$ Million) Forecast by Nature, 2017 to 2032

Table 30: Latin America Market Volume (Tons) Forecast by Nature, 2017 to 2032

Table 31: Latin America Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 32: Latin America Market Volume (Tons) Forecast by Application, 2017 to 2032

Table 33: Latin America Market Value (US$ Million) Forecast by Packaging, 2017 to 2032

Table 34: Latin America Market Volume (Tons) Forecast by Packaging, 2017 to 2032

Table 35: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2032

Table 36: Latin America Market Volume (Tons) Forecast by Sales Channel, 2017 to 2032

Table 37: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 38: Europe Market Volume (Tons) Forecast by Country, 2017 to 2032

Table 39: Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 40: Europe Market Volume (Tons) Forecast by Product Type, 2017 to 2032

Table 41: Europe Market Value (US$ Million) Forecast by Nature, 2017 to 2032

Table 42: Europe Market Volume (Tons) Forecast by Nature, 2017 to 2032

Table 43: Europe Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 44: Europe Market Volume (Tons) Forecast by Application, 2017 to 2032

Table 45: Europe Market Value (US$ Million) Forecast by Packaging, 2017 to 2032

Table 46: Europe Market Volume (Tons) Forecast by Packaging, 2017 to 2032

Table 47: Europe Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2032

Table 48: Europe Market Volume (Tons) Forecast by Sales Channel, 2017 to 2032

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 50: East Asia Market Volume (Tons) Forecast by Country, 2017 to 2032

Table 51: East Asia Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 52: East Asia Market Volume (Tons) Forecast by Product Type, 2017 to 2032

Table 53: East Asia Market Value (US$ Million) Forecast by Nature, 2017 to 2032

Table 54: East Asia Market Volume (Tons) Forecast by Nature, 2017 to 2032

Table 55: East Asia Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 56: East Asia Market Volume (Tons) Forecast by Application, 2017 to 2032

Table 57: East Asia Market Value (US$ Million) Forecast by Packaging, 2017 to 2032

Table 58: East Asia Market Volume (Tons) Forecast by Packaging, 2017 to 2032

Table 59: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2032

Table 60: East Asia Market Volume (Tons) Forecast by Sales Channel, 2017 to 2032

Table 61: South Asia & Pacific Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 62: South Asia & Pacific Market Volume (Tons) Forecast by Country, 2017 to 2032

Table 63: South Asia & Pacific Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 64: South Asia & Pacific Market Volume (Tons) Forecast by Product Type, 2017 to 2032

Table 65: South Asia & Pacific Market Value (US$ Million) Forecast by Nature, 2017 to 2032

Table 66: South Asia & Pacific Market Volume (Tons) Forecast by Nature, 2017 to 2032

Table 67: South Asia & Pacific Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 68: South Asia & Pacific Market Volume (Tons) Forecast by Application, 2017 to 2032

Table 69: South Asia & Pacific Market Value (US$ Million) Forecast by Packaging, 2017 to 2032

Table 70: South Asia & Pacific Market Volume (Tons) Forecast by Packaging, 2017 to 2032

Table 71: South Asia & Pacific Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2032

Table 72: South Asia & Pacific Market Volume (Tons) Forecast by Sales Channel, 2017 to 2032

Table 73: MEA Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 74: MEA Market Volume (Tons) Forecast by Country, 2017 to 2032

Table 75: MEA Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 76: MEA Market Volume (Tons) Forecast by Product Type, 2017 to 2032

Table 77: MEA Market Value (US$ Million) Forecast by Nature, 2017 to 2032

Table 78: MEA Market Volume (Tons) Forecast by Nature, 2017 to 2032

Table 79: MEA Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 80: MEA Market Volume (Tons) Forecast by Application, 2017 to 2032

Table 81: MEA Market Value (US$ Million) Forecast by Packaging, 2017 to 2032

Table 82: MEA Market Volume (Tons) Forecast by Packaging, 2017 to 2032

Table 83: MEA Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2032

Table 84: MEA Market Volume (Tons) Forecast by Sales Channel, 2017 to 2032

Figure 1: Global Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 2: Global Market Value (US$ Million) by Nature, 2022 to 2032

Figure 3: Global Market Value (US$ Million) by Application, 2022 to 2032

Figure 4: Global Market Value (US$ Million) by Packaging, 2022 to 2032

Figure 5: Global Market Value (US$ Million) by Sales Channel, 2022 to 2032

Figure 6: Global Market Value (US$ Million) by Region, 2022 to 2032

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2017 to 2032

Figure 8: Global Market Volume (Tons) Analysis by Region, 2017 to 2032

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 11: Global Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 12: Global Market Volume (Tons) Analysis by Product Type, 2017 to 2032

Figure 13: Global Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 14: Global Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 15: Global Market Value (US$ Million) Analysis by Nature, 2017 to 2032

Figure 16: Global Market Volume (Tons) Analysis by Nature, 2017 to 2032

Figure 17: Global Market Value Share (%) and BPS Analysis by Nature, 2022 to 2032

Figure 18: Global Market Y-o-Y Growth (%) Projections by Nature, 2022 to 2032

Figure 19: Global Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 20: Global Market Volume (Tons) Analysis by Application, 2017 to 2032

Figure 21: Global Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 22: Global Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 23: Global Market Value (US$ Million) Analysis by Packaging, 2017 to 2032

Figure 24: Global Market Volume (Tons) Analysis by Packaging, 2017 to 2032

Figure 25: Global Market Value Share (%) and BPS Analysis by Packaging, 2022 to 2032

Figure 26: Global Market Y-o-Y Growth (%) Projections by Packaging, 2022 to 2032

Figure 27: Global Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2032

Figure 28: Global Market Volume (Tons) Analysis by Sales Channel, 2017 to 2032

Figure 29: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2022 to 2032

Figure 30: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2022 to 2032

Figure 31: Global Market Attractiveness by Product Type, 2022 to 2032

Figure 32: Global Market Attractiveness by Nature, 2022 to 2032

Figure 33: Global Market Attractiveness by Application, 2022 to 2032

Figure 34: Global Market Attractiveness by Packaging, 2022 to 2032

Figure 35: Global Market Attractiveness by Sales Channel, 2022 to 2032

Figure 36: Global Market Attractiveness by Region, 2022 to 2032

Figure 37: North America Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 38: North America Market Value (US$ Million) by Nature, 2022 to 2032

Figure 39: North America Market Value (US$ Million) by Application, 2022 to 2032

Figure 40: North America Market Value (US$ Million) by Packaging, 2022 to 2032

Figure 41: North America Market Value (US$ Million) by Sales Channel, 2022 to 2032

Figure 42: North America Market Value (US$ Million) by Country, 2022 to 2032

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 44: North America Market Volume (Tons) Analysis by Country, 2017 to 2032

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 47: North America Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 48: North America Market Volume (Tons) Analysis by Product Type, 2017 to 2032

Figure 49: North America Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 50: North America Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 51: North America Market Value (US$ Million) Analysis by Nature, 2017 to 2032

Figure 52: North America Market Volume (Tons) Analysis by Nature, 2017 to 2032

Figure 53: North America Market Value Share (%) and BPS Analysis by Nature, 2022 to 2032

Figure 54: North America Market Y-o-Y Growth (%) Projections by Nature, 2022 to 2032

Figure 55: North America Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 56: North America Market Volume (Tons) Analysis by Application, 2017 to 2032

Figure 57: North America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 58: North America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 59: North America Market Value (US$ Million) Analysis by Packaging, 2017 to 2032

Figure 60: North America Market Volume (Tons) Analysis by Packaging, 2017 to 2032

Figure 61: North America Market Value Share (%) and BPS Analysis by Packaging, 2022 to 2032

Figure 62: North America Market Y-o-Y Growth (%) Projections by Packaging, 2022 to 2032

Figure 63: North America Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2032

Figure 64: North America Market Volume (Tons) Analysis by Sales Channel, 2017 to 2032

Figure 65: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2022 to 2032

Figure 66: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2022 to 2032

Figure 67: North America Market Attractiveness by Product Type, 2022 to 2032

Figure 68: North America Market Attractiveness by Nature, 2022 to 2032

Figure 69: North America Market Attractiveness by Application, 2022 to 2032

Figure 70: North America Market Attractiveness by Packaging, 2022 to 2032

Figure 71: North America Market Attractiveness by Sales Channel, 2022 to 2032

Figure 72: North America Market Attractiveness by Country, 2022 to 2032

Figure 73: Latin America Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 74: Latin America Market Value (US$ Million) by Nature, 2022 to 2032

Figure 75: Latin America Market Value (US$ Million) by Application, 2022 to 2032

Figure 76: Latin America Market Value (US$ Million) by Packaging, 2022 to 2032

Figure 77: Latin America Market Value (US$ Million) by Sales Channel, 2022 to 2032

Figure 78: Latin America Market Value (US$ Million) by Country, 2022 to 2032

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 80: Latin America Market Volume (Tons) Analysis by Country, 2017 to 2032

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 83: Latin America Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 84: Latin America Market Volume (Tons) Analysis by Product Type, 2017 to 2032

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 87: Latin America Market Value (US$ Million) Analysis by Nature, 2017 to 2032

Figure 88: Latin America Market Volume (Tons) Analysis by Nature, 2017 to 2032

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Nature, 2022 to 2032

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2022 to 2032

Figure 91: Latin America Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 92: Latin America Market Volume (Tons) Analysis by Application, 2017 to 2032

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 95: Latin America Market Value (US$ Million) Analysis by Packaging, 2017 to 2032

Figure 96: Latin America Market Volume (Tons) Analysis by Packaging, 2017 to 2032

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Packaging, 2022 to 2032

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Packaging, 2022 to 2032

Figure 99: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2032

Figure 100: Latin America Market Volume (Tons) Analysis by Sales Channel, 2017 to 2032

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2022 to 2032

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2022 to 2032

Figure 103: Latin America Market Attractiveness by Product Type, 2022 to 2032

Figure 104: Latin America Market Attractiveness by Nature, 2022 to 2032

Figure 105: Latin America Market Attractiveness by Application, 2022 to 2032

Figure 106: Latin America Market Attractiveness by Packaging, 2022 to 2032

Figure 107: Latin America Market Attractiveness by Sales Channel, 2022 to 2032

Figure 108: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 109: Europe Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 110: Europe Market Value (US$ Million) by Nature, 2022 to 2032

Figure 111: Europe Market Value (US$ Million) by Application, 2022 to 2032

Figure 112: Europe Market Value (US$ Million) by Packaging, 2022 to 2032

Figure 113: Europe Market Value (US$ Million) by Sales Channel, 2022 to 2032

Figure 114: Europe Market Value (US$ Million) by Country, 2022 to 2032

Figure 115: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 116: Europe Market Volume (Tons) Analysis by Country, 2017 to 2032

Figure 117: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 118: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 119: Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 120: Europe Market Volume (Tons) Analysis by Product Type, 2017 to 2032

Figure 121: Europe Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 122: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 123: Europe Market Value (US$ Million) Analysis by Nature, 2017 to 2032

Figure 124: Europe Market Volume (Tons) Analysis by Nature, 2017 to 2032

Figure 125: Europe Market Value Share (%) and BPS Analysis by Nature, 2022 to 2032

Figure 126: Europe Market Y-o-Y Growth (%) Projections by Nature, 2022 to 2032

Figure 127: Europe Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 128: Europe Market Volume (Tons) Analysis by Application, 2017 to 2032

Figure 129: Europe Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 130: Europe Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 131: Europe Market Value (US$ Million) Analysis by Packaging, 2017 to 2032

Figure 132: Europe Market Volume (Tons) Analysis by Packaging, 2017 to 2032

Figure 133: Europe Market Value Share (%) and BPS Analysis by Packaging, 2022 to 2032

Figure 134: Europe Market Y-o-Y Growth (%) Projections by Packaging, 2022 to 2032

Figure 135: Europe Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2032

Figure 136: Europe Market Volume (Tons) Analysis by Sales Channel, 2017 to 2032

Figure 137: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2022 to 2032

Figure 138: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2022 to 2032

Figure 139: Europe Market Attractiveness by Product Type, 2022 to 2032

Figure 140: Europe Market Attractiveness by Nature, 2022 to 2032

Figure 141: Europe Market Attractiveness by Application, 2022 to 2032

Figure 142: Europe Market Attractiveness by Packaging, 2022 to 2032

Figure 143: Europe Market Attractiveness by Sales Channel, 2022 to 2032

Figure 144: Europe Market Attractiveness by Country, 2022 to 2032

Figure 145: East Asia Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 146: East Asia Market Value (US$ Million) by Nature, 2022 to 2032

Figure 147: East Asia Market Value (US$ Million) by Application, 2022 to 2032

Figure 148: East Asia Market Value (US$ Million) by Packaging, 2022 to 2032

Figure 149: East Asia Market Value (US$ Million) by Sales Channel, 2022 to 2032

Figure 150: East Asia Market Value (US$ Million) by Country, 2022 to 2032

Figure 151: East Asia Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 152: East Asia Market Volume (Tons) Analysis by Country, 2017 to 2032

Figure 153: East Asia Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 154: East Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 155: East Asia Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 156: East Asia Market Volume (Tons) Analysis by Product Type, 2017 to 2032

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 159: East Asia Market Value (US$ Million) Analysis by Nature, 2017 to 2032

Figure 160: East Asia Market Volume (Tons) Analysis by Nature, 2017 to 2032

Figure 161: East Asia Market Value Share (%) and BPS Analysis by Nature, 2022 to 2032

Figure 162: East Asia Market Y-o-Y Growth (%) Projections by Nature, 2022 to 2032

Figure 163: East Asia Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 164: East Asia Market Volume (Tons) Analysis by Application, 2017 to 2032

Figure 165: East Asia Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 166: East Asia Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 167: East Asia Market Value (US$ Million) Analysis by Packaging, 2017 to 2032

Figure 168: East Asia Market Volume (Tons) Analysis by Packaging, 2017 to 2032

Figure 169: East Asia Market Value Share (%) and BPS Analysis by Packaging, 2022 to 2032

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by Packaging, 2022 to 2032

Figure 171: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2032

Figure 172: East Asia Market Volume (Tons) Analysis by Sales Channel, 2017 to 2032

Figure 173: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2022 to 2032

Figure 174: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2022 to 2032

Figure 175: East Asia Market Attractiveness by Product Type, 2022 to 2032

Figure 176: East Asia Market Attractiveness by Nature, 2022 to 2032

Figure 177: East Asia Market Attractiveness by Application, 2022 to 2032

Figure 178: East Asia Market Attractiveness by Packaging, 2022 to 2032

Figure 179: East Asia Market Attractiveness by Sales Channel, 2022 to 2032

Figure 180: East Asia Market Attractiveness by Country, 2022 to 2032

Figure 181: South Asia & Pacific Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 182: South Asia & Pacific Market Value (US$ Million) by Nature, 2022 to 2032

Figure 183: South Asia & Pacific Market Value (US$ Million) by Application, 2022 to 2032

Figure 184: South Asia & Pacific Market Value (US$ Million) by Packaging, 2022 to 2032

Figure 185: South Asia & Pacific Market Value (US$ Million) by Sales Channel, 2022 to 2032

Figure 186: South Asia & Pacific Market Value (US$ Million) by Country, 2022 to 2032

Figure 187: South Asia & Pacific Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 188: South Asia & Pacific Market Volume (Tons) Analysis by Country, 2017 to 2032

Figure 189: South Asia & Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 190: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 191: South Asia & Pacific Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 192: South Asia & Pacific Market Volume (Tons) Analysis by Product Type, 2017 to 2032

Figure 193: South Asia & Pacific Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 194: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 195: South Asia & Pacific Market Value (US$ Million) Analysis by Nature, 2017 to 2032

Figure 196: South Asia & Pacific Market Volume (Tons) Analysis by Nature, 2017 to 2032

Figure 197: South Asia & Pacific Market Value Share (%) and BPS Analysis by Nature, 2022 to 2032

Figure 198: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Nature, 2022 to 2032

Figure 199: South Asia & Pacific Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 200: South Asia & Pacific Market Volume (Tons) Analysis by Application, 2017 to 2032

Figure 201: South Asia & Pacific Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 202: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 203: South Asia & Pacific Market Value (US$ Million) Analysis by Packaging, 2017 to 2032

Figure 204: South Asia & Pacific Market Volume (Tons) Analysis by Packaging, 2017 to 2032

Figure 205: South Asia & Pacific Market Value Share (%) and BPS Analysis by Packaging, 2022 to 2032

Figure 206: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Packaging, 2022 to 2032

Figure 207: South Asia & Pacific Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2032

Figure 208: South Asia & Pacific Market Volume (Tons) Analysis by Sales Channel, 2017 to 2032

Figure 209: South Asia & Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2022 to 2032

Figure 210: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2022 to 2032

Figure 211: South Asia & Pacific Market Attractiveness by Product Type, 2022 to 2032

Figure 212: South Asia & Pacific Market Attractiveness by Nature, 2022 to 2032

Figure 213: South Asia & Pacific Market Attractiveness by Application, 2022 to 2032

Figure 214: South Asia & Pacific Market Attractiveness by Packaging, 2022 to 2032

Figure 215: South Asia & Pacific Market Attractiveness by Sales Channel, 2022 to 2032

Figure 216: South Asia & Pacific Market Attractiveness by Country, 2022 to 2032

Figure 217: MEA Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 218: MEA Market Value (US$ Million) by Nature, 2022 to 2032

Figure 219: MEA Market Value (US$ Million) by Application, 2022 to 2032

Figure 220: MEA Market Value (US$ Million) by Packaging, 2022 to 2032

Figure 221: MEA Market Value (US$ Million) by Sales Channel, 2022 to 2032

Figure 222: MEA Market Value (US$ Million) by Country, 2022 to 2032

Figure 223: MEA Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 224: MEA Market Volume (Tons) Analysis by Country, 2017 to 2032

Figure 225: MEA Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 226: MEA Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 227: MEA Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 228: MEA Market Volume (Tons) Analysis by Product Type, 2017 to 2032

Figure 229: MEA Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 230: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 231: MEA Market Value (US$ Million) Analysis by Nature, 2017 to 2032

Figure 232: MEA Market Volume (Tons) Analysis by Nature, 2017 to 2032

Figure 233: MEA Market Value Share (%) and BPS Analysis by Nature, 2022 to 2032

Figure 234: MEA Market Y-o-Y Growth (%) Projections by Nature, 2022 to 2032

Figure 235: MEA Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 236: MEA Market Volume (Tons) Analysis by Application, 2017 to 2032

Figure 237: MEA Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 238: MEA Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 239: MEA Market Value (US$ Million) Analysis by Packaging, 2017 to 2032

Figure 240: MEA Market Volume (Tons) Analysis by Packaging, 2017 to 2032

Figure 241: MEA Market Value Share (%) and BPS Analysis by Packaging, 2022 to 2032

Figure 242: MEA Market Y-o-Y Growth (%) Projections by Packaging, 2022 to 2032

Figure 243: MEA Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2032

Figure 244: MEA Market Volume (Tons) Analysis by Sales Channel, 2017 to 2032

Figure 245: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2022 to 2032

Figure 246: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2022 to 2032

Figure 247: MEA Market Attractiveness by Product Type, 2022 to 2032

Figure 248: MEA Market Attractiveness by Nature, 2022 to 2032

Figure 249: MEA Market Attractiveness by Application, 2022 to 2032

Figure 250: MEA Market Attractiveness by Packaging, 2022 to 2032

Figure 251: MEA Market Attractiveness by Sales Channel, 2022 to 2032

Figure 252: MEA Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Korea Whole-wheat Flour Market Analysis by Product Type, Nature, Application, Packaging, Sales Channel, and Region Through 2035

Japan Whole-wheat Flour Market Analysis by Product Type, Nature, Application, Packaging, Sales Channel, and Region Through 2035

Demand for Whole-Wheat Flour in EU Size and Share Forecast Outlook 2025 to 2035

Western Europe Whole Wheat Flour Market Analysis – Trends, Demand & Forecast 2025–2035

Flour Mixes Market Growth – Specialty Baking & Industry Trends 2025 to 2035

Flour Substitutes Market Analysis by Baked Goods, Noodles, Pastry, Fried Food, Pasta, Bread, Crackers Applications Through 2035

Flour Conditioner Market

Flour Improvers Market

Corn Flour Market Size and Share Forecast Outlook 2025 to 2035

Bean Flour Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Bean Flour Manufacturers

Pulse Flours Market Size and Share Forecast Outlook 2025 to 2035

Vegan Flour Market Growth - Plant-Based Innovation & Industry Demand 2025 to 2035

Cereal Flour Market Size and Share Forecast Outlook 2025 to 2035

Silica Flour Market Size and Share Forecast Outlook 2025 to 2035

Banana Flour Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Almond Flour Market Analysis - Size, Share, and Forecast 2025 to 2035

Millet Flour Market Analysis by Pearl Millet, Finger Millet, Foxtail Millet, Proso Millet, Kodo Millet, and Others Through 2035

Konjac Flour Market Analysis by Applications and Functions Through 2025 to 2035

Peanut Flour Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA