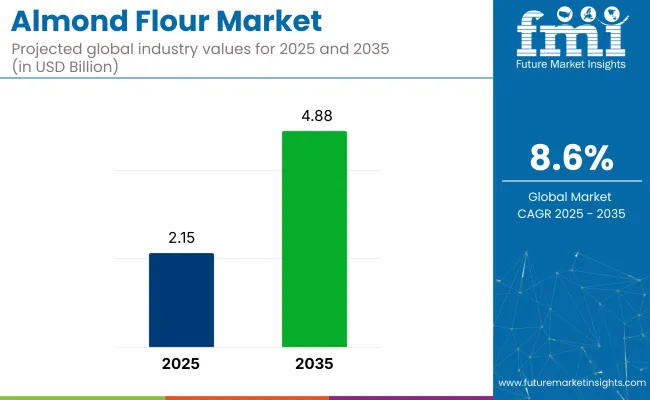

The almond flour market is experiencing substantial growth, with a year-on-year increase of 8.4%, reaching an estimated USD 2.15 billion by 2025. Forecasts predict a CAGR of 8.6%, leading to an industry value of USD 4.88 billion by 2035.

| Attributes | Description |

|---|---|

| Estimated Industry Size (2025E) | USD 2.15 billion |

| Projected Industry Value (2035F) | USD 4.88 billion |

| Value-based CAGR (2025 to 2035) | 8.6% |

The surge is driven by the growing preference for gluten-free, low-carb, and grain-free diets, particularly in the ketogenic, paleo, and Whole30 communities. Almond meals nutritional benefits, including its protein, healthy fats, and micronutrient content, further enhance its appeal. Innovations in baking and plant-based products also contribute to its expanding use in diverse food applications.

The sector holds a small yet notable share in its parent industries. Within the gluten-free products industry, almond flour accounts for approximately 6-8%, driven by its widespread use in gluten-free baking. in the nuts & seeds industry, it represents about 4-6%, as it is derived from almonds, a key player in the sector.

within the baking ingredients industry, almond flour holds a significant share of around 10-12%, owing to its popularity in premium and gluten-free baking. In the organic food industry, almond flour’s share is approximately 3-5%, as it is frequently available in organic forms. Lastly, in the health & wellness food industry, almond based flour captures around 2-4%, driven by its perceived health benefits in clean-label products.

Mark Masten, CEO of Treehouse California Almonds, emphasizes the company’s commitment to innovation and collaboration in the almond ingredient sector. He highlights the importance of understanding customer needs and developing tailored almond products to meet those demands.

The market is experiencing strong growth, driven by rising consumer demand for gluten-free, low-carb, and plant-based food options. These trends indicate that companies in the sector are focusing on product innovation and strategic partnerships to capitalize on emerging opportunities. This reflects a shared recognition of the market's potential and the strategies being employed to address evolving consumer preferences.

Nutritional awareness has increased appreciation for almond flour’s protein, healthy fats, and micronutrient density compared to refined flours. The plant-based movement has embraced in creating meat analogs and dairy-free formulations, with companies like Anthony’s Goods leading the way.

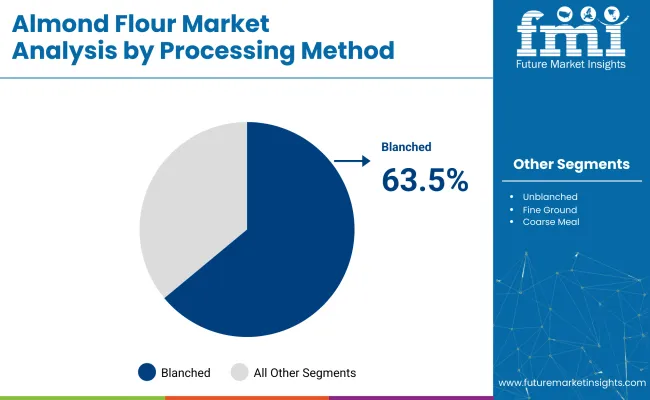

Almond flour market analysis by top investment segments. The segmentation has been conducted by processing method into blanched, unblanched, fine ground, and coarse meal. Certification status has been categorized into organic, conventional, non-GMO, and specialty certified.

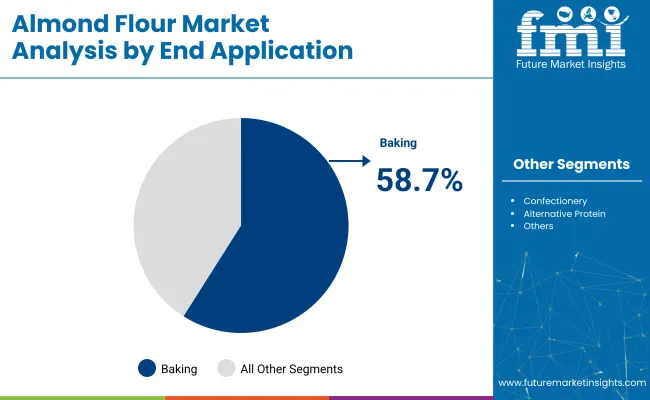

End application has been divided into baking, confectionery, alternative protein, and coatings and crusts. Packaging size has been segmented into bulk industrial, professional kitchen, retail standard, and single-use. Region has been classified into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia and Pacific, and the Middle East and Africa.

Blanched almond flour is projected to dominate with a 63.5% share in 2025.

The baking sector is expected to account for 58.7% of almond based flour applications by 2025.

Retail standard packaging is expected to capture 35% portion of the almond flour market in 2025.

Organic flour is expected to capture 40% share of the market, especially in 2025.

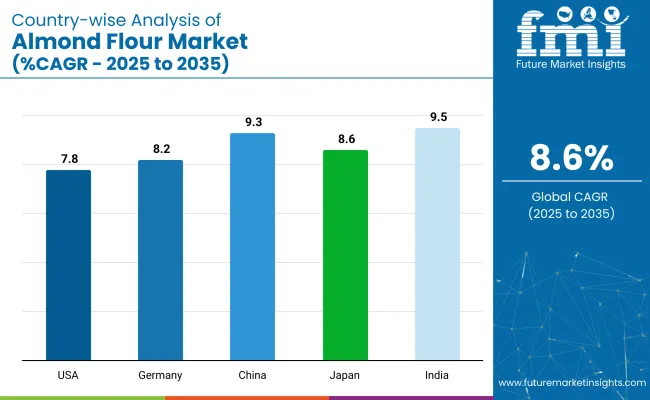

| Countries | CAGR (%) |

|---|---|

| United States | 7.8% |

| Germany | 8.2% |

| China | 9.3% |

| Japan | 8.6% |

| India | 9.5% |

India’s momentum is driven by its increasing demand for gluten-free products, fueled by rising disposable incomes and growing awareness of health-conscious diets. China follows closely, with a projected 9.3% CAGR, supported by a rapidly growing middle class seeking premium and healthier food options. In contrast, developed economies such as Japan (8.6%), Germany (8.2%), and the United States (7.8%) are expanding at a steady pace.

Germany is advancing its demand for plant-based, allergen-free ingredients, while Japan benefits from rising demand for gluten-free baking options in the health-conscious consumer segment. The United States continues to see steady growth in almond based flour adoption, particularly among health-conscious consumers. As the market adds over USD 200 million by 2035, both high-growth regions like India and China, as well as stable demand from OECD countries, will significantly shape its trajectory.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

The sector in the United States is expected to grow at a CAGR of 7.8% from 2025 to 2035. The demand for gluten-free and low-carb alternatives is driving significant interest in almond meal, particularly in the bakery and snack industries.

In the UK, the sector is expected to grow steadily with a CAGR of 7.2%. The rise of health-conscious consumers, alongside a growing preference for gluten-free and low-carb food alternatives, is driving the demand for almond based flour.

Germany's sector is projected to grow at a CAGR of 8.2%. The country’s health-conscious population is increasingly adopting gluten-free and plant-based food options, boosting almond flour’s demand across the food industry.

The almond flour sector in South Korea is experiencing steady growth, with a projected CAGR of 8.5%. South Korean consumers' growing interest in health and wellness is driving demand for gluten-free and low-carb ingredients like almond based flour.

India is poised to lead in almond flour consumption, with a projected CAGR of 9.5% from 2025 to 2035. The growing prevalence of health issues like obesity and diabetes is driving the demand for gluten-free and low-carb food alternatives.

The industry is dominated by well-established players such as Blue Diamond Growers and Bob's Red Mill Natural Foods. Blue Diamond Growers has focused on strategic product launches and maintaining strong brand recognition by offering a variety of almond-based products, including their flour range, aimed at both retail and foodservice sectors. Bob's Red Mill, known for its emphasis on healthy and natural ingredients, continuously invests in research and development to enhance its product offerings, catering to the increasing demand for gluten-free and low-carb options.

Emerging players like Anthony’s Goods and Woodland Foods are also carving a niche by offering organic and specialty flour products. The sector remains fragmented, with small and medium-sized players vying for share. Entry barriers include high production costs and the need for continuous innovation, while consolidation remains minimal due to the rise of niche offerings.

Leading Almond Flour Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 2.15 billion |

| Projected Market Size (2035) | USD 4.88 billion |

| CAGR (2025 to 2035) | 8.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Processing Methods Analyzed | Blanched, Unblanched, Fine Ground, Coarse Meal |

| Certification Status Analyzed | Organic, Conventional, Non-GMO, Specialty Certified |

| End Applications Analyzed | Baking, Confectionery, Alternative Protein, Coatings & Crusts |

| Packaging Sizes Analyzed | Bulk Industrial, Professional Kitchen, Retail Standard, Single-Use |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, France, United Kingdom, Italy, Spain, China, Japan, South Korea, India, Australia, United Arab Emirates (UAE), South Africa |

| Key Players | Blue Diamond Growers, Bob's Red Mill Natural Foods, King Arthur Flour Company, Barney Butter, Hodgson Mill, Anthony's Goods, Now Foods, Honeyville , Woodland Foods, Other Players |

| Additional Attributes | Dollar sales growth by product type, regional demand trends, competitive landscape, pricing strategies, consumer preferences, packaging innovation, distribution channels, and organic product demand. |

As per processing method, the industry has been categorized into Blanched, Unblanched, Fine Ground, and Coarse Meal.

This segment is further categorized into Organic, Conventional, Non-GMO, and Specialty Certified.

This segment is further categorized into Baking, Confectionery, Alternative Protein, and Coatings & Crusts.

This segment is further categorized into Bulk Industrial, Professional Kitchen, Retail Standard, and Single-Use.

Industry analysis has been conducted in key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is expected to reach USD 4.88 billion by 2035.

The market size is projected to be USD 2.15 billion in 2025.

The market is expected to grow at a CAGR of 8.6% from 2025 to 2035.

India is expected to grow at a CAGR of 9.5%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Almond Milk Market Size and Share Forecast Outlook 2025 to 2035

Almond Products Market Size and Share Forecast Outlook 2025 to 2035

Almond Oil-Based Serums Market Size and Share Forecast Outlook 2025 to 2035

Almond Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Almond Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Almond Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Almond Extract Market Analysis - Size, Share, and Forecast 2025 to 2035

Almond Drink Market Analysis - Size, Share, and Forecast 2025 to 2035

Almond Butter Market Growth - Healthy Spreads & Industry Demand 2025 to 2035

Demand for Almond Ingredients in EU Size and Share Forecast Outlook 2025 to 2035

Flour Mixes Market Growth – Specialty Baking & Industry Trends 2025 to 2035

Flour Substitutes Market Analysis by Baked Goods, Noodles, Pastry, Fried Food, Pasta, Bread, Crackers Applications Through 2035

Flour Conditioner Market

Flour Improvers Market

Corn Flour Market Size and Share Forecast Outlook 2025 to 2035

Bean Flour Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Bean Flour Manufacturers

Pulse Flours Market Size and Share Forecast Outlook 2025 to 2035

Vegan Flour Market Growth - Plant-Based Innovation & Industry Demand 2025 to 2035

Cereal Flour Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA