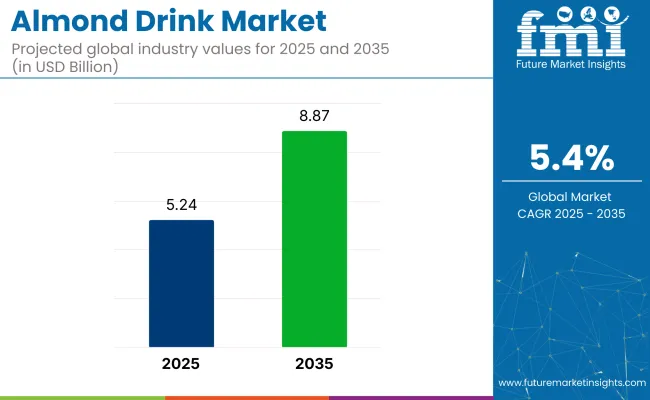

The global almond drink market is expected to grow from USD 5.24 billion in 2025 to USD 8.87 billion by 2035, at a CAGR of 5.4%. This growth is fueled by the rising demand for plant-based, dairy-free beverages driven by health, sustainability, and ethical concerns. Almond drinks are gaining popularity for their nutritional benefits, being low in calories, rich in vitamins, and a good source of calcium and vitamin D.

The industry holds varying shares within its parent industries. In the plant-based milk sector, almond milk leads with a 56% share of the global revenue. Within the dairy alternatives industry, almond drinks account for a substantial portion, estimated at around 30-35%, as they remain a top choice among plant-based milk options. In the non-alcoholic beverages sector, almond milk’s share is less defined but contributes notably, especially in the health-conscious segment.

Within the functional beverages industry, almond drinks, particularly fortified versions, make up a significant percentage, estimated at 5-7%. In the organic food and beverage industry, organic almond milk is growing rapidly, though it still holds a smaller share of around 3-4%.

In 2024, the almond drink industry experienced significant mergers, acquisitions, and innovations. Refresco acquired FríasNutrición, enhancing its plant-based beverage portfolio and driving product innovation. Oddlygood, a Finnish company, expanded into the UK industry by acquiring Rude Health, known for its clean-label almond milk products.

MPearlRock acquired Nutpods, a leading non-dairy creamer brand, further solidifying its position in the plant-based sector. Above Foods merged with Bite Acquisition Corporation, becoming publicly listed, which allowed for increased investment in sustainable and innovative plant-based formulations. These strategic moves showcase the industry's focus on growth, innovation, and meeting rising consumer demand for plant-based alternatives.

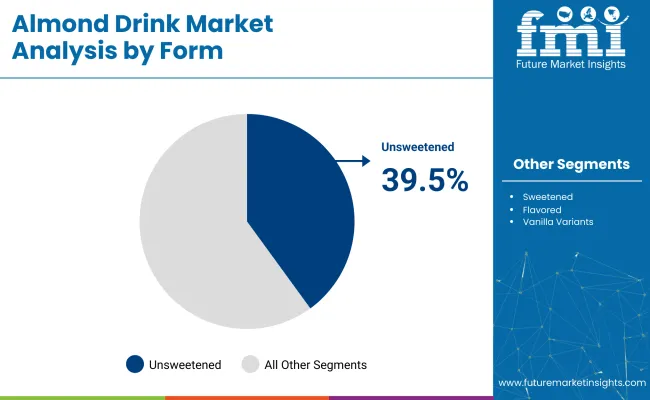

The industry will grow due to rising demand for plant-based beverages. Carton packs will hold 64.2% of the industry share in 2025, offering convenience and long shelf life. Unsweetened variants, capturing 39.5% of the flavor segment, cater to health-conscious, low-sugar preferences, driving growth in both retail and online platforms.

Unsweetened almond drinks will capture 39.5% of the flavor segment in 2025.

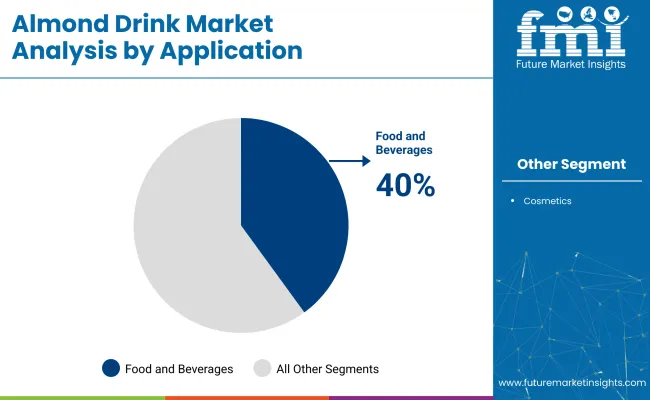

The food and beverage sector are expected to dominate the almond drink industry, contributing to a 40% share in 2025.

In 2025, hypermarkets and supermarkets are expected to capture 64% of the almond drink market share.

The product's appeal lies in its lactose-free, low-calorie, and nutrient-rich profile, making it a preferred alternative to dairy milk. Additionally, the rise in vegan and vegetarian populations, along with a surge in food allergies and lactose intolerance, further propels demand.

Recent Market Trends and Innovations by Key Players

Challenges in the Almond Drinks Market

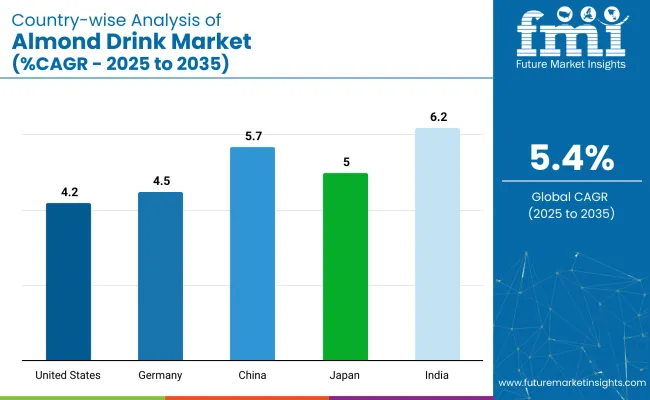

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 4.2% |

| Germany | 4.5% |

| China | 5.7% |

| Japan | 5.0% |

| India | 6.2% |

The OECD countries, including the United States and Germany, exhibit steady growth. The United States, with a projected CAGR of 4.2%, shows moderate growth, driven by a strong and consistent demand for plant-based beverages, particularly among health-conscious consumers.

As the industry matures, the USA continues to be a significant player in the almond drink segment, where demand for dairy alternatives is steadily rising. Germany, with a slightly higher CAGR of 4.5%, benefits from a long-standing health-focused consumer base and an established industry for plant-based milk options, ensuring continued stable growth.

The emerging industries within the BRICS group, especially India, are witnessing faster growth. India, with a projected CAGR of 6.2%, is experiencing a surge in demand for almond drinks, fueled by increasing health awareness, rising disposable incomes, and a growing preference for plant-based alternatives. The country’s expanding middle class and interest in dairy-free options position it as one of the fastest-growing industries for almond drinks.

China, with a projected CAGR of 5.7%, also reflects rapid adoption of plant-based beverages, as consumers seek healthier alternatives to dairy products. Japan, with a CAGR of 5.0%, continues to see steady growth driven by the increasing popularity of plant-based milk, especially among younger, health-conscious populations.

The report covers a detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

The in the USA is projected to grow at a 4.2% CAGR from 2025 to 2035, driven by increasing consumer demand for dairy-free and plant-based beverages. Increased interest in vegan and lactose-free diets is driving the popularity, known for their low-calorie content and high vitamin E levels.

The industry in the UK is expected to grow at a 4.5% CAGR from 2025 to 2035. This growth is driven by the increasing popularity of plant-based diets, as more consumers choose dairy-free beverages due to lactose intolerance or vegan preferences.

The industry is projected to grow at a 4.5% CAGR from 2025 to 2035. The industry is benefiting from increasing consumer interest in plant-based products, driven by health-conscious and environmentally aware consumers. These drinks are seen as a premium, natural alternative to dairy, aligning with Germany's preference for organic and responsibly sourced foods.

The Industry in china is set to experience robust growth, with a projected CAGR of 5.7% from 2025 to 2035. The growth is driven by increased health awareness among consumers, especially in urban areas, shifting from traditional dairy to plant-based alternatives.

The Industry in Japan is projected to grow at a 5.0% CAGR from 2025 to 2035, supported by increasing consumer interest in plant-based, health-conscious beverages.

The industry in India is anticipated to grow at a 6.2% CAGR from 2025 to 2035, driven by rising health concerns and increasing awareness of the harmful effects of excessive sugar consumption. Almond drinks are becoming popular, especially in urban areas, as a nutritious, low-calorie alternative to dairy products.

The almond drink industry is characterized by a mix of established players and emerging companies, all competing through innovation and product diversification. Leading brands such as Fuerst Day Lawson, The Pressery, and White Wave Foods continue to invest heavily in research and development, responding to the growing consumer demand for plant-based beverages.

Califia Farms has made significant strides by expanding its product range to include new flavors and sustainable packaging, while The Luz Almond Company Pty Ltd focuses on catering to the demand for organic and gluten-free options.

Dominant companies like Alpro and Hain Celestial Group benefit from their extensive distribution networks and strong brand presence, creating high entry barriers for new players. The industry remains fragmented, with consolidation taking place alongside the emergence of new, niche brands.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 5.24 billion |

| Projected Market Size (2035) | USD 8.87 billion |

| CAGR (2025 to 2035) | 5.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Form Types Analyzed | Sweetened, Unsweetened, Flavored, Chocolate, Vanilla |

| Applications Analyzed | Food & Beverages, Cosmetics |

| Distribution Channels Analyzed | Hypermarkets/Supermarkets, Department & Grocery Stores, Online Retailers, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, France, United Kingdom, Italy, Spain, China, Japan, South Korea, India, Australia, United Arab Emirates (UAE), South Africa |

| Key Players | Fuerst Day Lawson, The Pressery, White Wave Foods, Hain Celestial Group, The Luz Almond Company Pty Ltd, Nutriops, Hiland Dairy Foods, Califia Farms, Daiya Foods Inc., Pacific Foods of Oregon LLC, Alpro, Others |

| Additional Attributes | Dollar sales growth by form (sweetened/unsweetened), regional demand trends, competitive landscape, pricing strategies, distribution channels, consumer preferences, formulation innovations. |

It includes sweetened, unsweetened, flavored, chocolate, and vanilla variants.

It is categorized into food & beverages and cosmetics.

The industry is divided into hypermarkets/supermarkets, department & grocery stores, online retailers, and others.

The industry is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa

The industry is valued at USD 5.24 billion in 2025.

It is forecasted to reach USD 8.87 billion by 2035.

The industry is anticipated to grow at a CAGR of 5.4% during this period.

The food & beverages application segment is projected to lead the market with a 60% share in 2035.

East Asia is expected to be the key growth region, with a projected growth rate of 7.8%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Almond Milk Market Size and Share Forecast Outlook 2025 to 2035

Almond Products Market Size and Share Forecast Outlook 2025 to 2035

Almond Oil-Based Serums Market Size and Share Forecast Outlook 2025 to 2035

Almond Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Almond Flour Market Analysis - Size, Share, and Forecast 2025 to 2035

Almond Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Almond Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Almond Extract Market Analysis - Size, Share, and Forecast 2025 to 2035

Almond Butter Market Growth - Healthy Spreads & Industry Demand 2025 to 2035

Demand for Almond Ingredients in EU Size and Share Forecast Outlook 2025 to 2035

Drinkable Yogurt Market Size and Share Forecast Outlook 2025 to 2035

Drinking Fountain Market Size and Share Forecast Outlook 2025 to 2035

Drink Carrier Poly Bags Market Size and Share Forecast Outlook 2025 to 2035

Drink Cans Market Insights - Growth & Trends 2025 to 2035

Leading Providers & Market Share in Drink Carrier Poly Bags

Drinkware Accessories Market

Oat Drink Market Analysis - Size, Share & Forecast 2025 to 2035

Soft Drinks Packaging Market Size and Share Forecast Outlook 2025 to 2035

Soft Drinks Concentrates Market Trends - Growth & Forecast

Analysis and Growth Projections for Detox Drink market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA