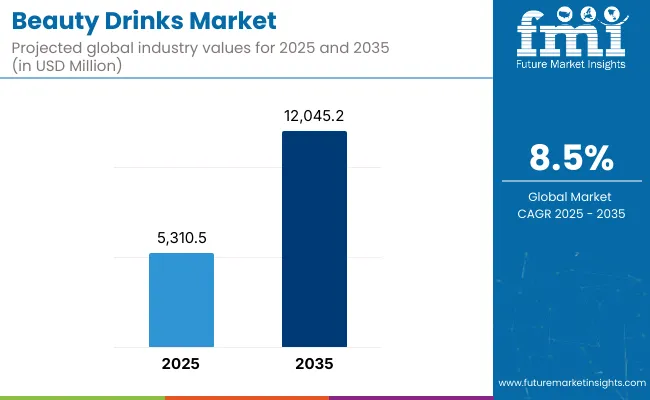

The Beauty Drinks Market is expected to record a valuation of USD 5,310.5 million in 2025 and USD 12,045.2 million in 2035. The overall expansion represents a CAGR of 8.5% and a 2.3X increase in market size.

Beauty Drinks Market Key Takeaways

| Metric | Value |

| Market Estimated Value in (2025E) | USD 5,310.5 million |

| Market Forecast Value in (2035F) | USD 12,045.2 million |

| Forecast CAGR (2025 to 2035) | 8.5% |

During the first five-year period from 2025 to 2030, the market increases from USD 5,310.5 million to USD 7,980 million, adding USD 2,669.5 million, which accounts for 39.9% of the total decade growth. This phase records steady adoption in collagen-based formulations, skin hydration-focused RTDs, and anti-aging beauty supplements, driven by consumer preference for ingestible skincare. Ready-to-drink (RTD) formats dominate this period as they cater to over 36% of consumer applications demanding convenience and on-the-go functionality.

The second half from 2030 to 2035 contributes USD 4,020 million, equal to 60.1% of total growth, as the market jumps from USD 8,025.2 million to USD 12,045.2 million. This acceleration is powered by widespread deployment of digitally native beauty brands, AI-personalized nutrition, and clinical-grade nutricosmetics in wellness routines. Multi-functional ingredient blends such as collagen with probiotics and botanical antioxidants capture a larger share above 55% by the end of the decade. Subscription-based DTC models and wellness analytics platforms add recurring revenue, increasing the online retail channel share beyond 34% in total market value.

From 2020 to 2024, the Beauty Drinks Market grew from USD 3,280 million to USD 4,780 million, driven by collagen-centric product adoption and early-stage consumer awareness in Asia-Pacific and North America. During this period, the competitive landscape was dominated by beauty-focused nutrition brands, controlling nearly 65% of total revenue, with leaders such as Shiseido Co., Ltd., Amorepacific Corporation, and The Bountiful Company (NeoCell) focusing on collagen-based hydration and anti-aging formulations.

Competitive differentiation relied on ingredient purity, product format (e.g., RTDs, ampoules), and beauty claims, while probiotics and botanicals were often bundled as auxiliary ingredients rather than primary selling points. Subscription-based or service-led models had minimal traction, contributing less than 5% of the total market value.

Demand for beauty drinks will expand to USD 5,310.5 million in 2025, and the revenue mix will shift as multi-functional formulations and online channels grow to over 40% share. Traditional product leaders face rising competition from digitally native DTC brands offering personalized skin-beauty nutrition, AI-powered supplement recommendations, and beauty-focused functional shots.

Major legacy players are pivoting to hybrid business models, integrating e-commerce, influencer channels, and subscription platforms to retain relevance. Emerging entrants specializing in gut-skin health connections, clean-label collagen, and sustainable packaging are gaining share. The competitive advantage is moving away from pure ingredient sourcing to ecosystem strength, digital reach, and recurring consumer engagement.

The Beauty Drinks Market is witnessing sustained growth due to the scientific repositioning of skincare as a nutritional solution, particularly among aging urban populations seeking alternatives to topical cosmetics. In markets such as China, Japan, and South Korea, long-standing cultural integration of “beauty-from-within” rituals has catalyzed the normalization of daily collagen, antioxidant, and botanical drink consumption.

This regional influence has rapidly diffused into Western markets like the USA and the UK, where consumers increasingly perceive nutricosmetics as an extension of skincare regimens. Beauty drinks are no longer marketed as supplements but as functional beverages with clinically supported benefits for hydration, elasticity, and pigmentation. This clinical backing, often displayed prominently on packaging, is accelerating conversion among health-literate consumers, especially those skeptical of traditional cosmetic products.

In parallel, format innovation and digital commerce have unlocked new revenue streams and elevated consumer engagement. Ready-to-drink ampoules, powder sachets, and effervescent tablets have been optimized for convenience and lifestyle integration, particularly among working professionals and beauty-conscious Gen Z consumers. Direct-to-consumer (DTC) models, subscription-based replenishment, and personalized skin-health journeys driven by AI tools are redefining how consumers access and stay loyal to beauty drink brands.

The shift toward multifunctional blendssuch as collagen combined with probiotics or vitamin Chas further enhanced value perception, enabling premium pricing in mature markets. These dynamics collectively contribute to the market’s robust upward trajectory from 2025 to 2035, especially in digitally mature and skin-health-aware economies.

The Beauty Drinks Market is segmented by product type, Ingredient Type, packaging format, distribution channel, and region, reflecting the diverse drivers of consumer behavior and product formulation strategies. Product types include Anti-Aging Beauty Drinks, Skin Hydration and Radiance Drinks, Hair and Nail Support Drinks, Detox and Cleansing Beauty Drinks, Skin Whitening / Brightening Drinks, Acne-Reducing and Skin Clarifying Drinks, and Multi-Functional / All-in-One Beauty Drinks, each addressing specific beauty concerns such as elasticity, radiance, or skin tone.

On the ingredient front, the market comprises Collagen-Based Beauty Drinks (including marine, bovine, and plant-based sources), Antioxidant-Enriched Drinks (with vitamin C, vitamin E, and polyphenols like resveratrol), Hyaluronic Acid-Infused Drinks, Biotin and Mineral-Enriched Drinks (featuring zinc, selenium, and silica), Probiotic and Prebiotic Beauty Drinks (using Lactobacillus, Bifidobacterium, inulin, FOS, and GOS), Botanical Extract-Based Drinks (with aloe vera, green tea, turmeric, goji berry, and acai), and Enzyme-Enhanced Drinks such as those with papain, bromelain, and ferulic acid.

Packaging formats span Ready-to-Drink (RTD) Bottles, Shot Bottles, Powder Sachets or Stick Packs, Effervescent Tablets, Capsules with Drink Activators, and Tetra Packs, catering to varying preferences for convenience and portability. Distribution occurs through Beauty Specialty Stores, Pharmacies and Drugstores, Online Beauty Retailers and DTC Brands, Supermarkets and Hypermarkets, Wellness Clinics and Dermatology Centers, and Salons and Spas, with digital platforms witnessing accelerated growth due to subscription and personalization models.

Regionally, the market spans North America, Asia-Pacific, Europe, Latin America, and the Middle East & Africa, with Asia-Pacific leading due to high adoption in countries like China and Japan, followed by North America where collagen-based RTDs and functional wellness beverages continue to gain traction.Regionally, the market is assessed across North America, Asia-Pacific,Europe, Latin America, and Middle East & Africa.

Asia-Pacific leads due to high adoption in China and Japan, while North America shows strong momentum through collagen-infused beverage launches and wellness-oriented formulations. Europe continues to grow steadily with innovation in clean-label and botanical formats.

| By Product Type | Value Share% 2025 |

|---|---|

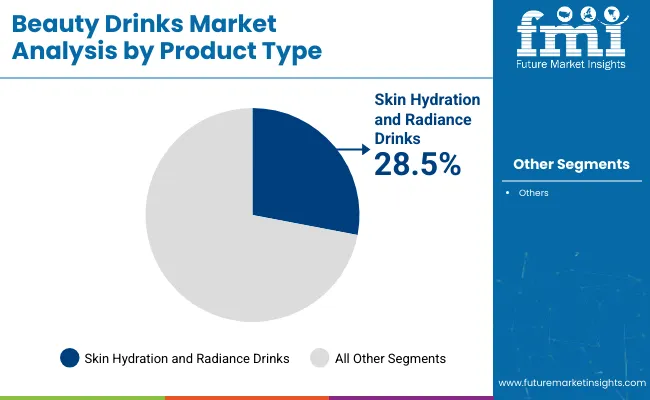

| Skin Hydration and Radiance Drinks | 28.5% |

| Others | 71.5% |

In 2025, Skin Hydration and Radiance Drinks account for 28.5% of the total product type segment, making it the leading category in the beauty drinks market. This dominance is attributed to rising consumer demand for ingestible solutions that improve skin texture, elasticity, and glow, particularly those formulated with collagen, hyaluronic acid, and vitamin C. The segment benefits from strong positioning in both skincare and wellness routines, with brands leveraging claims around moisture retention and skin barrier support.

Its popularity is especially pronounced among urban women aged 25-40 in Asia-Pacific and North America, where hydration is viewed as a foundation for long-term skin health. The remaining 71.5% is distributed among other segments such as anti-aging, detox, and multi-functional drinks, which continue to gain traction but have yet to match the broad appeal of hydration-centric formulations.

| By Product Type | Value Share% 2025 |

|---|---|

| Skin Hydration and Radiance Drinks | 28.5% |

| Others | 71.5% |

In 2025, Skin Hydration and Radiance Drinks lead the demand within the Ingredient Type segment, capturing 28.5% of the total market. This dominance stems from the widespread consumer preference for formulations containing collagen, hyaluronic acid, and vitamin C, which are clinically associated with improved moisture retention, elasticity, and skin luminosity.

Brands in this space have positioned hydration as the foundation of beauty-from-within routines, especially in regions like East Asia and North America where skin health is prioritized over cosmetic coverage.

The segment's growth is also supported by the popularity of ready-to-drink collagen beverages, which align with busy lifestyles and wellness trends. While other ingredient segments such as probiotics and botanical extracts are gaining relevance, they remain secondary in comparison to the strong functional association between hydration and visible beauty benefits.

| By Ingredient Type | Value Share% 2025 |

|---|---|

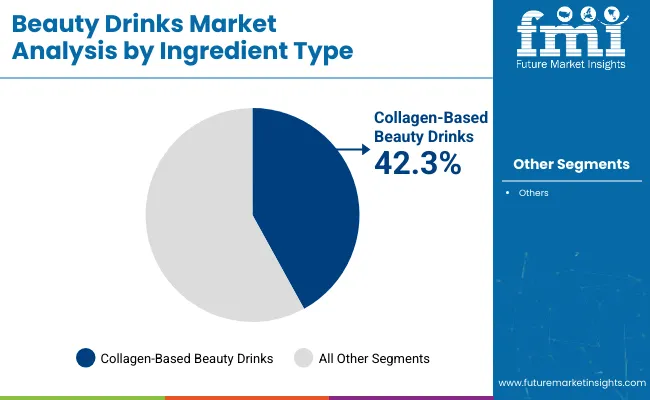

| Collagen-Based Beauty Drinks | 42.3% |

| Others | 57.7% |

In 2025, Collagen-Based Beauty Drinks dominate the Ingredient Type segment with a commanding 42.3% market share, underscoring their central role in the global beauty-from-within narrative. Collagenparticularly marine and bovine sourceshas become the gold standard ingredient for anti-aging, skin firmness, and hydration, making it the most trusted bioactive in beauty beverages. Its popularity is driven by strong consumer familiarity, widespread clinical claims, and high visibility across both retail and online platforms.

In markets like China, Japan, and the USA, collagen drinks have transitioned from niche supplements to daily-use products, often enhanced with vitamin C or hyaluronic acid to improve efficacy. While newer ingredient classes such as probiotics or botanicals are expanding, they have not displaced collagen’s leadership due to its long-standing reputation and versatile integration into RTDs, sachets, and shots. The segment is also benefiting from clean-label innovation and sustained demand from aging and beauty-conscious consumers.

Rising Integration of Beauty-from-Within into Mainstream Skincare Routines

The increasing consumer shift from topical beauty solutions to ingestible formats is a major driver of the beauty drinks market. As consumers seek holistic skin wellness, beauty-from-within has become a core component of daily skincare regimensparticularly among women aged 25-45. Collagen-infused drinks, antioxidant-based beverages, and hydration-boosting formulations are now perceived as routine extensions of skincare, similar to moisturizers or serums. This trend is reinforced by dermatologists, wellness influencers, and supplement brands co-promoting oral beauty products as clinically effective.

The growing acceptance of ingestible skincare is also supported by a surge in clinical research and claims around collagen, hyaluronic acid, and vitamin Cingredients proven to improve elasticity, hydration, and radiance. In Asia-Pacific, especially in Japan and China, beauty drinks are not seen as alternatives but as necessities. Their popularity is now translating into North America and Western Europe, where wellness-minded consumers increasingly value multi-functional, preventive beauty strategies. This seamless integration into skincare routines is significantly boosting daily use frequency and driving consistent volume growth.

Innovation in Product Formats and Ingredient Combinations

Rapid innovation in delivery formats and formulation science is reshaping the beauty drinks landscape. Unlike traditional supplement pills or powders, beauty drinks are now offered in convenient, lifestyle-integrated forms like RTD bottles, shot ampoules, powder sachets, and even effervescent tablets. These formats have enhanced portability, ease of use, and aesthetic appealfactors that strongly influence millennial and Gen Z purchasing behavior. Additionally, brands are combining core actives like collagen with complementary ingredients such as probiotics, adaptogens, biotin, and antioxidants to develop multi-benefit offerings.

This functional layering appeals to consumers seeking both visible beauty outcomes and broader wellness effects such as gut health, immunity, or energy. The expansion of ingredient optionsranging from marine collagen peptides and plant-based boosters to botanical extracts and enzyme systemshas also enabled product personalization across skin types, age groups, and beauty goals. Such innovation not only elevates product experience but also supports premium pricing and repeat purchase behavior.

Lack of Regulatory Standardization and Scientific Transparency

A major restraint in the beauty drinks market is the absence of standardized global regulations and validated efficacy benchmarks. In many countries, beauty drinks are classified under food or dietary supplements rather than therapeutic or dermatological categories, allowing manufacturers wide latitude in making claims without substantiating them through clinical trials. This regulatory ambiguity has led to market clutter, with numerous brands offering vague promises around skin whitening, radiance, or wrinkle reduction without peer-reviewed backing.

As a result, consumer trust is uneven, particularly in Western markets where skepticism toward ingestible beauty products remains higher. Additionally, the variability in ingredient concentrations, bioavailability, and interaction effects further complicates efficacy. The lack of harmonized labeling guidelines for ingredient origin, purity, or dosage hinders informed decision-making. This credibility gap limits category penetration beyond trend-driven buyers and poses a challenge for brands aiming to scale into healthcare-adjacent retail channels such as pharmacies or dermatology clinics.

Personalization and AI-Driven Beauty Nutrition Platforms

One of the most notable trends shaping the beauty drinks market is the rise of personalized beauty nutrition powered by AI and data analytics. Consumers are increasingly turning to digital platforms and apps that analyze skin type, age, lifestyle, and even microbiome data to recommend tailored ingestible beauty routines. Startups and established brands alike are leveraging AI to power quizzes, skin scanners, and health trackers that guide personalized supplement plansincluding beauty drinks with specific ingredient blends.

This trend is particularly strong in North America and parts of Europe, where personalized wellness is a growing consumer expectation. Beyond ingredient customization, AI tools also enable subscription-based delivery models and engagement strategies that enhance retention and lifetime value. Moreover, brands integrating diagnostic tools with beauty beverages are better positioned to enter dermatology-led channels or premium health retail. As consumers demand more precision and efficacy in their self-care purchases, AI-driven personalization is fast becoming a differentiator in the highly competitive beauty drinks space.

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 7.5% |

| USA | 8.7% |

| India | 9.1% |

| UK | 8.7% |

| Germany | 6.3% |

| Japan | 5.3% |

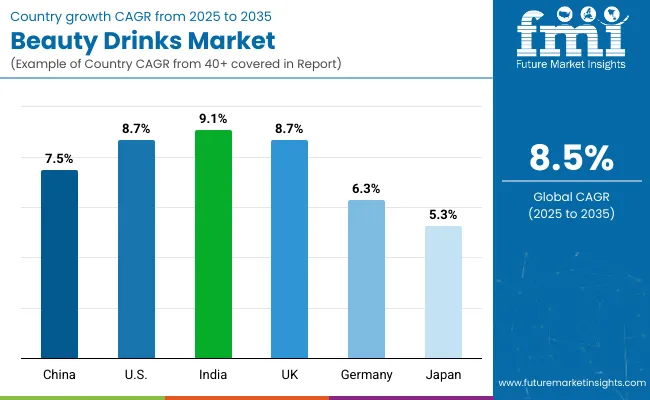

The Beauty Drinks Market exhibits diverse growth patterns across key countries, reflecting varying levels of market maturity, consumer behavior, and ingredient familiarity. India is projected to record the highest CAGR of 9.1% between 2025 and 2035, driven by a rising middle class, rapid urbanization, and increasing awareness of ingestible skincare. While still a nascent category, beauty drinks are gaining traction in India through online wellness platforms and collagen-based formulations targeting young urban women. The USA follows closely with an 8.5% CAGR, supported by the mainstreaming of functional beverages and strong uptake of collagen and multi-functional drink formats across e-commerce and health retail channels.

The UK also shows robust growth at 8.7%, led by clean-label innovation and demand for plant-based and probiotic-enriched drinks. China, with a 7.5% CAGR, remains the largest contributor by volume but is stabilizing due to its mature consumer base and widespread adoption of collagen drinks. Germany and Japan exhibit more modest CAGRs of 6.3% and 5.3%, respectively, reflecting high market penetration and slower innovation cycles. Japan’s position as an early adopter of beauty-from-within has limited its current growth potential, whereas Germany’s restrained uptake stems from conservative consumer preferences and regulatory caution.

| Year | USA Beauty Drinks Market (USD Million) |

|---|---|

| 2025 | 844.4 |

| 2026 | 924.2 |

| 2027 | 1011.6 |

| 2028 | 1107.2 |

| 2029 | 1211.9 |

| 2030 | 1326.5 |

| 2031 | 1451.9 |

| 2032 | 1589.1 |

| 2033 | 1739.4 |

| 2034 | 1903.8 |

| 2035 | 2083.8 |

The sales outlook for the Beauty Drinks Market in the United States indicates a strong upward trajectory between 2025 and 2035, with value sales projected to grow from USD 844.4 million in 2025 to USD 2083.8 million in 2035. This reflects a CAGR of approximately 8.5%, aligning with broader functional wellness trends and growing consumer acceptance of ingestible skincare.

Over the first half of the forecast period (2025-2030), sales increase steadily to reach USD 1,323.98 million, driven by widespread adoption of collagen-based RTD beverages and the rise of e-commerce-first nutricosmetic brands. USA consumers, particularly millennials and Gen Z, are embracing beauty-from-within products that offer hydration, anti-aging, and glow-enhancing benefits, supported by clinical claims and influencer marketing.

Between 2030 and 2035, sales accelerate further, rising by more than USD 752 million in just five years. This phase is expected to be shaped by technological integration in product personalization, AI-driven subscription platforms, and advanced functional blends that target not just beauty but also gut health, immunity, and stress management.

Growth is also supported by retail expansion into dermatology chains, wellness clinics, and pharmacies, which are increasingly accepting beauty drinks as part of holistic skincare solutions. As innovation deepens and consumer education improves, the USA market is set to transition from early adoption to mainstream penetration by the end of the forecast period.

The Beauty Drinks Market in the United Kingdom is projected to grow at a CAGR of 8.7% between 2025 and 2035, driven by shifting consumer preferences toward ingestible skincare, clean-label nutrition, and personalized beauty routines. A growing segment of health-conscious consumersparticularly urban millennials and Gen Zare turning to beauty drinks formulated with collagen, hyaluronic acid, probiotics, and antioxidants to enhance skin hydration, tone, and elasticity from within.

The rise of vegan and plant-based beauty beverages is further fueling demand, especially in specialty wellness retail and premium e-commerce channels. British consumers are also showing increasing trust in brands offering science-backed formulations with transparent ingredient sourcing. The market’s expansion is supported by regulatory openness toward functional foods and supplements, along with growing cross-channel integration between health, beauty, and pharmacy retail networks.

India is witnessing rapid growth in the Beauty Drinks Market, which is forecast to expand at a CAGR of 9.1% through 2035one of the highest globally. The expansion is being driven by increasing beauty and wellness awareness among urban consumers, rising disposable incomes, and a generational shift toward preventive skincare. Adoption is particularly strong in Tier 1 and emerging Tier 2 cities, where collagen-based RTDs, biotin-enriched drinks, and plant-based beauty beverages are gaining traction among women aged 20-40.

Domestic and international brands are leveraging digital channels and DTC models to expand reach, often combining AI-powered quizzes and skin-type analysis to offer personalized beauty drink subscriptions. As Ayurveda and clean-label demand intersect with modern functional nutrition, consumers are increasingly open to hybrid formulations that include ingredients like amla, turmeric, hyaluronic acid, and marine collagen.

The Beauty Drinks Market in China is expected to grow at a CAGR of 7.5% through 2035, maintaining its position as the largest national market globally. This growth is underpinned by strong cultural alignment with beauty-from-within concepts and widespread consumer acceptance of collagen-based drinks as part of daily skincare routines. Collagen RTDs, hyaluronic acid ampoules, and skin-brightening formulations dominate both e-commerce and physical retail, supported by aggressive innovation from local players and premium offerings from Japanese and Korean brands.

Municipal marketing campaigns, beauty tech platforms, and pharmacy chains have collectively normalized beauty drinks among urban women aged 20-45. China’s beauty drinks market also benefits from a maturing supply chain, local collagen production, and growing functional ingredient innovation, including traditional Chinese herbal extracts blended with Western actives.

| Countries | 2025 Share (%) |

|---|---|

| USA | 15.90% |

| China | 24.30% |

| Japan | 18.10% |

| Germany | 3.90% |

| UK | 3.20% |

| India | 4.90% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 17.30% |

| China | 23.10% |

| Japan | 14.40% |

| Germany | 4.30% |

| UK | 3.60% |

| India | 6.80% |

The Beauty Drinks Market in Germany is projected to grow at a CAGR of 6.3%, supported by rising consumer interest in skin health, aging wellness, and clinically-backed ingestible beauty solutions. Collagen-based formulations are being embraced by consumers aged 35 and above for anti-aging and hydration benefits.

Retailers are expanding shelf presence across drugstores, organic chains, and online wellness portals to meet growing demand. Domestic producers are formulating with marine collagen, biotin, and CoQ10 to cater to ingredient-conscious buyers. Sustainability considerations have also encouraged innovation in eco-friendly packaging formats.

| USA By Product Type | Value Share% 2025 |

|---|---|

| Skin Hydration and Radiance Drinks | 31.5% |

| Others | 68.5% |

The Beauty Drinks Market in the USA is projected at USD 401.5 million in 2025. Skin Hydration and Radiance Drinks contribute 31.5%, while the remaining 68.5% comes from other product categories, indicating a strong market for diversified beauty-enhancing formulations beyond hydration alone. This reflects a shift toward multi-functional products that target skin elasticity, hair strength, and anti-aging benefits, often combining ingredients like collagen peptides, biotin, hyaluronic acid, and antioxidants.

The growing awareness of ingestible skincare among millennials and Gen Z consumers, particularly through influencer-driven campaigns and celebrity-backed brands, has further widened the consumer base for both mainstream and niche beauty drinks. Functional beverages are increasingly being positioned as lifestyle enhancers, blurring the line between wellness and cosmetics.

Retail channels such as mass drugstores, premium beauty outlets, and e-commerce platforms are driving access and visibility, especially for collagen-centric blends that offer clinically validated claims. As consumers prioritize ingredient traceability and visible results, demand is rising for clinically supported formulations with sustainable sourcing.

| China By Ingredient Type | Value Share% 2025 |

|---|---|

| Collagen-Based Beauty Drinks | 45.2% |

| Others | 54.8% |

The Beauty Drinks Market in China is valued at USD 1290.5 million in 2025, with collagen-based beauty drinks leading at 45.2%, while other ingredient-based formulations make up the remaining 54.8%. The dominance of collagen-centric drinks is strongly aligned with consumer preferences for skin elasticity, anti-aging, and whitening benefitsattributes deeply embedded in Chinese beauty standards. Collagen peptides sourced from marine and bovine origins have gained widespread traction owing to their bioavailability and clinical validation in skin health improvements.

This segment is further supported by TCM-inspired infusions and hybrid formulations combining collagen with bird’s nest extract, goji berry, and pearl powder. Local innovation, strategic KOL endorsements, and integration into daily skincare rituals have elevated these drinks from supplements to aspirational lifestyle products. E-commerce, particularly via livestreaming platforms and social commerce, is accelerating market penetration across Tier 1 to Tier 3 cities. While other ingredient bases are gaining visibilityincluding hyaluronic acid, ceramides, and probioticscollagen maintains category leadership due to its entrenched association with visible beauty transformation.

The Beauty Drinks Market in 2025 is notably fragmented, with Shiseido Co., Ltd. accounting for 8.9% of the global value share, while the remaining 91.1% is distributed among a wide array of regional and emerging players. Shiseido’s dominance stems from its strong heritage in beauty innovation and its early investments in ingestible skincare, particularly collagen-based formulations. Its science-backed branding, premium positioning, and multichannel retail strategiesranging from dermatology clinics to luxury department storeshave secured consumer trust across Japan, China, and Southeast Asia. The brand’s commitment to R&D, coupled with patented delivery systems for enhanced collagen absorption, has enabled it to command a loyal user base despite growing competition.

The broader market is being reshaped by agile entrants focusing on plant-based formulations, adaptogens, and gut-skin axis claims. These players are leveraging influencer collaborations, subscription DTC models, and regional ingredients to appeal to younger consumers. While Shiseido retains a brand equity advantage, the market’s relatively low entry barriers and consumer appetite for novelty are fueling ongoing disruption. Strategic partnerships with functional food manufacturers, pharmaceutical firms, and wellness brands are becoming critical to sustaining competitive edge in this highly segmented space.

Key Developments in Beauty Drinks Market

| Item | Value |

|---|---|

| Quantitative Units | USD 5,310.50 Million |

| Product Type | Anti-Aging Beauty Drinks, Skin Hydration and Radiance Drinks, Hair and Nail Support Drinks, Detox and Cleansing Beauty Drinks, Skin Whitening / Brightening Drinks, Acne-Reducing and Skin Clarifying Drinks, Multi-Functional / All-in-One Beauty Drinks |

| Ingredient Type | Collagen-Based Beauty Drinks, Marine Collagen, Bovine Collagen, Plant-Based Collagen Enhancers, Antioxidant-Enriched Drinks, Vitamin C, Vitamin E, Polyphenols (Resveratrol, Flavonoids), Hyaluronic Acid-Infused Drinks, Biotin and Mineral-Enriched Drinks, Zinc, Selenium, Silica, Probiotic and Prebiotic Beauty Drinks, Lactobacillus, Bifidobacterium, Inulin, FOS, GOS, Botanical Extract-Based Drinks, Aloe Vera, Green Tea, Turmeric, Goji Berry, Acai, Chamomile, Enzyme-Enhanced Drinks, Papain, Bromelain, Ferulic Acid |

| Packaging Format | Ready-to-Drink Bottles (RTDs), Shot Bottles / Concentrates, Powder Sachets / Stick Packs, Effervescent Tablets, Capsules with Drink Activator, Tetra Packs / Carton Packs |

| Distribution Channel | Beauty Specialty Stores, Pharmacies and Drugstores, Online Beauty Retailers & DTC Brands, Supermarkets & Hypermarkets, Wellness Clinics and Dermatology Centers, Salons and Spas (Premium Segment) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Shiseido Co., Ltd., Amorepacific Corporation, Vital Proteins LLC (Nestlé), The Bountiful Company (NeoCell), Suntory Holdings, Swisse, Fancl Corporation, Hech, By-Health, Tokiwa |

| Additional Attributes | Dollar sales by product type and distribution channel, rise in nutricosmetics, collagen and hyaluronic acid dominance, regional trends in anti-aging demand, innovation in beauty-from-within formulations, preference for clean-label and functional ingredients, e-commerce growth, influence of K-beauty and J-beauty. |

The global Beauty Drinks Market is estimated to be valued at USD 5,310.5 million in 2025.

The market size for the Beauty Drinks Market is projected to reach USD 12,045.2 million by 2035.

The Beauty Drinks Market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in the Beauty Drinks Market are Anti-Aging Beauty Drinks, Skin Hydration and Radiance Drinks, Hair and Nail Support Drinks, Detox and Cleansing Beauty Drinks, Skin Whitening / Brightening Drinks, Acne-Reducing and Skin Clarifying Drinks, and Multi-Functional / All-in-One Beauty Drinks.

In terms of product type, the Skin Hydration and Radiance Drinks is expected to command the highest share in the Beauty Drinks Market in 2025, contributing approximately 28.5% of global sales.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beauty-from-Within Drinks Market Size and Share Forecast Outlook 2025 to 2035

Beauty and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Beauty and Personal Care Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beauty and Personal Care Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Beauty Supplements Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beauty Concierge Services Market Size and Share Forecast Outlook 2025 to 2035

Beauty Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

The Beauty and Personal Care Product Market is segmented by product type, distribution channel and region through 2025 to 2035.

Beauty Subscription Market Growth - Innovations, Trends & Forecast 2025 to 2035

Market Share Breakdown of Beauty Pillowcase Manufacturers

Beauty Pillowcase Market Report - Growth & Industry Outlook 2024-2034

C-Beauty Product Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

J-Beauty Product Market Analysis by Product Type, Type, Distribution Channel, and Region through 2035

K-Beauty Product Market Analysis by Product Type, End-user, Distribution Channel, and Region through 2025 to 2035

USA Beauty and Personal Care (BPC) Retail Vending Machine Market Outlook 2025 to 2035

SEA C-Beauty Product Market Analysis - Size, Share, and Forecast Outlook (2025 to 2035)

Snail Beauty Products Market

Herbal Beauty Product Market Size and Share Forecast Outlook 2025 to 2035

Edible Beauty Infusions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Coffee Beauty Products Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA