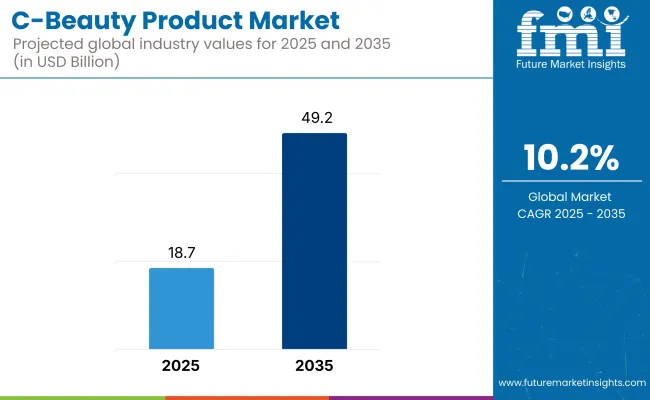

The global C-beauty product market is projected to expand from USD 18.7 billion in 2025 to approximately USD 49.2 billion by 2035, registering a CAGR of 10.2% during the forecast period. Sales in 2024 were estimated at USD 16.9 billion.

Emerging trends include increased preference for personalized and functional formulations, the adoption of scene-based skincare routines, and the integration of advanced technologies in retail formats. Demand is also rising for beauty devices and men’s grooming products, influenced by evolving consumer behavior and market restructuring.

The global C-beauty product market holds 20% of the global beauty and personal care market, driven by rising consumer interest in Chinese skincare, herbal ingredients, and affordability. It accounts for nearly 15% of the global cosmetics and toiletries market, supported by the export of makeup, facial care, and cleansing products.

The market contributes around 8% to the global consumer goods market, reflecting its retail presence across e-commerce and offline channels. It makes up 10% of the global health and wellness market, as brands introduce functional beauty products with dermatological and traditional Chinese medicine elements. In the global luxury goods market, it holds a 5% share, largely through premium C-beauty brands targeting younger global consumers across Asia, Europe, and North America.

The global C-beauty product market is projected to grow from USD 18.7 billion in 2025 to USD 49.2 billion by 2035, generating an absolute dollar opportunity of USD 30.5 billion over the ten-year period. This market expansion reflects a 2.63 times increase, underpinned by a compound annual growth rate of 10.2%. The growth curve signals rising preference for culturally grounded skincare, clinically supported active ingredients, and ingredient transparency as defining purchasing criteria across regions.

By 2030, the market is projected to reach approximately USD 30.3 billion, capturing about USD 11.6 billion in new market value during the first half of the decade. This accounts for nearly 38% of the total absolute opportunity. The second half is expected to generate USD 18.9 billion, reflecting acceleration in demand due to broader cross-border retail integration and entry of C-beauty brands into mainstream pharmacy, luxury, and specialty distribution formats.

Product innovation has been increasingly aligned with AI-generated diagnostics, precision formulation, and TCM-derived actives. Companies such as Pechoin and Florasis have strengthened brand visibility through vertically integrated digital ecosystems and strategic partnerships with cosmetic OEMs in Japan and France. This market is expected to remain structurally growth-oriented, with performance continuing to be shaped by functionality, authenticity, and region-specific formulation intelligence.

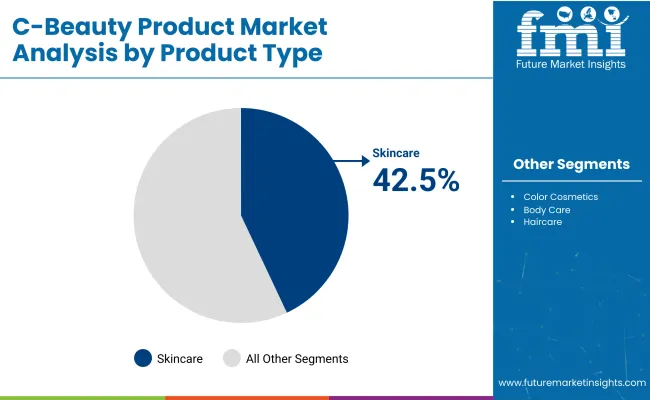

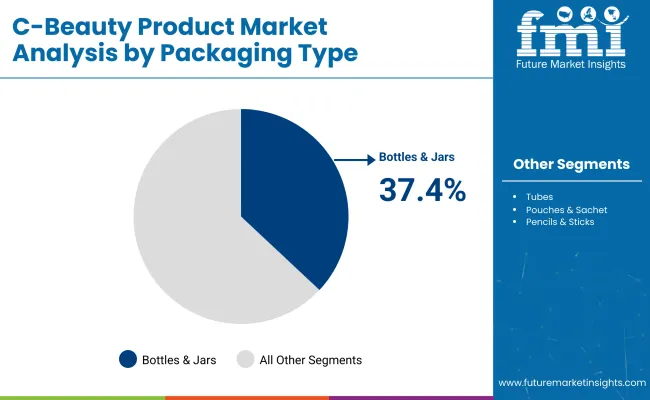

In 2025, facial skincare will command 42.5% of global C-beauty demand, led by cleansing, whitening, and hydration routines. Packaging in bottles and jars will make up 37.4% of unit share. Offline channels will retain 58.6% of revenue, while herbal or TCM-based ingredients will account for 28.5% of all product formulations. Region-specific strategies, ingredient familiarity, and packaging usability will continue to define market preferences.

Facial skincare will contribute 42.5% of global C-beauty revenue in 2025, driven by routine-based consumption of cleansers, toners, serums, and creams. The category benefits from consistent daily use and layering practices that increase product volume sold per user. Pechoin has expanded its whitening and spot-correction lines in Eastern Europe and Southeast Asia. Chando promotes glacier cream routines across South Korea and Central Asia, while Biohyalux is scaling up serum kits for the Middle East and Australia.

Bottles and jars are expected to account for 37.4% of global packaging in 2025, as consumers prioritize hygiene, product preservation, and aesthetic appeal. Serum bottles with controlled dispensing and cream jars for nighttime use are most popular. Pechoin’s double-layer cream jars are being rolled out in Japan. One Leaf’s pipette bottles have received traction in Eastern Europe, while Herborist’s ginseng cream jars have seen demand in the Middle East’s premium category.

Offline channels will account for 58.6% of total sales globally, driven by in-store trial preference, cultural trust factors, and beauty advisor-led purchases. Brick-and-mortar expansion across Southeast Asia, Latin America, and Eastern Europe supports awareness of lesser-known Chinese brands. Watsons, Sephora, and independent beauty stores continue to feature C-beauty pop-ups and demos to increase trial rates. Judydoll and Florasis are securing counter space across high-footfall locations in major metro areas.

Traditional Chinese ingredients will make up 28.5% of C-beauty product use globally in 2025. The demand is supported by consumer belief in plant-based, balanced skincare. Ingredients like ginseng, licorice root, peony, and angelica are featured prominently. Herborist’s modernized apothecary branding targets premium segments in France and Saudi Arabia. Yunnan Baiyao leverages medical-trust positioning in Thailand and Eastern Europe. Pechoin maintains mid-tier price points for its herbal whitening series across multilingual markets.

Global Cbeauty product exports grew by 18% in 2024, with total sales surpassing USD 8 billion. Skincare accounted for 55% of the market, followed by color cosmetics at 30%. Consumers aged 18-24 represented 42% of total buyers. Urban tier 2 cities saw above-average adoption. Lip tints, sheet masks, and glow serums contributed to 1.7× annualized inventory turnover across online and offline retail networks.

ECommerce Optimization and Influencer Algorithm Effect

More than 50% of Cbeauty revenues in 2024 were generated through digital flash sales and short-form video campaigns. Platforms with interactive shopping features enabled a 22% increase in basket size. Cross-border logistics centered in Malaysia and Singapore reduced average delivery time within Southeast Asia to 3.5 days.

Fulfillment infrastructure was optimized to support more than 70% of international shipments without local inventory stocking. Engagement through gamified livestreaming reached 4%, raising conversion rates in products priced below USD 10.

Certification Gaps and Repeat Purchase Weaknesses

Refund rates reached 4% in regions where certification or language labeling was unclear. Repeat purchases remained below 18% in North America and Europe compared to 35% in Southeast Asia. Delays of 6 to 8 weeks were recorded in markets requiring dermatological or halal certification. Abandonment during checkout occurred in 28% of overseas carts when label credibility was questioned. Visual homogeneity across brands led to brand fatigue and decreased recognition in crowded pricing bands.

Region-Smart Product Bundles and Seasonal Launches

In Southeast Asia, bundle sets including sheet masks and primers lifted conversion rates by 15%. Product launches aligned with regional festivals generated 28% higher uptake in Brazil and India. Entry-level kits under USD 12 contributed 45% of new user acquisition volume. Seasonal kits promoting anti-dullness or pollution defense achieved 32% growth in cities across Latin America. Repeat purchases rose by 11% in African and Southeast Asian markets through deeper shade range options and region-specific packaging.

Minimalist Visuals, Ingredient Clarity and Tech-Led Personalization

Minimalist labeling and visible ingredient highlights appeared on 65% of fast-selling SKUs. Products with single-ingredient claims made up 70% of new launches targeting wellness buyers. AI-powered skin diagnostics improved conversion by 23% when embedded in shopping apps. Shade-match tools boosted session durations by 40% among first-time users. Refill options were adopted in 18% of units sold in urban regions. Listings optimized for voice search improved visibility by 12% on global marketplaces.

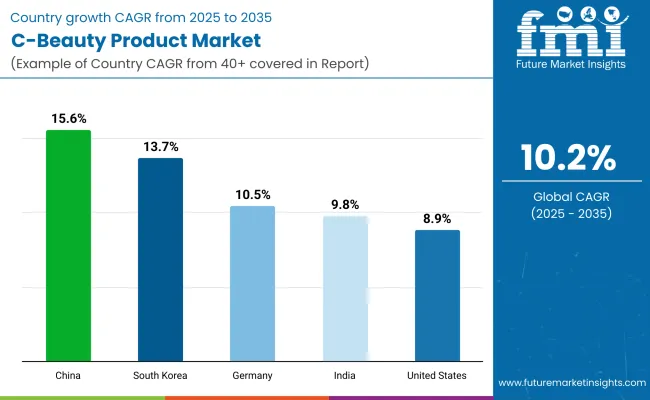

The global C-beauty product market is forecast to grow at a CAGR of 10.2% between 2025 and 2035. China leads at 15.6%, outperforming the global benchmark by 5.4 percentage points, supported by domestic brand dominance, ingredient innovation, and social commerce integration. South Korea follows at 13.7%, 3.5 points above the global average, where cross-border e-commerce and KOL-driven marketing enhance the visibility of Chinese-origin formulations.

Germany (OECD) posts 10.5%, slightly exceeding the global rate due to rising consumer trust in Made-in-China skincare and minimalist product lines. India registers 9.8%, just under the global average, where digital-first consumers are showing interest in Chinese derma-grade cosmetics and hybrid skincare.

The United States (OECD) trails at 8.9%, underperforming by 1.3 points, with distribution barriers and brand perception challenges slowing growth. ASEAN countries are recording high double-digit growth, particularly Thailand and Indonesia, where influencer marketing and competitive pricing are accelerating demand for C-beauty products.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

The C-beauty product market in China is forecast to grow at 15.6% CAGR from 2025 to 2035. This expansion has been attributed to the accelerated adoption of localized branding, traditional herbal formulations, and livestreaming commerce. Consumer preference in tier 2 and tier 3 cities has shifted toward domestic beauty labels promoting ingredients such as ginseng, angelica, and snow lotus.

Digital marketing tactics have been refined by companies like Perfect Diary and Florasis, which have embedded national pride into product messaging. Regional logistics infrastructure has supported wider distribution beyond coastal regions. The surge in male grooming consumption and targeted KOL promotions through Douyin and Little Red Book has further expanded visibility across demographic clusters.

South Koreas C-beauty product market is expected to register 13.7% CAGR through 2035, supported by its strategic shift toward domestic sourcing and minimalist skincare. Demand for Chinese-origin beauty goods has risen across the younger cohort as alternatives to J-beauty and K-beauty labels.

Products with clean labeling, simplified routines, and fewer-step applications have been imported via e-commerce platforms like Coupang and Naver Smart Store. Authenticity and ingredient traceability have influenced cross-border C-beauty sales. Strategic collaborations with Korean influencers by brands such as Judydoll and Colorkey have expanded C-beauty shelf presence across specialty retailers.

The demand in Germany is projected to experience 10.5% CAGR in the C-beauty product market between 2025 and 2035. German consumers have shown growing interest in niche beauty products that incorporate natural Chinese ingredients and cruelty-free certification.

C-beauty offerings have been distributed through dm-drogerie markt and Flaconi, where products have been marketed for anti-aging and skin-brightening benefits. Preference has shifted toward toners and serums with botanical actives such as tremella extract and centella asiatica. Product discovery through TikTok and Instagram reels has been driven by Gen Z consumers, while cross-border packaging has been optimized to meet EU labeling compliance.

The Industry in India is expected to witness 9.8% CAGR in the C-beauty product market from 2025 to 2035. The shift in product adoption has been influenced by changing skincare routines among middle-income urban youth.

Platforms such as Nykaa and Tira have introduced C-beauty brands with affordable positioning, strong visual branding, and KOL endorsements. Moisturizers, cleansers, and sheet masks have remained high-frequency categories, particularly among university-age consumers. The demand for animal-testing-free and paraben-free claims has shaped product curation. Indian skin tone compatibility and humidity resistance have been addressed by Chinese brands expanding through regional fulfillment hubs.

The C-Beauty MarketinUnited States is projected to record 8.9% CAGR in the C-beauty market between 2025 and 2035. Growth has been propelled by ethnic beauty segments and microinfluencer-led branding. American retailers including Ulta and iHerb have stocked C-beauty SKUs under clean beauty and skin barrier repair categories.

Content syndication through YouTube reviews and Reddit skincare forums has introduced brands like Winona and Biohyalux to audiences interested in Asian skincare innovations. Consumers have shown strong preference for minimalist packaging and function-first messaging. Derm-approved products with niacinamide, ceramide, and hyaluronic acid have entered the market targeting skin sensitivity and hormonal acne.

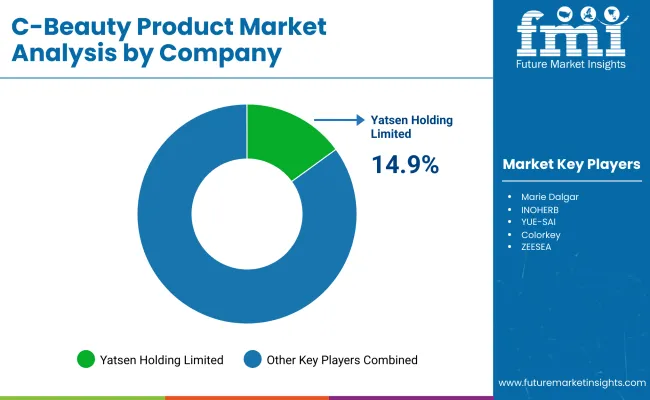

The global market features a mix of dominant brands and rising labels. Yatsen Holding has expanded Perfect Diary’s portfolio through influencer collaborations and livestream selling. Proya Cosmetics has invested in dermatological R&D, focusing on sensitive skin formulations. Winona and INOHERB continue to develop TCM-based skincare, targeting regional preferences.

Herborist and Chando maintain a presence through department store partnerships and regional campaigns. Emerging players like Colorkey and ZEESEA use vibrant packaging and short video marketing, while Maogeping Beauty emphasizes premium makeup artistry. Catkin and Focallure focus on online-first strategies, offering affordable SKUs. Product differentiation and regional marketing define current expansion efforts.

Entry into the global market is challenged by brand saturation, intellectual property risks, and regional regulation disparities. Consumer loyalty in established markets limits the visibility of new entrants, while fragmented retail distribution adds logistical complexity. Language-specific marketing and evolving product standards also raise operational costs for smaller players.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 18.7 billion |

| Projected Market Size (2035) | USD 49.2 billion |

| CAGR (2025 to 2035) | 10.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and units for volume |

| Product Types Analyzed (Segment 1) | Facial Skincare (Moisturizers, Cleansers, Face Masks, Serums & Essences, Toners), Color Cosmetics (Lipsticks, Foundations, Eye Makeup, Blushers), Body Care (Lotions, Washes, Scrubs), Haircare (Shampoo, Masks, Scalp Treatments), Fragrances (EDT, EDP, Mists), Men’s Grooming (Face Wash, Beard Oils, Multi-use Skincare) |

| Packaging Types Analyzed (Segment 2) | Bottles & Jars, Tubes, Pouches & Sachets, Pencils & Sticks, Others (Pump Dispensers, Spray Bottles, Compacts, Roll-ons) segmented by volume (ml/g) range |

| Sales Channels (Segment 3) | Online Channels (E-Commerce, Brand Websites), Offline Channels (Department Stores, Drugstores, Beauty Specialty Stores, Hypermarkets, Pop-up Stores) |

| Ingredient Types (Segment 4) | Herbal/TCM, Plant-Based Extracts, Synthetic Actives, Functional Ingredients (HA, Peptides, Retinol), Fermented Ingredients, Marine-based Ingredients |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa |

| Countries Covered | China, Japan, South Korea, United States, Canada, Germany, United Kingdom, France, India, Indonesia, Vietnam, Australia, UAE, Brazil, South Africa |

| Key Players Influencing the Market | Yatsen Holding Limited, Proya Cosmetics Co., Ltd, Chando Group, Winona, Herborist (Shanghai Jahwa), Marie Dalgar, INOHERB, YUE-SAI, Colorkey, ZEESEA, Venus Skin, Maogeping Beauty, Focallure, Catkin |

| Additional Attributes | Dollar sales by product type (skincare, color cosmetics, hair care) and application (dermacosmetics, clean beauty, halal/affordable luxury), demand driven by Gen Z social commerce and influencer-led e commerce, regional trends led by Asia Pacific with North America catching up, innovation in ingredient-driven clean formulations, halal-certified lines, sustainable packaging and expanded global footprint. |

The market is projected to reach USD 61.8 billion by 2035, rising from USD 16.5 billion in 2025.

A CAGR of 13.9% is expected during the forecast period.

Skincare is expected to lead with a 42.5% share in 2025.

Bottles and jars are projected to contribute 37.4% of the packaging market in 2025.

Yatsen Holding, parent of Perfect Diary, leads through cross-border expansion and localized brand collaborations.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

SEA C-Beauty Product Market Analysis - Size, Share, and Forecast Outlook (2025 to 2035)

Product Life-Cycle Management (PLM) IT Market Size and Share Forecast Outlook 2025 to 2035

Product Analytics Software Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Production Logistics Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Market Analysis - Size, Growth, and Forecast 2025 to 2035

Product Design Verification And Validation Solution Market Size and Share Forecast Outlook 2025 to 2035

Production Printer Market - Growth, Demand & Forecast 2025 to 2035

Product Information Management Market Growth – Trends & Forecast 2024-2034

Product Dispensing Machinery Market

Product Cost Management Market

CBD Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

USA Products from Food Waste Market Growth – Trends, Demand & Outlook 2025-2035

Competitive Overview of CBD Product Packaging Market Share

Soda Production Machine Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Date Product Market Share

Teff Products Market

Dairy Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Glass Product Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA