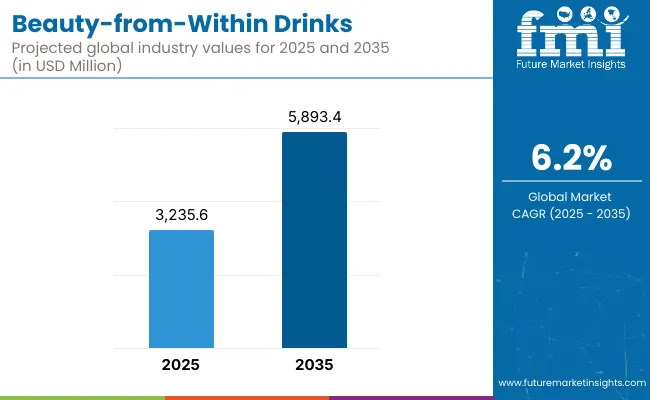

The global Beauty-from-Within Drinks Market is projected to be valued at USD 3,235.6 million in 2025, with a rise to USD 5,893.4 million by 2035, marking an absolute growth of USD 2,657.8 million over the decade. This expansion reflects a 6.2% CAGR, underpinned by measurable consumer shifts toward ingestible skincare solutions that bridge functional nutrition and aesthetic enhancement.

Beauty-from-Within Drinks Key Takeaways

| Metric | Value |

|---|---|

| Beauty-from-Within Drinks Estimated Value in (2025E) | USD 3,235.6 million |

| Beauty-from-Within Drinks Forecast Value in (2035F) | USD 5,893.4 million |

| Forecast CAGR (2025 to 2035) | 6.2% |

Demand is expected to be shaped not only by wellness trends but by verifiable performance claims, traceable ingredient sourcing, and innovations in bioavailability. During the first half of the decade (2025 to 2035), the market is forecast to increase by USD 1,077.5 million, reaching an estimated USD 4,313.1 million.

Growth during this period is expected to be concentrated around collagen peptide-based and hyaluronic acid-infused formulations, where evidence-backed skin hydration and elasticity outcomes have driven repeat usage. Influencer-backed brand activations and wellness subscription models are projected to catalyze consumer adoption, especially among digitally native demographics in East Asia and North America.

From 2030 to 2035, an additional USD 1,580.3 million in revenue is anticipated, signaling stronger mainstream penetration as regulatory harmonization, clean-label certifications, and personalization engines redefine product differentiation. Beauty-from-within drinks are projected to transition from niche premium offerings to core components of daily self-care routines, with growth led by adaptogen-infused and microbiome-supporting formats.

As science-led storytelling and AI-curated formulations become standard, the category is expected to shift toward clinically integrated beauty systems, further embedding these beverages within lifestyle-driven health regimens.

From 2020 to 2024, the Beauty-from-Within Drinks Market expanded from USD1,970 million to USD 3,235.6 million, driven by collagen-based RTD beverages and clean-label powdered drink mixes. During this period, the competitive landscape was led by USA-based and Australian-origin brands offering clinically supported, digitally native formulations. Influencer-led personalization and wellness subscription models dominated growth, while mainstream supplement brands began entering the beverage segment.

By 2025, the market is forecasted to reach USD 3,235.6 million, with a revenue shift toward science-driven personalizationand hybrid topical-ingestible ecosystems. Traditional supplement leaders are being challenged by beauty-tech startups offering AI-backed product pairing, microbiome-targeted drinks, and D2C platforms. Competitive edge is expected to move from brand recall alone to clinical validation, delivery format innovation, and consumer data integration across digital wellness touchpoints.

Growth in the Beauty-from-Within Drinks Market is being driven by a fundamental shift in consumer behavior, where beauty is increasingly viewed through the lens of holistic wellness. Traditional topical routines are being complemented and in many cases, replaced by ingestible solutions that promise measurable internal benefits for skin, hair, and nails.

The category’s momentum has been reinforced by clinical validation of key bioactives. For example, a 2023 Nestlé Health Science white paper reported a statistically significant reduction in wrinkle depth and skin roughness among users consuming collagen-based RTD beverages for 90 days.

Convenience and palatability advantages are being realized through ready-to-drink and powdered mix formats, which are being favored over pills or capsules. Personalized wellness journeys are being enabled through digital platforms, where ingredient transparency and targeted claims are influencing brand loyalty. Concurrently, rising environmental stressors and lifestyle-induced skin issues are fueling demand for ingestible beauty regimens that support skin health from within.

Supportive regulatory clarity and widespread access via e-commerce and D2C platforms have expanded consumer reach. Influencer marketing, peer reviews, and clinical storytelling are amplifying adoption, especially among younger demographics. As beauty-from-within products are integrated into spa, salon, and specialty health retail formats, this category is expected to transition from emerging trend to core wellness staple.

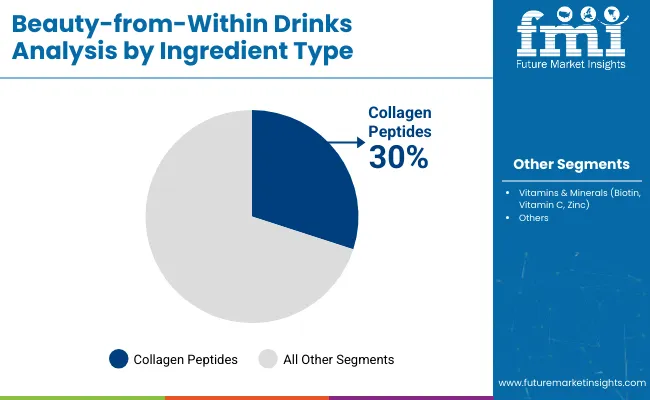

The Beauty-from-Within Drinks Market has been segmented across active ingredient type, product format, benefit claim, target consumer, sales channel, and packaging type to capture the nuanced evolution of product development and demand behavior. Ingredient segmentation has been defined by the bio functional actives used-ranging from collagen peptides and hyaluronic acid to adaptogen and marine extracts-each aligned to specific efficacy outcomes.

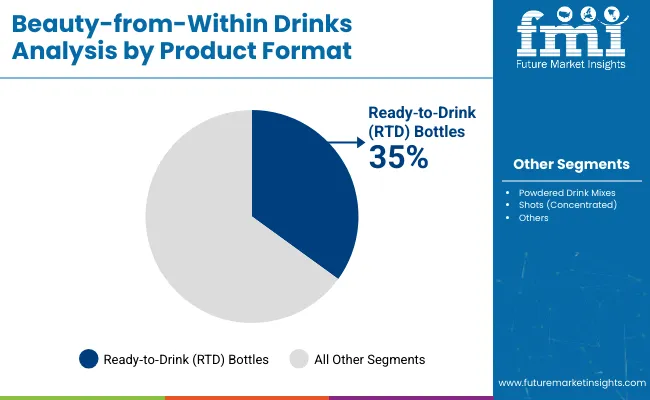

Product formats have been structured around consumption convenience, including ready-to-drink (RTD) bottles, powdered mixes, and concentrated shots. Functional benefits have been categorized by claims such as anti-aging, hydration, detoxification, and gut-skin health-each reflecting emerging priorities in preventative beauty. Segmentation by consumer profile has recognized women, men, and unisex positioning, enabling tailored marketing strategies.

Distribution has been mapped through Omni channel pathways, including e-commerce, specialty health retailers, salons, and D2C models. Finally, packaging segmentation has accounted for unit economics, sustainability, and user experience, featuring bottles, sachets, and multi-pack formats designed for on-the-go wellness integration.

| Active Ingredient Type | 2025 Share % |

|---|---|

| Collagen Peptides | 30% |

| Vitamins & Minerals (Biotin, Vitamin C, Zinc) | 12% |

Collagen peptides are expected to capture 30% of the total market share in 2025, supported by extensive clinical validation of their role in improving skin elasticity and hydration. According to studies published in the Journal of Cosmetic Dermatology (2024), daily intake of hydrolyzed collagen peptides resulted in a 20% increase in skin firmness within 8 weeks.

This leadership is being sustained by high clinical credibility in enhancing skin elasticity, moisture retention, and wrinkle reduction. A CAGR of 9.00% is forecasted as consumers increasingly demand ingestible formats with visible results. The segment is being strengthened by improved hydrolyzation techniques and dual-benefit positioning, such as joint and bone health.

Meanwhile, hyaluronic acid, holding 10% share, is gaining favor for its water-binding properties, especially in hydration-focused beverages. Vitamins and minerals, accounting for 12%, remain essential support actives, often used in synergistic blends to enhance absorption and cellular regeneration. Growth across all three is being reinforced by formulation science, transparent labeling, and outcome-oriented marketing.

| Product Format | 2025 Share % |

|---|---|

| Ready to Drink (RTD) Bottles | 35% |

| Powdered Drink Mixes | 25% |

| Shots (Concentrated) | 15% |

Ready-to-Drink (RTD) bottles are projected to lead the market in 2025 with a 35% share, driven by consumer preference for convenient, no-prep beauty solutions. According to a 2025 Euromonitor survey, 62% of wellness-focused consumers in urban Asia reported daily RTD collagen drink consumption as part of their skincare regimen. Their CAGR of 9.20% underscores continued consumer preference for liquid formats that offer immediacy and ease of use.

Powdered drink mixes, with a 25% share, are being favored for customization, lower shipping costs, and clean-label adaptability. Their 9.40% CAGR reflects rising traction in subscription-based D2C models. Concentrated shots, projected at 15% share, are benefiting from high nutrient density and format novelty, with a strong 9.70% CAGR, the highest among all formats. These three formats are expected to dominate future formulations as functionality, convenience, and user engagement are prioritized in product development.

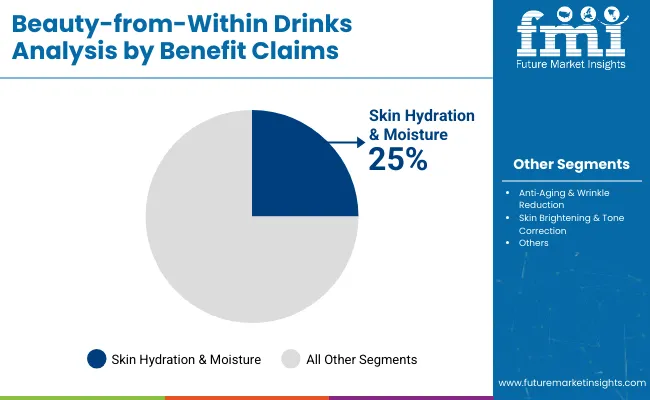

| Benefit Claims | 2025 Share % |

|---|---|

| Skin Hydration & Moisture | 25% |

| Anti Aging & Wrinkle Reduction | 25% |

| Skin Brightening & Tone Correction | 15% |

In 2025, skin hydration and anti-aging are each projected to command 25% of the market, together accounting for half of the category’s total value. Anti-aging’s 9.60% CAGR is expected to lead all claim types, driven by increasing consumer focus on collagen preservation, wrinkle smoothing, and elasticity improvement-often backed by dermatologist-endorsed studies.

Simultaneously, hydration claims are being driven by hyaluronic acid, ceramides, and electrolyte-based formulations, with a CAGR of 9.30%. As consumers shift toward preventive approaches and functional aesthetics, both claims are expected to remain top drivers of formulation strategy.

Skin brightening, holding 15% share, continues to rise in Asia and Latin America, where tone correction and radiance enhancement are strongly prioritized. Its 9.20% CAGR is supported by the use of antioxidant-rich botanicals and vitamin C-enriched blends.

Ingredient innovation and consumer demand for multifunctional wellness products have fueled the rise of beauty-from-within drinks, yet challenges persist in maintaining scientific credibility and navigating fragmented regulations. As category maturity deepens, the market is being redefined by clinically supported formulations, direct-to-consumer strategies, and personalized delivery formats.

Scientifically Backed Ingredient Efficacy Is Reshaping Consumer Trust

A major driver has been the growing body of peer-reviewed evidence validating the efficacy of ingredients such as collagen peptides, hyaluronic acid, and ceramides. A 2024 study in Clinical Nutrition Journal demonstrated a 28% improvement in dermal hydration after daily oral intake of hyaluronic acid over 6 weeks. Products making evidence-backed claims have been met with higher consumer trust and repeat purchase intent.

Formulations with quantifiable outcomes-such as improved hydration or wrinkle depth reduction-are being preferred, especially in premium pricing tiers. As demand shifts toward measurable functionality over aspirational marketing, brand portfolios are being repositioned around bioavailability, absorption rates, and synergistic ingredient stacks. This scientific rigor is expected to elevate category legitimacy and drive greater penetration in medically inclined wellness segments.

Personalized Beauty-From-Within Routines Are Being Normalized

A key trend has been the normalization of personalized ingestible beauty routines, enabled by AI-driven recommendation engines, skin diagnostics, and DNA-based assessments. These technologies are being integrated into beauty apps, D2C subscription models, and wellness ecosystems. As consumer expectations evolve from general benefits to targeted outcomes, brands are being compelled to deliver hyper-customized solutions aligned with skin type, age, lifestyle, and environment.

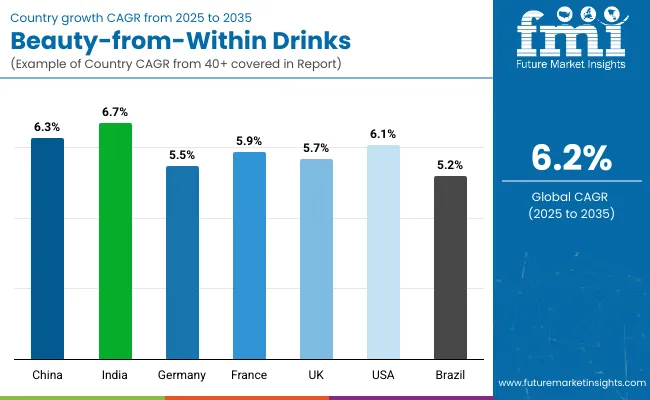

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.3% |

| India | 6.7% |

| Germany | 5.5% |

| France | 5.9% |

| UK | 5.7% |

| USA | 6.1% |

| Brazil | 5.2% |

Growth within the global Beauty-from-Within Drinks Market is being shaped by pronounced regional dynamics, reflecting variations in consumer awareness, wellness infrastructure, and regulatory alignment. Asia-Pacific has emerged as the most accelerated growth cluster, with India projected at a CAGR of 6.7% and China closely following at 6.31%.

Expansion in these countries is being driven by rising disposable incomes, rapid urbanization, and growing adoption of functional beverages among younger consumers. In China, domestic beauty innovation ecosystems and KOL-led product endorsements have created a favorable environment for ingestible skincare. In India, the integration of Ayurvedic botanicals with modern formats has enabled a unique product proposition aligned with preventive wellness.

Europe remains a critical market for premium-positioned beauty drinks, supported by France(5.9%), Germany (5.5%), and theUK (5.7%), where skin health is increasingly being managed through clinically supported formulations. Regulatory emphasis on clean-label claims and ingredient traceability is expected to reinforce brand credibility.

In North America, where the USA is projected at a CAGR of 6.1%, growth is being led by D2C wellness platforms and tech-enabled personalization tools. Meanwhile, Brazil (5.2%) is witnessing growing traction in collagen- and antioxidant-based formats through pharmacy and beauty retail, driven by rising beauty-consciousness in urban centers.

| Year | USA Berberine Market (USD Million) |

|---|---|

| 2025 | 776.5 |

| 2026 | 829.3 |

| 2027 | 883.3 |

| 2028 | 942.2 |

| 2029 | 993.7 |

| 2030 | 1,051.1 |

| 2031 | 1,110.4 |

| 2032 | 1,174.8 |

| 2033 | 1,247.6 |

| 2034 | 1,327.9 |

| 2035 | 1,411.1 |

The Beauty-from-Within Drinks Market in the United States is projected to grow at a CAGR of 6.1% from 2025 to 2035, reaching USD 1,411.1 million by 2035, up from USD 776.5 million in 2025. Growth is being fueled by increased consumer investment in holistic health regimens, with skin, hair, and gut-focused beverages gaining wider acceptance across demographics.

Premium-positioned RTD collagen beverages have been increasingly stocked by wellness-focused retailers and pharmacies, while powdered beauty blends are being incorporated into personalized subscription models. Scientific backing for ingredient efficacy particularly for hyaluronic acid, ceramides, and probiotics is expected to drive repeat purchase rates and increase product loyalty.

As consumer sophistication deepens and product differentiation becomes more clinically grounded, the USA market is expected to anchor regional leadership in North America.

The UK Beauty-from-Within Drinks Market is expected to experience sustained momentum, supported by a growing alignment between beauty routines and wellness behaviors. A strong demand for clean-label, non-GMO, and plant-based functional beverages has been observed, particularly in urban centers. With the CAGR projected at 5.7%, innovation is being driven by botanical extracts and antioxidant-rich formulations targeted at stress-related skin concerns.

India’s Beauty-from-Within Drinks Market is forecasted to expand at a 6.7% CAGR, driven by increasing disposable income, beauty-conscious youth populations, and the fusion of Ayurveda traditions with modern delivery formats. Regional brands are leveraging herbal actives like ashwagandha and turmeric to offer preventive and rejuvenating benefits in affordable formats.

China is anticipated to grow at a 6.3% CAGR, driven by widespread consumer acceptance of functional beauty beverages and highly developed influencer-led ecosystems. Collagen and hyaluronic acid drinks have become embedded in daily skincare routines among urban millennials and Gen Z women, with domestic players innovating in convenience, packaging, and co-branding.

| Country | 2025 |

|---|---|

| UK | 19.40% |

| Germany | 21.93% |

| Italy | 10.68% |

| France | 13.10% |

| Spain | 9.85% |

| BENELUX | 6.23% |

| Nordic | 5.60% |

| Rest of Europe | 13% |

| Country | 2035 |

|---|---|

| UK | 18.38% |

| Germany | 21.57% |

| Italy | 11.59% |

| France | 13.55% |

| Spain | 11.45% |

| BENELUX | 5.02% |

| Nordic | 5.46% |

| Rest of Europe | 13% |

Germany’s Beauty-from-Within Drinks Market is projected to expand at a 5.5% CAGR, led by demand for scientifically validated, additive-free products that meet stringent consumer safety and transparency standards. German consumers prioritize formulation integrity and often prefer products backed by dermatological associations and clinical data.

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Collagen Peptides | 32.0% |

| Hyaluronic Acid | 9.0% |

| Vitamins & Minerals (Biotin, Vitamin C, Zinc) | 12.0% |

| Antioxidants (Polyphenols, Astaxanthin) | 10.0% |

| Adaptogens (Ashwagandha, Rhodiola) | 6.0% |

| Botanical Extracts (Goji Berry, Aloe Vera) | 8.0% |

| Probiotics & Prebiotics | 7.0% |

| Marine Extracts (Algae, Seaweed) | 6.0% |

| Ceramides | 10.0% |

The Beauty-from-Within Drinks Market in Japan is projected to reach USD 42.7 million in 2025, withcollagen peptides contributing 32.0% of the total market value. A clear preference for clinically supported actives especially those associated with anti-aging and skin firmness-has been observed across key consumer segments. Ceramides and hyaluronic acid, each holding 10.0%, reflect Japan’s strong emphasis on skin barrier support and moisture retention, particularly among aging and sensitive-skin populations.

This composition signals Japan’s evolution into a science-forward ingestible beauty market, where consumer trust is grounded in efficacy, traceability, and dermatological endorsement. Ceramides have been favored in combination formats with probiotics and vitamins to enhance bioavailability and functional synergy. Hyaluronic acid’s presence is being reinforced by growing consumer education around deep hydration and cellular rejuvenation.

| Product Format Segment | Market Value Share, 2025 |

|---|---|

| Ready to Drink (RTD) Bottles | 36.0% |

| Powdered Drink Mixes | 24.0% |

| Shots (Concentrated) | 14.0% |

| Carbonated Beauty Drinks | 16.0% |

| Tea & Infused Water | 10.0% |

The Beauty-from-Within Drinks Market in South Korea is projected to reach USD 31.1 million in 2025, with ready-to-drink (RTD) bottles accounting for 36% of total market value, followed by carbonated beauty drinks at 16%. These segments are expected to maintain dominance due to cultural preferences for convenience, taste variety, and aesthetic packaging.

The RTD format has been widely adopted across South Korea’s urban centers, driven by demand for seamless integration into K-beauty routines. Functional beverages are being positioned as daily wellness enhancers, often co-branded with cosmetics or endorsed by K-pop influencers. RTD collagen drinks, in particular, are being embedded into skin-brightening and hydration regimes.

Carbonated beauty drinks have captured rising attention among younger consumers seeking novel textures and flavor-forward formulations. These formats are often infused with vitamins, hyaluronic acid, and antioxidants-designed to deliver both sensorial pleasure and functional benefit.

| Companies | Global Value Share 2025 |

|---|---|

| Vital Proteins | 10% |

| Others | 90% |

The Beauty-from-Within Drinks Market is moderately fragmented, with established global wellness brands, premium lifestyle players, and niche nutraceutical innovators competing across diverse functional positioning. Global leaders such as Vital Proteins, NeoCell, andGarden of Lifeare holding significant market share, driven by strong collagen-based portfolios, nationwide retail partnerships, and clinically supported formulations. Strategic focus has been placed on clean-label certifications, cross-category expansion, and integration into personalized wellness platforms.

Mid-sized innovators including HUM Nutrition, Olly Nutrition, andSkinade are gaining consumer traction through targeted formulations for skin hydration, anti-aging, and mood-beauty connections. Growth is being enabled by digital-first distribution, influencer-led storytelling, and subscription-based personalization, particularly among Gen Z and millennial users.

Premium lifestyle and holistic wellness brands such as The Beauty Chef, Sakara, and Reserveage Nutritionare differentiating through gut-skin health positioning, fermented ingredients, and adaptogen-infused formats. Emphasis has been placed on organic sourcing, sustainability narratives, and editorial-driven brand ecosystems.

Competitive advantage is expected to shift from ingredient claims alone to ecosystemintegration where efficacy, traceability, and consumer education converge. Future leadership will likely be defined by clinical data transparency, format innovation, andcustomized delivery systems embedded into holistic beauty routines.

Key Developments in Beauty-from-Within Drinks

| Item | Value |

|---|---|

| Quantitative Units | USD 3,235.6 Million |

| Active Ingredient Type | Collagen Peptides, Hyaluronic Acid, Vitamins & Minerals (Biotin, Vitamin C, Zinc), Antioxidants (Polyphenols, Astaxanthin), Adaptogens (Ashwagandha, Rhodiola), Botanical Extracts (Goji Berry, Aloe Vera), Probiotics & Prebiotics, Marine Extracts (Algae, Seaweed), Ceramides |

| Product Format | Ready-to-Drink (RTD) Bottles, Powdered Drink Mixes, Concentrated Shots, Carbonated Beauty Drinks, Tea & Infused Water |

| Benefit Claims | Skin Hydration, Anti-Aging & Wrinkle Reduction, Skin Brightening, Hair & Nail Strengthening, Detox & Radiance Boost, Gut-Skin Health Connection |

| Target Consumer | Women, Men, and Unisex |

| Sales Channel | Supermarkets & Hypermarkets, Specialty Health Stores, Online Retail, Direct-to-Consumer (D2C), and Salons & Spas |

| Packaging Type | Bottles (Glass, PET), Sachets/Stick Packs, Multi-Pack Bundles |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Vital Proteins, HUM Nutrition, Collagen ny Watsons,Olly Nutrition, NeoCell, The Beauty Chef, Skinade, Garden of Life, Reserveage Nutrition, Sakara |

| Additional Attributes | Market share by ingredient type and format, clean-label and organic adoption trends, rise in personalized nutrition, integration of AI diagnostics and D2C models, collagen formulation advancements, probiotic beauty innovation, regulatory influence on claim substantiation, and growth via influencer commerce and tech-driven retail. |

The global Beauty-from-Within Drinks is estimated to be valued at USD 3,235.6 million in 2025.

The market size for the Beauty-from-Within Drinks is projected to reach USD 5,893.4 million by 2035.

The Beauty-from-Within Drinks is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product formats in the Beauty-from-Within Drinks Market include Ready-to-Drink (RTD) Bottles, Powdered Drink Mixes, Concentrated Shots, Carbonated Beauty Drinks, and Tea & Infused Water.

In terms of benefit claims, Skin Hydration & Moisture segment is projected to command the largest share at 25% in the Beauty-from-Within Drinks Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Soft Drinks Packaging Market Size and Share Forecast Outlook 2025 to 2035

Soft Drinks Concentrates Market Trends - Growth & Forecast

Beauty Drinks Market Size and Share Forecast Outlook 2025 to 2035

Organic Drinks Market Size and Share Forecast Outlook 2025 to 2035

Low Fat Drinks Market Size and Share Forecast Outlook 2025 to 2035

Cannabis Drinks Market Size and Share Forecast Outlook 2025 to 2035

Collagen Drinks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Breakfast Drinks Market Size and Share Forecast Outlook 2025 to 2035

Alcoholic Drinks Packaging Market Size and Share Forecast Outlook 2025 to 2035

Aloe Vera Drinks Market Outlook – Growth, Size & Demand 2025-2035

Antioxidant Drinks Market Size and Share Forecast Outlook 2025 to 2035

Electrolyte Drinks Market Size and Share Forecast Outlook 2025 to 2035

GABA-Infused Drinks Market Size and Share Forecast Outlook 2025 to 2035

Powdered Soft Drinks Market Size and Share Forecast Outlook 2025 to 2035

Digestive Health Drinks Market Analysis by Ingredient Type, Sales Channel, Region Through 2025 to 2035

Chocolate Powdered Drinks Market Forecast and Outlook 2025 to 2035

Probiotic Wellness Drinks Market Size and Share Forecast Outlook 2025 to 2035

Demand for Protein-rich Shelf-stable UHT Oat Drinks in Latin America Size and Share Forecast Outlook 2025 to 2035

Demand of Heat Stable Whey for RTD Performance Drinks in EU Size and Share Forecast Outlook 2025 to 2035

Demand for RTD Whey Deployments for Shelf-stable Drinks in CIS Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA