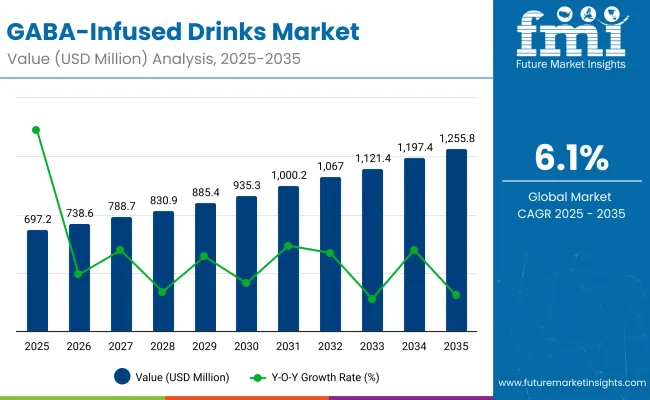

A valuation of USD 697.2 million is anticipated in 2025, with the market projected to reach USD 1,255.8 million by 2035. This increase of nearly USD 558.6 million underscores the transition of GABA beverages from a niche wellness product into a mainstream functional beverage category, validated by measurable consumer adoption trends.

| Metrics | Value |

|---|---|

| GABA-Infused Drinks Market Estimated Value in (2025E) | USD 697.2 million |

| GABA-Infused Drinks Market Forecast Value in (2035F) | USD 1,255.8 million |

| Forecast CAGR (2025 to 2035) | 6.0% |

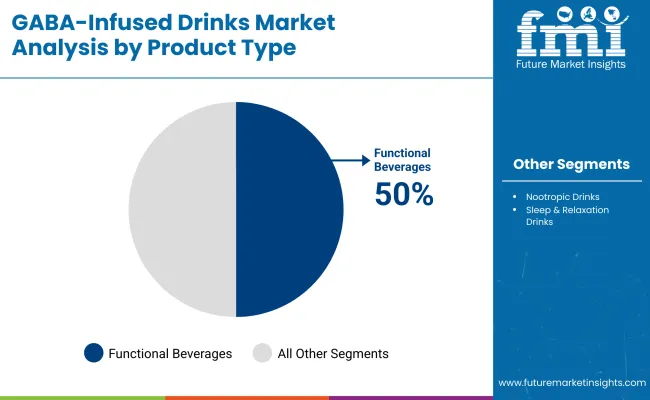

Between 2025 and 2030, the market is expected to climb from USD 697.2 million to USD 950.3 million, reflecting a gain of USD 253.1 million, or about 45% of the decade’s growth. This phase will likely be characterized by the early mainstreaming of stress-relief and sleep-support beverages, reinforced by wider retail penetration and consumer demand for clinically associated functional outcomes. Within this period, Functional Beverages are projected to dominate with a 50% share, emphasizing their integration into daily consumption routines.

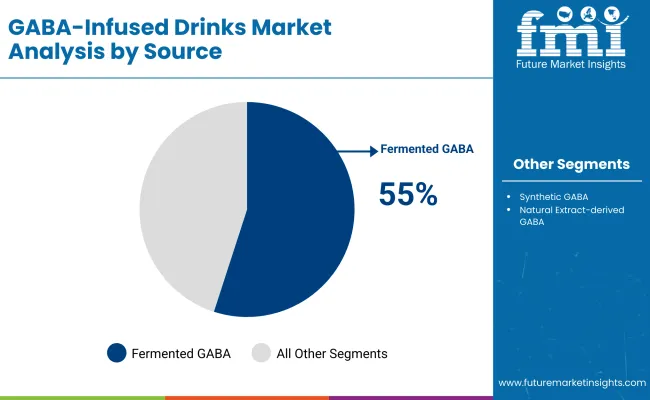

From 2030 to 2035, momentum is projected to strengthen, with the market rising from USD 950.3 million to USD 1,255.8 million, adding another USD 305.5 million (55% of decade growth). The strongest gains are expected in Sleep & Relaxation Drinks, forecasted to grow at 11.2% CAGR, while Fermented GABA will remain a preferred source with a 55% share in 2025, supported by consumer trust in natural fermentation. By 2035, the market is anticipated to nearly double in value, anchored by transparent claims, multi-demographic adoption, and expansion across omnichannel retail strategies.

Growth in the GABA-Infused Drinks Market is being propelled by rising consumer focus on mental wellness, stress relief, and sleep quality. Increasing awareness of functional ingredients is being reinforced by higher adoption of beverages offering measurable benefits beyond hydration. During the forecast period, demand is expected to be stimulated by greater acceptance of fermented GABA, which is perceived as both natural and trustworthy. Broader availability across supermarkets, health stores, and online platforms is being supported by expanding product ranges in functional, nootropic, and sleep-focused categories.

Younger demographics and urban professionals particularly those balancing digital lifestyles and high-stress work environments are increasingly driving adoption of GABA beverages are increasingly being drawn to beverages positioned as mood-enhancing or relaxation-inducing, creating repeat purchase behavior. Premiumization trends are being supported by clean-label positioning, co-active blends such as L-theanine and adaptogens, and transparent sourcing claims. Over the decade, acceleration is expected as sleep and relaxation formats capture faster growth, consolidating GABA beverages as a mainstream functional category.

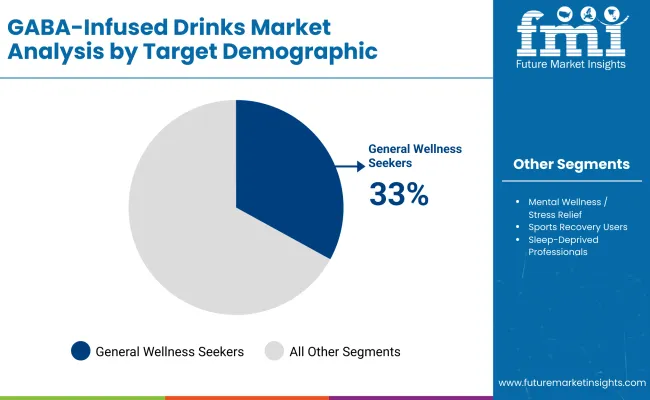

The GABA-Infused Drinks Market is segmented by product type, source, target demographics, sales channel, packaging format, and claims & positioning. Within product type, the market spans functional beverages, nootropic drinks, and sleep & relaxation drinks, reflecting the range of consumption occasions. Source segmentation includes fermented GABA, synthetic GABA, and natural extract-derived GABA, highlighting differences in cost efficiency and consumer trust. Target demographics cover general wellness seekers, mental wellness/stress relief consumers, sports recovery users, and sleep-deprived professionals. Each of these segments is projected to grow at varying rates, shaping the category’s long-term performance and competitive positioning.

| Product Type | Market Value Share, 2025 |

|---|---|

| Functional Beverages | 50% |

| Nootropic Drinks | 25% |

| Sleep & Relaxation Drinks | 25% |

The Functional Beverages segment is expected to contribute 50% of the GABA-Infused Drinks Market revenue in 2025, maintaining its lead as the dominant category. Growth is anticipated to be fueled by the clinically associated benefits of GABA for stress modulation, integrated into everyday drinks such as teas, waters, and dairy alternatives, reinforcing broad consumer acceptance. The segment’s expansion is projected to be further supported by a CAGR of 9.2%, reflecting steady penetration into mainstream beverage portfolios. Although functional beverages remain the anchor, the faster growth of sleep & relaxation formats is expected to gradually rebalance category shares. Over the forecast horizon, functional beverages are projected to retain their backbone role in driving mass adoption.

| Source | Market Value Share, 2025 |

|---|---|

| Fermented GABA | 55% |

| Synthetic GABA | 30% |

| Natural Extract-derived GABA | 15% |

The Fermented GABA segment is projected to dominate with a 55% share in 2025, a leadership reinforced by consumer trust in microbial fermentation and its long-standing cultural acceptance across East Asia. This segment is forecast to expand at a CAGR of 10.1%, outperforming synthetic and extract-derived sources. Synthetic GABA, holding 30%, is expected to retain significance due to affordability and consistent supply, while natural extract-derived sources, with 15% share, are anticipated to gain traction in premium-positioned beverages. The leadership of fermented GABA reflects both cultural acceptance and alignment with clean-label expectations. Over the next decade, it is projected that fermentation-derived GABA will remain the foundation of sourcing strategies, particularly in East Asia, while premium brands globally will adopt provenance-driven extract formats.

| Target Demographic | Market Value Share, 2025 |

|---|---|

| General Wellness Seekers | 33% |

| Mental Wellness/Stress Relief | 31% |

| Sports Recovery Users | 15% |

| Sleep-Deprived Professionals | 21% |

General Wellness Seekers are anticipated to hold the largest share at 33% in 2025, reflecting integration of GABA beverages into daily wellness routines rather than occasional use. Sleep-deprived professionals, expanding at 11.2% CAGR, reflect a rising shift toward evidence-backed relaxation formats. Sports recovery users, with 15% share, are forecast to maintain steady growth at 9.9% CAGR. Collectively, these demographic dynamics are expected to broaden the consumer base and diversify growth opportunities across the decade.

Complex regulatory scrutiny over functional claims is shaping category strategies, even as broader consumer adoption is reinforced by clean-label expectations, targeted formulations, and the normalization of functional beverages across retail and digital platforms.

Efficacy-Linked Purchase Behaviour

Growth in the GABA-Infused Drinks Market is being anchored by consumer behavior that ties repeat purchases to measurable outcomes. Unlike traditional soft drinks, this category is expected to evolve around a “proof-of-effect” model, where perceived calmness, improved sleep quality, or enhanced focus drive loyalty. Transparent dosing, third-party batch testing, and QR-linked product traceability are increasingly being prioritized, underscoring a shift toward verifiable efficacy claims. Over the forecast period, brands that link consumption to quantifiable markers such as sleep latency reduction or stress-level self-assessments are expected to secure higher lifetime value customers. This driver establishes efficacy not as a marketing add-on but as the central competitive differentiator.

Multi-Occasion Positioning

A major trend shaping the market is the repositioning of GABA-infused drinks from single-use relaxation aids into multi-occasion solutions. Products are being designed for morning composure, midday calm, and evening wind-down, creating a continuum of use-cases. This trend is expected to elevate volume growth as consumption is normalized alongside coffee and energy drinks. Companies that clearly define “time-of-day” relevance and integrate GABA into broader wellness routines are projected to outperform, as the market shifts toward functional beverages embedded into daily life.

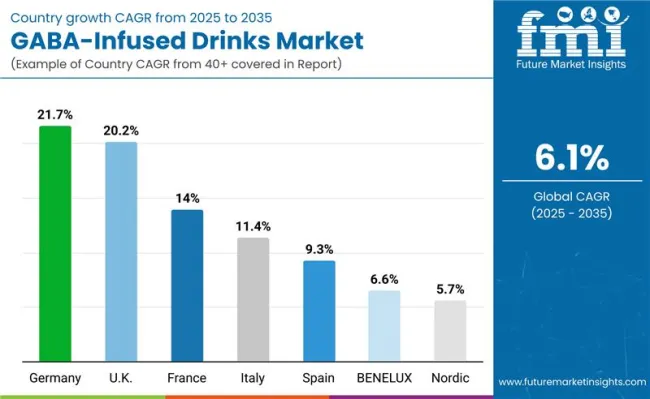

| Countries | CAGR |

|---|---|

| UK | 20.28% |

| Germany | 21.74% |

| Italy | 11.47% |

| France | 14.03% |

| Spain | 9.31% |

| BENELUX | 6.61% |

| Nordic | 5.78% |

The trajectory of the GABA-Infused Drinks Market is expected to display marked variation across major countries, reflecting cultural attitudes toward functional beverages, regulatory frameworks, and consumer readiness to adopt stress-relief solutions. The United States, projected at a 6.5% CAGR, is anticipated to remain the most mature market in North America, where functional wellness beverages are being normalized through mainstream retail channels and product innovation pipelines. In Europe, Germany and France are expected to expand steadily at 5.88% and 5.92% CAGR, respectively, driven by strong regulatory oversight and consumer trust in evidence-based health claims. The UK, at 5.09% CAGR, is forecast to show moderate growth, reflecting cautious adoption influenced by claim restrictions.

In Asia, China’s market, growing at 5.87% CAGR, is expected to consolidate around its established base of functional beverage consumers, supported by urban wellness trends. India, at 5.62% CAGR, is anticipated to represent an emerging growth hub, where functional drinks are increasingly integrated into urban and youth wellness routines. Latin America shows stronger acceleration, with Brazil leading at 6.18% CAGR, reflecting higher receptivity to stress-relief formats in urban centres. Collectively, these country-level variations are projected to shape the competitive landscape, as global players adjust portfolios and messaging to align with local consumer drivers and regulatory sensitivities.

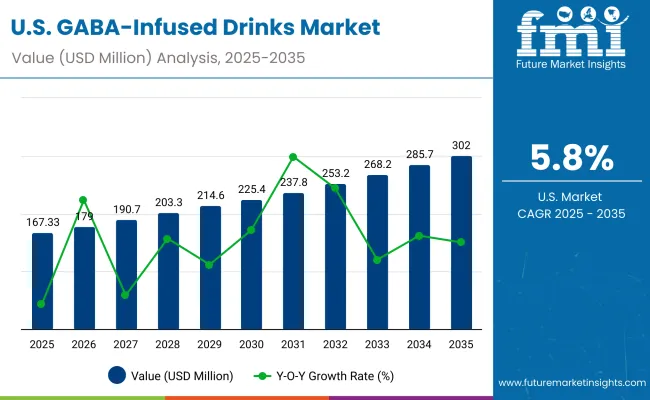

| Year | USA GABA-Infused Drinks Market (USD Million) |

|---|---|

| 2025 | 167.33 |

| 2026 | 179.0 |

| 2027 | 190.7 |

| 2028 | 203.3 |

| 2029 | 225.4 |

| 2030 | 225.4 |

| 2031 | 237.8 |

| 2032 | 253.2 |

| 2033 | 268.2 |

| 2034 | 285.7 |

| 2035 | 302.0 |

The GABA-Infused Drinks Market in the United States is projected to expand from USD 167.3 million in 2025 to USD 302.0 million by 2035, recording a CAGR of 6.1%. Growth momentum is expected to be supported by year-on-year expansions ranging between 5.0% and 7.0%, reflecting steady yet sustained adoption.

Expansion is anticipated to be underpinned by increasing consumer emphasis on stress relief, cognitive balance, and sleep wellness. Functional beverages are projected to retain dominance, while sleep-focused formulations are expected to achieve stronger acceleration within urban and professional demographics. The integration of GABA into teas, waters, and wellness-focused dairy alternatives is expected to broaden accessibility.

Clean-label fermented GABA is projected to strengthen its role in premium offerings, while online retail platforms are likely to amplify distribution and awareness. Over the decade, the USA market is expected to demonstrate resilience by balancing mature wellness demand with innovative product positioning across multiple consumption occasions.

The GABA-Infused Drinks Market in the UK is projected to grow at a CAGR of 6.5% between 2025 and 2035. The country’s share is expected to rise from 18.2% in 2025 to 20.9% in 2035, reflecting increasing consumer receptivity to wellness-centric beverages. Demand is anticipated to be shaped by strong interest in functional drinks positioned for stress relief and sleep aid, aligning with rising workplace stress and urban lifestyle pressures. Regulatory oversight on health claims is expected to shape brand narratives, favouring clean-label formulations and natural sourcing. Online retail and health-focused specialty channels are anticipated to accelerate product penetration among younger consumers.

The GABA-Infused Drinks Market in India is projected to record a CAGR of 5.22% over 2025-2035. Demand is expected to be driven by an expanding middle class increasingly focused on stress management and mental wellness solutions. Urban youth adoption is projected to accelerate, especially in categories such as sleep-support shots and GABA-blended nootropic formulations. Domestic beverage companies are anticipated to explore partnerships for fermented GABA sourcing, improving affordability and scalability. Retail expansion and the rapid growth of e-commerce are expected to bridge access gaps, especially in Tier-II and Tier-III cities. India’s trajectory is likely to evolve as consumers shift from traditional remedies to modern, functional beverage formats.

The GABA-Infused Drinks Market in China is projected to expand at a CAGR of 5.57% through 2025–2035. The market is expected to be supported by an established consumer base for functional beverages and continued innovation by domestic and global players. Cultural acceptance of natural wellness beverages is anticipated to favour fermented GABA formulations, aligning with consumer preferences for traditional health-inspired products. Urban demand is projected to remain concentrated in stress-relief and cognitive-support beverages, reflecting lifestyle pressures in major metropolitan regions. Expanding retail modernization and integration with digital commerce platforms are expected to enhance distribution scale and consumer awareness.

| Countries | 2025 |

|---|---|

| UK | 20.94% |

| Germany | 21.34% |

| Italy | 10.29% |

| France | 14.03% |

| Spain | 11.66% |

| BNELUX | 6.08% |

| Nordic | 5.94% |

| Rest of Europe | 10% |

| Countries | 2035 |

|---|---|

| UK | 19.44% |

| Germany | 20.20% |

| Italy | 9.33% |

| France | 13.33% |

| Spain | 11.01% |

| BNELUX | 5.23% |

| Nordic | 5.42% |

| Rest of Europe | 16% |

The GABA-Infused Drinks Market in Germany is projected to grow at a CAGR of 6.28% between 2025 and 2035. Market share is expected to remain high, with 21.9% in 2025 and 20.8% in 2035, maintaining Germany’s role as Europe’s largest market for GABA-based beverages. Strong consumer trust in evidence-backed functional claims is anticipated to sustain demand, especially within nootropic and stress-relief segments. Stringent regulatory oversight is projected to enhance product credibility, benefiting established brands that emphasize transparency and scientific validation. Distribution through supermarkets and wellness-focused retailers is expected to remain a dominant channel, while premiumization is likely to drive demand for fermented GABA.

| Component Segment | Market Value Share, 2025 |

|---|---|

| Fermented GABA | 50% |

| Synthetic GABA | 25% |

| Natural Extract-derived GABA | 25% |

The GABA-Infused Drinks Market in Japan is projected at a strong base in 2025, with fermented GABA contributing 55%, synthetic GABA holding 30%, and natural extract-derived GABA at 15%. The clear dominance of fermented GABA highlights Japan’s cultural and technological alignment with microbial fermentation, which has been embedded within its food innovation ecosystem. This preference reflects consumer trust in naturally derived solutions, as well as regulatory comfort with fermentation-based nutraceuticals.

The outlook is expected to be shaped by Japan’s emphasis on precision wellness, where GABA-infused teas and functional beverages are anticipated to gain significant traction. Digital platforms and e-commerce channels are projected to expand product accessibility, while functional claims around stress relief, sleep aid, and cognitive support are expected to consolidate consumer trust. As healthcare-conscious consumers increasingly demand science-backed beverages, the fermented segment is projected to continue leading premium-positioned products, while synthetic and natural extracts diversify affordability and choice.

| Range Segment | Market Value Share, 2025 |

|---|---|

| General Wellness Seekers | 33% |

| Mental Wellness / Stress Relief | 31% |

| Sports Recovery Users | 15% |

| Sleep-Deprived Professionals | 21% |

The GABA-Infused Drinks Market in South Korea is projected to advance steadily between 2025 and 2035, supported by shifting consumer lifestyles and rising focus on targeted wellness functions. In 2025, General Wellness Seekers dominate with 33%, followed by Mental Wellness/Stress Relief Consumers at 31%, Sleep-Deprived Professionals at 21%, and Sports Recovery Users at 15%.

The most significant momentum is expected fromSleep-Deprived Professionals, forecasted to grow at a11.20% CAGR, reflecting the country’s intense work schedules and increasing awareness of sleep-health beverages. Mental Wellness/Stress Relief, expanding at 10.50% CAGR, is projected to capture strong demand as mental resilience becomes central to urban lifestyles. General WellnessSeekers, while holding the largest base share, are expected to expand at a slower 9.50% CAGR, signaling a gradual shift toward more specialized consumption. Sports Recovery Users are projected to rise at 9.90% CAGR, reinforcing adoption within fitness and professional athletic routines.

The market outlook is further shaped by South Korea’s advanced retail ecosystem, where functional drinks are widely integrated into convenience stores, online marketplaces, and café chains. Premium positioning around cognitive support, relaxation, and recovery is expected to define the competitive landscape, with innovation in formulations driving both mainstream and niche adoption.

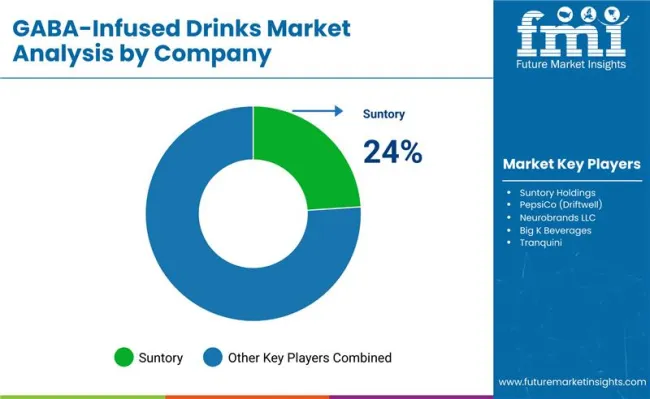

| Company | Global Value Share 2025 |

|---|---|

| Suntory | 24% |

| Others | 76% |

The GABA-Infused Drinks Market is moderately fragmented, with multinational beverage companies, functional food innovators, and regional specialists actively competing. Global leaders such as Nestlé, Suntory, and PepsiCo have been holding strong positions, supported by wide distribution networks, brand recognition, and ongoing investments in functional wellness portfolios. Their strategies are increasingly shaped by scientific validation, regulatory compliance, and functional claims around stress relief, relaxation, and cognitive health.

Mid-sized innovators, including Kirin Holdings, Yakult Honsha, and Asahi Group, are strengthening their foothold through fermentation expertise, R&D-driven formulations, and niche wellness branding. Their emphasis on Japan’s fermentation heritage and science-backed health positioning is expected to sustain their long-term competitiveness.

Niche-focused players and startups are projected to shape the premium and craft beverage space. Brands emphasizing natural extract-derived GABA, clean-label claims, and personalized wellness positioning are expected to benefit from rising consumer preference for transparent sourcing and functional authenticity.

Competitive differentiation is steadily moving beyond formulation toward integrated consumer engagement models, including e-commerce expansion, subscription-based wellness packs, and AI-driven personalization of beverage choices. By 2035, competitive advantage is expected to be determined less by production scale and more by scientific credibility, digital accessibility, and lifestyle integration.

Key Developments in GABA-Infused Drinks Market

| Item | Value |

|---|---|

| Quantitative Units | USD million |

| Component | Product Type: Functional Beverages (50% share; CAGR 9.20%); Nootropic Drinks (25%; CAGR 10.40%); Sleep & Relaxation Drinks (25%; CAGR 11.20%) |

| Range | GABA Source: Fermented GABA (55%; CAGR 10.10%); Synthetic GABA (30%; CAGR 8.70%); Natural Extract ‑ derived GABA (15%; CAGR 9.80%) |

| Technology | Claims & Positioning: Stress Relief; Sleep Aid; Mood Enhancer; Cognitive Support |

| Type | Packaging Format: Bottles (Plastic/Glass); Cans; Single ‑ serve Shots; Sachets (mix ‑ ins) |

| End-use Industry | Target Demographics (benchmark—South Korea): General Wellness Seekers (33%; CAGR 9.50%); Mental Wellness/Stress Relief (31%; CAGR 10.50%); Sports Recovery Users (15%; CAGR 9.90%); Sleep ‑ Deprived Professionals (21%; CAGR 11.20%) |

| Regions Covered | North America (30%); Europe (28%); East Asia (12%); South Asia & Pacific (25%); Latin America (2%); Middle East & Africa (3%) — Total 100% |

| Country Covered | United States; United Kingdom; Germany; France; Italy (EU sub ‑ region set provided); China; Japan; India; Brazil; South Korea |

| Key Companies Profiled | Suntory Holdings ( Iyemon Tokucha ; Suntory GABA Tea); PepsiCo ( Driftwell ); Neurobrands LLC (Neuro Sleep); Big K Beverages (Vibe Relaxation); Tranquini |

| Additional Attributes | Dollar sales by product type and GABA source; regional share mapping (as above); Europe sub ‑ region shares (UK, Germany, Italy, France, Spain, BENELUX, Nordic, Rest of Europe); country ‑ level CAGRs provided; South Korea demographic benchmark (shares + CAGRs); sales channels (Retail, Online, Foodservice, Specialty); packaging formats; EEAT ‑ aligned focus on transparent dosing and evidence ‑ based claims. |

The global GABA-Infused Drinks Market is estimated to be valued at USD 697.2 million in 2025.

The GABA-Infused Drinks Market size is projected to reach USD 1,255.8 million by 2035.

The GABA-Infused Drinks Market is expected to expand at a CAGR of 6.1% between 2025 and 2035.

The key product types in the GABA-Infused Drinks Market include Functional Beverages (50% share, 2025), Nootropic Drinks (25%), and Sleep & Relaxation Drinks (25%).

Fermented GABA is projected to command a 55% share in 2025, a leadership position supported by Japan’s regulatory comfort with fermentation technologies and global consumer preference for natural, science-backed formulations.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Soft Drinks Packaging Market Size and Share Forecast Outlook 2025 to 2035

Soft Drinks Concentrates Market Trends - Growth & Forecast

Beauty Drinks Market Size and Share Forecast Outlook 2025 to 2035

Organic Drinks Market Size and Share Forecast Outlook 2025 to 2035

Low Fat Drinks Market Size and Share Forecast Outlook 2025 to 2035

Cannabis Drinks Market Size and Share Forecast Outlook 2025 to 2035

Collagen Drinks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Breakfast Drinks Market Size and Share Forecast Outlook 2025 to 2035

Alcoholic Drinks Packaging Market Size and Share Forecast Outlook 2025 to 2035

Aloe Vera Drinks Market Outlook – Growth, Size & Demand 2025-2035

Antioxidant Drinks Market Size and Share Forecast Outlook 2025 to 2035

Electrolyte Drinks Market Size and Share Forecast Outlook 2025 to 2035

Powdered Soft Drinks Market Size and Share Forecast Outlook 2025 to 2035

Digestive Health Drinks Market Analysis by Ingredient Type, Sales Channel, Region Through 2025 to 2035

Chocolate Powdered Drinks Market Forecast and Outlook 2025 to 2035

Probiotic Wellness Drinks Market Size and Share Forecast Outlook 2025 to 2035

Beauty-from-Within Drinks Market Size and Share Forecast Outlook 2025 to 2035

Demand for Protein-rich Shelf-stable UHT Oat Drinks in Latin America Size and Share Forecast Outlook 2025 to 2035

Demand of Heat Stable Whey for RTD Performance Drinks in EU Size and Share Forecast Outlook 2025 to 2035

Demand for RTD Whey Deployments for Shelf-stable Drinks in CIS Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA