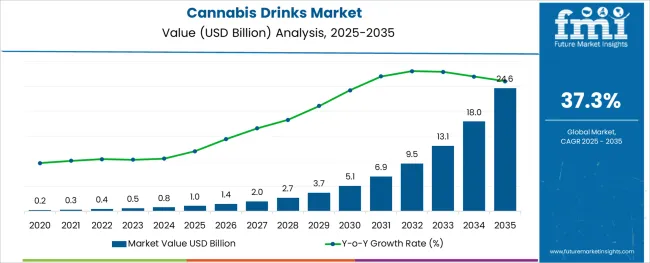

The Cannabis Drinks Market is estimated to be valued at USD 1.0 billion in 2025 and is projected to reach USD 24.6 billion by 2035, registering a compound annual growth rate (CAGR) of 37.3% over the forecast period.

The stainless steel valve tag market is expanding steadily as industrial sectors prioritize asset management, safety compliance, and equipment traceability. Increasing investments in infrastructure and process automation have heightened demand for robust and clear identification solutions capable of withstanding harsh environments.

The shift toward digital transformation in industries such as oil and gas, manufacturing, and utilities is encouraging the adoption of advanced tagging systems that support maintenance and audit operations. Growing awareness around regulatory compliance for equipment labeling and enhanced safety protocols is also influencing market expansion.

The rise of e-commerce platforms has facilitated easier procurement of valve tags, increasing accessibility for small to medium enterprises and broadening geographic reach. Material innovations and customization options continue to enhance product longevity and visibility, creating opportunities for market penetration across diverse industrial applications.

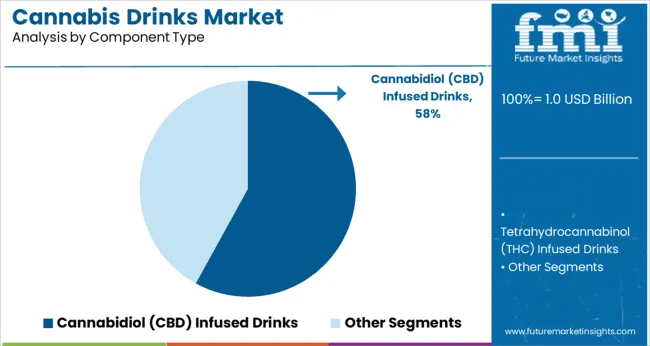

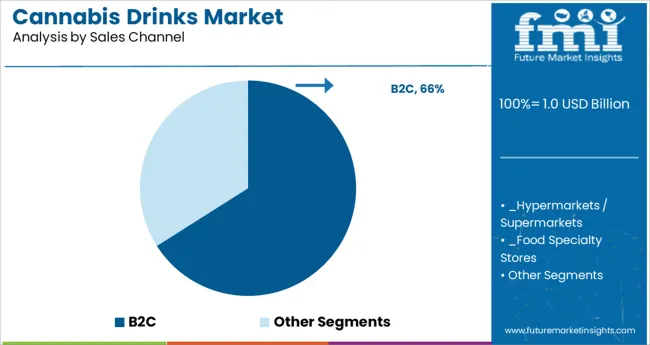

The market is segmented by Product Type, Component Type, Flavor Type, and Sales Channel and region. By Product Type, the market is divided into Non-Alcoholic Cannabis-Infused Drinks and Alcoholic Cannabis-Infused Drinks. In terms of Component Type, the market is classified into Cannabidiol (CBD) Infused Drinks and Tetrahydrocannabinol (THC) Infused Drinks. Based on Flavor Type, the market is segmented into Flavoured and Unflavoured. By Sales Channel, the market is divided into B2C and B2B / HoReCa. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Product Type, Component Type, Flavor Type, and Sales Channel and region. By Product Type, the market is divided into Non-Alcoholic Cannabis-Infused Drinks and Alcoholic Cannabis-Infused Drinks. In terms of Component Type, the market is classified into Cannabidiol (CBD) Infused Drinks and Tetrahydrocannabinol (THC) Infused Drinks. Based on Flavor Type, the market is segmented into Flavoured and Unflavoured. By Sales Channel, the market is divided into B2C and B2B / HoReCa. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The less than 30 mm thickness segment is expected to hold 41.3% of the revenue share in 2025 within the thickness category. This segment’s leadership is supported by its suitability for a wide range of valve sizes and equipment types, providing sufficient durability while minimizing material costs.

The thinner tags offer flexibility in installation, especially in tight spaces and complex piping systems, making them preferable for industries where compactness is critical. Their compatibility with standard mounting hardware and ability to endure corrosion and wear have reinforced demand in sectors emphasizing both performance and cost efficiency.

This balance between robustness and adaptability has contributed to the segment’s dominant position.

Within the product type category, engraved valve tags are projected to command 57.8% of the market revenue share in 2025, marking them as the leading product form. The prominence of engraved tags is due to their superior legibility, permanence, and resistance to environmental degradation such as fading, scratching, and chemical exposure.

Engraving allows precise and customizable marking, meeting stringent industry standards for traceability and safety. The technique supports complex information including serial numbers, barcodes, and QR codes, enhancing integration with digital asset management systems.

Manufacturers’ emphasis on delivering long-lasting, tamper-proof tags that reduce maintenance costs has reinforced the adoption of engraved tags in heavy industries.

The online distribution channel is expected to generate 63.7% of market revenue in 2025, making it the most dominant sales route. The growth of e-commerce platforms has revolutionized procurement by offering convenience, broader product selections, and competitive pricing to end-users across industries.

Online channels enable buyers to access detailed product specifications, customization options, and customer reviews, simplifying purchase decisions. This has particularly benefited small and medium-sized enterprises lacking traditional supply chain networks.

Additionally, digital platforms have streamlined order fulfillment and reduced lead times, fostering faster adoption. Vendors are increasingly investing in online marketplaces and direct-to-customer websites to expand reach and improve customer engagement, reinforcing the online channel’s leadership in the stainless steel valve tag market.

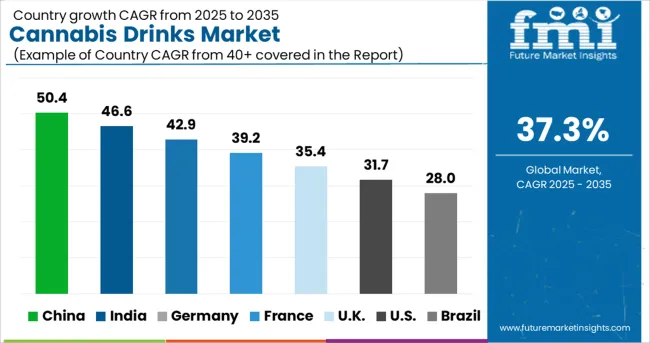

North America, led by the USA, is at the forefront of the cannabis-infused product sector. The region's functional beverage market has an exponential development pattern, and it had the greatest market share for cannabis drinks. Additionally, the presence of several producers is anticipated to support the expansion of the cannabis drinks market in the area during the forecast period.

Manufacturers are introducing cannabis, hemp, and marijuana beverages to the USA market as smoother, healthier substitutes for wine, beer, and spirits. Teas, still and sparkling waters, fruit-flavored items, as well as wine and beer infused with tetrahydrocannabinol are all examples of beverages.

A significant driver of development is the legalization of cannabis for both medicinal and recreational uses. The recreational and medicinal use of marijuana became legal in Canada in 2020. The United States has many territories such as New York, New Jersey, Vermont, and California where it is allowed to add cannabis infusion to meals and drinks. This aspect is anticipated to ratchet up the cannabis drinks market growth for cannabis-infused foods and beverages across North America.

Due to the legalization of low tetrahydrocannabinol and high cannabidiol goods in 13 USA states, there is a significant market for cannabidiol-infused cannabis beverages in the area.

In countries like Germany, France, Italy, and others, the use and consumption of cannabis-related products for therapeutic purposes have been legalized by the government.

The business for cannabis beverages in Europe is expected to increase over the next several years as customers become more socially accepting of them over alcoholic beverages. As a result, it is predicted that throughout the forecast period, the cannabis drinks market would expand significantly in Europe.

According to the Cannabis Trade Association, there were 250,000 cannabidiol consumers in the United Kingdom in 2020 compared to 125,000 in 2020. Due to the existence of marijuana-specific cafés and restaurants, demand is also high in the Netherlands.

The country's expanding cannabis tourism industry is anticipated to significantly increase demand. The legalization of marijuana for medicinal and recreational use is expected to result in a considerable increase in product demand in nations like Australia and Uruguay.

Since 2020, international producers have paid close attention to the development of non-alcoholic beer with tetrahydrocannabinol added. Female millennials dominate the market for non-alcoholic beer.

Calorie-free beverages rather than brownies and cookies are being promoted by manufacturers to the expanding female consumer base. Additionally, major producers of alcohol are making significant investments in the creation of non-alcoholic beverages.

Some international players are creating portfolios of cannabis-infused specialty beverages using molecules. These drinks come in a variety of unique and potent flavors and have a low-calorie count.

On the other hand, some cannabis drink market participants are also selling cannabis drinks with coffee flavors. These drinks include flavors that are reminiscent of coffee and come in a range of tetrahydrocannabinol and cannabidiol concentrations to accommodate different types of cannabis consumers.

Global players are even producing non-alcoholic cocktails that blend cannabis socialization with cocktail culture in a single bottle. These beverages have a wide range of flavors, each with an amazing fusion of herbal, floral, and dry overtones.

For first-time users, these cannabis drinks are great. Some well-known industry businesses develop beverages using carbonated water, fragrant oils, agave juice, and a small amount of Californian cannabis extract. These drinks deliver highly controlled effects that are milder than those of other cannabis-infused beverages. These are available at several dispensaries and could be bought online as well.

Cannabis drinks are expected to gain traction due to strong demand among millennials across the globe. According to the study, 0.2 million people in the USA in 2020 used cannabis recreationally.

Beer and wine sales dropped 15% in states where cannabis drinks were authorized, according to Georgia State University and the University of Connecticut. On the back of this, the demand for cannabis drinks is projected to surge by 20x over the upcoming decade.

Cannabis drinks demand grew at 18.0% CAGR between 2020 and 2024. Cannabis beverages are gaining immense popularity as a preference for soft drinks is rising. The low sugar content of drinks is one of the factors driving the demand in the market.

Recent research has revolutionized the industry over the period and is further projected to grow at a CAGR of 37.3% during the forecast period (2025 to 2035). In the global cannabis drinks market, the demand for alcoholic cannabis-infused drinks, CBD-infused drinks, and flavored cannabis drinks is expected to rise.

Cannabis Drinks Sales to Grow in the USA as the Product is Legalized

As per Future Market Insights (FMI), North America is expected to be the fastest-growing and largest market for cannabis drinks. The legalization of marijuana for recreational and medical purposes is expected to fuel the growth in the market.

According to the National Conference of State Legislatures, the District of Columbia, Puerto Rico, Guam, and the United States Virgin Islands have legalized medical cannabis programs for public use, which has resulted in the increased launch of various cannabis drinks.

Cannabis Drinks Sales to Surge in the United Kingdom with New Product Developments

Due to an increase in the consumption of medicinal cannabis, the demand for cannabis drinks in the United Kingdom is expected to rise over the assessment period. The number of CBD consumers in the United Kingdom has increased from 125,000 to 250,000 in 2020 & 2020 respectively, according to the Cannabis Trade Association.

Cannabis-related businesses in the United Kingdom are launching new products to keep up with the expanding trend of wellness beverages. CBD Cloud 9 and Ultra Brewing in Manchester, for example, have released the first CBD Session IPA beer in the United Kingdom, which is produced with cannabis sativa extract.

Alcohol Cannabis Infused

Over the forecast period, the rising consumption of cannabis-infused wellness drinks is expected to favor the growth in the market. The legalization of marijuana for recreational and medical uses is expected to have a significant influence on alcoholic cannabis-infused drinks sales. As a result, an increasing number of alcohol companies are investing in cannabis drinks.

For example, Hi-Fi Hops, a cannabis-based beverage with zero calories and carbs and infused with Cannabidiol (CBD) and Tetrahydrocannabinol, was launched by Lagunitas, Heineken's fast-growing California beer label (THC).

Burgeoning Demand for THC-Infused Drinks Propelling Cannabis Drinks Production

THC emulsifications are being developed by manufacturers of cannabis-infused beverages in order to achieve optimal suspension within liquids and a shorter uptake period. Leading cannabis drinks companies are catering to the growing demand for cannabis-based drinks, fueling the demand in the market.

Key cannabis drinks manufacturers are adopting strategies such as joint ventures, partnerships, mergers, and acquisitions, for innovative product lines. Also, top cannabis drinks brands are focusing on upgraded and modified products with rising demand for new formulations from the food and beverage industry.

For instance,

| Attribute | Details |

|---|---|

| Market Size Value in 2025 | USD 0.4 Billion |

| Market Forecast Value in 2035 | USD 8.3 Billion |

| Global Growth Rate | ~ 37.3% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | MT for Volume and billion for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; and Middle East and Africa |

| Key Countries Covered | United States of America, Canada, Germany, Brazil, Mexico, France, Italy, Spain, United Kingdom, Russia, China, Japan, South Korea, India, Australia, GCC Countries, South Africa, and others |

| Key Market Segments Covered | Product Type, Component, Flavor, Sales Channel, and Regions |

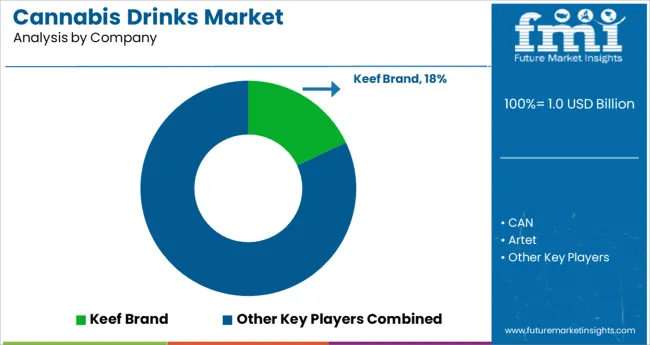

| Key Companies Profiled | Artet; CAN; Phivida Holdings Inc.; The Alkaline Water Company; VCC Brands; Koios Beverage Corporation; Keef Brand; Dixie Brands Inc.; Aphria; Hexo Corp; Canopy Growth; Others |

The global cannabis drinks market is estimated to be valued at USD 1.0 billion in 2025.

It is projected to reach USD 24.6 billion by 2035.

The market is expected to grow at a 37.3% CAGR between 2025 and 2035.

The key product types are non-alcoholic cannabis-infused drinks, _cannabis-infused water, _cannabis-infused coffee, _cannabis-infused tea, _cannabis-infused juice, _other cannabis-infused functional drinks, alcoholic cannabis-infused drinks, _cannabis-infused wine, _cannabis-infused beer and _other cannabis-infused spirits.

cannabidiol (cbd) infused drinks segment is expected to dominate with a 58.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cannabis Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cannabis Beverages Market Size and Share Forecast Outlook 2025 to 2035

Cannabis Packaging Equipment Market Growth - Forecast 2025 to 2035

Cannabis Concentrate Market Analysis - Size, Share, and Forecast 2025 to 2035

Cannabis Use Disorder Treatment Market – Trends & Innovations 2025 to 2035

Dry Herb Cannabis Vaporizers Market Size and Share Forecast Outlook 2025 to 2035

Portable Cannabis Vaporizer Market Size and Share Forecast Outlook 2025 to 2035

Automated Cannabis Testing Market Size and Share Forecast Outlook 2025 to 2035

Australia Legal Cannabis Market - Size, Share, and Forecast 2025 to 2035

North America, Europe & Asia Pacific Legal Cannabis Market Size and Share Forecast Outlook 2025 to 2035

Soft Drinks Packaging Market Size and Share Forecast Outlook 2025 to 2035

Soft Drinks Concentrates Market Trends - Growth & Forecast

Beauty Drinks Market Size and Share Forecast Outlook 2025 to 2035

Organic Drinks Market Size and Share Forecast Outlook 2025 to 2035

Low Fat Drinks Market Size and Share Forecast Outlook 2025 to 2035

Collagen Drinks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Breakfast Drinks Market Size and Share Forecast Outlook 2025 to 2035

Alcoholic Drinks Packaging Market Size and Share Forecast Outlook 2025 to 2035

Aloe Vera Drinks Market Outlook – Growth, Size & Demand 2025-2035

Antioxidant Drinks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA