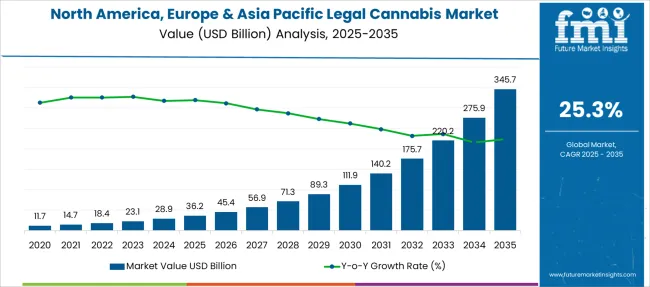

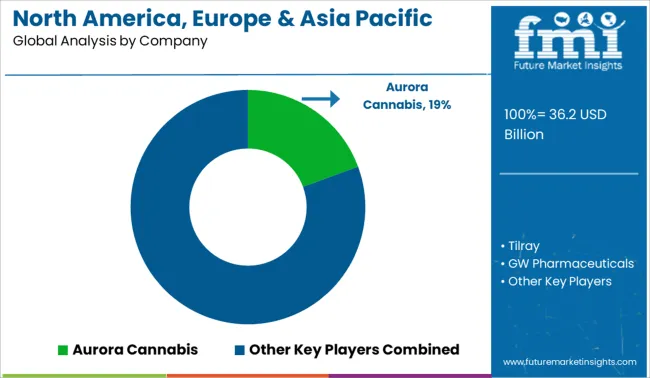

The North America, Europe & Asia Pacific Legal Cannabis Market is estimated to be valued at USD 36.2 billion in 2025 and is projected to reach USD 345.7 billion by 2035, registering a compound annual growth rate (CAGR) of 25.3% over the forecast period.

| Metric | Value |

|---|---|

| North America, Europe & Asia Pacific Legal Cannabis Market Estimated Value in (2025 E) | USD 36.2 billion |

| North America, Europe & Asia Pacific Legal Cannabis Market Forecast Value in (2035 F) | USD 345.7 billion |

| Forecast CAGR (2025 to 2035) | 25.3% |

The legal cannabis market across North America, Europe, and Asia Pacific is growing rapidly, driven by evolving regulations and expanding consumer acceptance. The medical use of cannabis is becoming increasingly recognized, prompting healthcare providers and policymakers to integrate cannabis-based treatments into standard care.

Regulatory reforms have facilitated access to cannabis products, supporting the expansion of cultivation, processing, and retail activities. The market is also influenced by increasing research into therapeutic benefits and a growing number of patients seeking alternative treatments.

Additionally, advancements in product quality and safety standards are improving consumer confidence. Rising public awareness and education about cannabis applications have further accelerated market growth. The combined impact of these factors is expected to continue driving expansion across the key regions.

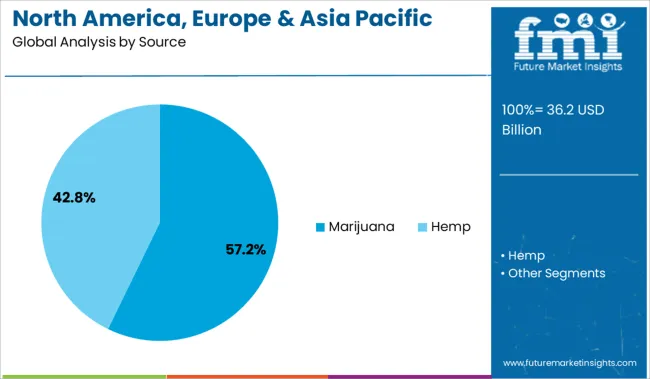

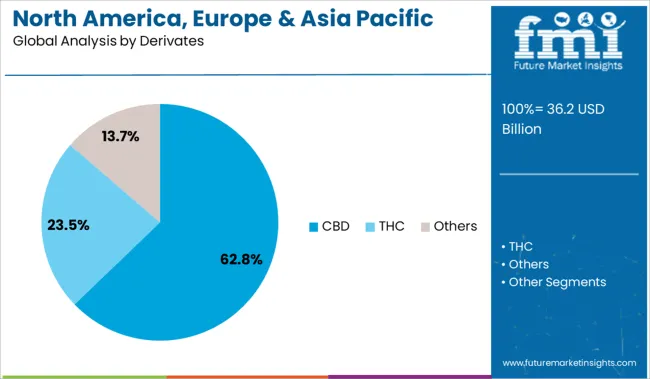

The market is segmented by Source, Derivates, and End-Use and region. By Source, the market is divided into Marijuana and Hemp. In terms of Derivates, the market is classified into CBD, THC, and Others. Based on End-Use, the market is segmented into Medical Use, Recreational Use, and Industrial Use. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Marijuana segment is projected to hold 57.2% of the legal cannabis market revenue in 2025, maintaining its leading position among sources. This is attributed to marijuana’s higher concentrations of active cannabinoids, making it the preferred raw material for both medical and recreational products.

The cultivation and processing of marijuana have benefited from technological advances and improved agricultural practices. Regulatory frameworks continue to support its use in approved medical applications, fueling steady demand.

Furthermore, marijuana’s versatility allows for extraction into various derivative products, sustaining its dominance as the primary source.

The CBD segment is expected to account for 62.8% of the market revenue in 2025, making it the dominant derivative product. CBD’s non-psychoactive properties have made it widely accepted for medical and wellness use. Clinical interest in CBD’s potential to manage conditions such as pain, inflammation, and anxiety has driven its incorporation into a variety of formulations.

Consumer preference for CBD products is bolstered by perceptions of safety and fewer regulatory restrictions compared to THC-rich products.

Its broad applicability in oils, tinctures, edibles, and topicals has expanded its market share significantly.

The Medical Use segment is projected to contribute 48.9% of the legal cannabis market revenue in 2025, leading among end-use categories. Growth in this segment has been driven by increased acceptance of cannabis as a therapeutic option for a range of conditions including chronic pain, epilepsy, and multiple sclerosis.

Healthcare providers have increasingly prescribed cannabis-based products due to growing clinical evidence supporting their efficacy. Patient demand has also risen as medical cannabis becomes more accessible through pharmacies and specialized dispensaries.

Regulatory support and ongoing research into cannabis therapeutics are expected to sustain growth in medical use applications.

In the upcoming years, the demand for medical marijuana is anticipated to increase due to the expanding number of states that have legalized the drug and the rising demand from both medical and recreational uses. This is expected to drive the demand for North America, Europe & Asia Pacific legal cannabis.

Demand for North America, Europe & Asia Pacific legal cannabis is anticipated to rise during the anticipated time frame as a result of more research and development being done.

In several parts of North America, Africa, Australia, Europe, and South America, marijuana is nominally recognized as a drug and is permitted for medical usage. But the majority of Middle Eastern and Asian nations continue to forbid it. Consumption, possession, purchase, or sale of the commodity is illegal and is regarded as a crime in developing nations like Japan, India, and Korea. As a result, it is anticipated that the legal environment for these items will prevent the North America, Europe & Asia Pacific legal cannabis industry from reaching its full growth potential. Growth is also anticipated to be constrained by adverse effects including cognitive impairment linked to its usage as medicine.

The global pandemic has significantly hampered the North America, Europe & Asia Pacific legal cannabis market growth. The North America, Europe & Asia Pacific legal cannabis market has been hit by a number of major challenges, including trade restrictions, the adoption of a lockdown in several important nations, and supply chain interruptions.

The highest North America, Europe & Asia Pacific legal cannabis market share in 2024—more than 65.0 percent—went to CBD. Since legalization, there has been a considerable increase in the use of medical cannabis, and the majority of products used for therapeutic purposes contain CBD.

Demand for North America, Europe & Asia Pacific legal cannabis is also anticipated to increase throughout the forecasted period as hemp-derived cannabidiol (CBD) is increasingly used in skincare and cosmetics, gummies, beverages, pet food, capsules, and dog treats.

In 2024, the medical use segment's North America, Europe & Asia Pacific legal cannabis revenue share was above 65.0 percent, which was the highest. Cannabis use has increased dramatically as more places legalize it, particularly in North America where most states have approved medical use of the drug. This is related to the product's expanding use in the treatment of insomnia, anxiety disorders, and chronic pain. Furthermore, the expansion of the segment is being aided by rising practitioner knowledge.

Due to the relaxation of cannabis use legislation, the Asia Pacific region of the North America, Europe & Asia Pacific legal cannabis market is anticipated to see a large increase in the recreational use segment.

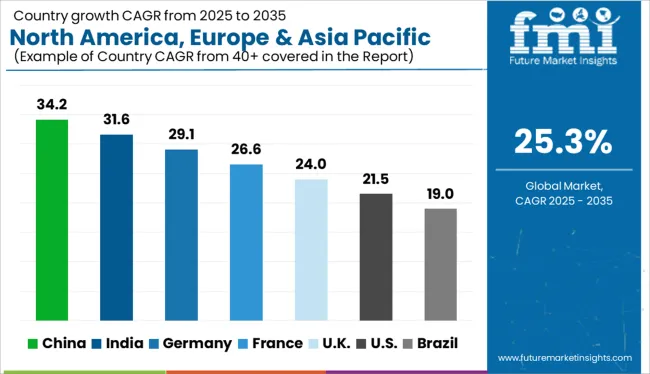

Asia-Pacific region of the North America, Europe & Asia Pacific legal cannabis market is anticipated to experience the fastest growth during the anticipated time. Growth is anticipated to be boosted by the increasing legalization and supportive laws for the use of cannabis and its derivative products in various nations. For instance, Thailand delisted marijuana from its list of prohibited substances in 2024. This is expected to lead to an increase in hemp and marijuana use across the nation.

Highest North America, Europe & Asia Pacific legal cannabis market share in 2024 belonged to North America, which was worth USD 11.7 billion. As of July 2020, it was allowed for recreational use in eleven states and the District of Columbia. All state medical hemp legislation in the United States accepted it as a treatment or medication for ailments like cancer, Alzheimer's disease, anorexia, arthritis, chronic pain, epilepsy, and post-traumatic stress disorder. By taking the lead in the international legalization of marijuana, Canada has recently become recognized as a flag-bearer nation. Additionally, the number of its farmers in the U.S. has substantially expanded, supporting its use and consumption. This is expected to boost sales of North America, Europe & Asia Pacific legal cannabis and give local businesses access to new revenue streams.

Europe is the second-largest region in the North America, Europe & Asia Pacific legal cannabis market after the United States because of its progressive laws and rising medicinal marijuana use. Trials have shown that medicinal marijuana is helpful in some European nations, where it is being used lawfully in healthcare settings to treat everything from cancer to appetite stimulants for those with AIDS-related disease.

The demand for North America, Europe & Asia Pacific legal cannabis is also anticipated to rise quickly as a result of changes in government policies. The necessary legislation is very new in many nations; the Greek government legalised medical marijuana in 2020, the same year as the United Kingdom. As a result, it is anticipated that increased use of the product for medical purposes will increase regional sales.

As the tide of legalization slowly sweeps the world, the North America, Europe & Asia Pacific legal cannabis industry remains fiercely competitive and vibrantly dynamic. New collaborations and expansions are already under way. Younger consumers are predicted to develop more complex patterns of recreational consumption and take greater risks when experimenting with various product variants. Therefore, a change from flower/bud to more processed formats including edibles, oils, and topical applications is being caused by the rapidly growing popularity of recreational use, and this movement has been adequately reacted to by important North America, Europe & Asia Pacific legal cannabis market players.

Recent Developments in Global North America, Europe & Asia Pacific Legal Cannabis Market

The world's largest cannabis company will be formed through the combination of Aphria Inc. and Tilray, Inc. (Canada), according to a definitive agreement that was signed in December 2024. The combined company would have a full line of branded Cannabis 2.0 goods in Canada, supported by low-cost facilities for cultivation, processing, and manufacturing.

One of the biggest independent craft breweries, SW Brewing Company, LLC (US), was acquired by Aphria Inc. in November 2024. SweetWater provides complementing cannabis lifestyle brands, which would aid Aphria in broadening the scope of its product line.

Olla, founded in 2020, which aspires to be the WordPress of online cannabis retailers, offers a completely configurable interface that enables businesses to create custom websites without having to give up important web space to another provider's branding. Olla aims to make the process of ordering cannabis online simpler for everyone. It was created with a mobile-first attitude and has open connections with cannabis POS and CRM systems like Flow Hub and Green Bits. Olla-using retailers report an order completion rate of 88 percent, a fivefold increase in order volume, and 92 percent of customers placing mobile orders.

The global north america, europe & asia pacific legal cannabis market is estimated to be valued at USD 36.2 billion in 2025.

The market size for the north america, europe & asia pacific legal cannabis market is projected to reach USD 345.7 billion by 2035.

The north america, europe & asia pacific legal cannabis market is expected to grow at a 25.3% CAGR between 2025 and 2035.

The key product types in north america, europe & asia pacific legal cannabis market are marijuana, _flower, _oil & tinctures, hemp, _hemp cbd, _supplements and _industrial hemp.

In terms of derivates, CBD segment to command 62.8% share in the north america, europe & asia pacific legal cannabis market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

North America Boat Trailer Market Size and Share Forecast Outlook 2025 to 2035

North America Cryogenic Label Printer Market Size and Share Forecast Outlook 2025 to 2035

North America Chitosan Market Size and Share Forecast Outlook 2025 to 2035

North America Underground Mining Vehicle Market Size and Share Forecast Outlook 2025 to 2035

North America Bulk Aseptic Packaging Market Size and Share Forecast Outlook 2025 to 2035

North America Licorice Extract Market Size and Share Forecast Outlook 2025 to 2035

North America Par Baked Bread Market Size and Share Forecast Outlook 2025 to 2035

North America Silo Bags Market Size and Share Forecast Outlook 2025 to 2035

North America Fresh Meat Packaging Market Size and Share Forecast Outlook 2025 to 2035

Northern Blotting Market Size and Share Forecast Outlook 2025 to 2035

North America Ceramic Barbeque Grill Market Size and Share Forecast Outlook 2025 to 2035

North America Temperature Sensor Market Size and Share Forecast Outlook 2025 to 2035

North American Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

North America Head-up Display Market Size and Share Forecast Outlook 2025 to 2035

North America Ceiling Cassette Market Size and Share Forecast Outlook 2025 to 2035

North America Pressure Regulating Valves Market Size and Share Forecast Outlook 2025 to 2035

North America Flame Retardant Thermoplastics Market Size and Share Forecast Outlook 2025 to 2035

North and Central America Proppant Market Size and Share Forecast Outlook 2025 to 2035

Fire Pit Market Analysis in North America - Growth, Trends and Forecast from 2025 to 2035

North America Employee Recognition Software Market – Growth & Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA