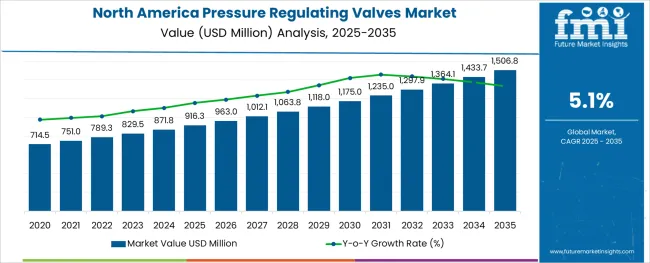

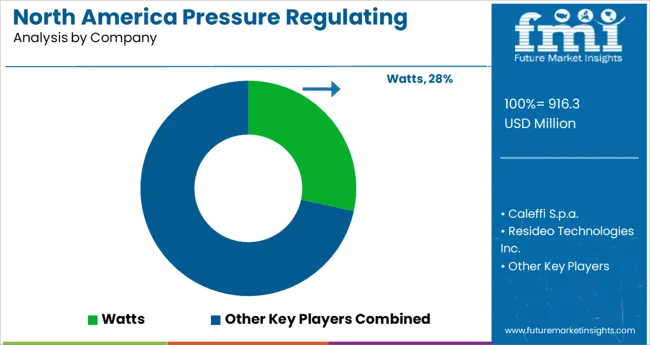

The North America Pressure Regulating Valves Market is estimated to be valued at USD 916.3 million in 2025 and is projected to reach USD 1506.8 million by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

The North America pressure regulating valves market is benefiting from accelerating infrastructure modernization, stricter energy efficiency regulations, and the expansion of automation across sectors such as residential construction, water treatment, and oil & gas processing

Technology vendors are thus investing in smart, IoT enabled valves that support predictive maintenance and real-time monitoring, fostering greater system resilience . Complementing this, growth in residential and commercial building projects especially multifamily units has created sustained installation opportunities With forecasted CAGR of approximately 5.1% through 2032, market prospects appear robust.

Innovation in barrier materials, enhanced traceability platforms, and modular valve configurations are expected to further elevate both performance and user trust in reusable systems.

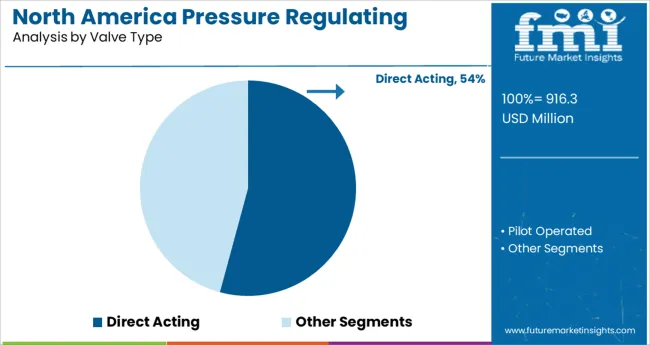

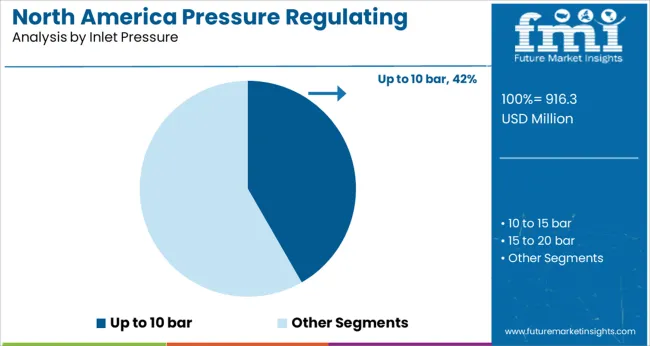

The market is segmented by Valve Type, Inlet Pressure, Diameter, and End Use and region. By Valve Type, the market is divided into Direct Acting and Pilot Operated. In terms of Inlet Pressure, the market is classified into Up to 10 bar, 10 to 15 bar, 15 to 20 bar, and Above 20 bar. Based on Diameter, the market is segmented into 3/8, 1/2, 3/4, 1, 1 ¼”, and Up to 2. By End Use, the market is divided into Apartments & Condominiums, Townhouses, and Villas. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

It is observed that direct acting valves contribute to 54.20% of the total revenue in the valve type category, making it the leading segment. Their mechanical simplicity, absence of external actuators, and quick response characteristics make them highly preferred for low to medium flow control requirements. These valves have gained significant acceptance due to their reliability, compact footprint, and suitability for a broad range of utility and domestic applications.

The ability to regulate pressure without relying on pilot systems reduces complexity and operational risk. Maintenance efficiency and lower production costs have further elevated their market positioning, especially in aging infrastructure and retrofitting scenarios.

As the demand for straightforward and durable valve configurations rises across public utilities, municipal networks, and mid-scale commercial installations, the direct acting variant continues to lead due to its functional resilience and widespread compatibility.

It is noted that the up to 10 bar inlet pressure category holds a 41.70% revenue share, establishing it as the most prominent range within the inlet pressure segmentation. This dominance is underpinned by the operational compatibility of this pressure band with most residential and commercial water distribution systems.

Valves rated for this range provide an ideal balance of control accuracy and cost-effectiveness, aligning with pressure specifications commonly used in domestic plumbing, HVAC systems, and irrigation lines. Their adaptability across diverse installation environments and the reduced risk of over pressurization make them a standard selection for installers and contractors. Additionally, streamlined certification and system compliance at this pressure level have encouraged mass-market adoption.

As systems prioritize stability, ease of integration, and safe pressure thresholds, valves operating within the 10 bar range remain the preferred choice, reinforcing their leadership within the inlet pressure category.

According to historical data from 2020 to 2024, the market for Pressure Regulating Valves increased by volume at a CAGR of 1.4%. The estimated global market demand for these valves in 2025 is estimated at USD 782.9 Million.

According to the research, the USA ranked as the 39th country in the world in terms of infrastructure investment in 2020. The growing number of housing units in the USA and the registered annual growth in the Canadian construction industry are the major factors responsible for the steady growth of the North American market during the historical period.

According to research, the year-on-year change in the growth of America’s Pressure Regulating valves for 2024 is 3.4%, the reason being numerous new product innovations and increased spending in research and development by key market participants and adherence to stringent government regulations.

In accordance with the above factors, the functional features of the pressure regulating valves, which include robustness, dirt tolerance, energy efficiency, and preventing overpressure, are the important aspects that are driving the market during the forecast period between 2025 and 2035.

Direct-acting pressure regulating valves is ideal solutions for precision control of flow rate or pressure. This is boosting the market growth of Pressure Regulating Valves in the North American region.

The drive to install pressure-reducing valves is also related to the retrofitting of a number of pre-existing valves to make them more water and energy-efficient, and to a lesser extent, in new infrastructure and renovation of multifamily residential buildings.

Key market participants are transforming into industry leaders by developing innovative solutions for these markets that seek to comply with rigorous third-party regulations, meet new building and plumbing standards, and meet project and program requirements.

In 2024, the market size of the USA construction sector was registered at around USD 1.6 trillion and it is projected to increase further in the coming years.

In addition to this, in the North American region, the construction of the multi-story building shows a considerable record, which is seen as a way to provide a high density for the installation of pressure regulating valves in these buildings, which help to regulate or reduce the pressure of water from the city mains to provide a lower, more functional pressure for distribution in each of the apartments.

Hence, these factors are estimated to emerge as an opportunity to boost the growth of the pressure-regulating valve market.

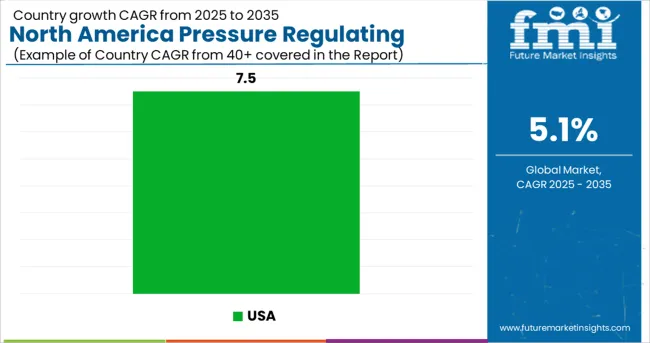

The USA is expected to hold more than 75% of the North American market by 2035 and is estimated to grow with a CAGR of 5.1% through the forecast period.

The USA population is rising steadily manner hence fueling the trend of the new home construction market. According to the USA Department of Commerce, the number of housing units in the USA has been growing year after year. In 2024, the housing units increased by one million as compared to the year 2024.

In addition to this, USA new building construction spending is expected to grow by more than USD 916.3 billion by the end of 2025. Hence, retrofit in Infrastructure renovation and new building construction will remain the primary growth factors for the targeted market in the USA region.

Canada is expected to gain 110 bps points between 2025 and 2035 and is set to create an absolute dollar opportunity worth more than USD 109.6 million during the same period.

The construction industry in Canada is a dynamic industry that contributes significantly to the economy, accounting for 7.5% of Canada’s gross domestic product.

According to Statistics Canada, the residential building construction price index rose by 18.1 percent in 2024 as Canada is one of the fastest-growing countries in terms of residential sector infrastructure. A growing population and the rising needs of the residential sector are estimated to create significant opportunities for the market in the forecast period.

On the basis of the end-user segment, Apartments, and condominiums are expected to account for 55% of the overall market share, and this dominance is expected to continue throughout the forecast period.

The housing market has developed into a crucial economic metric that indicates consumers' purchasing power and the health of the housing industry.

The housing sector, in turn, has an effect on a number of other economic sectors, and as a result, it influences how the targeted market is developing. PRV is used to reduce the pressure of flowing water, steam, or liquid to a predetermined manageable level in residential infrastructure.

On the basis of valve type, direct-acting valves are the most popular pressure-regulating valves among all types. These valves accounted for more than 55% of market revenue in 2025.

One of the biggest benefits of Direct Acting Pressure Regulating Valves is that they are the most popular type owing to their outstanding features like being robust, dirt tolerant, and preventing overpressure.

The necessary flow and pressure are provided by direct-operated pressure regulating valves in order to meet the system set point. They react immediately to changes in downstream pressure.

Manufacturers in the market are following the new product strategy by developing highly innovative products with reduced product costs, which enhances their product portfolio and helps them to gain market compatibility with future market trends.

Key market participants are concentrating on diversifying their product lines through merger and acquisition activities.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | million for Value, ‘000 Units for Volume |

| Key Countries Covered | USA & Canada |

| Key Market Segments Covered | By Valve Type, By Inlet Pressure, By Diameter, By End-Use, and By Countries |

| Key Companies Profiled | Danfoss A/S; Reliance Worldwide Corporation; Parker Hannifin; Zurn Water Solutions; Apollo Valves; Watts Water Technologies Company |

| Report Coverage | Market Forecast, brand share analysis, competition intelligence, Drivers, Restraints, Opportunities and Threats analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global north america pressure regulating valves market is estimated to be valued at USD 916.3 million in 2025.

It is projected to reach USD 1,506.8 million by 2035.

The market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types are direct acting and pilot operated.

up to 10 bar segment is expected to dominate with a 41.7% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Northern Blotting Market Size and Share Forecast Outlook 2025 to 2035

Northern Europe Calcium Sulphate Market Size and Share Forecast Outlook 2025 to 2035

North America Boat Trailer Market Size and Share Forecast Outlook 2025 to 2035

North America Cryogenic Label Printer Market Size and Share Forecast Outlook 2025 to 2035

North America Chitosan Market Size and Share Forecast Outlook 2025 to 2035

North America Underground Mining Vehicle Market Size and Share Forecast Outlook 2025 to 2035

North America Bulk Aseptic Packaging Market Size and Share Forecast Outlook 2025 to 2035

North America Licorice Extract Market Size and Share Forecast Outlook 2025 to 2035

North America Par Baked Bread Market Size and Share Forecast Outlook 2025 to 2035

North America Silo Bags Market Size and Share Forecast Outlook 2025 to 2035

North America Fresh Meat Packaging Market Size and Share Forecast Outlook 2025 to 2035

North America Ceramic Barbeque Grill Market Size and Share Forecast Outlook 2025 to 2035

North America Temperature Sensor Market Size and Share Forecast Outlook 2025 to 2035

North American Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

North America Head-up Display Market Size and Share Forecast Outlook 2025 to 2035

North America, Europe & Asia Pacific Legal Cannabis Market Size and Share Forecast Outlook 2025 to 2035

North America Ceiling Cassette Market Size and Share Forecast Outlook 2025 to 2035

North America Flame Retardant Thermoplastics Market Size and Share Forecast Outlook 2025 to 2035

Fire Pit Market Analysis in North America - Growth, Trends and Forecast from 2025 to 2035

North America Electrical Testing Services Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA