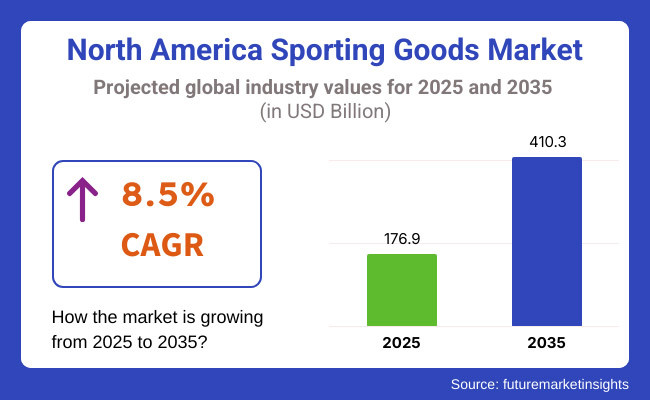

The North America Sporting Goods market is projected to reach USD 176.9 billion in 2025 and expand to USD 410.3 billion by 2035, reflecting a compound annual growth rate (CAGR) of 8.5% over the forecast period. This strong growth highlights rising health consciousness, active lifestyles, and expanding access to diverse sports products.

Key drivers include increasing consumer focus on health and fitness, the growing popularity of outdoor and recreational sports, and the rise of athleisure fashion. Additionally, online retail platforms are making sports equipment more accessible, offering convenience, competitive pricing, and extensive product variety that cater to evolving consumer preferences.

Restraints include high competition leading to price pressures, supply chain disruptions, and fluctuating raw material costs. Seasonal demand variations, especially in outdoor and winter sports equipment, may also impact sales consistency. Moreover, concerns over counterfeit goods and quality control issues in e-commerce channels pose risks to consumer trust and brand integrity.

Opportunities lie in smart sports equipment, wearable fitness technology, and personalized gear driven by technological innovation. Increasing participation in organized sports and government initiatives promoting physical activity support expansion. Sustainable and eco-friendly goods also offer growth potential, appealing to environmentally conscious consumers.

Trends include rising demand for multifunctional fitness equipment, growth of at-home workout gear, and increased adoption of wearable health trackers. The blending of fashion and fitness through athleisure wear continues to influence consumer purchasing behavior. Furthermore, influencer marketing and brand collaborations are reshaping how goods are marketed and consumed.

Between 2020 to 2024, the North America Sporting Goods industry experienced dynamic growth driven by growing health and wellness awareness, digital fitness, and sustainability. The pandemic created a surge in demand for home fitness equipment, outdoor equipment, and athleisure wear as consumers sought alternative ways of staying active. E-commerce was in the limelight, with brands such as Nike, Adidas, and Under Armour emphasizing direct-to-consumer (DTC) models, AI-driven recommendations, and virtual try-ons to engage consumers.

Sustainability was a differentiator, with consumers rushing towards sustainable products from recycled materials and plant-based fibers. Brands stepped in by introducing carbon-neutral manufacturing processes and eco-friendly apparel.

In the absence of threats such as supply chain disruptions, commodity price uncertainty, and inflation, brands adapted to deal with localized manufacturing, nearshoring, and selective inventory build, enabling sustained growth. From 2025 through 2035, the industry in North America will shift with performance-enhancing equipment, AI-based fitness solutions, and experiential sporting activities.

Smart exercise gear equipped with AI sensing will offer instant feedback on posture and stamina, and AI-driven virtual trainers will offer customized coaching programs. Virtual reality (VR) and augmented reality (AR) will allow consumers to experience products virtually and engage in gamified training. Sustainability takes center stage with technologies such as lab-grown leather, bioengineered fiber, and zero-waste manufacturing. Self-repairing material and wearable-embedded technology give real-time biometric data.

Customization expands, with 3D printing allowing bespoke sporting equipment. Virtual sports and e-sports boost demand for ergonomic equipment, with hybrid sports experience combining physical and gaming. Subscription models expand with access flexibility for high-performance kits. Wellness and health will be integrated into product design, with intelligent wearables to help alleviate stress, AI-powered recovery equipment, and mindfulness-focused fitness products becoming mainstream.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Green policies, trade tariffs imposed on imports | Systematized eco-certifications, carbon-neutral directives |

| AI-tracking for fitness, wearable technology integrated with the cloud | AR/VR training sessions, biometric-integrated smart clothing |

| Growth in e-commerce, increased home fitness | Immersive sporting experiences, metaverse-led competitions |

| AI-enabled gym gear, fitness apps | AI-led virtual coaching, smart clothing, real-time feedback |

| Recycled materials, environmentally friendly consumers | Circular economy uptake, lab-grown sustainable materials |

| AI-led customized fitness plans | Predictive injury prevention, real-time biometric coaching |

| Supply chain disruptions, nearshoring tactics | On-demand 3D printing, adaptive manufacturing processes |

| Digital fitness boom, sustainability focus | AI-led customization, immersive digital sports expansion |

North America is experiencing transformations in sports equipment due to changing consumer preferences, new technological innovations, and the growing trend of health consciousness. Individual buyers are avoiding high costs and preferring durable equipment, with an increasing interest in smart sports equipment and eco-friendly products.

Schools and colleges are stressing the importance of lower-cost, more durable sports equipment that can be used for the long term. Professional sports teams are concerned with sophisticated technology, custom gear, and high-end equipment that they can provide to the sportsmen to improve their performance.

Gyms and fitness studios are interested in long-lasting, high-tech equipment such as wearables, resistance bands, and recovery tools that can cater to an array of physical training needs. Environment protection is a critical issue that is being faced by all branches, transforming into the practice of using recycled materials and green production methods.

Stores are giving utmost priority to the branding and the techniques used to lure in both professionals and leisure shoppers. With digital integration and online shopping having a lid on the market, brands, on the other hand, have turned to AI to deliver personalized proposals and interactive retail experiences to customer engagement and sales drive.

The North American industry is susceptible to the risks brought about by economic factors, such as the changes in consumer spending directed by the financial situations. During economic downturns, the sales of non-essential items like sports gear fall, which, in turn, leads to revenue loss. The planners have to arrange for the financial risk situation as well as to contemplate the strategies like diversification or loyalty programs which are the means to be made and keep customers and achieve sales.

Another issue retailers face is seasonal demand fluctuations. Winter sports gear is mostly sold in the cold season, while summer products jump up in sales in the warmer season. Inventories need the management of Retailers to avoid both shortages and overordering. Lack of proper planning can lead to huge financial losses that could also affect both the big brands and the small retailers.

The level of competition is very high as old brands and new brands are fighting for the market sector. Price wars and heavy discounting have an impact on the profit margin. Instead of the former, companies should do differently as their means of differentiation, that is, through innovation, better quality, or gear that stands out. Marketing strategies and endorsements are also very important in the process of keeping the brand visible.

The supply crisis results in product scarcity and price changes. Sporting goods depend on materials such as rubber, textiles, and metals, which are materials that have limited supply due to political conflicts, transportation delays, or inflation. Companies are expected to expand their supplier networks and also be flexible in the logistics in order to avoid the risks that seem to be connected to supply chain failures that are not foreseen.

American football and golf are the most popular ball sports for growth in the North American sports and fitness accessories industry.

Admittedly, American football is still a dominating entity, and in 2025, it will make up about 53.7% of the ball sports market share. Demand for jerseys, cleats, and protective gear is driven largely by the NFL, NCAA football, and youth leagues. The NFL draws more than 200 million viewers in a season, while college football is a multibillion-dollar business.

Companies such as Riddell and Schutt are creating helmets that measure impact in an effort to limit concussions. In addition to the increase in participation, youth and flag football, 5.2 million players, is also increasing appetite for lightweight protective gear. There’s a thriving market for officially licensed team gear, and Nike, Adidas, and Fanatics have been helped by solid jersey and accessory sales.

At the same time, golf is expected to contribute 46.3% to the game ball sports market in 2025. Interest is growing among young people, women, and casual golfers, and there is an increasing demand for equipment. Big manufacturers like Titleist, Callaway, and TaylorMade have been using AI-driven club and ball designs to improve performance as well.

And the proliferation of golf simulators and entertainment venues like Topgolf and Drive Shack is bringing the sport to more of the younger demographic. The high-end segment is growing, too, with brands such as PXG and Scotty Cameron satisfying the demand for premium and custom-fitted golf equipment.

The largest distribution channel in 2025 will be modern trade, which will account for 63.2% of the share. The majority of sales occur through specialty sporting goods retailers, big-box chains, and stores that have integrated e-commerce. Retailers such as Amazon and REI fill general needs for professional athletes and recreational athletes alike through personalized consultations, vast inventories, and in-person experiences in stores.

Hybrid retail models, where shoppers use the Internet to browse for products, get personalized recommendations, and place orders to pick up in stores, have revolutionized shopping, and that, in turn, makes merchants’ pricing strategies more complicated. Top brands, including Nike and Adidas, also harness this trend and, specifically, develop flagship stores blending in technology to generate improved in-store shopping experiences for brands undergoing customers.

Key suppliers have their own branded shops in malls. They are investing heavily in their department store divisions, which are projected to achieve a share of 36.8% in 2025, responding mainly to customers looking for casual sportswear and entry-level sporting goods. Stores such as Walmart, Target, and Kohl’s are still favorites for a wide array of buyers because of their reasonably priced products and convenience.

With plenty of foot traffic and promotional sales, these stores are staples for sports hardware, athleisure, and fitness essentials throughout the year. However, with the growing threat of DTC models and online marketplaces, department stores need to adapt to stay relevant, including launching private-label sportswear programs and forming partnerships with top brands.

| Countries | CAGR (2025 to 2035) |

|---|---|

| The USA | 7.9% |

| Canada | 7.5% |

North America's sales of sports goods are expanding immensely, with the United States leading the growth due to increasing health consciousness, sports and fitness activity levels, and continuous technological advancements in sports equipment. Individuals are embracing active lifestyles, which are fueling home fitness solutions and environmentally friendly sports equipment usage.

The expansion of intelligent fitness equipment, wearable technology, and AI-based training equipment is transforming the industry. For example, computerized fitness apps and smart treadmills enable users to track performance in real-time, which boosts engagement and productivity.

Direct-to-consumer and e-commerce channels are propelling sales by allowing brands to deliver tailored products and merge distribution. Nike, Under Armour, and Wilson Sporting Goods are going the entire way to spend money on sustainable materials, AI-powered performance analysis, and tailored sports equipment. The creation of bio-based shoes, reusable sports apparel, and AI-designed training protocols heralds this change towards innovation and sustainability.

Canada is evolving step by step with the support of policies by the government regarding sports participation and rising trends of high-performance winter sports apparatus. The "Active People, Active Communities" policy of the Government of Canada is stimulating interest in training apparel, sports clothing, and shoes. Sporting outdoor activities like skiing, hiking, and cycling also stimulates the demand for adventure and outdoor clothing.

These include players such as Lululemon, Bauer, and CCM, who are leaders in performance wear, high-end winter sports equipment, and connected fitness. The United States and Canada are witnessing long-term sporting goods growth with strong fundamentals and ongoing investment in innovation.

The North American industry is moderately consolidated, led by global sportswear giants, and supported by regional players and emerging fitness brands. Companies are leveraging smart technology, sustainable materials, and direct-to-consumer (DTC) channels to align with growing consumer demand for performance, personalization, and eco-consciousness. Innovation in connected fitness equipment, high-performance apparel, and outdoor gear is critical to maintaining competitive advantage.

Leading Players include Nike, Inc., Adidas AG, Under Armour, Inc., VF Corporation (The North Face), and Columbia Sportswear, who dominate through brand strength, product innovation, and integrated digital platforms.

Key Offerings focus on athletic footwear, high-performance sportswear, outdoor and adventure gear, and digitally connected fitness solutions. Emphasis is on sustainability, smart wearables, and moisture- and temperature-regulating technologies.

The rise in health-conscious lifestyles, outdoor recreation, and athleisure trends shapes Market Evolution. Integration of digital fitness tools, sustainability initiatives, and tailored customer experiences are reshaping consumer engagement and product development.

Strategic Factors include investments in R&D for smart sports gear, circular economy initiatives, and omnichannel retail strategies. Companies aim to enhance performance, comfort, and sustainability while building brand loyalty through immersive digital ecosystems.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Nike, Inc. | 25-30% |

| Adidas AG | 15-20% |

| Under Armour, Inc. | 12-16% |

| VF Corporation (The North Face) | 10-14% |

| Columbia Sportswear | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Nike, Inc. | Develops cutting-edge athletic footwear, apparel, and digital fitness solutions. |

| Adidas AG | Innovates in high-performance sportswear, sustainable materials, and digital engagement. |

| Under Armour, Inc. | Specializes in performance-enhancing activewear with moisture-wicking technology. |

| VF Corporation (The North Face) | Focuses on outdoor sports gear and technical performance wear. |

| Columbia Sportswear | Provides eco-friendly, weather-resistant gear for outdoor and adventure sports. |

Strategic Outlook of Key Companies

Nike, Inc. (25-30%) Nike dominates in North America with its innovative product designs, digital ecosystem, and strong brand influence across multiple sports categories.

Adidas AG (15-20%) Adidas is a leader in sustainability and performance-driven sportswear, leveraging technology like 3D-printed shoes and recycled materials to meet consumer demands.

Under Armour, Inc. (12-16%) Under Armour focuses on high-performance athletic wear, incorporating sweat-wicking fabrics and compression technology to enhance training and recovery.

VF Corporation (The North Face) (10-14%) The North Face specializes in premium outdoor and adventure gear, offering durable and innovative solutions for extreme conditions.

Columbia Sportswear (6-10%) Columbia is known for its all-weather outdoor apparel, integrating sustainability with advanced insulation and moisture management technology.

Other Key Players (30-40% Combined) Several other companies are making significant strides by focusing on innovation, digital engagement, and performance-driven designs.

The distribution channel is bifurcated into online and offline.

By sports type, the bifurcation is as racquet Sports and Ball Sports.

The overall market size for the North America Sporting Goods Market was USD 176.9 Billion in 2025.

The North America Sporting Goods Market is expected to reach USD 410.3 Billion in 2035.

The demand will grow due to rising health consciousness, increasing participation in sports and fitness activities, and advancements in sporting equipment technology.

The top 5 contributors to the North America Sporting Goods Market are the USA, Canada, and Mexico.

Athletic apparel, footwear, and fitness equipment are expected to command a significant share over the assessment period.

Table 1: Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Market Value (US$ Million) Forecast by Sports Type, 2018 to 2033

Table 4: Market Volume (Units) Forecast by Sports Type, 2018 to 2033

Table 5: Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 6: Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 7: Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: Market Value (US$ Million) Forecast by Sports Type, 2018 to 2033

Table 10: Market Volume (Units) Forecast by Sports Type, 2018 to 2033

Table 11: Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 12: Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Market Value (US$ Million) by Sports Type, 2023 to 2033

Figure 2: Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 3: Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Market Value (US$ Million) Analysis by Sports Type, 2018 to 2033

Figure 9: Market Volume (Units) Analysis by Sports Type, 2018 to 2033

Figure 10: Market Value Share (%) and BPS Analysis by Sports Type, 2023 to 2033

Figure 11: Market Y-o-Y Growth (%) Projections by Sports Type, 2023 to 2033

Figure 12: Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 13: Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 14: Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 15: Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 16: Market Attractiveness by Sports Type, 2023 to 2033

Figure 17: Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 18: Market Attractiveness by Region, 2023 to 2033

Figure 19: Market Value (US$ Million) by Sports Type, 2023 to 2033

Figure 20: Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 21: Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: Market Value (US$ Million) Analysis by Sports Type, 2018 to 2033

Figure 27: Market Volume (Units) Analysis by Sports Type, 2018 to 2033

Figure 28: Market Value Share (%) and BPS Analysis by Sports Type, 2023 to 2033

Figure 29: Market Y-o-Y Growth (%) Projections by Sports Type, 2023 to 2033

Figure 30: Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 31: Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 32: Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 33: Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 34: Market Attractiveness by Sports Type, 2023 to 2033

Figure 35: Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 36: Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Northern Blotting Market Size and Share Forecast Outlook 2025 to 2035

Northern Europe Calcium Sulphate Market Size and Share Forecast Outlook 2025 to 2035

North America Boat Trailer Market Size and Share Forecast Outlook 2025 to 2035

North America Cryogenic Label Printer Market Size and Share Forecast Outlook 2025 to 2035

North America Chitosan Market Size and Share Forecast Outlook 2025 to 2035

North America Underground Mining Vehicle Market Size and Share Forecast Outlook 2025 to 2035

North America Bulk Aseptic Packaging Market Size and Share Forecast Outlook 2025 to 2035

North America Licorice Extract Market Size and Share Forecast Outlook 2025 to 2035

North America Par Baked Bread Market Size and Share Forecast Outlook 2025 to 2035

North America Silo Bags Market Size and Share Forecast Outlook 2025 to 2035

North America Fresh Meat Packaging Market Size and Share Forecast Outlook 2025 to 2035

North America Ceramic Barbeque Grill Market Size and Share Forecast Outlook 2025 to 2035

North America Temperature Sensor Market Size and Share Forecast Outlook 2025 to 2035

North American Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

North America Head-up Display Market Size and Share Forecast Outlook 2025 to 2035

North America, Europe & Asia Pacific Legal Cannabis Market Size and Share Forecast Outlook 2025 to 2035

North America Ceiling Cassette Market Size and Share Forecast Outlook 2025 to 2035

North America Pressure Regulating Valves Market Size and Share Forecast Outlook 2025 to 2035

North America Flame Retardant Thermoplastics Market Size and Share Forecast Outlook 2025 to 2035

Fire Pit Market Analysis in North America - Growth, Trends and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA