The North America electrical testing services market is seeing significant growth as the demand for dependable and efficient electrical systems rises across commercial, industrial and residential segments. Electrical testing services help identify potential issues and components at risk of failure since they are conducted based on established industry standards.

With industries laying more emphasis on the time span and durability of their electric frameworks, the demand for expert electrical testing services is increasing. The increasing adoption of automation, smart grids, and renewable energy systems is another driver, as these technologies require comprehensive electrical testing solutions to ensure that all components work together seamlessly.

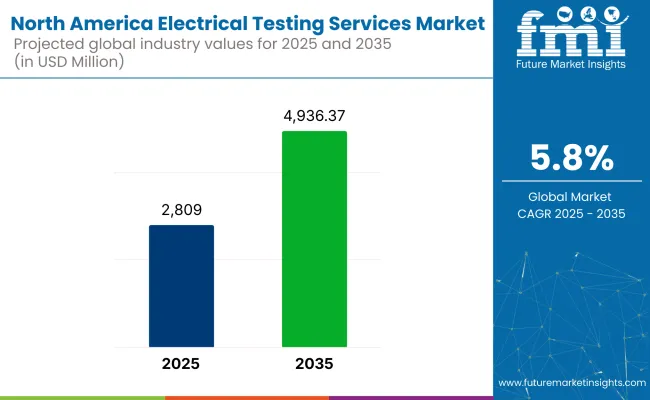

By 2025, the market is expected to surpass USD 2,809 million, and by 2035, it could grow to USD 4,936.37 million, achieving a compound annual growth rate (CAGR) of 5.8%. The market growth is driven by increasing industrialization, stringent safety regulations, and rising investments in energy-efficient electrical systems.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 2,809 million |

| Projected Market Size in 2035 | USD 4,936.37 million |

| CAGR (2025 to 2035) | 5.8% |

The growing focus on predictive maintenance and remote monitoring technologies is revolutionizing the electrical testing landscape, offering cost-effective and proactive solutions to identify potential failures before they occur. The increasing complexity of electrical systems in emerging technologies, such as electric vehicles and renewable energy projects, is creating additional demand for specialized testing services to ensure seamless integration and performance.

The growth of electrical testing services market in North America is mainly due to the presence of the large industrial base in the USA as well as the stringent safety codes and regulatory compliance requirements that need to be met. Increasing demand for smart grid installations and energy-efficient systems, along with the proliferation of infrastructures projects, is considerably driving the growth of electrical testing services.

Market opportunities are multiplying thanks to federal and state government programs designed to modernize energy infrastructure and improve grid reliability. Continued growth of the USA electrical testing services market is expected from the increasing need to minimize electrical outages, reduce operational downtime, and ensure compliance with changing environmental regulations.

The electrical testing services market in Canada is growing at a steady pace, owing to increasing infrastructure development, rise in energy-efficient building systems, and growing sustainability initiatives. With stringent electrical safety codes and standards in place, Canadian industries are rapidly embracing electrical testing solutions to ensure compliance.

The mining, oil & gas and manufacturing sectors are among the highest consumers of electrical testing services, seeking repeated inspections and upkeep to maintain the reliability and safety of equipment. With Canada continuing to build renewable energy and smart grid and efficiency systems, the need for electrical testing services will expand, particularly in sectors focusing on improving energy production and consumption.

The electrical testing services market in Mexico continues to maintain growth, bolstered by the increase in its industrial base and the construction of additional manufacturing plants. The government is spending massive amounts on the updating of electrical grid networks, support for new smart grid systems, and tighter safety regulations for factories and businesses.

In Mexico, the booming automotive, manufacturing, and construction industries will generate further demand for regular electrical testing services to make sure that the equipment works efficiently while preventing electrical hazards. The growing integration of Mexico into the global supply chain and its rapid industrialization are expected to fuel the demand for improved electrical testing services, particularly in energy-intensive sectors.

North America electrical testing services market will continue to grow due, to the increasing complexity of electrical systems, regulatory requirements, and the growing need for energy-efficient solutions. The demand for professional electrical testing services to ensure safety and optimal performance will only increase as industries embrace cutting-edge technologies like smart grids, renewable energy, and automation.

As industries increasingly prioritize predictive maintenance and preventive measures, the electrical testing services market is poised for continued innovation and growth, addressing the ever-changing needs of various sectors throughout the North American region.

High Installation and Maintenance Costs

It can serve as an advantage because, electrical testing services require massive upfront expenses when you include equipment, installation, and continuous maintenance. The cost implications can be a profound deterrent, particularly for small enterprises operating on a shoestring budget. High maintenance requirements for complex systems in industries like manufacturing and power generation cause costs to rise, restricting access to certain markets.

Complexity of Regulatory Compliance

Federal, state, and local regulations related to electrical testing services are continually evolving. Compliance standards come at immense costs to maintain in training, up-to-date equipment, and constant certification. It also imposes a degree of complexity that can slow the adoption of services, especially among smaller firms or newer market entrants, as they may require industry-specific expertise to meet regulatory standards.

Growing Demand for Preventive Maintenance

As people become more aware of how critical system reliability is, the demand for preventive electrical testing services only continues to rise. Many businesses and utilities are embracing routine testing schedules to catch issues early on so that downtime can be minimized and dangerous failures avoided. In industries such as manufacturing, energy, and commercial infrastructure, any electrical failure can lead to significant loss, making this trend especially common.

Integration of Renewable Energy Sources

As the relevance of renewable energy sources such as solar and wind rises, so does the need for reliable electrical testing services. Renewable energy integration into existing energy grids brings forth additional challenges that include the need to handle variations in power generation and to ensure that the sources are compatible with the system. Electrical testing services will play a critical role in achieving stability of grid and enabling climate-friendly energy solutions to be integrated in a safe and efficient manner.

From 2020 to 2024, the North America electrical testing services market experienced steady growth, fueled by increasing investments in infrastructure and a focus on maintaining reliability and safety in various sectors such as power generation, manufacturing, and utilities. Technologies like condition-based monitoring and remote diagnostics became more prevalent, enabling more efficient and proactive maintenance.

The line graph shows that the market is anticipated to experience substantial growth in the next decade, from 2025 to 2035, propelled by advancements in smart grid technology, integration of renewable energy sources, and the advent of IoT-enabled systems. As electrical systems become more complex, testing services will evolve to support the needs of more comprehensive, digital infrastructure and green energy solutions, emphasizing real-time data gathering, predictive maintenance, and regulatory compliance.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Aspect | 2020 to 2024 Trends |

|---|---|

| Key Growth Driver | Infrastructure upgrades, reliability focus |

| Product Innovations | Condition-based monitoring, remote testing |

| Distribution Channels | Direct sales through service providers |

| Dominant Regions | United States, Canada |

| Regulatory Focus | Safety and compliance standards |

| Investment Trends | Infrastructure maintenance, efficiency improvements |

| Customer Base | Utilities, manufacturing, commercial properties |

| Competitive Strategy | Cost-efficiency, reliability |

| Market Aspect | 2025 to 2035 Projections |

|---|---|

| Key Growth Driver | Smart grids, renewable energy integration |

| Product Innovations | IoT -enabled services, real-time diagnostics |

| Distribution Channels | Online platforms, automated service solutions |

| Dominant Regions | United States, Mexico, expanding into smart cities |

| Regulatory Focus | Sustainability and energy efficiency mandates |

| Investment Trends | Smart technology integration, green energy solutions |

| Customer Base | Smart cities, renewable energy companies, industrial facilities |

| Competitive Strategy | Technological innovation, sustainability, predictive services |

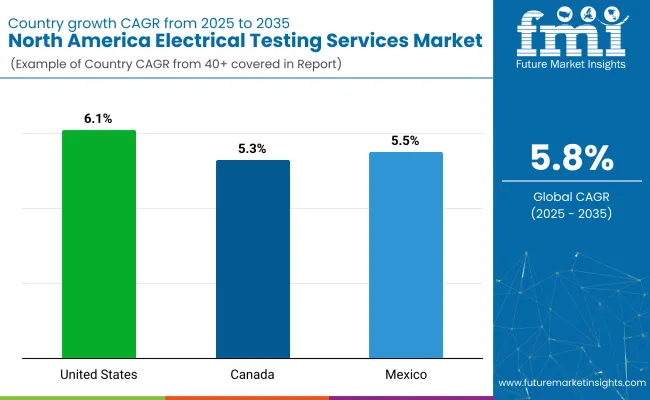

The United States accounts for the majority of the North American electrical testing services market share, due to the presence of a large industrial market and strong safety regulations. As more focus is placed on electrical safety and adherence to regulatory standards, like OSHA and NFPA, the need for electrical testing services is rapidly growing.

Market potential in such sectors as manufacturing, construction, and utilities is further driven up by the expansion of renewable energy installations and the growing emphasis on infrastructure modernization.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.1% |

The Canada electrical testing services market is likely to witness a tremendous growth over the forecast period.

Increasing demand for electrical testing services in residential and commercial buildings is being driven by the Canadian government's commitment to sustainable energy solutions and green infrastructure. Funding for energy storage, transmission and distribution is growing within the region and is driving demand for professional electrical testing services.

| Country | CAGR (2025 to 2035) |

|---|---|

| Canada | 5.3% |

Growth of energy sector in Mexico and need for better energy infrastructure to drive the Electrical testing services market in the country. Expanding manufacturing, automotive and construction industries, coupled with governmental efforts to modernize electrical grid systems, are presenting new opportunities for electrical testing services.

The focus on electrical safety and sustainability of power usage in Mexico is driving demand for professional electrical testing, maintenance and certification services in commercial and residential applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| Mexico | 5.5% |

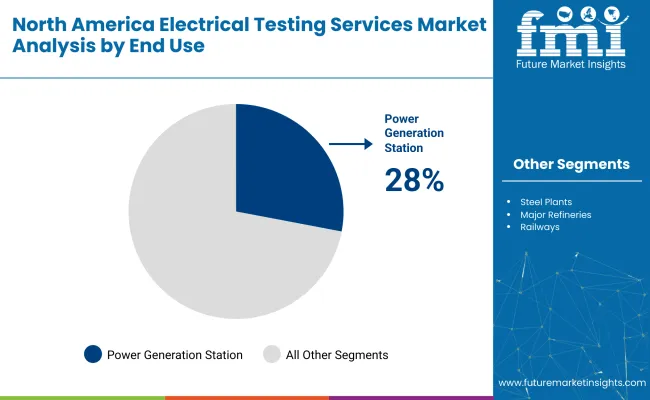

| End Use | Market Share (2025) |

|---|---|

| Power Generation Stations | 28% |

The power generation stations end-use segment is anticipated to dominate the market over the forecast period owing to the high amount of maintenance work required as well as stringent testing methods employed to ensure the safety and efficiency of power plants. Power plants are a critical piece of the puzzle for producing electricity, and they span coal, natural gas, nuclear, and renewable energy facilities that all rely on a variety of testing equipment and services to uphold strict operational standards and compliance with regulatory requirements.

This calls for testing equipment like turbines, boilers, generators, and electrical systems so that even the most subtle signs of wear can be detected early, leading to a reduction in expensive plant downtimes and facilitating plants in running at optimum performance levels. Routine maintenance activities like preventative inspections, safety checks and performance evaluations are critical in reducing unexpected breakdowns, increasing machinery life and optimizing energy generation.

Routine maintenance is just a part of the challenge; power generation stations must also comply with strict regulations and environmental standards, requiring emissions, water usage, and other environmental testing that happens with regular frequency. This creates a need for more sophisticated testing and monitoring systems that can provide accurate field-based data and ensure compliance with regulations.

This is further driven by the increasing complexity of modern power plants, which are becoming more reliant on advanced technology, automation, and integration of renewable energy sources. This not only helps the utilities avoid expensive regulatory penalties or shutdowns, but also enables better energy production and a more sustainable power generation mix.

The world is moving towards a more eco-friendly energy system, and that means power plants need to stay at the forefront of technology to continue cutting-time testing on their sums, which obviously requires them to adapt to new technologies as they evolve. Therefore, the power generation sector continuously dominates the demand for maintenance, testing, and diagnostic services.

As a final point, the bulk function of end-users purchasing any testing equipment and service is power generation stations being the end users due to the high operational complexity and stringent and ever-evolving regulatory compliance and for the need to keep the equipment running smoothly and efficiently and safe to operate. This segment will remain a key driver for testing and maintenance solutions as the energy landscape continues to evolve.

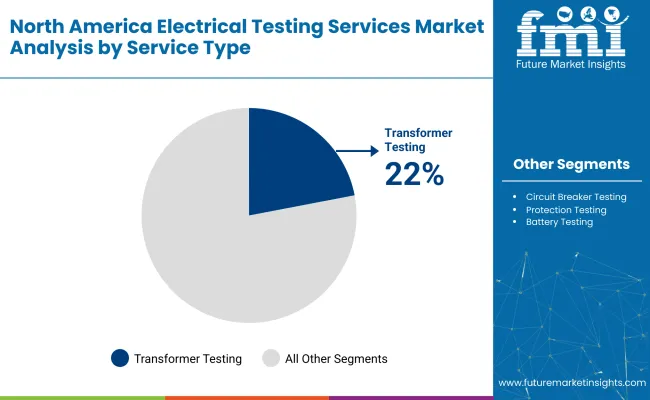

| Service Type | Market Share (2025) |

|---|---|

| Transformer Testing | 22% |

The transformer testing service type holds the largest share in the power generation and distribution market, as transformers are a vital part of the electrical grid. They are key components in the power system which either increase or decrease the voltage there and transfer energy at high voltage to consumers.

Due to their significance, frequent testing and maintenance are essential to prevent the threat of failure that could result in wide-ranging power outages, costly equipment damage, or danger to the public. Transformer testing services are in more demand as there is a need of ensuring that transformer is well-tuned to operate at peak performance, without degrading any efficiency and reliability.

Routine testing detects problems like insulation breakdown, overheating, and electrical unbalance, which, if not caught early enough, can trigger failures of catastrophic proportions. If maintenance processes are based on assessments and estimates, operators can proactively address issues before costly unplanned shutdowns arise, thus increasing the longevity of transformers.

As electrical systems become more complex, renewable energy sources become integrated, and more grids expand, transformer testing becomes clearer the more critical it is. As smart grids become more widely adopted and demand for power without interruptions rises, transformer testing becomes a critical part of maintaining transformer health without which grid stability is impossible and power outages inevitable.

The frequency of testing will help to avoid such losses. These include dielectric strength testing, thermal monitoring, oil quality analysis, and partial discharge testing. As the world moves towards renewable energy and electricity is relied upon more for critical infrastructure, transformer testing will remain key to the power generation and distribution industry. As utilities and industry prioritize reliability, transformer testing services will experience spectacular demand to ensure smooth and efficient operation of power distribution networks.

Due to the growing demand for effective and dependable electrical infrastructure in various sectors, the North American electrical testing services market is expanding significantly. A rise in investments in the industrial and residential sectors and increased focus on electrical safety standards further spur the growth of the market.

With the introduction of advanced testing technologies such as infrared testing and ultrasound diagnostics, companies are frequently improving their service offerings to improve performance watching and predictive maintenance capabilities. The changing regulations in the oil & gas, power generation & manufacturing industries are also attributable to the demand for compliance testing services. In addition, these inhibitors along with technology developments are likely to accelerate market growth until 2035.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Technomark Engineers India | 15-18% |

| Inel Power System Engineers | 12-15% |

| InserHitech Engineers | 10-13% |

| Voltech Group | 8-10% |

| Rulka Electricals | 8-10% |

| Other Key Players (combined) | 25% |

| Company Name | Key Offerings/Activities |

|---|---|

| Technomark Engineers India | In 2024, the company expanded its service portfolio to include advanced transformer testing solutions to cater to the renewable energy sector’s growing demand. |

| Inel Power System Engineers | In 2023, launched a mobile testing unit for on-site electrical inspections, allowing remote service delivery in underserved regions and enhancing service accessibility. |

| InserHitech Engineers | In 2025, introduced a cloud-based platform for real-time monitoring of electrical testing data, improving operational efficiency and transparency. |

| Voltech Group | In 2024, acquired a leading electrical testing firm to bolster their service capabilities in the North American market and enhance their portfolio of testing solutions. |

| Rulka Electricals | In 2023, introduced eco-friendly electrical testing equipment, aligning with the industry’s shift toward sustainability and providing customers with greener alternatives. |

Key Company Insights

Technomark Engineers India (15-18%)

Transformers constitute an important segment of Technomark Engineers India’s offerings in North America, where the company is a leading player in the electrical testing services market. Drawing on its existing proficiency, the firm has moved into the green energy space to address the rising need for clean, efficient energy.

The synergy and co-innovation of Technomark’s adherent to technology & sustained high-quality standards paved the way for valuable partnerships with some of the region’s leading names in power generation and industrial sectors. Investing in R&D helps the company better meet evolving customer needs, while also positioning it for long-term success.

Inel Power System Engineers (12-15%)

Inel power system engineers fills a spark gap with mobile testing units in North America. With that, the company can provide high-quality electrical testing services in remote areas developed where traditional service delivery would prove inefficient.

With a dedicated approach that is all about doing testing at the location of use, they ensure that says spent on downtimes is kept to a bare minimum and this can significantly add value for customers, especially those from manufacturing and constructions backgrounds. Driven by customer needs and requirements, Inel has been continually optimizing its service availability, offering greater accessibility for users while better cementing its place in the market.

InserHitech Engineers (10-13%)

The shift to digital transformation has propelled InserHitech engineers into a position of prominence within the electrical testing services arena. Electric’s innovative cloud-based system for real-time monitoring of data offers a new standard for operational efficiency by providing integrated real-time insights into electrical system performance for its clients.

InserHitech not only does serve better but also enhances the predictive maintenance of its systems to reduce downtime for customers and prevent failure in an expensive way. Leading edge tech like this keeps the company ahead of competitors, and reinforces its leadership in the field.

Voltech Group (8-10%)

In the North American electrical testing services market Voltech Group has a strong position, gained through targeted acquisitions. As a result of this acquisition, the organization has broad service offerings with in-house equipment that meets its clients' needs, especially through the increased engagement that is expected in manufacturing, oil & gas and power generation.

The acquisition of REU amongst others will enable Voltech to build on its existing portfolio again allowing them to expand upon their high quality range of electrical testing solutions. The company has a strong presence in the market, which is aided by its concentration on delivering operational efficiency and safety standards.

Rulka Electricals (8-10%)

Sustainability is one of the key factors that set Rulka Electricals apart in the market. The company has embraced this trend by launching eco-friendly electrical testing equipment that conforms to our growing industry mandate of going green. This advancement caters to contemporary environmental regulations and attracts clients interested in eco-friendly and cost-saving solutions. By placing a high emphasis on sustainability, while also providing the highest levels of service, Rulka promises to be a leading competitor in the North American electrical testing services industry.

Other Key Players (25% Combined)

The overall market size for North America electrical testing services market was USD 2,809 million in 2025.

The North America electrical testing services market expected to reach USD 4,936.37 million in 2035.

The increasing adoption of automation, smart grids, and renewable energy systems will drive the demand for North America electrical testing services market.

The top 5 countries which drives the development of North America electrical testing services market are United States, Canada and Mexico.

Power generation stations segment driving market growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Northern Blotting Market Size and Share Forecast Outlook 2025 to 2035

Northern Europe Calcium Sulphate Market Size and Share Forecast Outlook 2025 to 2035

North America Boat Trailer Market Size and Share Forecast Outlook 2025 to 2035

North America Cryogenic Label Printer Market Size and Share Forecast Outlook 2025 to 2035

North America Chitosan Market Size and Share Forecast Outlook 2025 to 2035

North America Underground Mining Vehicle Market Size and Share Forecast Outlook 2025 to 2035

North America Bulk Aseptic Packaging Market Size and Share Forecast Outlook 2025 to 2035

North America Licorice Extract Market Size and Share Forecast Outlook 2025 to 2035

North America Par Baked Bread Market Size and Share Forecast Outlook 2025 to 2035

North America Silo Bags Market Size and Share Forecast Outlook 2025 to 2035

North America Fresh Meat Packaging Market Size and Share Forecast Outlook 2025 to 2035

North America Ceramic Barbeque Grill Market Size and Share Forecast Outlook 2025 to 2035

North America Temperature Sensor Market Size and Share Forecast Outlook 2025 to 2035

North American Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

North America Head-up Display Market Size and Share Forecast Outlook 2025 to 2035

North America, Europe & Asia Pacific Legal Cannabis Market Size and Share Forecast Outlook 2025 to 2035

North America Ceiling Cassette Market Size and Share Forecast Outlook 2025 to 2035

North America Pressure Regulating Valves Market Size and Share Forecast Outlook 2025 to 2035

North America Flame Retardant Thermoplastics Market Size and Share Forecast Outlook 2025 to 2035

Fire Pit Market Analysis in North America - Growth, Trends and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA