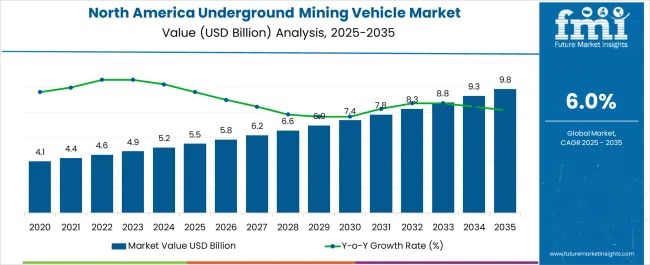

The North America Underground Mining Vehicle Market is estimated to be valued at USD 5.5 billion in 2025 and is projected to reach USD 9.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

| Metric | Value |

|---|---|

| North America Underground Mining Vehicle Market Estimated Value in (2025 E) | USD 5.5 billion |

| North America Underground Mining Vehicle Market Forecast Value in (2035 F) | USD 9.8 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The North America underground mining vehicle market is experiencing robust growth driven by increasing mineral exploration, technological advancements in vehicle automation, and heightened emphasis on worker safety. Demand for specialized vehicles is being reinforced by deeper mining operations and the need for equipment capable of operating in harsh underground conditions.

Investments in electrification and battery powered vehicles are gaining momentum as mining companies prioritize sustainability and compliance with environmental regulations. Rising coal, metal, and mineral production across the region continues to create opportunities for innovative vehicle deployment.

Moreover, integration of telematics, predictive maintenance, and advanced navigation systems is reshaping operational efficiency and reducing downtime. The outlook remains positive as both established mining companies and emerging operators focus on enhancing productivity and safety standards while meeting stringent regulatory requirements.

The ground support segment is projected to hold 48.60% of the total revenue share by 2025 within the equipment type category, making it the leading segment. Growth is supported by the increasing need for vehicles that ensure structural stability and operational safety in underground environments.

These vehicles play a critical role in reinforcing mine shafts and tunnels, thereby reducing risks of collapse and ensuring uninterrupted production. Technological upgrades such as automated bolting systems and improved material handling capabilities are enhancing efficiency and reliability.

As underground mining operations expand deeper and become more complex, the demand for ground support vehicles continues to strengthen, positioning this segment as the key contributor to market revenue.

The mining operators segment is expected to account for 57.20% of total revenue by 2025, establishing it as the dominant ownership category. The preference for direct ownership by mining operators is driven by the need for customized vehicle fleets that meet specific operational demands.

This ownership model allows operators to have greater control over maintenance schedules, equipment utilization, and technological upgrades. Additionally, long term cost benefits and reduced reliance on leasing partners are reinforcing the dominance of this segment.

With increasing focus on automation and electrification, mining operators are investing heavily in in house vehicle fleets to gain competitive advantages in operational efficiency and safety performance.

The coal mining segment is projected to represent 44.90% of the market by 2025 under the application category, making it the leading segment. Strong demand is being driven by continued reliance on coal for energy generation in certain regions and the requirement for specialized underground vehicles that can operate effectively in challenging geological conditions.

Coal mining operations demand robust equipment with high safety and productivity standards, fueling adoption of advanced underground vehicles. Regulatory emphasis on safe mining practices has further accelerated the need for vehicles designed to withstand harsh coal environments.

As coal remains a significant part of the energy mix in North America, this segment continues to dominate the underground mining vehicle market.

The North America underground mining vehicle market was worth USD 3,550 million in 2020. It accumulated a market value of USD 4,286.7 million in 2025 while growing at a CAGR of 4.8% during the historical period.

Driven by increase investment for extraction of minerals and ores in mining industry and rapid industrialization across Canada, Mexico and the USA, the North America underground mining vehicle market will rise at 6% CAGR between 2025 and 2035.

Coal mining has experienced rapid growth in past few years across North America due to which industries are expanding their production capacities. Consumption of coal across North America has increased past few years, leading to increased mining activities to extract the remaining coal for generating power and other sources.

Underground mining vehicle are gaining popularity due to their durability and wide range of applications in diverse end-use industries. As per Future Market Insights, rental service providers are the preferred owners in various sectors due to easy availability and cost-effectiveness.

Leading manufacturers are focusing on expansion of their product portfolio. Increasing investments on research & development activities to improve the durability and efficiency will aid the growth.

The underground mining vehicles are also being most popular for their LPDT, LHD, and underground haulers for transporting the materials from the mine to the preferred location where the material is then further processed.

Shearers are the major ground support/production unit which used for the extraction of the coal and ore form the mine and also used to make small granules of the metal/material rocks.

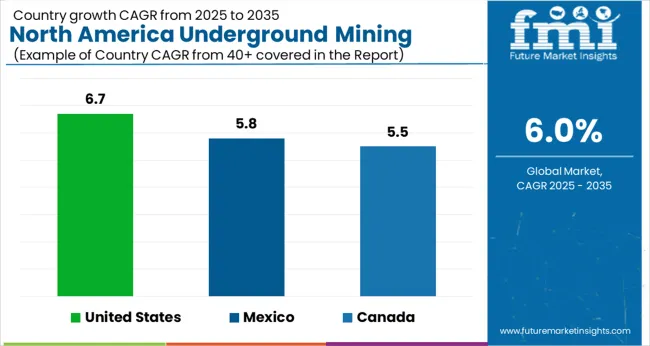

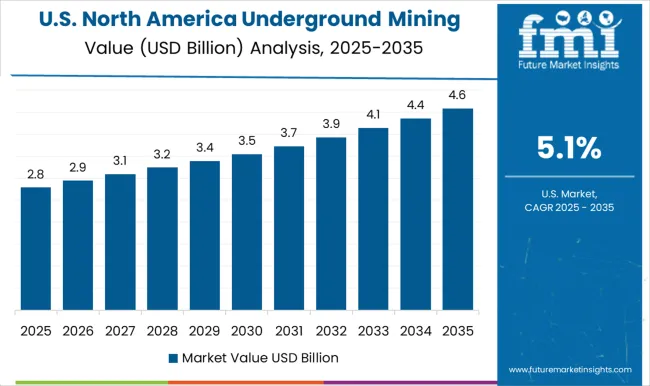

The United States is expected to hold prominent share during the forecast period, according to Future Market Insights. The United States is expected to account for nearly 38%of the North America market through 2035. The market in this region is expected to grow with a CAGR of 6.2% during the forecast period.

The United States' mining and excavation industry is one of the main factors supporting the market growth. Presence of numerous rental service providers across the United States will aid the growth.

As underground mining vehicle owners are looking to curb the maintenance cost, key players are eyeing the United States underground mining vehicle market through long term partnerships with small mine operator.

The metal mining application segment will witness steady growth and outpace the coal mining segment in the coming years as the demand for precious metals is rising in the United States.

Demand for underground mining vehicles in Canada is expected to rise at nearly 6% CAGR over the forecast period. Owing to its development in the mining sector, Canada is one of the prominent nation in the mining industry.

With increasing mining activities across Canada, the market outlook is expected to witness steady growth. Increasing production of coal across the country will increase the sales of underground mining vehicles.

As per FMI, production equipment shows moderate growth in as other applications such as non-metallic minerals mining are also expected to increase.

The market is expected to witness steady growth as underground mining activities across Mexico gains traction. It is expected to account for over 22%of North America’s underground mining vehicles sales throughout the forecast period.

The demand in for mining vehicles in this region is expected to grow with a CAGR of 5.8% during the forecast period.

The market outlook in the Mexico is moderate as the sales of ground support equipment and production equipment rises in the country. Due to lack of government support for mining activities, preference for rental underground mining vehicles service is driving the adoption.

Based on underground mining vehicles equipment, ground support is leading the segment, accounting for nearly 42% of the market in 2025. The demand from this segment is expected to rise with a CAGR of 6.5% during the forecast period.

Increasing demand for roof bolter, shearers, and scalers in the underground mining for extraction of the metals, coal and other ores is driving the segment growth.

Metal mining and non-metallic mining is expected to witness higher growth in the future as the application of coal mining is increasing. Rising metallic and non-metallic mining activities such as mining of precious metals and others are growing rapidly, boosting the segment growth.

Metallic and non-metallic mining, collectively, will have a market share of nearly 65%. The demand from metal mining is expected to grow with a CAGR of 6.8% during the forecast period.

The rental service providers segment are expected to contribute for over 40% of market share in 2025. The segment share is expected to increase in near future as the new vehicles prices are high.

Due to the high presence of local players in mining industry, to cut down the high initial investment and reduce maintenance cost, owners opt for rental service for underground mining vehicles.

Start-ups play a vital role in identifying growth opportunities in the North America underground mining vehicle market. Their ability to convert inputs into outputs and navigate market uncertainties contributes to the industry's growth. A few of the startups are as follows:

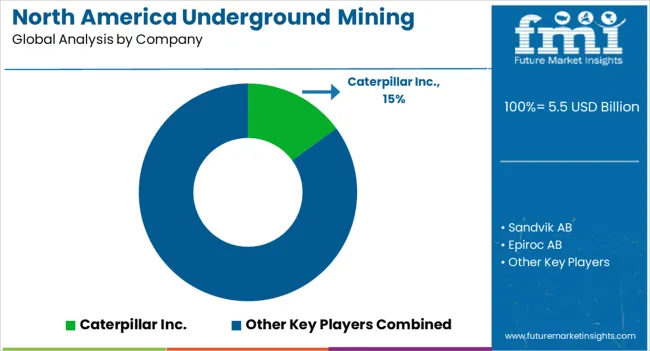

The market for North America underground mining vehicle is highly competitive, with numerous prominent industry players making substantial investments in increasing their manufacturing capabilities.

The key industry players Caterpillar Inc., Sandvik AB, Epiroc AB, Komatsu Ltd., Boart Longyear Ltd., Hitachi Construction Machinery, Hermann Paus Maschienfabrik GmbH, Timberland Equipment, Getman Corporation, Kovatera Inc., Maccaferri Inc. Liebherr Group, Sany Heavy Industry Co. Ltd., Volvo Construction Equipment, Astec Industries Inc, J.C. Bamford Excavators Ltd. (JCB), Normet, Maclean Engineering and Marketing Co., J.H. Fletcher and Co.

Some key developments in the North America underground mining vehicle market are:

| Report Attribute | Details |

|---|---|

| Market Value in 2025 | USD 5.5 billion |

| Market Value in 2035 | USD 9.8 billion |

| Growth Rate | CAGR of 6% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Equipment Type, Ownership, Application, Country |

| Regions Covered | North America |

| Key Countries Profiled | United States, Canada |

| Key Companies Profiled | Caterpillar Inc.; Sandvik AB; Epiroc AB; Komatsu Ltd.; Boart Longyear Ltd.; Hitachi Construction Machinery; Liebherr Group; Sany Heavy Industry Co. Ltd.; Volvo Construction Equipment; Astec Industries Inc.; J.C. Bamford Excavators Ltd. (JCB); Normet; Maclean Engineering and Marketing Co.; J.H. Fletcher and Co.; Hermann Paus Maschienfabrik GmbH; Timberland Equipment; Getman Corporation; Kovatera Inc.; Maccaferri Inc. |

| Customization & Pricing | Available Upon Request |

The global North America underground mining vehicle market is estimated to be valued at USD 5.5 billion in 2025.

The market size for the North America underground mining vehicle market is projected to reach USD 9.6 billion by 2035.

The North America underground mining vehicle market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in North America underground mining vehicle market are ground support, _roof bolter, _scalers, _shotcrete sprayers, _shearers, production equipment, _lpdt, _lhd, _underground haulers, _scrapers, _dozers, _mining drills, _continuous miners, _mining excavators and shovels, _others (shaft sinking equipment, feeder breaker, etc.), utility equipment, _scissor lift, _personnel carrier truck, _boom truck, _fuel lube trucks, _remixers and _others.

In terms of ownership, mining operators segment to command 57.2% share in the North America underground mining vehicle market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Northern Blotting Market Size and Share Forecast Outlook 2025 to 2035

Northern Europe Calcium Sulphate Market Size and Share Forecast Outlook 2025 to 2035

North America Boat Trailer Market Size and Share Forecast Outlook 2025 to 2035

North America Cryogenic Label Printer Market Size and Share Forecast Outlook 2025 to 2035

North America Chitosan Market Size and Share Forecast Outlook 2025 to 2035

North America Bulk Aseptic Packaging Market Size and Share Forecast Outlook 2025 to 2035

North America Licorice Extract Market Size and Share Forecast Outlook 2025 to 2035

North America Par Baked Bread Market Size and Share Forecast Outlook 2025 to 2035

North America Silo Bags Market Size and Share Forecast Outlook 2025 to 2035

North America Fresh Meat Packaging Market Size and Share Forecast Outlook 2025 to 2035

North America Ceramic Barbeque Grill Market Size and Share Forecast Outlook 2025 to 2035

North America Temperature Sensor Market Size and Share Forecast Outlook 2025 to 2035

North American Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

North America Head-up Display Market Size and Share Forecast Outlook 2025 to 2035

North America, Europe & Asia Pacific Legal Cannabis Market Size and Share Forecast Outlook 2025 to 2035

North America Ceiling Cassette Market Size and Share Forecast Outlook 2025 to 2035

North America Pressure Regulating Valves Market Size and Share Forecast Outlook 2025 to 2035

North America Flame Retardant Thermoplastics Market Size and Share Forecast Outlook 2025 to 2035

Fire Pit Market Analysis in North America - Growth, Trends and Forecast from 2025 to 2035

North America Electrical Testing Services Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA