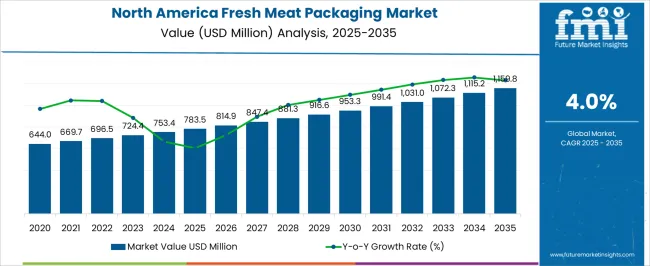

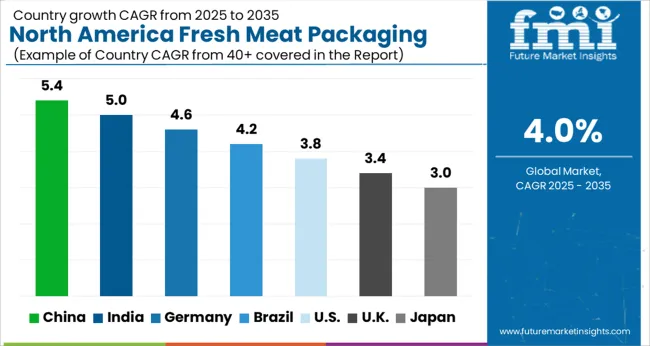

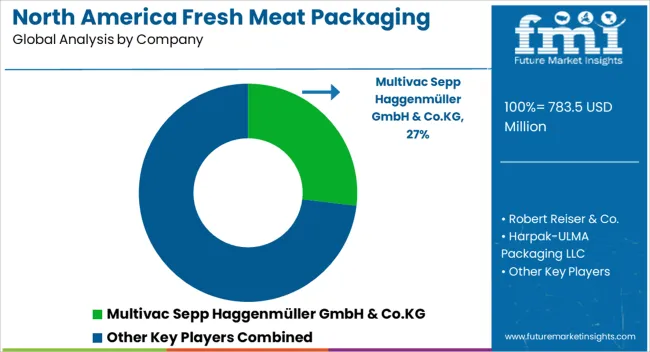

The North America Fresh Meat Packaging Market is estimated to be valued at USD 783.5 million in 2025 and is projected to reach USD 1159.8 million by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

| Metric | Value |

|---|---|

| North America Fresh Meat Packaging Market Estimated Value in (2025 E) | USD 783.5 million |

| North America Fresh Meat Packaging Market Forecast Value in (2035 F) | USD 1159.8 million |

| Forecast CAGR (2025 to 2035) | 4.0% |

The North America fresh meat packaging market is witnessing strong momentum due to evolving consumer preferences for safe, high quality, and longer lasting meat products. Rising demand for convenience foods and the growth of organized retail have accelerated the adoption of innovative packaging technologies that ensure freshness and extend shelf life.

Regulatory focus on food safety standards and reduction of food waste is also shaping industry practices. Investments in advanced packaging solutions with barrier properties and sustainability features are further influencing the market landscape.

Technological developments in modified atmospheric packaging and vacuum sealing are addressing both quality preservation and environmental considerations. The future outlook remains positive as stakeholders continue to emphasize product safety, sustainability, and enhanced customer experience, making fresh meat packaging an essential enabler for growth across the meat value chain.

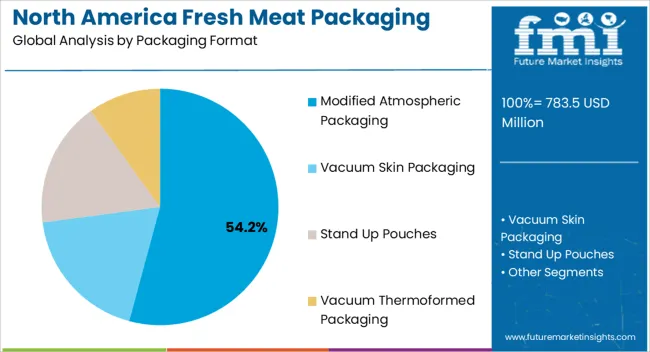

The modified atmospheric packaging format segment is expected to account for 54.20% of total revenue by 2025 within the packaging format category, making it the leading segment. Its dominance is attributed to its ability to significantly extend shelf life, maintain color stability, and preserve nutritional value in meat products.

Adoption has been reinforced by growing consumer demand for fresh appearance and taste, alongside retail requirements for longer display times. This format also reduces spoilage and food waste, aligning with sustainability objectives across the supply chain.

As retail and distribution networks expand, reliance on modified atmospheric packaging has been strengthened, consolidating its leadership in the packaging format category.

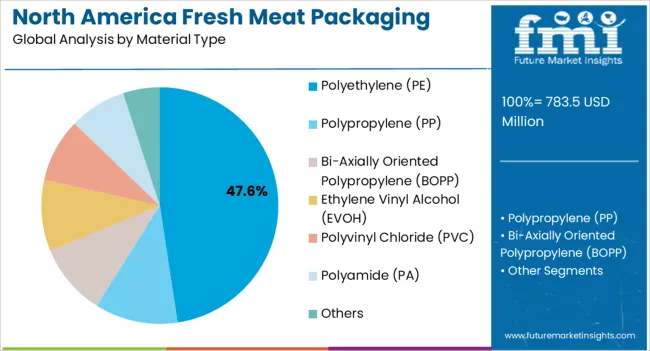

The polyethylene material type segment is projected to contribute 47.60% of total market revenue by 2025 under the material type category, making it the most prominent segment. Its popularity is driven by its flexibility, durability, and strong barrier properties that ensure product safety and quality.

Polyethylene has been widely adopted due to its cost effectiveness and compatibility with advanced sealing technologies. Ongoing innovations in recyclable and bio based polyethylene solutions are further boosting its relevance in a sustainability focused market.

This balance of performance, affordability, and environmental adaptability has enabled polyethylene to maintain its position as the leading material choice in fresh meat packaging.

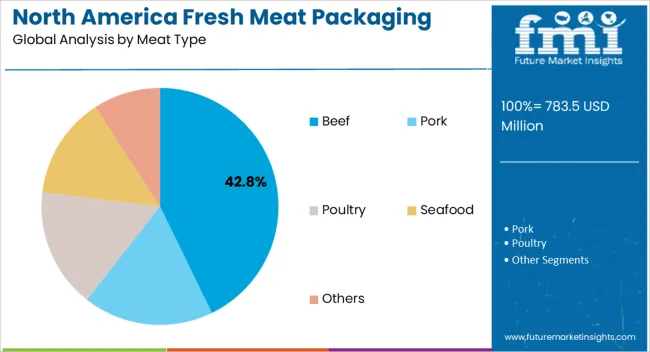

The beef segment is anticipated to hold 42.80% of total market revenue by 2025 within the meat type category, positioning it as the dominant segment. This leadership is a result of strong consumer demand for premium protein sources and the preference for packaged beef products that guarantee freshness and safety.

Retailers and distributors are prioritizing beef packaging solutions that deliver extended shelf life and minimize contamination risks. Additionally, cultural dietary preferences and the widespread consumption of beef across North America have reinforced its substantial share.

Enhanced packaging solutions tailored for beef preservation continue to strengthen its dominance in the meat type segment.

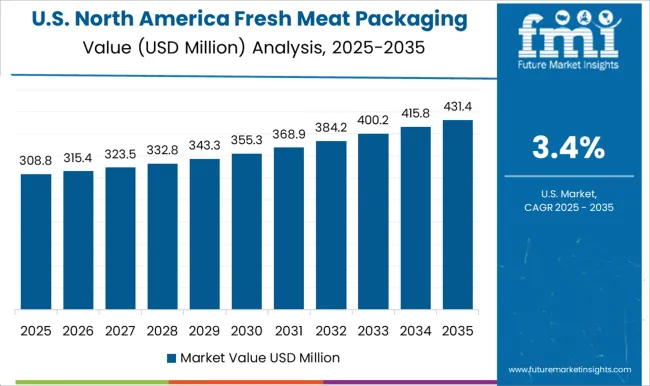

The North America fresh meat packaging market was worth USD 644 million in 2020. It accumulated a market value of USD 783.5 million in 2025 while growing at a CAGR of 3.4% during the historical period.

A shift in consumer demand for bio-based materials for manufacturing fresh meat packaging as a replacement for toxic plastic is anticipated to change market outlook in the coming years.

Rising environmental concerns and stringent government rules and regulations are expected to generate new opportunities for the market players. This might help these players to move ahead toward innovation in the fresh meat packaging market, thereby driving growth in the market.

Various manufacturers are already utilizing sustainable packaging for fresh meat. However, few market players are yet to do so as they are conducting extensive research and development activities to achieve sustainability goals.

The suppliers of fresh meat packaging are witnessing huge demand due to rising production of various poultry, meat, and seafood in North America. Increasing demand for flexible packaging in the packaging of fresh meat is anticipated to generate new growth opportunities for market expansion. The major function of primary packaging is to avoid and protect the product from any damage or contamination.

Flexible packaging such as polypropylene and polyethylene possess numerous properties that cater to the needs of primary packaging like high barrier feature, lightweight, and minimal probability of contamination, which keeps the product safe from external elements. Therefore, rising demand for flexible packaging is expected to drive growth in the market.

Growing demand for eco-friendly packaging solutions is driving market growth

The facility of customization in transparent fresh meat packaging and rising demand for convenient packaging solutions among urban population are expected to drive market growth over the forecast period.

Key industry players are looking towards incorporating recycled material such as ethylene-vinyl alcohol copolymer in fresh meat packaging to replace the packaging solutions containing polystyrene foam trays and plastic film. This is expected to drive market growth.

Increasing consumer awareness and concern toward harmful effects of non-biodegradable plastic on the environment is positively influencing the market growth. This is pushing the market players to manufacture bio-plastics and molded fiber materials that are compliant with regulatory standards and performance requirements set in packaging to keep the meat fresh for consumption.

The market is further driven by changing lifestyles and hectic schedules of the people. Consumers are looking for convenient packaging solutions that allow easy handling, transportation, and storage. Due to this, the demand for fresh meat packaging is expected to rise in the forecast period.

Availability of alternative solutions to restrict market expansion

Volatile raw packaging materials costs are expected to restrain market growth. High prices of innovative packaging are anticipated to restrict product demand in the forecast period. Also, supply chain disruptions due to growing availability of alternative solutions are further expected to hold back market expansion.

United States driving growth with a dominating market share

The United States of America accounted for 92.6% regional market share in 2025. The fresh meat packaging market in this region is expected to grow with a CAGR of 3.8% from 2025 to 2035. The region is expected to retain its trend of dominance by commanding over 93% market share by end of 2025.

The rising consumption of meat products is expected to drive product demand during the forecast period. The region is anticipated to reflect substantial growth due to the steady investments in research and development activities to provide innovative packaging solutions.

Rising consumption of animal meat especially pork, poultry, and beef in this region is expected to fuel product demand in the coming years. Rapid urbanization and improving standard of living are the main factors influencing the consumption of animal products in this region.

The export of beef and poultry and presence of advanced processing infrastructure in the country is further expected to drive market growth. Increasing awareness among consumers regarding the importance of food safety & hygiene is helping the market to grow. The rising demand for packaging solutions that guarantee freshness and quality of the meat while avoiding contamination is expected to fuel the product demand in the coming years.

A flourishing e-commerce industry is further fuelling the demand for packaging solutions that are tamper-proof, durable, and can tolerate wear and tear due to shipping and handling. This is expected to drive demand for fresh meat packaging solutions in United States of America.

Canada Driving Growth with Significant CAGR

Canada accounted for 7.4% regional revenue share in 2025, in fresh meat packaging market. The market in this region is expected to grow with a CAGR of 5.3% during the forecast period.

As per Agriculture and Agri-Food Canada, Animal Industry Division, in 2024, over 354 million chickens were slaughtered in federally inspected slaughterhouses in Canada.

An increase in butchering activities and the establishment of supermarkets and retail chains have made animal meat readily available across this region. Growing demand for sustainable packaging which keeps meat fresh and offers enhanced shelf life is expected to fuel the sales of fresh meat packaging products in this region.

Canada is renowned for its commitment to environmental sustainability. With rising consumer awareness in this region, purchasing decisions are also witnessing a change. Due to this, the region is witnessing a significant demand for sustainable packaging solutions that are biodegradable, recyclable, and have a low carbon footprint.

Polyethylene driving market growth with a dominating segment share

Polyethylene accounted for a revenue share of 50% in 2025, on the basis of material type. This segment is expected to grow with a CAGR of 4.2% during the forecast period.

The elasticity and low production cost of polyethylene compared to other materials are the key factors expected to fuel its demand in the forecast period. Increasing consumption of plastic containers in industrial and household applications is further anticipated to propel product demand during the forecast period.

The ability of polyethylene to maintain freshness and quality of the meat for a long period of time is driving its demand. Polyethylene helps to prevent contamination from external factors and maintains suitable temperature and humidity levels within the packaging.

Beef leading the market with a sizeable market share

In 2025, beef accounted for a sizeable revenue share of 31.9% in the North America fresh meat packaging market. This segment is projected to grow with a CAGR of 6.2%.

Growing awareness about the advantages of consuming beef as a rich source of protein is expected to drive growth in the segment in the coming years. Increasing awareness regarding the diseases related to fresh and raw pork and poultry is estimated to drive beef consumption in North America.

Start-ups help in predicting future growth opportunities in any market. New players have the potential to generate impressive returns which directly benefits the expansion of any industry. These start-ups are generally more productive at transforming inputs into outputs with more flexibility and adaptability, the ability to adopt volatile market conditions. Some of the start-ups that will propel the expansion of North American fresh meat packaging market are:

The North America fresh meat packaging market is extremely competitive and consists of various key industry players. These players are heavily investing in manufacturing fresh meat packaging solutions.

The key industry players are Multivac Sepp Haggenmüller GmbH & Co.KG, Sealpac International BV., Robert Reiser & Co, Harpak-ULMA Packaging, LLC, ALKAR-RapidPak, Inc., Bemis Company, Inc, Winpak Ltd., Sealed Air Corp., Berry Plastic Group, Coveris Holdings S.A.

Key market players are leveraging on inorganic growth strategies like acquisition, mergers, partnerships, and collaboration to enhance their product portfolio. This is expected to fuel the North American fresh meat packaging market.

| Report Attribute | Details |

|---|---|

| Market Value in 2025 | USD 783.5 million |

| Market Value in 2035 | USD 1159.8 million |

| Growth Rate | CAGR of 4% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Packaging Format, Material Type, Meat Type, Region |

| Key Countries Profiled | United States, Canada |

| Key Companies Profiled | Multivac Sepp Haggenmüller GmbH & Co.KG; Robert Reiser & Co.; Harpak-ULMA Packaging LLC; ALKAR-RapidPak, Inc.; Sealpac International BV.; Bemis Company Inc.; Winpak Ltd.; Sealed Air Corp.; Berry Plastic Group Inc.; Coveris Holdings S.A. |

| Customization | Available upon Request |

The global north america fresh meat packaging market is estimated to be valued at USD 783.5 million in 2025.

The market size for the north america fresh meat packaging market is projected to reach USD 1,159.8 million by 2035.

The north america fresh meat packaging market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in north america fresh meat packaging market are modified atmospheric packaging, vacuum skin packaging, stand up pouches and vacuum thermoformed packaging.

In terms of material type, polyethylene (pe) segment to command 47.6% share in the north america fresh meat packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Northern Blotting Market Size and Share Forecast Outlook 2025 to 2035

Northern Europe Calcium Sulphate Market Size and Share Forecast Outlook 2025 to 2035

North America Boat Trailer Market Size and Share Forecast Outlook 2025 to 2035

North America Cryogenic Label Printer Market Size and Share Forecast Outlook 2025 to 2035

North America Chitosan Market Size and Share Forecast Outlook 2025 to 2035

North America Underground Mining Vehicle Market Size and Share Forecast Outlook 2025 to 2035

North America Licorice Extract Market Size and Share Forecast Outlook 2025 to 2035

North America Par Baked Bread Market Size and Share Forecast Outlook 2025 to 2035

North America Silo Bags Market Size and Share Forecast Outlook 2025 to 2035

North America Ceramic Barbeque Grill Market Size and Share Forecast Outlook 2025 to 2035

North America Temperature Sensor Market Size and Share Forecast Outlook 2025 to 2035

North American Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

North America Head-up Display Market Size and Share Forecast Outlook 2025 to 2035

North America, Europe & Asia Pacific Legal Cannabis Market Size and Share Forecast Outlook 2025 to 2035

North America Ceiling Cassette Market Size and Share Forecast Outlook 2025 to 2035

North America Pressure Regulating Valves Market Size and Share Forecast Outlook 2025 to 2035

North America Flame Retardant Thermoplastics Market Size and Share Forecast Outlook 2025 to 2035

Fire Pit Market Analysis in North America - Growth, Trends and Forecast from 2025 to 2035

North America Electrical Testing Services Market - Growth & Demand 2025 to 2035

North America In-building Wireless Market Growth - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA