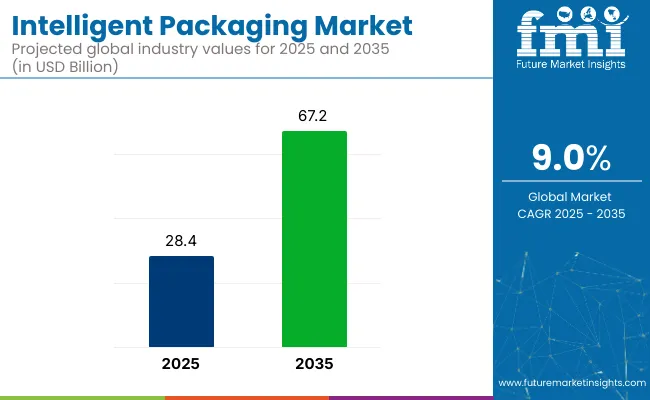

The global intelligent packaging market is valued at USD 28.4 billion in 2025 and is poised to be worth USD 67.2 billion by 2035, registering a robust CAGR of 9.0%. Market expansion is driven by rising demand for smart, traceable, and sustainable packaging solutions across industries such as food & beverage, pharmaceuticals, logistics, and personal care.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 28.4 billion |

| Forecast Value (2035) | USD 67.2 billion |

| Forecast CAGR (2025 to 2035) | 9.0% |

Increased focus has been placed on extending shelf life, ensuring product safety, and enabling real-time monitoring through embedded technologies like RFID, QR codes, and time-temperature indicators. High adoption rates have been particularly observed in developed economies such as the USA, Germany, and Japan, while rapid uptake in emerging Asian countries has been contributing significantly to global growth.

In 2025, the intelligent packaging market is poised to be fueled by the primary packaging segment, which is anticipated to account for over 45% of the total market share, supported by the integration of smart technologies such as RFID tags, temperature indicators, and freshness sensors.

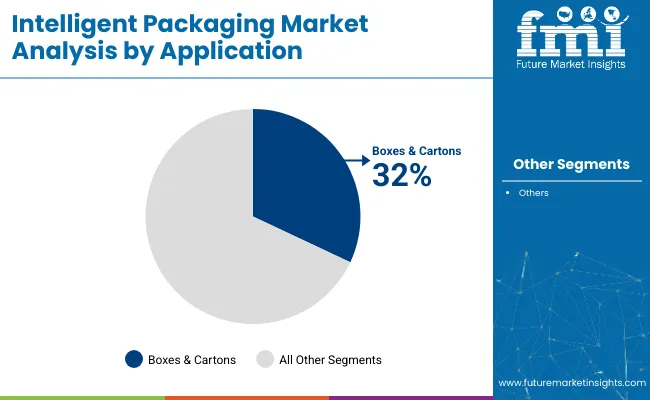

Within the application segment, boxes & cartons have been projected to represent approximately 32% of the market, driven by their growing use across food distribution, retail, and logistics applications. The USA has been forecasted to register a CAGR of 8.7% from 2025 to 2035, influenced by regulatory developments, digital infrastructure investments, and expanded usage of intelligent packaging across the food, pharmaceutical, and supply chain sectors.

Innovations within the intelligent packaging landscape have been centered on enhancing product tracking, consumer engagement, and material sustainability. Technologies such as AI-enabled sensors, interactive NFC tags, and blockchain-based authentication tools have been integrated to improve transparency and reduce counterfeiting risks.

Additionally, traditional packaging formats have been upgraded with smart features, including tamper-evident seals, freshness indicators, and temperature-sensitive labels. A rising emphasis has been placed on environmentally friendly solutions, with manufacturers increasingly turning to biodegradable substrates, recycled paperboard, and plant-based polymers.

Durability and product lifecycle performance have been improved through smart material engineering, while greater personalization and modularity such as adjustable shelf-life displays have also been adopted.

The market is segmented by technology, level of packaging, application, end use, and region. By technology, the market has been categorized into indicators, sensors, interactive packaging/data carriers, and active packaging. Based on the level of packaging, segmentation has been done into primary packaging, secondary packaging, and tertiary packaging.

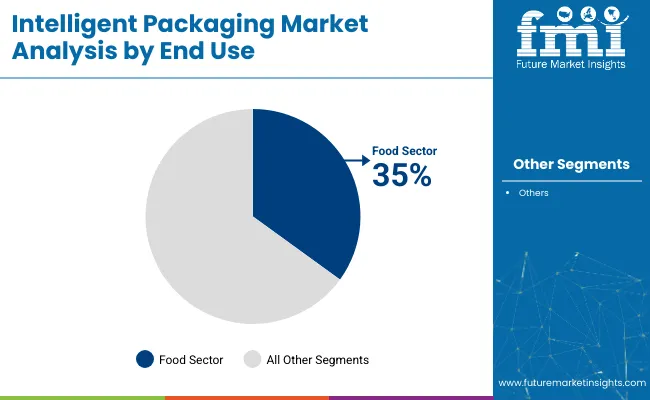

In terms of application, the market has been divided into bottles and jars, blisters, trays & clamshells, cans, boxes & cartons, vials, ampoules, & prefilled syringes, bags & pouches, films & wraps, mailers, and labels, tapes, & tags. By end use, the market has been segmented into food, beverage, healthcare, cosmetics, logistics & transport, consumer electronics, personal care & homecare, and other consumer goods (apparel, toys, stationery, automotive).

The interactive packaging/data carriers' segment has been projected to lead the technology category, accounting for 38% of the global market share by 2025. Growing demand for product traceability, consumer engagement, and counterfeit prevention has been driving the widespread adoption of QR codes, NFC tags, and blockchain-linked packaging formats.

Primary packaging has been projected to lead the packaging level segment, contributing over 45% of the global market share by 2025. This dominance has been supported by its direct interaction with products, particularly in the food, beverage, and healthcare sectors, where safety, traceability, and user engagement have been prioritized.

Boxes and cartons have been anticipated to lead the application segment, accounting for 32% of the global market share in 2025. Their widespread use in retail, logistics, and consumer packaging has positioned them as a preferred format for smart packaging integration.

The food sector has been forecasted to dominate the end-use category, capturing 35% of the global intelligent packaging market share by 2025. High emphasis on shelf-life extension, freshness monitoring, and contamination prevention has driven adoption across packaged food and beverage manufacturers.

The intelligent packaging market has witnessed notable growth, supported by rising demand for traceable, responsive, and sustainable packaging across food, healthcare, and logistics sectors. Advancements in smart sensors, IoT integration, and eco-friendly material development have been playing a crucial role in shaping market momentum.

Recent Trends in the Intelligent Packaging Market

Challenges in the Intelligent Packaging Market

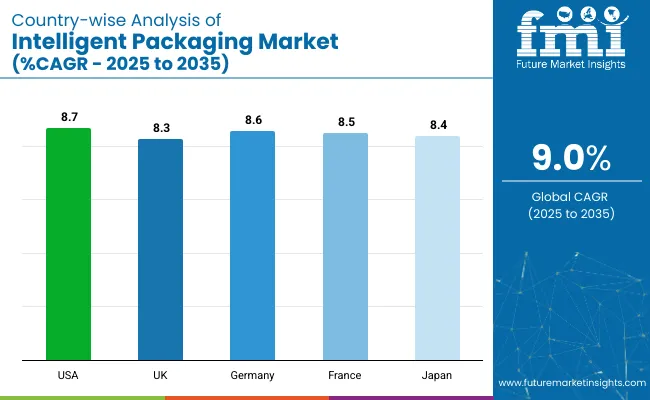

The USA intelligent packaging market has been projected to grow at a CAGR of 8.7% from 2025 to 2035. Growth has been supported by widespread adoption of RFID tags, freshness indicators, and IoT-enabled tracking systems across the food, pharmaceutical, and logistics sectors.

The UK intelligent packaging market has been anticipated to register a CAGR of 8.3% over the forecast period. Increased focus on food waste reduction, product safety, and connected packaging has been driving demand across retail and healthcare applications.

Germany’s intelligent packaging market has been forecasted to expand at a CAGR of 8.6% from 2025 to 2035. As a central hub for industrial and pharmaceutical exports, the country has relied on smart packaging to enhance traceability and sustainability across its advanced supply chains.

In France, intelligent packaging sales have been projected to grow at a CAGR of 8.5% throughout the forecast period. The market has been shaped by consumer preference for sustainable, traceable packaging and the enforcement of eco-design policies across sectors.

Japan’s intelligent packaging market has been expected to expand at a CAGR of 8.4% through 2035. A high-tech manufacturing base and stringent quality requirements have fueled growth in sectors requiring smart, compact, and compliant packaging.

The intelligent packaging market has been observed as moderately consolidated, with major global players maintaining notable market shares while emerging and regional companies have continued to introduce specialized innovations. Competitive strategies have been shaped by the integration of smart technologies, investment in sustainable materials, geographic expansion, and collaborations with downstream industries to enhance product utility and market reach.

Tier-one firms such as Amcor, Sealed Air Corporation, Avery Dennison, and Stora Enso have been investing heavily in eco-friendly materials, RFID and sensor-based solutions, and advanced manufacturing capabilities. These companies have focused on expanding their digital packaging portfolios, scaling AI and IoT integration, and forming partnerships with logistics, healthcare, and retail brands to support traceability, compliance, and consumer engagement initiatives.

Recent Intelligent Packaging Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 28.4 billion |

| Projected Market Size (2035) | USD 67.2 billion |

| CAGR (2025 to 2035) | 9.0% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions / Volume in million units |

| By Technology | Indicators, Sensors, Interactive Packaging/Data Carriers, Active Packaging |

| By Level of Packaging | Primary Packaging, Secondary Packaging, Tertiary Packaging |

| By Application | Bottles & Jars, Blisters, Trays & Clamshells, Cans, Boxes & Cartons, Vials, Ampoules & Prefilled Syringes, Bags & Pouches, Films & Wraps, Mailers, Labels, Tapes & Tags |

| By End Use | Food, Beverage, Healthcare, Cosmetics, Logistics & Transport, Consumer Electronics, Personal Care & Homecare, Other Consumer Goods (Apparel, Toys, Stationery, Automotive) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Amcor plc., Crown Holding Inc., 3M Company, CCL Industries Inc., Huhtamaki Global, DS Smith, Avery Dennison Corporation, Honeywell International Inc., Tetra Pak International S.A., and Sealed Air Corporation |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The market is expected to reach USD 67.2 billion by 2035.

The global market is projected to grow at a CAGR of 9.0% during this period.

Primary packaging is expected to lead with over 45% market share in 2025.

Boxes and cartons are expected to account for approximately 32% of the market in 2025.

The USA is anticipated to register the fastest growth, with a CAGR of 8.7% through 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Active & Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Controlled Intelligent Packaging Market

Active, Smart, and Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Active, Smart, and Intelligent Packaging Manufacturers

Intelligent Completion Market Size and Share Market Forecast and Outlook 2025 to 2035

Intelligent Rubber Tracks Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Cervical Massager Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Garment Hanging Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Rotary Kiln Monitoring Systems Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Multifunctional Laser Bird Repeller Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Platform Management Interface (IPMI) Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Lighting Control Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Enterprise Data Capture Software Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Intelligent Vending Machine Market Insights – Demand, Size & Industry Trends 2025–2035

Intelligent Transportation System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Intelligent Virtual Store Design Solution Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Enterprise Data Capture Software Market Size, Growth, and Forecast 2025 to 2035

Intelligent Fencing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA