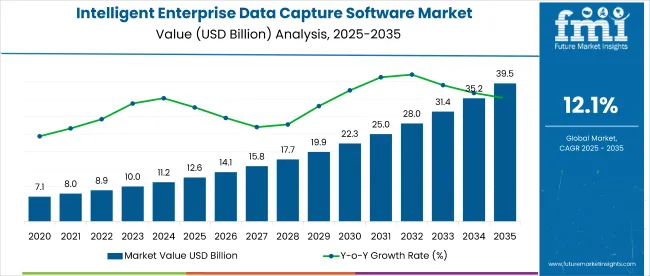

The global Intelligent Enterprise Data Capture Software market is expected to exhibit robust growth, rising from a valuation of USD 12.6 billion in 2025 to approximately USD 39.3 billion by 2035, reflecting a CAGR of 12.1%. North America, driven primarily by the USA, remains dominant due to advanced AI infrastructure and regulatory compliance initiatives, while South Asia & Pacific regions, particularly India, exhibit the highest growth rates attributed to government initiatives and growing adoption by SMEs.

Key market drivers include the need for improved operational efficiency and compliance in document management, predominantly in the BFSI and healthcare sectors. Increasing focus on automation to eliminate manual data entry errors, enhance decision-making capabilities, and maintain regulatory compliance accelerates market adoption.

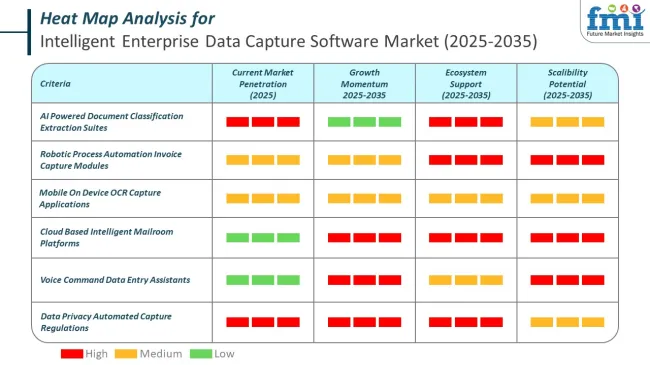

Technological advancements such as AI, machine learning, OCR, and NLP offer rapid, precise data extraction and integration, further fueling demand. Additionally, rising emphasis on data security and privacy regulations encourages enterprises to adopt advanced data capture solutions. Moreover, the widespread integration of cloud computing infrastructure further facilitates scalability and remote accessibility, thus broadening the market reach.

Looking ahead, significant innovations such as the integration of AI with quantum computing, hyperautomation combining RPA and ML, and real-time analytics are set to revolutionize enterprise data capture processes. Companies are anticipated to invest extensively in hybrid cloud environments, autonomous data ecosystems, and sustainable ESG data management practices. Furthermore, the rise of decentralized AI models for enhanced real-time document processing and conversational AI interfaces is projected to drive further expansion of this market in the coming decade.

Additionally, increased collaboration between AI solution providers and cloud infrastructure vendors is anticipated, facilitating more customized and secure enterprise solutions. A notable shift toward lease-based pricing models tailored to diverse business needs is also expected, enabling greater accessibility for small and medium-sized enterprises.

Compliance with evolving electronic-records export mandates is shaping vendor capabilities in the intelligent enterprise data capture software market. Both EU and USA regulatory frameworks demand format integrity, metadata fidelity, and long-term legal validity in digital record management.

The intelligent enterprise data capture software market is heavily influenced by advanced technologies that enhance automation, accuracy, and decision-making. These tools transform raw enterprise data into actionable intelligence across finance, healthcare, manufacturing, and logistics.

The Intelligent Enterprise Data Capture Software Market is undergoing rapid digital transformation as businesses demand real-time insights, error-free processing, and end-to-end automation. Traditional OCR-based systems are being replaced by AI-driven platforms that extract, classify, and validate both structured and unstructured data at scale.

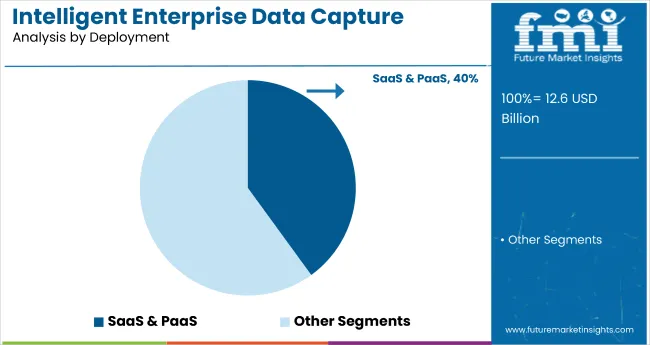

The Intelligent Enterprise Data Capture Software market is segmented into key categories such as Component, which includes Software solutions like Optical Character Recognition, Intelligent Document Recognition, Handwriting Recognition, and Services including Consulting, Training, Implementation & Support. Deployment comprises On-premise, SaaS & PaaS, and Hybrid models.

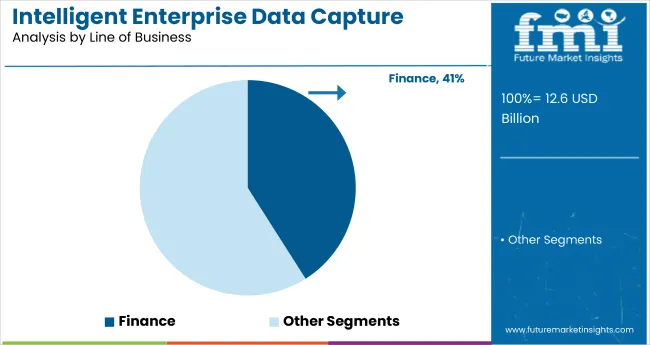

Industry covers BFSI, Healthcare, Retail, Government, Manufacturing, and Others (Media & Entertainment, Education, Professional Services, and Construction). Line of Business includes Finance, Sales, Human Resource, Marketing, and Legal Sector. Region includes North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

The Optical Character Recognition (OCR) segment is anticipated to experience the strongest growth within the Intelligent Enterprise Data Capture Software market with a CAGR of 14.5%. The high accuracy and integration capabilities of OCR with artificial intelligence (AI) and natural language processing (NLP) significantly enhance document digitization and automation.

OCR effectively automates data extraction from printed and handwritten documents, improving operational efficiency across industries like BFSI, healthcare, and manufacturing. The growing adoption of cloud-based OCR solutions and advancements in deep learning algorithms further drive market growth, reducing human errors and enabling efficient real-time data processing.

| Category | CAGR (2025 to 2035) |

|---|---|

| Optical Character Recognition (OCR) | 14.5% |

| Category | Market Share |

|---|---|

| SaaS & PaaS | 40% |

SaaS (Software as a Service) and PaaS (Platform as a Service) deployment models, collectively holding around 40% of the overall deployment segment expected to grow at a CAGR of 15.2%, are poised to dominate the market due to their scalability, cost-efficiency, and ease of integration with existing enterprise systems.

SaaS and PaaS solutions facilitate rapid implementation, continuous updates, and remote accessibility, driving adoption among SMEs and large enterprises alike. Businesses increasingly prefer subscription-based, cloud-hosted models that offer flexibility and robust data security features, accelerating the adoption of SaaS and PaaS deployments in industries like healthcare, retail, and BFSI.

| Category | CAGR (2025 to 2035) |

|---|---|

| Finance | 41% |

The Finance segment, expected to grow at a CAGR of 41%, is projected to experience notable growth in the Intelligent Enterprise Data Capture Software market during 2025 to 2035. Increased regulatory scrutiny, demand for enhanced financial compliance, and stringent data management standards drive substantial investment in intelligent data capture technologies.

Financial departments utilize advanced software solutions to automate processes such as invoice processing, risk assessment, financial audits, and fraud detection, significantly improving accuracy and operational efficiency. Growing emphasis on secure, scalable, and integrated financial management solutions further boosts adoption within this segment.

The BFSI (Banking, Financial Services, and Insurance) industry, anticipated to grow at a CAGR of 13.8%, is projected to lead in terms of growth and adoption due to stringent regulatory compliance requirements and the critical need for automated, secure document processing.

AI-powered intelligent data capture solutions effectively manage voluminous unstructured data such as invoices, regulatory filings, and contracts, enhancing fraud detection capabilities and operational accuracy. Continuous advancements in financial technology and increasing cybersecurity concerns further incentivize BFSI institutions to invest substantially in intelligent enterprise data capture software.

| Category | CAGR (2025 to 2035) |

|---|---|

| BFSI | 13.8% |

The market is the transformation of industries as the data-driven priority shift of organizations, and there is a lot of emphasis on having automatic, accurate, and efficient data management. Software developers are more inclined to develop state-of-the-art AI-oriented solutions that boost document processing, optical character recognition (OCR), and data extraction for enterprises.

Corporate companies are attaching more importance to the provision of hassle-free association with the already installed enterprise resource planning (ERP) and customer relationship management (CRM) systems, which in turn would streamline operations to a smaller extent and help in better decision-making.

The providers of the cloud services are the ones who take the major part in giving the products of incrementing, the high-quality solutions which, by implication, will provide direct data processing and availability. The end-users of small and medium-sized companies and other types of organizations are demanding expense-efficient, intuitive solutions that could increase their productivity and still meet the necessary security standards.

Contracts and Deals Analysis

| Company | Contract Value (USA USD Million) |

|---|---|

| SpinSys-Diné | Approximately USD 35.13 |

| USA Department of Transportation (DOT) | Approximately USD 25.11 |

| Defense Information Systems Agency (DISA) | Approximately USD 18.05 |

| GEP SMART | Approximately USD 30.15 |

Global intelligent enterprise data capture software pricing strategies must be carefully tailored to customers with unique software demands and growth rates. The price structure must be well-planned to provide easy access to business sizes ranging from the smallest to the largest while at the same time being profitable to the software vendor.

Value-based pricing is a strategy worth considering, especially in sectors where automation is vital for productivity, such as finance, logistics, and healthcare. Acknowledging the value of reducing errors in manual processing, increasing compliance, and improving operational speed, companies are ready to pay extra money for sophisticated AI-based solutions.

Subscription-based pricing is the most common approach in the market, and it allows the client to choose the payment plan for completing the job, either monthly or yearly. It does not give providers a recurring revenue stream and allows clients to scale their operations based only on what they really need.

Lease pricing makes it possible for suppliers to set different prices based on the bundle of features provided. For example, a basic plan may consist of the OCR scanner function, while the premium plan would include AI automation, third-party app integration, and superior analytics. Such a strategy might help to serve both small and big enterprises.

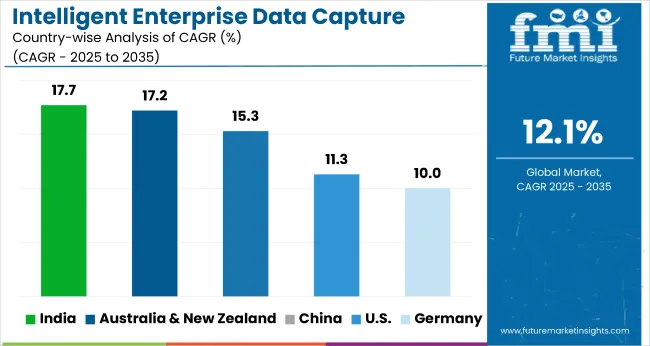

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 11.3% |

| Germany | 10.0% |

| China | 15.3% |

| India | 17.7% |

| Australia & New Zealand | 17.2% |

The United States dominates the market as a result of its cutting-edge AI infrastructure, in addition to substantial demand for enterprise automation and regulation-compliant data handling practices. BFSI, healthcare, IT & telecom, and retail verticals are big spenders on AI-driven document processing to enhance their operational efficiency and compliance. UiPath, OpenText, and Databricks are automation technology leaders with document processing processes using machine learning.

The rise of big data analytics combined with high cloud adoption rates has made the switch to smart capture solutions a necessity for greater real-time processing and remote collaboration. The availability of a strong SaaS ecosystem, government initiatives to promote AI adoption, and compliance regulations for cybersecurity also create conditions that drive growth at an accelerated pace in the market. According to FMI, the USA market is expected to witness high growth at an 11.3% CAGR through 2035.

Drivers of Growth in the USA

| Key Drivers | Details |

|---|---|

| AI & Automation Leadership | Heavy investment in AI-powered document processing by USA companies is driving workflow automation. |

| Cloud-First Strategies | Firms are adopting cloud-based intelligent capture solutions for scalability and remote accessibility. |

| Regulatory Compliance | Data security regulations drive the demand for advanced document management solutions. |

The Intelligent Enterprise Data Capture Software Market in China is expanding at a rapid pace owing to the heavy government promotion of AI, automation, and industrial digitization. The "Made in China 2025" policy fosters smart manufacturing, accelerating logistics, fintech, and e-commerce implementation. Chinese technology leaders such as Alibaba, Tencent, and Huawei design AI-powered document processing solutions based on deep learning to support real-time analysis.

Increased adoption of smart document processing by China's burgeoning e-commerce and finance sectors enhances the efficiency of fraud prevention and transaction verification. In addition, cloud data security and cybersecurity regulations require industries to invest in AI-driven enterprise data capture solutions. The growing adoption of 5G and IoT-based smart manufacturing drives even more demand for real-time automatic document handling.

China's Growth Drivers

| Key Drivers | Details |

|---|---|

| Industrial Digitalization | Smart factory and fintech expansion drive demand for intelligent document handling. |

| E-commerce & Fintech Growth | AI-driven automation supports secure transactions and efficient data management. |

| Cybersecurity Regulations | Stringent compliance needs fuel investment in safe, AI-based data capture solutions. |

The 4th industrial revolution and the accompanying era of digitalization have generated an extensive implementation of AI-powered document processing in manufacturing, automotive, and logistics. In Germany, enterprises leverage intelligent capture solutions to automate supply chains, boost operational efficiency, and enhance data assurance. The BFSI segment is also the strictest in terms of financial regulation, as it includes AI-based data capture software for secure transactions and anti-fraud programs.

Companies such as SAP and Siemens are investing in AI-based workflow automation, which is gaining popularity in industrial and enterprise settings. FMI projects that the German market will grow at a 10.0% CAGR during the forecast period.

Growth Drivers in Germany

| Key Drivers | Details |

|---|---|

| Industry 4.0 Adoption | Industrial automation and supply chain management are optimized with AI-driven data capture solutions. |

| GDPR Compliance | Large data protection regulations drive business investment in secure data capture solutions. |

| BFSI Security Requirements | Banks and insurers ensure Compliance and fraud prevention through AI-driven document processing. |

India's intelligent enterprise data capture software market is booming primarily due to digital transformation initiatives, cloud adoption, and the gradual growth of small and medium businesses (SMEs). In India, various government initiatives like “Digital India” and “Make in India” have motivated organizations to embrace AI-based document processing in order to enhance operational efficiency and regulatory compliance.

Industries heading the race for intelligent capture solutions include BFSI, healthcare, IT services, and e-commerce. Cloud-based automation is increasingly adopted by Indian enterprises, and thus, they look for cost-effective, scalable SaaS-based AI. Leading IT service providers like TCS, Infosys, and Wipro incorporate intelligent document processing into the enterprise process to help expand the market.

India Growth Drivers

| Key Drivers | Details |

|---|---|

| Digital India Initiative | Government-backed digitization drives enterprise automation requirements. |

| SME Cloud Adoption | Affordable, SaaS-based options spur AI-based document processing adoption. |

| BFSI & E-commerce Growth | Secure, AI-powered data capture solutions improve financial transactions and fraud detection. |

Growth in the market in Australia and New Zealand is being driven by increased investment in AI technologies, regulatory compliance initiatives, and an increase in the number of digital banks. Under prescribed Consumer Data Right (CDR) and Privacy Act laws, the banking sector is dependent on AI-led mechanization to ensure a protected advanced exchange. In the healthcare sector, AI-based document processing is used to process and manage patient information while ensuring compliance with data protection laws.

All of this is concentrated in order to allow remote workers to use cloud-based intelligent capture technology to automate processes, as well as Australia's and New Zealand region's remote-working enterprises aiming towards business continuity. Moreover, the highly increased integration and adoption of AI-powered automation by retail, logistics, and government verticals will further drive the market growth.

Growth Drivers in Australia & New Zealand

| Key Drivers | Details |

|---|---|

| Financial Sector Compliance | Artificial intelligence-driven document processing ensures data privacy compliance. |

| Healthcare Digitalization | Intelligent capture software manages patient information on autopilot. |

| Cloud-Based Automation | Businesses invest in SaaS-based smart document processing technology. |

This is the Intelligent Enterprise Data Capture Software Market that encourages the presentation of new ideas in machine learning (ML), robotic process automation (RPA), artificial intelligence (AI), and optical character recognition (OCR). Data extraction, processing, and integration from various systems within the organization using automated solutions are the requirements of businesses nowadays.

The competitive players are UiPath, Blue Prism, Hyperscience, OpenText, and Nanonets. They are compared in terms of such features as accuracy and scalability, as well as whether they have cloud integration and the level of automation in different industries. UiPath and Blue Prism have offerings in document processing through RPA, whereas Hyperscience provides AI-powered automation through a human-in-the-loop approach. OpenText emphasizes deep ERP/CRM integration; Nanonets use low-code AI models that are adaptable to varied data capture.

The evolutionary direction for the SaaS business model and pay-per-use pricing will serve to attract small and medium businesses. Other new entrants and niche players complement this move by introducing unique products catered towards finance, healthcare, and legal services.

To enhance market positioning, companies have entered strategic partnerships and collaborations with cloud providers, IT service firms, and automation platforms. The lively mergers and acquisitions, AI-driven innovations, and improvements in compliance will keep companies competing in this fast-growing market if they invest in their intelligent, adaptive, and scalable automation.

Recent Industry Developments

SAP SE's announcement in February 2025 regarding SAP Business Data Cloud is directed toward unifying SAP and third-party data across organizational boundaries for easy integration and management of data.

In September 2024, Intuit introduced a new customizable enterprise suite of financial products in the USA to knit together a series of offerings, including QuickBooks, in a drive to automate some vital financial processes and attract new customers seeking AI-based financial management solutions.

In August 2024, Capgemini agreed to acquire Syniti of enterprise data management software and services, strengthening Capgemini's expertise in data-driven digital transformation, particularly large-scale SAP transformations.

In May 2024, JBI Studios acquired Cody AI, an AI platform, and launched 'AI Suite' to develop next-generation enterprise AI solutions for the financial services sector, focused on fast-tracking AI capacities for enterprises and SMBs.

UiPath (18-22%)

A leader in enterprise automation, UiPath integrates RPA with AI-powered intelligent document processing to optimize workflow automation across industries.

Blue Prism (14-18%)

Blue Prism offers intelligent automation platforms with AI and ML capabilities, helping enterprises streamline business processes and drive digital transformation.

Hyperscience (10-14%)

Specializing in AI-driven document processing, Hyperscience enables automated data capture and classification for heavily regulated industries like finance and healthcare.

OpenText (8-12%)

A key player in enterprise content management, OpenText provides AI-enhanced document capture and compliance automation solutions for large organizations.

Nanonets (6-10%)

A rising player in AI-powered OCR, Nanonets focuses on no-code automation for small businesses and industry-specific document processing.

Other Key Players (30-40% Combined)

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 12.6 billion |

| Projected Market Size (2035) | USD 39.3 billion |

| CAGR (2025 to 2035) | 12.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameter | Revenue in USD billion |

| By Component | Software (Handwriting Recognition, Optical Character Recognition, Intelligent Document Recognition), Services (Consulting, Training, Implementation & Support) |

| By Deployment | On-premise, SaaS & PaaS, Hybrid |

| By Industry | BFSI, Healthcare, Retail, Government, Manufacturing, Others |

| By Line of Business | Finance, Sales, Human Resource, Marketing, Legal Sector |

| By Industry | BFSI, Healthcare, Media & Entertainment, Education, Professional Services, Construction, Retail, Government, Manufacturing. |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | ABBYY, Adobe, Ephesoft, Artsyl Technologies, CAPSYS Technologies, Oracle Corporation, SAP SE, Open Text Corporation, Hyland Software, Inc., Nuance Communications |

| Additional Attributes | AI integration, deployment models, data types, regional trends, competitive landscape. |

| Customization and Pricing | Available upon request |

The market is projected to witness a CAGR of 12.1% between 2025 and 2035.

The market is predicted to reach USD 12.6 billion in 2025.

The market is anticipated to reach USD 39.3 billion by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 16.4% in the assessment period.

The key companies in the industry include ABBYY, Adobe, Ephesoft, Artsyl Technologies, CAPSYS Technologies, Oracle Corporation, SAP SE, Open Text Corporation, Hyland Software, Inc., and Nuance Communications.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 4: Global Market Value (US$ Million) Forecast by Line of Business, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Industry, 2019 to 2034

Table 6: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 8: North America Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Line of Business, 2019 to 2034

Table 10: North America Market Value (US$ Million) Forecast by Industry, 2019 to 2034

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 12: Latin America Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 14: Latin America Market Value (US$ Million) Forecast by Line of Business, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Industry, 2019 to 2034

Table 16: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 17: Western Europe Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 18: Western Europe Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Line of Business, 2019 to 2034

Table 20: Western Europe Market Value (US$ Million) Forecast by Industry, 2019 to 2034

Table 21: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 22: Eastern Europe Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 23: Eastern Europe Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 24: Eastern Europe Market Value (US$ Million) Forecast by Line of Business, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Industry, 2019 to 2034

Table 26: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 27: South Asia and Pacific Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 28: South Asia and Pacific Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 29: South Asia and Pacific Market Value (US$ Million) Forecast by Line of Business, 2019 to 2034

Table 30: South Asia and Pacific Market Value (US$ Million) Forecast by Industry, 2019 to 2034

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: East Asia Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 33: East Asia Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 34: East Asia Market Value (US$ Million) Forecast by Line of Business, 2019 to 2034

Table 35: East Asia Market Value (US$ Million) Forecast by Industry, 2019 to 2034

Table 36: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 37: Middle East and Africa Market Value (US$ Million) Forecast by Component, 2019 to 2034

Table 38: Middle East and Africa Market Value (US$ Million) Forecast by Deployment, 2019 to 2034

Table 39: Middle East and Africa Market Value (US$ Million) Forecast by Line of Business, 2019 to 2034

Table 40: Middle East and Africa Market Value (US$ Million) Forecast by Industry, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Component, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Line of Business, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Industry, 2024 to 2034

Figure 5: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 13: Global Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 14: Global Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 15: Global Market Value (US$ Million) Analysis by Line of Business, 2019 to 2034

Figure 16: Global Market Value Share (%) and BPS Analysis by Line of Business, 2024 to 2034

Figure 17: Global Market Y-o-Y Growth (%) Projections by Line of Business, 2024 to 2034

Figure 18: Global Market Value (US$ Million) Analysis by Industry, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by Industry, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by Industry, 2024 to 2034

Figure 21: Global Market Attractiveness by Component, 2024 to 2034

Figure 22: Global Market Attractiveness by Deployment, 2024 to 2034

Figure 23: Global Market Attractiveness by Line of Business, 2024 to 2034

Figure 24: Global Market Attractiveness by Industry, 2024 to 2034

Figure 25: Global Market Attractiveness by Region, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Component, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Line of Business, 2024 to 2034

Figure 29: North America Market Value (US$ Million) by Industry, 2024 to 2034

Figure 30: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 34: North America Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 38: North America Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 39: North America Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 40: North America Market Value (US$ Million) Analysis by Line of Business, 2019 to 2034

Figure 41: North America Market Value Share (%) and BPS Analysis by Line of Business, 2024 to 2034

Figure 42: North America Market Y-o-Y Growth (%) Projections by Line of Business, 2024 to 2034

Figure 43: North America Market Value (US$ Million) Analysis by Industry, 2019 to 2034

Figure 44: North America Market Value Share (%) and BPS Analysis by Industry, 2024 to 2034

Figure 45: North America Market Y-o-Y Growth (%) Projections by Industry, 2024 to 2034

Figure 46: North America Market Attractiveness by Component, 2024 to 2034

Figure 47: North America Market Attractiveness by Deployment, 2024 to 2034

Figure 48: North America Market Attractiveness by Line of Business, 2024 to 2034

Figure 49: North America Market Attractiveness by Industry, 2024 to 2034

Figure 50: North America Market Attractiveness by Country, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by Component, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) by Line of Business, 2024 to 2034

Figure 54: Latin America Market Value (US$ Million) by Industry, 2024 to 2034

Figure 55: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 59: Latin America Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 62: Latin America Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by Line of Business, 2019 to 2034

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Line of Business, 2024 to 2034

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Line of Business, 2024 to 2034

Figure 68: Latin America Market Value (US$ Million) Analysis by Industry, 2019 to 2034

Figure 69: Latin America Market Value Share (%) and BPS Analysis by Industry, 2024 to 2034

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by Industry, 2024 to 2034

Figure 71: Latin America Market Attractiveness by Component, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Deployment, 2024 to 2034

Figure 73: Latin America Market Attractiveness by Line of Business, 2024 to 2034

Figure 74: Latin America Market Attractiveness by Industry, 2024 to 2034

Figure 75: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Component, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 78: Western Europe Market Value (US$ Million) by Line of Business, 2024 to 2034

Figure 79: Western Europe Market Value (US$ Million) by Industry, 2024 to 2034

Figure 80: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 82: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 83: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 84: Western Europe Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 85: Western Europe Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 86: Western Europe Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 87: Western Europe Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 88: Western Europe Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 89: Western Europe Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 90: Western Europe Market Value (US$ Million) Analysis by Line of Business, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Line of Business, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Line of Business, 2024 to 2034

Figure 93: Western Europe Market Value (US$ Million) Analysis by Industry, 2019 to 2034

Figure 94: Western Europe Market Value Share (%) and BPS Analysis by Industry, 2024 to 2034

Figure 95: Western Europe Market Y-o-Y Growth (%) Projections by Industry, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Component, 2024 to 2034

Figure 97: Western Europe Market Attractiveness by Deployment, 2024 to 2034

Figure 98: Western Europe Market Attractiveness by Line of Business, 2024 to 2034

Figure 99: Western Europe Market Attractiveness by Industry, 2024 to 2034

Figure 100: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) by Component, 2024 to 2034

Figure 102: Eastern Europe Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 103: Eastern Europe Market Value (US$ Million) by Line of Business, 2024 to 2034

Figure 104: Eastern Europe Market Value (US$ Million) by Industry, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 106: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 110: Eastern Europe Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 111: Eastern Europe Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 112: Eastern Europe Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 113: Eastern Europe Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 114: Eastern Europe Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 115: Eastern Europe Market Value (US$ Million) Analysis by Line of Business, 2019 to 2034

Figure 116: Eastern Europe Market Value Share (%) and BPS Analysis by Line of Business, 2024 to 2034

Figure 117: Eastern Europe Market Y-o-Y Growth (%) Projections by Line of Business, 2024 to 2034

Figure 118: Eastern Europe Market Value (US$ Million) Analysis by Industry, 2019 to 2034

Figure 119: Eastern Europe Market Value Share (%) and BPS Analysis by Industry, 2024 to 2034

Figure 120: Eastern Europe Market Y-o-Y Growth (%) Projections by Industry, 2024 to 2034

Figure 121: Eastern Europe Market Attractiveness by Component, 2024 to 2034

Figure 122: Eastern Europe Market Attractiveness by Deployment, 2024 to 2034

Figure 123: Eastern Europe Market Attractiveness by Line of Business, 2024 to 2034

Figure 124: Eastern Europe Market Attractiveness by Industry, 2024 to 2034

Figure 125: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 126: South Asia and Pacific Market Value (US$ Million) by Component, 2024 to 2034

Figure 127: South Asia and Pacific Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 128: South Asia and Pacific Market Value (US$ Million) by Line of Business, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) by Industry, 2024 to 2034

Figure 130: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 131: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 132: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: South Asia and Pacific Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 138: South Asia and Pacific Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 139: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 140: South Asia and Pacific Market Value (US$ Million) Analysis by Line of Business, 2019 to 2034

Figure 141: South Asia and Pacific Market Value Share (%) and BPS Analysis by Line of Business, 2024 to 2034

Figure 142: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Line of Business, 2024 to 2034

Figure 143: South Asia and Pacific Market Value (US$ Million) Analysis by Industry, 2019 to 2034

Figure 144: South Asia and Pacific Market Value Share (%) and BPS Analysis by Industry, 2024 to 2034

Figure 145: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Industry, 2024 to 2034

Figure 146: South Asia and Pacific Market Attractiveness by Component, 2024 to 2034

Figure 147: South Asia and Pacific Market Attractiveness by Deployment, 2024 to 2034

Figure 148: South Asia and Pacific Market Attractiveness by Line of Business, 2024 to 2034

Figure 149: South Asia and Pacific Market Attractiveness by Industry, 2024 to 2034

Figure 150: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 151: East Asia Market Value (US$ Million) by Component, 2024 to 2034

Figure 152: East Asia Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) by Line of Business, 2024 to 2034

Figure 154: East Asia Market Value (US$ Million) by Industry, 2024 to 2034

Figure 155: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 156: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 159: East Asia Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 160: East Asia Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 161: East Asia Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 162: East Asia Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 165: East Asia Market Value (US$ Million) Analysis by Line of Business, 2019 to 2034

Figure 166: East Asia Market Value Share (%) and BPS Analysis by Line of Business, 2024 to 2034

Figure 167: East Asia Market Y-o-Y Growth (%) Projections by Line of Business, 2024 to 2034

Figure 168: East Asia Market Value (US$ Million) Analysis by Industry, 2019 to 2034

Figure 169: East Asia Market Value Share (%) and BPS Analysis by Industry, 2024 to 2034

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by Industry, 2024 to 2034

Figure 171: East Asia Market Attractiveness by Component, 2024 to 2034

Figure 172: East Asia Market Attractiveness by Deployment, 2024 to 2034

Figure 173: East Asia Market Attractiveness by Line of Business, 2024 to 2034

Figure 174: East Asia Market Attractiveness by Industry, 2024 to 2034

Figure 175: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Value (US$ Million) by Component, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) by Deployment, 2024 to 2034

Figure 178: Middle East and Africa Market Value (US$ Million) by Line of Business, 2024 to 2034

Figure 179: Middle East and Africa Market Value (US$ Million) by Industry, 2024 to 2034

Figure 180: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 182: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 183: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 184: Middle East and Africa Market Value (US$ Million) Analysis by Component, 2019 to 2034

Figure 185: Middle East and Africa Market Value Share (%) and BPS Analysis by Component, 2024 to 2034

Figure 186: Middle East and Africa Market Y-o-Y Growth (%) Projections by Component, 2024 to 2034

Figure 187: Middle East and Africa Market Value (US$ Million) Analysis by Deployment, 2019 to 2034

Figure 188: Middle East and Africa Market Value Share (%) and BPS Analysis by Deployment, 2024 to 2034

Figure 189: Middle East and Africa Market Y-o-Y Growth (%) Projections by Deployment, 2024 to 2034

Figure 190: Middle East and Africa Market Value (US$ Million) Analysis by Line of Business, 2019 to 2034

Figure 191: Middle East and Africa Market Value Share (%) and BPS Analysis by Line of Business, 2024 to 2034

Figure 192: Middle East and Africa Market Y-o-Y Growth (%) Projections by Line of Business, 2024 to 2034

Figure 193: Middle East and Africa Market Value (US$ Million) Analysis by Industry, 2019 to 2034

Figure 194: Middle East and Africa Market Value Share (%) and BPS Analysis by Industry, 2024 to 2034

Figure 195: Middle East and Africa Market Y-o-Y Growth (%) Projections by Industry, 2024 to 2034

Figure 196: Middle East and Africa Market Attractiveness by Component, 2024 to 2034

Figure 197: Middle East and Africa Market Attractiveness by Deployment, 2024 to 2034

Figure 198: Middle East and Africa Market Attractiveness by Line of Business, 2024 to 2034

Figure 199: Middle East and Africa Market Attractiveness by Industry, 2024 to 2034

Figure 200: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Intelligent Enterprise Data Capture Software Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Intelligent Enterprise Data Capture Software Market in Korea – Trends & Forecast 2025 to 2035

Western Europe Intelligent Enterprise Data Capture Software Market - Growth & Forecast 2025-2035

Enterprise Data Observability Software Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Data Loss Prevention (DLP) Services Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Data Management Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Metadata Management Market Size and Share Forecast Outlook 2025 to 2035

Data Extraction Software Market

Software-Defined Data Center Market Size and Share Forecast Outlook 2025 to 2035

Data Integration Software/Tool Market

Lead Capture Software Market Size and Share Forecast Outlook 2025 to 2035

MEA Enterprise Software Market - Growth & Forecast 2025 to 2035

Database Monitoring – AI & Automation for Performance Optimization

Document Capture Software Market Size and Share Forecast Outlook 2025 to 2035

Account-Based Data Software Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Resource Planning (ERP) Software Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Data Management Software Market Size and Share Forecast Outlook 2025 to 2035

AI-Based Data Observability Software Market Size and Share Forecast Outlook 2025 to 2035

Structured Data Management Software Market Size and Share Forecast Outlook 2025 to 2035

Enterprise IP Management Software Market Growth – Trends & Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA