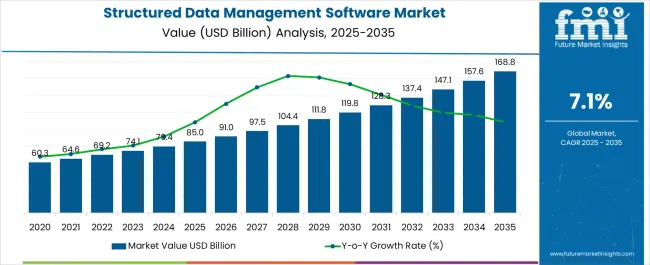

The Structured Data Management Software Market is estimated to be valued at USD 85.0 billion in 2025 and is projected to reach USD 168.8 billion by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period.

| Metric | Value |

|---|---|

| Structured Data Management Software Market Estimated Value in (2025 E) | USD 85.0 billion |

| Structured Data Management Software Market Forecast Value in (2035 F) | USD 168.8 billion |

| Forecast CAGR (2025 to 2035) | 7.1% |

The structured data management software market is progressing steadily as organizations prioritize data integrity, regulatory compliance, and scalable information governance. The shift toward digital transformation across industries has amplified the demand for robust solutions that can organize, secure, and optimize structured datasets effectively.

Cloud-native architectures, AI-powered automation, and advanced analytics capabilities are reshaping traditional data management practices, enabling enterprises to unlock greater value from their data assets while reducing operational risk. Future growth is expected to be fueled by increasing data volumes from transactional systems, heightened focus on privacy laws, and the strategic need for real-time decision-making.

Continuous investments in platform modernization and an expanding ecosystem of integration tools are paving the way for greater adoption across diverse organizational scales and sectors.

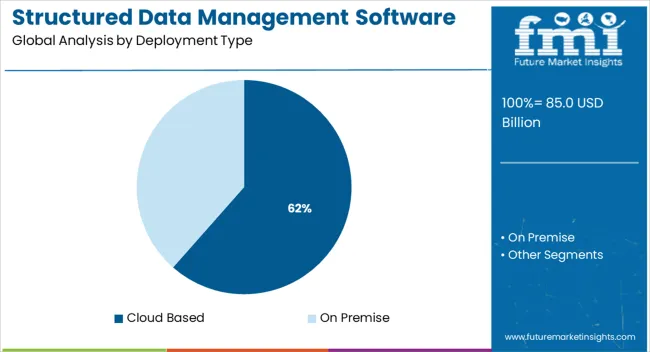

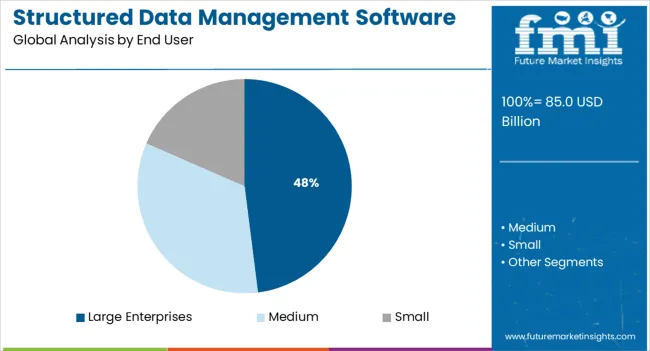

The market is segmented by Deployment Type and End User and region. By Deployment Type, the market is divided into Cloud Based and On Premise. In terms of End User, the market is classified into Large Enterprises, Medium, and Small. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by deployment type, the cloud based segment is expected to command 61∙5% of the market revenue in 2025, establishing itself as the leading deployment model. This leadership is attributed to the scalability, cost efficiency, and flexibility offered by cloud platforms, which have become essential in supporting dynamic business needs.

Cloud based solutions have enabled enterprises to manage growing data volumes without substantial upfront infrastructure investments while ensuring accessibility across geographies. Enhanced security protocols, seamless updates, and the ability to integrate with modern analytics and AI services have further accelerated cloud adoption.

Organizations have also favored cloud based deployments for their capacity to support remote workforces, enhance collaboration, and meet stringent compliance requirements with greater agility. These factors have reinforced the cloud based segment’s position as the preferred choice for structured data management initiatives.

Segmented by end user, large enterprises are projected to hold 48∙0% of the structured data management software market revenue in 2025, retaining their leading position. This dominance has been supported by the sheer scale and complexity of data operations in large organizations, which necessitate sophisticated management tools.

Large enterprises have been better positioned to invest in comprehensive data strategies that encompass governance, security, analytics, and compliance, making advanced software solutions indispensable. Their ability to allocate dedicated budgets, build specialized teams, and integrate structured data platforms with existing enterprise systems has enabled efficient utilization and stronger ROI.

Moreover, the imperative to comply with increasingly stringent data privacy regulations and to derive competitive advantages from data-driven insights has further cemented the large enterprise segment’s prominence in driving the market forward.

The market for structured data management software is anticipated to expand as a result of rising need for centralized data storage solutions to manage sensitive information. The market is anticipated to increase as a result of increasing organizational need for data processing systems.

During the projected period, expanding adoption of structured data management software across various industries is anticipated to create revenue possibilities for software suppliers.

Concerns about Data Security and Privacy to Impede Structured Data Management Software Market Expansion

The market's growth may be constrained by the growing security concerns to data privacy on digital platforms that are brought on by organizations' increasing adoption of data platforms.

Data breaches have a negative financial impact on businesses. The structured data management software market expansion is additionally anticipated to be hampered by growing cyber-attacks on company data.

Due to the region's early adoption of new database technologies by key industries (banking, manufacturing, IT & telecom), as well as the presence of significant solution providers, North America owns a significant share of the global market.

Asia-Pacific Outlook

The Asia-Pacific market is estimated to grow the quickest during the forecast period due to the increasing adoption of structured data management software platforms to manage corporate information for enhancing the efficiency of business operations by offering access to a centralized database.

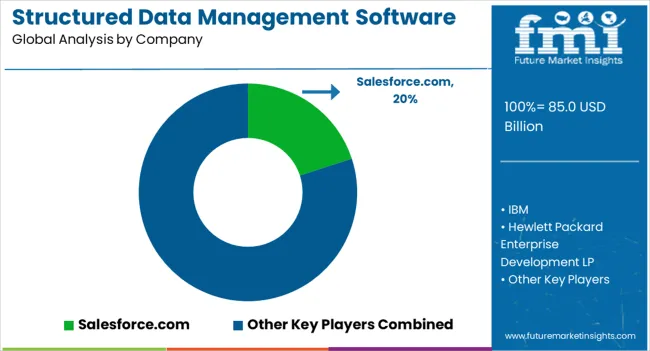

Hewlett Packard Enterprise Development LP, Clarity Information Solutions, IBM, Salesforce.com, Teradata, Oracle, SAS Institute Inc., and Rackspace USA, Inc. are among the prominent participants in the global structured data management software market.

Overall, the market's growth prospects are positive, since adoption across most small and medium-sized businesses is expected to climb in the near future. Market participants have been investing large resources in R&D initiatives to support growth and improve internal business processes.

Launch

In April 2024, IBM Corporation will launch a storage system for data management across hybrid clouds. The storage solution is expected to improve data management in hybrid cloud environments, resulting in increased data availability and flexibility.

Increasing data volume, complexity from stringent regulations, new database applications, and legal discovery requirements is posing challenges to organizations of all sizes. In order to address these challenges, organizations are utilizing structured data management software which enables organizations to store and manage various forms of data generated during operations.

A structured data management software facilitates efficient archiving of legacy data from existing applications and retire the complete data store from existing applications, in turn reducing application footprint and enhancing performance.

These software solutions enables enterprises to retire the outdated applications through automated processes such as extracting, validating, and deleting data.

Databases that have been in service since long time, accumulate large amount of data. Significant part of this data remains inactive which can be efficiently stored in a less expensive location outside the active database. Also, accumulation of such old records in the active database slows performance of the database, in turn leading to the need for additional, expensive hardware tools.

Therefore, in order to avoid such complexities and ensuring smooth system performance, enterprises are utilizing structured data management software solutions. This enables the user to balance the need for long-term records retention along with optimal database performance.

The market growth of structured data management software solutions is driven by various factors such as increasing data volumes that adversely affect database performance, need to retain and manage large volumes of historical data in effective manner, and to effectively address regulatory compliance demands to avoid financial penalties.

Additionally, the structured data management software market is propelled by the several advantages offered by these solutions. Some of these advantages include immediate and indistinguishable access to the archive data, enables critical data to survive longer than the originating applications or databases, and accelerates application retirement processes to shorten time to cost savings.

However, the growth of market is confronted by challenges such as concerns related security and data privacy, and frequent cyber-attacks on enterprises, which has decreased the demand for database products to some extent.

The major players active in the global structured data management software market include Hewlett Packard Enterprise Development LP, Clarity Information Solutions, IBM, Salesforce.com, Teradata, Oracle, SAS Institute Inc., and Rackspace USA, Inc.

Overall it can be concluded that the growth prospects of the structured data management software market are promising, as adoption across most small and medium enterprises is set to increase in the foreseeable future.

North America

Latin America

Europe

Asia Pacific excluding Japan (APEJ)

Japan

Middle East and Africa

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

Global structured data management software market is mainly classified on the basis of deployment type, end user and regions.

The global structured data management software market is estimated to be valued at USD 85.0 billion in 2025.

The market size for the structured data management software market is projected to reach USD 168.8 billion by 2035.

The structured data management software market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in structured data management software market are cloud based and on premise.

In terms of end user, large enterprises segment to command 48.0% share in the structured data management software market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Structured Cabling Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Structured Product Label Management Market Share

Structured Product Label Management Market Outlook 2025-2035

UK Structured Product Label Management Market Insights – Trends, Growth & Forecast 2025-2035

USA Structured Product Label Management Market Analysis – Size, Trends & Industry Outlook 2025-2035

Japan Structured Product Label Management Market Outlook – Size, Share & Innovations 2025-2035

Germany Structured Product Label Management Market Report – Trends, Demand & Forecast 2025-2035

GCC Countries Structured Product Label Management Market Analysis – Growth, Demand & Outlook 2025-2035

Data Center Market Forecast and Outlook 2025 to 2035

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Datacenter Infrastructure Services Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Data Center Automatic Transfer Switches and Switchgears Market Size and Share Forecast Outlook 2025 to 2035

Data Discovery Market Size and Share Forecast Outlook 2025 to 2035

Data Masking Technology Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Rack Server Market Size and Share Forecast Outlook 2025 to 2035

Data Center Liquid Cooling Market Size and Share Forecast Outlook 2025 to 2035

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Data Lake Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA