The Germany Structured Product Label (SPL) Management Market is projected to reach a market value of USD 7,927.6 million in 2025 and is expected to grow at a CAGR of 12.8%, reaching USD 26,321.2 million by 2035. The market's expansion is driven by the increasing demand for compliance solutions, digitization of labelling processes, and the adoption of advanced SPL technologies by pharmaceutical, biotechnology, and medical device companies.

| Attributes | Values |

|---|---|

| Estimated Germany Industry Size 2025 | USD 7,927.6 million |

| Projected Germany Industry Size 2035 | USD 26,321.2 million |

| Value-based CAGR from 2025 to 2035 | 12.8% |

The German single point of delivery (SPL) market is undergoing rapid evolution, encouraged by European Medicines Agency (EMA) regulation and greater automation across regulatory workflows. There is an increasing demand for cloud-based SPL solutions because companies need efficient, real-time compliance tracking and electronic labelling submissions.

Additionally, the adoption of AI-powered validation tools enhances data quality and minimizes compliance vulnerabilities. As a result, the pharma, biopharma, and life sciences companies are accelerating their labelling processes, reducing errors, and achieving compliance to the stricter EMA standards with more efficiency than before.

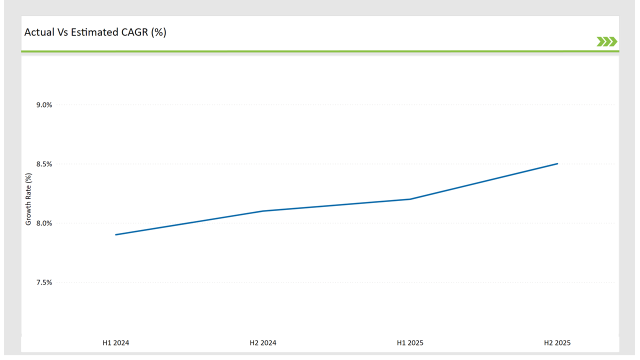

The following table illustrates the compound annual growth rate (CAGR) trends for the Germany SPL market over six-month intervals, providing a structured analysis of market progression.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 12.3% |

| H2, 2024 | 12.5% |

| H1, 2025 | 12.7% |

| H2, 2025 | 13.0% |

H1 signifies January to June, while July to December analysis is signified through H2.

This growth is attributed to increasing investments in SPL automation, regulatory standardization, and digital transformation of labeling management across multiple sectors. The CAGR has improved steadily from 12.3% in H1 2024 to 13.0% in H2 2025, reflecting a positive market trajectory.

| Date | Development/M&A Activity & Details |

|---|---|

| Jan-2025 | SAP introduced AI-driven SPL automation software for European regulatory compliance. |

| Oct-2024 | Veeva Systems expanded its cloud-based SPL offerings in Germany, integrating real-time regulatory updates. |

| Mar-2024 | EMA enforced stricter labeling guidelines for digital submissions, accelerating SPL adoption. |

| Sep-2024 | IBM partnered with leading CROs to develop blockchain-enabled SPL compliance tools. |

| Dec-2023 | Oracle acquired a Germany-based SPL solutions firm to enhance its market presence. |

The regulatory landscape and technological advancements are shaping the SPL market, with vendors focusing on automation, cloud-based compliance tools, and AI-driven regulatory tracking solutions.

AI-Powered SPL Automation Enhances Efficiency

It utilises AI and automates SPL processes drastically improving compliance accuracy by removing human errors from regulatory submissions. Pharmaceuticals and biotechnology companies use automated tools to streamline approval processes, reduce compliance risks, and increase operational efficiency.

Artificial intelligence algorithms analyse previous regulatory trends, anticipate compliance failures, and optimize structured labelling workflows, minimized approval periods. The rejection of integration facilitates the amalgamation of technology with SPL solutions which avails resulting advancement and efficiency irritation during the filings.

Cloud-Based SPL Platforms Witness Rapid Adoption

The cloud-based SPL platforms are being rapidly adopted in Germany for their scalable, accessible and real-time SPL compliance updates. These solutions empower enterprises by allowing them to guarantee secure regulatory submissions, automate workflows, and keep updated labelling documentation without massive infrastructure outlays.

The introduction of cloud-based SPL platforms enables companies to adopt regulatory collaboration across geographies while adhering to changing EMA regulations. The transition towards cloud solutions is projected to fuel continuous growth in the market during the next decade.

EMA Regulations Drive Digital Labelling Compliance

With evolving EMA regulations, the need for digital labelling solutions has grown significantly. Structured product label compliance ensures the transparency, traceability, and accuracy of medical product information. Complying with EMA’s regulatory frameworks necessitates life sciences companies to stay abreast of and update their SPL systems regularly.

As a result, there has been a rise in adoption of digital labelling solutions, allowing firms to simplify regulatory submissions and reduce risk of non-compliance. They also create greater efficiency through real time monitoring and verification of product labels.

Blockchain-Based SPL Tracking Enhances Security

Blockchain technology is transforming SPL management by ensuring data security, transparency, and traceability. Leading SPL providers are integrating blockchain-based solutions to authenticate structured labelling data and prevent regulatory fraud.

The decentralized nature of blockchain enhances compliance tracking, allowing regulatory authorities and life sciences companies to maintain a tamper-proof record of label modifications. As Germany strengthens its regulatory landscape, blockchain-based SPL tracking is poised to become a game-changing innovation in structured product label management.

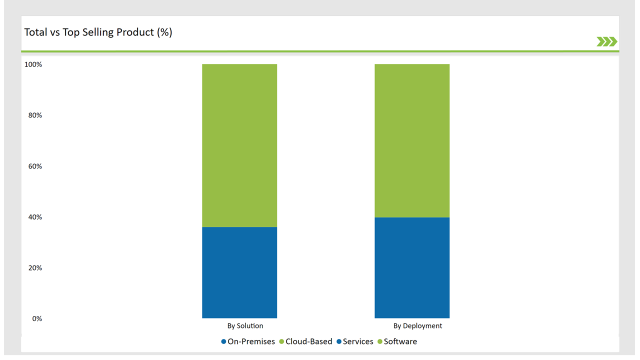

| Solution | Market Share (2025) |

|---|---|

| Software | 64.1% |

| Services | 35.9% |

Software dominates the SPL market, accounting for 64.1% of total revenue in 2025. The demand for software solutions is increasing as pharmaceutical, biotechnology, and medical device companies seek automation-driven compliance tools.

AI-powered SPL software streamlines regulatory workflows, enhances accuracy, and enables companies to handle large-scale digital labelling processes efficiently. Services, including regulatory consulting, integration support, and managed SPL solutions, continue to grow steadily as companies require expert guidance to navigate complex regulatory landscapes.

| Deployment Type | Market Share (2025) |

|---|---|

| Cloud-Based | 60.3% |

| On-Premises | 39.7% |

Cloud-based SPL solutions hold the largest market share at 60.3%, primarily due to their cost-effectiveness and ease of scalability. Enterprises prefer cloud-based deployment as it offers seamless real-time compliance tracking, automated updates, and integration with existing enterprise IT ecosystems.

The on-premises deployment remains relevant for companies requiring high security, data control and customized regulatory workflows. However, as cloud technology matures, the on-premises market share is expected to gradually decline.

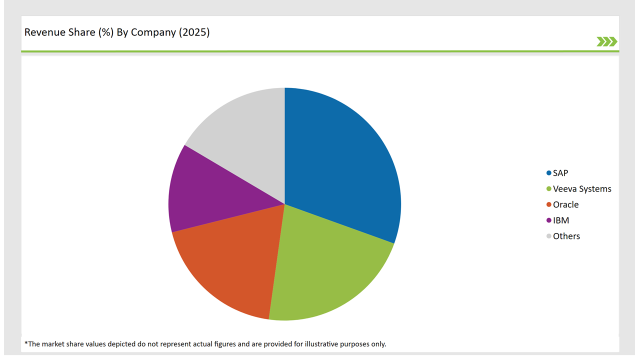

Key players in the Germany SPL market are investing in cloud solutions, AI-driven compliance tools, and blockchain security. Dominant companies include SAP, Veeva Systems, Oracle, IBM, and emerging SPL solution providers.

| Vendors | Market Share (2025) |

|---|---|

| SAP | 30.5% |

| Veeva Systems | 21.7% |

| Oracle | 18.9% |

| IBM | 12.4% |

| Others | 16.5% |

Software and Services. Software holds a higher share due to compliance automation and integration.

Cloud-Based and On-Premises. Cloud solutions are growing rapidly due to ease of scalability.

Pharmaceutical Companies, Biotechnology Companies, Medical Device Companies, Regulatory Authorities, and CROs. Pharmaceuticals and biotech firms are key adopters

The market will expand at a CAGR of 12.8% from 2025 to 2035.

By 2035, the market will reach USD 26,321.2 million.

AI-powered SPL Automation, Cloud based SPL Platforms and Blockchain based Tracking.

Munich is the leading regions due to their strong pharmaceutical and biotech presence.

SAP, Veeva Systems, Oracle Corporation and IBM.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Evaluating Structured Product Label Management Market Share

Structured Product Label Management Market Outlook 2025-2035

UK Structured Product Label Management Market Insights – Trends, Growth & Forecast 2025-2035

USA Structured Product Label Management Market Analysis – Size, Trends & Industry Outlook 2025-2035

Japan Structured Product Label Management Market Outlook – Size, Share & Innovations 2025-2035

GCC Countries Structured Product Label Management Market Analysis – Growth, Demand & Outlook 2025-2035

Product Cost Management Market

Structured Data Management Software Market Size and Share Forecast Outlook 2025 to 2035

Germany In-mold Labels Market Report – Size, Demand & Growth 2025-2035

Product Life-Cycle Management (PLM) IT Market Size and Share Forecast Outlook 2025 to 2035

Product Information Management Market Growth – Trends & Forecast 2024-2034

Germany Hyaluronic Acid Products Market Trends – Size, Share & Growth 2025-2035

Germany Supplier Quality Management Applications Market Trends – Growth, Share & Outlook 2025-2035

Germany Bagasse Tableware Products Market Outlook – Size, Trends & Forecast 2025-2035

Germany Enterprise Internet Reputation Management Market Outlook – Demand & Forecast 2025–2035

Product Tour Software for SaaS Market Size and Share Forecast Outlook 2025 to 2035

Germany Culinary Tourism Market Size and Share Forecast Outlook 2025 to 2035

Labels Market Forecast and Outlook 2025 to 2035

Label Applicators Market Size and Share Forecast Outlook 2025 to 2035

Labeling and Coding Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA