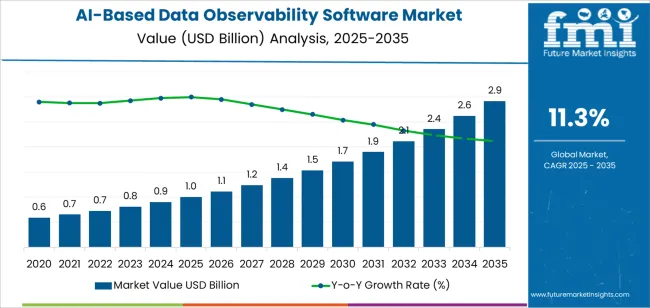

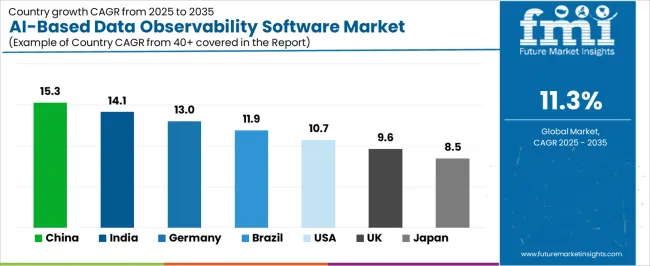

The AI-based data observability software market expands from USD 1.0 billion in 2025 to USD 3.0 billion by 2035 at a CAGR of 11.3%, shaped by regional advances in digital modernization, cloud adoption, and enterprise analytics maturity. Asia Pacific leads global growth, driven by strong adoption in China and India, where expanding data-engineering teams, rapid cloud migration, and AI-enabled analytics ecosystems generate sustained demand for automated observability. China grows at 15.3% as enterprises adopt AI-powered data-reliability tools for large-scale fintech, telecom, and e-commerce datasets. India follows at 14.1%, supported by IT-services integration, cloud-native transformation across BFSI and healthcare, and a fast-maturing digital-operations landscape. Japan and South Korea maintain steady adoption due to precision-driven operational requirements and increased use of AI in industrial and financial systems.

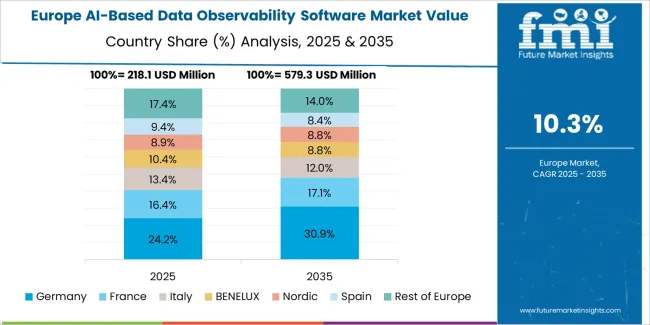

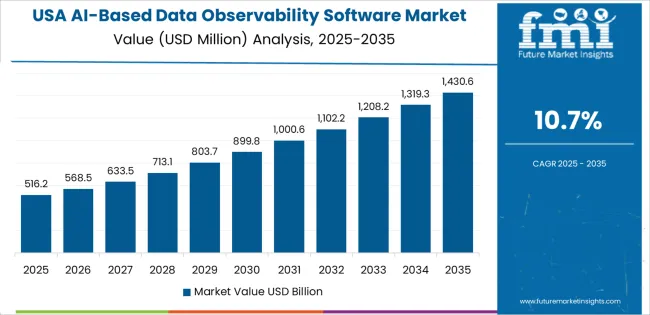

Europe contributes robust growth, led by Germany at 13.0% as enterprises enforce strict data-governance and lineage-traceability mandates aligned with regulatory frameworks. The U.K. and France strengthen adoption through cloud-native modernisation, enhanced compliance structures, and growing use of observability tools in financial services, logistics, and public-sector applications. The region benefits from mature governance ecosystems that prioritize documentation accuracy and automated anomaly detection. North America remains a core market with the United States advancing at 10.7%, supported by mature multi-cloud architectures, strong R&D in AI-driven monitoring, and heavy adoption across healthcare, retail, and high-volume digital services. Brazil anchors Latin America with 11.9% growth as cloud migration accelerates and fintech ecosystems expand. Across all regions, adoption accelerates as enterprises shift to continuous monitoring of distributed data pipelines, embed lineage mapping into governance frameworks, and rely on predictive diagnostics to stabilize analytics, AI, and operational systems.

Asia Pacific leads market expansion, supported by digital modernization in China, India, and Southeast Asian economies. Europe and North America maintain strong adoption through established enterprise analytics ecosystems and investment in AI governance frameworks. Key participants include Telmai, Sifflet, Acceldata, Monte Carlo, Arize AI, Logz.io, and WhyLabs, focusing on automated monitoring, pipeline resilience, and integration with cloud-native data platforms.

Growth rate volatility analysis indicates a moderate volatility index during the early years, followed by gradual stabilization as observability platforms become embedded in enterprise data operations. Between 2025 and 2028, volatility will remain higher due to rapid adoption cycles, shifting cloud-migration strategies, and variations in AI deployment budgets. Market dynamics during this phase will be influenced by differing enterprise readiness levels and uneven modernization across industries.

From 2029 to 2035, the volatility index is expected to decline as observability tools mature and integration with data pipelines, governance frameworks, and automated quality monitoring becomes standardized. Wider use of anomaly detection, lineage tracking, and predictive diagnostics will support predictable, subscription-based demand. Regulatory pressure for reliable data controls will also reduce fluctuations by making observability a recurring operational requirement rather than a discretionary investment. The long-term volatility profile reflects a technology-driven market transitioning from early expansion driven by modernization projects to a stable phase supported by continuous monitoring needs and structured enterprise data-management practices.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.0 billion |

| Market Forecast Value (2035) | USD 3.0 billion |

| Forecast CAGR (2025 to 2035) | 11.3% |

The market for AI-based data observability software is growing as organisations face increasing volumes and complexity of data pipelines, analytics environments and hybrid cloud architectures. Software platforms that apply artificial intelligence to monitor dataflows, detect anomalies, identify root causes and ensure data integrity provide higher visibility and reliability across data operations. Growth is driven by rising demand for real-time insights, the prevalence of advanced analytics and machine learning workflows, and the need to govern data quality in large-scale enterprise systems. Toolsets incorporating ML-based anomaly detection, lineage tracing, automated notification and self-healing capabilities are gaining wide adoption.

Regulatory requirements for data governance, auditability and controls in sectors such as finance, healthcare and retail amplify need for observability solutions. On the supply side, vendors leverage AI-native architectures and cloud-based delivery models to scale globally and accelerate deployment. Constraints include high initial implementation and licence costs, complexity in integrating with legacy data stacks, and a shortage of skilled professionals able to configure and interpret AI-driven observability insights effectively.

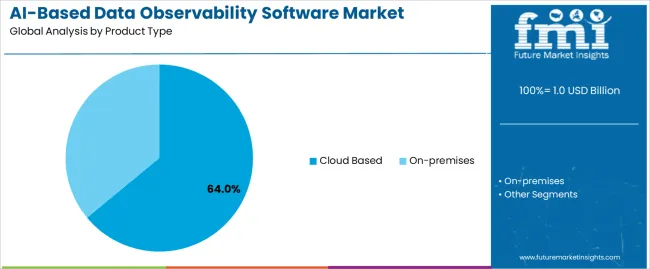

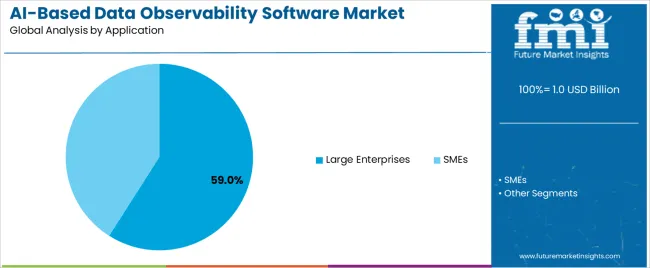

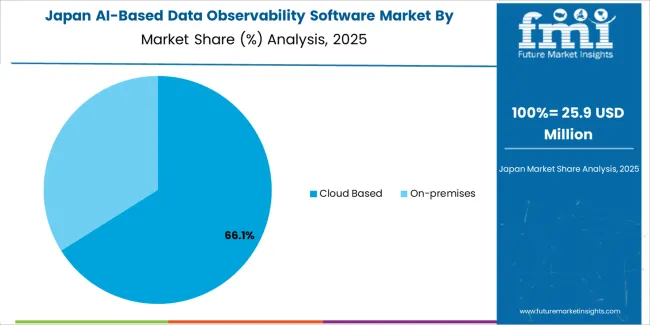

The AI-based data observability software market is segmented by product type and application. By product type, the market includes cloud-based and on-premises platforms. Based on application, it is categorized into large enterprises and SMEs. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

The cloud-based segment holds the leading position in the AI-based data observability software market, representing an estimated 64.0% of total market share in 2025. Cloud deployments support real-time anomaly detection, automated data quality monitoring, and scalable pipeline analysis across distributed data environments. These platforms benefit from elastic computing resources, enabling rapid model updates, continuous data scanning, and integration with modern cloud data warehouses.

Demand is reinforced by organizations transitioning to cloud-native architectures and relying on AI-driven observability to identify schema drift, data degradation, lineage issues, and pipeline failures. The on-premises segment, estimated at 36.0%, remains essential in industries with strict data governance requirements, including finance, healthcare, and public sector operations where data residency and compliance obligations restrict cloud adoption.

Key factors supporting the cloud-based segment include:

The large enterprises segment accounts for approximately 59.0% of the AI-based data observability software market in 2025. Large organizations manage extensive, diverse data pipelines and require automated monitoring systems to maintain data accuracy, detect anomalies, and ensure reliability across analytics, machine learning models, and operational systems.

Enterprises adopt AI-based observability tools to reduce operational risks associated with data drift, system downtime, and corrupted datasets, particularly in environments with high regulatory oversight and complex data governance structures. The SMEs segment, representing roughly 41.0%, is expanding as smaller organizations adopt cloud-native analytics stacks and rely on automated observability to reduce manual monitoring and engineering overhead.

Primary dynamics driving demand from the large enterprises segment include:

Rising data complexity, growing reliance on real-time analytics, and increased adoption of automated monitoring are driving market growth.

The AI-Based Data Observability Software Market is expanding as organisations manage larger, more complex data pipelines across cloud, hybrid, and multi-platform environments. Businesses depend on accurate, timely data for analytics, machine learning, and operational decision-making, which increases the need for tools that detect anomalies, lineage issues, and quality degradation without manual oversight. AI-driven observability platforms automate root-cause analysis, pattern detection, and anomaly prediction, reducing downtime and improving data reliability. Growth in digital transformation across finance, e-commerce, telecom, and healthcare strengthens adoption, as these sectors require high-trust data to support compliance, customer experience, and mission-critical workloads.

High implementation cost, integration challenges, and limited in-house expertise are restraining adoption.

AI-based observability tools often require substantial investment in platform licensing, cloud resources, and configuration, which slows uptake in smaller organisations. Integrating observability systems with diverse data stacks, legacy architectures, and siloed applications can be technically complex and may lengthen deployment timelines. Many enterprises lack in-house data reliability specialists or AI operations expertise, which increases dependence on external support and raises overall cost. Concerns about false positives, over-alerting, or lack of transparency in AI-driven recommendations also limit adoption among businesses seeking predictable, interpretable monitoring systems.

Growth in autonomous data quality management, expansion of cloud-native observability features, and rising adoption in emerging digital economies are shaping market trends.

Vendors are introducing autonomous data-quality modules that continuously learn from pipeline behavior to improve accuracy and reduce manual tuning. Cloud providers are embedding native observability tools within data warehouses, lakehouses, and integration platforms, enabling easier deployment for cloud-first organisations. Emerging markets in Asia Pacific, Eastern Europe, and Latin America are adopting AI-based observability as digital-service sectors expand and data governance requirements strengthen. Enhanced focus on lineage visualisation, multi-cloud interoperability, and predictive reliability analytics supports the market’s shift toward fully automated, scalable data observability ecosystems.

The global AI-based data observability software market is expanding rapidly through 2035, supported by increased data-pipeline complexity, wider adoption of cloud-native architectures, and the rising need for automated monitoring of data quality, lineage, and operational stability. China leads with a 15.3% CAGR, followed by India at 14.1%, reflecting strong digital-infrastructure growth and enterprise adoption of AI-enabled data-monitoring tools. Germany grows at 13.0%, supported by regulated data-governance standards and industrial digitalization. Brazil records 11.9%, driven by cloud modernization and analytics expansion. The United States grows at 10.7%, supported by mature enterprise data ecosystems, while the United Kingdom (9.6%) and Japan (8.5%) sustain stable adoption through structured IT-governance systems and precision-driven data-operations practices.

| Country | CAGR (%) |

|---|---|

| China | 15.3 |

| India | 14.1 |

| Germany | 13.0 |

| Brazil | 11.9 |

| USA | 10.7 |

| UK | 9.6 |

| Japan | 8.5 |

China’s market grows at 15.3% CAGR, supported by rapid enterprise digitization, expansion of AI-driven analytics platforms, and increased use of automated monitoring tools in large-scale data environments. Companies adopt AI-based observability software to track data lineage, detect pipeline anomalies, and maintain accuracy across high-volume transactional systems. Cloud providers and domestic software vendors offer integrated observability modules designed for distributed architectures, enabling real-time quality scoring and drift detection. Growth in manufacturing, fintech, telecommunications, and e-commerce strengthens use of AI-based data monitoring to ensure operational continuity. National initiatives promoting digital modernization broaden adoption across state-linked and private enterprises.

Key Market Factors:

India’s market grows at 14.1% CAGR, supported by expanding data-engineering activity, growth in IT services, and rising demand for automated data-quality safeguards within cloud and hybrid environments. Enterprises adopt AI-based observability platforms to detect anomalies, monitor schema changes, and maintain pipeline consistency across large transactional datasets. IT-services firms integrate observability solutions into digital-transformation projects for BFSI, healthcare, and e-commerce clients. Domestic cloud adoption accelerates use of AI-enabled data-monitoring tools among SMEs and digital-native companies. Increased focus on governance, auditability, and operational reliability strengthens platform adoption across emerging business hubs.

Market Development Factors:

Germany’s market grows at 13.0% CAGR, supported by strict data-governance requirements, industrial digitalization, and strong enterprise use of automated monitoring tools. Manufacturers, financial institutions, and logistics firms integrate observability software to ensure high-quality operational data across regulated environments. Providers develop platforms emphasizing traceability, drift detection, and automated lineage mapping aligned with European compliance standards. Growth in Industry 4.0 programs increases the volume of sensor-driven datasets requiring continuous monitoring. German enterprises prioritize reliability and documentation accuracy, encouraging widespread use of AI-based observability solutions in production environments.

Key Market Characteristics:

Brazil’s market grows at 11.9% CAGR, driven by cloud migration, expansion of digital-service platforms, and increased need for reliable data pipelines across e-commerce, finance, and telecom sectors. Companies use observability tools to monitor data transformations, identify operational inconsistencies, and maintain accuracy across integrated analytics environments. Fintech growth strengthens demand for continuous data-health monitoring to support compliance-driven operations. Domestic enterprises adopt observability modules bundled within cloud services, enabling standardized quality assessments with minimal configuration. Broader digitalization across public and private sectors increases platform deployment.

Market Development Factors:

The United States grows at 10.7% CAGR, supported by mature enterprise data ecosystems, growth in real-time analytics platforms, and strong R&D activity in AI-enabled monitoring. Large corporations deploy observability tools to manage complex data pipelines across hybrid and multi-cloud environments. Software providers focus on automated anomaly detection, lineage reconstruction, and data-reliability scoring. Increased adoption of AI-assisted decision systems strengthens the need for continuous data-quality oversight. Growth in high-volume sectors such as healthcare, retail, and digital services accelerates platform usage across distributed data environments.

Key Market Factors:

The United Kingdom’s market grows at 9.6% CAGR, supported by strong financial-services activity, expansion of cloud-native platforms, and increased focus on data quality within regulated environments. Companies adopt observability software to maintain reliable data pipelines for reporting, analytics, and automated operations. Platforms offer compliance-aligned monitoring tools, including drift alerts, lineage tracking, and quality scoring. Growth in professional services, digital-first enterprises, and public-sector modernization initiatives supports use of standardized observability frameworks. Integration with governance platforms reinforces enterprise adoption.

Market Development Factors:

Japan’s market grows at 8.5% CAGR, supported by precision-driven data-operations requirements, modernization of enterprise systems, and rising adoption of automated monitoring across manufacturing, financial services, and technology sectors. Organizations deploy observability software to track pipeline reliability, monitor schema stability, and detect deviations affecting analytical output. Domestic enterprises value documentation accuracy and high reliability, reinforcing demand for AI-enabled anomaly detection and lineage mapping. Increased integration of cloud services and IoT-driven workflows supports broader adoption in industrial contexts.

Key Market Characteristics:

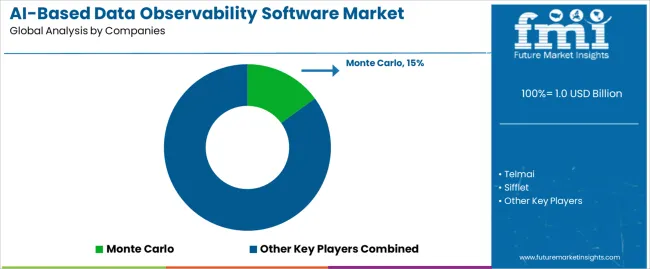

The AI-based data observability software market is moderately consolidated, with about twenty providers supplying monitoring and quality assurance tools for modern data pipelines. Monte Carlo leads the market with an estimated 15.0% global share, supported by its structured approach to data incident detection, coverage across warehouse and lake environments, and adoption among technology-driven enterprises. Its position is reinforced by automated lineage, anomaly detection, and integration with major cloud platforms.

Acceldata, Sifflet, Telmai, and Arize AI follow as key competitors, offering AI-assisted monitoring for data quality, reliability, and model performance. Their competitive strengths include metric-based alerting, pipeline-wide visibility, and compatibility with distributed processing systems. WhyLabs and Logz.io hold mid-tier positions, focusing on scalable monitoring for ML workflows and log-based anomaly identification. iceDQ, Decube, and Soda.io contribute to quality verification through rule-based and machine-learning-supported validation frameworks designed for operational teams.

Large enterprise vendors such as Informatica, IBM, Cisco, New Relic, Datadog, Splunk, Dynatrace, and ScienceLogic expand market reach by integrating observability modules into existing AIOps, application monitoring, and data management platforms. Their advantage lies in established customer bases and broad monitoring ecosystems. Emerging participants including Greptime address specialized use cases in real-time data infrastructure.

Competition in this market centers on anomaly detection accuracy, lineage completeness, integration depth, and operational scalability. Growth is driven by increased reliance on distributed data systems, rising volumes of structured and unstructured data, and the need for continuous reliability monitoring across analytics, governance, and machine learning environments.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Product Type | Cloud Based, On-premises |

| Application | Large Enterprises, SMEs |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | Telmai, Sifflet, Acceldata, Monte Carlo, Arize AI, Logz.io, WhyLabs, iceDQ, Decube, ScienceLogic, New Relic, Informatica, IBM, Soda.io, Lightup, Cisco, Datadog, Dynatrace, Splunk, Greptime |

| Additional Attributes | Dollar sales by product type and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of AI-driven data quality, monitoring, and observability platforms; advancements in anomaly detection, lineage tracing, and automated data reliability tooling; integration with cloud data warehouses, data lakes, real-time analytics systems, and enterprise AI pipelines. |

The global ai-based data observability software market is estimated to be valued at USD 1.0 billion in 2025.

The market size for the ai-based data observability software market is projected to reach USD 2.9 billion by 2035.

The ai-based data observability software market is expected to grow at a 11.3% CAGR between 2025 and 2035.

The key product types in ai-based data observability software market are cloud based and on-premises.

In terms of application, large enterprises segment to command 59.0% share in the ai-based data observability software market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Data Security Posture Management (DSPM) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Data Loss Prevention (DLP) Services Market Size and Share Forecast Outlook 2025 to 2035

Data Center Market Forecast and Outlook 2025 to 2035

DataOps Platform Market Size and Share Forecast Outlook 2025 to 2035

Datacenter Infrastructure Services Market Size and Share Forecast Outlook 2025 to 2035

Data Acquisition Hardware Market Size and Share Forecast Outlook 2025 to 2035

Data Center Automatic Transfer Switches and Switchgears Market Size and Share Forecast Outlook 2025 to 2035

Data Discovery Market Size and Share Forecast Outlook 2025 to 2035

Data Masking Technology Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Rack Server Market Size and Share Forecast Outlook 2025 to 2035

Data Center Power Management Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Data Center Power Management Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Data Center Liquid Cooling Market Size and Share Forecast Outlook 2025 to 2035

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Data Centre Colocation Market Size and Share Forecast Outlook 2025 to 2035

Data Lake Market Size and Share Forecast Outlook 2025 to 2035

Data Center RFID Market Size and Share Forecast Outlook 2025 to 2035

Data Center Accelerator Market Size and Share Forecast Outlook 2025 to 2035

Data Lakehouse Market Size and Share Forecast Outlook 2025 to 2035

Data Center Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA