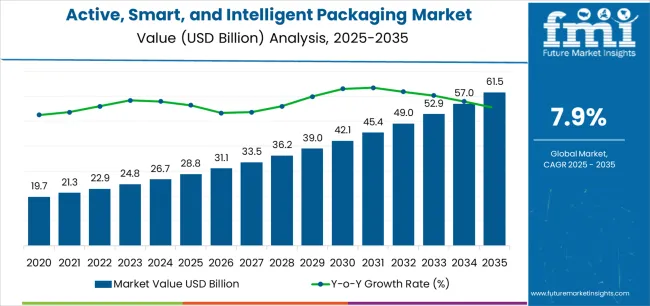

The Active, Smart, and Intelligent Packaging Market is estimated to be valued at USD 28.8 billion in 2025 and is projected to reach USD 61.5 billion by 2035, registering a compound annual growth rate (CAGR) of 7.9% over the forecast period.

The active, smart, and intelligent packaging market is experiencing robust expansion driven by the growing demand for extended shelf life, improved product safety, and enhanced traceability across supply chains. Increasing consumer preference for packaged and ready-to-eat foods, coupled with advancements in material science and sensor technology, is accelerating adoption across multiple end-use industries.

The market is also benefitting from regulatory support for sustainable and smart packaging solutions, encouraging manufacturers to integrate eco-friendly materials and data-driven monitoring systems. Companies are investing in research and development to introduce multifunctional packaging with real-time condition tracking, freshness indicators, and antimicrobial properties.

The future outlook remains strong as digital transformation in logistics, coupled with rising awareness of food wastage reduction, is fostering widespread deployment of intelligent packaging technologies Growth rationale is based on evolving retail structures, consumer demand for transparency, and the strategic shift toward smart, efficient, and sustainable packaging formats that enhance both product integrity and brand differentiation.

| Metric | Value |

|---|---|

| Active, Smart, and Intelligent Packaging Market Estimated Value in (2025 E) | USD 28.8 billion |

| Active, Smart, and Intelligent Packaging Market Forecast Value in (2035 F) | USD 61.5 billion |

| Forecast CAGR (2025 to 2035) | 7.9% |

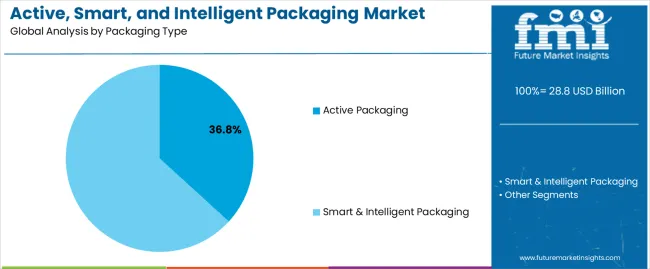

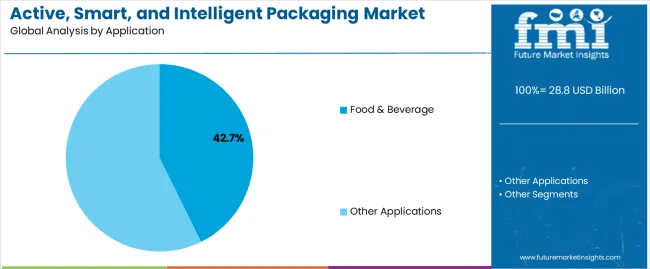

The market is segmented by Packaging Type and Application and region. By Packaging Type, the market is divided into Active Packaging and Smart & Intelligent Packaging. In terms of Application, the market is classified into Food & Beverage and Other Applications. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The active packaging segment, accounting for 36.80% of the packaging type category, has emerged as the leading format due to its effectiveness in maintaining product freshness, quality, and safety throughout distribution. Its adoption has been supported by technologies such as oxygen scavengers, moisture absorbers, and antimicrobial layers that actively interact with the product environment.

Demand has been reinforced by food manufacturers and retailers seeking to minimize spoilage and extend product shelf life. Continuous innovation in biodegradable active components and nano-enabled materials has improved performance consistency and sustainability.

Regulatory encouragement for reducing food waste and enhancing food safety standards has further accelerated uptake The segment’s dominance is expected to continue as producers integrate active functionalities into broader smart packaging systems, ensuring compatibility with modern logistics and consumer expectations.

The food and beverage segment, representing 42.70% of the application category, has maintained leadership owing to its extensive use of smart and active packaging for product preservation, safety assurance, and quality enhancement. Rising global consumption of processed and packaged foods has driven manufacturers to adopt intelligent solutions that monitor freshness, detect contamination, and communicate storage conditions.

The segment’s growth has been strengthened by stringent regulatory frameworks and increasing consumer awareness regarding product authenticity and safety. Integration of time-temperature indicators, freshness sensors, and QR-based traceability systems has improved transparency and supply chain management.

The shift toward sustainable, recyclable, and interactive packaging has also supported adoption The segment is projected to retain its dominant share as innovation and digital technologies continue to reshape the food packaging landscape globally.

The global active, smart, and intelligent packaging market was valued at USD 19.7 billion in 2020. The global demand for active, smart, and intelligent packaging solutions increased at a rate of 4.8% between 2020 and 2025. The overall market value was about USD 28.8 billion by 2025.

The food & beverages along with the pharmaceutical sector being the prominent consumers of active, smart & intelligent packaging witnessed a negative during 2024 and 2024. However, in the subsequent year due to a sharp rise in demand for pharmaceutical vaccines and supplies the packaging with indicators of market growth during this period skyrocketed.

| Attributes | Details |

|---|---|

| Active, Smart, and Intelligent Packaging Market Value (2020) | USD 19.7 billion |

| Market Revenue (2025) | USD 28.8 billion |

| Market Historical Growth Rate (CAGR 2020 to 2025) | 4.8% CAGR |

The average consumer in all parts of the globe has witnessed rising income, which has LED to higher expenditure and changes in consumption patterns. In addition, due to rapid urbanization in all regions, many consumers have witnessed a shift to a fast-paced lifestyle relying more on packaged food and beverage items.

Also, in the last decade, a surge in the number of modern retail outlets as well as modern trade has been further bolstered by the digital revolution. As more and more consumers switched preferences towards e-commerce, a fresh wave of online food retail and delivery services emerged.

All these developments have LED to an increase in demand for fresh products with extended shelf-life, thus creating the perfect atmosphere for the growth of the active, smart, and intelligent packaging market.

The table below lists the countries that are figured to present the most lucrative growth opportunities for the regional technological packaging solutions market.

| Regional Market Comparison | CAGR (2025 to 2035) |

|---|---|

| United States | 7.9% |

| Germany | 7.7% |

| United Kingdom | 7.1% |

| India | 9% |

| China | 9.7% |

The active, smart, and intelligent packaging sales in the United States are projected to advance at 7.9% CAGR through 2035. Key highlights for the United States market include:

Demand for active, smart, and intelligent packaging solutions in the United Kingdom is projected to rise at a rate of 7.1% over the next ten years.

The active, smart, and intelligent packaging industry of China is to expand at a rate of 9.7% per year till 2035.

Germany is anticipated to hold almost 20% market share across Europe and advance at a rate of 7.7% per year till 2035.

Sales of active, smart, and intelligent packaging solutions are anticipated to increase at a rate of 9% between 2025 and 2035.

As per the study, the interactive packaging segment is likely to account for almost 41.6% of the total advanced packaging solutions market in 2025.

| Attributes | Details |

|---|---|

| Top Technology Type or Segment | Interactive Packaging |

| Market Share in 2025 | 41.6% |

Based on application, the bags and pouches segment is estimated to contribute 18.5% of the market demand in 2025.

| Attributes | Details |

|---|---|

| Top Application Type or segment | Bags & Pouches |

| Market Share in 2025 | 18.5% CAGR |

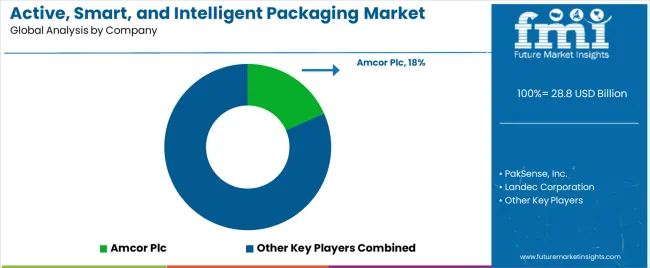

Globally renowned manufacturers across active, smart & intelligent packaging are eyeing to enter into strategic partnerships with major end use industries. They are also focusing on launching innovative packaging to satisfy modern-day packaging needs. Furthermore, the competition in the packaging with sensors market is expected to intensify through continuous product innovation by domestic and international manufacturers.

Recent Developments in the Global Active, Smart, and Intelligent Packaging Market

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 26.6 billion |

| Projected Market Size (2035) | USD 59.1 billion |

| Anticipated Growth Rate (2025 to 2035) | 8.3% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million or billion for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Middle East & Africa (MEA); East Asia; South Asia and Oceania |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, Spain, Italy, France, United Kingdom, Russia, China, India, Australia & New Zealand, GCC Countries, and South Africa |

| Key Segments Covered | By Packaging Type, By Application, and By Region |

| Key Companies Profiled | PakSense, Inc.; Landec Corporation; Sealed Air Corporation; Crown Holdings, Inc.; Amcor Plc; 3M Company; Timestrip UK Ltd.; Cryolog S.A.; Vitsab International AB; Varcode, Ltd.; LCR Hallcrest LLC; Thin Film Electronics ASA; CCL Industries Inc.; Temptime Corporation; Multisorb Technologies, Inc.; Coveris Holdings S.A. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global active, smart, and intelligent packaging market is estimated to be valued at USD 28.8 billion in 2025.

The market size for the active, smart, and intelligent packaging market is projected to reach USD 61.5 billion by 2035.

The active, smart, and intelligent packaging market is expected to grow at a 7.9% CAGR between 2025 and 2035.

The key product types in active, smart, and intelligent packaging market are active packaging, _oxygen scavenging sachets, _modified atmosphere packaging (map), smart & intelligent packaging, _time & temperature indicator (tti) labels, _freshness indicators and _radio frequency identification (rfid) tags.

In terms of application, food & beverage segment to command 42.7% share in the active, smart, and intelligent packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Distribution Among Active, Smart, and Intelligent Packaging Manufacturers

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Reactive Hot Melt Adhesive Market Forecast Outlook 2025 to 2035

Active Wear Market Size and Share Forecast Outlook 2025 to 2035

Refractive Surgery Device Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair Market Forecast and Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Advanced Active Cleaning System for ADAS Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Smart Water Management Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA