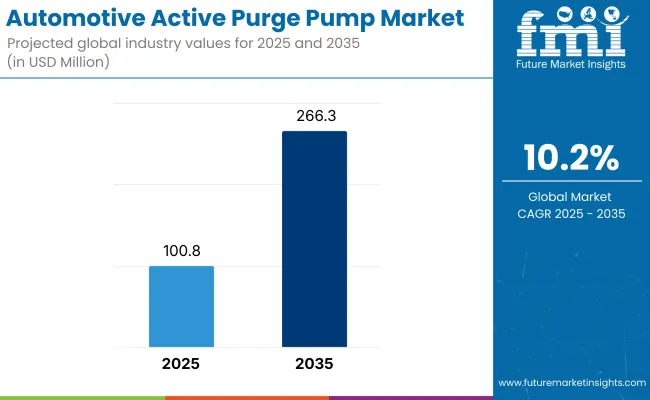

The global automotive active purge pump market is projected to grow from USD 100.8 million in 2025 to USD 266.3 million by 2035, registering a compound annual growth rate (CAGR) of 10.2%. This growth is being driven by increasingly stringent emission control regulations and the transition of automotive platforms toward electrified and electronically controlled fuel system components.

Active purge pumps are being used to manage hydrocarbon vapors stored in fuel system canisters by directing them into the engine intake for combustion. Unlike traditional purge systems that rely on engine vacuum, active variants operate independently, offering consistent purging performance under all engine conditions. These systems are being integrated into evaporative emission control architectures in compliance with global Onboard Diagnostics (OBD) standards.

Vitesco Technologies has developed an active purge pump capable of regulating hydrocarbon vapor flow to the intake manifold, independent of engine vacuum. According to the company’s official documentation, the pump includes diagnostic functionality to detect evaporative leak faults and supports original equipment manufacturers (OEMs) with scalable system integration.

In 2024, a utility patent titled CN116018454A was published, attributed to BAIC Motor Co., Ltd. The patent describes a modular active purge pump assembly comprising a motor-driven pump connected to the activated carbon canister and a bypass valve system that facilitates both refueling and purging. This design supports stable fuel tank pressure regulation and enhances the operational control of evaporative emissions.

Further development is being observed in the form of AI-integrated purge control systems and electric-powered vapor management modules. These innovations are aimed at optimizing system response and enabling predictive diagnostics, especially in hybrid and plug-in hybrid vehicle platforms.

The merger of Vitesco Technologies with Schaeffler AG in October 2024 is expected to strengthen R&D capabilities in e-mobility and fuel system components. As regulations tighten and hybrid adoption grows, active purge pumps are anticipated to become a foundational component of next-generation emission control systems, sustaining market expansion through 2035.

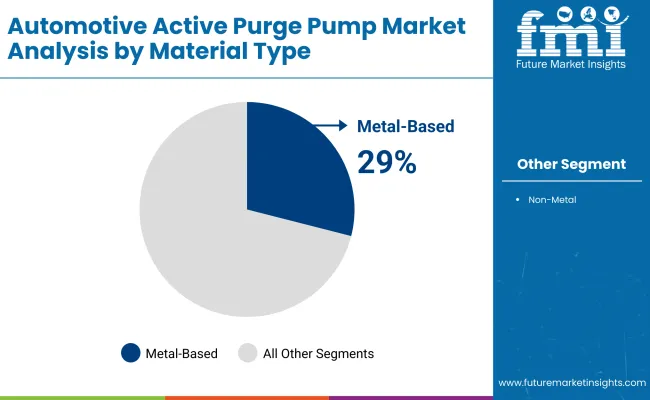

As of 2025, metal-based components are estimated to contribute approximately 29% of the global automotive active purge pump market. Over the forecast period from 2025 to 2035, this material segment is projected to expand at a compound annual growth rate (CAGR) of 9.6%. This growth is being supported by the material’s superior thermal stability, mechanical strength, and resistance to chemical degradation in harsh engine environments.

Metal housings and internal structures are being favored for applications requiring extended durability under fluctuating temperature and pressure conditions, particularly in ICE-based and hybrid powertrains. Active purge pumps constructed from aluminum and stainless steel alloys are being utilized to ensure consistent structural integrity during long-duration vehicle operation and exposure to fuel vapors.

While polymer-based alternatives are gaining traction due to light weighting demands, metal components continue to be specified in commercial vehicle platforms and premium passenger cars, where high-load thermal endurance and longevity are prioritized. Manufacturers are expected to retain metal-based pump variants in modular platforms where backward compatibility and component robustness are critical to performance and regulatory compliance.

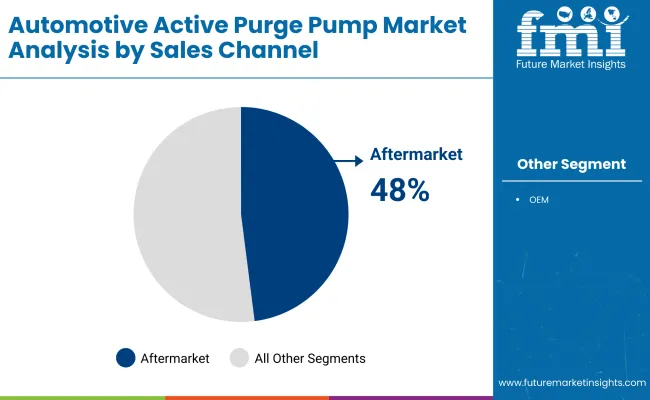

As of 2025, aftermarket fitments account for nearly 48% of the global automotive active purge pump market. Through the forecast period ending in 2035, this segment is projected to expand at a CAGR of 11%. Growth is being driven by increasing demand for retrofitting emission control systems in aging vehicle fleets, particularly in regions where regulatory upgrades are being phased in over time.

Vehicle owners and fleet operators are increasingly adopting aftermarket active purge pump solutions to meet evolving evaporative emission standards without replacing entire fuel system assemblies. Installations are being undertaken during routine maintenance cycles, especially in light-duty commercial vehicles and older passenger cars that were originally fitted with passive purge systems.

The aftermarket segment is also benefiting from the availability of modular purge pump kits that offer compatibility with a wide range of vehicle models. Suppliers have responded by expanding distribution through authorized service networks and offering plug-and-play systems that simplify integration. As inspection regimes tighten and urban emission zones expand, the demand for aftermarket active purge pump replacements is expected to remain strong across both developed and emerging automotive markets.

North America is expected to have a significant share of the Automotive Active Purge Pump Market, owing to strict regulations regarding emissions and high vehicle production rates along with increasing demand for fuel-efficient powertrains. The EPA and California Air Resources Board (CARB) regulations designed for advanced fuel vapor management system put the United States and Canada in the top of the regions.

Major automotive manufacturers, including General Motors, Ford, and Stellantis, are introducing active purge pumps in both gasoline and hybrid (including plug-in hybrid electric vehicles, or PHEVs) applications to improve fuel economy and reduce evaporative emissions. Increasing consumer awareness regarding environmental sustainability and fuel economy benefits also drives the market growth.

Europe accounts for a significant portion of the Automotive Active Purge Pump Market, as nations like Germany, the UK, France, and Italy spearhead automotive R&D, emissions control technologies, and hybrid vehicle production. Strict Euro 7 regulations in the European Union, which will be applied in the next few years, are forcing automakers to use updated EVAP systems, with electrically driven purge pumps.

Growing demand for highly fuel-efficient and low-emission vehicle & engine components, in turn, is fuelling the shift towards hybrid powertrains in direct response to EU emission reduction objectives. Developing APPs like VW, BMW, and Mercedes-Benz are taking the lead in hybrids and plug-in hybrids as a means of improving fuel economy while meeting requirements.

Based on region, the automotive active purge pump market is anticipated to lead by Asia-Pacific region, showing the highest CAGR, owing to increasing vehicle production, higher adoption of hybrid and fuel-efficient vehicles along with rising environmental awareness. Countries such as China, Japan, South Korea and India emerge as major players under these parameters due to their growing automotive industries along with government policies to encourage emission reducing technologies.

The aggressive emission reduction regulations introduced by China, the world's largest market for automobiles, are also driving the use of EVAP control systems such as APPs in gasoline- and hybrid-powered vehicles. Automakers in Japan and South Korea, which includes the likes of Toyota, Honda, Hyundai and Kia, are working on fuel vapor recovery systems, lightweight purge pump components, and AI-augmented emission control systems.

Market growth is also being fuelled by India's increasing urbanization and its growing emphasis on emission control regulations leading automakers to adopt advanced purge pump technologies into new vehicle models as they seek compliance with Bharat Stage VI (BSVI) emission regulations.

Challenges

High Costs and Shift to Fully Electric Vehicles

The high cost of advanced EVAP control systems increases the vehicle manufacturing expenses for end-use manufacturers, which is likely to restrain the growth of the Automotive Active Purge Pump Market in the near future. In fact, electronic purge pumps with predictive capabilities are more expensive to produce due to sophisticated engineering and a need for precision manufacturing.

Moreover, the urgent shift towards purely electric vehicles (EVs) that wouldn't need fuel vapor management systems, presents a long-term concern for the sustainability of the market. With governments globally banning ICE vehicles and pushing EV adoption, the demand for APPs in regular gasoline and hybrid vehicles are likely to drop-off over the longer term.

Opportunities

AI-Driven Emission Control and Electrified Purge Pump Technologies

There are challenges for this market but also major growth opportunities. The use of AI-powered emission control strategies to adjust purge cycles in real time based on the fuel tank pressure, ambient temperature, and other vehicle operation data is enhancing fuel economy and emissions.

The introduction of electrically powered purge pumps (eAPPs) that have no dependence on engine vacuum systems is restructuring EVAP control on hybrid and plug-in hybrid vehicles. The development of new lightweight composite materials, smart purge pump sensors, and AI-based predictive maintenance are also improving APP efficiency, durability, and vehicle configuration.

The production growth of hybrid vehicles, rising investment in sustainable fuel technologies, along with regulatory mandates for zero-emission vehicle components - these trends are adding to the overall market demand and pushing the market towards even more sustainable automotive solutions. The use of automated fuel vapor management technologies is poised to increase as automakers further enhance fuel economy and emissions compliance.

The automotive active purge pump (APP) market witnessed significant growth from 2020 to 2024, fueled by stricter emission regulations, a rise in vehicle electrification, and improvements in evaporative emission control systems. After that, active purge pumps are used for actively purging fuel vapor from the evaporative emission control system (EVAP) into the combustion engine for burning hydrocarbon emissions. The government policies such as USA Environmental Protection Agency (EPA) Tier 3 standards, Euro 6 emission norms, and China 6 regulations and others, which mandated lower limits for the emission of volatile organic compounds (VOC) and higher consumption for high-efficiency purge pumps, should drive the segment during the forecast period.

The automotive active purge pump market is projected to make paradigm shifts between 2025 and 2035, due to advancements such as AI-driven purge optimization, cutting-edge nanomaterial-based filters, and intelligent evaporative emission control systems. Adaptation of purge pump technologies for hybrid powertrains and alternate fuel systems will shift as zero-emission vehicles (ZEVs) and fuel-cell electric vehicles (FCEVs) become a larger part of the automotive market. Predictive vapor management, real-time diagnostics, and adaptive emission reduction based on driving conditions, fuel type, and climate variables will be driven by AI-enhanced active purge control systems in the future.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with EPA Tier 3, Euro 6, and China 6 emission norms. |

| Technological Advancements | Development of electrically driven purge pumps, advanced solenoid valves, and smart diagnostic integration. |

| Industry Applications | Used in internal combustion engine (ICE) vehicles, hybrid cars, and plug-in hybrid electric vehicles (PHEVs). |

| Adoption of Smart Equipment | Integration of OBD-compliant purge pump diagnostics and vacuum-assisted purge cycles. |

| Sustainability & Cost Efficiency | Shift toward low-energy purge solutions, reduced hydrocarbon emissions, and energy-efficient EVAP control. |

| Data Analytics & Predictive Modeling | Use of OBD-II data for fault detection and basic performance analytics. |

| Production & Supply Chain Dynamics | Challenges in component sourcing, cost-sensitive manufacturing, and emission compliance requirements. |

| Market Growth Drivers | Growth driven by global emission reduction policies, hybrid vehicle adoption, and demand for fuel efficiency. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter hybrid vehicle emission mandates, AI-driven emission tracking, and blockchain-based component certification. |

| Technological Advancements | AI-powered adaptive purge control, nanomaterial-based VOC filtration, and real-time emission optimization. |

| Industry Applications | Expansion into synthetic fuel-powered vehicles, fuel-cell EVs (FCEVs), and next-gen hybrid powertrains. |

| Adoption of Smart Equipment | IoT-enabled predictive purge scheduling, AI-driven vapor management, and self-calibrating purge modules. |

| Sustainability & Cost Efficiency | 3D-printed lightweight purge pump components, bio-based purge system materials, and energy-efficient purge cycle optimization. |

| Data Analytics & Predictive Modeling | AI-driven purge optimization, predictive failure analytics, and blockchain-enabled real-time emission monitoring. |

| Production & Supply Chain Dynamics | AI-enhanced supply chain automation, decentralized manufacturing hubs, and blockchain-tracked component authentication. |

| Market Growth Drivers | Future expansion fueled by AI-powered emission management, sustainable fuel vapor recovery, and next-gen hybrid-electric powertrain adoption. |

The USA automotive active purge pump market is evolving thanks to strict emission rules, high uptake of evaporative emission control systems, and advancements in fuel economy technology. Under stringent emission guidelines handed down by the Environmental Protection Agency (EPA) and California Air Resources Board (CARB) automakers need to add active purge pump tech to meet hydrocarbon emissions limits.

Though the adoption of hybrid and plug-in hybrid vehicles (PHEVs) is on the rise, and the need for efficient fuel vapor management systems grows, evaporative emissions must be adequately handled. Ford, General Motors, and Tesla are investing in next-gen purge pumps to comply with changing emission regulations.

| Country | CAGR (2025 to 2035) |

|---|---|

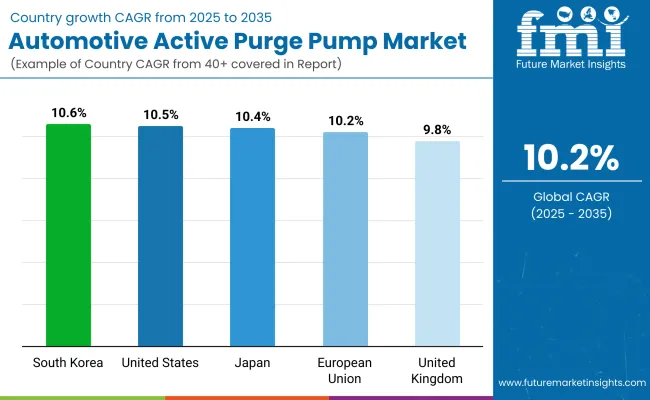

| USA | 10.5% |

Increasing focus on emission control, government-led clean air initiatives, and rising investments in hybrid vehicle technology have driven the Automotive Active Purge Pump Market in the United Kingdom. The UK government’s 2050 Net Zero policy and introduction of Ultra Low Emission Zones (ULEZ) have meant that OEMs are being forced to address their EVAP systems which is in turn driving up the demand for active purge pumps.

While the UK automotive industry moves towards the electrification of vehicles, there is still a strong demand for its hybrid and highly fuel-efficient combustion engine vehicles that keep the needs for advanced fuel vapor management systems strong.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 9.8% |

The EU automotive active purge pump market is growing steadily owing to strict Euro 7 emission standards, rising production of hybrid vehicles, along with a strong focus on fuel efficiency improvements. The European Commission’s Green Deal is forcing OEMs to retrofit low-emission technology, like advanced purge pump systems, into IC and hybrid applications.

The leading markets are in Germany, France and Italy, where OEMs like Volkswagen, BMW and Renault have invested in advanced purge pump technologies to meet the new evaporative emission requirements. Growth in demand for high-performance purge pumps is also being driven by the increasing emphasis on plug-in hybrid vehicles (PHEVs).

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 10.2% |

The early adoption and leadership in technology reflected by Japan, along with stringent regulatory arrangements in place for emission control and evolving fuel vapor management systems are all aiding the growth of the automotive active purge pump market in Japan. Minister of Land, Infrastructure, Transport and Tourism (MLIT) of Japan is enforcing stricter evaporative emission standards, which is pushing the automakers to use advanced purge pumps in hybrid and fuel efficient cars.

Japanese automotive manufacturers like Toyota, Honda, and Nissan have been leveraging their purification capabilities to implement next-gen technology for purge pumps to smooth vehicle dynamics and enhance the metering of fuel systems, thereby improving emissions and efficiency.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.4% |

In South Korea, the Automotive Active Purge Pump Market is accelerating due to government-backed emission reduction initiatives, booming automotive industry improvements, and increasing hybrid vehicle use. And to comply with stricter fuel vapor emission regulations from the South Korean Ministry of Environment, automakers are leaning towards sophisticated purge pump technologies.

Hyundai and KiaReduce gasoline vapors or evaporative emissions from vehicles through smart EVAP systems, AI-based fuel management, or green vehicle components that improve purge pump system efficiency. Additional increasing demand for next-generation purge pumps is being driven by the roll-out of plug-in hybrid (PHEV) production.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 10.6% |

The Automotive Active Purge Pump (APP) Market continues to grow due to factors like growing emission restrictions, the change towards evaporative emissions control and improvement in vehicle fuel systems efficient. Specialized active purge pumps are also crucial in reducing hydrocarbon emissions since they are responsible for managing fuel vapors and are targeted in design to hybrid & ICE (internal combustion engine) vehicles.

Firms target electric-driven purge pumps, intelligent monitoring systems, and lightweight materials to improve fuel efficiency, decrease emissions, and increase system longevity. This market comprises top automotive component suppliers, manufacturers of emission control systems, and powertrain technology companies, all of whom contribute to the next generation of evaporative emissions solutions.

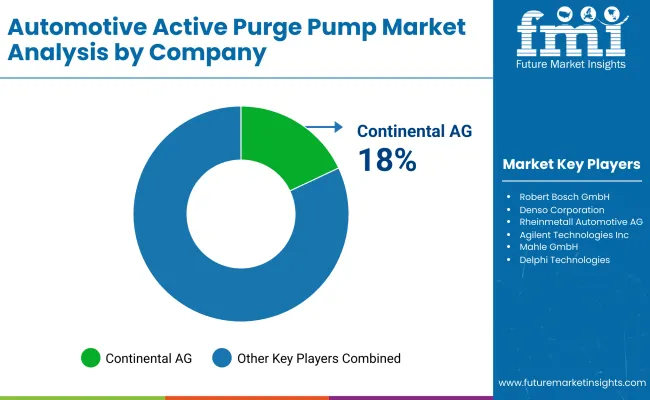

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Continental AG | 18-22% |

| Robert Bosch GmbH | 15-19% |

| Denso Corporation | 10-14% |

| Rheinmetall Automotive AG | 8-12% |

| Agilent Technologies Inc. | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Continental AG | Develops high-efficiency active purge pumps with integrated diagnostics and smart control features for emissions reduction. |

| Robert Bosch GmbH | Specializes in electric purge pump systems that enhance hydrocarbon vapor management and fuel system performance. |

| Denso Corporation | Manufactures compact and energy-efficient active purge pumps for hybrid and ICE vehicles. |

| Rheinmetall Automotive AG | Focuses on low-emission evaporative purge systems with advanced sensor integration. |

| Agilent Technologies Inc. | Provides automotive-grade purge pump solutions with precise vacuum control and hydrocarbon management. |

Key Company Insights

Continental AG (18-22%)

Continental leads the active purge pump market, offering smart, electronically controlled purge pumps designed for low-emission and hybrid vehicle applications.

Robert Bosch GmbH (15-19%)

Bosch specializes in AI-enhanced purge pump technologies, integrating real-time emissions monitoring and adaptive purge control.

Denso Corporation (10-14%)

Denso focuses on lightweight, high-efficiency purge pumps, optimizing fuel vapor recovery and emissions compliance in next-gen hybrid powertrains.

Rheinmetall Automotive AG (8-12%)

Rheinmetall develops low-emission active purge systems with integrated sensors for real-time fuel vapor detection and control.

Agilent Technologies Inc. (6-10%)

Agilent provides high-precision purge pumps, catering to automotive fuel system testing, emissions reduction, and hydrocarbon control solutions.

Other Key Players (30-40% Combined)

Several automotive emissions control system manufacturers and component suppliers contribute to advancements in purge pump efficiency, durability, and compliance with global emission standards. These include:

The overall market size for the Automotive Active Purge Pump Market was USD 100.8 Million in 2025.

The Automotive Active Purge Pump Market is expected to reach USD 266.3 Million in 2035.

Stringent emission regulations, increasing vehicle electrification, and growing demand for fuel-efficient and eco-friendly automotive components will drive market growth.

The USA, Germany, China, Japan, and South Korea are key contributors.

Electrically driven purge pumps are expected to dominate due to their efficiency in reducing hydrocarbon emissions and compliance with emission standards.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Manufacturing Process, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Manufacturing Process, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Manufacturing Process, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Manufacturing Process, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Manufacturing Process, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Manufacturing Process, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Manufacturing Process, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Manufacturing Process, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Manufacturing Process, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Manufacturing Process, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Manufacturing Process, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Manufacturing Process, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Manufacturing Process, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Manufacturing Process, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Manufacturing Process, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Manufacturing Process, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Manufacturing Process, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Manufacturing Process, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Manufacturing Process, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Manufacturing Process, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Manufacturing Process, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 26: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Manufacturing Process, 2023 to 2033

Figure 28: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 29: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Manufacturing Process, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Manufacturing Process, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Manufacturing Process, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Manufacturing Process, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Manufacturing Process, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 56: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Manufacturing Process, 2023 to 2033

Figure 58: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 59: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Manufacturing Process, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Manufacturing Process, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Manufacturing Process, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Manufacturing Process, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Manufacturing Process, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Manufacturing Process, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Manufacturing Process, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Manufacturing Process, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Manufacturing Process, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Manufacturing Process, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Manufacturing Process, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Manufacturing Process, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Manufacturing Process, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Manufacturing Process, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Manufacturing Process, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Manufacturing Process, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Manufacturing Process, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Manufacturing Process, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Manufacturing Process, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Manufacturing Process, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Manufacturing Process, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Manufacturing Process, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Manufacturing Process, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Manufacturing Process, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Manufacturing Process, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Manufacturing Process, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Manufacturing Process, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Manufacturing Process, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Manufacturing Process, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Manufacturing Process, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Manufacturing Process, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Manufacturing Process, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Manufacturing Process, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Manufacturing Process, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Manufacturing Process, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Material Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Manufacturing Process, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA