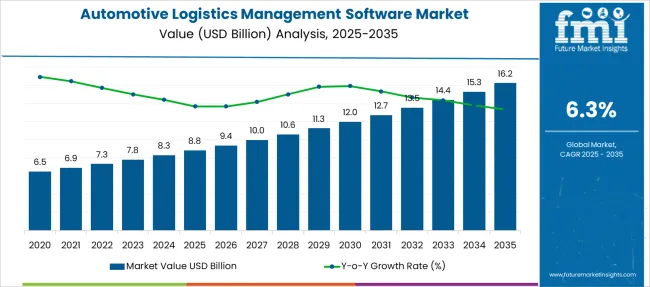

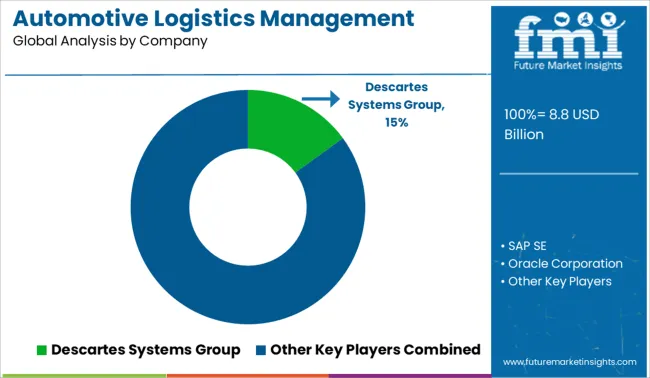

The Automotive Logistics Management Software Market is estimated to be valued at USD 8.8 billion in 2025 and is projected to reach USD 16.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Logistics Management Software Market Estimated Value in (2025 E) | USD 8.8 billion |

| Automotive Logistics Management Software Market Forecast Value in (2035 F) | USD 16.2 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The Automotive Logistics Management Software market is gaining momentum as OEMs and Tier 1 suppliers strive to optimize supply chain visibility, cost control, and operational efficiency. Increasing complexity in global automotive production and just-in-time inventory systems has necessitated intelligent digital solutions that enhance coordination between manufacturing, warehousing, and distribution networks.

The growing adoption of electric vehicles and multi-tier supply chains has further intensified the need for logistics platforms capable of real-time tracking and predictive analytics. Regulatory compliance and sustainability goals are prompting firms to adopt cloud-enabled, AI-driven logistics software to monitor carbon footprints and reduce waste.

Market growth is also being supported by rising demand for modular software platforms that can be easily scaled across domestic and international logistics functions. The convergence of telematics, IoT, and logistics analytics is enabling better decision-making, while continued digital transformation across automotive ecosystems ensures a strong future outlook for this market..

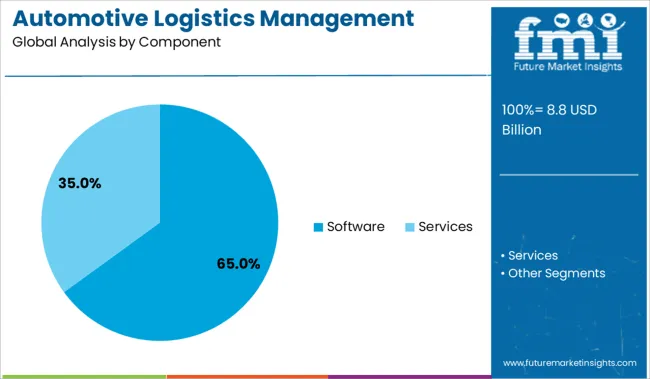

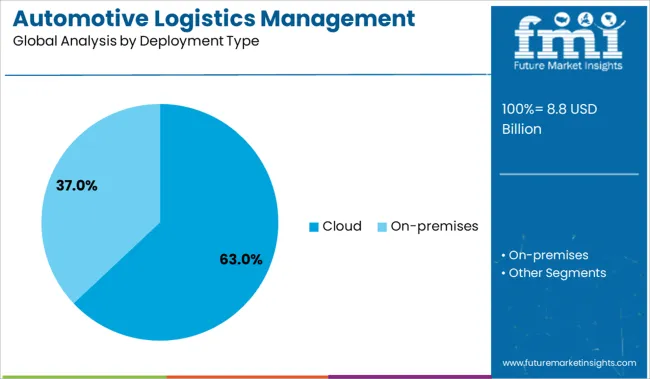

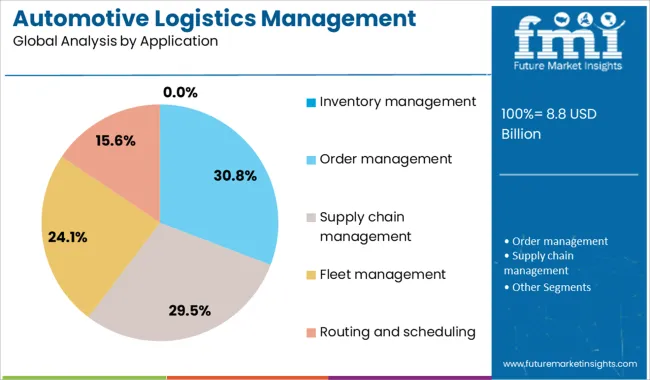

The automotive logistics management software market is segmented by component, deployment type, and application and geographic regions. The automotive logistics management software market is divided into Software and Services. In terms of deployment type, the automotive logistics management software market is classified into Cloud and On-premises. Based on the application of the automotive logistics management software market, it is segmented into inventory management, Order management, Supply chain management, Fleet management, Routing and scheduling, Logistics planning, Transport management system, and Others. Regionally, the automotive logistics management software industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The software component segment is projected to account for 65% of the Automotive Logistics Management Software market revenue share in 2025, establishing it as the leading component. This dominance has been driven by the increasing shift from manual processes to digital platforms that allow real-time visibility and control across logistics operations. Software platforms have been enabling seamless integration of transport management, warehouse coordination, supplier communication, and data analytics.

The transition toward AI and machine learning-powered logistics tools has been further accelerating software adoption. Automotive manufacturers have shown a preference for configurable platforms that improve operational responsiveness and reduce downtime. Enhanced customization and integration with enterprise systems have supported this segment's growth.

Moreover, software solutions have proven critical for automating documentation, improving compliance, and enhancing traceability across the supply chain. As global automotive firms focus on building resilient, agile logistics systems, software is expected to remain the core enabler of digital logistics strategies..

The cloud deployment type segment is expected to contribute 63% of the Automotive Logistics Management Software market revenue in 2025, placing it as the dominant deployment model. Growth in this segment has been attributed to the need for scalable, flexible, and cost-efficient platforms capable of supporting dynamic logistics operations. Cloud-based solutions have enabled real-time data access, multi-location coordination, and fast deployment without large capital expenditures.

Automotive OEMs and suppliers have increasingly adopted cloud models to improve responsiveness in global supply chains and ensure business continuity. The ability to implement updates instantly and integrate with partner ecosystems has been a key advantage of cloud infrastructure.

Furthermore, growing demand for mobile access, remote monitoring, and platform interoperability has made the cloud the preferred deployment model. As organizations prioritize agility and data-driven operations, cloud-based logistics platforms are anticipated to lead the market due to their ease of adoption and operational scalability..

The inventory management segment within the Automotive Logistics Management Software market is gaining strong traction and is poised for continued advancement. This application area has been instrumental in optimizing parts availability, minimizing excess inventory, and ensuring just-in-time delivery across complex automotive supply chains. Increasing vehicle model diversity and component modularization have added layers of complexity to inventory handling, creating a pressing need for intelligent inventory planning tools.

Software solutions focused on inventory management have been enabling predictive stock analysis, automatic reorder alerts, and integration with production schedules. These capabilities have helped manufacturers reduce carrying costs and avoid production delays.

As the industry embraces digital twins and real-time material flow visibility, inventory management software is being embedded deeper into logistics systems. The application is further supported by its ability to reduce waste, enhance fulfillment accuracy, and align procurement with demand forecasting, making it a strategic function within the evolving automotive logistics ecosystem..

Demand for automotive logistics management software is increasing as OEMs and Tier-1 suppliers digitize inbound, outbound, and spare-parts flow. Sales of cloud-based TMS and visibility platforms are accelerating due to EV-driven supply complexity, chip shortages, and the need for predictive transport orchestration.

Demand for automotive logistics management software surged 31% in 2025 as EV production introduced multi-tier part sourcing challenges. Battery module transit tracking and critical-path visibility tools helped Tier-1 suppliers reduce buffer inventory by 23% in Europe. Inbound routing algorithms integrating lithium-cell compliance reduced carrier rejections by 19%. In China, OEMs added API-linked milestone alerts to coordinate JIT delivery of electric drivetrain components. Software with VIN-linked traceability also enabled real-time escalation of supply delays, reducing plant line-stops by 14%. USA EV factories deployed digital dock scheduling tools, improving trailer turnaround by 21%, while layered inventory views allowed logistics planners to prioritize constrained parts by build-criticality.

Sales of cloud-native automotive logistics platforms rose 37% in 2025, driven by persistent chip shortages and rising recall volumes. OEMs with centralized control towers saw a 26% improvement in supplier OTIF (On-Time-In-Full) scores. North American parts distributors used software-integrated reverse logistics modules to cut warranty claim cycle time by 17%. In South Korea, auto brands used digital freight matching features to secure spot capacity 3.2× faster during Tier-2 supplier outages. Recall-specific lot-tracking modules helped isolate defective brake systems within 48 hours, down from 4.5 days in 2023. Predictive shipment delay analytics also enabled proactive build plan adjustments, minimizing cost per disruption event by 22%.

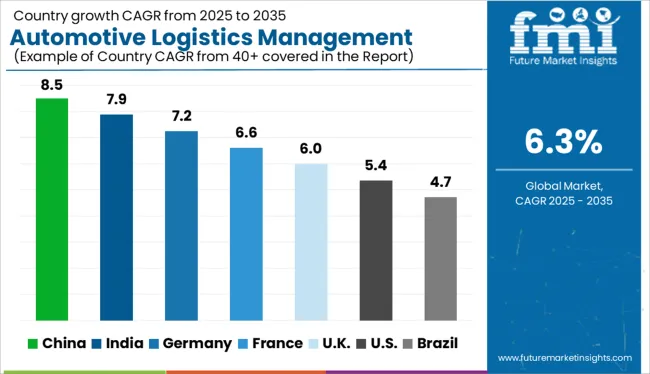

| Country | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

| USA | 5.4% |

| Brazil | 4.7% |

The global automotive logistics management software market is projected to grow at a CAGR of 6.0% between 2025 and 2035. Leading the expansion, China (BRICS) records the highest growth at 8.5%, outperforming the global average by 2.5 percentage points, driven by rapid digital transformation in manufacturing and government-backed smart mobility initiatives. India (BRICS) follows with 7.9% (+1.9 pp), supported by rising vehicle production, adoption of cloud-based logistics solutions, and growth in tier-1 and tier-2 automotive hubs. Within the OECD bloc, Germany posts 7.2% (+1.2 pp), propelled by its automotive export strength and investments in supply chain digitization. The UK aligns exactly with the global average at 6.0%, indicating steady adoption. In contrast, the United States trails at 5.4% (–0.6 pp), reflecting a more mature software market with slower implementation cycles. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is projected to experience a CAGR of 8.5% in the automotive logistics management software market through 2035, making it the most dynamic market in this sector. From 2020 to 2024, original equipment manufacturers (OEMs) focused on implementing basic digital logistics tools to handle increased volumes. There has been a recent shift toward more advanced solutions, such as AI-driven fleet orchestration and predictive analytics. This change is largely driven by the rapid growth of China's electric vehicle (EV) manufacturing sector, which requires precise coordination of inbound components. In response, domestic software providers are enhancing their Software as a Service (SaaS) platforms with cloud-native infrastructure designed specifically for tiered automotive supply chains.

The market in India is anticipated to rise at a CAGR of 7.9% from 2025 to 2035, fueled by a rapid shift toward digitized logistics across automotive clusters. While 2020–2024 saw reliance on ERP-linked manual systems, the next decade promises widespread automation in part-tracking and vehicle dispatch management. Government-backed initiatives such as the National Logistics Policy are catalyzing IT adoption across component manufacturers and regional logistics providers. SaaS platforms offering multi-language and mobile-first features are enabling deeper market penetration.

Germany is poised to experience a CAGR of 7.2% in the automotive logistics software market, supported by its strong industrial base and precision-driven OEM networks. Between 2020 and 2024, adoption was focused on plant-level logistics optimization; the future lies in end-to-end visibility across supplier ecosystems. German automakers are prioritizing carbon transparency in logistics workflows, prompting investment in software that tracks emissions per shipment. Cloud-based integrations with warehouse automation and route planning tools are being tested across major Tier 1 facilities.

The UK automotive logistics management software market is projected to expand at a CAGR of 6.0% between 2025 and 2035, amid rising pressure to improve delivery speed and compliance post-Brexit. While 2020–2024 saw fragmented adoption across logistics providers, consolidation is underway with OEMs standardizing software platforms across partners. Vendor focus is shifting to plug-and-play APIs, real-time exception handling, and customs integration. The market is also seeing a rise in demand for software tools that assist with green logistics reporting under upcoming ESG mandates.

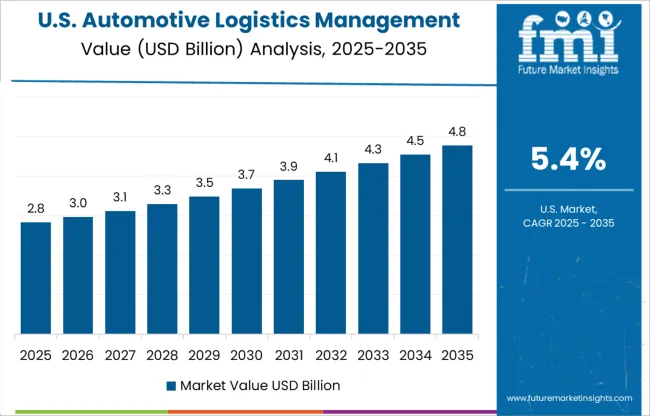

The USA market is forecast to grow at a CAGR of 5.4% from 2025 to 2035, led by increasing automation of outbound logistics and dealer network optimization. During 2020–2024, most software deployment was siloed in warehousing; the shift now is toward unified logistics visibility and predictive vehicle distribution planning. Automotive OEMs are integrating cloud-based tools that support analytics on transit delays, route performance, and carrier compliance. North American Tier 1 suppliers are also pushing for end-to-end tracking to reduce delivery exceptions.

Sales of automotive logistics management software are projected to rise steadily through 2025, fueled by digital transformation across OEM supply chains. Descartes Systems Group holds a significant market share, backed by its robust multimodal transport optimization tools tailored for Tier 1 suppliers and OEMs. SAP SE and Oracle Corporation remain strong contenders, leveraging their end-to-end enterprise integration capabilities to streamline parts inventory, order tracking, and JIT delivery workflows. Kinaxis Inc. is expanding its footprint through real-time demand-sensing algorithms suited for volatile auto production cycles. Demand for automotive logistics management software from BluJay Solutions, Manhattan Associates, and Infor is climbing in Europe and Asia as automakers invest in AI-driven route planning, fleet management, and carbon emission tracking modules to meet ESG targets.

Recent Automotive Logistics Management Software Industry News In September 2024, Mahindra & Mahindra selected Kinaxis’ AI-powered Maestro™ platform to enhance end-to-end automotive supply chain orchestration. The collaboration aims to improve demand forecasting, scenario planning, and transparency across its global production network.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.8 Billion |

| Component | Software and Services |

| Deployment Type | Cloud and On‑premises |

| Application | Inventory management, Order management, Supply chain management, Fleet management, Routing and scheduling, Logistics planning, Transport management system, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Descartes Systems Group, SAP SE, Oracle Corporation, Kinaxis Inc., BluJay Solutions, and Others (e.g., Manhattan, Infor…) |

| Additional Attributes | Dollar sales by software category and vehicle production stage, demand dynamics across tier 1 suppliers and OEM networks, regional trends in cloud-native platform adoption, innovation in real-time shipment tracking and AI-powered demand forecasting, environmental impact of logistics optimization and carbon footprint reduction, and emerging use cases in EV assembly workflows and autonomous supply chain orchestration. |

The global automotive logistics management software market is estimated to be valued at USD 8.8 billion in 2025.

The market size for the automotive logistics management software market is projected to reach USD 16.2 billion by 2035.

The automotive logistics management software market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in automotive logistics management software market are software, services, _professional and _managed.

In terms of deployment type, cloud segment to command 63.0% share in the automotive logistics management software market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Software Market Size and Share Forecast Outlook 2025 to 2035

Automotive Logistics Market Size and Share Forecast Outlook 2025 to 2035

Automotive Oil Management Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Data Management Market Size and Share Forecast Outlook 2025 to 2035

Software License Management (SLM) Market Size and Share Forecast Outlook 2025 to 2035

Automotive Engine Management Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dealer Management System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Battery Management System Market Growth - Trends & Forecast 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Logistics Visibility Software Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Exam Management Software Market

Quote Management Software Market Size and Share Forecast Outlook 2025 to 2035

Trade Management Software Market Size and Share Forecast Outlook (2025 to 2035)

Event Management Software Market Analysis - Size, Share, and Forecast 2025 to 2035

Grant Management Software Market - Trends, Size & Forecast 2025 to 2035

Video Management Software Market

Server Management Software Market Size and Share Forecast Outlook 2025 to 2035

Skills Management Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA