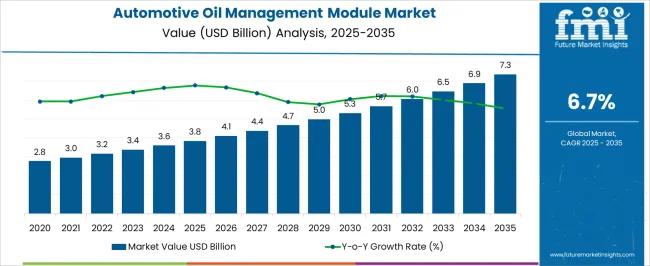

The automotive oil management module market is projected to grow from USD 3.8 billion in 2025 to USD 7.3 billion by 2035, with a CAGR of 6.7%. A seasonality or cyclicality detection analysis reveals that the market follows a relatively consistent growth pattern with some fluctuations based on external factors like economic cycles, technological adoption rates, and vehicle manufacturing trends. Between 2025 and 2030, the market grows from USD 3.8 billion to USD 5.3 billion, contributing USD 1.5 billion in growth, with an average annual increase of approximately USD 0.3 billion. The growth during this phase is steady, driven by increased demand for efficient oil management in vehicles as fuel efficiency and emissions regulations tighten globally. The market shows a slight acceleration from 2025 to 2027, followed by a more stable increase from 2027 to 2030, indicating a peak followed by a more predictable pattern. From 2030 to 2035, the market continues its upward trend, moving from USD 5.3 billion to USD 7.3 billion, contributing USD 2 billion in growth. This period exhibits steady growth, supported by technological advancements in automotive oil management systems, and continued demand for improved engine performance and fuel efficiency. Overall, the seasonality or cyclicality analysis indicates a strong, stable growth trajectory, with some initial acceleration followed by a more balanced pace as the market matures.

| Metric | Value |

|---|---|

| Automotive Oil Management Module Market Estimated Value in (2025 E) | USD 3.8 billion |

| Automotive Oil Management Module Market Forecast Value in (2035 F) | USD 7.3 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

The automotive oil management module market is witnessing steady growth, driven by the rising complexity of engine systems, emphasis on fuel efficiency, and regulatory mandates for emission reduction. As internal combustion engine optimization remains a focus in hybrid and transitional automotive strategies, oil management modules are being integrated into broader thermal and lubrication architectures.

OEMs are adopting modular oil systems that enhance engine life, optimize viscosity control, and reduce oil consumption delivering operational benefits in both passenger and commercial vehicles. Increasing electrification of auxiliary components and the transition to smart, sensor-enabled lubrication systems are expected to redefine module design requirements.

Additionally, the growing use of lightweight materials and integrated hardware-software interfaces is enabling advanced oil management capabilities that align with evolving drivetrain and platform architectures across the global automotive landscape.

The automotive oil management module market is segmented by component, function, end use, and geographic region.

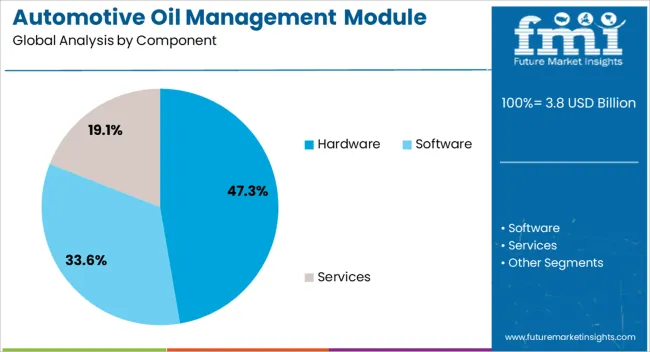

By component, the market is divided into hardware, software, and services.

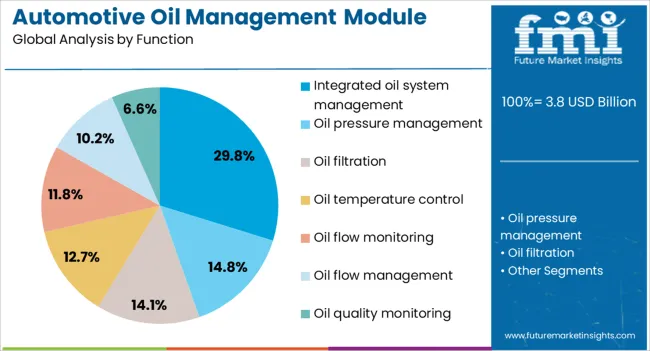

By function, it is classified into integrated oil system management, oil pressure management, oil filtration, oil temperature control, oil flow monitoring, oil flow management, and oil quality monitoring.

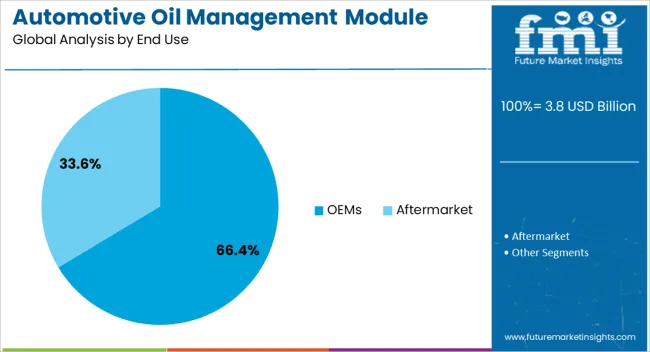

By end use, the market is segmented into OEMs and aftermarket.

By region, the automotive oil management module industry is categorized into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Hardware is projected to contribute 47.30% of the total market revenue in 2025, positioning it as the leading component in automotive oil management modules. This dominance is being driven by the need for robust physical systems that can withstand high-pressure lubrication cycles and maintain consistent performance across diverse driving conditions.

Key components such as pumps, reservoirs, and oil routing systems are being engineered with precision-molded thermoplastics and lightweight metals to ensure durability and integration with compact engine designs. Enhanced thermal resistance and vibration stability have increased their acceptance in performance and heavy-duty applications.

As modularity becomes central to next-generation powertrain platforms, demand for optimized hardware solutions with minimal maintenance requirements continues to lead adoption across OEM supply chains.

Integrated oil system management is anticipated to account for 29.80% of the market share in 2025, making it the leading functional area within oil management modules. This growth is being influenced by the increasing demand for unified control systems that monitor oil quality, temperature, flow rate, and pressure in real-time.

Integration of sensors, control valves, and electronic control units (ECUs) has allowed for predictive maintenance and adaptive oil flow adjustments, supporting engine efficiency and compliance with stringent emission norms. Automotive platforms that prioritize fuel economy and long-term engine health are driving OEMs to move away from standalone oil systems toward holistic management modules.

The growing trend toward smart lubrication as part of digital vehicle health monitoring is expected to accelerate this segment’s dominance.

OEMs are expected to contribute 66.40% of the overall market revenue in 2025, emerging as the dominant end-user group. This position is supported by the push for integrated powertrain solutions directly at the manufacturing stage, where oil management modules are embedded into engine and hybrid system designs.

OEMs are prioritizing module standardization across multiple vehicle models to achieve economies of scale and compliance with global efficiency regulations. Strategic investments in R&D and collaborations with Tier 1 suppliers are enabling the development of proprietary oil systems that reduce warranty costs and improve lifecycle performance.

As vehicle architectures evolve with increased electrification and modularity, OEMs are taking a proactive role in driving innovations in oil system integration and thermal management efficiency.

The automotive oil management module market is growing as automotive manufacturers focus on improving engine performance, efficiency, and lifespan. These modules are essential for monitoring and managing oil levels, quality, and temperature in vehicles, ensuring optimal engine health and reducing maintenance costs. With increasing consumer demand for advanced vehicle technologies and stricter emission regulations, the market for oil management systems is expanding. Technological advancements in sensor technologies and smart oil monitoring solutions are driving market growth. Despite challenges such as high implementation costs and integration complexity, opportunities are emerging through the development of more cost-effective, efficient, and eco-friendly solutions.

The automotive oil management module market is driven by the growing demand for improved engine efficiency, longevity, and reduced maintenance costs. Oil management modules are critical in ensuring optimal oil performance by monitoring oil levels, temperature, and quality in real-time, which helps maintain engine health and reduce wear and tear. As vehicles become more technologically advanced and complex, the need for precise and automated oil management systems is rising. The focus on increasing engine lifespan and reducing downtime due to engine issues is pushing the adoption of oil management modules. Additionally, the growing awareness of maintenance costs and the need for eco-friendly solutions to reduce waste further fuels market demand.

A significant challenge for the automotive oil management module market is the high initial cost and complexity of integrating these advanced systems into existing vehicles. Automotive manufacturers must invest in sophisticated sensors, monitoring systems, and software solutions, which increases the overall vehicle cost. Moreover, retrofitting existing vehicle models with oil management systems can be difficult and expensive, particularly in older vehicle models that were not designed for such technology. The complexity of integrating oil management modules with other in-vehicle systems, such as engine control units (ECUs), can also pose challenges. As a result, the adoption of these systems is often restricted to higher-end or newer vehicle models, limiting widespread use.

The automotive oil management module market presents significant opportunities due to technological advancements and the increasing adoption of electric vehicles (EVs). The integration of advanced sensors, artificial intelligence (AI), and machine learning into oil management systems offers the potential for more precise, real-time monitoring of oil performance. In addition, the increasing demand for electric vehicles provides new growth opportunities. Even though EVs do not use traditional oil, oil management modules are critical in hybrid vehicles and in optimizing performance in vehicles that use non-liquid cooling systems. As the demand for hybrid vehicles increases, the need for effective oil management solutions that monitor hybrid engine systems will create new avenues for market expansion.

A key trend in the automotive oil management module market is the integration of smart technology and the Internet of Things (IoT). Oil management systems are becoming more sophisticated, incorporating IoT sensors that offer real-time monitoring and analytics of oil performance. This integration allows for predictive maintenance, reducing the risk of engine failure and minimizing downtime. Smart oil management systems can provide drivers and fleet managers with immediate data on oil quality and potential issues through mobile apps or in-vehicle displays. This trend toward connected vehicles is driving the development of more advanced oil management modules that enable greater control and transparency, aligning with the industry's shift toward smarter, more efficient automotive solutions.

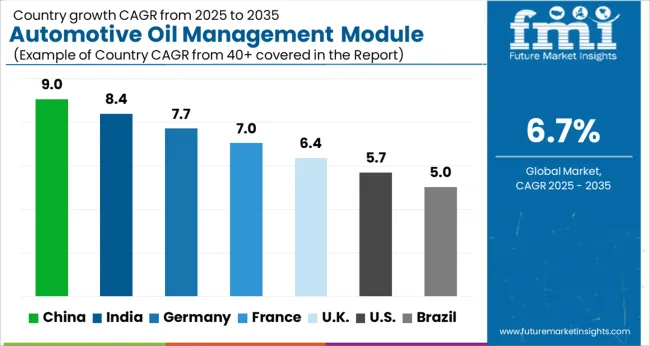

The automotive oil management module market is projected to grow at a global CAGR of 6.7% from 2025 to 2035, with China leading at 9.0%. India follows closely at 8.4%, while Germany records 7.7%. The United Kingdom shows 6.4% growth, and the United States stands at 5.7%. The market growth is fueled by increasing demand for efficient oil management in vehicles, especially with the rise of electric vehicles (EVs) and stricter regulations on fuel efficiency and emissions. The expansion of automotive manufacturing in emerging markets, particularly in China and India, further boosts the market. The increasing demand for long-lasting, high-performance engines and the development of advanced automotive technologies will continue to drive the adoption of oil management modules in vehicles worldwide.

China is projected to grow at a CAGR of 9.0% through 2035, driven by the rapid expansion of its automotive industry. The demand for automotive oil management modules in China is increasing as both traditional internal combustion engine (ICE) vehicles and electric vehicles (EVs) are being integrated with more efficient oil management systems. The Chinese government’s stringent emission regulations and the push for more energy-efficient vehicles are further driving this demand. Additionally, the country’s growing emphasis on environmentally friendly technologies is contributing to the widespread adoption of advanced oil management systems. The market is also supported by the rise of domestic automotive manufacturers, which are incorporating these systems into their vehicle designs.

Germany is projected to grow at a CAGR of 7.7% through 2035, with a steady demand for automotive oil management modules in the country. As a leader in automotive manufacturing, Germany’s focus on high-performance, energy-efficient vehicles drives the adoption of advanced oil management systems. The country’s automotive industry is moving toward sustainable mobility solutions, which include more efficient oil management for both ICE vehicles and hybrids. The increasing focus on vehicle longevity, engine efficiency, and lowering emissions is contributing to the market's growth. Additionally, advancements in automotive technology, including automation and AI, are expected to further drive demand for oil management modules.

India is projected to grow at an 8.4% CAGR through 2035, with the growing demand for automotive oil management modules primarily driven by the expansion of its automotive industry. As the country becomes a key player in the global automotive manufacturing sector, the need for advanced oil management systems in vehicles is expected to rise significantly. India’s increasing focus on reducing emissions and improving fuel efficiency aligns with the adoption of these systems. Furthermore, as the country moves towards more energy-efficient transportation options, including hybrid and electric vehicles, the market for oil management modules is likely to expand. Additionally, government initiatives promoting automotive safety and eco-friendly technologies further support market growth.

The United Kingdom is projected to grow at a CAGR of 6.4% through 2035, with the increasing demand for efficient automotive oil management systems. The country’s automotive sector is embracing new technologies that promote engine efficiency and reduce emissions. As part of the shift toward greener transportation options, there is a growing need for oil management solutions that contribute to improved vehicle performance and longevity. The UK government’s initiatives aimed at reducing carbon emissions and promoting energy-efficient vehicles further contribute to the market’s growth. Additionally, the demand for oil management systems in high-performance vehicles and the increasing adoption of electric and hybrid vehicles in the UK are expected to drive demand.

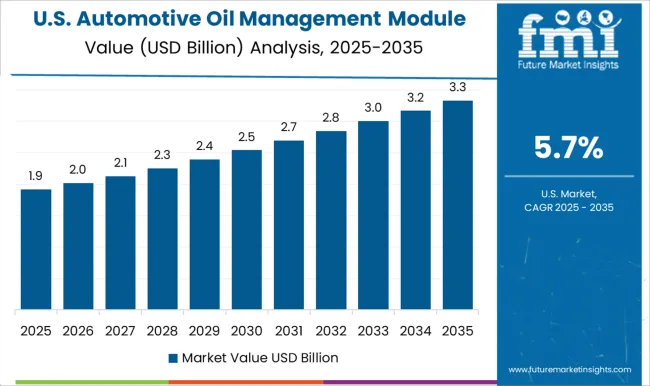

The United States is projected to grow at a CAGR of 5.7% through 2035, driven by the increasing demand for oil management modules in both traditional and electric vehicles. As the USA automotive industry transitions to more fuel-efficient and environmentally friendly solutions, the need for advanced oil management systems is rising. The market is also supported by the growing adoption of hybrid vehicles, which require sophisticated oil management technologies. In addition, the USA government’s stringent fuel efficiency and emission standards encourage automakers to incorporate these systems in their vehicles. As consumer awareness of vehicle efficiency and maintenance increases, demand for oil management modules is expected to rise.

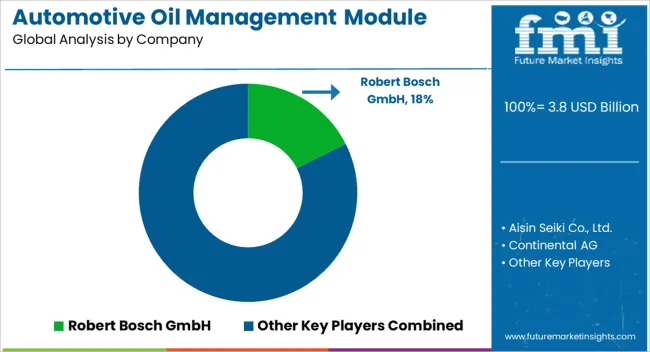

The automotive oil management module market is shaped by leading suppliers providing innovative solutions to monitor and optimize oil consumption and ensure the efficient operation of engine systems. Robert Bosch GmbH is a market leader, offering advanced oil management modules that integrate seamlessly with engine control systems, ensuring improved fuel efficiency and reduced emissions. Aisin Corporation and Continental AG specialize in high-performance oil management solutions, focusing on advanced monitoring technologies and precise oil delivery systems for automotive engines. DENSO Corporation and Faurecia S.A. provide cutting-edge components for the automotive industry, offering oil management systems designed to enhance engine life and optimize oil performance, especially for hybrid and electric vehicles.

Hyundai Mobis Co., Ltd. and Lear Corporation focus on offering integrated oil management solutions that meet the growing demand for fuel-efficient and environmentally friendly vehicle systems. Magna International Inc. and Valeo SA offer oil management modules that enhance vehicle performance while reducing maintenance costs, focusing on improving system reliability and extending engine life. ZF Friedrichshafen AG is another major player, providing oil management solutions for heavy-duty and commercial vehicles, emphasizing durability and high-performance standards. Competitive differentiation in this market is driven by innovation in oil filtration, temperature regulation, integration with engine control systems, and cost-efficiency. Barriers to entry include the need for significant R&D investment, compliance with environmental regulations, and the establishment of strong partnerships with vehicle manufacturers. Strategic priorities include developing more efficient, compact oil management systems and expanding solutions for electric vehicles.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Component | Hardware, Software, and Services |

| Function | Integrated oil system management, Oil pressure management, Oil filtration, Oil temperature control, Oil flow monitoring, Oil flow management, and Oil quality monitoring |

| End Use | OEMs and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Robert Bosch GmbH, Aisin Corporation, Continental AG, DENSO Corporation, Faurecia S.A., Hyundai Mobis Co., Ltd., Lear Corporation, Magna International Inc., Valeo SEsope, and ZF Friedrichshafen AG |

| Additional Attributes | Dollar sales by product type (oil filtration systems, oil coolers, oil sensors) and end-use segments (passenger vehicles, commercial vehicles, electric vehicles). Demand dynamics are driven by the growing emphasis on fuel efficiency, the increasing adoption of electric and hybrid vehicles, and advancements in engine technologies. Regional trends indicate strong growth in North America and Europe, where emissions regulations and fuel efficiency standards are pushing the adoption of advanced oil management systems, while Asia-Pacific is expanding due to rising automotive production and technological advancements. |

The global automotive oil management module market is estimated to be valued at USD 3.8 billion in 2025.

The market size for the automotive oil management module market is projected to reach USD 7.3 billion by 2035.

The automotive oil management module market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in automotive oil management module market are hardware, software and services.

In terms of function, integrated oil system management segment to command 29.8% share in the automotive oil management module market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA